As filed with the Securities and Exchange Commission on January 19, 2018

Securities Act File No. 333-221882

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-2

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

☐

Pre-Effective Amendment No.

☒

Post-Effective Amendment No. 1

Great Elm Capital Corp.

(Exact Name of Registrant as Specified in Charter)

800 South Street, Suite 230

Waltham, Massachusetts 02453

(Address of Principal Executive Offices)

(617) 375-3000

(Registrant's Telephone Number, Including Area Code)

Peter A. Reed

Chief Executive Officer

Great Elm Capital Corp.

800 South Street, Suite 230

Waltham, MA 02453

(Name and Address of Agent for Service)

COPIES TO:

|

Michael K. Hoffman

Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New York, NY 10022

(212) 735-3000

|

William J. Tuttle

Erin M. Lett

Dechert LLP

1900 K Street NW

Washington, DC 20006

(202) 261-3300

|

If any securities being registered on this form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933, other than securities offered in connection with a dividend reinvestment plan, check the following box.

☐

It is proposed that this filing will become effective (check appropriate box):

|

|

☐

|

when declared effective pursuant to section 8(c).

|

If appropriate, check the following box:

|

|

☐

|

This post-effective amendment designates a new effective date for a previously filed

[

post-effective amendment

] [

registration statement

]

.

|

|

|

☐

|

This form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act and the Securities Act registration statement number of the earlier effective registration statement for the same offering is

|

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 to the Registration Statement on Form N-2 (File No. 333-

221882

) of Great Elm Capital Corp (the “Registration Statement”) is being filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended (the “Securities Act”), solely for the purpose of filing exhibits to the Registration Statement. Accordingly, this Post-Effective Amendment No. 1 consists only of a facing page, this explanatory note and Part C of the Registration Statement on Form N-2 setting forth the exhibits to the Registration Statement. This Post-Effective Amendment No. 1 does not modify any other part of the Registration Statement. Pursuant to Rule 462(d) under the Securities Act, this Post-Effective Amendment No. 1 shall become effective immediately upon filing with the Securities and Exchange Commission. The contents of the Registration Statement are hereby incorporated by reference.

PART C — OTHER INFORMATION

Item 25.

Financial Statements and Exhibits

Financial Statements

The financial statements listed in the index to financial statements to the prospectus are incorporated herein by reference.

Exhibits

Unless otherwise indicated, all references are to exhibits to the applicable filing by Great Elm Capital Corp. (the "Registrant") under File No. 814-01211 with the Securities and Exchange Commission.

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

(a)

|

|

Amended and Restated Charter of the Registrant (incorporated by reference to Exhibit 3.1 to the Form 8-K filed on November 7, 2016)

|

|

|

|

|

|

(b)

|

|

Bylaws of the Registrant (incorporated by reference to Exhibit 99.2 to the Form N-14 8C filed on August 1, 2016)

|

|

|

|

|

|

(d)(1)*

|

|

Global certificate for the Notes

|

|

|

|

|

|

(d)(2)

|

|

Indenture, dated as of September 18, 2017, by and between the Registrant and American Stock Transfer & Trust Company, LLC, as trustee (the "Trustee") (incorporated by reference to Exhibit 4.1 to the Form 8-K filed on September 21, 2017)

|

|

|

|

|

|

(d)(3)*

|

|

Second Supplemental Indenture, dated as of January 19, 2019, by and between the Registrant and the Trustee

|

|

|

|

|

|

(d)(4)

|

|

Form T-1 of the Trustee (incorporated by reference to Exhibit (d)(4) to the Form N-2 (File No. 333-221882) filed on December 4, 2017)

|

|

|

|

|

|

(d)(5)

|

|

Form of certificate for the Registrant's common stock (incorporated by reference to Exhibit 99.5 to the Registration Statement on Form N-14 filed on August 1, 2016)

|

|

|

|

|

|

(d)(6)

|

|

6.50% Notes due 2022 (incorporated by reference to Exhibit 4.3 to the Form 8-K/

A

filed on September 21, 2017)

|

|

|

|

|

|

(d)(7)

|

|

6.50% Notes due 2022 (incorporated by reference to Exhibit 4.3 to the Form 8-K filed on September 29, 2017)

|

|

|

|

|

|

(d)(8)

|

|

First Supplemental Indenture, dated as of September 18, 2017 (incorporated by reference Exhibit 4.2 to the Form 8-K/

A

filed on September 21, 2017)

|

|

|

|

|

|

(e)

|

|

Dividend Reinvestment Plan (incorporated by reference to Exhibit 99.13(D) to Amendment No. 1 to the Form N-14 (File No. 333-212817) filed on September 26, 2016)

|

|

|

|

|

|

(g)

|

|

Investment Management Agreement, dated as of September 27, 2016, by and between the Registrant and Great Elm Capital Management, Inc. (incorporated by reference to Exhibit 10.1 to the Form 8-K (File No. 814-01211) filed on November 7, 2016)

|

|

|

|

|

|

(h)

|

|

Form of underwriting agreement (incorporated by reference to Exhibit (h) to the Form N-2/A (File No. 333-221882) filed on December 15, 2017)

|

|

|

|

|

|

(j)

|

|

Custodian Agreement, dated as of October 27, 2016, by and between the Registrant and State Street Bank and Trust Company, a Massachusetts trust company (incorporated by reference to Exhibit 10.3 to the Form 10-K filed on March 29, 2017)

|

|

|

|

|

|

(k)(1)

|

|

Agreement and Plan of Merger, dated as of June 23, 2016, by and between Full Circle Capital Corporation and the Registrant (incorporated by reference to the Rule 425 filing on June 27, 2016)

|

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

(k)(2)

|

|

Subscription Agreement, dated as of June 23, 2016, by and among the Registrant, Great Elm Capital Group, Inc. and the investment funds signatory thereto (incorporated by reference to the Rule 425 filing on June 27, 2016)

|

|

|

|

|

|

(k)(3)

|

|

Administration Agreement, dated as of September 27, 2016, by and between the Registrant and GECM (incorporated by reference to Exhibit 10.2 to the Form 8-K filed on November 7, 2016)

|

|

|

|

|

|

(k)(4)

|

|

Form of Indemnification Agreement (incorporated by reference to Exhibit 10.4 to the Form 8-K filed on November 7, 2016)

|

|

|

|

|

|

(k)(5)

|

|

Amended and Restated Registration Rights Agreement, dated as of November 4, 2016, by and among the Registrant and the holders named therein (incorporated by reference to Exhibit 10.3 to the Form 8-K filed on November 7, 2016)

|

|

|

|

|

|

(l)(1)

|

|

Opinion of Skadden, Arps, Slate, Meagher & Flom LLP

(incorporated by reference to Exhibit (l)(1) to the Form N-2/A (File No. 333-221882) filed on December 15, 2017)

|

|

|

|

|

|

(l)(2)

|

|

Opinion of Venable LLP (incorporated by reference to Exhibit (l)(2) to the Form N-2/A (File No. 333-221882) filed on December 15, 2017)

|

|

|

|

|

|

(l)(3)*

|

|

Opinion of Skadden, Arps, Slate, Meagher & Flom LLP

|

|

|

|

|

|

(n)(1)

|

|

Consent of Deloitte & Touche LLP, Registered Independent Accounting Firm

(incorporated by reference to Exhibit (n)(1) to the Form N-2/A (File No. 333-221882) filed on January 9, 2018)

|

|

|

|

|

|

(n)(2)

|

|

Consent of RSM US LLP, Registered Independent Accounting Firm

(incorporated by reference to Exhibit (n)(1) to the Form N-2/A (File No. 333-221882) filed on January 9, 2018)

|

|

|

|

|

|

(n)(3)

|

|

Consent of Skadden, Arps, Slate, Meagher & Flom LLP (incorporated by reference to Exhibit (l)(1) to the Form N-2/A (File No. 333-221882) filed on December 15, 2017)

|

|

|

|

|

|

(n)(4)

|

|

Consent of Venable LLP (incorporated by reference to Exhibit (l)(2) to the Form N-2/A (File No. 333-221882) filed on December 15, 2017)

|

|

|

|

|

|

(n)(5)

|

|

Power of Attorney (incorporated by reference to the signature page to the Form N-2 (File No. 333-221882) filed on December 4, 2017)

|

|

|

|

|

|

(r)(1)

|

|

Code of Ethics of Registrant (incorporated by reference to Exhibit 14.1 to the Form 10-K filed on March 29, 2017)

|

|

|

|

|

|

(r)(2)

|

|

Code of Ethics of Great Elm Capital Management, Inc. (incorporated by reference to Exhibit 14.2 to the Form 10-K filed on March 29, 2017)

|

The agreements included or incorporated by reference as exhibits to this registration statement contain representations and warranties by each of the parties to the applicable agreement. These representations and warranties were made solely for the benefit of the other parties to the applicable agreement and (i) were not intended to be treated as categorical statements of fact, but rather as a way of allocating the risk to one of the parties if those statements prove to be inaccurate; (ii) may have been qualified in such agreement by disclosures that were made to the other party in connection with the negotiation of the applicable agreement; (iii) may apply contract standards of "materiality" that are different from "materiality" under the applicable securities laws; and (iv) were made only as of the date of the applicable agreement or such other date or dates as may be specified in the agreement.

Item 26. Marketing Arrangements

The information contained under the heading "Underwriting" on the prospectus is incorporated herein by reference.

Item 27. Other Exp

enses of Issuance and Distribution**

|

SEC registration fee

|

|

$

|

7,093

|

|

|

Nasdaq Global Select Additional Listing Fees

|

|

|

45,000

|

|

|

FINRA filing fee

|

|

|

9,125

|

|

|

Accounting fees and expenses

|

|

|

30,000

|

|

|

Legal fees and expenses

|

|

|

250,000

|

|

|

Printing and engraving

|

|

|

35,000

|

|

|

Miscellaneous fees and expenses

|

|

|

123,782

|

|

|

Total

|

|

$

|

500,000

|

|

|

**

|

These amounts (other than the commission registration fee, Nasdaq fee and FINRA fee) are estimates.

|

Item 28. Persons Controlled by or Under Common Control

|

Entity

|

|

Ownership

|

|

|

Jurisdiction of

Organization

|

|

PF Facility Solutions LLC

|

|

|

100%

|

|

|

Delaware

|

|

Double Duce Lodging, LLC

|

|

|

100%

|

|

|

Texas

|

Item 29.

Number of Holders of Securities

The following table sets forth the number of record holders of our securities at January 2, 2018.

|

Title of Class

|

|

Number of Record Holders

|

|

|

Common stock, par value $0.01 per share

|

|

|

11

|

|

|

6.50% Notes due 2022

|

|

1

|

|

Item 30. Indemnification

Reference is made to Section 2-418 of the Maryland General Corporation Law, Article VII of the Registrant's charter and Article XI of the Registrant's Amended and Restated Bylaws.

Maryland law permits a Maryland corporation to include in its charter a provision limiting the liability of its directors and officers to the corporation and its stockholders for money damages except for liability resulting from (a) actual receipt of an improper benefit or profit in money, property or services or (b) active and deliberate dishonesty established by a final judgment as being material to the cause of action. The Registrant's charter contains such a provision which eliminates directors' and officers' liability to the maximum extent permitted by Maryland law, subject to the requirements of the Investment Company Act.

The Registrant's charter authorizes the Registrant, to the maximum extent permitted by Maryland law and subject to the requirements of the Investment Company Act, to indemnify any present or former director or officer or any individual who, while serving as the Registrant's director or officer and at the Registrant's request, serves or has served another corporation, real estate investment trust, partnership, joint venture, trust, employee benefit plan or other enterprise as a director, officer, partner or trustee, from and against any claim or liability to which that person may become subject or which that person may incur by reason of his or her service in any such capacity and to pay or reimburse their reasonable expenses in advance of final disposition of a proceeding. The Registrant's bylaws obligate the Registrant, to the maximum extent permitted by Maryland law and subject to the requirements of the Investment Company Act, to indemnify any present or former director or officer or any individual who, while serving as the Registrant's director or officer and at the Registrant's request, serves or has served another corporation, real estate investment trust, partnership, joint venture, trust, employee benefit plan or other enterprise as a director, officer, partner or trustee and who is made, or threatened to be made, a party to the proceeding by reason of his or her service in that capacity from and against any claim or liability to which that person may become subject or which that person may

incur by reason of his or her service in any such capacity and to pay or reimburse his or her reasonable expenses in advance of final disposition of a proceeding. The charter and bylaws also permit the Registrant to i

ndemnify and advance expenses to any person who served a predecessor of the Registrant in any of the capacities described above and any of the Registrant's employees or agents or any employees or agents of the Registrant's predecessor. In accordance with t

he Investment Company Act, the Registrant will not indemnify any person for any liability to which such person would be subject by reason of such person's willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the

conduct of his or her office.

Maryland law requires a corporation (unless its charter provides otherwise, which the Registrant's charter does not) to indemnify a director or officer who has been successful in the defense of any proceeding to which he or she is made, or threatened to be made, a party by reason of his or her service in that capacity. Maryland law permits a corporation to indemnify its present and former directors and officers, among others, against judgments, penalties, fines, settlements and reasonable expenses actually incurred by them in connection with any proceeding to which they may be made, or threatened to be made, a party by reason of their service in those or other capacities unless it is established that (a) the act or omission of the director or officer was material to the matter giving rise to the proceeding and (1) was committed in bad faith or (2) was the result of active and deliberate dishonesty, (b) the director or officer actually received an improper personal benefit in money, property or services or (c) in the case of any criminal proceeding, the director or officer had reasonable cause to believe that the act or omission was unlawful. However, under Maryland law, a Maryland corporation may not indemnify for an adverse judgment in a suit by or in the right of the corporation or for a judgment of liability on the basis that a personal benefit was improperly received unless, in either case, a court orders indemnification, and then only for expenses. In addition, Maryland law permits a corporation to advance reasonable expenses to a director or officer in advance of final disposition of a proceeding upon the corporation's receipt of (a) a written affirmation by the director or officer of his or her good faith belief that he or she has met the standard of conduct necessary for indemnification by the corporation and (b) a written undertaking by him or her or on his or her behalf to repay the amount paid or reimbursed by the corporation if it is ultimately determined that the standard of conduct was not met.

Investment Manager, Administrator and Principal Underwriter

The Investment Management Agreement provides that, absent willful misfeasance, bad faith or gross negligence in the performance of its duties or by reason of the reckless disregard of its duties and obligations, Great Elm Capital Management, Inc. and its officers, managers, agents, employees, controlling persons, members and any other person or entity affiliated with it are entitled to indemnification from the Registrant for any damages, liabilities, costs and expenses (including reasonable attorneys' fees and amounts reasonably paid in settlement) arising from the rendering of Great Elm Capital Management, Inc.’s services under the Investment Management Agreement or otherwise as an investment adviser of the Registrant.

The Administration Agreement provides that, absent willful misfeasance, bad faith or gross negligence in the performance of its duties or by reason of the reckless disregard of its duties and obligations, Great Elm Capital Management, Inc. and its officers, managers, agents, employees, controlling persons, members and any other person or entity affiliated with it are entitled to indemnification from the Registrant for any damages, liabilities, costs and expenses (including reasonable attorneys' fees and amounts reasonably paid in settlement) arising from the rendering of Great Elm Capital Management, Inc.'s services under the Administration Agreement or otherwise as administrator for the Registrant.

The Underwriting Agreement provides that each underwriter severally agrees to indemnify and hold harmless the Registrant, its directors and officers, and any person who controls the Registrant within the meaning of Section 15 of the Securities Act of 1933, as amended (the “Securities Act”), or Section 20 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), from and against any loss, liability, claim, damage or expense that the Registrant or any such person may incur, insofar as the loss, liability, claim, damage or expense arises out of or is based upon any untrue statement or alleged untrue statement of a material fact

contained in and in conformity with information concerning such underwriter furnished in writing by or on behalf of such expressly for use in the Registration Statement (or in the Registration Statement as amended b

y any post-effective amendment hereof by the Registrant) or in the prospectus contained in the Registration Statement, or arises out of or is based upon any omission or alleged omission to state a material fact in connection with such information required

to be stated in the Registration Statement or such prospectus or necessary to make such information not misleading.

The law also provides for comparable indemnification for corporate officers and agents. Insofar as indemnification for liability arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

The Registrant has entered into indemnification agreements with its directors. The indemnification agreements are intended to provide the Registrant's directors the maximum indemnification permitted under Maryland law and the Investment Company Act. Each indemnification agreement provides that the Registrant shall indemnify the director who is a party to the agreement (an "Indemnitee"), including the advancement of legal expenses, if, by reason of his or her corporate status, the Indemnitee is, or is threatened to be, made a party to or a witness in any threatened, pending, or completed proceeding, other than a proceeding by or in the right of the Registrant.

Item 31. Business and Other Connections of Investment Advisor

For information as to the business, profession, vocation or employment of a substantial nature of each of the officers and directors of the Advisor, reference is made to GECM's Form ADV, filed with the SEC under the Advisers Act and incorporated herein by reference upon filing.

Item 32. Location of Accounts and Records

All accounts, books and other documents required to be maintained by Section 31(a) of the Investment Company Act and the rules thereunder are maintained at the offices of:

|

|

1.

|

the Registrant, 800 South Street, Suite 230, Waltham, MA 02453;

|

|

|

2.

|

the Transfer Agent, American Stock Transfer & Trust Company, LLC, 6201 15th Avenue, Brooklyn, NY 11219;

|

|

|

3.

|

the Custodian, State Street Bank and Trust Company, 100 Huntington Avenue, Boston, Massachusetts 02116; and

|

|

|

4.

|

GECM, 800 South Street, Suite 230, Waltham, MA 02453.

|

Item 33.

Management Services

Not Applicable.

Item 34.

Undertakings

|

|

5.

|

(a) For the purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of a registration statement in reliance upon Rule 430A and contained in the form of prospectus filed by the Registrant under Rule 497(h) under the Securities Act of 1933 shall be deemed to be part of the Registration Statement as of the time it was declared effective.

|

(b) For the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of the securities at that time shall be deemed to be the initial bona fide offering thereof.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant has duly caused this Registration Statement on Form N-2 to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Waltham, in the Commonwealth of Massachusetts, on January 19, 2018.

|

|

GREAT ELM CAPITAL CORP.

|

|

|

|

|

|

By:

|

|

/s/ Peter A. Reed

|

|

|

Name:

|

|

Peter A. Reed

|

|

|

Title:

|

|

Chief Executive Officer

|

Pursuant to the requirements of the Securities Act, this Registration Statement and power of attorney have been signed by the following persons in the capacities indicated on January 19, 2018.

|

Name

|

|

Capacity

|

|

|

|

|

|

/s/ Peter A. Reed

|

|

Chief Executive Officer, President and Director (Principal Executive Officer)`

|

|

Peter A. Reed

|

|

|

|

|

|

|

|

/s/ Michael J. Sell

|

|

Chief Financial Officer and Treasurer (Principal Financial Officer and Principal Accounting Officer)

|

|

Michael J. Sell

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

Michael C. Speller

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

Mark Kuperschmid

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

Randall Revell Horsey

|

|

|

|

|

|

|

|

*

|

|

Director

|

|

John E. Stuart

|

|

|

|

|

|

|

|

* By:

|

|

/s/Peter A. Reed

|

|

|

|

Peter S. Reed

|

|

|

|

Attorney-in-fact

|

INDEX TO EXHIBITS

|

|

|

|

Exhibit Number

|

Description of Exhibit

|

|

(d)(1)

|

Global certificate for the Notes

|

|

|

|

|

(d)(3)

|

Second Supplemental Indenture, dated as of January 19, 2018, by and between the Registrant and the Trustee

|

|

|

|

|

(l)(3)

|

Opinion of Skadden, Arps, Slate, Meagher & Flom LLP

|

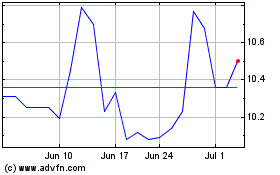

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Mar 2024 to Apr 2024

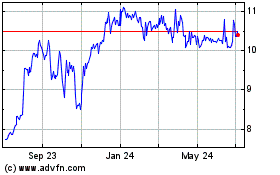

Great Elm Capital (NASDAQ:GECC)

Historical Stock Chart

From Apr 2023 to Apr 2024