Filed Pursuant to Rule 424(b)(3)

File No. 333-215204

Prospectus Supplement No. 3

(To Prospectus dated June 9, 2017)

701,500 American Depositary Shares

Each Representing 40 Ordinary Shares

Issuable Upon Exercise of 701,500

Warrants

Immuron Limited

This Prospectus Supplement No. 3

supplements and amends the prospectus dated June 9, 2017, as so supplemented and amended referred to herein as the Prospectus.

Prospective investors should carefully review the Prospectus and this Prospectus Supplement No. 3

.

This Prospectus Supplement No. 3 is

qualified by reference to the Prospectus, except to the extent that the information in this Prospectus Supplement No. 3 updates

or supersedes the information contained in the Prospectus, including any supplements thereto. This Prospectus Supplement No. 3

is not complete without, and may not be delivered or utilized except in connection with, the Prospectus, including any supplement

thereto. We are offering 701,500 American Depositary Shares (each, an “ADS” and, collectively the “ADSs”),

each ADS representing forty (40) of our ordinary shares, issuable upon exercise of 701,500 Warrants. Each Warrant has a per ADS

exercise price of $10.00 and expires five years from the date of issuance.

Our ADSs and Warrants are listed on

The NASDAQ Capital Market under the symbols “IMRN” and “IMRNW,” respectively. Our ordinary shares are listed

on the Australian Securities Exchange under the symbol “IMC.” On January 17, 2018, the closing price of our ordinary

shares on the Australian Securities Exchange was AUD$0.24 per ordinary share and the closing price of our ADSs on The NASDAQ Capital

Market was $6.90

We are an “emerging growth

company,” as that term is used in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and, as such, we have elected

to comply with certain reduced public company reporting requirements for future filings.

Investing in our ordinary shares

in the form of ADSs involves a high degree of risk. See “

Risk Factors

” beginning on page 7 of the Annual Report

on Form 20-F for the fiscal year ended June 30, 2017, which comprises Prospectus Supplement No. 2 dated November 2, 2017, as the

same may be updated in future prospectus supplements.

Neither the SEC nor any state securities

commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus or this prospectus

supplement. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement

is January 18, 2018.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the Month of January 2018

Commission

File Number: 001-38104

IMMURON

LIMITED

(Name

of Registrant)

Level

3, 62 Lygon Street, Carlton South, Victoria, 3053, Australia 3053

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐ ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate

by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

IMMURON

LIMITED

January

18, 2018,

Immuron Limited (ASX:IMC) (NASDAQ:IMRN) (the “Company”).

a)

Dismissal of independent registered public accounting firm

On

December 18, 2017, the Company dismissed Marcum LLP as the Company’s independent registered public accounting firm.

The

audit reports of Marcum LLP on the consolidated financial statements of the Company for each of the three most recent fiscal years

did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope

or accounting principles, except that the audit report of Marcum LLP, dated December 20, 2016 on the consolidated financial statements

of the Company as of June 30, 2016 and 2015, and for the years ended June 2016, 2015 and 2014, noted certain restatements to give

effect for errors in the classification of customer discounts and allowances as a reduction to revenue, measurement and recognition

of share-based payments, the accounting for equity issued in connection with convertible debt and certain amounts reflected in

the statements of cash flows. Further, the loss per share for each year was restated. In addition, the Company made certain revisions

to the footnotes to the consolidated financial statements.

During

the Company’s fiscal years ended June 30, 2015, June 30, 2016 and June 30, 2017 and during the subsequent interim period through

December 18, 2017, there were no disagreements with Marcum LLP on any matter of accounting principles or practices, financial

statement disclosure or auditing scope or procedures that, if not resolved to Marcum LLP’s satisfaction, would have caused Marcum

LLP to make reference to the subject matter of the disagreement in connection with its reports and there were no “reportable

events” as defined in Item 304(a)(1)(v) of Regulation S-K except as follows: Material weaknesses were identified by Marcum

LLP in some aspects of our internal control over financial reporting specifically surrounding the assessment of some certain significant

transactions and properly performing certain reviews and monitoring controls in the preparation of the financial statements in

accordance with International Financial Reporting Standards, as promulgated by International Accounting Standards Board.

The

Company provided Marcum LLP with a copy of the disclosures in this report prior to filing with the Securities and Exchange Commission

(the “SEC”). A copy of Marcum’s letter dated January 18, 2018 to the SEC, stating whether it agrees with the

statements made in this report, is filed as Exhibit 99.1 to this report.

b)

Engagement of New Independent Registered Public Accounting Firm

.

On

December 18, 2017, the Audit Committee engaged Grant Thornton Audit Pty Ltd as the Company’s independent registered public accounting

firm for the year ending June 30, 2018.

During

the three most recent fiscal years ended June 30, 2017 and during the subsequent interim period through January 17, 2018, neither

the Company nor anyone on its behalf consulted Grant Thornton Audit Pty Ltd regarding any of the matters or events set forth in

Item 304(a)(2) of Regulation S-K.

EXHIBITS

Exhibit

Number

|

|

Description

|

|

|

|

|

|

|

99.1

|

|

Letter from Marcum LLP

|

|

99.2

|

|

Immuron Appoints Grant Thornton as Company Auditors

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

IMMURON LIMITED

|

|

|

|

|

|

|

|

|

|

|

|

Date: January

18, 2018

|

By:

|

/s/ Peter Vaughan

|

|

|

|

|

Peter Vaughan

|

|

|

|

Joint-Chief Financial Officer

|

Exhibit

99.1

[MARCUM LETTEREAD]

January 18, 2018

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Commissioners:

We have read the statements made by Immuron Limited in its Form 6-K dated January 18, 2018. We agree with the statements concerning

our Firm in such Form 6-K; we are not in a position to agree or disagree with other statements of Immuron Limited contained

therein.

Very truly yours,

/s/ Marcum

llp

Marcum

llp

Exhibit 99.2

Immuron

Appoints Grant Thornton as Company Auditors

January

18

th

, 2018, Melbourne, Australia

: Immuron Limited (ASX:IMC) (NASDAQ:IMRN) (the “Company”) is pleased

to advise the Company’s has appointed Grant Thornton Audit Pty Ltd at act as the independent auditors of Immuron for both the

Australian and US financial reporting requirements.

Grant

Thornton will replace the incumbent US Auditor Marcum LLP and, subject to clearance from ASIC, William Buck Audit Pty Ltd in Australia

for both the FY2018 half year review, and full year audit processes.

This

change will streamline the reporting process by being able to work with one audit firm across both jurisdictions which comes with

many efficiencies and advantages.

The

Board and management of Immuron would take this opportunity to thank both the William Buck and Marcum audit teams for their assistance

and service over the past 5 and 2 years respectively, especially throughout the lengthy and complex US listing process undertaken

last year.

For

and on behalf of the Company,

Kind

Regards;

Peter

Vaughan

Company

Secretary

-

- - END - - -

About

Grant Thornton:

Grant

Thornton Australia Pty Ltd has more than 1,200 people working in offices in Adelaide, Brisbane, Cairns, Melbourne, Perth and Sydney.

Grant Thornton Australia provides assurance, tax, and advisory services to organisations in Australia and around the globe. As

a member firm of Grant Thornton International Ltd, Grant Thornton Australia is a part of a network with more than 47,000 people

in over 130 countries and is committed to promoting transparency, executing high quality audits, managing risks and upholding

independence.

Grant

Thornton Australia currently audits a significant number of Life Sciences companies a number of which are ASX and NASDAQ dual-listed

companies.

ABOUT

IMMURON:

Immuron

Ltd (ASX: IMC) is a biopharmaceutical company focused on developing and commercialising oral immunotherapeutics for the treatment

of many gut mediated diseases. Immuron has a unique and safe technology platform that enables a shorter development therapeutic

cycle. The Company currently markets and sells Travelan® for the prevention of travellers’ diarrhea whilst its lead

product candidate IMM-124E is in Phase 2 clinical trials for NASH and ASH. These products together with the Company’s other

preclinical immunotherapy pipeline products targeting immune-related diseases currently under development, will meet a large unmet

need in the market. For more information visit:

http://www.immuron.com

FORWARD-LOOKING

STATEMENTS:

This

press release may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of

1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. Such statements include, but are not limited to,

any statements relating to our growth strategy and product development programs and any other statements that are not historical

facts. Forward-looking statements are based on management’s current expectations and are subject to risks and uncertainties

that could negatively affect our business, operating results, financial condition and stock value. Factors that could cause actual

results to differ materially from those currently anticipated include: risks relating to our growth strategy; our ability to obtain,

perform under and maintain financing and strategic agreements and relationships; risks relating to the results of research and

development activities; risks relating to the timing of starting and completing clinical trials; uncertainties relating to preclinical

and clinical testing; our dependence on third-party suppliers; our ability to attract, integrate and retain key personnel; the

early stage of products under development; our need for substantial additional funds; government regulation; patent and intellectual

property matters; competition; as well as other risks described in our SEC filings. We expressly disclaim any obligation or undertaking

to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations

or any changes in events, conditions or circumstances on which any such statement is based, except as required by law.

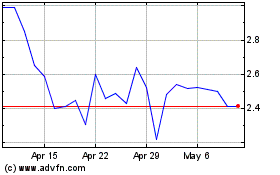

Immuron (NASDAQ:IMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

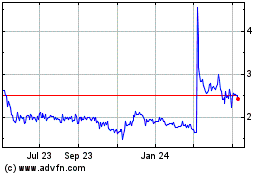

Immuron (NASDAQ:IMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024