Current Report Filing (8-k)

January 17 2018 - 5:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 10, 2018

HYATT HOTELS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-34521

|

|

20-1480589

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

150 North Riverside Plaza

Chicago, IL

|

|

60606

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (312)

750-1234

Former name or former address, if changed since last report: Not Applicable

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2

of the Securities Exchange Act of 1934 (17 CFR

§240.12b-2).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On January 10, 2018, Hyatt Hotels Corporation

(“Hyatt”) and Hotel Investors I, Inc., as Borrowers, certain subsidiaries of Hyatt (the “Guarantors”), various lenders, Wells Fargo Bank, National Association, as Administrative Agent, Bank of America, N.A., as Syndication Agent,

Wells Fargo Securities, LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Deutsche Bank Securities Inc., JPMorgan Chase Bank, N.A., and The Bank of Nova Scotia, as Joint Book Runners and

Co-Lead

Arrangers, and Deutsche Bank Securities, Inc., JPMorgan Chase Bank, N.A., The Bank of Nova Scotia, Goldman Sachs Lending Partners LLC, SunTrust Bank, and U.S. Bank National Association, as

Co-Documentation

Agents, entered into a First Amendment to Second Amended and Restated Credit Agreement (the “Amendment”). The Amendment provides for a $1.5 billion senior unsecured revolving credit

facility (the “Credit Facility”) that matures on January 10, 2023.

The Amendment amends that certain Second Amended and Restated Credit

Agreement, dated as of January 6, 2014, by and among Hyatt and Hotel Investors I, Inc., the guarantors party thereto, the lenders party thereto and Wells Fargo Bank, National Association, as Administrative Agent, and provides for the extension

of the Maturity Date of the Credit Facility to January 10, 2023 and for certain adjustments to the pricing of the Credit Facility, among other things.

The foregoing description of the Amendment is qualified in its entirety by reference to the text of the Amendment, a copy of which is attached hereto as

Exhibit 10.1 and incorporated herein by reference. The Amendment has been included as an exhibit to this filing to provide investors and security holders with information regarding its terms and is not intended to provide any other factual

information about Hyatt or any of its subsidiaries. The representations and warranties in the Amendment were made only for the purposes of the Amendment, as of a specified date, may be subject to a contractual standard of materiality different from

what might be viewed as material to stockholders, or may have been used for the purpose of allocating risk between the parties. Accordingly, the representations and warranties in the Amendment are not necessarily characterizations of the actual

state of facts concerning Hyatt or any of its subsidiaries at the time they were made or otherwise and should only be read in conjunction with the other information that Hyatt makes publicly available in reports, statements and other documents filed

with the Securities and Exchange Commission.

|

Item 2.02.

|

Results of Operations and Financial Condition

|

Reference is made to the Current Report on Form 8-K filed

by Hyatt with the SEC on December 14, 2017. As previously announced, on December 11, 2017, Hyatt received net cash proceeds of approximately $217 million related to the sale of Avendra LLC to Aramark Corporation. Upon further review and

analysis of the accounting treatment related to Hyatt’s receipt of such net proceeds, the Company expects to recognize a gain of approximately $217 million in equity earnings from unconsolidated hospitality ventures in conjunction with such

sale transaction, to be realized entirely in 2017. As previously announced, the gain will be characterized as a special item and recorded outside of Adjusted EBITDA, Adjusted Net Income and Adjusted EPS.

The information in this Item 2.02 of this Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or

otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by Hyatt Hotels Corporation under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as set forth by

specific reference in such filing.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an

Off-Balance

Sheet Arrangement of a Registrant.

|

The information included in Item 1.01 of this report is incorporated by reference into this Item 2.03.

|

Item 9.01:

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

10.1

|

|

First Amendment to that certain Second Amended and Restated Credit Agreement, dated as of January

10, 2018, among Hyatt Hotels Corporation and Hotel Investors I, Inc., as Borrowers, certain subsidiaries of Hyatt Hotels Corporation, as Guarantors, various Lenders and Wells Fargo Bank, National Association, as Administrative Agent

|

FORWARD-LOOKING STATEMENTS

Forward-Looking Statements in this Current Report on Form 8-K, which are not historical facts, are forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements include statements about our expected accounting treatment and results of operations, financial performance, prospects or future events and involve known and unknown risks that are

difficult to predict. As a result, our actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of

words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,”

“continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon

estimates and assumptions that, while considered reasonable by us and our management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, among others, the risks discussed in the

Company’s filings with the SEC, including our annual report on Form 10-K, which filings are available from the SEC. We caution you not to place undue reliance on any forward-looking statements, which are made only as of the date of this

Current Report on Form 8-K. We do not undertake or assume any obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors

affecting forward-looking statements, except to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other

forward-looking statement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Hyatt Hotels Corporation

|

|

|

|

|

|

|

Date: January 17, 2018

|

|

|

|

By:

|

|

/s/ Patrick J. Grismer

|

|

|

|

|

|

Name:

|

|

Patrick J. Grismer

|

|

|

|

|

|

Title:

|

|

Executive Vice President, Chief Financial Officer

|

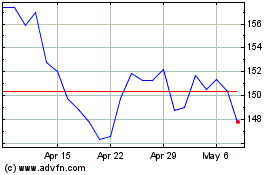

Hyatt Hotels (NYSE:H)

Historical Stock Chart

From Mar 2024 to Apr 2024

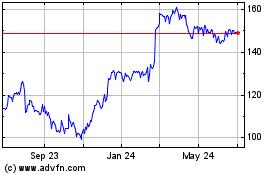

Hyatt Hotels (NYSE:H)

Historical Stock Chart

From Apr 2023 to Apr 2024