Fourth-Quarter GAAP Net Income Attributable

to Common Stock of $44 Million ($0.10 Per Diluted Share); Full-Year

GAAP Net Income Attributable to Common Stock of $273 Million ($0.62

Per Diluted Share)

Fourth-Quarter Core Earnings Attributable to

Common Stock, Excluding the Impact of the Tax Act, of $83 Million

($0.19 Per Diluted Share, an Increase of 22 Percent Compared to

Year-Ago Period); Full-Year Core Earnings Attributable to Common

Stock, Excluding the Impact of the Tax Act, of $317 Million ($0.72

Per Diluted Share, an Increase of 35 Percent Compared to Year-Ago

Period)

Private Education Loan Portfolio Grows to

$17.2 Billion, Up 22 Percent From Dec. 31, 2016

Sallie Mae (Nasdaq: SLM), formally SLM Corporation, today

released fourth-quarter and full-year 2017 financial results

reflecting GAAP net income attributable to the company’s common

stock of $44 million and $273 million, respectively. After

adjusting for the effects of the Tax Cuts and Jobs Act of 2017 (the

“Tax Act”), the financial results included core earnings

attributable to the company’s common stock of $83 million and $317

million for the fourth-quarter and full-year 2017, respectively,

reflecting core earnings per diluted share increases of 22 percent

and 35 percent, respectively, compared to the year-ago periods.

Absent the effect of the Tax Act, core earnings growth was driven

by a 22-percent increase in the private education loan portfolio,

an improved net interest margin, and operating efficiency

improvements. The Tax Act was signed into law on Dec. 22, 2017.

“We are pleased 2017 was another solid year as evidenced by

customer experience innovations, continued improvements in our net

interest margin, sound credit trends, increased operating

efficiency, and an expanding market share, which all contributed to

our strong earnings growth,” said Raymond J. Quinlan, chairman and

CEO. “Recent tax legislation will increase our earnings,

resulting in both higher profits and the opportunity to invest in

service upgrades, technological efficiencies, and diversified

product offerings, all of which will strengthen our franchise for

the future.”

For the fourth-quarter 2017, GAAP net income was $47 million,

compared with $70 million in the year-ago quarter. GAAP net income

attributable to the company’s common stock was $44 million ($0.10

diluted earnings per share) in the fourth-quarter 2017, compared

with $65 million ($0.15 diluted earnings per share) in the

year-ago quarter. The year-over-year decrease was primarily

attributable to the required accounting treatment for the effects

of the Tax Act.

The Tax Act lowered federal corporate tax rates from 35 percent

to 21 percent, beginning in 2018. Because the Tax Act was enacted

during the fourth-quarter 2017, the company was required to reflect

the application of the lower tax rate in future years to its

deferred tax assets, liabilities and indemnification receivables.

Therefore, at Dec. 31, 2017, the company recorded a provisional

estimate which resulted in a $15 million net increase in tax

expense and reduced non-interest income by $24 million to

reflect the effect of the lower tax rate. Absent the impact of the

Tax Act, GAAP net income would have been $86 million and GAAP

net income attributable to the company’s common stock would have

been $82 million ($0.19 diluted earnings per share) in the

fourth-quarter 2017. For a reconciliation of the effect of the Tax

Act on the GAAP Consolidated Statements of Income of the company,

see page 11 of this release.

For 2017, GAAP net income was $289 million, compared with $250

million in 2016. GAAP net income attributable to the company’s

common stock was $273 million ($0.62 diluted earnings per share) in

2017, compared with $229 million ($0.53 diluted earnings per

share) in 2016. Absent the impact of the Tax Act, GAAP net income

would have been $328 million, and GAAP net income attributable

to the company’s common stock would have been $312 million ($0.71

diluted earnings per share) in 2017.

Fourth-quarter 2017 results vs. fourth-quarter 2016

included:

- Private education loan originations of

$634 million, up 4 percent.

- Net interest income of $309 million, up

26 percent.

- Net interest margin of 6.00 percent, up

45 basis points.

- Average private education loans

outstanding of $17.3 billion, up 23 percent.

- Average yield on the private education

loan portfolio was 8.61 percent, up 53 basis points.

- Private education loan provision for

loan losses was $49 million, up from $43 million.

- Private education loans in forbearance

were 3.7 percent of private education loans in repayment and

forbearance, up from 3.5 percent.

- Private education loan delinquencies as

a percentage of private education loans in repayment were 2.4

percent, up from 2.1 percent.

Core earnings for the fourth-quarter 2017 were $47 million,

compared with $73 million in the year-ago quarter. Core earnings

attributable to the company’s common stock were $44 million ($0.10

diluted earnings per share) in the fourth-quarter 2017, compared

with $67 million ($0.15 diluted earnings per share) in the

year-ago quarter. Absent the impact of the Tax Act, core earnings

would have been $86 million, and core earnings attributable to the

company’s common stock would have been $83 million ($0.19

diluted earnings per share) in the fourth-quarter 2017.

Core earnings for 2017 were $294 million, compared with $252

million for 2016. Core earnings attributable to the company’s

common stock were $278 million ($0.63 diluted earnings per share)

for 2017, compared with $231 million ($0.53 diluted earnings per

share) for 2016. Absent the impact of the Tax Act, core earnings

would have been $333 million, and core earnings attributable to the

company’s common stock would have been $317 million ($0.72 diluted

earnings per share) for 2017.

Fourth-quarter 2017 and full-year 2017 GAAP results included $1

million and $8 million, respectively, of pre-tax losses from

derivative accounting treatment that are excluded from core

earnings results, vs. pre-tax losses of $4 million and

$3 million, respectively, in the year-ago periods.

Sallie Mae provides core earnings because it is one of several

measures used to evaluate management performance and allocate

corporate resources. The difference between core earnings and GAAP

net income is driven by mark-to-market unrealized gains and losses

on derivative contracts recognized in GAAP net income, but not in

core earnings results. Management believes its derivatives are

effective economic hedges, and, as such, they are a critical

element of the company’s interest rate risk management

strategy.

Total Non-Interest Income and Expenses

In the fourth-quarter 2017, to reflect the application of the

Tax Act’s lower rate in future years, the company reduced other

income by $24 million due to a lower valuation of tax

indemnification receivables. Unrelated to the Tax Act, the company

also reduced other income by $9 million due to the expiration of a

portion of indemnified uncertain tax positions. Tax expense was

reduced by corresponding amounts for both of these items. Absent

these two tax-related items, other income was $2 million lower than

in the fourth-quarter 2016 primarily due to reduced credit card

revenue from the company’s Upromise subsidiary.

Total non-interest expenses were $119 million in the

fourth-quarter 2017, compared with $98 million in the year-ago

quarter. Operating expenses grew 21 percent from the year-ago

quarter, and the non-GAAP operating efficiency ratio increased to

41.2 percent in the fourth-quarter 2017, from 37.9 percent in

the year-ago quarter. Absent the impact of the Tax Act and the

reduction in indemnified uncertain tax positions that, when

combined, reduced other income by $32 million, the non-GAAP

operating efficiency ratio would have been 37.1 percent for the

fourth-quarter 2017.

Excluding FDIC assessment fees, which grew 32 percent as a

result of a 22-percent increase in its private education loan

portfolio, non-interest expenses grew 20 percent from the

year-ago quarter. The increase in operating expenses was driven by

the growth in the portfolio and investments associated with the

development of the company’s graduate school loan program, the

personal loan product and investments in the brand to support the

core business and diversification efforts.

Total non-interest expenses were $449 million for 2017, compared

with $386 million for 2016. Full-year operating expenses grew 16

percent year-over-year, while the non-GAAP operating efficiency

ratio decreased to 39.6 percent in 2017 from 40.1 percent in

2016. Absent the impact of the Tax Act and the reduction in

indemnified uncertain tax positions that, when combined, reduced

other income by $35 million in 2017, the non-GAAP operating

efficiency ratio would have been 38.4 percent for 2017.

Income Tax Expense

Income tax expense increased to $66 million in the

fourth-quarter 2017 from $43 million in the year-ago quarter. The

effective income tax rate in fourth-quarter 2017 was 58.5 percent,

an increase from 38.0 percent in the year-ago quarter. The increase

in the effective tax rate was primarily the result of the one-time

revaluation of the company’s deferred tax assets and liabilities to

apply the Tax Act’s lower rate in future years. The company

recorded a provisional estimate which resulted in a $15 million net

increase in tax expense from the revaluation of an indemnified

liability (a $23 million reduction in expense) and all other

deferred tax assets and liabilities (a $38 million increase in

expense). Unrelated to the Tax Act, the company recorded a

$9 million decrease in tax expense due to the previously

mentioned expiration of a portion of indemnified uncertain tax

positions. Absent these three items, the company’s effective tax

rate for the fourth-quarter 2017 would have been 41.1 percent.

Income tax expense increased to $203 million in 2017 from $164

million in 2016. The company’s effective income tax rate increased

to 41.2 percent in 2017 from 39.6 percent in 2016.

The company expects its effective income tax rate to be

approximately 26 percent in 2018 as a result of the Tax Act.

Capital

The regulatory capital ratios of the company’s Sallie Mae Bank

subsidiary continue to exceed guidelines for institutions

considered “well capitalized.” At Dec. 31, 2017, Sallie Mae Bank’s

regulatory capital ratios were as follows:

Dec. 31,

2017

“Well Capitalized”Regulatory Requirements

Common Equity Tier 1 Capital (to Risk-Weighted Assets) 12.0 percent

6.5 percent Tier 1 Capital (to Risk-Weighted Assets) 12.0 percent

8.0 percent Total Capital (to Risk-Weighted Assets) 13.3 percent

10.0 percent Tier 1 Capital (to Average Assets) 11.2 percent 5.0

percent

Deposits

Deposits at the company totaled $15.5 billion ($8.2 billion in

brokered deposits and $7.3 billion in retail and other deposits) at

Dec. 31, 2017, compared with $13.4 billion ($7.1 billion in

brokered deposits and $6.3 billion in retail and other deposits) at

Dec. 31, 2016.

Guidance

The company expects 2018 results to be as follows:

- Full-year diluted core earnings per

share: $0.97 - $1.01.

- Full-year private education loan

originations of $5.0 billion.

- Full-year non-GAAP operating efficiency

ratio: 37 percent - 38 percent.

The company plans to make investments in 2018 that will

accelerate the diversification of its consumer lending platform

into the personal loan and credit card businesses. In addition, the

company will invest in several technology infrastructure projects,

including migrating infrastructure to the cloud. These investments

will total up to $30 million and are expected to add revenue and

improve efficiency in future years. The impact of these investments

is included in the guidance provided above.

***

Sallie Mae will host an earnings conference call tomorrow,

Jan. 18, 2018, at 8 a.m. EST. Sallie Mae executives will be on

hand to discuss various highlights of the quarter and to answer

questions related to Sallie Mae’s performance. Individuals

interested in participating in the call should dial 877-356-5689

(USA and Canada) or dial 706-679-0623 (international) and use

access code 4876499 starting at 7:45 a.m. EST. A live audio webcast

of the conference call may be accessed at

www.SallieMae.com/investors. A replay of the conference call will

be available approximately two hours after the call’s conclusion

and will remain available through Feb. 7, 2018, by dialing

855-859-2056 (USA and Canada) or 404-537-3406 (international) with

access code 4876499.

Presentation slides for the conference call may be accessed at

www.SallieMae.com/investors under the webcasts tab.

This press release contains “forward-looking statements” and

information based on management’s current expectations as of the

date of this release. Statements that are not historical facts,

including statements about the company’s beliefs, opinions or

expectations and statements that assume or are dependent upon

future events, are forward-looking statements. Forward-looking

statements are subject to risks, uncertainties, assumptions and

other factors that may cause actual results to be materially

different from those reflected in such forward-looking statements.

These factors include, among others, the risks and uncertainties

set forth in Item 1A “Risk Factors” and elsewhere in the

company’s Annual Report on Form 10-K for the year ended

Dec. 31, 2016 (filed with the Securities and Exchange

Commission (“SEC”) on Feb. 24, 2017) and subsequent filings with

the SEC; increases in financing costs; limits on liquidity;

increases in costs associated with compliance with laws and

regulations; failure to comply with consumer protection, banking

and other laws; changes in accounting standards and the impact of

related changes in significant accounting estimates; any adverse

outcomes in any significant litigation to which the company is a

party; credit risk associated with the company’s exposure to third

parties, including counterparties to the company’s derivative

transactions; and changes in the terms of education loans and the

educational credit marketplace (including changes resulting from

new laws and the implementation of existing laws). The company

could also be affected by, among other things: changes in its

funding costs and availability; reductions to its credit ratings;

failures or breaches of its operating systems or infrastructure,

including those of third-party vendors; damage to its reputation;

risks associated with restructuring initiatives, including failures

to successfully implement cost-cutting and restructuring

initiatives and the adverse effects of such initiatives on the

company’s business; changes in the demand for educational financing

or in financing preferences of lenders, educational institutions,

students and their families; changes in law and regulations with

respect to the student lending business and financial institutions

generally; changes in banking rules and regulations, including

increased capital requirements; increased competition from banks

and other consumer lenders; the creditworthiness of the company’s

customers; changes in the general interest rate environment,

including the rate relationships among relevant money-market

instruments and those of the company’s earning assets versus the

company’s funding arrangements; rates of prepayments on the loans

made by the company and its subsidiaries; changes in general

economic conditions and the company’s ability to successfully

effectuate any acquisitions; and other strategic initiatives. The

preparation of the company’s consolidated financial statements also

requires management to make certain estimates and assumptions,

including estimates and assumptions about future events. These

estimates or assumptions may prove to be incorrect. All

forward-looking statements contained in this release are qualified

by these cautionary statements and are made only as of the date of

this release. The company does not undertake any obligation to

update or revise these forward-looking statements to conform such

statements to actual results or changes in its expectations.

The company reports financial results on a GAAP basis and also

provides certain “Core Earnings” performance measures. The

difference between the company’s “Core Earnings” and GAAP results

for the periods presented were the unrealized, mark-to-market

gains/losses on derivative contracts (excluding current period

accruals on the derivative instruments), net of tax. These are

recognized in GAAP, but not in “Core Earnings” results. The company

provides “Core Earnings” measures because this is what management

uses when making management decisions regarding the company’s

performance and the allocation of corporate resources. The

company’s “Core Earnings” are not defined terms within GAAP and may

not be comparable to similarly titled measures reported by other

companies.

For additional information, see “Management’s Discussion and

Analysis of Financial Condition and Results of Operations — GAAP

Consolidated Earnings Summary -‘Core Earnings’ ” in the company’s

Form 10-Q for the quarter ended Sept. 30, 2017 for a further

discussion and the “‘Core Earnings’ to GAAP Reconciliation” table

in this press release for a complete reconciliation between GAAP

net income and “Core Earnings.”

In 2016, our non-GAAP operating efficiency ratio was calculated

for the periods presented as the ratio of (a) the total

non-interest expense numerator to (b) the net revenue denominator

(which consisted of net interest income, before provision for

credit losses, plus non-interest income).

In the first-quarter 2017, we began calculating and reporting

our non-GAAP operating efficiency ratio as the ratio of (a) the

total non-interest expense numerator to (b) the net revenue

denominator (which consists of the sum of net interest income,

before provision for credit losses, and non-interest income, and

the net impact of derivative accounting as defined in the “‘Core

Earnings’ to GAAP Reconciliation” table in this Press Release). We

believe this change will improve visibility into our management of

operating expenses over time and eliminate the variability in this

ratio that may be related to the changes in fair value of our

derivative contracts that we consider economic hedges and which do

not affect how we manage operating expenses. This change conforms

the treatment of our hedging activities in our operating efficiency

ratio to our non-GAAP “Core Earnings” measure. The impact of this

change on the non-GAAP operating efficiency ratio reported in each

of our prior quarterly and annual periods is immaterial. This ratio

provides useful information to investors because it is a measure

used by our management team to monitor our effectiveness in

managing operating expenses. Other companies may use similarly

titled non-GAAP financial measures that are calculated differently

from our ratio. Accordingly, our non-GAAP operating efficiency

ratio may not be comparable to similar measures used by other

companies.

The fourth-quarter 2017 and full-year 2017 financial results

reported in this press release reflect the required accounting

treatment for the estimated effects of the Tax Act. We also report

in this press release certain fourth-quarter 2017 and full-year

2017 financial statement items absent the effects of the Tax Act,

including a reconciliation on page 11 of this press release of the

effect of the Tax Act on the GAAP Consolidated Statements of

Income. (Estimated effects may be refined in future periods as

further information becomes available.) We believe this additional

disclosure will be helpful to investors by illustrating and

quantifying the impact of the required accounting treatment for the

effects of the Tax Act. In addition, management will use the

financial results absent the effect of the Tax Act as a basis for

making management decisions regarding the company’s performance in

2017. Our financial results absent the effect of the Tax Act are

unique to our company, are not defined terms within GAAP and may

not be comparable to adjustments made by, or to similarly captioned

measures reported by, other companies.

***

Sallie Mae (Nasdaq: SLM) is the nation’s saving,

planning, and paying for college company. Whether college is a long

way off or just around the corner, Sallie Mae offers products that

promote responsible personal finance, including private

education loans, Upromise rewards, scholarship search, college

financial planning tools, and online retail banking. Learn more

at SallieMae.com. Commonly known as Sallie Mae, SLM

Corporation and its subsidiaries are not sponsored by or agencies

of the United States of America.

Selected Financial Information and

Ratios

(Unaudited)

Quarters Ended Years Ended

December 31, December 31,

(In thousands,

except per share data and percentages)

2017 2016 2017 2016

Net income attributable to SLM Corporation common stock $

43,866 $ 64,736 $ 273,220 $ 229,123 Diluted earnings per common

share attributable to SLM Corporation $ 0.10 $ 0.15 $ 0.62 $ 0.53

Weighted average shares used to compute diluted earnings per share

438,932 435,419 438,551 432,919 Return on assets 0.9 % 1.5 % 1.4 %

1.5 % Non-GAAP operating efficiency ratio - old method(1) 41.3 %

38.6 % 39.9 % 40.2 % Non-GAAP operating efficiency ratio - new

method(2) 41.2 % 37.9 % 39.6 % 40.1 %

Other Operating

Statistics Ending Private Education Loans, net $ 17,244,830 $

14,113,409 $ 17,244,830 $ 14,113,409 Ending FFELP Loans, net

929,159 1,011,678 929,159

1,011,678 Ending total education loans, net $ 18,173,989

$ 15,125,087 $ 18,173,989 $ 15,125,087

Average education loans $ 18,258,153 $ 15,082,071 $

17,147,089 $ 13,811,081

_________ (1) In 2016, our non-GAAP operating efficiency ratio was

calculated for the periods presented as the ratio of (a) the total

non-interest expense numerator to (b) the net revenue denominator

(which consisted of net interest income, before provision for

credit losses, plus non-interest income). (2) In the

first-quarter 2017, we began calculating and reporting our non-GAAP

operating efficiency ratio as the ratio of (a) the total

non-interest expense numerator to (b) the net revenue denominator

(which consists of the sum of net interest income, before provision

for credit losses, and non-interest income, and the net impact of

derivative accounting as defined in the “‘Core Earnings’ to GAAP

Reconciliation” table in this Press Release). We believe this

change will improve visibility into our management of operating

expenses over time and eliminate the variability in this ratio that

may be related to the changes in fair value of our derivative

contracts that we consider economic hedges and which do not affect

how we manage operating expenses. This change conforms the

treatment of our hedging activities in our operating efficiency

ratio to our non-GAAP “Core Earnings” measure. The impact of this

change on the non-GAAP operating efficiency ratio reported in each

of our prior quarterly and annual periods is immaterial. This ratio

provides useful information to investors because it is a measure

used by our management team to monitor our effectiveness in

managing operating expenses. Other companies may use similarly

titled non-GAAP financial measures that are calculated differently

from our ratio. Accordingly, our non-GAAP operating efficiency

ratio may not be comparable to similar measures used by other

companies.

SLM CORPORATION

CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per

share amounts)

(Unaudited)

December 31, December 31,

2017 2016 Assets Cash and cash equivalents $

1,534,339 $ 1,918,793 Available-for-sale investments at fair value

(cost of $247,607 and $211,406, respectively) 244,088 208,603 Loans

held for investment (net of allowance for losses of $251,475 and

$184,701, respectively) 18,567,641 15,137,922 Restricted cash and

investments 101,836 53,717 Other interest-earning assets 21,586

49,114 Accrued interest receivable 967,482 766,106 Premises and

equipment, net 89,748 87,063 Tax indemnification receivable 168,011

259,532 Other assets 84,853 52,153

Total assets $ 21,779,584 $ 18,533,003

Liabilities Deposits $ 15,505,383 $ 13,435,667 Long-term

borrowings 3,275,270 2,167,979 Income taxes payable, net 102,285

184,324 Upromise related liabilities 243,080 256,041 Other

liabilities 179,310 141,934 Total

liabilities 19,305,328 16,185,945

Commitments and contingencies Equity

Preferred stock, par value $0.20 per share, 20 million shares

authorized: Series A: 0 and 3.3 million shares issued,

respectively, at stated value of $50 per share — 165,000 Series B:

4 million and 4 million shares issued, respectively, at stated

value of $100 per share 400,000 400,000 Common stock, par value

$0.20 per share, 1.125 billion shares authorized: 443.5 million and

436.6 million shares issued, respectively 88,693 87,327 Additional

paid-in capital 1,222,277 1,175,564 Accumulated other comprehensive

income (loss) (net of tax expense (benefit) of $1,696 and ($5,364),

respectively) 2,748 (8,671 ) Retained earnings 868,182

595,322 Total SLM Corporation stockholders’

equity before treasury stock 2,581,900 2,414,542 Less: Common stock

held in treasury at cost: 11.1 million and 7.7 million shares,

respectively (107,644 ) (67,484 ) Total equity

2,474,256 2,347,058 Total liabilities and

equity $ 21,779,584 $ 18,533,003

SLM CORPORATION

CONSOLIDATED STATEMENTS OF

INCOME

(In thousands, except per share

amounts)

(Unaudited)

Quarters Ended Years Ended

December 31, December 31, 2017

2016 2017 2016 Interest income:

Loans $ 392,399 $ 295,241 $ 1,413,505 $ 1,060,487 Investments 2,016

2,005 8,288 9,160 Cash and cash equivalents 5,081

2,767 15,510 7,599 Total

interest income 399,496 300,013 1,437,303 1,077,246

Interest

expense: Deposits 66,218 40,775 223,691 148,408 Interest

expense on short-term borrowings 2,107 1,495 6,341 7,322 Interest

expense on long-term borrowings 21,980 12,309

78,050 30,178 Total interest

expense 90,305 54,579 308,082

185,908 Net interest income 309,191 245,434

1,129,221 891,338 Less: provisions for credit losses 55,324

43,226 185,765 159,405

Net interest income after provisions for credit losses

253,867 202,208 943,456

731,933

Non-interest income (loss): Gains on

sales of loans, net — 230 — 230 Losses on derivatives and hedging

activities, net (940 ) (4,114 ) (8,266 ) (958 ) Other income (loss)

(21,066 ) 13,235 5,364

69,544 Total non-interest income (loss) (22,006 )

9,351 (2,902 ) 68,816

Non-interest expenses: Compensation and benefits 55,796

45,337 213,319 183,996 FDIC assessment fees 7,473 5,661 28,950

19,209 Other operating expenses 55,281 47,038

206,351 182,202 Total operating

expenses 118,550 98,036 448,620 385,407 Acquired intangible asset

amortization expense 118 159 469

906 Total non-interest expenses 118,668

98,195 449,089 386,313

Income before income tax expense 113,193 113,364 491,465

414,436 Income tax expense 66,190 43,122

202,531 164,109

Net

income 47,003 70,242 288,934 250,327 Preferred stock dividends

3,137 5,506 15,714

21,204 Net income attributable to SLM Corporation common

stock $ 43,866 $ 64,736 $ 273,220 $ 229,123

Basic earnings per common share attributable to SLM

Corporation $ 0.10 $ 0.15 $ 0.63 $ 0.54

Average common shares outstanding 431,980

428,368 431,216 427,876 Diluted

earnings per common share attributable to SLM Corporation $ 0.10

$ 0.15 $ 0.62 $ 0.53 Average common and

common equivalent shares outstanding 438,932

435,419 438,551 432,919

SLM CORPORATION

CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME

(In thousands)

(Unaudited)

Quarters Ended Years Ended

December 31, December 31, 2017

2016 2017 2016 Net income $ 47,003 $

70,242 $ 288,934 $ 250,327 Other comprehensive income (loss):

Unrealized losses on investments (50 ) (6,515 ) (716 ) (1,792 )

Unrealized gains on cash flow hedges 11,631

37,546 19,195 13,764 Total

unrealized gains 11,581 31,031 18,479 11,972 Income tax expense

(4,416 ) (11,889 ) (7,060 ) (4,584 )

Other comprehensive income, net of tax expense 7,165

19,142 11,419 7,388 Total

comprehensive income $ 54,168 $ 89,384 $ 300,353

$ 257,715

“Core Earnings” to GAAP Reconciliation

The following table reflects adjustments associated with our

derivative activities..

Quarters Ended Years Ended December

31, December 31,

(Dollars in

thousands, except per share amounts)

2017 2016 2017 2016

“Core Earnings” adjustments to GAAP: GAAP net income

$ 47,003 $ 70,242 $ 288,934 $ 250,327 Preferred stock dividends

3,137 5,506 15,714 21,204 GAAP net

income attributable to SLM Corporation common stock $ 43,866 $

64,736 $ 273,220 $ 229,123 Adjustments: Net impact of

derivative accounting(1) 706 4,386 8,197 3,127 Net tax effect(2)

270 1,682 3,131 1,199 Total “Core

Earnings” adjustments to GAAP 436 2,704 5,066

1,928 “Core Earnings” attributable to SLM Corporation

common stock $ 44,302 $ 67,440 $ 278,286 $ 231,051 GAAP

diluted earnings per common share $ 0.10 $ 0.15 $ 0.62 $ 0.53

Derivative adjustments, net of tax — — 0.01

— “Core Earnings” diluted earnings per common share $ 0.10 $

0.15 $ 0.63 $ 0.53 ______ (1) Derivative Accounting: “Core

Earnings” exclude periodic unrealized gains and losses caused by

the mark-to-market valuations on derivatives that do not qualify

for hedge accounting treatment under GAAP, as well as the periodic

unrealized gains and losses that are a result of ineffectiveness

recognized related to effective hedges under GAAP (but include

current period accruals on derivative instruments), net of tax.

Under GAAP, for our derivatives held to maturity, the cumulative

net unrealized gain or loss over the life of the contract will

equal $0. (2) “Core Earnings” tax rate is based on the

effective tax rate at the Bank where the derivative instruments are

held.

Reconciliation of the Effect of the Tax

Act on the GAAP Consolidated Statements of Income

Quarter Ended Year Ended

December 31, 2017 December 31, 2017

(Dollars in

thousands, except per share amounts)

AsReported

Tax ActAdjustments

Adjusted(Non-GAAP)

AsReported

Tax ActAdjustments

Adjusted(Non-GAAP)

Net interest income $ 309,191 $ — $ 309,191 $ 1,129,221 $ —

$ 1,129,221 Less: provisions for credit losses 55,324

— 55,324 185,765 —

185,765 Net interest income after provisions for credit

losses 253,867 — 253,867 943,456 — 943,456 Total

non-interest income (loss) (22,006 ) 23,532

(1)

1,526 (2,902 ) 23,532

(1)

20,630 Total non-interest expenses 118,668 —

118,668 449,089 —

449,089 Income before income tax expense 113,193 23,532 136,725

491,465 23,532 514,997 Income tax expense 66,190

(15,035 )

(2)

51,155 202,531 (15,035 )

(2)

187,496

Net income 47,003 38,567 85,570 288,934

38,567 327,501 Preferred stock dividends 3,137

— 3,137 15,714 —

15,714 Net income attributable to SLM Corporation common stock $

43,866 $ 38,567 $ 82,433 $ 273,220 $ 38,567

$ 311,787 Basic earnings per common share

attributable to SLM Corporation $ 0.10 $ 0.09 $ 0.19

$ 0.63 $ 0.09 $ 0.72 Average common shares

outstanding 431,980 — 431,980

431,216 — 431,216 Diluted

earnings per common share attributable to SLM Corporation $ 0.10

$ 0.09 $ 0.19 $ 0.62 $ 0.09 $ 0.71

Average common and common equivalent shares outstanding

438,932 — 438,932 438,551

— 438,551 ______ (1) Represents

the reduction in a tax-related indemnification receivable due to

the lower federal corporate tax rate set forth in the Tax Act.

(2) Represents the net reduction in deferred tax assets and

liabilities due to the lower federal corporate tax rate set forth

in the Tax Act.

Average Balance Sheets - GAAP

The following table reflects the rates earned on

interest-earning assets and paid on interest-bearing liabilities

and reflects our net interest margin on a consolidated basis.

Quarters Ended Years Ended December

31, December 31, 2017 2016

2017 2016

(Dollars in

thousands)

Balance Rate Balance Rate

Balance Rate Balance Rate

Average Assets Private Education Loans $ 17,318,182 8.61 % $

14,057,669 8.08 % $ 16,176,351 8.43 % $ 12,747,756 8.02 % FFELP

Loans 939,971 4.07 1,024,402 3.71 970,738 3.91 1,063,325 3.53

Personal and other loans 265,113 10.22 3,496 7.50 112,857 9.89

1,114 6.77 Taxable securities 316,378 2.52 479,384 1.65 326,757

2.53 407,860 2.24 Cash and other short-term investments 1,604,619

1.26 2,017,081 0.55 1,454,344

1.07 1,480,170 0.51 Total interest-earning

assets 20,444,263 7.75 % 17,582,032 6.79 % 19,041,047 7.55 %

15,700,225 6.86 % Non-interest-earning assets 1,331,197

816,337 1,104,598 772,167 Total

assets $ 21,775,460 $ 18,398,369 $ 20,145,645

$ 16,472,392

Average Liabilities and Equity

Brokered deposits $ 7,923,341 1.87 % $ 7,302,429 1.32 % $ 7,224,869

1.75 % $ 7,154,218 1.31 % Retail and other deposits 7,351,063 1.55

5,961,087 1.09 6,939,520 1.40 5,095,631 1.06 Other interest-bearing

liabilities(1) 3,261,087 2.94 2,205,726 2.51

2,932,681 2.88 1,476,740 2.58

Total interest-bearing liabilities 18,535,491 1.93 % 15,469,242

1.40 % 17,097,070 1.80 % 13,726,589 1.35 %

Non-interest-bearing liabilities 778,258 624,285 647,294 539,215

Equity 2,461,711 2,304,842 2,401,281 2,206,588

Total liabilities and equity $ 21,775,460 $

18,398,369 $ 20,145,645 $ 16,472,392

Net interest margin 6.00 % 5.55 % 5.93 % 5.68 % ______ (1)

Includes the average balance of our unsecured borrowing, as well as

secured borrowings and amortization expense of transaction costs

related to our term asset-backed securitizations and our

asset-backed commercial paper funding facility.

Earnings per Common Share

Quarters Ended Years Ended December 31,

December 31,

(In thousands,

except per share data)

2017 2016 2017 2016

Numerator: Net income $ 47,003 $ 70,242 $ 288,934 $ 250,327

Preferred stock dividends 3,137 5,506 15,714

21,204 Net income attributable to SLM Corporation common stock $

43,866 $ 64,736 $ 273,220 $ 229,123

Denominator: Weighted average shares used to compute basic

EPS 431,980 428,368 431,216 427,876 Effect of dilutive securities:

Dilutive effect of stock options, restricted stock, restricted

stock units and Employee Stock Purchase Plan (“ESPP”)(1)(2) 6,952

7,051 7,335 5,043 Weighted average shares used

to compute diluted EPS 438,932 435,419 438,551

432,919

Basic earnings per common share attributable to

SLM Corporation: $ 0.10 $ 0.15 $ 0.63 $

0.54

Diluted earnings per common share attributable to

SLM Corporation: $ 0.10 $ 0.15 $ 0.62 $

0.53 __________

(1)

Includes the potential dilutive effect of additional common

shares that are issuable upon exercise of outstanding stock

options, restricted stock, restricted stock units, and the

outstanding commitment to issue shares under the ESPP, determined

by the treasury stock method.

(2)

For the quarters ended December 31, 2017, and 2016, securities

covering 0 and less than 1 million shares, respectively, and for

the years ended December 31, 2017 and 2016, securities covering 0

and approximately 1 million shares, respectively, were outstanding

but not included in the computation of diluted earnings per share

because they were anti-dilutive.

Allowance for Loan Losses

Metrics

Quarter Ended December 31, 2017

(Dollars in

thousands)

FFELPLoans

Private EducationLoans

PersonalLoans

Total Allowance for Loan Losses: Beginning

balance $ 1,352 $ 227,167 $ 1,400 $ 229,919 Total provision 76

49,437 5,558 55,071 Net charge-offs: Charge-offs (296 ) (36,828 )

(339 ) (37,463 ) Recoveries — 5,419 9 5,428

Net charge-offs (296 ) (31,409 ) (330 ) (32,035 ) Loan

sales(1) — (1,480 ) (1,480 ) Ending Balance $ 1,132

$ 243,715 $ 6,628 $ 251,475 Allowance:

Ending balance: individually evaluated for impairment $ — $ 94,682

$ — $ 94,682 Ending balance: collectively evaluated for impairment

$ 1,132 $ 149,033 $ 6,628 $ 156,793 Loans: Ending balance:

individually evaluated for impairment $ — $ 990,351 $ — $ 990,351

Ending balance: collectively evaluated for impairment $ 927,660 $

16,441,816 $ 400,280 $ 17,769,756 Net charge-offs as a percentage

of average loans in repayment (annualized)(2) 0.17 % 1.07 % 0.50 %

Allowance as a percentage of the ending total loan balance 0.12 %

1.40 % 1.66 % Allowance as a percentage of the ending loans in

repayment(2) 0.15 % 2.00 % 1.66 % Allowance coverage of net

charge-offs (annualized) 0.96 1.94 5.02 Ending total loans, gross $

927,660 $ 17,432,167 $ 400,280 Average loans in repayment(2) $

711,614 $ 11,740,773 $ 264,876 Ending loans in repayment(2) $

746,456 $ 12,206,033 $ 400,280 ________

(1)

Represents fair value adjustments on loans

sold.

(2)

Loans in repayment include loans on which

borrowers are making interest only or fixed payments, as well as

loans that have entered full principal and interest repayment

status after any applicable grace period.

Quarter

Ended December 31, 2016

(Dollars in

thousands)

FFELP

Loans

Private Education

Loans

Personal

Loans

Total Allowance for Loan Losses: Beginning balance $

2,209 $ 162,630 $ — $ 164,839 Total provision 224 42,808 58 43,090

Net charge-offs: Charge-offs (262 ) (25,224 ) — (25,486 )

Recoveries — 3,284 —

3,284 Net charge-offs (262 ) (21,940 ) — (22,202 )

Loan sales(1) — (1,026 ) —

(1,026 ) Ending Balance $ 2,171 $ 182,472 $ 58

$ 184,701 Allowance: Ending balance: individually

evaluated for impairment $ — $ 86,930 $ — $ 86,930 Ending balance:

collectively evaluated for impairment $ 2,171 $ 95,542 $ 58 $

97,771 Loans: Ending balance: individually evaluated for impairment

$ — $ 612,606 $ — $ 612,606 Ending balance: collectively evaluated

for impairment $ 1,010,908 $ 13,639,069 $ 12,894 $ 14,662,871 Net

charge-offs as a percentage of average loans in repayment

(annualized)(2) 0.13 % 0.95 % — % Allowance as a percentage of the

ending total loan balance 0.21 % 1.28 % — % Allowance as a

percentage of the ending loans in repayment(2) 0.28 % 1.88 % — %

Allowance coverage of net charge-offs (annualized) 2.07 2.08 —

Ending total loans, gross $ 1,010,908 $ 14,251,675 $ — Average

loans in repayment(2) $ 788,196 $ 9,265,149 $ — Ending loans in

repayment(2) $ 786,332 $ 9,709,758 $ — ________

(1)

Represents fair value adjustments on loans sold.

(2)

Loans in repayment include loans on which borrowers are making

interest only or fixed payments, as well as loans that have entered

full principal and interest repayment status after any applicable

grace period.

Year Ended December 31, 2017

(Dollars in

thousands)

FFELP

Loans

Private Education

Loans

Personal

Loans

Total Allowance for Loan Losses: Beginning balance $

2,171 $ 182,472 $ 58 $ 184,701 Total provision (85 ) 178,542 7,138

185,595 Net charge-offs: Charge-offs (954 ) (130,063 ) (579 )

(131,596 ) Recoveries — 17,635

11 17,646 Net charge-offs (954 ) (112,428 )

(568 ) (113,950 ) Loan sales(1) — (4,871 )

— (4,871 ) Ending Balance $ 1,132 $

243,715 $ 6,628 $ 251,475 Allowance: Ending

balance: individually evaluated for impairment $ — $ 94,682 $ — $

94,682 Ending balance: collectively evaluated for impairment $

1,132 $ 149,033 $ 6,628 $ 156,793 Loans: Ending balance:

individually evaluated for impairment $ — $ 990,351 $ — $ 990,351

Ending balance: collectively evaluated for impairment $ 927,660 $

16,441,816 $ 400,280 $ 17,769,756 Net charge-offs as a percentage

of average loans in repayment(2) 0.13 % 1.03 % 0.47 % Allowance as

a percentage of the ending total loan balance 0.12 % 1.40 % 1.66 %

Allowance as a percentage of the ending loans in repayment(2) 0.15

% 2.00 % 1.66 % Allowance coverage of net charge-offs 1.19 2.17

11.67 Ending total loans, gross $ 927,660 $ 17,432,167 $ 400,280

Average loans in repayment(2) $ 745,039 $ 10,881,058 $ 119,606

Ending loans in repayment(2) $ 746,456 $ 12,206,033 $ 400,280

______

(1)

Represents fair value adjustments on loans sold.

(2)

Loans in repayment include loans on which borrowers are making

interest only or fixed payments, as well as loans that have entered

full principal and interest repayment status after any applicable

grace period.

Year Ended December 31,

2016

(Dollars in

thousands)

FFELPLoans

Private EducationLoans

PersonalLoans

Total Allowance for Loan Losses:

Beginning balance $ 3,691 $ 108,816 $ — $ 112,507 Total provision

(172 ) 159,511 58 159,397 Net charge-offs: Charge-offs (1,348 )

(90,203 ) — (91,551 ) Recoveries — 10,382 —

10,382 Net charge-offs (1,348 ) (79,821 ) — (81,169 ) Loan

sales(1) — (6,034 ) — (6,034 ) Ending Balance $ 2,171

$ 182,472 $ 58 $ 184,701 Allowance:

Ending balance: individually evaluated for impairment $ —

$

86,930

$ — $ 86,930 Ending balance: collectively evaluated for impairment

$ 2,171 $ 95,542 $ 58 $ 97,771 Loans: Ending balance: individually

evaluated for impairment $ — $ 612,606 $ — $ 612,606 Ending

balance: collectively evaluated for impairment $ 1,010,908 $

13,639,069 $ 12,894 $ 14,662,871 Net charge-offs as a percentage of

average loans in repayment(2) 0.17 % 0.96 % — % Allowance as a

percentage of the ending total loan balance 0.21 % 1.28 % — %

Allowance as a percentage of the ending loans in repayment(2) 0.28

% 1.88 % — % Allowance coverage of net charge-offs 1.61 2.29 —

Ending total loans, gross $ 1,010,908 $ 14,251,675 $ — Average

loans in repayment(2) $ 793,203 $ 8,283,036 $ — Ending loans in

repayment(2) $ 786,332 $ 9,709,758 $ —

______

(1) Represents fair value adjustments on loans sold.

(2) Loans in repayment include loans on which borrowers are making

interest only or fixed payments, as well as loans that have entered

full principal and interest repayment status after any applicable

grace period.

Private Education Loan Key Credit

Quality Indicators

Private Education Loans Credit Quality

Indicators December 31, 2017 December

31, 2016

(Dollars in

thousands)

Balance(1) % of Balance

Balance(1) % of Balance

Cosigners: With cosigner $ 15,658,539 90 % $ 12,816,512 90 %

Without cosigner 1,773,628 10 1,435,163 10

Total $ 17,432,167 100 % $ 14,251,675 100 %

FICO at Original Approval(2): Less than 670 $ 1,153,591 6 %

$ 920,132 6 %

670-699

2,596,959 15 2,092,722 15

700-749

5,714,554 33 4,639,958 33 Greater than or equal to 750 7,967,063

46 6,598,863 46 Total $ 17,432,167

100 % $ 14,251,675 100 % Seasoning(3): 1-12

payments $ 4,256,592 24 % $ 3,737,110 26 % 13-24 payments 3,229,465

19 2,841,107 20 25-36 payments 2,429,238 14 1,839,764 13 37-48

payments 1,502,327 9 917,633 7 More than 48 payments 1,256,813 7

726,106 5 Not yet in repayment 4,757,732 27 4,189,955

29 Total $ 17,432,167 100 % $ 14,251,675

100 %

______

(1) Balance represents gross Private Education Loans.

(2) Represents the higher credit score of the cosigner or the

borrower. (3) Number of months in active repayment (whether

interest only payment, fixed payment or full principal and interest

payment status) for which a scheduled payment was due.

Personal Loan Key Credit Quality

Indicators

Personal Loans Credit Quality Indicators

December 31, 2017 December 31, 2016

Credit Quality

Indicators:

Balance(1) % of Balance

Balance(1)

% of Balance

FICO at Original Approval: Less than 670 $ 32,156 8

%

$ 1,189 9 %

670-699

114,731 29 3,139 24

700-749

182,025 45 5,678 44 Greater than or equal to 750 71,368 18

2,888 23 Total $ 400,280 100 % $ 12,894

100 % Seasoning(2): 0-12 payments $ 400,280 100 % $

12,894 100 % 13-24 payments — — — — 25-36 payments — — — — 37-48

payments — — — — More than 48 payments — — — —

Total $ 400,280 100 % $ 12,894 100 %

______

(1) Balance represents gross Personal Loans. (2)

Number of months in active repayment for which a scheduled payment

was due.

Private Education Loan

Delinquencies

The following table provides information regarding the loan

status of our Private Education Loans. Loans in repayment include

loans making interest only or fixed payments as well as loans that

have entered full principal and interest repayment status after any

applicable grace period.

Private Education Loans

December 31, 2017 2016

(Dollars in

thousands)

Balance % Balance % Loans

in-school/grace/deferment(1) $ 4,757,732 $ 4,189,955 Loans in

forbearance(2) 468,402 351,962 Loans in repayment and percentage of

each status: Loans current 11,911,128 97.6 % 9,509,394 97.9 % Loans

delinquent 31-60 days(3) 179,002 1.5 124,773 1.3 Loans delinquent

61-90 days(3) 78,292 0.6 51,423 0.5 Loans delinquent greater than

90 days(3) 37,611 0.3 24,168 0.3 Total

loans in repayment 12,206,033 100.0 % 9,709,758 100.0

% Total loans, gross 17,432,167 14,251,675 Deferred origination

costs 56,378 44,206 Total loans 17,488,545 14,295,881

Allowance for losses (243,715 ) (182,472 ) Total loans, net $

17,244,830 $ 14,113,409 Percentage of loans in

repayment 70.0 % 68.1 % Delinquencies as a percentage of loans in

repayment 2.4 % 2.1 % Loans in forbearance as a percentage of loans

in repayment and forbearance 3.7 % 3.5 % _______

(1)

Deferment includes customers who have returned to school or

are engaged in other permitted educational activities and are not

yet required to make payments on the loans (e.g., residency periods

for medical students or a grace period for bar exam preparation).

(2)

Loans for customers who have requested extension of grace period

generally during employment transition or who have temporarily

ceased making full payments due to hardship or other factors,

consistent with established loan program servicing policies and

procedures.

(3)

The period of delinquency is based on the number of days scheduled

payments are contractually past due. Loans in full

principal and interest repayment status in our Private Education

Loan portfolio at December 31, 2017 increased by 38 percent

compared with December 31, 2016, and total 41 percent of our

Private Education Loan portfolio at December 31, 2017.

Summary of Our Loan Portfolio

Ending Loan Balances, net

December 31, 2017

(Dollars in

thousands)

PrivateEducationLoans

FFELPLoans

PersonalLoans

TotalPortfolio

Total loan portfolio: In-school(1) $ 3,740,237 $ 257 $ — $

3,740,494 Grace, repayment and other(2) 13,691,930 927,403

400,280 15,019,613 Total, gross 17,432,167

927,660 400,280 18,760,107 Deferred origination costs and

unamortized premium 56,378 2,631 — 59,009 Allowance for loan losses

(243,715 ) (1,132 ) (6,628 ) (251,475 ) Total loan portfolio, net $

17,244,830 $ 929,159 $ 393,652 $ 18,567,641

% of total 93 % 5 % 2 % 100 % _______ (1)

Loans for customers still attending school and who are not yet

required to make payments on the loan. (2) Includes loans in

deferment or forbearance.

December 31, 2016

(Dollars in

thousands)

PrivateEducationLoans

FFELPLoans

PersonalLoans

TotalPortfolio

Total loan portfolio: In-school(1) $ 3,371,870 $ 377 $ — $

3,372,247 Grace, repayment and other(2) 10,879,805 1,010,531

12,893 11,903,229 Total, gross 14,251,675

1,010,908 12,893 15,275,476 Deferred origination costs and

unamortized premium 44,206 2,941 47,147 Allowance for loan losses

(182,472 ) (2,171 ) (58 ) (184,701 ) Total loan portfolio, net $

14,113,409 $ 1,011,678 $ 12,835 $ 15,137,922

% of total 93 % 7 % — % 100 % _______ (1)

Loans for customers still attending school and who are not yet

required to make payments on the loan. (2) Includes loans in

deferment or forbearance.

Average Loan Balances (net of unamortized

premium/discount)

Quarters Ended Years Ended December

31, December 31,

(Dollars in

thousands)

2017 2016 2017 2016

Private Education Loans $ 17,318,182 94 % $

14,057,669 93 % $ 16,176,351 94 % $

12,747,756 92 % FFELP Loans 939,971 5 1,024,402 7

970,738 5 1,063,325 8 Personal Loans 265,113 1 —

— 112,857 1 — — Total

portfolio $ 18,523,266 100 % $ 15,082,071 100 % $

17,259,946 100 % $ 13,811,081 100 %

Loan Activity

Quarter Ended December 31, 2017

(Dollars in

thousands)

PrivateEducationLoans

FFELPLoans

PersonalLoans

TotalPortfolio

Beginning balance $ 16,959,241 $ 950,524 $ 130,700 $ 18,040,465

Acquisitions and originations 638,634 — 290,387 929,021 Capitalized

interest and deferred origination cost premium amortization 240,593

6,141 — 246,734 Sales (1,495 ) — — (1,495 ) Loan consolidation to

third-parties (209,273 ) (6,692 ) — (215,965 ) Repayments and other

(382,870 ) (20,814 ) (27,435 ) (431,119 ) Ending balance $

17,244,830 $ 929,159 $ 393,652 $ 18,567,641

Quarter Ended December 31, 2016

(Dollars in

thousands)

PrivateEducationLoans

FFELPLoans

PersonalLoans

TotalPortfolio

Beginning balance $ 13,725,959 $ 1,034,545 $ — $ 14,760,504

Acquisitions and originations 612,991 — 12,926 625,917 Capitalized

interest and deferred origination cost premium amortization 181,052

8,901 — 189,953 Sales (1,609 ) — — (1,609 ) Loan consolidation to

third-parties (104,493 ) (10,118 ) — (114,611 ) Repayments and

other (300,491 ) (21,650 ) (91 ) (322,232 ) Ending balance $

14,113,409 $ 1,011,678 $ 12,835 $ 15,137,922

Year Ended December 31, 2017

(Dollars in

thousands)

PrivateEducationLoans

FFELPLoans

PersonalLoans

TotalPortfolio

Beginning balance $ 14,113,409 $ 1,011,678 $ 12,835 $ 15,137,922

Acquisitions and originations 4,818,843 — 424,889 5,243,732

Capitalized interest and deferred origination cost premium

amortization 462,030 31,396 — 493,426 Sales (6,992 ) — — (6,992 )

Loan consolidation to third-parties (630,877 ) (36,856 ) — (667,733

) Repayments and other (1,511,583 ) (77,059 ) (44,072 ) (1,632,714

) Ending balance $ 17,244,830 $ 929,159 $ 393,652

$ 18,567,641

Year Ended December 31,

2016

(Dollars in

thousands)

PrivateEducationLoans

FFELPLoans

PersonalLoans

TotalPortfolio

Beginning balance $ 10,515,505 $ 1,115,086 $ — $ 11,630,591

Acquisitions and originations 4,685,622 — 12,926 4,698,548

Capitalized interest and deferred origination cost premium

amortization 339,163 35,774 — 374,937 Sales (9,521 ) — — (9,521 )

Loan consolidation to third-parties (277,636 ) (45,014 ) — (322,650

) Repayments and other (1,139,724 ) (94,168 ) (91 ) (1,233,983 )

Ending balance $ 14,113,409 $ 1,011,678 $ 12,835

$ 15,137,922

Private Education Loan Originations

The following table summarizes our Private Education Loan

originations. Originations represent loans that were funded or

acquired during the period presented.

Quarters

Ended Years Ended December 31, December

31,

(Dollars in

thousands)

2017 % 2016 %

2017 %

2016 % Smart

Option - interest only(1) $ 157,032 25 % $ 156,508 26 % $ 1,214,927

25 % $ 1,189,517 25 % Smart Option - fixed pay(1) 186,370 29

177,771 29 1,380,892 29 1,403,421 30 Smart Option - deferred(1)

276,854 44 263,296 44 2,118,719 44 2,034,100 44 Smart Option -

principal and interest 1,333 — 1,319 — 8,234 — 7,953 — Parent Loan

12,315 2 8,794 1 77,388 2

31,272 1 Total Private Education Loan originations $

633,904 100 % $ 607,688 100 % $ 4,800,160 100

% $ 4,666,263 100 % Percentage of loans with a

cosigner 85 % 87 % 88 % 89 % Average FICO at approval(2) 746 748

747 748 _______ (1) Interest only, fixed pay and deferred

describe the payment option while in school or in grace period. (2)

Represents the higher credit score of the cosigner or the borrower.

Deposits

Interest bearing deposits are summarized as follows:

December 31, 2017 2016

(Dollars in

thousands)

Amount

Year-EndWeightedAverageStated

Rate(1)

Amount

Year-EndWeightedAverageStated

Rate(1)

Money market $ 7,731,966 1.80 % $ 7,129,404 1.22 % Savings

738,243 1.10 % 834,521 0.84 % Certificates of deposit 7,034,121

1.93 % 5,471,065 1.41 % Deposits - interest bearing $

15,504,330 $ 13,434,990 _____ (1) Includes the

effect of interest rate swaps in effective hedge relationships.

Regulatory Capital

(Dollars in

thousands)

Actual

“Well Capitalized”Regulatory

Requirements

Amount Ratio Amount

Ratio As of December 31, 2017: Common Equity

Tier 1 Capital (to Risk-Weighted Assets) $ 2,386,220 12.0 % $

1,289,682 ≥ 6.5 % Tier 1 Capital (to Risk-Weighted Assets) $

2,386,220 12.0 % $ 1,587,300 ≥ 8.0 % Total Capital (to

Risk-Weighted Assets) $ 2,634,301 13.3 % $ 1,984,126 ≥ 10.0 % Tier

1 Capital (to Average Assets) $ 2,386,220 11.2 % $ 1,067,779 ≥ 5.0

%

As of December 31, 2016: Common Equity Tier 1

Capital (to Risk-Weighted Assets) $ 2,011,583 12.6 % $ 1,038,638 ≥

6.5 % Tier 1 Capital (to Risk-Weighted Assets) $ 2,011,583 12.6 % $

1,278,323 ≥ 8.0 % Total Capital (to Risk-Weighted Assets) $

2,197,997 13.8 % $ 1,597,904 ≥ 10.0 % Tier 1 Capital (to Average

Assets) $ 2,011,583 11.1 % $ 907,565 ≥ 5.0 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180117006482/en/

Sallie MaeMedia:Martha Holler,

302-451-4900martha.holler@salliemae.comorRick

Castellano,

302-451-2541rick.castellano@salliemae.comorInvestors:Brian

Cronin, 302-451-0304brian.cronin@salliemae.com

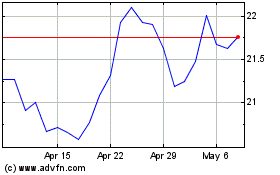

SLM (NASDAQ:SLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

SLM (NASDAQ:SLM)

Historical Stock Chart

From Apr 2023 to Apr 2024