Current Report Filing (8-k)

January 17 2018 - 4:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act

Date of Report (Date of earliest event

reported):

October 20, 2017

AMERICAN REALTY INVESTORS, INC.

(Exact Name of Registrant as Specified

in its Charter)

|

Nevada

|

001-15663

|

75-2847135

|

|

(State or other

jurisdiction of incorporation)

|

(Commission

File No.)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

1603 LBJ Freeway, Suite 800

Dallas, Texas

|

75234

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number,

including area code

469-522-4200

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Section 8 - Other Events

Item 8.01. Other Events

By letter dated October

20, 2017, the holder of 200,000 shares of Series A Cumulative Convertible Preferred Stock (the “

Series A Preferred Stock

”)

of American Realty Investors, Inc. (the “

Issuer

” or the “

Company

” or “

ARL

”)

surrendered 200,000 shares for conversion into Common Stock. Under the Articles of Incorporation, the “

Conversion Date

”

was the date of surrender and the calculated “

Conversion Price

” was 90% of the simple average of the daily closing

price of the Common Stock for the twenty Trading Days immediately prior to the date of conversion on the New York Stock Exchange

(“

NYSE

”), which yielded an average closing price, resulting in a Conversion Price of $7.90 per share. As of

the Conversion Date, the 200,000 shares of Series A Preferred Stock of ARL also had accumulated dividends, which yielded additional

accrued dividends to be added to the aggregate liquidation value, which, when divided by the Conversion Price, yielded a base amount,

which was rounded up to 482,716 shares of Common Stock issued upon conversion to such holder. The issuance of 482,716 shares of

Common Stock, which actually occurred on January 12, 2018, increased the number of issued and outstanding shares of Common Stock

from 15,543,690 shares to 16,026,406 shares of Common Stock. No significant effect occurred with respect to the balance sheet of

ARL except that certain dividends payable were eliminated as a liability by crediting the same amount to stockholders’ equity.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf

by the undersigned, hereunto duly authorized.

Dated: January 16, 2018

AMERICAN REALTY

INVESTORS, INC.

By:

/s/ Gene S. Bertcher

Gene S. Bertcher, Executive

Vice

President and Chief Financial

Officer

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf

by the undersigned, hereunto duly authorized.

Dated: January

16, 2018 AMERICAN REALTY INVESTORS, INC.

By:

/s/ Gene S. Bertcher

Gene S. Bertcher, Executive Vice

President and Chief Financial

Officer

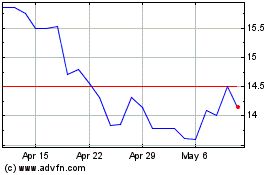

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Mar 2024 to Apr 2024

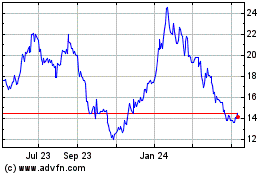

American Realty Investors (NYSE:ARL)

Historical Stock Chart

From Apr 2023 to Apr 2024