Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-218535

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be

Registered(1)

|

|

Proposed Maximum

Aggregate Offering

Price Per Security

|

|

Proposed Maximum

Aggregate Offering

Price(1)

|

|

Amount of

Registration Fee(2)

|

|

|

|

1.0% Convertible Senior Notes due 2025

|

|

$690,000,000

|

|

98.75%

|

|

$681,375,000

|

|

$84,832

|

|

|

|

Common Stock, par value $0.01 per share

|

|

—(3)

|

|

—(3)

|

|

—(3)

|

|

—(4)

|

|

|

|

Total Registration Fee

|

|

|

|

|

|

|

|

$84,832

|

|

|

-

(1)

-

Equals

the aggregate principal amount of the 1.0% Convertible Senior Notes due 2025 (the "notes") being offered hereunder, including $90,000,000 in aggregate

principal amount of notes that may be offered and sold pursuant to the exercise in full of the underwriters' over-allotment option.

-

(2)

-

Calculated

in accordance with Rule 457(r) of the Securities Act of 1933, as amended (the "Securities Act"). This "Calculation of Registration Fee" table shall

be deemed to update the "Calculation of Registration Fee" table in the registrant's Registration Statement on Form S-3ASR (File No. 333-218535) in accordance with Rules 456(b) and

457(r) under the Securities Act.

-

(3)

-

Represents

an indeterminate number of shares of common stock that may be issued from time to time upon conversion of the notes, subject to adjustment in accordance

with the terms of the notes and the indenture governing the notes.

-

(4)

-

Pursuant

to Rule 457(i) under the Securities Act, there is no additional filing fee with respect to the shares of common stock issuable upon conversion of the

notes because no additional consideration will be received in connection with the exercise of the conversion privilege.

Table of Contents

PROSPECTUS SUPPLEMENT

(To prospectus dated June 6, 2017)

$600,000,000

Exact Sciences Corporation

1.0% Convertible Senior Notes due 2025

We are offering $600 million aggregate principal amount of 1.0% Convertible Senior Notes due 2025. We will

pay interest on the notes on

January 15 and July 15 of each year, beginning July 15, 2018. The notes will mature on January 15, 2025, unless earlier repurchased by us or converted.

Holders

may convert their notes at their option prior to the close of business on the business day immediately preceding July 15, 2024 only under the following circumstances:

(1) on any date during any calendar quarter (and only during such calendar quarter) beginning after March 31, 2018 if the closing sale price of our common stock was more than 130% of the

applicable conversion price on each applicable trading day for at least 20 trading days (whether or not consecutive) in the period of the 30 consecutive trading days ending on the last trading day of

the immediately preceding calendar quarter; (2) during the five business day period following any five consecutive trading day period in which the trading price per $1,000 principal amount of

notes for each trading day during such five trading day period was less than 98% of the product of the closing sale price of our common stock and the applicable conversion rate on each such trading

day; or (3) upon the occurrence of specified corporate events. On or after July 15, 2024 until the close of business on the second scheduled trading day immediately preceding the

maturity date, holders may convert all or a portion of their notes at any time. Upon conversion, we will pay or deliver, as the case may be, cash, shares of our common stock or a combination of cash

and shares of our common stock, at our election, as described in this prospectus supplement.

The

initial conversion rate for the notes will be 13.2569 shares of common stock per $1,000 principal amount of notes (equivalent to an initial conversion price of approximately $75.43

per share of common stock). The conversion rate will be subject to adjustment in certain events but will not be adjusted for accrued interest as described herein. Following certain corporate

transactions, we will increase the applicable conversion rate for a holder that elects to convert its notes in connection with such corporate transactions by a number of additional shares of our

common stock as described in this prospectus supplement.

If

we undergo a fundamental change (as defined herein) prior to maturity of the notes, holders will have the right, at their option, to require us to repurchase for cash all or a

portion of their notes at a repurchase price equal to 100% of the principal amount of the notes being repurchased, plus accrued and unpaid interest to, but excluding, the fundamental change repurchase

date.

We

may not redeem the notes prior to the maturity date.

The

notes will rank senior in right of payment to all of our future indebtedness that is expressly subordinated in right of payment to the notes; rank equally in right of payment to all

of our future liabilities that are not so subordinated; be effectively junior to all of our existing and future secured indebtedness and other secured obligations, to the extent of the value of the

assets securing that indebtedness and other secured obligations; and be structurally subordinated to all liabilities (including trade payables) of our subsidiaries.

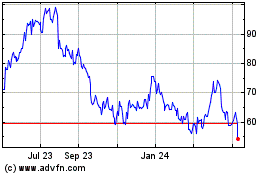

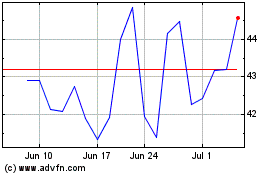

Our

common stock trades on the NASDAQ Capital Market under the symbol "EXAS". On January 11, 2018, the last sale price of the shares as reported on the NASDAQ Capital Market was

$55.06 per share.

Investing in the notes involves risks that are described in the "Risk Factors" section beginning on page S-14 of

this prospectus supplement.

|

|

|

|

|

|

|

|

Per Note

|

|

Total

|

|

Public offering price(1)

|

|

98.75%

|

|

$592,500,000

|

|

Underwriting discount(2)

|

|

1.25%

|

|

$7,500,000

|

|

Proceeds, before expenses, to us

|

|

97.5%

|

|

$585,000,000

|

-

(1)

-

Plus

accrued interest from January 17, 2018, if settlement occurs after that date.

-

(2)

-

We

refer you to the "Underwriting" section of this prospectus supplement for additional information regarding underwriter compensation.

We

have granted the underwriters an option to purchase up to an additional $90,000,000 aggregate principal amount of notes, solely to cover over-allotments, if any, for 30 days

after the date of this prospectus supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the

accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

notes will be ready for delivery in book-entry form only through the facilities of The Depository Trust Company for the accounts of its participants on or about January 17,

2018.

Sole Book-Running Manager

BofA Merrill Lynch

|

|

|

|

|

Canaccord Genuity

|

|

Leerink Partners

|

The date of this prospectus supplement is January 11, 2018.

Table of Contents

TABLE OF CONTENTS

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus form part of a registration statement on Form S-3 that we filed with the

Securities and Exchange Commission, or the "SEC," using a "shelf" registration process. This document contains two parts. The first part consists of this prospectus supplement, which provides you with

specific information about this offering. The second part, the accompanying prospectus, provides more general information, some of which may not apply to this offering. Generally, when we refer only

to the "prospectus," we are referring to both parts combined together with all documents incorporated by reference.

In

this prospectus supplement, the "Company," "we," "us" and "our" and similar terms refer to Exact Sciences Corporation and its subsidiaries. References to our "common stock" refer to

the common stock of Exact Sciences Corporation.

This

prospectus supplement, and the information incorporated herein by reference, may add, update or change information in the accompanying prospectus and in any free writing

prospectuses we may provide to you in connection with this offering. You should read both this prospectus supplement and the accompanying prospectus together with additional information described

under the headings "Where You Can Find More Information" and "Incorporation of Certain Information by Reference." If there is any inconsistency between the information in this prospectus supplement

and the accompanying prospectus, you should rely on the information in this prospectus supplement.

You should rely only on the information contained in or incorporated by reference to this prospectus supplement and the accompanying prospectus. Neither we nor

the underwriters have authorized any other person to provide information different from that contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by

reference herein and therein. If anyone provides you with different or inconsistent information, you should not rely on it. The information in this prospectus supplement, the accompanying prospectus

and in any free writing prospectuses we may provide to you in connection with this offering is accurate only as of their respective dates, regardless of time of delivery. Our business, financial

condition, results of operations and prospects may have changed since those dates.

We

are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the

offering of the securities in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement must inform themselves about, and

observe any restrictions relating to, the offering of the securities and the distribution of this prospectus supplement outside the United States. This prospectus supplement does not constitute, and

may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement by any person in any jurisdiction in which it is

unlawful for such person to make such an offer or solicitation.

All

references in this prospectus to our consolidated financial statements include, unless the context indicates otherwise, the related notes.

The

industry and market data and other statistical information contained in this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference are

based on management's own estimates, independent publications, government publications, reports by market research firms or other published independent sources, and, in each case, are believed by

management to be reasonable estimates. Although we believe these sources are reliable, we have not independently verified the information. None of the independent industry publications used in this

prospectus supplement, the accompanying prospectus or the documents we incorporate by reference were prepared on our or our affiliates' behalf and none of the sources cited by us consented to the

inclusion of any data from its reports, nor have we sought their consent.

S-1

Table of Contents

This

prospectus and the documents incorporated by reference herein include trademarks, tradenames and service marks that are our property or the property of licensors or other third

parties. Solely for convenience, such trademarks and tradenames may appear without any "™" or "®" symbol. However, failure to include such symbols is not intended to suggest,

in any way, that we will not assert our rights or the rights of any applicable licensor or other third party to such trademarks, tradenames and service marks.

S-2

Table of Contents

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING INFORMATION

Certain information set forth in this prospectus supplement, set forth in the accompanying prospectus or incorporated by reference herein or

therein, may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities

Exchange Act of 1934, as amended (the "Exchange Act"), that are intended to be covered by the "safe harbor" created by those sections. Forward-looking statements, which are based on certain

assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of forward-looking terms such as "believe," "expect," "may," "will," "should," "would,"

"could," "seek," "intend," "plan," "estimate," "goal," "anticipate," "project" or other comparable terms. All statements other than statements of historical facts included in this prospectus

supplement regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples of forward-looking statements include, among

others, statements we make regarding expected future operating results, anticipated results of our sales and marketing efforts, expectations concerning payer reimbursement and the anticipated results

of our product development efforts. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and

assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements

relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and

financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that

could cause our actual results and financial condition to differ materially from those

indicated in the forward-looking statements include, among others, the following: our ability to successfully and profitably market our products and services; the acceptance of our products and

services by patients and healthcare providers; our ability to meet demand for our products and services; the willingness of health insurance companies and other payers to cover Cologuard and reimburse

us for our performance of the Cologuard test; the amount and nature of competition from other cancer screening products and services; the effects of the adoption, modification or repeal of any

healthcare reform law, rule, order, interpretation or policy; the effects of changes in healthcare pricing, coverage and reimbursement, including without limitation as a result of the Protecting

Access to Medicare Act of 2014; recommendations, guidelines and quality metrics issued by various organizations such as the U.S. Preventive Services Task Force, the American Cancer Society, and the

National Committee for Quality Assurance regarding cancer screening or our products and services; our ability to successfully develop new products and services; our success establishing and

maintaining collaborative, licensing and supplier arrangements; our ability to maintain regulatory approvals and comply with applicable regulations; and the other risks and uncertainties included in

this prospectus supplement under the caption "Risk Factors," and those risks and uncertainties described in the documents incorporated by reference into this prospectus supplement and the accompanying

prospectus. Therefore, you should not rely on any of these forward-looking statements. We urge you to consider those risks and uncertainties in evaluating our forward-looking statements. All

subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. We

further caution readers not to place undue reliance upon any such forward-looking statements, which speak only as of the date made. Except as otherwise required by the federal securities laws, we

undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or

otherwise.

S-3

Table of Contents

SUMMARY

The information below is only a summary of more detailed information included elsewhere in or incorporated by reference

in this prospectus supplement and the accompanying prospectus. This summary may not contain all the information that is important to you or that you should consider before making an investment

decision. Please read this entire prospectus supplement and the accompanying prospectus, including the risk factors, as well as the information incorporated by reference in this prospectus supplement

and the accompanying prospectus, carefully.

Recent Developments

We expect to report revenue between $86.9 million and $87.9 million for the fourth quarter ended December 31, 2017, an

increase of 148 percent from the same quarter of 2016. We completed approximately 176,000 Cologuard tests during the fourth quarter of 2017, 115-percent growth from the same period of 2016.

Higher than anticipated year-end collections had a positive impact on revenues and average revenue recognized per test.

For

the full-year 2017, we anticipate reporting revenue between $265.5 million and $266.5 million, a year-over-year increase of 168 percent. Completed Cologuard

test volume during 2017 was approximately 571,000 tests, a 134-percent increase from 2016.

Nearly

11,000 health care providers ordered Cologuard for the first time during the fourth quarter ended December 31, 2017. The number of providers who have ordered Cologuard

since its launch increased to nearly 102,000 during 2017.

We

have not yet completed preparation of our financial statements for the fourth quarter or full year of 2017. The revenue ranges presented for the quarter and year ended

December 31, 2017 are preliminary and unaudited and are thus inherently uncertain and subject to change. We are in the process of completing our customary year-end close and review procedures

as of and for the year ended December 31, 2017, and there can be no assurance that our final results for this period will not differ from these estimates. During the course of the preparation

of our consolidated financial statements and related notes as of and for the year ended December 31, 2017, we or our independent registered public accountants may identify items that could

cause our final reported results to be materially different from the preliminary financial estimates presented herein.

Our

top priorities for 2018 are to (1) continue to strengthen our core Cologuard business including by increasing the size of our nationwide sales force by approximately 200

representatives, which would bring our total number of sales personnel to approximately 550, (2) prepare for future demand including by continuing to invest in people, processes, technology and

systems to build capacity, and (3) expand our product pipeline by developing additional cancer diagnostic tests, which may include liver and lung cancer tests, and that we expect will result in

a material increase to our research and development expenditures.

Our Company

We are a molecular diagnostics company currently focused on the early detection and prevention of some of the deadliest forms of cancer. We

have developed an accurate, non-invasive, patient-friendly screening test called Cologuard for the early detection of colorectal cancer and pre-cancer, and we are currently working on the development

of additional tests for other types of cancer, with the goal of becoming a leader in cancer diagnostics.

S-4

Table of Contents

Our Cologuard® Test

Colorectal cancer is the second leading cause of cancer deaths in the United States and the leading cause of cancer deaths in the U.S. among

non-smokers. Each year in the U.S. there are approximately:

-

•

-

135,000 new cases of colorectal cancer

-

•

-

50,000 deaths from colorectal cancer

Colorectal

cancer treatment represents a significant, growing healthcare cost. As of 2010, $14 billion was spent annually in the U.S. on colorectal cancer treatment, and the

projected annual treatment costs are expected to be $20 billion in 2020. The incidence of colorectal cancer in Medicare patients is expected to rise from 106,000 cases in 2010 to more than

180,000 cases in 2030.

It

is widely accepted that colorectal cancer is among the most preventable, yet least prevented cancers. Colorectal cancer can take up to 10-15 years to progress from a

pre-cancerous lesion to metastatic cancer and death. Patients who are diagnosed early in the progression of the disease—with pre-cancerous lesions or polyps or early-stage

cancer—are more likely to have a complete recovery and to be treated less expensively. Accordingly, the American Cancer Society ("ACS") recommends that all people age 50 and older undergo

regular colorectal cancer screening. Of the more than 80 million people in the U.S. for whom routine colorectal cancer screening is recommended, 38 percent have not been screened

according to current guidelines. Poor compliance with screening guidelines has meant that nearly two-thirds of colorectal cancer diagnoses are made in the disease's late stages. The five-year survival

rates for stages 3 and 4 are 67 percent and 12 percent, respectively. We believe the large underserved population of unscreened and inadequately screened patients represents a

significant opportunity for a patient-friendly screening test.

Our

Cologuard test is a non-invasive stool-based DNA ("sDNA") screening test that utilizes a multi-target approach to detect DNA and hemoglobin biomarkers associated with colorectal

cancer and pre-cancer. Eleven biomarkers are targeted that have been shown to be strongly associated with colorectal cancer and pre-cancer. Methylation, mutation, and hemoglobin results are combined

in the laboratory analysis through a proprietary algorithm to provide a single positive or negative reportable result.

On

August 11, 2014 the U.S. Food and Drug Administration ("FDA") approved Cologuard for use as the first and only sDNA non-invasive colorectal cancer screening test. Our

submission to the FDA for Cologuard included the results of our pivotal DeeP-C clinical trial that had over 10,000 patients enrolled at 90 sites in the U.S. and Canada. The results of our DeeP-C

clinical trial for Cologuard were published in the New England Journal of Medicine in April 2014. The peer-reviewed study, "Multi-target Stool DNA Testing for Colorectal-Cancer Screening," highlighted

the performance of Cologuard in the trial population:

-

•

-

Cancer Sensitivity: 92%

-

•

-

Stage I and II Cancer Sensitivity: 94%

-

•

-

High-Grade Dysplasia Sensitivity: 69%

-

•

-

Specificity: 87%

The

competitive advantages of sDNA screening may provide a significant market opportunity. If the test were used by 40-percent of the eligible screening population at a three-year

screening interval, we estimate the potential U.S. market for sDNA screening would be more than $5.5 billion, annually.

S-5

Table of Contents

Our

commercialization strategy includes three main elements focusing on physicians, patients, and payers.

Our

sales team actively engages with physicians and their staffs to emphasize the need for colorectal cancer screening, educate them on the value of Cologuard, and enroll them in our

physician ordering system to enable them to prescribe the test. We focus on specific physicians based on Cologuard order history and on physician groups and larger regional and national health

systems.

Securing

inclusion in guidelines and quality measures is a key part of our physician engagement strategy since many physicians rely on such guidelines and quality measures when making

screening recommendations. In June 2016, the US Preventive Services Task Force ("USPSTF") issued an updated recommendation statement for colorectal cancer screening and gave an "A" grade to colorectal

cancer screening starting at age 50 and continuing until age 75. The statement specifies seven screening methods, including FIT-DNA (which is Cologuard).

Many

professional colorectal cancer screening guidelines in the U.S., including those of the ACS and the National Comprehensive Cancer Network ("NCCN"), recommend regular screening

using any of a variety of methods. Since 2008, joint colorectal cancer screening guidelines endorsed by the ACS have included sDNA screening technology as a screening option for the detection of

colorectal cancer in average risk, asymptomatic individuals age 50 and older. In October 2014, the ACS updated its colorectal cancer screening guidelines to specifically include Cologuard as a

recommended screening test. In June 2016, the NCCN updated its Colorectal Cancer Screening Guidelines to add sDNA screening, at a once-every-three-years interval, to its list of recommended screening

tests.

In

October 2016, the National Committee for Quality Assurance ("NCQA") included Cologuard testing on a three-year interval in the 2017 Healthcare Effectiveness Data and Information Set

("HEDIS") measures. More than 90 percent of America's health plans measure quality based on HEDIS. In April 2017, the Centers for Medicare & Medicaid Services ("CMS") included Cologuard

in its updated 2018 Medicare Advantage Star Ratings program.

A

critical part of the value proposition of Cologuard is our compliance program, which involves active engagement with patients and physicians. This customer-service-oriented activity

is focused on helping patients to complete Cologuard tests that have been ordered for them by their physicians and supporting physicians in their efforts to have their patients screened.

After

the launch of Cologuard, we initiated a significant public relations effort to engage patients in the United States. We have conducted targeted direct-to-patient advertising

campaigns through social media, print and other channels. In 2016, we began a national television advertising campaign. To date, we have focused our efforts on cable television most commonly viewed by

our target patient demographic. We continue our targeted direct-to-patient advertising initiatives. During the second and third quarters of 2017 we launched new content for our television advertising

campaign, highlighting the ease of use of Cologuard, which includes 30-second television spots intended to make our television advertising more cost effective. During 2018 we plan to maintain our

current television advertising efforts and increase our efforts with social and digital media and engage in some national partnerships that should increase awareness for Cologuard.

The

cornerstone of our payer-engagement strategy was securing coverage from CMS. Medicare covers approximately 47% of patients in the screening population for Cologuard. On

October 9, 2014, CMS issued a National Coverage Determination ("NCD") for Cologuard following a parallel review process with FDA. Cologuard was the first screening test approved by FDA and

covered by CMS through that

process. As outlined in the NCD, Medicare Part B covers Cologuard once every three years for beneficiaries who meet all of the following criteria:

S-6

Table of Contents

-

•

-

asymptomatic (no signs or symptoms of colorectal disease including, but not limited to, lower gastrointestinal pain, blood in stool, positive

guaiac fecal occult blood test or fecal immunochemical test), and

-

•

-

at average risk for developing colorectal cancer (e.g., no personal history of adenomatous polyps, colorectal cancer, or inflammatory

bowel disease, including Crohn's Disease and ulcerative colitis; no family history of colorectal cancers or adenomatous polyps, familial adenomatous polyposis or hereditary non-polyposis

colorectal cancer).

In

the 2017 Clinical Laboratory Fee Schedule, CMS established reimbursement for Cologuard at $512.43. Payments from CMS are currently subject to sequestration. Under the Protecting

Access to Medicare Act of 2014 ("PAMA"), effective January 1, 2018, the CMS reimbursement rate for Cologuard was set at $508.87, which was the volume-weighted median of private payer rates for

Cologuard for the period from January 1, 2016 to June 30, 2016. We expect the CMS reimbursement rate established for 2018 to remain in place for three years, after which it would be

reset based on the volume-weighted median of private payer rates for Cologuard during the data collection period between January 1, 2019 and June 30, 2019.

In

addition to Medicare reimbursement, we seek to secure favorable coverage and in-network reimbursement agreements from commercial payers. Some commercial payers have issued positive

coverage decisions for Cologuard and others have agreed to cover Cologuard as an in-network service. In-network agreements with payers have varying terms and conditions, including reimbursement rate,

term and termination. From time to time in the ordinary course of our business, we may enter into new agreements, certain existing agreements may expire without renewal and certain other existing

agreements may be terminated by us or the third-party payer. We believe that commercial payers' reimbursement of Cologuard will depend on a number of factors, including payers' determination that it

is: sensitive and specific for colorectal cancer; not experimental or investigational; approved or recommended by major organizations' guidelines; reliable, safe and effective; medically necessary;

appropriate for the specific patient; and cost-effective. Also, some payers may apply various medical management requirements, including a requirement that they give prior authorization for a

Cologuard test before they are willing to pay for it. Other payers may perform post-payment reviews or audits, which could lead to payment recoupments. Medical management, such as prior authorizations

and post-payment review or audits, may require that we, patients, or physicians provide the payer with extensive medical records and other information.

Coverage

of Cologuard may also depend, in whole or in part, on whether payers determine, or courts and/or regulatory authorities determine, coverage is required under applicable federal

or state laws mandating coverage of certain colorectal cancer screening services. For example, Section 2713 of the Patient Protection and Affordable Care Act ("ACA") mandates that certain

health insurers cover evidence-based items or services that have in effect a rating of "A" or "B" in the current recommendations of USPSTF without imposing any patient cost-sharing ("ACA Mandate").

Similarly, federal regulations require that Medicare Advantage plans cover "A" or "B" rated preventive services without patient cost-sharing. Following the June 2016 update to the USPSTF colorectal

cancer screening recommendation statement, CMS issued an updated Evidence of Coverage notice for Medicare Advantage plans that affirms such plans must include coverage of Cologuard every three years

without patient cost-sharing. While we believe the ACA Mandate will require certain health insurers to cover Cologuard without patient cost-sharing (following an initial phase-in period between one

and two years from the date of the updated USPSTF recommendation statement depending on the date a given plan year commences), it is possible that certain health insurers will disagree. It is also

possible that the ACA Mandate will be repealed or significantly modified in the future.

Similarly,

we believe the laws of approximately 30 states currently mandate coverage of Cologuard by certain health insurance plans. While some insurers have agreed with our

interpretation

S-7

Table of Contents

regarding

certain state mandates, other insurers have disagreed. In some cases, we have filed lawsuits in an effort to enforce state laws we believe require coverage of Cologuard, and we may file

additional suits in the future. We may or may not be successful in any such lawsuit.

We

are pursuing a variety of strategies to increase commercial payer coverage for Cologuard, including providing cost effectiveness data to payers to make the case for Cologuard

reimbursement. We are focusing our efforts on large national and regional insurers and health plans that have affiliated health systems.

We

believe quality metrics may influence payers' coverage decisions, as well as physicians' cancer screening procedures. Some government and private payers are adopting

pay-for-performance programs that differentiate payments for healthcare services based on the achievement of documented quality metrics, cost efficiencies or patient outcomes. Payers may look to

quality measures such as the HEDIS and CMS Star Ratings measures to assess quality of care. We believe inclusion in the HEDIS measures and Star Ratings measures may have a positive impact on payers'

willingness to reimburse Cologuard, as well as on physicians' willingness to prescribe the test.

As

part of our commercialization strategy, we established a state-of-the-art, highly automated lab facility that is certified pursuant to federal Clinical Laboratory Improvement

Amendments ("CLIA") requirements to process Cologuard tests and provide patient results. Our commercial lab operation is housed in a 50,000 square foot facility in Madison, Wisconsin. At our lab, we

currently have the capacity to process approximately one million tests per year. We are expanding our current lab facility to increase our capacity to more than two and a half million tests per year

by mid-2018.

During

the fourth quarter of 2017 we began construction of a new clinical laboratory facility in Madison, WI that is expected to increase our annual capacity by approximately two

million tests per year. The construction is expected to be completed by mid-2019 and at that time our total capacity at both facilities should be more than four and a half million tests per year.

We

also are developing a pipeline of potential future products and services. We are continuing to collaborate with MAYO Foundation for Medical Education and Research ("MAYO"), our

development partner for Cologuard, on developing new tests, with the goal of becoming a leader in the early detection of cancer. We believe our proprietary technology platform provides a strong

foundation for the development of additional cancer diagnostic tests. Through our collaboration with MAYO, we have identified proprietary biomarkers for several major cancers, including liver cancer

and lung cancer. We have successfully performed validation studies on tissue samples for seven major cancers and on blood samples for four major cancers.

The

ACS estimates that lung cancer will be diagnosed in 223,000 Americans and cause 156,000 deaths in the United States in 2017. Currently, more than half of lung cancer cases are

diagnosed at an advanced stage, after symptoms appear, when the five-year survival rate is in the low single digits. We are currently developing a blood-based biomarker test to aid in the early

detection of lung cancer in individuals with lung nodules discovered through a computerized tomography ("CT") or other scan. Such a test may help reduce the number of unnecessary biopsies and other

follow-up procedures, and thereby reduce costs and improve health outcomes. We recently completed a multi-round study of nearly 400 patients, which demonstrated high accuracy for detecting lung cancer

at all stages.

We

also continue to explore opportunities for improving Cologuard, including improvements that could lower our cost of sales.

Corporate Information

Our executive offices are located at 441 Charmany Drive, Madison, Wisconsin 53719. Our telephone number is (608) 284-5700. Our Internet

website address is

www.exactsciences.com

. Our Internet website and the information contained therein or connected thereto are not part of this

prospectus supplement or the accompanying prospectus.

S-8

Table of Contents

THE OFFERING

The summary below describes the principal terms of the notes. Certain of the terms and conditions described below are subject to important

limitations and exceptions. For a more detailed description of the terms and conditions of the notes, see the section entitled "Description of the Notes." With respect to the discussion of the terms

of the notes on the cover page, in this section and in the section entitled "Description of the Notes," references to "the Company," "we," "our," and "us" refer solely to Exact Sciences Corporation

and not its subsidiaries.

|

|

|

|

|

Issuer:

|

|

Exact Sciences Corporation

|

|

Notes Offered:

|

|

$600,000,000 aggregate principal amount of 1.0% Convertible Senior Notes due 2025. We have granted the underwriters an

option to purchase up to an additional $90,000,000 aggregate principal amount of notes solely to cover over-allotments.

|

|

Maturity Date:

|

|

January 15, 2025, unless earlier converted.

|

|

Interest and Payment Dates:

|

|

1.0% per year, payable semi-annually in arrears on January 15 and July 15 of each year, beginning July 15,

2018. We will pay additional interest, if any, at our election as the sole remedy relating to the failure to comply with our reporting obligations as described under "Description of the Notes—Events of Default; Notice and Waiver."

|

|

Ranking:

|

|

The notes will be our senior unsecured obligations that will:

|

|

|

|

•

rank senior in right of

payment to all of our future indebtedness that is expressly subordinated in right of payment to the notes;

|

|

|

|

•

rank equally in right of

payment to all of our future liabilities that are not so subordinated;

|

|

|

|

•

be effectively junior to

all of our existing and future secured indebtedness and other secured obligations, to the extent of the value of the assets securing that indebtedness and other secured obligations; and

|

|

|

|

•

be structurally

subordinated to all indebtedness and other liabilities (including trade payables) of our subsidiaries.

|

|

|

|

See "Description of the Notes—Ranking."

|

S-9

Table of Contents

|

|

|

|

|

|

|

As of September 30, 2017, our total consolidated indebtedness was approximately $4.7 million, all of which was secured. As of

September 30, 2017, our subsidiaries had $3.5 million of indebtedness and other liabilities (including trade payables). After giving effect to the issuance of the notes (assuming no exercise of the underwriters' option to purchase

additional notes), our total consolidated indebtedness would have been approximately $604.7 million as of September 30, 2017. In December 2017, we entered into (i) a revolving loan agreement, which provides us with a 24-month secured

revolving credit facility of up to $15.0 million and (ii) a construction loan agreement, which provides us with a non-revolving secured construction loan of $25.6 million. As of December 31, 2017, we had not drawn any funds from

these two agreements.

|

|

|

|

The indenture governing the notes will not limit our ability to incur additional indebtedness in the future, including

senior secured indebtedness.

|

|

Conversion Rights:

|

|

Prior to the close of business on the business day immediately preceding July 15, 2024, you may, at your option,

convert your notes, in multiples of $1,000 principal amount, but only under the following circumstances:

|

|

|

|

•

on any date during any

calendar quarter (and only during such calendar quarter) beginning after March 31, 2018 if the closing sale price (as defined in "Description of the Notes—Conversion Rights—Conversion Upon Satisfaction of Sale Price Condition") of our

common stock was more than 130% of the applicable conversion price on each applicable trading day for at least 20 trading days (whether or not consecutive) in the period of the 30 consecutive trading days ending on the last trading day of the

immediately preceding calendar quarter;

|

|

|

|

•

during a specified period

if we distribute to all or substantially all holders of our common stock any rights, options or warrants (other than pursuant to a stockholders rights plan) entitling them to purchase, for a period of 45 calendar days or less from the announcement

date for such distribution, shares of our common stock at a price per share less than the average of the closing sale prices for the ten consecutive trading day period ending on, and including, the trading day immediately preceding the announcement

date for such distribution;

|

|

|

|

•

during a specified period

if we distribute to all or substantially all holders of our common stock cash or other assets, debt securities or rights to purchase our securities (other than pursuant to a stockholders rights plan), which distribution has a per share value

exceeding 10% of the closing sale price of our common stock on the trading day immediately preceding the announcement date for such distribution;

|

|

|

|

•

during a specified period

if a fundamental change occurs or if we engage in certain corporate transactions; or

|

S-10

Table of Contents

|

|

|

|

|

|

|

•

during the five business

day period following any five consecutive trading day period in which the trading price (as defined in "Description of the Notes—Conversion Rights—Conversion Upon Satisfaction of Trading Price Condition") per $1,000 principal amount of

notes for each trading day during such five trading day period was less than 98% of the product of the closing sale price of our common stock and the applicable conversion rate on each such trading day.

|

|

|

|

On or after July 15, 2024 until the close of business on the second scheduled trading day immediately preceding the

maturity date, you may, at your option, convert all or any portion of your notes, in multiples of $1,000 principal amount, at any time, regardless of the foregoing circumstances.

|

|

|

|

The conversion rate for the notes is initially 13.2569 shares of common stock per $1,000 principal amount of notes

(equivalent to an initial conversion price of approximately $75.43 per share of common stock), subject to adjustment as described in this prospectus supplement.

|

|

Settlement upon Conversion:

|

|

Upon conversion, we will pay or deliver, as the case may be, cash, shares of our common stock (and cash in lieu of

fractional shares) or a combination of cash and shares of our common stock, at our election. If we satisfy our conversion obligation solely in cash or through payment and delivery, as the case may be, of a combination of cash and shares of our common

stock, the amount of cash and shares of common stock, if any, due upon conversion will be based on a daily conversion value or a daily settlement amount, as applicable (as described herein) calculated on a proportionate basis for each VWAP trading

day (as defined herein) in a 30 VWAP trading day observation period (as defined herein). You will not receive any separate cash payment or additional shares for interest, if any, accrued and unpaid to the conversion date, except in limited

circumstances. Instead, interest will be deemed paid by the cash, shares of our common stock or a combination of cash and shares of our common stock paid or delivered, as the case may be, to you upon conversion of a note. See "Description of the

Notes—Conversion Rights."

|

|

No Redemption:

|

|

We may not redeem the notes prior to the maturity date, and no "sinking fund" is provided for the notes, which means we are

not required to redeem or retire the notes periodically.

|

S-11

Table of Contents

|

|

|

|

|

Adjustment to Conversion Rate Upon a Make-Whole Fundamental Change:

|

|

If the effective date (as defined herein) of a make-whole fundamental change (as defined herein) occurs prior to the maturity date of the

notes and a holder elects to convert its notes in connection with such make-whole fundamental change, we will increase the conversion rate by a number of additional shares. The number of additional shares will be determined by reference to the table

in "Description of the Notes—Conversion Rights—Adjustment to Conversion Rate Upon a Make-Whole Fundamental Change," based on the effective date and the price paid (or deemed paid) per share of our common stock in such make-whole fundamental

change. If holders of our common stock receive only cash in a make-whole fundamental change, the price paid (or deemed paid) per share will be the cash amount paid per share. Otherwise, the price paid (or deemed paid) per share will be equal to the

average of the closing sale prices of our common stock over the five trading day period ending on, and including, the trading day immediately preceding the effective date of such make-whole fundamental change.

|

|

Fundamental Change Repurchase Right of Holders:

|

|

If we undergo a fundamental change (as defined under "Description of the Notes—Fundamental Change Put") prior to

maturity of the notes, subject to certain conditions, you will have the right, at your option, to require us to repurchase for cash all or a portion of your notes in minimum principal amounts of $1,000 or whole multiples thereof at a repurchase price

equal to 100% of the principal amount of the notes being repurchased, plus accrued and unpaid interest to, but excluding, the fundamental change repurchase date. See "Description of the Notes—Fundamental Change Put."

|

|

Book-Entry Form:

|

|

The notes will be issued in book-entry form and will be represented by permanent global certificates deposited with, or on

behalf of, The Depository Trust Company, or DTC, and registered in the name of Cede & Co. as DTC's nominee. Beneficial interests in any of the notes will be shown on, and transfers will be effected only through, records maintained by

DTC or its nominee and any such interest may not be exchanged for certificated securities, except in limited circumstances.

|

|

Listing:

|

|

We do not intend to apply for listing of the notes on any securities exchange or any automated dealer quotation system. Our

common stock is listed on the NASDAQ Capital Market under the symbol "EXAS".

|

|

Use of Proceeds:

|

|

We estimate that our net proceeds from this offering, after deducting underwriting discounts and estimated offering fees and

expenses, will be approximately $583.5 million (or $671.3 million if the underwriters exercise in full their option to purchase $90,000,000 in additional notes from us).

|

S-12

Table of Contents

|

|

|

|

|

|

|

We intend to use the net proceeds we receive from this offering for general corporate and working capital purposes. See "Use of

Proceeds."

|

|

Trustee:

|

|

U.S. Bank National Association

|

|

Absence of a Public Market for the Notes:

|

|

The notes are new securities, and there is currently no established market for the notes. Accordingly, we cannot assure you

as to the development or liquidity of any market for the notes. See "Underwriting—New Issue of Notes." We have been advised by the underwriters that they presently intend to make a market in the notes after completion of the offering. However,

they are under no obligation to do so and may discontinue any market-making activities at any time without notice. We do not intend to apply for a listing of the notes on any securities exchange or any automated dealer quotation system.

|

|

Risk Factors:

|

|

You should read the "Risk Factors" beginning on page S-14 of this prospectus supplement and the other information

included or incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors you should consider carefully before deciding to invest in the notes.

|

|

U.S. Federal Income Tax Considerations:

|

|

For the U.S. federal income tax considerations of the holding, disposition and conversion of the notes, and the holding and

disposition of our common stock, see "Material U.S. Federal Income Tax Considerations."

|

S-13

Table of Contents

RISK FACTORS

We operate in a rapidly changing environment that involves a number of risks, some of which are beyond our control.

This discussion highlights some of the risks that may affect future operating results. These are the risks and uncertainties we believe are most important for you to consider. We cannot be certain

that we will successfully address these risks. If we are unable to address these risks, our business may not grow, our stock price may suffer and we may be unable to stay in business. Additional risks

and uncertainties not presently known to us, which we currently deem immaterial or which are similar to those faced by other companies in our industry or business in general, may also impair our

business operations.

Risks Related to Our Business

We may never become profitable.

We have incurred losses since we were formed and only began generating revenue from Cologuard, our only product, in 2014. From our date of

inception on February 10, 1995 through September 30, 2017, we have accumulated a total deficit of approximately $838.9 million. We expect to continue investing significantly

toward development and commercialization of our colorectal cancer screening technology and other products and services. If our revenue does not grow significantly, we will not be profitable. We cannot

be certain that the revenue from the sale of any products or services based on our technologies will be sufficient to make us profitable.

We may need additional capital to execute our business plan.

Although we believe that we have sufficient capital to fund our operations for at least the next twelve months, we may require additional

capital to fully fund our current strategic plan, which includes successfully commercializing Cologuard and developing a pipeline of future products and services. Additional financing may not be

available in amounts or on terms satisfactory to us or at all. Our success in raising additional capital may be significantly affected by general market conditions, the market price of our common

stock, our financial condition, uncertainty about the future commercial success of Cologuard, the development and commercial success of future products or services, regulatory developments, the status

and scope of our intellectual property, any ongoing litigation, our compliance with applicable laws and regulations and other factors. If we raise additional funds through the sale of equity,

convertible debt or other equity-linked securities, our stockholders' ownership will be diluted. We may issue securities that have rights, preferences and privileges senior to our common stock. If we

raise additional funds through collaborations, licensing arrangements or other structured financing transactions, we may relinquish rights to certain of our technologies or products or services, grant

security interests in our assets or grant licenses to third parties on terms that are unfavorable to us.

Our success depends heavily on our Cologuard colorectal cancer screening test.

For the foreseeable future, our ability to generate revenues will depend almost entirely on the commercial success of our Cologuard test. The

commercial success of our Cologuard test and our ability to generate revenues will depend on a variety of factors, including the following:

-

•

-

acceptance in the medical community;

-

•

-

inclusion of Cologuard in healthcare guidelines and recommendations, such as those developed by ACS and USPSTF;

-

•

-

inclusion of Cologuard in quality measures including the HEDIS measures and the CMS Medicare Advantage Star Ratings;

S-14

Table of Contents

-

•

-

recommendations and studies regarding Cologuard specifically or colorectal cancer screening generally that may be published by government

agencies, professional organizations, academic or medical journals or other key opinion leaders;

-

•

-

patient acceptance of and demand for the Cologuard test;

-

•

-

patient compliance with orders for the Cologuard test by healthcare providers, and patient adherence over time to recommendations regarding

periodic re-screening;

-

•

-

successful sales, marketing, and educational programs, including successful direct-to-patient marketing such as television advertising and

social media;

-

•

-

the number of patients screened for colorectal cancer, as well as the number of patients who use Cologuard for that purpose;

-

•

-

sufficient coverage and reimbursement by third-party payers, which may depend in whole or in part on multiple factors, including federal or

state laws that mandate coverage for colorectal cancer screening, the extent to which those laws mandate coverage of Cologuard and the enforcement of those laws;

-

•

-

the amount and nature of competition from other colorectal cancer or pre-cancer screening products and procedures;

-

•

-

maintaining FDA marketing approval of Cologuard;

-

•

-

the ease of use of our ordering process for physicians;

-

•

-

maintaining and defending patent protection for the intellectual property relevant to Cologuard; and

-

•

-

our ability to establish and maintain adequate commercial manufacturing, distribution, sales and CLIA laboratory testing capabilities.

If

we are unable to develop and maintain substantial sales of our Cologuard test or if we are significantly delayed or limited in doing so, our business prospects, financial condition

and results of operation would be adversely affected.

Our quarterly operating results could be subject to significant fluctuation, which could increase the

volatility of our stock price and cause losses to our stockholders.

Our revenues and results of operations may fluctuate significantly, depending on a variety of factors, including the

following:

-

•

-

our success in marketing and selling, and changes in demand for, our Cologuard test, and the level of reimbursement and collection obtained for

Cologuard;

-

•

-

seasonal variations affecting physician recommendations for colorectal cancer screenings and patient compliance with physician recommendations,

including without limitation holidays and weather events;

-

•

-

our success in collecting payments from third-party payers, patients and collaborative partners, variation in the timing of these payments and

recognition of these payments as revenues;

-

•

-

the pricing of our Cologuard test, including potential changes in CMS or other reimbursement rates;

-

•

-

fluctuations in the amount and timing of our selling and marketing costs and our ability to manage costs and expenses and effectively implement

our business; and

S-15

Table of Contents

-

•

-

our research and development activities, including the timing of costly clinical trials.

Other companies or institutions may develop and market novel or improved methods for detecting colorectal

cancer or pre-cancer, which may make our technologies less competitive or obsolete.

The market for colorectal cancer and pre-cancer screening is large, consisting of more than 80 million Americans age 50 and above for

whom routine colorectal cancer screening is recommended. As a result, this market has attracted competitors, some of which possess significantly greater financial and other resources and development

capabilities than we do. Some companies and institutions are developing serum-based tests and screening tests based on the detection of proteins, nucleic acids or the presence of fragments of mutated

genes in the blood that are produced by colorectal cancer or pre-cancer. We are aware of at least six companies—Epigenomics AG, Applied Proteomics, Inc., Gene News, EDP Biotech

Corporation, GRAIL, Inc., and Volition Diagnostics—that have developed, or are developing, blood-based tests for the detection of colorectal cancer. Epigenomics AG received FDA

approval for its blood-based screening test for colorectal cancer, Epi proColon, in April 2016, and began offering the test commercially in May 2016. We believe other companies are also working on

so-called "liquid biopsy" tests using next-generation sequencing or other technology, and these tests could represent significant competition for Cologuard and other tests we may develop. Our

Cologuard test also faces competition from procedure-based

detection technologies such as flexible sigmoidoscopy, colonoscopy and "virtual" colonoscopy (a radiological imaging approach that visualizes the inside of the bowel by use of spiral computerized

axial tomography known as a CT scan) as well as traditional screening tests such as FOBT and FIT and newer screening technologies such as the PillCam COLON cleared by FDA in February 2014. Our

competitors may also be working on additional methods of detecting colorectal cancer and pre-cancer that have not yet been announced.

Beyond

our Cologuard test, as we seek to develop other tools to detect cancer and pre-cancer, we expect to compete with a broad range of organizations in the U.S. and other countries

that are engaged in the development, production and commercialization of cancer diagnostic tools. These competitors include:

-

•

-

biotechnology, diagnostic and other life science companies;

-

•

-

academic and scientific institutions;

-

•

-

governmental agencies; and

-

•

-

public and private research organizations.

We

may be unable to compete effectively against our competitors either because their products and services are superior or because they may have more expertise, experience, financial

resources or stronger business relationships. Our competitors may have broader product lines and greater name recognition than we do. We have limited experience developing tests for the detection of

non-colorectal cancers and we cannot guarantee that our research and development activities will be successful in developing any marketable testing products or services. Further, even if we do develop

new marketable products or services, our current and future competitors may develop products and services that are more commercially attractive than ours and they may bring those products and services

to market, sooner than we are able to.

We face uncertainty related to healthcare reform, pricing, coverage and reimbursement, which could reduce our

revenue.

Healthcare reform laws, including the Patient Protection and Affordable Care Act (the "ACA") and the Protecting Access to Medicare Act of 2014

("PAMA"), are significantly affecting the U.S. healthcare and medical services industry. Existing legislation, and possible future legal and regulatory changes, including potential repeal of the ACA,

elimination of penalties regarding the individual

S-16

Table of Contents

mandate

for coverage, or approval of health plans that allow lower levels of coverage for preventive services, could substantially change the structure and finances of the health insurance system and

the methodology for reimbursing medical services, drugs and devices, including our current and future products and services. Any change in reimbursement policy could result in a change in patient

cost-sharing, which could adversely affect patient willingness and ability to use our Cologuard test and any other product or service we may develop. Healthcare reforms, which may intend to reduce

healthcare costs, may have the effect of discouraging third-party payers from covering certain kinds of medical products and services, particularly newly developed technologies, such as our Cologuard

test or other products or tests we may develop in the future.

The

ACA requires that non-grandfathered health plans cover, without patient cost-sharing, preventive services that have in effect a grade of "A" or "B" in the current recommendations of

USPSTF (the "ACA Mandate"). The requirement to cover, without cost-sharing, a newly recommended preventive service applies to each non-grandfathered health plan starting with the first plan year that

begins at least one year after the date of the recommendation. In June 2016, USPSTF issued an updated colorectal screening recommendation, assigning an A grade to "screening for colorectal cancer

starting at age 50 years and continuing until age 75 years." We believe the "A" grade should be interpreted to apply to the seven types of colorectal cancer tests specifically identified

by USPSTF in its recommendation—including Cologuard, which was included for the first time in that recommendation—for adults ages 50 to 75 and that Cologuard should therefore

be included within the ACA Mandate for colorectal cancer screening tests. However, health plans may assert that they are not required to cover Cologuard under the ACA Mandate. Enforcement of the ACA

Mandate may depend, in whole or in part, on state, federal or other third party enforcement actions that we would not control. Further, a court or regulatory agency may agree with arguments that may

be made by insurers and determine that the ACA Mandate does not require that they cover Cologuard or may otherwise interpret the ACA Mandate in a manner unfavorable to us. Also, Congress may modify or

repeal all or part of the ACA, and any such modification or repeal may repeal or limit the ACA Mandate for preventive services. If the ACA Mandate for preventive services is repealed or modified, if

the ACA Mandate is determined not to require coverage of Cologuard, if the ACA Mandate is otherwise interpreted in a manner unfavorable to us, or if we are unable to secure

effective enforcement of the ACA Mandate, even if it is held to require coverage of Cologuard, our business prospects, financial condition and results of operation may be adversely affected.

Several

states have laws mandating coverage for preventive services, such as colorectal cancer screening services, applicable to certain health insurers. Not all of these laws apply to

Cologuard, however. Further, if the ACA is repealed or replaced, or even if it is not, states may decide to modify their laws, which may include repeal of those coverage mandates that we believe

currently apply to Cologuard.

Under

PAMA, effective January 1, 2018, the CMS reimbursement rate for Cologuard was set at $508.87, which was the volume-weighted median of private payer rates for Cologuard from

January 1, 2016 through June 30, 2016. The CMS reimbursement rate will subsequently be reset every three years, based on the volume-weighted median of private payer rates experienced in

the applicable six-month data collection period. If the CMS reimbursement rate for Cologuard is reduced pursuant to PAMA or otherwise, our revenues would likely be adversely affected. PAMA presents

significant uncertainty for future CMS reimbursement rates for Cologuard. Because Medicare currently covers 47% of patients in the screening population for Cologuard, any reduction in the CMS

reimbursement rates for Cologuard would negatively affect our revenues and our business prospects.

S-17

Table of Contents

If third-party payers, including managed care organizations, do not approve and maintain reimbursement for

our Cologuard test at adequate reimbursement rates, we may be unable to successfully commercialize our Cologuard test which, we expect, would limit or slow our revenue generation and likely have a

material adverse effect on our business.

Successful commercialization of our Cologuard test depends, in large part, on the availability of adequate reimbursement from government

insurance plans, managed care organizations and private insurance plans. Although we received a positive coverage decision and what we believe is an adequate reimbursement rate from CMS for our

Cologuard test, it is also critical that other third-party payers approve and maintain reimbursement for our Cologuard test at adequate reimbursement rates. Third-party payers are increasingly

attempting to contain healthcare costs by limiting both coverage and the level of reimbursement for new healthcare products. As a result, there is significant uncertainty surrounding whether the use

of tests that incorporate new technology, such as our Cologuard test, will be eligible for coverage by third-party payers or, if eligible for coverage, what the reimbursement rates will be.

Reimbursement of sDNA colorectal cancer screening by a third-party payer may depend on a number of factors, including a payer's determination that tests using our technologies are: sensitive and

specific for colorectal cancer and pre-cancer; not experimental or investigational; approved or recommended by the major guidelines organizations; subject to applicable

federal or state coverage mandates; reliable, safe and effective; medically necessary; appropriate for the specific patient; and cost-effective.

If

we are unable to obtain positive decisions from third-party payers, including managed care organizations, approving reimbursement for our Cologuard test at adequate levels, its

commercial success will be compromised and our revenues would be significantly limited. We may also experience material delays in obtaining such reimbursement decisions and payment for our Cologuard

test that are beyond our control. Further, there can be no assurance that CMS and commercial payers who initially decide to cover Cologuard will continue to do so. We are pursuing a variety of

strategies to increase commercial payer coverage and reimbursement of Cologuard. In certain situations, where we believe payers are obligated to cover Cologuard under federal and state laws that

mandate coverage for certain colorectal cancer screening tests, we have sued to enforce coverage obligations. We may pursue similar litigation in the future. Such litigation may be costly, may divert

management attention from other responsibilities, may cause payers, including those not directly involved in the litigation, to resist contracting with us, and may ultimately prove unsuccessful.

As

noted above, federal and state coverage mandates may be deemed not to apply to Cologuard, may be interpreted in a manner unfavorable to us, may be difficult to enforce and are

subject to repeal or modification. For example, the ACA may be repealed or materially modified, in whole or in part, or replaced with an alternative legal framework governing healthcare matters. Such

repeal modification or replacement may eliminate or modify the coverage mandate for preventive services, and any such elimination or modification may have an adverse effect on our business prospects.

Moreover,

coverage determinations and reimbursement rates are subject to change, and we cannot guarantee that even if we initially achieve adequate coverage and reimbursement rates,

they will be applicable to our Cologuard test in the future. As noted above, under PAMA, our Medicare reimbursement rate will be subject to adjustment based on our volume-weighted median commercial

reimbursement rate. A reduction in our Medicare reimbursement rate could significantly and adversely affect our business products, financial condition and results of operation.

Even

where a third-party payer agrees to cover Cologuard, other factors may have a significant impact on the actual reimbursement we receive for a Cologuard test from that payer. For

example, if we do not have a contract with a given payer, we may be deemed an "out-of-network" provider by that payer, which could result in a greater portion of the cost of the Cologuard test being

borne by the

S-18

Table of Contents

patient.

We may be unsuccessful in our efforts to enter into, or maintain, a network contract with a given payer, and we expect that our network status with a given payer may change from time to time

for a variety of reasons, many of which may be outside our control. To the extent Cologuard is out of

network for a given payer, physicians may be less likely to prescribe Cologuard for their patients and their patients may be less likely to comply with any such orders. Also, some payers may require

that they give prior authorization for a Cologuard test before they are willing to pay for it or review claims post-service to ensure the service was medically appropriate for specific patients. Prior

authorization and other medical management requirements may require that we, patients or physicians provide the payer with extensive medical records and other information. Prior authorization and

other medical management requirements impose a significant additional cost on us, may be difficult to comply with given our position as a laboratory, may make physicians less likely to prescribe

Cologuard for their patients, and may make patients less likely to comply with physician orders for Cologuard, all or any of which may have an adverse effect on our revenues.

If our clinical studies do not satisfy providers, payers, patients and others as to the reliability,

effectiveness and superiority of our Cologuard test or any future test we may develop and seek to commercialize, we may experience reluctance or refusal on the part of physicians to order, and

third-party payers to pay for, such test.

Although we have received FDA approval for our Cologuard test, if the results of our research and clinical studies and our sales and marketing

activities relating to communication of these results, do not convince guidelines organizations, physicians and other healthcare providers, third-party payers and patients that our Cologuard test is

reliable, effective and superior to alternative screening methods, we may experience reluctance or refusal on the part of physicians to order, and third-party payers to pay for, our Cologuard test,

which could adversely affect our business prospects. Likewise, if the results of our research and clinical studies and our sales and marketing activities relating to communication of these results, do

not convince guidelines organizations, physicians and other healthcare providers, third-party payers and patients that other tests we may develop and seek to commercialize in the future are reliable,

effective and superior to alternative tests, we may experience reluctance or refusal on the part of physicians to order, and third-party payers to pay for, those tests, which could adversely affect

our business prospects.

We have finite selling and marketing resources and only limited sales, marketing, customer support,

manufacturing, distribution and commercial laboratory experience, which may restrict our success in commercializing Cologuard and other products we may develop and we may be unsuccessful in entering

into or maintaining third-party arrangements to support our internal efforts.

To grow our business as planned, we must expand our sales, marketing and customer support capabilities, which will involve developing and

administering our commercial infrastructure and/or collaborative commercial arrangements and partnerships. We must also maintain satisfactory arrangements for the manufacture and distribution of our

Cologuard test. Also, in connection with the launch of Cologuard in late 2014, we began operating a CLIA certified lab facility to process Cologuard tests and provide patient results. We have limited

experience managing a sales force, customer support operation and operating a manufacturing operation and clinical lab facility and we may encounter difficulties retaining and managing the specialized

workforce these activities require. We may seek to partner with others to assist us with any or all of these functions. However, we may be

unable to find appropriate third parties with whom to enter into these arrangements. Furthermore, if we do enter into these arrangements, these third parties may not perform as expected or the

arrangements may otherwise prove to be detrimental to our short- and long-term results. For example, certain third-party arrangements may cause us to forego or defer the development or acquisition of

internal capabilities. If a third-party arrangement fails to perform as expected or if it is terminated prematurely for any reason, our business may be harmed not only by such failure or termination

itself,

S-19

Table of Contents

but

also by the opportunity cost associated with our not timely developing or acquiring necessary or useful capabilities internally.

If we are unable to deploy and maintain effective sales and marketing capabilities, we will have difficulty

achieving market awareness and selling our products and services.

To achieve commercial success for our Cologuard test and our future products and services, we must continue to develop and grow our sales and

marketing organization and our sales and marketing organization must effectively explain to healthcare providers the reliability, effectiveness and benefits of Cologuard and our future products and

services as compared to alternatives. We may not be able to successfully manage our dispersed or inside sales forces or our sales force may not be effective. Because of the competition for their

services, we may be unable to partner with or retain additional qualified sales representatives, either as our employees or independent contractors or through independent sales organizations. We may

not be able to enter into agreements with sales representatives on commercially reasonable terms, if at all. Further, market competition for commercial and marketing talent is significant, and we may

not be able to hire or retain such talent on commercially reasonable terms, if at all.

Establishing

and maintaining sales and marketing capabilities will be expensive and time-consuming. Our expenses associated with maintaining our sales force may be disproportional

compared to the revenues we may be able to generate on sales of the Cologuard test or any future products or services.

The success of our Cologuard test depends on the degree of market acceptance by physicians, patients,