Reports Comprehensive Loss Per Share of

$0.02, Income before Taxes of $364 Million on $515 Million in Net

Revenues, and Loss Per Share on Net Income of $0.02.

Declares Quarterly Dividend of $0.10 Per

Share.

Interactive Brokers Group, Inc. (NASDAQ GS: IBKR) an automated

global electronic broker and market maker, today reported a diluted

loss per share on a comprehensive basis of $0.02 for the quarter

ended December 31, 2017, compared to a diluted loss per share on a

comprehensive basis of $0.05 for the same period in 2016. Excluding

other comprehensive income, the Company reported a diluted loss per

share of $0.02 for the quarter, compared to diluted earnings per

share of $0.07 for the same period in 2016. The results for the

quarter were negatively impacted by the effects of the Tax Cuts and

Jobs Act (the “Tax Act”), enacted on December 22, 2017, which

decreased diluted earnings per share by $0.45.

Net revenues were $515 million and income before income taxes

was $364 million this quarter, compared to net revenues of $193

million and income before income taxes of $28 million for the same

period in 2016. The results for the quarter were positively

impacted by strong growth in net interest income, which increased

$66 million, or 48%, and higher commissions, which increased $20

million, or 13% from the year-ago quarter. Trading gains decreased

64% from the year-ago quarter on lower market making trading

volumes as we completed the transfer of our U.S. options market

making business to Two Sigma Securities, LLC in the third quarter

of 2017.

In addition, the results for the quarter include a $6 million

gain on our currency diversification strategy, compared to a $152

million loss in the same period in 2016; and a $9 million net

mark-to-market loss on our U.S. government securities portfolio,

compared to an $11 million net mark-to-market loss in the same

period in 2016.

The Tax Act significantly revised U.S. corporate income tax law

by, among other things, reducing the corporate income tax rate to

21% and implementing a modified territorial tax system that

includes a one-time transition tax on deemed repatriated earnings

of foreign subsidiaries. As a result of the Tax Act, this quarter

includes a net reduction in consolidated earnings of approximately

$84 million, of which $62 million is due to the one-time

repatriation tax and a net $22 million is related to the

remeasurement of U.S. deferred tax assets at lower enacted

corporate tax rates. The impact of the Tax Act recognized this

quarter may materially differ due to, among other things, changes

in interpretations and assumptions the Company has made, guidance

that may be issued and actions the Company may take as a result of

the Tax Act.

For the year ended December 31, 2017, comprehensive diluted

earnings per share were $1.22, compared to comprehensive diluted

earnings per share of $1.19 in 2016. Excluding other comprehensive

income, the Company reported diluted earnings per share of $1.07

for 2017, compared to diluted earnings per share of $1.25 in 2016.

The results for 2017 were negatively impacted by the effects of the

Tax Act, which decreased diluted earnings per share by $0.46. Net

revenues were $1,702 million and income before income taxes was

$1,049 million for 2017, compared to net revenues of $1,396 million

and income before income taxes of $761 million in 2016.

The Interactive Brokers Group, Inc. Board of Directors declared

a quarterly cash dividend of $0.10 per share. This dividend is

payable on March 14, 2018 to shareholders of record as of March 1,

2018.

Business Highlights

Fourth Quarter 2017:

- 71% pretax profit margin for this

quarter, up from 15% in the year-ago quarter.

- 65% Electronic Brokerage pretax profit

margin for this quarter, up from 57% in the year-ago quarter.

- Customer equity grew 46% from the

year-ago quarter to $124.8 billion and customer debits increased

52% to $29.5 billion.

- Customer accounts increased 25% from

the year-ago quarter to 483 thousand.

- Total DARTs1 increased 14% from the

year-ago quarter to 730 thousand.

- Brokerage segment equity was $4.9

billion. Total equity was $6.4 billion.

Full Year 2017:

- 62% pretax profit margin for 2017, up

from 55% in 2016.

- 61% Electronic Brokerage pretax profit

margin for 2017, unchanged from 2016.

- Total DARTs increased 4% from 2016 to

688 thousand.

_____________________________

1 Daily average revenue trades (DARTs) are based on customer

orders.

Segment Overview

Electronic Brokerage

Electronic brokerage segment income before income taxes

increased 50%, to $252 million in the quarter ended December 31,

2017, compared to the same period last year. Net revenues increased

33% to $390 million on higher net interest income and commissions

revenue.

Net interest income increased 51% as average customer credit and

margin loan balances and benchmark interest rates increased from

the year-ago quarter. Commissions revenue increased 13% from the

year-ago quarter on higher customer volumes in options and stocks,

which increased 15% and 43%, respectively, from the year-ago

quarter. Pretax profit margin was 65% for the quarter ended

December 31, 2017, up from 57% in the same period last year.

Customer accounts grew 25% to 483 thousand and customer equity

increased 46% from the year-ago quarter to $124.8 billion. Total

DARTs for cleared and execution-only customers increased 14% to 730

thousand from the year-ago quarter. Cleared DARTs were 681

thousand, 15% higher than in the same period last year.

Market Making

Market making segment income before income taxes decreased to $8

million in the quarter ended December 31, 2017, due to lower

trading gains, partially offset by lower operating costs, as we

completed the transfer of our U.S. options market making business

to Two Sigma Securities, LLC in the third quarter of 2017.

Effects of Foreign Currency Diversification

In connection with our currency diversification strategy, we

have determined to base our net worth in GLOBALs, a basket of 14

major currencies in which we hold our equity. In this quarter, our

currency diversification strategy increased our comprehensive

earnings by $5 million, as the U.S. dollar value of the GLOBAL

increased by approximately 0.14%. In 2017, our currency

diversification strategy increased our comprehensive earnings by

$175 million, as the U.S. dollar value of the GLOBAL increased by

approximately 3.06%. The effects of the currency diversification

strategy are reported as components of (1) Other Income in the

corporate segment and (2) Other Comprehensive Income (“OCI”).

Conference Call Information:

Interactive Brokers Group will hold a conference call with

investors today, January 16, 2018, at 4:30 p.m. ET to discuss its

quarterly results. Investors who would like to listen to the

conference call live should dial 877-324-1965 (U.S. domestic) and

631-291-4512 (international). The number should be dialed

approximately ten minutes prior to the start of the conference

call. Ask for the “Interactive Brokers Conference Call.”

The conference call will also be accessible simultaneously, and

through replays, as an audio webcast through the Investor Relations

section of the Interactive Brokers web site,

www.interactivebrokers.com/ir.

About Interactive Brokers Group, Inc.:

Interactive Brokers Group affiliates provide automated trade

execution and custody of securities, commodities and foreign

exchange around the clock on over 120 markets in numerous countries

and currencies from a single IB Universal Account℠ to customers

worldwide. We service individual investors, hedge funds,

proprietary trading groups, financial advisors and introducing

brokers. Our four decades of focus on technology and automation has

enabled us to equip our customers with a uniquely sophisticated

platform to manage their investment portfolios at the lowest cost

according to Barron’s Best Online Brokers review, March 20, 2017.

We strive to provide our customers with advantageous execution

prices and trading, risk and portfolio management tools, research

facilities and investment products, all at low prices, positioning

them to achieve superior returns on investments.

Cautionary Note Regarding Forward-Looking Statements:

The foregoing information contains certain forward-looking

statements that reflect the Company’s current views with respect to

certain current and future events and financial performance. These

forward-looking statements are and will be, as the case may be,

subject to many risks, uncertainties and factors relating to the

Company’s operations and business environment which may cause the

Company’s actual results to be materially different from any future

results, expressed or implied, in these forward-looking statements.

Any forward-looking statements in this release are based upon

information available to the Company on the date of this release.

The Company does not undertake to publicly update or revise its

forward-looking statements even if experience or future changes

make it clear that any statements expressed or implied therein will

not be realized. Additional information on risk factors that could

potentially affect the Company’s financial results may be found in

the Company’s filings with the Securities and Exchange

Commission.

INTERACTIVE BROKERS GROUP, INC. AND

SUBSIDIARIES

OPERATING DATA

TRADE

VOLUMES: (in 000's, except %) Brokerage

Market Brokerage Non Avg. Trades

Making % Cleared % Cleared

% Total % per U.S.

Period Trades

Change Trades

Change Trades

Change Trades

Change Trading Day 2015

65,937 242,846 18,769 327,553 1,305 2016 64,038 -3% 259,932 7%

16,515 -12% 340,485 4% 1,354 2017 31,282 -51% 265,501 2% 14,835

-10% 311,618 -8% 1,246 4Q2016 15,253 63,074 3,933 82,260

1,316 4Q2017 4,263 -72% 71,502 13% 3,800 -3% 79,565 -3% 1,273

3Q2017 6,834 66,262 3,698 76,794 1,229 4Q2017 4,263 -38%

71,502 8% 3,800 3% 79,565 4% 1,273

CONTRACT AND SHARE

VOLUMES: (in 000's, except %)

TOTAL Options % Futures*

% Stocks % Period

(contracts) Change

(contracts) Change

(shares) Change 2015

634,388 140,668 172,742,520 2016 572,834 -10% 143,287 2%

155,439,227 -10% 2017 395,885 -31% 124,123 -13% 220,247,921 42%

4Q2016 141,695 34,173 41,805,268 4Q2017 89,381 -37% 31,445

-8% 58,373,129 40% 3Q2017 93,470 31,508 55,195,706 4Q2017

89,381 -4% 31,445 0% 58,373,129 6%

MARKET MAKING

Options % Futures* % Stocks

% Period (contracts)

Change (contracts)

Change (shares)

Change 2015 335,406 14,975 15,376,076 2016

307,377 -8% 14,205 -5% 13,082,887 -15% 2017 102,025 -67% 5,696 -60%

7,139,622 -45% 4Q2016 73,843 3,481 2,249,744 4Q2017 11,228

-85% 1,002 -71% 1,750,178 -22% 3Q2017 18,676 1,040 1,814,393

4Q2017 11,228 -40% 1,002 -4% 1,750,178 -4%

BROKERAGE

TOTAL Options % Futures* %

Stocks % Period

(contracts) Change

(contracts) Change

(shares) Change 2015

298,982 125,693 157,366,444 2016 265,457 -11% 129,082 3%

142,356,340 -10% 2017 293,860 11% 118,427 -8% 213,108,299 50%

4Q2016 67,852 30,692 39,555,524 4Q2017 78,153 15% 30,443 -1%

56,622,951 43% 3Q2017 74,794 30,468 53,381,313 4Q2017 78,153

4% 30,443 0% 56,622,951 6% * Includes options on futures

INTERACTIVE BROKERS GROUP, INC. AND

SUBSIDIARIES

OPERATING DATA, CONTINUED

BROKERAGE CLEARED Options

% Futures* % Stocks %

Period (contracts)

Change (contracts)

Change (shares)

Change 2015 244,356 124,206 153,443,988 2016

227,413 -7% 128,021 3% 138,523,932 -10% 2017 253,304 11% 116,858

-9% 209,435,662 51% 4Q2016 59,354 30,452 38,598,113 4Q2017

66,232 12% 30,041 -1% 55,714,749 44% 3Q2017 64,363 30,034

52,515,806 4Q2017 66,232 3% 30,041 0% 55,714,749 6% *

Includes options on futures

BROKERAGE STATISTICS (in 000's, except % and where

noted) Year over Year 4Q2017

4Q2016 % Change Total

Accounts 483 385 25% Customer Equity (in billions)* $ 124.8 $ 85.5

46% Cleared DARTs 681 591 15% Total Customer DARTs 730 640

14%

Cleared Customers (in $'s, except DART per

account) Commission per DART $ 3.92 $ 4.01 -2% DART per Avg.

Account (Annualized) 363 394 -8% Net Revenue per Avg. Account

(Annualized) $ 3,318 $ 3,205 4%

Consecutive Quarters

4Q2017 3Q2017 %

Change Total Accounts 483 457 6% Customer Equity (in

billions)* $ 124.8 $ 115.7 8% Cleared DARTs 681 646 5% Total

Customer DARTs 730 695 5%

Cleared Customers (in $'s,

except DART per account) Commission per DART $ 3.92 $ 3.96 -1%

DART per Avg. Account (Annualized) 363 365 -1% Net Revenue per Avg.

Account (Annualized) $ 3,318 $ 3,249 2% * Excludes

non-customers.

INTERACTIVE BROKERS GROUP, INC. AND

SUBSIDIARIES

NET INTEREST MARGIN

(UNAUDITED)

Three Months Twelve

Months Ended December 31, Ended December 31,

2017 2016 2017 2016 (in

millions) Average interest-earning assets Segregated

cash and securities $ 22,803 $ 24,679 $ 23,824 $ 24,134 Customer

margin loans 26,982 18,407 23,289 16,506 Securities borrowed 3,757

4,560 3,964 4,155 Other interest-earning assets 3,610

2,397 2,970 2,495 $ 57,152 $ 50,043 $ 54,047 $ 47,290

Average interest-bearing liabilities Customer credit

balances $ 47,561 $ 42,315 $ 45,515 $ 39,980 Securities loaned

4,350 3,424 3,917 2,897 $ 51,911 $

45,739 $ 49,432 $ 42,877

Net interest income

Segregated cash and securities, net $ 66 $ 39 $ 226 $ 149 Customer

margin loans 122 60 392 217 Securities borrowed and loaned, net 49

38 161 156 Customer credit balances (43) (4) (123) (12) Other net

interest income1 13 5 32 17 Net

interest income $ 207 $ 138 $ 688 $ 527

Net interest

margin ("NIM") 1.44% 1.10% 1.27%

1.11%

Annualized yields Segregated cash and

securities 1.15% 0.63% 0.95% 0.62% Customer margin loans 1.79%

1.30% 1.68% 1.31% Customer credit balances 0.36% 0.04% 0.27% 0.03%

1 Includes income from financial

instruments which has the same characteristics as interest, but is

reported in other income.

INTERACTIVE BROKERS GROUP, INC. AND

SUBSIDIARIES

SEGMENT FINANCIAL INFORMATION

(UNAUDITED)

Three Months Twelve

Months Ended December 31, Ended December 31,

2017 2016 2017 2016

(in millions)

Electronic Brokerage Net revenues $ 390 $ 294 $ 1,405

$ 1,239 Non-interest expenses 138 126 545

483 Income before income taxes $ 252 $ 168 $ 860 $

756 Pre-tax profit margin 65% 57% 61% 61%

Market

Making Net revenues $ 25 $ 45 $ 86 $ 190 Non-interest expenses

17 33 113 146 Income (loss)

before income taxes $ 8 $ 12 $ (27) $ 44 Pre-tax profit

(loss) margin 32% 27% (31%) 23%

Corporate 1

Net revenues $ 100 $ (146) $ 211 $ (33) Non-interest expenses

(4) 6 (5) 6 Income (loss) before

income taxes $ 104 $ (152) $ 216 $ (39)

Total

Net revenues $ 515 $ 193 $ 1,702 $ 1,396 Non-interest expenses

151 165 653 635 Income before

income taxes $ 364 $ 28 $ 1,049 $ 761 Pre-tax profit margin

71% 15% 62% 55%

_________________________________________________

1 Corporate includes corporate related activities as well as

inter-segment eliminations and gains and losses on positions held

as part of our overall currency diversification strategy.

INTERACTIVE BROKERS GROUP, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME

(UNAUDITED)

Three Months Twelve

Months Ended December 31, Ended December 31,

2017 2016 2017 2016 (in

millions, except share and per share data) Revenues:

Trading gains $ 14 $ 39 $ 40 $ 163 Commissions 170 150 647 612

Interest income 282 160 908 606 Other income (loss) 127

(134) 332 94 Total revenues 593 215

1,927 1,475 Interest expense 78 22 225

79 Total net revenues 515 193

1,702 1,396 Non-interest expenses: Execution and

clearing 56 61 241 244 Employee compensation and benefits 57 68 249

242 Occupancy, depreciation and amortization 13 13 47 51

Communications 6 7 28 30 General and administrative 19 16 86 62

Customer bad debt - - 2 6 Total

non-interest expenses 151 165 653 635

Income before income taxes 364 28 1,049 761 Income

tax expense 200 7 256 62 Net

income 164 21 793 699 Net income attributable to

noncontrolling interests 166 17 717 615

Net income (loss) available for common stockholders $ (2) $

4 $ 76 $ 84 Earnings (loss) per share: Basic $ (0.02) $ 0.07

$ 1.09 $ 1.28 Diluted $ (0.02) $ 0.07 $ 1.07 $ 1.25 Weighted

average common shares outstanding: Basic 71,473,863 67,983,085

69,926,933 66,013,247 Diluted 72,373,829 68,967,280 70,904,921

67,299,413 Comprehensive income: Net income (loss) available

for common stockholders $ (2) $ 4 $ 76 $ 84 Other comprehensive

income: Cumulative translation adjustment, before income taxes -

(7) 11 (4) Income taxes related to items of other comprehensive

income - - - - Other comprehensive income, net

of tax - (7) 11 (4) Comprehensive

income (loss) available for common stockholders $ (2) $ (3) $ 87 $

80 Comprehensive income attributable to noncontrolling

interests: Net income attributable to noncontrolling interests $

166 $ 17 $ 717 $ 615 Other comprehensive income - cumulative

translation adjustment (1) (40) 54 (21)

Comprehensive income (loss) attributable to noncontrolling

interests $ 165 $ (23) $ 771 $ 594

INTERACTIVE BROKERS GROUP, INC. AND

SUBSIDIARIES

EARNINGS PER SHARE ON COMPREHENSIVE

INCOME

(UNAUDITED)

Three Months

Twelve Months Ended December 31, Ended December

31, 2017 2016 2017 2016

(in millions, except share and per share data)

Comprehensive income (loss) available for common stockholders, net

of tax $ (2) $ (3) $ 87 $ 80 Comprehensive earnings (loss)

per share: Basic $ (0.02) $ (0.05) $ 1.24 $ 1.21 Diluted $ (0.02) $

(0.05) $ 1.22 $ 1.19 Weighted average common shares

outstanding: Basic 71,473,863 67,983,085 69,926,933 66,013,247

Diluted 72,373,829 68,967,280 70,904,921 67,299,413

INTERACTIVE BROKERS GROUP, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

December 31,

2017

December 31,

2016

(in millions) Assets Cash and cash equivalents

$ 1,781 $ 1,925 Cash and securities - segregated for regulatory

purposes 20,232 24,017 Securities borrowed 2,957 3,629 Securities

purchased under agreements to resell 2,061 111 Financial

instruments owned, at fair value 3,154 4,037 Receivables from

customers, net of allowance for doubtful accounts 29,821 19,409

Receivables from brokers, dealers and clearing organizations 774

1,040 Other assets 382 505

Total assets

$ 61,162 $ 54,673

Liabilities and equity

Liabilities Short-term borrowings $ 15 $ 74

Securities loaned 4,444 4,293 Securities sold under agreements to

repurchase 1,316 - Financial instruments sold but not yet

purchased, at fair value 767 2,145 Other payables: Customers 47,548

41,731 Brokers, dealers and clearing organizations 283 239 Other

payables 356 371 48,187 42,341

Total liabilities 54,729 48,853

Equity

Stockholders' equity 1,090 974 Noncontrolling interests

5,343 4,846 Total equity 6,433 5,820

Total liabilities and equity $ 61,162 $ 54,673

December 31, 2017 December 31, 2016 Ownership of

IBG LLC Membership Interests

Interests

%

Interests

%

IBG, Inc. 71,479,604 17.4% 67,989,967 16.6% Noncontrolling

interests (IBG Holdings LLC) 340,229,444 82.6% 341,444,304 83.4%

Total IBG LLC membership interests 411,709,048 100.0%

409,434,271 100.0%

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180116006670/en/

For Interactive Brokers Group,

Inc.Investors:Nancy Stuebe,

203-618-4070orMedia:Kalen Holliday,

203-913-1369

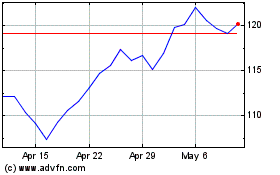

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Mar 2024 to Apr 2024

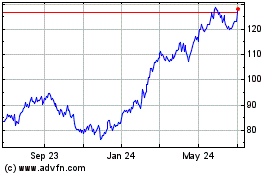

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Apr 2023 to Apr 2024