As

filed with the Securities and Exchange Commission on January 12, 2018

Registration

No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Akoustis

Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

3661

|

33-1229046

|

(State or other jurisdiction

of

incorporation or organization)

|

(Primary Standard

Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

9805

Northcross Center Court, Suite A

Huntersville, NC 28078

(704)-997-5735

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Jeffrey

B. Shealy, CEO

Akoustis Technologies, Inc.

9805 Northcross Center Court, Suite A

Huntersville, NC 28078

(704) 997-5735

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy

to:

Adam

P. Wheeler, Esq.

Womble Carlyle Sandridge & Rice, LLP

1200 Nineteenth Street NW, Suite 500

Washington, DC 20036

(202) 467-6900

Approximate

date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933 check the following box. ☑

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

(Do not check if a smaller reporting

company)

|

Smaller reporting company

|

☑

|

|

|

|

|

Emerging growth company

|

☑

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

☐

|

Title

of Each Class of Securities to be Registered

|

|

Amount

to be

Registered (1)

|

|

Proposed

Maximum

Offering

Price

Per

Share (2)

|

|

Proposed

Maximum

Aggregate

Offering

Price

(2)

|

|

Amount

of

Registration

Fee

|

|

Common

Stock, par value $0.001 per share

|

|

3,293,255

|

|

$6.36

|

|

$20,945,102

|

|

$2,607.67

|

|

|

(1)

|

Consists

of (a) 2,892,269 outstanding shares of the registrant’s common stock, (b) 154,177

shares of the registrant’s common stock that may become issuable upon exercise

of common stock purchase warrants, and (c) up to 246,809 shares of common stock issuable

pursuant to the price-protected anti-dilution provision applicable to 2,468,094 of the

outstanding shares referenced in (a) above. Pursuant to Rule 416 under the Securities

Act of 1933, as amended, to the extent that such outstanding shares and warrants provide

for an increase in an amount issuable or exercisable to prevent dilution resulting from

stock splits, stock dividends, or similar transactions, this registration statement shall

be deemed to cover such additional shares of common stock issuable in connection with

any such provision.

|

|

|

(2)

|

Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under

the Securities Act of 1933, as amended, based on the average of the high and low prices

of the registrant’s common stock as reported by the NASDAQ Stock Market LLC on

January 10, 2018. The shares offered hereunder may be sold by the selling stockholders

from time to time in the open market, through privately negotiated transactions or a

combination of these methods, at market prices prevailing at the time of sale or at negotiated

prices.

|

The

registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall

become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until

the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to

sell these securities and the selling stockholders are not soliciting an offer to buy these securities in any state where the

offer or sale is not permitted.

Subject

to completion, dated January 12, 2018

AKOUSTIS

TECHNOLOGIES, INC.

Prospectus

3,293,255 Shares

Common Stock

This

prospectus relates to the sale of up to 3,293,255 shares of our common stock, par value $0.001 per share (the “Common Stock”),

by the selling stockholders of Akoustis Technologies, Inc., a Delaware corporation, listed in this prospectus. Of the shares being

offered, 2,892,269 are presently issued and outstanding, 154,177 are issuable upon exercise of Common Stock purchase warrants,

and 246,809 may become issuable pursuant to the price-protected anti-dilution provision applicable to 2,468,094 outstanding shares

referenced above. The shares offered by this prospectus may be sold by the selling stockholders from time to time in the open

market, through privately negotiated transactions or a combination of these methods, at market prices prevailing at the time of

sale or at negotiated prices.

The

distribution of the shares by the selling stockholders is not subject to any underwriting agreement. We will not receive any proceeds

from the sale of the shares by the selling stockholders. We will bear all expenses of registration incurred in connection with

this offering, but all selling and other expenses incurred by the selling stockholders will be borne by them.

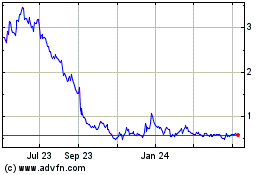

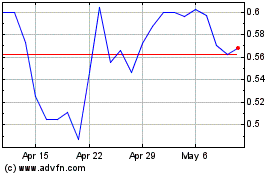

Our

Common Stock is traded on the NASDAQ Capital Market (“NASDAQ”) under the symbol “AKTS.” On January 10,

2018, the last reported sale price for our Common Stock was $6.41 per share.

We

are an “Emerging Growth Company” as defined in the Jumpstart Our Business Startups Act of 2012 and, as such, have

elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus

Summary - Implications of Being an Emerging Growth Company.”

Our

business and an investment in our securities involve a high degree of risk. Before making any investment in our securities, you

should read and carefully consider risks described in the “Risk Factors” section beginning on page 8 of

this prospectus.

You

should rely only on the information contained in this prospectus or any prospectus supplement or amendment thereto. We have not

authorized anyone to provide you with different information. This prospectus may only be used where it is legal to sell these

securities. The information in this prospectus is only accurate on the date of this prospectus, regardless of the time of any

sale of securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This

prospectus is dated January 12, 2018.

You

should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with

information that is different from that contained in this prospectus. If anyone provides you with different or inconsistent information,

you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other information

that others may give you. The selling stockholders are offering to sell and seeking offers to buy these securities only in jurisdictions

where offers and sales are permitted. You should assume that the information contained in this prospectus is accurate only as

of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Common Stock. Our

business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer

of any securities in any jurisdiction where the offer is not permitted.

TABLE

OF CONTENTS

PROSPECTUS

SUMMARY

The

following summary highlights information contained elsewhere in this prospectus. This summary is not complete and does not contain

all of the information that should be considered before investing in our Common Stock. Potential investors should read the entire

prospectus carefully, including the more detailed information regarding our business provided below in the “Description

of Business” section, the risks of purchasing our Common Stock discussed under the “Risk Factors” section, and

our financial statements and the accompanying notes to the financial statements.

Unless

the context indicates or requires otherwise, all references in this registration statement to “Akoustis Technologies,”

“Akoustis,” the “Company,” “we,” “us” and “our” refer to Akoustis

Technologies, Inc. and its wholly owned consolidated subsidiaries, Akoustis, Inc., and Akoustis Manufacturing New York, Inc.,

each of which are Delaware corporations.

This

prospectus includes the trademarks of Akoustis, Inc., Akoustis

TM

and BulkOne®, See “Description of Business

- Intellectual Property”. All references to Akoustis and BulkOne® in this prospectus are intended to include reference

to such trademarks.

Overview

Akoustis

is an early stage company focused on developing, designing and manufacturing innovative radio frequency (RF) filter products for

the mobile wireless device industry. We use a patented fundamentally new piezoelectric resonator technology that we call BulkONE®

in the manufacturing of bulk acoustic wave (BAW) resonators, the building blocks of high selectivity “RF” filters

required to route signals in a smartphone or other mobile or wearable device, cellular infrastructure and WiFi routers. Filters

are a critical component of the RF front-end (RFFE), and their use has multiplied with the launch and licensing of 4G/LTE, emerging

5G and WiFi frequency bands. They are used to define the range of frequencies of radio signals that are transmitted (the “passband”)

and simultaneously reject unwanted signals.

We

plan to use single-crystal piezoelectric materials to develop a new class of BAW RF filters with a fundamental advantage to reduce

losses over existing thin film RF filter technologies. We believe our technology will be disruptive to the RFFE market through

the following expected advantages:

|

|

●

|

Wider

bandwidth coverage,

|

|

|

●

|

Smaller

filter supports higher level of integration and lower manufacturing costs,

|

|

|

●

|

Improved

power compression and linearity,

|

|

|

●

|

Reduced

power amplifier cost, for the ultimate purpose of manufacturing our BAW RF filters,

|

|

|

●

|

Reduced

heat generation and reduced battery loading, and

|

|

|

●

|

Reduced

guard band between adjacent frequency bands.

|

Once

our technology is qualified for mass production, we expect to design and sell single-crystal BAW RF filter products using our

BulkONE® technology. Our product focus is on innovative single-band filter products for the growing smartphone and RFFE module

market, which can be used to make duplexer or multiplexer filter products necessary for the mobile market. These products present

the greatest near-term potential for commercialization of our technology. According to a Mobile Experts May 2016 report, the mobile

filter market is expected to grow from $8.2 billion in 2017 to greater than $12 billion by 2021.

For

a glossary of technical terms used herein, see “Description of Business – Glossary” below.

Recent

Developments

On

March 23, 2017, we entered into an Asset Purchase Agreement and a Real Property Purchase Agreement (collectively, the “STC-MEMS

Agreements”) with The Research Foundation for the State University of New York (“RF-SUNY”) and Fuller Road Management

Corporation (“FRMC”), an affiliate of RF-SUNY (collectively, “Sellers”), respectively, to acquire certain

specified assets, including STC-MEMS, a semiconductor wafer-manufacturing and microelectromechanical systems (“MEMS”)

operation with associated wafer-manufacturing tools, and the associated real estate and improvements located in Canandaigua, New

York used in the operation of STC-MEMS (the assets and real estate and improvements referred to together herein as the “STC-MEMS

Business”). Pursuant to the STC-MEMS Agreements, the Company also agreed to assume post acquisition date substantially all

of the ongoing obligations of the STC-MEMS Business incurred in the ordinary course of business.

We

completed the acquisition of the STC-MEMS Business through our wholly-owned subsidiary, Akoustis Manufacturing New York, Inc.,

a Delaware corporation formed in connection with the acquisition, on June 26, 2017 for an aggregate purchase price of $2.8 million

in cash. The Company recorded net assets acquired of $6.3 million for purchase consideration of $4.6 million (includes $2.85 million

of cash paid at closing plus $1.7 million real estate contingent liability), which resulted in the recording of a bargain purchase

gain of $1.7 million.

The

STC-MEMs acquisition allows the Company to internalize manufacturing, increase capacity and control its wafer supply chain for

single crystal BAW RF filters. We have now successfully transferred our research and development (“R&D”) resonator

filter process flow into the facility, which recently received ISO 9001:2015 certification. We plan to utilize the facility to

optimize our BulkONE® technology and to consolidate all aspects of wafer manufacturing for our disruptive and patented high

band BAW RF filters targeting the multi-billion dollar mobile and other wireless markets. This planned consolidation of the Company’s

supply chain into the STC-MEMS Business started on June 26, 2017 and is expected to shorten time-to-market for our RF products,

greatly enhancing our ability to service customers upon completion of development and design specifications. Furthermore, we believe

that shorter time-to-market cycles provide us with the opportunity to increase the number of our potential customers.

In

November 2017, we announced our first shipment of high performance single-crystal BAW diplexer filter module prototypes. These

initial prototypes were shipped pursuant to a customer engagement and purchase order announced by the Company in May 2017. The

purchase order covers the cost of engineering development and initial delivery of BAW RF diplexers for band-specific applications

in the frequency spectrum below 1.5GHz. Akoustis expects follow on shipments of small form-factor bandpass diplexer filter solutions

that replace larger legacy-filter technology, which enables system miniaturization without trading off performance.

This

is the fourth BAW filter prototype shipment that Akoustis has recently made. In August and September 2017, AKTS separately

announced first shipments of high performance LTE-TDD Band 41, 2.6 GHz BAW RF filter prototypes that it believes will satisfy

the challenging filter requirements in the high growth 4G LTE mobile market in China, a first shipment of premium high-band BAW

filter prototypes for a radar application that will operate with a passband between 3.5GHz and 3.9GHz, and a first shipment

of the industry’s first single-crystal 5.2GHz BAW RF filters for 802.11ac Tri-Band WiFi routers.

In

December 2017, the Company closed the Second 2017 Offering (as defined under “Selling Stockholders—The

Second 2017 Offering” below) in which it sold an aggregate 2,640,819 shares of Common Stock at $5.50 per share for aggregate

gross proceeds before expenses of $14,524,504. For additional information about the Second 2017 Offering, including information

regarding price-protection anti-dilution rights and placement agent compensation, refer to “Selling Stockholders –

The Second 2017 Offering” below.

Capital

Needs

The

Company believes that it has sufficient cash to fund its operations through August 2018. However, there is no assurance that the

Company’s projections and estimates are accurate. In the event that the Company does not obtain the funds needed to develop

its technology and enable future sales, or the Company experiences costs in excess of estimates to continue its R&D plan,

it is possible that the Company would not have sufficient resources to continue as a going concern for the next year. In order

to mitigate these risks, the Company is actively managing and controlling the Company’s cash outflows.

About

This Offering

This

prospectus relates to the public offering, which is not being underwritten, by the selling stockholders listed in this prospectus,

of up to 3,293,255 shares of our Common Stock. Of the shares being offered, 2,892,269 are presently issued and outstanding, 154,177

are issuable upon exercise of Common Stock purchase warrants, and up to 246,809 shares may become issuable pursuant to the price-protected

anti-dilution provision applicable to 2,468,094 outstanding shares referenced above. The shares offered by this prospectus may

be sold by the selling stockholders from time to time in the open market, through negotiated transactions or otherwise at market

prices prevailing at the time of sale or at negotiated prices. We will receive none of the proceeds from the sale of the shares

by the selling stockholders. We will bear all expenses of registration incurred in connection with this offering, but all selling

and other expenses incurred by the selling stockholders will be borne by them.

Selected

Risks Associated with an Investment in Shares of Our Common Stock

An

investment in shares of our Common Stock is highly speculative and is subject to numerous risks described in the section entitled

“Risk Factors” and elsewhere in this prospectus. You should carefully consider these risks before making an investment.

Some of these risks include:

|

|

●

|

We

have a limited operating history upon which investors can evaluate our business and future

prospects.

|

|

|

●

|

We

have a history of losses (we have incurred net losses of approximately $21.2 million

for the period from May 12, 2014 (inception) to September 30, 2017), will need substantial

additional funding to continue our operations and may not achieve or sustain profitability

in the future.

|

|

|

●

|

If

we are unable to obtain additional financing on acceptable terms, we may have to curtail

our growth or cease our development plans and operations.

|

|

|

●

|

You

could lose all of your investment.

|

|

|

●

|

You

may experience dilution of your ownership interests because of the future issuance of

additional shares of our common or preferred stock or other securities that are convertible

into or exercisable for our common or preferred stock.

|

|

|

●

|

We

may not generate revenues or achieve profitability.

|

|

|

●

|

Our

products may not be able to be commercialized or accepted in the market.

|

|

|

●

|

If

we are unable to establish effective marketing and sales capabilities or enter into agreements

with third parties to market and sell our RF filters, we may not be able to effectively

generate product revenues.

|

|

|

●

|

If

we fail to obtain, maintain and enforce our intellectual property rights, we may not

be able to prevent third parties from using our proprietary technologies and may lose

access to technologies critical to our products.

|

Corporate

Information

Our

principal executive offices are located at 9805 Northcross Center Court, Suite A, Huntersville, North Carolina 28078. Our telephone

number is (704) 997-5735. Our website address is

www.akoustis.com

. The information on, or that can be accessed through,

our website is not part of this prospectus.

Implications

of Being an Emerging Growth Company

We

are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an

emerging growth company until the earlier of (i) June 30, 2019, the last day of the fiscal year following the fifth anniversary

of the date of the first sale of our Common Stock pursuant to an effective registration statement under the Securities Act; (ii)

the last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more; (iii) the date on which

we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed

to be a large accelerated filer under applicable SEC rules. We expect that we will remain an emerging growth company for the foreseeable

future, but cannot retain our emerging growth company status indefinitely and will no longer qualify as an emerging growth company

on or before June 30, 2019. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the “JOBS Act,”

and references herein to “emerging growth company” have the meaning associated with it in the JOBS Act. For so long

as we remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements

that are applicable to other public companies that are not emerging growth companies.

These

exemptions include:

|

|

●

|

not

being required to comply with the requirement of auditor attestation of our internal

control over financial reporting,

|

|

|

●

|

not

being required to comply with any requirement that may be adopted by the Public Company

Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to

the auditor’s report providing additional information about the audit and the financial

statements,

|

|

|

●

|

reduced

disclosure obligations regarding executive compensation, and

|

|

|

●

|

not

being required to hold a nonbinding advisory vote on executive compensation and stockholder

approval of any golden parachute payments not previously approved.

|

For

as long as we continue to be an emerging growth company, we expect that we will take advantage of the reduced disclosure obligations

available to us as a result of that classification. We have taken advantage of certain of those reduced reporting burdens in this

prospectus. Accordingly, the information contained herein may be different than the information you receive from other public

companies in which you hold stock.

An

emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities

Act for complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain

accounting standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves

of this extended transition period, and as a result, we will not be required to adopt new or revised accounting standards on the

dates on which adoption of such standards is required for other public reporting companies.

We

are also a “smaller reporting company” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), and have elected to take advantage of certain of the scaled disclosure requirements available

for smaller reporting companies.

The

Offering

|

Common

stock currently outstanding

|

22,378,852

shares (1)

|

|

|

|

|

Preferred stock

currently outstanding

|

None

|

|

|

|

|

Common stock offered

by the Company

|

None

|

|

|

|

|

Common stock offered

by the selling stockholders

|

3,293,255 shares

(2)

|

|

|

|

|

Use of proceeds

|

We will not receive

any of the proceeds from the sales of our Common Stock by the selling stockholders.

|

|

|

|

|

NASDAQ symbol

|

AKTS

|

|

|

|

|

Risk Factors

|

You should carefully

consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk

Factors” section beginning on page 8 of this prospectus before

deciding whether or not to invest in shares of our Common Stock.

|

(1)

As of January 10, 2018. This number excludes:

|

|

●

|

warrants

to purchase 756,809 shares of Common Stock (including warrants currently exercisable

to purchase up to 602,632 shares of Common Stock),

|

|

|

●

|

options

to purchase 1,166,859 shares of Common Stock (including options currently exercisable

to purchase up to 80,000 shares of Common Stock),

|

|

|

●

|

unvested

restricted stock units for 771,494 shares of Common Stock, and

|

|

|

●

|

246,809

shares of Common Stock that may become issuable pursuant to the price-protected anti-dilution

provision applicable to 2,468,094 of the outstanding shares. See “Selling Stockholders—The Second 2017 Offering.”

|

See

“Description of Securities” below.

(2)

Consists of 2,892,269 outstanding shares of Common Stock, 154,177 shares of Common Stock issuable upon exercise of Common Stock

purchase warrants, and 246,809 shares of Common Stock that may become issuable pursuant to the price-protected anti-dilution provisions

applicable to 2,468,094 of the outstanding shares.

NOTE

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements, including, without limitation, in the sections captioned “Description of

Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and

Results of Operations,” and elsewhere. Any and all statements contained in this prospectus that are not statements of historical

fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,”

“could,” “project,” “estimate,” “predict,” “potential,” “strategy,”

“anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,”

“continue,” “intend,” “expect,” “future,” and terms of similar import (including

the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking

statements may contain one or more of these identifying terms. Forward-looking statements in this prospectus may include, without

limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives

relating to the development of commercially viable radio frequency filters, (ii) a projection of income (including income/loss),

earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii)

our future financial performance, including any such statement contained in a discussion and analysis of financial condition by

management or in the results of operations included pursuant to the rules and regulations of the SEC, and (iv) the assumptions

underlying or relating to any statement described in points (i), (ii) or (iii) above.

The

forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may

not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions

and are subject to a number of risks and uncertainties and other influences, many of which are beyond our control. Actual results

and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements

as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking

statements or cause actual results to differ materially from expected or desired results may include, without limitation:

|

|

●

|

our

inability to obtain adequate financing,

|

|

|

●

|

our

limited operating history,

|

|

|

●

|

our

inability to generate significant revenues or achieve profitability,

|

|

|

●

|

the

results of our research and development (R&D) activities,

|

|

|

●

|

our

inability to achieve acceptance of our products in the market,

|

|

|

●

|

general

economic conditions, including upturns and downturns in the industry,

|

|

|

●

|

our

limited number of patents,

|

|

|

●

|

failure

to obtain, maintain and enforce our intellectual property rights,

|

|

|

●

|

our

inability to attract and retain qualified personnel,

|

|

|

●

|

our

reliance on third parties to complete certain processes in connection with the manufacture

of our products,

|

|

|

●

|

product

quality and defects,

|

|

|

●

|

existing

or increased competition,

|

|

|

●

|

our

ability to market and sell our products,

|

|

|

●

|

our

inability to successfully integrate our STC-MEMS Business (as defined below under “Description

of Business – Recent Developments – Business Developments”) in our

business,

|

|

|

●

|

our

failure to innovate or adapt to new or emerging technologies,

|

|

|

●

|

our

failure to comply with regulatory requirements,

|

|

|

●

|

results

of any arbitration or litigation that may arise,

|

|

|

●

|

stock

volatility and illiquidity,

|

|

|

●

|

our

failure to implement our business plans or strategies,

|

|

|

●

|

our

failure to remediate the material weakness in our internal control over financial reporting,

and

|

|

|

●

|

our

failure to maintain the Trusted Foundry accreditation of our New York fabrication facility.

|

A

description of some of the risks and uncertainties that could cause our actual results to differ materially from those described

by the forward-looking statements in this prospectus appears in the section captioned “Risk Factors” and elsewhere

in this prospectus. Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties

related to them and to the risk factors. Except as may be required by law, we do not undertake any obligation to update the forward-looking

statements contained in this prospectus to reflect any new information or future events or circumstances or otherwise.

RISK

FACTORS

An

investment in shares of our Common Stock is highly speculative and involves a high degree of risk. We face a variety of risks

that may affect our operations or financial results and many of those risks are driven by factors that we cannot control or predict.

Before investing in our Common Stock, you should carefully consider the following risks, together with the financial and other

information contained in this prospectus. If any of the following risks actually occurs, our business, prospects, financial condition

and results of operations could be materially adversely affected. In that case, the trading price of our Common Stock would likely

decline and you may lose all or a part of your investment. Only those investors who can bear the risk of loss of their entire

investment should invest in our Common Stock.

Prospective

investors should consider carefully whether an investment in the Company is suitable for them in light of the information contained

in this prospectus and the financial resources available to them. The risks described below do not purport to be all the risks

to which the Company or the Company could be exposed. This section is a summary of the risks that we presently believe are material

to the operations of the Company. Additional risks of which we are not presently aware or which we presently deem immaterial may

also impair the Company’s business, financial condition or results of operations.

Risks

Related to our Business and the Industry in Which We Operate

We

have a limited operating history upon which investors can evaluate our business and future prospects.

We

are an early stage company that has not yet begun any commercial operations. Historically, we were a shell company with no operating

history and no assets other than cash. Upon consummation of a merger with Akoustis, Inc. in May 2015, we redirected our business

focus towards the development of advanced single-crystal BAW filter products for RF front-ends (RFFEs) for use in the mobile wireless

device industry. Although Akoustis since its inception focused its activity on R&D of high efficiency acoustic wave resonator

technology utilizing single-crystal piezoelectric materials, this technology has not yet obtained marketing approval or been verified

in commercial manufacturing, and its RF filters have not generated any material level of sales.

Since

our expectations of potential customers and future demand for our products are based on estimates of planned operations rather

than experience, it is difficult for our management and our investors to accurately forecast and evaluate our future prospects

and our revenues. Our proposed operations are therefore subject to all of the risks inherent in light of the expenses, difficulties,

complications and delays frequently encountered in connection with the formation of any new business and the development of a

product, as well as those risks that are specific to our business in particular. An investment in an early stage company such

as ours involves a degree of risk, including the possibility that your entire investment may be lost. The risks include, but are

not limited to, our reliance on third parties to complete some processes for the manufacturing of our product, the possibility

that we will not be able to develop functional and scalable products, or that although functional and scalable, our products and/or

services will not be accepted in the market. To successfully introduce and market our products at a profit, we must establish

brand name recognition and competitive advantages for our products. There are no assurances that the Company can successfully

address these challenges. If it is unsuccessful, the Company and its business, financial condition and operating results will

be materially and adversely affected.

We

may not generate revenues or achieve profitability.

We

have incurred operating losses since our inception and expect to continue to have negative cash flow from operations. We have

only generated minimal revenues from shipment of product while our primary sources of funds have been R&D grants, private

placements of our equity, and debt. We have experienced net losses of approximately $21.2 million for the period from May 12,

2014 (inception) to September 30, 2017. Our future profitability will depend on our ability to create a sustainable business model

and generate revenues, which is subject to a number of factors, including our ability to successfully implement our strategies

and execute our R&D plan, our ability to implement our improved design and cost reductions into manufacturing of our RF filters,

the availability of funding, market acceptance of our products, consumer demand for end products incorporating our products, our

ability to compete effectively in a crowded field, our ability to respond effectively to technological advances by timely introducing

our new technologies and products, and global economic and political conditions.

Our

future profitability also depends on our expense levels, which are influenced by a number of factors, including the resources

we devote to developing and supporting our projects and potential products, the continued progress of our research and development

of potential products, our ability to improve R&D efficiencies, license fees or royalties we may be required to pay, and the

potential need to acquire licenses to new technology, the availability of intellectual property for licensing or acquisition,

or the use of our technology in new markets, which could require us to pay unanticipated license fees and royalties in connection

with these licenses.

Our

development and commercialization efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing

our revenues to offset higher expenses. These expenses, among other things, may cause our net income and working capital to decrease.

If we fail to generate revenue and manage our expenses, we may never achieve profitability, which would adversely and materially

affect our ability to provide a return to our investors.

The

industry and the markets in which the Company operates are highly competitive and subject to rapid technological change.

The

markets in which we intend to compete are intensely competitive. We will operate primarily in the industry that designs and produces

semiconductor components for wireless communications and other wireless devices, which is subject to rapid changes in both product

and process technologies based on demand and evolving industry standards. The intended markets for our products are characterized

by:

|

|

●

|

rapid

technological developments and product evolution,

|

|

|

●

|

rapid

changes in customer requirements,

|

|

|

●

|

frequent

new product introductions and enhancements,

|

|

|

●

|

continuous

demand for higher levels of integration, decreased size and decreased power consumption,

|

|

|

●

|

short

product life cycles with declining prices over the life cycle of the product, and

|

|

|

●

|

evolving

industry standards.

|

The

continuous evolutions of these technologies and frequent introduction of new products and enhancements have generally resulted

in short product life cycles for wireless semiconductor products, in general, and for RFFEs, in particular. Our R&D activity

and resulting products could become obsolete or less competitive sooner than anticipated because of a faster than anticipated

change in one or more of the above-noted factors. Therefore, in order for our RF filters to be competitive and achieve market

acceptance, we need to keep pace with rapid development of new process technologies, which requires us to:

|

|

●

|

respond

effectively to technological advances by timely introducing our new technologies and

products,

|

|

|

●

|

successfully

implement our strategies and execute our R&D plan in practice,

|

|

|

●

|

improve

the efficiency of our technology, and

|

|

|

●

|

implement

our improved design and cost reductions into manufacturing of our RF filters.

|

We

are still developing our products, and they may not be accepted in the market.

Although

we believe that our BulkONE® acoustic wave resonator technology that utilizes single-crystal piezoelectric materials will

provide material advantages over existing RF filters and are currently developing various methods of integration suitable for

implementation of this technology to RF filters, we cannot be certain that our RF filters will be able to achieve or maintain

market acceptance. While we have fabricated R&D resonators that demonstrate the feasibility of our BulkONE® technology,

we are still in the process of stabilizing this technology into our NY fabrication facility for manufacturing of our RF filters,

and this technology is not verified yet in practice or on a commercial scale. There are also no records that can demonstrate our

ability to successfully overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving

fields. In addition to our limited operating history, we will depend on a limited number of manufacturers and customers for a

significant portion of our revenue in the future and we cannot guarantee their acceptance of our products. Each of these factors

may adversely affect our ability to implement our business strategy and achieve our business goals.

The

successful development of our BulkONE® technology and market acceptance of our RF filters will be highly complex and will

depend on the following principal competitive factors, including our ability to:

|

|

●

|

comply

with industry standards and effectively compete against current technology for producing

RF acoustic wave filters,

|

|

|

●

|

differentiate

our products from offerings of our competitors by delivering RF filters that are higher

in quality, reliability and technical performance,

|

|

|

●

|

anticipate

customer and market requirements, changes in technology and industry standards and timely

develop improved technologies that meet high levels of satisfaction of our potential

customers,

|

|

|

●

|

maintain,

grow and manage our internal teams to the extent we increase our operations and develop

new segments of our business,

|

|

|

●

|

develop

and maintain successful collaborative, strategic, and other relationships with manufacturers,

customers and contractors,

|

|

|

●

|

protect,

develop or otherwise obtain adequate intellectual property for our technology and our

filters, and

|

|

|

●

|

obtain

strong financial, sales, marketing, technical and other resources necessary to develop,

test, manufacture, commercialize and market our filters.

|

If

we are unsuccessful in accomplishing these objectives, we may not be able to compete successfully against current and potential

competitors. As a result, our BulkOne® technology and our RF filters may not be accepted in the market and we may never attain

profitability.

We

will face intense competition, which may cause pricing pressures, decreased gross margins and loss of potential market share and

may materially and adversely affect our business, financial condition and results of operations.

We

will compete with U.S. and international semiconductor manufacturers and mobile semiconductor companies of all sizes in terms

of resources and market share, some of whom have significantly greater financial, technical, manufacturing and marketing resources

than we do. We expect competition in our markets to intensify as new competitors enter the RF component market, existing competitors

merge or form alliances, and new technologies emerge. Our competitors may introduce new solutions and technologies that are superior

to our BAW technology, are verified on a commercial scale, and have achieved widespread market acceptance. Certain of our competitors

may be able to adapt more quickly than we can to new or emerging technologies and changes in customer requirements or may be able

to devote greater resources to the development, promotion and sale of their products than we can. This implementation may require

us to modify the manufacturing process for our filters, design new products to more stringent standards, and redesign some existing

products, which may prove difficult for us and result in delays in product deliveries and increased expenses.

Increased

competition could also result in pricing pressures, declining average selling prices for our RF filters, decreased gross margins

and loss of potential market share. We will need to make substantial investments to develop these enhancements and technologies,

and we cannot assure investors that we will have funds available for these investments or that these enhancements and technologies

will be successful. If a competing technology emerges that is, or is perceived to be, superior to our existing technology and

we are unable to adapt to these changes and to compete effectively, our market share and financial condition could be materially

and adversely affected, and our business, revenue, and results of operations could be harmed.

Changes

in general economic conditions, together with other factors, cause significant upturns and downturns in the industry, and our

business, therefore, may also experience cyclical fluctuations in the future.

From

time to time, changes in general economic conditions, together with other factors, may cause significant upturns and downturns

in the semiconductor industry. These fluctuations are due to a number of factors, many of which are beyond our control, including:

|

|

●

|

levels

of inventory in our end markets,

|

|

|

●

|

availability

and cost of supply for manufacturing of our RF filters using our design,

|

|

|

●

|

changes

in end-user demand for the products manufactured with our technology and sold by our

prospective customers,

|

|

|

●

|

industry

production capacity levels and fluctuations in industry manufacturing yields,

|

|

|

●

|

market

acceptance of our future customers’ products that incorporate our RF filters,

|

|

|

●

|

the

gain or loss of significant customers,

|

|

|

●

|

the

effects of competitive pricing pressures, including decreases in average selling prices

of our RF filters,

|

|

|

●

|

new

product and technology introductions by competitors,

|

|

|

●

|

changes

in the mix of products produced and sold, and

|

|

|

●

|

intellectual

property disputes.

|

As

a result, the demand for our products can change quickly and in ways we may not anticipate, and our business, therefore, may also

experience cyclical fluctuations in future operating results. In addition, future downturns in the electronic systems industry

could adversely impact our revenue and harm our business, financial condition and results of operations.

If

we are unable to attract and retain qualified personnel to contribute to the development, manufacture and sale of our products,

we may not be able to effectively operate our business.

As

the source of our technological and product innovations, our key technical personnel represent a significant asset. We believe

that our future success is highly dependent on the continued services of our current key officers, employees, and Board members,

as well as our ability to attract and retain highly skilled and experienced technical personnel. The loss of their services could

have a detrimental effect on our operations. Specifically, the loss of the services of Jeffrey Shealy, our President and Chief

Executive Officer, John Kurtzweil, our Chief Financial Officer, David Aichele, our Vice President of Business Development, Richard

Ogawa, our Special Legal Advisor, any major change in our Board or management, or our inability to attract, retain and motivate

qualified personnel could have a material adverse effect on our ability to operate our business. The competition for management

and technical personnel is intense in the wireless semiconductor industry, and therefore, we cannot assure you that we will be

able to attract and retain qualified management and other personnel necessary for the design, development, manufacture and sale

of our products.

Product

defects could adversely affect the results of our operations and may expose us to product liability claims.

The

fabrication of RF filters is a complex and precise process. If we or any of our manufacturers fails to successfully manufacture

wafers that conform to our design specifications and the strict regulatory requirements of the Federal Communications Commission

(“FCC”), it may result in substantial risk of undetected flaws in components or other materials used by our manufacturers

during fabrication of our filters and could lead to product defects and costs to repair or replace these parts or materials. Any

such failure would significantly impact our ability to develop and implement our technology and to improve performance of our

RF filters. Our inability to comply with such requirements could result in significant costs, as well as negative publicity and

damage to our reputation that could reduce demand for our products.

We

also could be subject to product liability lawsuits if the wireless devices containing our RF filters cause injury. Recently interest

groups have requested that the FCC investigate claims that wireless communications technologies pose health concerns and cause

interference with airbags, hearing aids and medical devices. Any such product liability claims may include allegations of defects

in manufacturing, defects in design, a failure to warn of dangers inherent in the product or inadequate disclosure of risks related

to the use of our product, negligence, strict liability and a breach of warranties. Claims could also be asserted under state

consumer protection acts.

If

we are unable to establish effective marketing and sales capabilities or enter into agreements with third parties to market and

sell our RF filters, we may not be able to effectively generate product revenues.

We

have limited experience selling, marketing or distributing products and currently have a small internal marketing and sales force.

In order to launch and commercialize our technology and our RF filters, we must build on a territory-by-territory basis marketing,

sales, distribution, managerial and other non-technical capabilities or make arrangements with third parties to perform these

services, and we may not be successful in doing so. Therefore, we may choose to collaborate, either globally or on a territory-by-territory

basis, with third parties that have direct sales forces and established distribution systems, either to augment our own sales

force and distribution systems or in lieu of our own sales force and distribution systems. If so, our success will depend, in

part, on our ability to enter into and maintain collaborative relationships for such capabilities, such collaborator’s strategic

interest in the products under development and such collaborator’s ability to successfully market and sell any such products.

If

we are unable to enter into such arrangements when needed on acceptable terms or at all, we may not be able to successfully commercialize

our filters. Further, to the extent that we depend on third parties for marketing and distribution, any revenues we receive will

depend upon the efforts of such third parties, and there can be no assurance that such efforts will be successful. If we decide

in the future to establish an internal sales and marketing team with technical expertise and supporting distribution capabilities

to commercialize our RF filters, it could be expensive and time consuming and would require significant attention of our executive

officers to manage. We may also not have sufficient resources to allocate to the sales and marketing of our filters. Any failure

or delay in the development of sales, marketing and distribution capabilities, either through collaboration with one or more third

parties or through internal efforts, would adversely impact the commercialization of any of our products that we obtain approval

to market. As a result, our future product revenue would suffer and we may incur significant additional losses

Risks

Related to Our Intellectual Property

If

we fail to obtain, maintain and enforce our intellectual property rights, we may not be able to prevent third parties from using

our proprietary technologies.

Our

long-term success largely depends on our ability to market technologically competitive products which, in turn, largely depends

on our ability to obtain and maintain adequate intellectual property protection and to enforce our proprietary rights without

infringing the proprietary rights of third parties. While we rely upon a combination of our patent applications currently pending

with the United State Patent and Trademark Office (“USPTO”), our trademarks, copyrights, trade secret protection and

confidentiality agreements to protect the intellectual property related to our technologies, there can be no assurance that:

|

|

●

|

our

currently pending or future patent applications will result in issued patents,

|

|

|

●

|

our

limited patent portfolio will provide adequate protection to our core technology,

|

|

|

●

|

we

will succeed in protecting our technology adequately in all key jurisdictions, or

|

|

|

●

|

we

can prevent third parties from disclosure or misappropriation of our proprietary information

which could enable competitors to quickly duplicate or surpass our technological achievements,

thus eroding any competitive advantage we may derive from the proprietary information.

|

We

have a limited number of patent applications which may not result in issued patents or patents that fully protect our intellectual

property.

In

the United States and internationally we have twenty (20) pending patent applications; however, there is no assurance that any

of the pending applications or our future patent applications will result in patents being issued, or that any patents that may

be issued as a result of existing or future applications will provide meaningful protection or commercial advantage to us.

The

process of seeking patent protection in the United States and abroad can be long and expensive. Since patent applications in the

United States and most other countries are confidential for a period of time after filing, we cannot be certain at the time of

filing that we are the first to file any patent application related to our single-crystal acoustic wave filter technology. In

addition, patent applications are often published as part of the patent application process, even if such applications do not

issue as patents. When published, such applications will become publicly available, and proprietary information disclosed in the

application will become available to others. While at present we are unaware of competing patent applications, competing applications

could potentially surface.

Even

if all of our pending patent applications are granted and result in registration of our patents, we cannot predict the breadth

of claims that may be allowed or enforced, or that the scope of any patent rights could provide a sufficient degree of protection

that could permit us to gain or keep our competitive advantage with respect to these products and technologies. For example, we

cannot predict:

|

|

●

|

the

degree and range of protection any patents will afford us against competitors, including

whether third parties will find ways to make, use, sell, offer to sell or import competitive

products without infringing our patents,

|

|

|

●

|

if

and when patents will be issued,

|

|

|

●

|

if

third parties will obtain patents claiming inventions similar to those covered by our

patents and patent applications,

|

|

|

●

|

if

third parties have blocking patents that could be used to prevent us from marketing our

own patented products and practicing our own technology, or

|

|

|

●

|

whether

we will need to initiate litigation or administrative proceedings (e.g. at the USPTO)

in connection with patent rights, which may be costly whether we win or lose.

|

As

a result, the patent applications we own may fail to result in issued patents in the United States. Third parties may challenge

the validity, enforceability or scope of any issued patents or patents issued to us in the future, which may result in those patents

being narrowed, invalidated or held unenforceable. Even if they are unchallenged, our patents and patent applications may not

adequately protect our intellectual property or prevent others from developing similar products that do not infringe the claims

made in our patents. If the breadth or strength of protection provided by the patents we hold or pursue is threatened, we may

not be able to prevent others from offering similar technology and products in the RFFE mobile market and our ability to commercialize

our RF filters with technology protected by those patents could be threatened.

If

we fail to obtain issued patents outside of the United States, our ability to prevent misappropriation of our proprietary information

or infringement of our intellectual property rights in countries outside of the United States where our filters may be sold in

the future may be significantly limited. If we file foreign patent applications related to our pending U.S. patent applications

or to our issued patents in the United States, these applications may be contested and fail to result in issued patents outside

of the United States or we may be required to narrow our claims. Even if some or all of our patent applications are granted outside

of the United States and result in issued patents, effective enforcement of rights granted by these patents in some countries

may not be available due to the differences in foreign patent and other laws concerning intellectual property rights, a relatively

weak legal regime protecting intellectual property rights in these countries, and because it is difficult, expensive and time-consuming

to police unauthorized use of our intellectual property when infringers are overseas. This failure to obtain or maintain adequate

protection of our intellectual property rights outside of the United States could have a materially adverse effect on our business,

results of operations and financial conditions.

We

may be involved in lawsuits to protect or enforce our patents, which could be expensive, time-consuming and unsuccessful.

Competitors

may infringe our patents or the patents of our potential licensors. To attempt to stop infringement or unauthorized use, we may

need to file infringement claims, which can be expensive and time consuming and distract management.

If

we pursue any infringement proceeding, a court may decide that a patent of ours or our licensors is not valid or is unenforceable,

or may refuse to stop the other party from using the relevant technology on the grounds that our patents do not cover the technology

in question. Additionally, any enforcement of our patents may provoke third parties to assert counterclaims against us. Some of

our current and potential competitors have the ability to dedicate substantially greater resources to enforcing their intellectual

property rights than we have. Moreover, the legal systems of certain countries, particularly certain developing countries, do

not favor the enforcement of patents, which could reduce the likelihood of success of, or the amount of damages that could be

awarded resulting from, any infringement proceeding we pursue in any such jurisdiction. An adverse result in any infringement

litigation or defense proceedings could put one or more of our patents at risk of being invalidated, held unenforceable, or interpreted

narrowly and could put our patent applications at risk of not issuing, which could limit the ability of our filters to compete

in those jurisdictions.

Interference

proceedings could be provoked by third parties or brought by the USPTO to determine the priority of inventions with respect to

our patents or patent applications. An unfavorable outcome could require us to cease using the related technology or to attempt

to license rights to use it from the prevailing party. Our business could be harmed if the prevailing party does not offer us

a license on commercially reasonable terms, or at all.

We

need to protect our trademark rights and disclosure of our trade secrets to prevent competitors from taking advantage of our goodwill.

We

believe that the protection of our trademark rights is an important factor in product recognition, protecting our brand, maintaining

goodwill, and maintaining or increasing market share. We currently have two trademarks that we have filed to register with the

USPTO — the Akoustis and BulkONE® marks — and we may expend substantial cost and effort in an attempt to register

new trademarks and maintain and enforce our trademark rights. If we do not adequately protect our rights in our trademarks from

infringement, any goodwill that we have developed in those trademarks could be lost or impaired.

Third

parties may claim that the sale or promotion of our products, when and if we have any, may infringe on the trademark rights of

others. Trademark infringement problems occur frequently in connection with the sale and marketing of products in the RFFE mobile

industry. If we become involved in any dispute regarding our trademark rights, regardless of whether we prevail, we could be required

to engage in costly, distracting and time-consuming litigation that could harm our business. If the trademarks we use are found

to infringe upon the trademark of another company, we could be liable for damages and be forced to stop using those trademarks,

and as result, we could lose all the goodwill that has been developed in those trademarks.

In

addition to the protection afforded by patents and trademarks, we seek to rely on copyright, trade secret protection and confidentiality

agreements to protect proprietary know-how that is not patentable, processes for which patents are difficult to enforce and any

other elements of our processes that involve proprietary know-how, information or technology that is not covered by patents. For

Akoustis, this includes chip layouts, circuit designs, resonator layouts and implementation, and membrane definition. Although

we require all of our employees and certain consultants and advisors to assign inventions to us, and all of our employees, consultants,

advisors and any third parties who have access to our proprietary know-how, information or technology to enter into confidentiality

agreements, our trade secrets and other proprietary information may be disclosed or competitors may otherwise gain access to such

information or independently develop substantially equivalent information. If we are unable to prevent material disclosure of

the intellectual property related to our technologies to third parties, we will not be able to establish or maintain the competitive

advantage that we believe is provided by such intellectual property, which would weaken our competitive market position, and materially

adversely affect our business and operational results.

Development

of certain technologies with our manufacturers may result in restrictions on jointly-developed intellectual property.

In

order to maintain and expand our strategic relationship with manufacturers of our filters, we may, from time to time, develop

certain technologies jointly with these manufacturers and file for further intellectual property protection and/or seek to commercialize

such technologies. We may enter into joint development agreements with manufacturers to provide for joint development works and

joint intellectual property rights by us and by such manufacturer. Such agreements may restrict our commercial use of such intellectual

property, or may require written consent from, or a separate agreement with, that manufacturer. In other cases, we may not have

any rights to use intellectual property solely developed and owned by such manufacturer or another third party. If we cannot obtain

commercial use rights for such jointly-owned intellectual property or intellectual property solely owned by these manufacturers,

our future product development and commercialization plans may be adversely affected.

We

may be subject to claims of infringement, misappropriation or misuse of third party intellectual property that, regardless of

merit, could result in significant expense and loss of our intellectual property rights.

The

semiconductor industry is characterized by the vigorous pursuit and protection of intellectual property rights. We have not undertaken

a comprehensive review of the rights of third parties in our field. From time to time, we may receive notices or inquiries from

third parties regarding our products or the manner in which we conduct our business suggesting that we may be infringing, misappropriating

or otherwise misusing patent, copyright, trademark, trade secret and other intellectual property rights. Any claims that our technology

infringes, misappropriates or otherwise misuses the rights of third parties, regardless of their merit or resolution, could be

expensive to litigate or settle and could divert the efforts and attention of our management and technical personnel, cause significant

delays and materially disrupt the conduct of our business. We may not prevail in such proceedings given the complex technical

issues and inherent uncertainties in intellectual property litigation. If such proceedings result in an adverse outcome, we could

be required to:

|

|

●

|

pay

substantial damages, including treble damages if we were held to have willfully infringed,

|

|

|

●

|

cease

the manufacture, offering for sale or sale of the infringing technology or processes,

|

|

|

●

|

expend

significant resources to develop non-infringing technology or processes,

|

|

|

●

|

obtain

a license from a third party, which may not be available on commercially reasonable terms,

or may not be available at all, or

|

|

|

●

|

lose

the opportunity to license our technology to others or to collect royalty payments based

upon successful protection and assertion of our intellectual property against others.

|

In

addition, our agreements with prospective customers and manufacturing partners may require us to indemnify such customers and

manufacturing partners for third party intellectual property infringement claims. Pursuant to such agreements, we may be required

to defend such customers and manufacturing partners against certain claims that could cause us to incur additional costs. While

we endeavor to include as part of such indemnification obligations a provision permitting us to assume the defense of any indemnification

claim, not all of our current agreements contain such a provision and we cannot provide any assurance that our future agreements

will contain such a provision, which could result in increased exposure to us in the case of an indemnification claim.

Defense

of any intellectual property infringement claims against us, regardless of their merit, would involve substantial litigation expense

and would be a significant diversion of resources from our business. In the event of a successful claim of infringement against

us, we may have to pay substantial damages, obtain one or more licenses from third parties, limit our business to avoid the infringing

activities, pay royalties and/or redesign our infringing technology or alter related formulations, processes, methods or other

technologies, any or all of which may be impossible or require substantial time and monetary expenditure. The occurrence of any

of the above events could prevent us from continuing to develop and commercialize our filters and our business could materially

suffer.

Risks

Related to our Financial Condition

We

have a history of losses, will need substantial additional funding to continue our operations and may not achieve or sustain profitability

in the future.

Our

operations have consumed substantial amounts of cash since inception. We have incurred losses since our incorporation and formation

in 2014. Although our newly acquired STC-MEMS Business has a potential revenue stream estimation of $1.5 million in the current

fiscal year, (which are not guaranteed), and although we plan to apply for additional grants in the calendar years 2017 and 2018,

we do not expect meaningful revenues from our resonator technology until at least the first half of the calendar year 2018. There

is no guarantee that the grants we apply for will be awarded to us, and if our forecasts for the Company prove incorrect, the

business, operating results and financial condition of the Company will be materially and adversely affected. We anticipate that

our operating expenses will increase in the foreseeable future as we continue to pursue the development of our patent-pending

single-crystal acoustic wave filter technology, invest in marketing, sales and distribution of our RF filters to grow our business,

acquire customers, commercialize our technology in the mobile wireless market and continue the transition of our manufacturing

to our STC-MEMS Business. These efforts may prove more expensive than we currently anticipate, and we may not succeed in generating

sufficient revenues to offset these higher expenses. In addition, we expect to incur significant expenses related to regulatory

requirements and our ability to obtain, protect, and defend our intellectual property rights.

We

may also encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may increase our capital

needs and/or cause us to spend our cash resources faster than we expect. Accordingly, we will need to obtain substantial additional

funding in order to continue our operations.

To

date, we have financed our operations through a mix of investments from private investors, the incurrence of debt, and grant funding,

and we expect to continue to utilize such means of financing for the foreseeable future. Additional funding from those or other

sources may not be available when or in the amounts needed, on acceptable terms, or at all. If we raise capital through the sale

of equity, or securities convertible into equity, it would result in dilution to our then existing stockholders, which could be

significant depending on the price at which we may be able to sell our securities. If we raise additional capital through the

incurrence of indebtedness, we would likely become subject to covenants restricting our business activities, and holders of debt

instruments may have rights and privileges senior to those of our equity investors. In addition, servicing the interest and principal

repayment obligations under debt facilities could divert funds that would otherwise be available to support research and development,

or commercialization activities. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay,

reduce or eliminate our R&D programs for our acoustic wave filter technology or any future commercialization efforts. Any

of these events could materially and adversely affect our business, financial condition and prospects, and could cause our business

to fail.

Our

independent registered public accounting firm has expressed doubt about our ability to continue as a going concern.

The

Company’s historical financial statements have been prepared under the assumption that we will continue as a going concern.

Our independent registered public accounting firm has issued a report that included an explanatory paragraph referring to our

recurring net losses and accumulated deficit and expressing substantial doubt in our ability to continue as a going concern. Our

ability to continue as a going concern is dependent upon our ability to obtain additional equity financing or other capital, attain