Filed Pursuant to Rule 424(b)(5)

Registration No. 333-203622

Prospectus Supplement

(To Prospectus dated April 24, 2015)

ENERGOUS CORPORATION

Common

Stock

Having

an Aggregate Offering Price of Up to

$40,000,000

We have entered into a distribution

agreement with Raymond James & Associates, Inc., as our sales agent, relating to the shares of common stock of Energous

Corporation, par value $0.00001, offered by this prospectus supplement. In accordance with the terms of the distribution agreement,

we may offer and sell shares of common stock having an aggregate offering price of up to $40,000,000 from time to time through

or to our sales agent.

Sales of common stock under this prospectus

supplement, if any, will be made by means of ordinary brokers’ transactions through the facilities of The Nasdaq Stock Market,

any other national securities exchange or facility thereof, a trading facility of a national securities association or an alternate

trading system, to or through a market maker or directly on or through an electronic communication network or any similar market

venue, at market prices, in block transactions or as otherwise agreed between us and the sales agent. Our common stock trades on

The Nasdaq Stock Market under the symbol “WATT.” On January 11, 2018, the last reported sale price of our common stock

on The Nasdaq Stock Market was $23.02 per share.

The compensation of our sales agent

for sales of common stock shall be a commission rate equal to 2.5% of the gross sales price per share of common stock. The net

proceeds from any sales under this prospectus supplement will be used as described under “Use of Proceeds” in this

prospectus supplement.

Under the terms of the distribution

agreement, we also may sell common stock to the sales agent as principal for its own account at a price agreed upon at the time

of the sale. If we sell common stock to the sales agent as principal, we will enter into a separate terms agreement with the sales

agent, and the sale will be made pursuant to the terms thereunder.

The sales agent is not required to sell

any specific number or dollar amount of common stock but will use its commercially reasonable efforts, as our agent and subject

to the terms of the distribution agreement, to sell the common stock offered, as instructed by us. The offering of common stock

pursuant to the distribution agreement will terminate upon the earlier of (i) the sale of all common stock subject to the

distribution agreement or (ii) the termination of the distribution agreement by us or by the sales agent pursuant to the terms

of the distribution agreement.

We are an “emerging growth company”

as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced

public company reporting requirements for this prospectus and future filings. See “Prospectus Supplement Summary—Implications

of Being an Emerging Growth Company.”

Investing in our common stock involves

a high degree of risk. Please read “Risk Factors” beginning on page S-6 of this prospectus supplement and the accompanying

prospectus and in the documents incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

RAYMOND JAMES

The date of this prospectus supplement is

January 12, 2018.

Table

of Contents

About This

Prospectus Supplement

This prospectus supplement and the accompanying

prospectus form part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the

SEC, using a “shelf” registration process. This document contains two parts. The first part consists of this prospectus

supplement, which provides you with specific information about this offering. The second part, the accompanying prospectus, provides

more general information, some of which may not apply to this offering. Generally, when we refer only to the “prospectus,”

we are referring to both parts combined. This prospectus supplement, and the information incorporated herein by reference, may

add, update or change information in the accompanying prospectus. You should read the entire prospectus supplement as well as the

accompanying prospectus and the documents incorporated by reference herein that are described under the headings “Where You

Can Find More Information” and “Incorporation of Certain Information by Reference.” If there is any inconsistency

between the information in this prospectus supplement and the accompanying prospectus, you should rely on the information in this

prospectus supplement.

You should rely only on the information

contained in or incorporated by reference into this prospectus supplement, the accompanying prospectus and any free writing prospectus

we may provide to you in connection with this offering. Neither we nor the sales agent have authorized any other person to provide

you with different information. If anyone provides you with different or inconsistent information, you should not rely on it.

The information appearing in this prospectus

supplement, the accompanying prospectus and any free writing prospectus we may provide to you in connection with this offering

is accurate only as of the date of the respective document and any information we have incorporated by reference is accurate only

as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement, the

accompanying prospectus, any free writing prospectus we may provide to you in connection with this offering, or any sale of a security.

Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this

prospectus supplement, the accompanying prospectus, any free writing prospectus prepared by us or on our behalf, and the documents

incorporated by reference in the prospectus supplement, in their entirety before making any investment decision.

We are offering to sell, and seeking offers

to buy, our securities only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement

and the offering of the securities in certain jurisdictions may be restricted by law. Persons outside the United States who come

into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering

of the securities and the distribution of this prospectus supplement outside the United States. This prospectus supplement does

not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities

offered by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an

offer or solicitation.

The industry and market data and other statistical

information contained in this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference

are based on management’s estimates, independent publications, government publications, reports by market research firms

or other published independent sources, and, in each case, are believed by management to be reasonable estimates. Although we believe

these sources are reliable, we have not independently verified the information. None of the independent industry publications used

in this prospectus supplement, the accompanying prospectus or the documents we incorporate by reference were prepared on our or

our affiliates’ behalf and none of the sources cited by us consented to the inclusion of any data from its reports, nor have

we sought their consent.

The representations, warranties and covenants

made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus were

made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among

the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations,

warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants

should not be relied on as accurately representing the current state of our affairs.

In this prospectus supplement, unless otherwise

stated or the context otherwise requires, the terms “Energous,” “we,” “us,” “our”

and the “Company” refer to Energous Corporation. References to our “common stock” refer to the common stock

of Energous Corporation.

All references in this prospectus supplement

to our financial statements include, unless the context indicates otherwise, the related notes.

Cautionary

Statement About Forward-Looking Information

This prospectus supplement, the accompanying

prospectus and the documents incorporated by reference herein or therein, contain forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that

are intended to be covered by the “safe harbor” created by those sections. Forward-looking statements, which are based

on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of forward-looking

terms such as “believe,” “expect,” “may,” “will,” “should,” “could,”

“seek,” “intend,” “plan,” “estimate,” “anticipate” or other comparable

terms. All statements other than statements of historical facts included in this prospectus supplement, the accompanying prospectus

and the documents incorporated by reference herein or therein regarding our strategies, prospects, financial condition, operations,

costs, plans and objectives are forward-looking statements. Examples of forward-looking statements include, among others, statements

we make regarding expectations for product shipments, revenues, liquidity and financial performance, the anticipated results of

our development efforts and the timing for receipt of required regulatory approvals and product launches. Forward-looking statements

are only on our current beliefs, expectations and assumptions regarding the future of our business, strategies, projections, anticipated

events and trends, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our

actual results and financial condition may differ materially from those indicated in our forward-looking statements. Therefore,

you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial

condition to differ materially from those indicated in the forward-looking statements include, among others: our ability to develop

commercially feasible technology; receipt of necessary regulatory approvals; our ability to find and maintain development partners;

market acceptance of our technology; the amount and nature of competition in our industry; our ability to protect our intellectual

property; other risks and uncertainties included in this prospectus supplement under the caption “Risk Factors;” and

risks and uncertainties described in documents incorporated by reference into this prospectus supplement and the accompanying prospectus.

We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments

or otherwise.

PROSPECTUS

SUPPLEMENT Summary

This summary highlights certain information

about us, this offering and selected information contained elsewhere in or incorporated by reference into this prospectus supplement

or the accompanying prospectus. This summary is not complete and does not contain all of the information that you should consider

before deciding whether to invest in our securities. For a more complete understanding of our company and this offering, we encourage

you to read and consider carefully the more detailed information in this prospectus supplement and the accompanying prospectus,

including the information under the heading “Risk Factors” in this prospectus supplement beginning on page S-6, in

the accompanying prospectus beginning on page 5, and in our most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q

and the information incorporated by reference in this prospectus supplement and the accompanying prospectus.

Company Overview

We have developed a technology called WattUp®

that consists of proprietary semiconductor chipsets, software, hardware designs and antennas that enables radio frequency (“RF”)

based charging for electronic devices, providing wire-free charging solutions for contact-based charging as well as at a distance

charging, ultimately enabling charging with mobility under full software control. We believe our proprietary technology can be

utilized in a variety of devices, including wearables, hearing aids, earbuds, Bluetooth headsets, Internet of Things (“IoT”)

devices, smartphones, tablets, e-book readers, keyboards, mice, remote controls, rechargeable lights, cylindrical batteries, medical

devices and any other device with similar charging requirements that would otherwise need a battery or a connection to a power

outlet.

We believe our technology is novel in its

approach, in that we are developing a solution that charges electronic devices by surrounding them with a focused, three-dimensional

RF energy pocket. We are engineering solutions that we expect to enable the wire-free transmission of energy for “near field”

contact-based applications as well as “far field” applications of up to 15 feet in radius or in a circular charging

envelope of up to 30 feet. We are also developing our far field transmitter technology to seamlessly mesh (much like a network

of WiFi routers) to form a wire-free charging network that will allow users to charge their devices as they walk from room-to-room

or throughout a large space. To date, we have developed multiple transmitter prototypes in various form factors and power capabilities.

In November 2016, we entered into a Strategic

Alliance Agreement with Dialog Semiconductor plc (“Dialog”), pursuant to which Dialog will manufacture and distribute

integrated circuit products incorporating our wire-free charging technology. Dialog will be our exclusive supplier of these products

for the general market. Our WattUp technology will use Dialog's SmartBond® Bluetooth low energy solution as the out-of-band

communications channel between the wireless transmitter and receiver. In most cases, Dialog's power management technology will

then be used to distribute power from the WattUp receiver integrated circuit to the rest of the device while Dialog's AC/DC Rapid

Charge™ power conversion technology delivers power to the wireless transmitter.

Recent Developments

FCC Certification for Power-at-a-Distance Wireless Charging

On December 26, 2017, we announced Federal

Communications Commission (FCC) certification of our first-generation WattUp Mid Field transmitter, which sends focused, RF-based

power to devices at a distance of up to three feet, while also charging multiple devices at once. Our WattUp Mid Field transmitter

underwent rigorous, multi-month testing to verify it met consumer safety and regulatory requirements. We believe this achievement

represents the first certification of a Part 18 FCC approved power-at-a-distance wireless charging transmitter, and also establishes

a precedent that will streamline both our future FCC and international regulatory approvals, as well as the regulatory approvals

of our customers for their respective end-products.

Preliminary Estimated Financial Information for the Fourth

Quarter of 2017

We have presented preliminary estimated

financial information below for our fourth quarter ended December 31, 2017 based on currently available information. We have not

finalized our financial results for the quarter and Marcum LLP, our independent registered public accounting firm, has not performed

any procedures with respect to the preliminary estimated financial information contained below, nor has Marcum expressed any opinion

or other assurance on such preliminary estimated financial information. These preliminary estimates should not be regarded as a

representation by us, our management or the sales agent as to our actual financial results for our fourth quarter. The preliminary

estimated financial information presented below is subject to change, and our actual financial results may differ from such preliminary

estimates and such differences could be material.

The following are preliminary estimates

for our fourth quarter ended December 31, 2017:

|

|

§

|

Revenue of $0.03 million;

|

|

|

§

|

GAAP operating expenses between $11.2 million and $11.5 million;

|

|

|

§

|

Depreciation and amortization expenses of approximately $0.3 million;

|

|

|

§

|

Stock-based compensation expense between $3.2 million and $3.45 million;

and

|

|

|

§

|

Cash and cash equivalents of approximately $12.8 million as of December

31, 2017.

|

Current Outlook

We are currently making the transition from

product development to commercial revenue generation from chip sales. During the fourth quarter of 2017, we began shipping chips

through Dialog to customers, but in limited quantities that were not recognized as revenue. We expect to recognize modest levels

of chip revenue in the first quarter of 2018. Growth in our chip revenue depends on a variety of factors, including our success

in securing design wins, and the success of our customers in commercializing their end-products and receiving regulatory approval

to sell their end-products to consumers. We expect end-products incorporating our Near Field transmitter technology to be available

to consumers in the first half of 2018, while end-products incorporating our Mid Field transmitter technology will be available

to consumers in the second half of 2018. We anticipate that shipments of our customers’ end-products will begin in modest

volumes and will grow over time based on consumer demand. Shipments of silicon chips for revenue will follow the same curve as

both the number of WattUp enabled products hit the market and consumer demand expands for the WattUp enable products in the market.

Given these factors, we expect that our chip revenue will remain at modest levels through the third quarter of 2018, with opportunities

for growth thereafter. We expect to continue generating engineering services revenue during 2018, although the timing and magnitude

of this revenue is difficult to predict.

Implications of Being an Emerging Growth Company

We are an “emerging growth company,”

as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and, for as long as we continue to be an “emerging

growth company,” we may choose to take advantage of exemptions from various reporting requirements applicable to other public

companies but not to “emerging growth companies,” including, but not limited to, not being required to comply with

the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding

executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding

advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could

be an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal

year in which our annual gross revenues exceed $1.07 billion, (ii) the date that we become a “large accelerated filer”

as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, which would occur if the market value of our common

shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal

quarter, or (iii) the date on which we have issued more than $1.07 billion in non-convertible debt during the preceding three-year

period. We are choosing to “opt out” of the extended transition periods available under the JOBS Act for complying

with new or revised accounting standards, and intend to take advantage of the other exemptions.

Corporate Information

We were incorporated in Delaware on October

30, 2012 under the name DvineWave, Inc. and changed our name to Energous Corporation in January 2014. The address of our corporate

headquarters is 3590 North First Street, Suite 210, San Jose, CA, 95134 and our telephone number is (408) 963-0200. Our website

can be accessed at

www.energous.com

. Our Internet website and the information contained therein or connected thereto are

not part of this prospectus supplement or the accompanying prospectus.

The Offering

|

Shares we are offering

|

|

Common stock, par value $0.00001 per share, having an aggregate offering price of up to $40,000,000.

|

|

|

|

|

|

Manner of offering

|

|

“At-the-market” offerings that may be made

from time to time through our sales agent, Raymond James & Associates, Inc., or Raymond James. See “Plan of Distribution.”

|

|

|

|

|

|

Use of proceeds

|

|

We intend to use the net proceeds from this offering, after deducting the sales agent’s commissions and our offering expenses, to fund our product development efforts, regulatory activities, business development and support functions, and for general and administrative expenses and other general corporate purposes. See “Use of Proceeds” for additional information.

|

|

|

|

|

|

Risk factors

|

|

Investing in our common stock involves a high degree of risk. You should carefully consider all the information included or incorporated by reference in this prospectus supplement prior to investing in our common stock. In particular, we urge you to carefully read the “Risk Factors” section of this prospectus supplement and in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus.

|

|

|

|

|

|

Nasdaq Stock Market Symbol

|

|

“WATT”

|

Risk Factors

Before you make a decision to invest

in our securities, you should consider carefully the risks described below, together with other information in this prospectus

supplement, the accompanying prospectus and the information incorporated by reference herein and therein, including any risk factors

contained in our annual and other reports filed with the SEC. If any of the following events actually occur, our business, operating

results, prospects or financial condition could be materially and adversely affected. This could cause the trading price of our

common stock to decline and you may lose all or part of your investment. The risks described below are not the only ones that we

face. Additional risks not presently known to us or that we currently deem immaterial may also significantly impair our business

operations and could result in a complete loss of your investment.

Risks Related to Our Business

Other than engineering services revenues, we have no history

of generating meaningful product revenue, and we may never achieve or maintain profitability.

We have a limited operating history upon

which investors may rely in evaluating our business and its prospects. We have generated only very limited revenues to date and

we have a history of losses from operations. As of September 30, 2017 we had an accumulated deficit of approximately $163 million.

Our ability to generate revenues on a more reliable and larger scale, and to achieve profitability, will depend on our ability

to execute our business plan, complete the development of our technology, and incorporate it into products that customers wish

to buy, and to do so rapidly with appropriate financing if necessary. If we are unable to generate revenues of significant scale

to cover our costs of doing business, our losses will continue and we may not achieve profitability, which could negatively impact

the value of your investment in our securities.

Terms of our Development and License Agreement with a

tier-one consumer electronics company could inhibit potential licensees from working with us in specific markets.

We have entered into a Development and License

Agreement with a tier-one consumer electronics company to embed our WattUp wire-free charging receiver and transmitter technology

in various products, including mobile consumer electronics and related accessories. This agreement provides our strategic partner

a time-to-market advantage during the development and until one year after the first customer shipment for specified WattUp-enabled

consumer products. This may inhibit other potential licensees of our technology from engaging with us on competing consumer products,

and may cause them to seek solutions offered by other companies, which could have a negative impact on our revenue opportunities

and financial results.

We may be unable to demonstrate the feasibility of our

technology.

We have developed working prototypes of

products using our technology, but additional research and development is required to commercialize our technology for mid field

and far field applications so that it can be successfully integrated into commercial products. Our research and development efforts

remain subject to the risks associated with the development of new products that are based on emerging technologies, such as unanticipated

technical problems, the inability to identify products utilizing our technology that will be in demand with customers, getting

our technology designed in to those products, designing new products for manufacturability, and achieving acceptable price points

for final products. Our technology must also satisfy customer expectations and be suitable for them to use in consumer applications.

Any delays in developing our technology that arise from factors of this sort would aggravate our exposure to the risk of having

inadequate capital to fund the research and development needed to complete development of these products. Technical problems causing

delays would cause us to incur additional expenses that would increase our operating losses. If we experience significant delays

in developing our technology and products based on it for use in potential commercial applications, particularly after incurring

significant expenditures, our business may fail and you could lose the value of your investment in our company. To our knowledge,

the technological concepts we are applying have never previously been successfully applied. If we fail to develop practical and

economical commercial products based on our technology, our business may fail and you could lose the value of your investment in

our stock.

The FCC may deny approval for our technology, and future

legislative or regulatory changes may impair our business.

Our wire-free charging technology involves

transmission of power using radio frequency (RF) energy, which is subject to regulation by the Federal Communications Commission,

or FCC. It may also be subject to regulation by other federal, state and local agencies. We design our technology to operate in

a RF band that is also used for Wi-Fi routers and other wireless consumer electronics. Some customer applications may require us

to develop our technology to work at different frequencies. The FCC grants product approval if, among other things, the human exposure

to radio frequency emissions is below specified thresholds. For products that transmit more power, additional FCC approvals are

required. There can be no assurance that devices incorporating our technology will receive FCC approval or that other governmental

approvals will not be required. Our efforts to obtain FCC approval for devices using our technology is costly and time consuming.

If approvals are not obtained in a timely and cost-efficient manner, our business and operating results would be materially harmed.

In addition, new laws or regulations governing our technology could impose restrictions on us that could require us to redesign

our technology or future products, or that are difficult or impracticable to comply with, all of which would adversely affect our

revenues and financial results.

We are dependent upon our strategic relationship with

Dialog Semiconductor, a provider of electronics products, and there can be no assurance that we will achieve the expected benefits

of this relationship.

We have entered into a strategic cooperation

agreement with Dialog Semiconductor, a provider of electronics products, pursuant to which we licensed our WattUp technology to

Dialog and Dialog became the exclusive provider of our technology. We intend to leverage Dialog’s sales and distribution

channels and its operational capabilities to accelerate market adoption of our technology, while we focus our resources on research

and development of our technology. There can be no assurance that Dialog will promote our technology successfully, or that it will

be successful in producing and distributing related products to our customers’ specifications. Dialog may have other priorities

or may encounter difficulties in its own business that interfere with the success of our relationship. If this strategic relationship

does not work as we intend, then we may be required to seek an arrangement with another strategic partner, or to develop internal

capabilities, which will require a commitment of management time and our financial resources to identify a replacement strategic

partner, or to develop our own production and distribution capabilities. As a result, we may be unable without undue expense to

replace this agreement with one or more new strategic relationships to promote and provide our technology.

We may require additional financing in order to achieve

our business plans, and there is no guarantee that it will be available on acceptable terms, or at all.

We may not have sufficient funds to fully

implement our business plans. We expect that we will need to raise additional capital through new financings, even if we begin

to generate meaningful commercial revenue. Such financings could include equity financing, which may be dilutive to stockholders,

or debt financing, which could restrict our ability to borrow from other sources. In addition, such securities may contain rights,

preferences or privileges senior to those of current stockholders. As a result of economic conditions, general global economic

uncertainty, political change, and other factors, we do not know whether additional capital will be available when needed, or that,

if available, we will be able to obtain additional capital on reasonable terms. If we are unable to raise additional capital due

to the volatile global financial markets, general economic uncertainty or other factors, we may be required to curtail development

of our technology or reduce operations as a result, or to sell or dispose of assets. Any inability to raise adequate funds on commercially

reasonable terms could have a material adverse effect on our business, results of operations and financial condition, including

the possibility that a lack of funds could cause our business to fail and liquidate with little or no return to investors.

Expanding our business operations as we intend will impose

new demands on our financial, technical, operational and management resources.

To date we have operated primarily in the

research and development phase of our business. If we are successful, we will need to expand our business operations, which will

impose new demands on our financial, technical, operational and management resources. If we do not upgrade our technical, administrative,

operating and financial control systems, or the unexpected expansion difficulties arise, including issues relating to our research

and development activities and retention of experienced scientists, managers and engineers, could have a material adverse effect

on our business, our results of operations and financial condition, and our ability to timely execute our business plan. If we

are unable to implement these actions in a timely manner, our results may be adversely affected.

If products incorporating our technology are launched

commercially but do not achieve widespread market acceptance, we will not be able to generate the revenue necessary to support

our business.

Market acceptance of a wire-free charging

system as a preferred method to recharge low-power fixed and mobile electronic devices will be crucial to our continued success.

The following factors, among others, may affect the rate and level of market acceptance of products in our industry:

|

|

•

|

the price of products incorporating our technology relative to other products or competing technologies;

|

|

|

•

|

the effectiveness of sales and marketing efforts of our commercialization partners;

|

|

|

•

|

the support and rate of acceptance of our technology and solutions with our joint development partners;

|

|

|

•

|

perceptions, by individual and enterprise users, of our technology’s convenience, safety, efficiency and benefits compared to competing technologies;

|

|

|

•

|

press and blog coverage, social media coverage, and other publicity factors which are not within our control; and

|

|

|

•

|

regulatory developments.

|

If we are unable to achieve or maintain

market acceptance of our technology, and if related products do not win widespread market acceptance, our business will be significantly

harmed.

If products incorporating our technology are commercially

launched, we may experience seasonality or other unevenness in our financial results in consumer markets or a long and variable

sales cycle in enterprise markets.

Our strategy depends on the development

of successful commercial products and effectively licensing our technology into the consumer, enterprise and commercial markets.

We will need to understand procurement and buying cycles to be successful in licensing our technology. We anticipate it is possible

that demand for our technology could vary similarly with the market for products with which our technology may be used, for example,

the market for new purchases of laptops, tablet, mobile phones, gaming systems, toys, wearables and the like. Such consumer markets

are often seasonal, with peaks in and around the December holiday season and the August-September back-to-school season. Enterprises

and commercial markets may have annual or other budgeting and buying cycles that could affect us, and, particularly if we are designated

as a capital improvement project, we may have a long or unpredictable sales cycle.

We may not be able to achieve all the features we seek

to include in our technology.

We have developed working prototypes of

commercial products that utilize our technology. Additional features and performance specifications we seek to include in our technology

have not yet been developed. For example, some customer applications may require specific combinations of cost, footprint, efficiencies

and capabilities at various charging power levels and distances as part of an overall system. We believe our research and development

efforts will yield additional functionality and capabilities over time. However, there can be no assurance that we will be successful

in achieving all the features we are targeting and our inability to do so may limit the appeal of our technology to consumers.

Future products based on our technology may require the

user to purchase additional products to use with existing devices. To the extent these additional purchases are inconvenient, the

adoption of our technology under development or other future products could be slowed, which would harm our business.

For rechargeable devices that utilize our

receiver technology, the technology may be embedded in a sleeve, case or other enclosure. For example, products such as remote

controls or toys equipped with replaceable AA size or other batteries would need to be outfitted with enhanced batteries and other

hardware enabling the devices to be rechargeable by our system. In each case, an end user would be required to retrofit the device

with a receiver and may be required to upgrade the battery technology used with the device (unless, for example, compatible battery

technology and a receiver are built into the device). These additional steps and expenses may offset the convenience for some users

and discourage some users from purchasing our technology under development or other future products. Such factors may inhibit adoption

of our technology, which could harm our business. We have not developed an enhanced battery for use in devices with our technology,

and our ability to enable use of our technology with devices that require an enhanced battery will depend on our ability to develop

a commercial version of such a battery that could be manufactured at a reasonable cost. If we fail to develop or enable a commercially

practicable enhanced battery, our business could be harmed, and we may need to change our strategy and target markets.

Laboratory conditions differ from field conditions, which

could affect the effectiveness of our technology under development or other future products. Failures to move from laboratory to

the field effectively would harm our business.

When used in the field, our technology may

not perform as expected based on test results and performance of our technology under controlled laboratory circumstances. For

example, in the laboratory a configuration of obstructions of transmission will be arranged in some fashion, but in the field receivers

may be obstructed in many different and unpredictable ways over which we have no control. These conditions may significantly diminish

the power received at the receiver or the effective range of the transmitter, because the RF energy from the transmitter may be

absorbed by obscuring or blocking material or may need to be reflected off a surface to reach the receiver, making the transmission

distance longer than straight-line distances. The failure of products using our technology or other future products to be able

to meet the demands of users in the field could harm our business.

Safety concerns and legal action by private parties may

affect our business.

We believe that our technology is safe.

However, it is possible that we could discover safety issues with our technology or that some people may be concerned with wire-free

transmission of power in a manner that has occurred with some other wireless technologies as they were put into residential and

commercial use, such as the safety concerns that were raised by some regarding the use of cellular telephones and other devices

to transmit data wirelessly in close proximity to the human body. In addition, while we believe our technology is safe, users of

our technology under development or other future products who suffer medical ailments may blame the use of products incorporating

our technology, as occurred with a small number of users of cellular telephones. A discovery of safety issues relating to our technology

could have a material adverse effect on our business and any legal action against us claiming our technology caused harm could

be expensive, divert management and adversely affect us or cause our business to fail, whether or not such legal actions were ultimately

successful.

Our industry is subject to intense competition and rapid

technological change, which may result in technology that is superior to ours. If we are unable to keep pace with changes in the

marketplace and the direction of technological innovation and customer demands, our technology and products may become less useful

or obsolete and our operating results will suffer.

The consumer electronics industry in general,

and the power, recharging and alternative recharging segments in particular, are subject to intense and increasing competition

and rapidly evolving technologies. Because products incorporating our technology are expected to have long development cycles,

we must anticipate changes in the marketplace and the direction of technological innovation and customer demands. To compete successfully,

we will need to demonstrate the advantages of our products and technologies over established alternatives, and over newer methods

of power delivery. Traditional wall plug-in recharging remains an inexpensive alternative to our technology. Directly competing

technologies such as inductive charging, magnetic resonance charging, conductive charging, ultrasound and other yet unidentified

solutions may have greater consumer acceptance than the technologies we have developed. Furthermore, certain competitors may have

greater resources than we have and may be better established in the market than we are. We cannot be certain which other companies

may have already decided to or may in the future choose to enter our markets. For example, consumer electronics products companies

may invest substantial resources in wireless power or other recharging technologies and may decide to enter our target markets.

Successful developments of competitors that result in new approaches for recharging could reduce the attractiveness of our products

and technologies or render them obsolete.

Our future success will depend in large

part on our ability to establish and maintain a competitive position in current and future technologies. Rapid technological development

may render our technology or future products based on our technology obsolete. Many of our competitors have greater corporate,

financial, operational, sales and marketing resources than we have, as well as more experience in research and development. We

cannot assure you that our competitors will not develop or market technologies that are more effective or commercially attractive

than our products or that would render our technologies and products obsolete. We may not have or the financial resources, technical

expertise, marketing, distribution or support capabilities to compete successfully in the future. Our success will depend in large

part on our ability to maintain a competitive position with our technologies.

Our competitive position also depends on

our ability to:

|

|

•

|

generate widespread awareness, acceptance and adoption by the consumer and enterprise markets of our technology under development and future products;

|

|

|

•

|

design a product that may be sold at an acceptable price point;

|

|

|

•

|

develop new or enhanced technologies or features that improve the convenience, efficiency, safety or perceived safety, and productivity of our technology under development and future products;

|

|

|

•

|

properly identify customer needs and deliver new products or product enhancements to address those needs;

|

|

|

•

|

limit the time required from proof of feasibility to routine production;

|

|

|

•

|

limit the timing and cost of regulatory approvals;

|

|

|

•

|

attract and retain qualified personnel;

|

|

|

•

|

protect our inventions with patents or otherwise develop proprietary products and processes; and

|

|

|

•

|

secure sufficient capital resources to expand both our continued research and development, and sales and marketing efforts.

|

If our technology does not compete well based on these or other

factors, our business could be harmed.

It is difficult and costly to protect our intellectual

property and our proprietary technologies, and we may not be able to ensure their protection.

Our success depends significantly on our

ability to obtain, maintain and protect our proprietary rights to the technologies used in products incorporating our technologies.

Patents and other proprietary rights provide uncertain protections, and we may be unable to protect our intellectual property.

For example, we may be unsuccessful in defending our patents and other proprietary rights against third party challenges. If we

do not have the resources to defend our intellectual property, the value of our intellectual property and our licensed technology

will decline, threatening our potential revenue and results of operations.

We depend upon a combination of patent, trade secrets,

copyright and trademark laws to protect our intellectual property and technology.

We rely on a combination of patents, trade

secrets, copyright and trademark laws, nondisclosure agreements and other contractual provisions and technical security measures

to protect our intellectual property rights. These measures may not be adequate to safeguard our technology. If they do not protect

our rights adequately, third parties could use our technology, and our ability to compete in the market would be reduced. Although

we are attempting to obtain patent coverage for our technology where available and where we believe appropriate, there are aspects

of the technology for which patent coverage may never be sought or received. We may not possess the resources to or may not choose

to pursue patent protection outside the United States or any or every country other than the United States where we may eventually

decide to sell our future products. Our ability to prevent others from making or selling duplicate or similar technologies will

be impaired in those countries in which we have no patent protection. Although we have a number of patent applications on file

in the United States, the patents may not issue, may issue only with limited coverage or may issue and be subsequently successfully

challenged by others and held invalid or unenforceable.

Similarly, even if patents do issue based

on our applications or future applications, any issued patents may not provide us with any competitive advantages. Competitors

may be able to design around our patents or develop products that provide outcomes comparable or superior to ours. Our patents

may be held invalid or unenforceable as a result of legal challenges by third parties, and others may challenge the inventorship

or ownership of our patents and pending patent applications. In addition, if we secure protection in countries outside the United

States, the laws of some foreign countries may not protect our intellectual property rights to the same extent as do the laws of

the United States. In the event a competitor infringes upon our patent or other intellectual property rights, enforcing those rights

may be difficult and time consuming. Even if successful, litigation to enforce our intellectual property rights or to defend our

patents against challenge could be expensive and time consuming and could divert our management’s attention. We may not have

sufficient resources to enforce our intellectual property rights or to defend our patents against a challenge.

Our strategy is to deploy our technology

into the market by licensing patent and other proprietary rights to third parties and customers. Disputes with our licensors may

arise regarding the scope and content of these licenses. Further, our ability to expand into additional fields with our technologies

may be restricted by existing licenses or licenses we may grant to third parties in the future.

The policies we use to protect our trade

secrets may not be effective in preventing misappropriation of our trade secrets by others. In addition, confidentiality agreements

executed by our employees, consultants and advisors may not be enforceable or may not provide meaningful protection for our trade

secrets or other proprietary information in the event of unauthorized use or disclosure. Litigating a trade secret claim is expensive

and time consuming, and the outcome is unpredictable. Moreover, our competitors may independently develop equivalent knowledge

methods and know-how. If we are unable to protect our intellectual property rights, we may be unable to prevent competitors from

using our own inventions and intellectual property to compete against us, and our business may be harmed.

We may be subject to patent infringement or other intellectual

property lawsuits that could be costly to defend.

Because our industry is characterized by

competing intellectual property, we may become involved in litigation based on claims that we have violated the intellectual property

rights of others. Determining whether a product infringes a patent involves complex legal and factual issues, and the outcome of

patent litigation actions is often uncertain. No assurance can be given that third party patents containing claims covering our

products, parts of our products, technology or methods do not exist, have not been filed, or could not be filed or issued. Because

of the number of patents issued and patent applications filed in our technical areas or fields (including some pertaining specifically

to wireless charging technologies), our competitors or other third parties may assert that our products and technology and the

methods we employ in the use of our products and technology are covered by United States or foreign patents held by them. In addition,

because patent applications can take many years to issue and because publication schedules for pending applications vary by jurisdiction,

there may be applications now pending which may result in issued patents that our technology under development or other future

products would infringe. Also, because the claims of published patent applications can change between publication and patent grant,

there may be published patent applications that may ultimately issue with claims that we infringe. There could also be existing

patents that one or more of our technologies, products or parts may infringe and of which we are unaware. As the number of competitors

in the market for wire-free power and alternative recharging solutions increases, and as the number of patents issued in this area

grows, the possibility of patent infringement claims against us increases. Some of our competitors may be able to sustain the costs

of complex patent litigation more effectively than we can because they have substantially greater resources. In addition, any uncertainties

resulting from the initiation and continuation of any litigation could have a material adverse effect on our ability to raise the

funds necessary to continue our operations.

In the event that we become subject to a

patent infringement or other intellectual property lawsuit and if the relevant patents or other intellectual property were upheld

as valid and enforceable and we were found to infringe or violate the terms of a license to which we are a party, we could be prevented

from selling any infringing products of ours unless we could obtain a license or were able to redesign the product to avoid infringement.

If we were unable to obtain a license or successfully redesign, we might be prevented from selling our technology under development

or other future products. If there is a determination that we have infringed the intellectual property rights of a competitor or

other person, we may be required to pay damages, pay a settlement, or pay ongoing royalties, or be enjoined. In these circumstances,

we may be unable to sell our products or license our technology at competitive prices or at all, and our business and operating

results could be harmed.

We could become subject to product liability claims,

product recalls, and warranty claims that could be expensive, divert management’s attention and harm our business.

Our business exposes us to potential liability

risks that are inherent in the marketing and sale of products used by consumers. We may be held liable if our technology under

development now or in the future causes injury or death or are found otherwise unsuitable during usage. Our technology under development

incorporates sophisticated components and computer software. Complex software can contain errors, particularly when first introduced.

In addition, new products or enhancements may contain undetected errors or performance problems that, despite testing, are discovered

only after installation. While we believe our technology is safe, users could allege or possibly prove defects (some of which could

be alleged or proved to cause harm to users or others) because we design our technology to perform complex functions involving

RF energy, possibly in close proximity to users. A product liability claim, regardless of its merit or eventual outcome, could

result in significant legal defense costs. The coverage limits of our insurance policies we may choose to purchase to cover related

risks may not be adequate to cover future claims. If sales of products incorporating our technology increase or we suffer future

product liability claims, we may be unable to maintain product liability insurance in the future at satisfactory rates or with

adequate amounts. A product liability claim, any product recalls or excessive warranty claims, whether arising from defects in

design or manufacture or otherwise, could negatively affect our sales or require a change in the design or manufacturing process,

any of which could harm our reputation and business, harm our relationship with licensors of our products, result in a decline

in revenue and harm our business.

In addition, if a product that we or a strategic

partner design is defective, whether due to design or manufacturing defects, improper use of the product or other reasons, we or

our strategic partners may be required to notify regulatory authorities and/or to recall the product. A required notification to

a regulatory authority or recall could result in an investigation by regulatory authorities of products incorporating our technology,

which could in turn result in required recalls, restrictions on the sale of such products or other penalties. The adverse publicity

resulting from any of these actions could adversely affect the perception of our customers and potential customers. These investigations

or recalls, especially if accompanied by unfavorable publicity, could result in our incurring substantial costs, losing revenues

and damaging our reputation, each of which would harm our business.

We are subject to risks associated with our utilization

of consultants.

To improve productivity and accelerate our

development efforts while we build out our own engineering team, we may use experienced consultants to assist in selected development

projects. We take steps to monitor and regulate the performance of these independent third parties. However, arrangements with

third party service providers may make our operations vulnerable if these consultants fail to satisfy their obligations to us as

a result of their performance, changes in their own operations, financial condition, or other matters outside of our control. Effective

management of our consultants is important to our business and strategy. The failure of our consultants to perform as anticipated

could result in substantial costs, divert management’s attention from other strategic activities, or create other operational

or financial problems for us. Terminating or transitioning arrangements with key consultants could result in additional costs and

a risk of operational delays, potential errors and possible control issues as a result of the termination or during the transition.

If we are not able to secure advantageous license agreements

for our technology, our business and results of operations will be adversely affected.

We pursue the licensing of our technology

as a primary means of revenue generation. We believe there are many companies that would be interested in implementing our technology

into their devices. We have entered into one product development and license agreement with a tier-one consumer electronics company

that has the potential to yield license revenue. We have also entered into a number of evaluation and joint development agreements

with potential strategic partners. However, these agreements do not commit either party to a long-term relationship and any of

these parties may disengage with us at any time. Creating a licensing business relationship often takes a substantial effort, as

we expect to have to convince the counterparty of the efficacy of our technology, meet design and manufacturing requirements, satisfy

marketing and product needs, and comply with selection, review and contracting requirements. There can be no assurance that we

will be able to gain access to potential licensing partners, or that they will ultimately decide to integrate our technology with

their products. We may not be able to secure license agreements with customers on advantageous terms, and the timing and volume

of revenue earned from license agreements will be outside of our control. If the license agreements we enter into do not prove

to be advantageous to us, our business and results of operations will be adversely affected.

We are highly dependent on key members of our executive

management team. Our inability to retain these individuals could impede our business plan and growth strategies, which could have

a negative impact on our business and the value of your investment.

Our ability to implement our business plan

depends, to a critical extent, on the continued efforts and services of a very small number of key executives. If we lose the services

of any of these persons, we could be required to expend significant time and money in the pursuit of replacements, which may result

in a delay in the implementation of our business plan and plan of operations. If necessary, we can give no assurance that we could

find satisfactory replacements for these individuals on terms that would not be unduly expensive or burdensome to us. We do not

currently carry a key-man life insurance policy that would assist us in recouping our costs in the event of the death or disability

of any of these executives.

Our success and growth depend on our ability to attract,

integrate and retain high-level engineering talent.

Because of the highly specialized and complex

nature of our business, our success depends on our ability to attract, hire, train, integrate and retain high-level engineering

talent. Competition for such personnel is intense because we compete for talent against many large profitable companies and our

inability to adequately staff our operations with highly qualified and well-trained engineers could render us less efficient and

impede our ability to develop and deliver a commercial product. Such a competitive market could put upward pressure on labor costs

for engineering talent. We may incur significant costs to attract and retain highly qualified talent, and we may lose new employees

to our competitors or other technology companies before we realize the benefit of our investment in recruiting and training them.

Volatility or lack of performance in our stock price may also affect our ability to attract and retain qualified personnel.

Risks Related to Ownership of Our Common Stock

You may lose all of your investment.

Investing in our common stock involves a

high degree of risk. As an investor, you may never recoup all, or even part of, your investment and you may never realize any return

on your investment. You must be prepared to lose all of your investment.

Our stock price is likely to continue to be volatile.

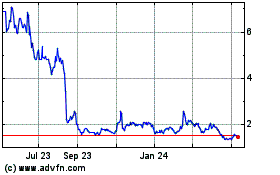

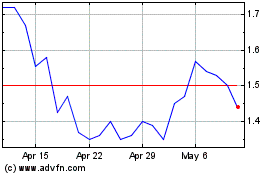

The market price of the common stock has

fluctuated significantly since it was first listed on The Nasdaq Stock Market on March 28, 2014. Our common stock has experienced

an intra-day trading high of $33.50 per share and a low of $6.91 per share over the last 52 weeks. The price of our common stock

may continue to fluctuate significantly in response to factors, many of which are beyond our control, including the following:

|

|

•

|

Regulatory announcements, such as the recent FCC approval of our mid-range transmitter and receiver technology;

|

|

|

•

|

actual or anticipated variations in operating results;

|

|

|

•

|

the limited number of holders of the common stock;

|

|

|

•

|

changes in the economic performance and/or market valuations of other technology companies;

|

|

|

•

|

our announcements of significant strategic partnerships, regulatory developments and other events;

|

|

|

•

|

announcements by other companies in the wire-free charging space;

|

|

|

•

|

articles published or rumors circulated by third parties regarding our business, technology or development partners;

|

|

|

•

|

additions or departures of key personnel; and

|

|

|

•

|

sales or other transactions involving our capital stock.

|

We are an “emerging growth company,” and are

able to take advantage of reduced disclosure requirements applicable to “emerging growth companies,” which could make

our common stock less attractive to investors.

We are an “emerging growth company,”

as defined in the Jumpstart Our Business Startups Act of 2012, or JOBS Act, and, for as long as we continue to be an “emerging

growth company,” we intend to take advantage of certain exemptions from various reporting requirements applicable to other

public companies but not to “emerging growth companies,” including, but not limited to, not being required to comply

with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive

compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory

vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could be an

“emerging growth company” for up to five years, or until the earliest of (i) the last day of the first fiscal year

in which our annual gross revenues exceed $1.07 billion, (ii) the date that we become a “large accelerated filer” as

defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates

exceeds $700.0 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which

we have issued more than $1.07 billion in non-convertible debt during the preceding three year period. We cannot predict if investors

will find our common stock less attractive if we choose to rely on these exemptions. If some investors find our common stock less

attractive as a result of any choices to reduce future disclosure, there may be a less active trading market for our common stock

and our stock price may be more volatile.

We have not paid dividends in the past and have no immediate

plans to pay dividends.

We plan to reinvest all of our earnings,

to the extent we have earnings, in order to market our products and technology and to cover operating costs and to otherwise become

and remain competitive. We do not plan to pay any cash dividends with respect to our securities in the foreseeable future. We cannot

assure you that we would, at any time, generate sufficient surplus cash that would be available for distribution to the holders

of our common stock as a dividend.

Concentration of ownership among our existing executive

officers, directors and significant stockholders may prevent new investors from influencing significant corporate decisions.

All decisions with respect to the management

of our company are made by our board of directors and our officers, who beneficially own approximately 9% of our common stock collectively.

In addition, our greater than 5% stockholders such as Dialog Semiconductor plc, Emily and Malcolm Fairbairn, Hood River Capital

Management, and DvineWave beneficially owned approximately 13.3%, 7.7%, 7.4% and 7.4%, respectively, of our common stock as of

December 31, 2017. As a result, these stockholders will be able to exercise a significant level of control over all matters requiring

stockholder approval, including the election of directors, amendment of our certificate of incorporation and approval of significant

corporate transactions. This control could have the effect of delaying or preventing a change of control of our company or changes

in management and will make the approval of certain transactions difficult or impossible without the support of these stockholders.

We expect to continue to incur significant costs as a

result of being a public reporting company and our management will be required to devote substantial time to meet our compliance

obligations.

As a public reporting company, we incur

significant legal, accounting and other expenses. We are subject to reporting requirements of the Securities Exchange Act of 1934

and rules subsequently implemented by the Securities and Exchange Commission (“SEC”) that require us to establish and

maintain effective disclosure controls and financial controls, as well as some specific corporate governance practices. Our management

and other personnel are expected to devote a substantial amount of time to compliance initiatives associated with our public reporting

company status.

We may be subject to securities litigation, which is expensive

and could divert management attention.

Our stock price has fluctuated in the past,

most recently following our announcement of FCC approval of our mid-field transmitter technology, and it may be volatile in the

future. In the past, companies that have experienced volatility in the market price of their securities have been subject to securities

class action litigation, and we may be the target of litigation of this sort in the future. Securities litigation is costly and

can divert management attention from other business concerns, which could seriously harm our business and the value of your investment

in our company.

An active trading market for our common stock may not

be maintained.

Our stock is currently traded on The Nasdaq

Stock Market, but we can provide no assurance that we will be able to maintain an active trading market on The Nasdaq Stock Market

or any other exchange in the future. If an active market for our common stock is not maintained, it may be difficult for our stockholders

to sell shares without depressing the market price for the shares or at all. An inactive market may also impair our ability to

raise capital to continue to fund operations by selling shares and may impair our ability to acquire other companies or technologies

by using our shares as consideration.

If securities or industry analysts do not publish research

or reports about our business, or publish negative reports about our business, our stock price and trading volume could decline.

The trading market for our common stock

will depend in part on the research and reports that securities or industry analysts publish about us or our business. We do not

have any control over these analysts. There can be no assurance that analysts will continue to cover us or provide favorable coverage.

If one or more of the analysts who cover us downgrade our stock or change their opinion of our stock, our stock price would likely

decline. If one or more of these analysts cease coverage of our company or fail to regularly publish reports on us, we could lose

visibility in the financial markets, which could cause our stock price or trading volume to decline.

Our charter documents and Delaware law may inhibit a takeover

that stockholders consider favorable.

Provisions of our certificate of incorporation

and bylaws, and applicable Delaware law, may delay or discourage transactions involving an actual or potential change in control

or change in our management, including transactions in which stockholders might otherwise receive a premium for their shares, or

transactions that our stockholders might otherwise deem to be in their best interests. The provisions in our certificate of incorporation

and bylaws:

|

|

•

|

authorize our board of directors to issue preferred stock without stockholder approval and to designate the rights, preferences and privileges of each class; if issued, such preferred stock would increase the number of outstanding shares of our capital stock and could include terms that may deter an acquisition of us;

|

|

|

•

|

limit who may call stockholder meetings;

|

|

|

•

|

do not permit stockholders to act by written consent;

|

|

|

•

|

do not provide for cumulative voting rights; and

|

|

|

•

|

provide that all vacancies may be filled by the affirmative vote of a majority of directors then in office, even if less than a quorum.

|

In addition, Section 203 of the Delaware

General Corporation Law may limit our ability to engage in any business combination with a person who beneficially owns 15% or

more of our outstanding voting stock unless certain conditions are satisfied. This restriction lasts for a period of three years

following the share acquisition. These provisions may have the effect of entrenching our management team and may deprive you of

the opportunity to sell your shares to potential acquirers at a premium over prevailing prices. This potential inability to obtain

a control premium could reduce the price of our common stock.

Risks Related to this Offering

Our management will have broad discretion

as to the use of proceeds from this offering and we may not use the proceeds effectively.

Our management will have broad discretion

in the application of the net proceeds from this offering, if any, and could spend the proceeds in ways that do not improve our

results of operations or enhance the value of our common stock. You will be relying on the judgment of our management concerning

these uses and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being

used appropriately. The failure of our management to apply these funds effectively could result in unfavorable returns and uncertainty

about our prospects, each of which could cause the price of our common stock to decline.

The exercise of our outstanding options

and warrants and the vesting of our outstanding restricted stock units will dilute stockholders and could decrease our stock price.

The exercise of our outstanding options

and warrants and the vesting of our outstanding restricted stock units may adversely affect our stock price due to sales of a large

number of shares or the perception that such sales could occur. These factors also could make it more difficult to raise funds

through future offerings of our securities, and could adversely impact the terms under which we could obtain additional equity

capital. Exercise of outstanding options and warrants, vesting of outstanding restricted stock units or any future issuance of

additional shares of common stock or other equity securities, including but not limited to options, warrants, restricted stock

units or other derivative securities convertible into our common stock, may result in significant dilution to our stockholders

and may decrease our stock price.

The shares of our common stock offered

under this prospectus supplement and the accompanying base prospectus may be sold in “at-the-market” offerings, and

investors who buy shares at different times will likely pay different prices.

Investors who purchase shares under this

prospectus supplement and the accompanying base prospectus at different times will likely pay different prices, and so may experience

different outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices,

and numbers of shares sold, and to determine the minimum sales price for shares sold. Investors may experience declines in the

value of their shares as a result of share sales made in connection with “at-the-market” offerings at prices lower

than the prices they paid.

The actual number of shares we will issue under the distribution

agreement, at any one time or in total, is uncertain.

Subject to certain limitations in the distribution

agreement and compliance with applicable law, we and our sales agent may mutually agree to sell shares of our common stock under

a transaction acceptance at any time throughout the term of the distribution agreement. The number of shares that are sold by Raymond

James after agreement on the terms of the transaction acceptance will fluctuate based on the market price of the shares of our

common stock during the sales period and limits we set with our sales agent. Because the price per share of each share sold will

fluctuate based on the market price of our shares of common stock during the sales period, it is not possible to predict the number

of shares that will ultimately be issued.

Use of Proceeds

We may issue and sell shares of our common

stock having aggregate sale proceeds of up to $40,000,000 from time to time. There can be no assurance that we will be able to

sell any shares under or fully utilize the sales agreement with Raymond James as a source of financing. Because there is no minimum

offering amount required as a condition to close this offering, the actual total public offering amount, commissions and proceeds

to us, if any, are not determinable at this time. We currently intend to use the net proceeds from this offering to fund our product

development efforts, regulatory activities, business development and support functions, and for general and administrative expenses

and other general corporate purposes. The amounts and timing of our use of proceeds will vary depending on many factors, including

regulatory developments, the amount of cash generated or used by our operations, and the rate of growth, if any, of our business.

As a result, we will retain broad discretion in the allocation of the net proceeds, if any, we receive in connection with securities

offered pursuant to this prospectus supplement and investors will be relying on the judgment of our management regarding the application

of the proceeds.

Until we use the net proceeds of this offering,

we intend to invest the funds in short-term, investment-grade, interest-bearing securities.

MATERIAL

UNITED STATES FEDERAL INCOME TAX CONSEQUENCES

FOR NON-U.S. HOLDERS OF OUR COMMON STOCK

The following summary describes the material

U.S. federal income tax consequences of the acquisition, ownership and disposition of our common stock acquired in this offering