Current Report Filing (8-k)

January 12 2018 - 6:07AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 11, 2018

ENERGOUS

CORPORATION

(Exact Name of Registrant as Specified in

Charter)

|

Delaware

|

001-36379

|

46-1318953

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

3590 North First Street, Suite 210

San Jose, California 95134

|

|

(Address of Principal Executive Offices)(Zip

Code)

Registrant’s telephone number,

including area code: (408) 963-0200

|

|

Not Applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

x

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On January 11, 2018, Energous Corporation

(“Energous”) entered into a Distribution Agreement (the “Distribution Agreement”) with Raymond James &

Associates, Inc., as agent (“Raymond James”), pursuant to which Energous may offer and sell, from time to time through

Raymond James, shares of its common stock, par value $0.00001 per share (the “Common Stock”), with aggregate gross

proceeds of up to $40.0 million (the “Shares”). The offer and sale of the Shares will be made pursuant to a shelf registration

statement on Form S-3 and the related prospectus (File No. 333-203622) filed by Energous with the Securities and Exchange

Commission (the “SEC”) on April 24, 2015 and declared effective by the SEC on April 30, 2015, as

supplemented by a prospectus supplement dated January 11, 2018 and filed with the SEC pursuant to Rule 424(b) under the Securities

Act of 1933, as amended (the “Securities Act”).

Under the Distribution Agreement, Raymond

James may sell the Shares in sales deemed to be “at-the-market” equity offerings as defined in Rule 415 promulgated

under the Securities Act, including sales made directly on or through Nasdaq. If agreed to in a transaction notice, Energous may

also sell common stock to Raymond James as principal, at a purchase price agreed upon by Raymond James and Energous. The offer

and sale of the Shares pursuant to the Distribution Agreement will terminate upon the earlier of (a) the sale of all of the

Shares subject to the Distribution Agreement or (b) the termination of the Distribution Agreement by Raymond James or Energous

pursuant to the terms thereof.

Energous will pay Raymond James a commission

of 2.5% of the aggregate gross proceeds from any Shares sold by Raymond James and Energous has agreed to provide Raymond James

with customary indemnification and contribution rights, including for liabilities under the Securities Act. Energous also

will reimburse Raymond James for certain specified expenses in connection with entering into the Distribution Agreement. The Distribution

Agreement contains customary representations and warranties and conditions to the placements of the Shares pursuant thereto.

The foregoing description of the Distribution

Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Distribution Agreement.

A copy of the Distribution Agreement is filed with this Current Report on Form 8-K as Exhibit 1.1 and is incorporated herein by

reference.

A copy of the opinion of Fenwick & West

LLP, relating to the validity of the Shares to be issued pursuant to the Distribution Agreement, is filed with this Current Report

on Form 8-K report as Exhibit 5.1.

This Current Report on Form 8-K shall

not constitute an offer to sell or the solicitation of an offer to buy the Shares, nor shall there be any offer, solicitation,

or sale of Energous’s Common Stock in any state in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state.

|

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

FCC Certification for Power-at-a-Distance Wireless Charging

On December 26, 2017, Energous announced

Federal Communications Commission (FCC) certification of its first-generation WattUp Mid Field transmitter, which sends focused,

RF-based power to devices at a distance of up to three feet, while also charging multiple devices at once. Energous’s WattUp

Mid Field transmitter underwent rigorous, multi-month testing to verify it met consumer safety and regulatory requirements. Energous

believes this achievement represents the first certification of a Part 18 FCC approved power-at-a-distance wireless charging transmitter,

and also establishes a precedent that will streamline both its future FCC and international regulatory approvals, as well as the

regulatory approvals of its customers for their respective end-products.

Preliminary Estimated Financial Information for the Fourth

Quarter of 2017

Energous has presented preliminary estimated

financial information below for its fourth quarter ended December 31, 2017 based on currently available information. Energous has

not finalized its financial results for the quarter and Marcum LLP, Energous’s independent registered public accounting firm,

has not performed any procedures with respect to the preliminary estimated financial information contained below, nor has Marcum

expressed any opinion or other assurance on such preliminary estimated financial information. These preliminary estimates should

not be regarded as a representation by Energous, its management or the sales agent as to Energous’s actual financial results

for its fourth quarter. The preliminary estimated financial information presented below is subject to change, and Energous’s

actual financial results may differ from such preliminary estimates and such differences could be material.

The following are preliminary estimates

for Energous’s fourth quarter ended December 31, 2017:

|

|

§

|

Revenue of $0.03 million;

|

|

|

§

|

GAAP operating expenses between $11.2 million and $11.5 million;

|

|

|

§

|

Depreciation and amortization expenses of approximately $0.3 million;

|

|

|

§

|

Stock-based compensation expense between $3.2 million and $3.45 million;

and

|

|

|

§

|

Cash and cash equivalents of approximately $12.8 million as of December

31, 2017.

|

Current Outlook

Energous is currently making the transition

from product development to commercial revenue generation from chip sales. During the fourth quarter of 2017, Energous began shipping

chips through Dialog to customers, but in limited quantities that were not recognized as revenue. Energous expects to recognize

modest levels of chip revenue in the first quarter of 2018. Growth in Energous’s chip revenue depends on a variety of factors,

including its success in securing design wins, and the success of its customers in commercializing their end-products and receiving

regulatory approval to sell their end-products to consumers. Energous expects end-products incorporating its Near Field transmitter

technology to be available to consumers in the first half of 2018, while end-products incorporating its Mid Field transmitter technology

will be available to consumers in the second half of 2018. Energous anticipates that shipments of its customers’ end-products

will begin in modest volumes and will grow over time based on consumer demand. Shipments of silicon chips for revenue will follow

the same curve as both the number of WattUp enabled products hit the market and consumer demand expands for the WattUp enable products

in the market. Given these factors, Energous expects that its chip revenue will remain at modest levels through the third quarter

of 2018, with opportunities for growth thereafter. Energous expects to continue generating engineering services revenue during

2018, although the timing and magnitude of this revenue is difficult to predict.

Energous is filing the risk factors attached

hereto as Exhibit 99.1 for the purpose of supplementing and updating its risk factor disclosure. The updated risk factors are filed

as Exhibit 99.1 to this current report on Form 8-K and are incorporated herein by reference.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ENERGOUS CORPORATION

|

|

|

|

|

|

Date: January 11, 2018

|

By:

|

/s/ Brian Sereda

|

|

|

|

Brian Sereda

|

|

|

|

Chief Financial Officer

|

INDEX TO EXHIBITS

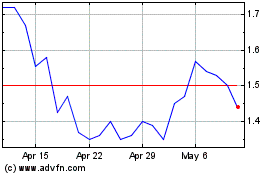

Energous (NASDAQ:WATT)

Historical Stock Chart

From Mar 2024 to Apr 2024

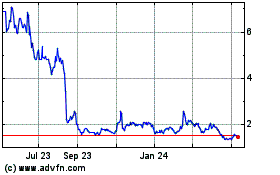

Energous (NASDAQ:WATT)

Historical Stock Chart

From Apr 2023 to Apr 2024