Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

January 11 2018 - 3:09PM

Edgar (US Regulatory)

Filed Pursuant To Rule 433

Registration No. 333-215204

January 11, 2018

Interview

with Jerry Kanellos: RedChip Money Report Transcript

[Jon]

Let’s

go to the interview. We're here with Jerry Kanellos, CEO of Immuron. Jerry, welcome back to the show.

[Jerry]

Thanks

for having me again.

[Jon]

Now

Jerry, Immuron is developing and commercializing oral immunotherapies for the treatment of gut-mediated diseases. Let's start with

an overview of your platform and what makes it unique.

[Jerry]

Yeah

sure. Our technology platform is based, as you said, on oral immunoglobulins derived from engineered, hyper-immune, bovine colostrum.

This technology is like human intravenous immunoglobulins, which derive from human plasma. And a product which generates about

sixteen billion dollars in revenue in the US alone. The major difference between the two technologies is that we have the capability

of producing highly specific immunoglobulins to any pathogenic bacteria, and our products are orally active. The bovine IgG that

we use can withstand the acidic environment of the stomach and is resistant to proteolysis by the digestive enzymes found in the

G.I. tract.

[Jon]

Jerry,

Wall Street analysts cover your stock with a high buy rating. What's the essential value proposition? Why should investors take

interest in Immuron today?

[Jerry]

Well

Immuron is a clinical stage biopharmaceutical company targeting inflammatory, mediated, and infectious diseases with our oral immunoglobulin

therapeutics. We have a validated technology platform with a registered asset which is generating growing revenue, and we have

two lead clinical assets in phase two development for the treatment of fatty liver diseases and clostridium difficile infection.

Fatty liver

disease is forecast to be a forty billion dollar market opportunity for anyone playing in that space in the year 2020, and there's

no therapeutic approved at the moment to tackle that particular disease. Clostridium difficile infection is also one of the hospital

super bugs and that's forecast to be a 1.5 billion dollar business in the year 2020, as well. And they're the two arenas we currently

are playing in.

[Jon]

While

most small biopharma companies are pre-revenue, Immuron complements its larger development work with a revenue-generating product

that treats traveler's diarrhea. Jerry, what can you tell us about this product, its sales, and what's the expected growth?

[Jerry]

Yeah

sure. Travelan is our first product that we've taken to market. It is a listed medicine in Australia and in Canada, and

we're fortunate enough to be able to sell the product into the U.S. as a dietary supplement. The label claim is a

preventative to traveler's diarrhea and we're enjoying about 1.4 million dollars’ worth of revenue last financial year,

and we're seeing twenty percent growth in Australia, and the product is significantly selling in the U.S., particularly

focused on the traveler's medical clinics.

[Jon]

Thank

you. With multiple clinical trials underway, there will be several milestones investors can be looking for. Can you give us an

overview of that timeline?

[Jerry]

Yeah

sure. Currently, we have four phase 2 trials ongoing.

Three of

our trials are focused on fatty liver. The company is sponsoring a program in NASH. We also have a pediatric non-alcoholic fatty

liver disease study, and also a study targeting alcoholic steatohepatitis. And we have just recently initiated a trial on clostridium

difficile infection.

Our NASH

program is headed by Dr. Arun Sanyal from the University of Virginia. The study has recruited a hundred and thirty three NASH biopsy

positive patients. The last patient attended his last scheduled visit in October, and all twenty-five clinical sites are now closed.

The database is locked and is undergoing quality review. And we anticipate reporting our topline results in quarter one, 2018.

We also

have two NIH-funded studies. Dr. Miriam Vos from the Emory University is a lead principal investigator of our pediatric non-alcoholic

fatty liver disease study. The study has recruited ten of the targeted forty patients. And we expect topline results for this study

to reported in quarter four, 2018.

Dr Arun

Sanyal is also the lead principal investigator for our alcoholic steatohepatitis study. And the study has recruited forty out of

the sixty-six targeted patients, and we anticipate seeing results reported in quarter one, 2019 for that program.

We have

also initiated, as I mentioned earlier, a clinical study focusing on clostridium difficile infection. We're currently recruiting

and targeting sixty patients for that particular project, and we hope to see topline results reporting in quarter four, 2018.

[Jon]

Jerry,

thanks for being on the show. We look forward to hearing more from you and Immuron in the near future.

[Jerry]

Thanks

for your time, guys.

[Jon]

Now

to get more information about Immuron Limited, visit RedChip.com.

And finally,

Immuron, stock symbol IMRN on the NASDAQ. Immuron is expected to report results from its phase 2 trial in NASH in the coming weeks.

Multiple Wall Street analysts are covering the stock with buy ratings and price targets as high as fifteen dollars per shares.

Trade in your five dollars right now, this could be a big winner for investors in 2018.

We have filed a registration statement with the

Securities and Exchange Commission, or SEC, for the offering to which this communication relates. Before you invest, you should

read the prospectus dated June 9, 2017 and the prospectus supplement dated November 2, 2017 and the other documents that we have

filed with the SEC for more complete information about us and this offering. You may get these documents for free by visiting

EDGAR on the SEC web site at www.sec.gov.

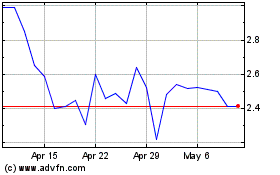

Immuron (NASDAQ:IMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

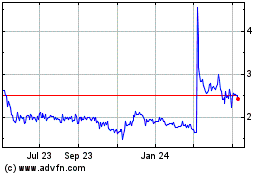

Immuron (NASDAQ:IMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024