Current Report Filing (8-k)

January 10 2018 - 4:56PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 4, 2018

VERU INC.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

|

|

Wisconsin

|

|

1-13602

|

|

39-1144397

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

I.D. Number)

|

|

|

|

|

|

4400 Biscayne Boulevard

Suite 888

Miami,

Florida

|

|

33137

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

305-509-6897

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the

filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

Section 5 – Corporate Governance and Management

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers

On January 4, 2018, Daniel Haines, Chief Financial Officer of Veru Inc. (the “Company”), informed the Company

that he was resigning to pursue other interests. Mr. Haines’ duties as Chief Financial Officer were assigned effective as of January 4, 2018 to Michele Greco.

Michele Greco, age 58, has served as Chief Administrative Officer of the Company since December 2017 and as Executive Vice President

of Finance of the Company since October 2016. Ms. Greco served as Executive Vice President and Chief Financial Officer of the Company from December 2014 to October 2016 and served as Vice President and Chief Financial Officer of

the Company from January 2013 to December 2014. Ms. Greco is a CPA with nearly 30 years of experience in public accounting with Ernst & Young LLP. From January 2011 to February 2012, Ms. Greco provided consulting

services to Systems Research Incorporated as a recruiter of finance professionals. From March 2009 to January 2011, Ms. Greco was involved in a series of personal business ventures. From 1994 to March 2009, Ms. Greco served as an audit

partner with Ernst & Young LLP. Ms. Greco joined Ernst & Young LLP in 1981.

Greco Employment

Agreement

. The Company and Ms. Greco are parties to an Executive Employment Agreement, dated as of October 4, 2017 (the “Greco Employment Agreement”), which superseded Ms. Greco’s previous Employment Agreement

dated as of April 5, 2016, as amended. The Greco Employment Agreement does not have a definite term. Pursuant to the terms of the Greco Agreement, Ms. Greco receives a minimum annual base salary of $223,958, is eligible to receive an

annual bonus equal to 50% of her base salary under the Company’s annual incentive bonus program and is entitled to participate in the Company’s equity incentive plan. Ms. Greco is also entitled to participate in all of the

Company’s employee benefit plans, practices and programs on a basis no less favorable than other similarly situated employees. In the event that Ms. Greco’s employment is terminated by the Company without “cause” or by

Ms. Greco for “good reason” (each as defined in the Greco Employment Agreement), Ms. Greco will be entitled to continuation of her base salary for a period of one year following termination, payment of any unpaid annual bonus for

any completed fiscal year, payment of a pro rated payment of her target bonus for the year in which the termination occurs and continuation of medical and dental insurance coverage until the earliest of (i) one year following termination,

(ii) the date Ms. Greco is no longer eligible to receive COBRA or comparable state law continuation coverage or (iii) the date on which Ms. Greco becomes eligible to receive substantially similar coverage from another employer or

another source. If Ms. Greco’s employment is terminated by the Company without “cause” or by Ms. Greco for “good reason” within six months following a “change in control” (as defined in the Greco

Employment Agreement), then in addition to the benefits described in the preceding sentence Ms. Greco will be entitled to the accelerated vesting of all unvested equity compensation awards. The Greco Employment Agreement contains customary

noncompetition, nonsolicitation and nondisclosure covenants on the part of Ms. Greco.

2

The foregoing description of the Greco Employment Agreement does not purport to be complete and

is qualified by reference to the Greco Employment Agreement, a copy of which is filed as Exhibit 10.1 to this report and is incorporated herein by reference.

Haines Separation Agreement

. The Company and Daniel Haines entered into a Separation Agreement and General Release, dated as of

January 4, 2018 (the “Haines Separation Agreement”). Under the Haines Separation Agreement and subject to the terms and conditions set forth therein, the Company and Mr. Haines have agreed to, among other items, the following:

|

|

•

|

|

Mr. Haines will receive a separation payment equal to six month’s base salary, payable over a six month period.

|

|

|

•

|

|

In lieu of the stock option for 80,888 shares issued to Mr. Haines on December 14, 2017 in payment of Mr. Haines’ bonus for fiscal 2017, the Company will pay Mr. Haines a cash bonus of $80,888

within 15 days after the Company closes on a future financing that nets the Company at least $8 million of gross cash proceeds.

|

|

|

•

|

|

The Company accelerated the vesting of a stock option held by Mr. Haines as to 116,667 shares with an exercise price of $1.20 per share and agreed that such option may be exercised through January 4, 2019.

|

The foregoing description of the Haines Separation Agreement is qualified in its entirety by reference to the full text of

the Haines Separation Agreement, which is filed as Exhibit 10.2 to this Current Report on Form

8-K

and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following

exhibits are filed herewith:

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

VERU INC.

|

|

Date: January 10, 2018

|

|

|

|

|

|

|

|

|

|

BY

|

|

/s/ Kevin J. Gilbert

|

|

|

|

|

|

|

|

Kevin J. Gilbert, Senior Vice President -

Corporate Development and Legal

|

4

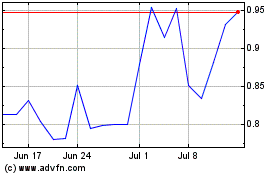

Veru (NASDAQ:VERU)

Historical Stock Chart

From Mar 2024 to Apr 2024

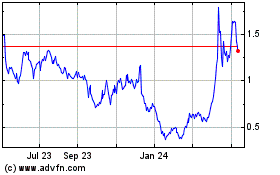

Veru (NASDAQ:VERU)

Historical Stock Chart

From Apr 2023 to Apr 2024