Current Report Filing (8-k)

January 09 2018 - 5:27PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 15, 2017

PHI

GROUP, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

002-78335-NY

|

|

90-0114535

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

No.)

|

|

5348

Vegas

Drive # 237 Las

Vegas,

NV

|

|

89108

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: 702-475-5430

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Precommencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Precommencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

Item

1.01. Entry Into a Material Definitive Agreement.

On

December 15, 2017, PHI Group, Inc. (the “Company”), entered into an Investment Agreement with Gridline Communications,

Inc. (“Gridline”) to form a special purpose vehicle (“SPV”) under the name of Matrix Communications, Inc.,

as the holding company to acquire all the stock of Gridline Communications and its sister company GridlineX as well as finance

and implement Gridline’s high-speed broadband communications business.

According

to the Investment Agreement, the Matrix Communications will acquire all ownership and rights of the Investee in connection with

high-speed broadband networks and related supporting assets to serve government, commercial and consumer telephony, data and video

needs in the Republic of Equatorial Guinea as the first point of entry into the African Continent. Matrix Communications’

authorized capital will include 600 million shares of Common Stock and 300 million shares of Preferred Stock. PHI Group will be

the sole holder of Common Stock in the SPV initially and will retain fifteen percent equity interest thereof following the capitalization

plan.

The

Investment Agreement is scheduled to close on or before January 15, 2018, unless extended by mutual consent of both parties to

the Agreement.

The

foregoing description of the Investment Agreement between PHI Group, Inc. and Gridline Communications dated December 15, 2017

is qualified in its entirety by reference to the full text of said Agreement, which is filed as Exhibit 10.1 to this Current Report

on Form 8-K and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Dated:

January 9, 2018

|

|

PHI

GROUP, INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/

Henry D. Fahman

|

|

|

|

Henry

D. Fahman

|

|

|

|

Chairman

and CEO

|

|

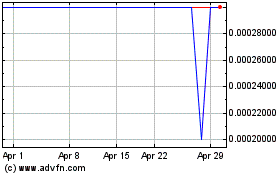

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

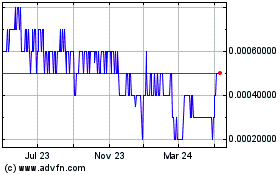

PHI (PK) (USOTC:PHIL)

Historical Stock Chart

From Apr 2023 to Apr 2024