Arch Capital Group Ltd. Announces Updated Catastrophe Loss Estimates and Other Information Related to Operations

January 09 2018 - 4:46PM

Business Wire

- Estimated $60 to $75 million related to

2017 fourth quarter catastrophic events, primarily related to the

California wildfires

- Estimated $15 to $20 million charge on

the Company’s net deferred tax assets related to the impact of

lower U.S. corporate tax rates beginning in 2018

- Estimated 17% to 20% effective tax rate

on pre-tax operating income for the 2017 fourth quarter excluding

the charge on the Company’s net deferred tax asset as noted

above

During the fourth quarter of 2017, a series of wildfires burned

across many areas of California and a series of smaller catastrophe

events occurred around the globe. Arch Capital Group Ltd. [NASDAQ:

ACGL] has established a range of pre-tax losses of $60 million to

$75 million, net of reinsurance recoveries and reinstatement

premiums, for these 2017 fourth quarter catastrophic events. For

clarity, this estimated range incorporates and updates the $30

million to $55 million range previously disclosed by the Company in

its Quarterly Report on Form 10-Q for the 2017 third quarter. The

previous range reflected the first series of California wildfires

only (also referred to as the Tubbs fire), whereas this current

range reflects the Tubbs Fire, the second series of California

wildfires (also referred to as the Thomas Fire) and other

catastrophic events from around the globe. At this time, there are

significant uncertainties surrounding the number of claims and

scope of damage for both the Tubbs and Thomas Fires, as well as the

other global events. The Company’s estimate for these events is

based on currently available information derived from modeling

techniques, industry assessment of exposure, preliminary claims

information obtained from the Company’s clients and brokers to date

and a review of in-force contracts. Actual losses from these events

may vary materially from the estimates due to the inherent

uncertainties in making such determinations.

The Company entered into intercompany loss portfolio transfers

(LPTs) effective on December 31, 2017 that transferred

approximately $1.35 billion of net retained reserves for losses and

allocated loss adjustment expenses between its subsidiaries. Given

that these transactions involve two related parties, and in

accordance with GAAP, they eliminate in consolidation. These

transactions support the Company’s ongoing capital management

strategies.

As a result of the reduction in the U.S. corporate tax rate from

35% to 21% effective January 1, 2018 pursuant to the Tax Cuts and

Job Act of 2017, the Company anticipates that it will write down a

portion of its deferred tax asset by approximately $15 million to

$20 million in the 2017 fourth quarter. Such charge will be

excluded from after-tax operating income available to Arch common

shareholders, a non-GAAP financial measure, as it is not reflective

of operations.

Additionally, the Company estimates that the effective tax rate

on pre-tax operating income for the fourth quarter of 2017 will be

in a range of 17% to 20%. This estimate is based on both statutory

income tax rates applied to underwriting income, expenses and

investment returns by jurisdiction, as well as an amalgam of

discrete items that includes, but is not limited to, the impact of

vested or exercised equity compensation, changes in judgment with

respect to valuation allowances and changes related to the LPTs

referenced above. The effective tax rate for the 2017 fourth

quarter reflects an increased proportion of U.S. based operating

income. The losses related to the 2017 fourth quarter catastrophic

occurrences emanated mostly from our non-U.S. underwriting

operations. Although additional information will be provided during

the Company’s earnings call scheduled for February 13, 2018, this

tax rate range is subject to change as analyses of group-wide loss

reserves and investment returns, among other areas, are

finalized.

Arch Capital Group Ltd., a Bermuda-based company with

approximately $11.04 billion in capital at September 30, 2017,

provides insurance, reinsurance and mortgage insurance on a

worldwide basis through its wholly owned subsidiaries.

Cautionary Note Regarding Forward-Looking Statements

The Private Securities Litigation Reform Act of 1995 provides a

"safe harbor" for forward−looking statements. This release or any

other written or oral statements made by or on behalf of Arch

Capital Group Ltd. and its subsidiaries may include forward−looking

statements, which reflect our current views with respect to future

events and financial performance. All statements other than

statements of historical fact included in or incorporated by

reference in this release are forward−looking statements.

Forward−looking statements can generally be identified by the

use of forward−looking terminology such as "may," "will," "expect,"

"intend," "estimate," "anticipate," "believe" or "continue" or

their negative or variations or similar terminology.

Forward−looking statements involve our current assessment of risks

and uncertainties. Actual events and results may differ materially

from those expressed or implied in these statements. A

non-exclusive list of the important factors that could cause actual

results to differ materially from those in such forward-looking

statements includes the following: adverse general economic and

market conditions; increased competition; pricing and policy term

trends; fluctuations in the actions of rating agencies and our

ability to maintain and improve our ratings; investment

performance; the loss of key personnel; the adequacy of our loss

reserves, severity and/or frequency of losses, greater than

expected loss ratios and adverse development on claim and/or claim

expense liabilities; greater frequency or severity of unpredictable

natural and man-made catastrophic events; the impact of acts

of terrorism and acts of war; changes in regulations and/or tax

laws in the United States or elsewhere; our ability to successfully

integrate, establish and maintain operating procedures as well as

integrate the businesses we have acquired or may acquire into the

existing operations; changes in accounting principles or policies;

material differences between actual and expected assessments for

guaranty funds and mandatory pooling arrangements; availability and

cost to us of reinsurance to manage our gross and net exposures;

the failure of others to meet their obligations to us; and other

factors identified in our filings with the U.S. Securities and

Exchange Commission.

The foregoing review of important factors should not be

construed as exhaustive and should be read in conjunction with

other cautionary statements that are included herein or elsewhere.

All subsequent written and oral forward−looking statements

attributable to us or persons acting on our behalf are expressly

qualified in their entirety by these cautionary statements. We

undertake no obligation to publicly update or revise any

forward−looking statement, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180109006761/en/

Arch Capital Group Ltd.Mark D. Lyons, 441-278-9250

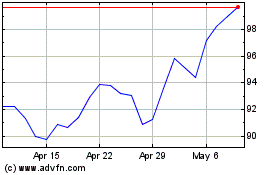

Arch Capital (NASDAQ:ACGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arch Capital (NASDAQ:ACGL)

Historical Stock Chart

From Apr 2023 to Apr 2024