Current Report Filing (8-k)

January 09 2018 - 4:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 5, 2018

Tandem Diabetes Care, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36189

|

|

20-4327508

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

11075 Roselle Street, San Diego, CA

|

|

92121

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Registrant’s telephone number, including area code: (858) 366-6900

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

⌧

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

⌧

Item 2.02

Results of Operations and Financial Condition

.

On January 9, 2018, the Company issued a press release announcing its

unaudited, preliminary financial results for the quarter and full year ended

December

31, 2017, as well as its preliminary financial guidance for the full year ended December 31, 2018.

A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K

.

The 2017

unaudited

financial results contained in the press release are preliminary and subject to adjustment. The final, audited financial results will be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 to be filed with the Securities and Exchange Commission.

The information provided under this Item 2.02, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for the

purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

2018 Compensation Arrangement with President and Chief Executive Officer

On January 5, 2018, the Board of Directors (the “

Board

”) of Tandem Diabetes Care, Inc. (the “

Company

”) approved a reduction in the base salary for Kim Blickenstaff, the Company’s President and Chief Executive Officer, from his

base

salary of $583,495 for 2017 (the “

Prior Base Salary

”), to $1.00 for 2018. The reduction was approved by the Board at Mr. Blickenstaff’s request. Mr. Blickenstaff also declined consideration of a 2017 discretionary cash bonus payment.

In connection with the reduction in base salary, the Board approved the adoption of a cash bonus arrangement that will be utilized to calculate the cash bonus, if any, that may become payable to Mr. Blickenstaff with respect to fiscal year 2018 (the “

2018 Cash Bonus

”

). The 2018 Cash Bonus is designed to align the interests of Mr. Blickenstaff with the Company’s business goals and strategies, and to further the objectives of the Company’s executive compensation program.

The target 2018 Cash Bonus amount for Mr. Blickenstaff will be set at $583,495, reflecting an amount equal to 100% of the Prior Base Salary.

The 2018 Cash Bonus may be earned based on the achievement of all of the following Company financial performance objectives, which were also approved by the Board:

|

|

•

|

the Company’s actual revenue for fiscal year 2018 must be at least equal to a pre-established 2018 revenue target.

|

|

|

•

|

the Company’s actual operating margin for fiscal year 2018 must be at least equal to a pre-established 2018 operating margin target.

|

|

|

•

|

the Company’s Earnings before Interest, Taxes, Depreciation and Amortization (excluding stock-based compensation and any accrual towards a 2018 Cash Bonus payment to Mr. Blickenstaff ) must be positive for the fourth fiscal quarter of 2018.

|

If the Company does not achieve all

of the financial performance objectives, as determined by the Board, no 2018 Cash Bonus will be paid. If the Company achieves all of the financial performance objectives, the 2018 Cash Bonus will be paid to Mr. Blickenstaff in full by no later than March 15, 2019. Mr. Blickenstaff will not be eligible for any additional cash incentive compensation for his service during 2018.

In the event the Company terminates Mr. Blickenstaff’s employment at any time during 2018, Mr. Blickenstaff will be entitled to receive payment of the pro-rata portion of the Prior Base Salary based on the number of days elapsed in 2018 through the date of termination. In the event of a change in control of the Company, the determination of Mr. Blickenstaff’s “Base Compensation” under the terms of his Amended and Restated Severance Agreement dated November 4, 2013 shall be equal to the sum of the Prior Base Salary and the target amount of his cash bonus for fiscal year 2017.

Item 9.01

Financial Statements and

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Tandem Diabetes Care, Inc.

|

|

|

|

|

By:

|

|

/s/

David B. Berger

|

|

|

|

David B. Berger

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

Date:

January 9

, 2018

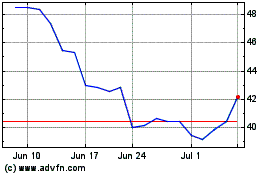

Tandem Diabetes Care (NASDAQ:TNDM)

Historical Stock Chart

From Mar 2024 to Apr 2024

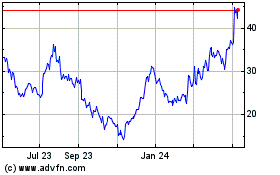

Tandem Diabetes Care (NASDAQ:TNDM)

Historical Stock Chart

From Apr 2023 to Apr 2024