Current Report Filing (8-k)

January 09 2018 - 8:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

January 5, 2018

LIPOCINE INC.

(Exact name of registrant as specified in

its charter)

Commission File No. 001-36357

|

Delaware

|

|

99-0370688

|

(State or other jurisdiction

of incorporation)

|

|

(IRS Employer

Identification Number)

|

675 Arapeen Drive, Suite 202

Salt Lake City, Utah 84108

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including

area code:

(801) 994-7383

Former name or former address, if changed

since last report:

Not Applicable

______________________

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR § 240.12b-2).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On January 5, 2018, Lipocine Inc. (the “Company”),

the Company’s wholly owned subsidiary, Lipocine Operating Inc. (the “Subsidiary”), and Silicon Valley Bank (“SVB”)

entered into a Loan and Security Agreement (the “Loan and Security Agreement”) pursuant to which SVB has agreed to

lend the Company $10.0 million.

The principal borrowed under the Loan and Security Agreement

bears a fixed interest rate equal to the Prime Rate plus one percent per annum, which interest is payable monthly. The loan matures

on December 1, 2021. The Company is only required to make monthly interest payments until December 31, 2018, following which the

Company will be required to also make equal monthly payments of principal for the remainder of the term; provided, however, that

if on or prior to May 31, 2018, the Company receives evidence reasonably satisfactory to SVB that the Company has received FDA

approval for TLANDO

TM

, the interest-only payment period will be extended to June 30, 2019. The Company will also be

required to pay an additional final payment at maturity equal to $650,000 (the “Final Payment Charge”). At its option,

the Company may prepay all amounts owed under the Loan and Security Agreement (including all accrued and unpaid interest and the

Final Payment Charge), subject to a prepayment charge if the loan has been outstanding for less than two years, which prepayment

charge is determined based on the date the loan is prepaid.

In connection with the Loan and Security Agreement, the Company

and the Subsidiary granted to SVB a security interest in substantially all of the Company’s and the Subsidiary’s assets

now owned or hereafter acquired, excluding intellectual property and certain other assets. In addition, if TLANDO is not approved

by the FDA on or prior to May 31, 2018, the Company will be required to maintain $5.0 million of cash collateral at SVB until such

time as TLANDO is approved by the FDA. The Loan and Security Agreement also provides for standard indemnification of SVB and contains

representations, warranties and certain covenants of the Company and the Subsidiary. While any amounts are outstanding under the

Loan and Security Agreement, the Company is subject to a number of affirmative and negative covenants, including covenants regarding

dispositions of property, business combinations or acquisitions, incurrence of additional indebtedness and transactions with affiliates,

among other customary covenants. The Company is also restricted from paying dividends or making other distributions or payments

on its capital stock, subject to limited exceptions. Upon the occurrence of an event of default by the Company under the Loan and

Security Agreement, SVB will have customary acceleration, collection and foreclosure remedies.

The foregoing summary is qualified in its entirety by reference

to the Loan and Security Agreement, which is included as Exhibit 10.1 to this report and incorporated by reference herein.

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

|

The information provided in Item 1.01 of this Current Report

on Form 8-K is incorporated by reference into this Item 2.03.

|

|

Item 9.01

|

Financial Statements and Exhibits.

|

See Exhibit Index attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

LIPOCINE INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

January 9, 2018

|

|

By:

|

/s/ Mahesh V. Patel

|

|

|

|

|

|

|

Mahesh V. Patel

|

|

|

|

|

|

|

President and Chief Executive Officer

|

EXHIBIT INDEX

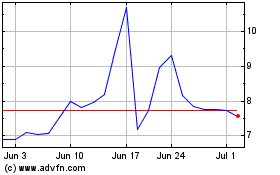

Lipocine (NASDAQ:LPCN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lipocine (NASDAQ:LPCN)

Historical Stock Chart

From Apr 2023 to Apr 2024