Lexington Realty Trust (“Lexington”) (NYSE:LXP), a real estate

investment trust (REIT) focused on single-tenant real estate

investments, announced the following update on its fourth quarter

2017 transaction activity.

Highlights

- Acquired four industrial properties for an aggregate cost of

$140 million.

- Disposed of eight properties for an aggregate of $48

million.

- Formed a joint venture which acquired a 151-acre parcel of land

to pursue industrial build-to-suit opportunities.

- Collected $49 million in full satisfaction of a loan to a joint

venture.

- Financed an office property generating initial gross proceeds

of $45 million.

- Repaid $40 million on the revolving credit facility and retired

$9 million of secured debt.

- Completed one million square feet of new leases and lease

extensions with portfolio 98.9% leased at quarter end.

- Increased the quarterly common share/unit dividend/distribution

to $0.1775 per common share/unit.

Transaction Activity

|

ACQUISITIONS |

|

Primary Tenant |

|

Location |

|

Sq. Ft. (Approx.) |

|

Property Type |

|

Estimated Initial

Basis($000) |

|

ApproximateLease

Term(Yrs) |

| Caterpillar Inc. |

|

Lafayette, IN |

|

309,000 |

|

|

Industrial |

|

$ |

17,450 |

|

|

7 |

| FCA US LLC |

|

Romulus, MI |

|

500,000 |

|

|

Industrial |

|

38,893 |

|

|

15 |

| Lipari Foods Operating

Company, LLC |

|

Warren, MI |

|

260,000 |

|

|

Industrial |

|

46,955 |

|

|

15 |

| FCA US LLC |

|

Winchester, VA |

|

400,000 |

|

|

Industrial |

|

36,700 |

|

|

14 |

| |

|

|

|

1,469,000 |

|

|

|

|

$ |

139,998 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Including fourth quarter acquisition activity,

consolidated 2017 acquisition activity totaled $727.6 million at

average GAAP and cash capitalization rates of 7.3% and 6.4%,

respectively.

Additionally, in December 2017, Lexington formed

a joint venture with a developer to pursue industrial build-to-suit

opportunities. The joint venture acquired a parcel of land totaling

151 acres in a submarket of Columbus, Ohio. Lexington's initial

contribution to the joint venture was $5.8 million.

|

|

|

|

|

PROPERTY DISPOSITIONS |

|

Primary Tenant |

|

Location |

|

Property Type |

|

Gross Disposition

Price($000) |

|

Annualized Net Income

(Loss)(1)($000) |

|

Annualized NOI(1) ($000) |

|

Month of Disposition |

|

%Leased |

| National-Louis

University(2) |

|

Lisle,

IL |

|

Office |

|

$ |

9,120 |

|

|

$ |

222 |

|

|

$ |

1,813 |

|

|

October |

|

100 |

% |

| Vacant |

|

High

Point, NC |

|

Multi-Tenant - Industrial |

|

10,000 |

|

|

508 |

|

|

1,134 |

|

|

October |

|

0 |

% |

| Vacant |

|

Fisher, IN |

|

Multi-Tenant -Office |

|

9,000 |

|

|

(371 |

) |

|

(371 |

) |

|

October |

|

0 |

% |

| Vacant(3) |

|

Pine

Bluff, AR |

|

Office |

|

43 |

|

|

311 |

|

|

386 |

|

|

October |

|

0 |

% |

| Food Lion, LLC/Delhaize

America, Inc. |

|

Staunton, VA |

|

Other |

|

1,688 |

|

|

158 |

|

|

166 |

|

|

November |

|

100 |

% |

| Entergy Arkansas,

Inc. |

|

Little

Rock, AR |

|

Office |

|

3,100 |

|

|

182 |

|

|

237 |

|

|

December |

|

100 |

% |

| Time Customer Service,

Inc. |

|

Tampa,

FL |

|

Office |

|

13,700 |

|

|

722 |

|

|

1,128 |

|

|

December |

|

100 |

% |

| Toys "R" Us, Inc./Toys

"R" Us-Delaware, Inc.(4) |

|

Tulsa,

OK |

|

Other |

|

1,233 |

|

|

3 |

|

|

106 |

|

|

December |

|

100 |

% |

| |

|

|

|

|

|

$ |

47,884 |

|

|

$ |

1,735 |

|

|

$ |

4,599 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Quarterly period prior to sale, excluding impairment charges,

annualized.

- Conveyed to lender in a foreclosure sale.

- Property was sold subject to a lease which expired October 31,

2017.

- Tenant has declared bankruptcy.

Including fourth quarter disposition activity,

consolidated 2017 property disposition volume totaled $241.7

million at average GAAP and cash capitalization rates of 7.5% and

7.7%, respectively.

LOAN INVESTMENTS

Lexington collected $49.1 million in full

satisfaction of a loan made to a joint venture that owns a property

in Katy, Texas. The joint venture satisfied the loan with proceeds

from a new third-party mortgage financing in the original principal

amount of $50 million, which bears interest at an annual rate of

5.13% and matures in December 2022.

Leasing Activity

During the fourth quarter of 2017, Lexington

executed the following new and extended leases:

| |

|

LEASE EXTENSIONS |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Location |

|

Primary

Tenant(1) |

|

Prior Term |

|

LeaseExpiration Date |

|

Sq. Ft. |

| |

|

Office/Multi-Tenant |

|

|

|

|

|

|

|

|

| 1 |

|

Statesville |

NC |

|

Geodis Logistics

LLC |

|

12/2017 |

|

12/2020 |

|

639,800 |

|

|

2 |

|

Honolulu |

HI |

|

N/A |

|

2017 |

|

2018 |

|

1,900 |

|

|

2 |

|

Total office lease extensions |

|

|

|

|

|

|

641,700 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Industrial |

|

|

|

|

|

|

|

|

|

1 |

|

Franklin |

TN |

|

Essex Group, Inc. |

|

12/2018 |

|

12/2023 |

|

289,330 |

|

|

1 |

|

Total industrial lease extensions |

|

|

|

|

|

|

|

289,330 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

Total lease extensions |

|

|

|

|

|

|

|

931,030 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

NEW

LEASES |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Location |

|

|

|

|

|

Lease Expiration Date |

|

Sq. Ft. |

| |

|

Office/Multi-Tenant |

|

|

|

|

|

|

|

|

| 1 |

|

Farmers Branch |

TX |

|

Home Point Financial

Corporation |

|

|

|

11/2025 |

|

64,788 |

|

|

2 |

|

Farmers

Branch |

TX |

|

BBVA Dallas Creation

Center, Inc. |

|

|

|

07/2028 |

|

33,028 |

|

|

2 |

|

Total new office leases |

|

|

|

|

|

|

|

97,816 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

Total new leases |

|

|

|

|

|

|

|

97,816 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

5 |

|

TOTAL NEW AND EXTENDED LEASES |

|

|

|

|

|

|

|

1,028,846 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

- Leases greater than 10,000 square feet.

As of December 31, 2017, Lexington's portfolio

was 98.9% leased.

Dividends/Distributions

As previously announced, during the fourth

quarter of 2017, Lexington increased its quarterly common share/

unit dividend/distribution to $0.1775 per common share/unit, which

equates to an annualized dividend of $0.71 per common share/unit.

The declared quarterly dividend/distribution will be payable on

January 16, 2018 to common shareholders/unitholders of record as of

December 29, 2017. In addition, Lexington declared a dividend of

$0.8125 per share on its Series C Preferred, which is expected to

be paid February 15, 2018 to Series C Preferred Shareholders of

record as of January 31, 2018.

Balance Sheet/Capital

Markets

In the fourth quarter, Lexington obtained an

aggregate $45.4 million in nonrecourse financing on an office

property in Charlotte, North Carolina, consisting of a first

mortgage loan and a mezzanine loan. The first mortgage in the

original principal amount of $37.4 million has a 15-year term,

bears interest at a fixed rate of 5.3% and is interest-only for the

first 10 years. The mezzanine financing in an initial principal

amount of $8.0 million has a five-year term, is interest only at a

fixed rate of 5.0% and may be increased to $12 million upon certain

events.

Also, during the fourth quarter, Lexington

repaid $40.0 million on its revolving credit facility and retired

the $9.3 million mortgage encumbering its Orlando, Florida

property.

ABOUT LEXINGTON REALTY TRUST

Lexington Realty Trust (NYSE:LXP) is a publicly

traded real estate investment trust (REIT) that owns a diversified

portfolio of real estate assets consisting primarily of equity

investments in single-tenant net-leased commercial properties

across the United States. Lexington seeks to expand its portfolio

through build-to-suit transactions, sale-leaseback transactions and

other transactions, including acquisitions. For more information or

to follow Lexington on social media, visit www.lxp.com.

Contact:Investor or Media Inquiries, Heather GentryLexington

Realty TrustPhone: (212) 692-7200 E-mail: HGentry@lxp.com

This release contains certain forward-looking

statements which involve known and unknown risks, uncertainties or

other factors not under Lexington's control which may cause actual

results, performance or achievements of Lexington to be materially

different from the results, performance, or other expectations

implied by these forward-looking statements. Factors that could

cause or contribute to such differences include, but are not

limited to, those discussed under the headings “Management's

Discussion and Analysis of Financial Condition and Results of

Operations” and “Risk Factors” in Lexington's periodic reports

filed with the Securities and Exchange Commission, including risks

related to: (1) the successful consummation of any lease,

acquisition, build-to-suit, financing or other transaction, (2) the

failure to continue to qualify as a real estate investment trust,

(3) changes in general business and economic conditions, including

the impact of any legislation, (4) competition, (5) increases in

real estate construction costs, (6) changes in interest rates, (7)

changes in accessibility of debt and equity capital markets, and

(8) future impairment charges. Copies of the periodic reports

Lexington files with the Securities and Exchange Commission are

available on Lexington's web site at www.lxp.com. Forward-looking

statements, which are based on certain assumptions and describe

Lexington's future plans, strategies and expectations, are

generally identifiable by use of the words “believes,” “expects,”

“intends,” “anticipates,” “estimates,” “projects”, “may,” “plans,”

“predicts,” “will,” “will likely result,” “is optimistic,” “goal,”

“objective” or similar expressions and include initial projected

leveraged returns. Except as required by law, Lexington undertakes

no obligation to publicly release the results of any revisions to

those forward-looking statements which may be made to reflect

events or circumstances after the occurrence of unanticipated

events. Accordingly, there is no assurance that Lexington's

expectations will be realized.

References to Lexington refer to Lexington

Realty Trust and its consolidated subsidiaries. All interests in

properties and loans are held through special purpose entities,

which are separate and distinct legal entities, some of which are

consolidated for financial statement purposes and/or disregarded

for income tax purposes. The assets and credit of each special

purpose entity with a property subject to a mortgage loan (a

“property owner subsidiary”) are not available to creditors to

satisfy the debt and other obligations of any other person,

including any other special purpose entity or affiliate.

Consolidated entities that are not property owner subsidiaries do

not directly own any of the assets of a property owner subsidiary

(or the general partner, member of managing member of such property

owner subsidiary, but merely hold partnership, membership or

beneficial interests therein which interests are subordinate to the

claims of the property owner subsidiary's general partner's,

member's or managing member's creditors).

Non-GAAP Financial Measures -

Definitions

Lexington has used non-GAAP financial measures

as defined by the Securities and Exchange Commission Regulation G

in this release and in other public disclosures.

Lexington believes that the measures defined

below are helpful to investors in measuring our performance or that

of an individual investment. Since these measures exclude certain

items which are included in their respective most comparable

measures under generally accepted accounting principles (“GAAP”),

reliance on the measures has limitations; management compensates

for these limitations by using the measures simply as supplemental

measures that are weighed in balance with other GAAP measures.

These measures are not necessarily indications of our cash flow

available to fund cash needs. Additionally, they should not be used

as an alternative to the respective most comparable GAAP measures

when evaluating Lexington's financial performance or cash flow from

operating, investing or financing activities or liquidity.

Cash Rent: Cash Rent is calculated by making

adjustments to GAAP rent to remove the impact of GAAP required

adjustments to rental income such as adjustments for straight-line

rents relating to free rent periods and contractual rent increases.

Cash Rent excludes lease termination income. Lexington believes

Cash Rent provides a meaningful indication of an investment's

ability to fund cash needs.

GAAP and Cash Yield or Capitalization Rate: GAAP

and cash yields or capitalization rates are measures of operating

performance used to evaluate the individual performance of an

investment. These measures are estimates and are not presented or

intended to be viewed as a liquidity or performance measure that

present a numerical measure of Lexington's historical or future

financial performance, financial position or cash flows. The yield

or capitalization rate is calculated by dividing the annualized NOI

(as defined below, except GAAP rent adjustments are added back to

rental income to calculate GAAP yield or capitalization rate) the

investment is expected to generate (or has generated) divided by

the acquisition/completion cost (or sale) price.

Net Operating Income (“NOI”): NOI is a measure

of operating performance used to evaluate the individual

performance of an investment. This measure is not presented or

intended to be viewed as a liquidity or performance measure that

presents a numerical measure of Lexington's historical or future

financial performance, financial position or cash flows. Lexington

defines NOI as operating revenues (rental income (less GAAP rent

adjustments and lease termination income), tenant reimbursements

and other property income) less property operating expenses. Other

REITs may use different methodologies for calculating NOI, and

accordingly, Lexington's NOI may not be comparable to other

companies. Because NOI excludes general and administrative

expenses, interest expense, depreciation and amortization,

acquisition-related expenses, other nonproperty income and losses,

and gains and losses from property dispositions, it provides a

performance measure that, when compared year over year, reflects

the revenues and expenses directly associated with owning and

operating commercial real estate and the impact to operations from

trends in occupancy rates, rental rates, and operating costs,

providing a perspective on operations not immediately apparent from

net income. Lexington believes that net income is the most directly

comparable GAAP measure to NOI.

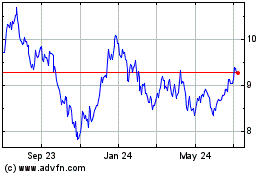

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

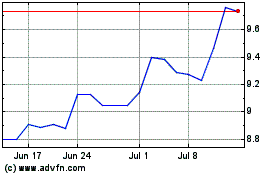

LXP Industrial (NYSE:LXP)

Historical Stock Chart

From Apr 2023 to Apr 2024