Current Report Filing (8-k)

January 08 2018 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

January 3, 2018

Date of Report (Date of earliest event reported)

US FOODS HOLDING CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37786

|

|

26-0347906

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification Number)

|

9399 W. Higgins Road, Suite 500

Rosemont, IL 60018

(Address of principal executive offices)

(847) 720-8000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

|

It

em

5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On January 3, 2018, US Foods, Inc. (the “

Company

), a wholly-owned subsidiary of US Foods Holding Corp., amended the Executive Severance Agreements (as amended and restated, the “

Revised Agreements

”) with each of its executive officers (each, an “

Executive

” and together, the “

Executives

”).

Each of the Revised Agreements is effective as of January 3, 2018, and replaces the previous severance agreement between the Company and the respective Executive (the “

Previous Agreements

”). The Revised Agreements eliminate the excise tax gross-up provisions contained in the Previous Agreements and provide for enhanced severance benefits in the event of a qualifying termination of the Executive’s employment following a change in control of the Company. Under the Previous Agreements, the level of severance benefits was the same notwithstanding the qualifying termination taking place in connection with, or in the absence of, a change in control.

Under the Revised Agreements, if the Executive terminates his or her employment for “good reason” or the Executive’s employment is terminated without “cause” within eighteen months following a change in control of the Company, then the Executive shall be entitled to, among other things, (i) salary continuation for 24 months (30 months in the case of the Chief Executive Officer), and (ii) a severance payment equal to 2.0 times (2.5 times in the case of the Chief Executive Officer) the Executive’s then-current target annual bonus. In addition, in the event that the severance payments and other benefits payable to the Executive constitute a “parachute payment” under Section 280G of the Internal Revenue Code of 1986, as amended (the “

Code

”), and would be subject to the applicable excise tax under Section 4999 of the Code, the Executive will be entitled to elect to either: (i) receive the full amount of such payments (in which case the Executive would be responsible for paying the excise tax) or (ii) have the amount of the payments reduced to a level at which the excise tax would no longer apply.

The Revised Agreements are, in all other material respects, substantially the same as the Previous Agreements.

The foregoing description of the Revised Agreements does not purport to be complete and is qualified in its entirety by reference to the form of the Revised Agreement, which is attached as Exhibit 10.1 to this Current Report on Form 8-K

and incorporated herein by reference.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

DATED: January 8, 2018

|

|

|

|

US Foods Holding Corp.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Kristin M. Coleman

|

|

|

|

|

|

|

|

|

|

Executive Vice President, General Counsel and Chief Compliance Officer

|

|

|

|

|

|

|

|

|

|

|

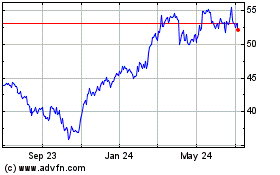

US Foods (NYSE:USFD)

Historical Stock Chart

From Mar 2024 to Apr 2024

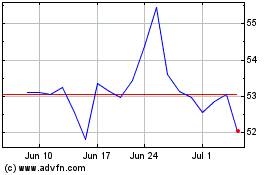

US Foods (NYSE:USFD)

Historical Stock Chart

From Apr 2023 to Apr 2024