Current Report Filing (8-k)

January 08 2018 - 7:40AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 8, 2018

Commission file number:

001-35653

Sunoco LP

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

30-0740483

|

|

(State or other jurisdiction of

Incorporation or organization)

|

|

(IRS Employer

Identification No.)

|

8020 Park Lane, Suite 200

Dallas, TX 75231

(Address

of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (832)

234-3600

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of

the Securities Exchange Act of 1934

(§240.12b-2

of this

chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01

|

Regulation FD Disclosure.

|

On January 8, 2018, Sunoco LP (the

“Partnership”) issued a press release announcing that it and its wholly owned subsidiary, Sunoco Finance Corp., commenced a private offering to eligible purchasers (the “Notes Offering”) of senior notes due 2023, senior notes due

2026 and senior notes due 2028 (collectively, the “Notes”) in an aggregate principal amount of $1.75 billion. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form

8-K

and is incorporated in this Item 7.01 by reference. This announcement does not constitute an offer to sell, or the solicitation of an offer to buy, the Notes.

Certain information regarding the Partnership and the Notes Offering is set forth in Exhibit 99.2 hereto and incorporated herein by reference.

The information included herein shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

In May 2014, the Financial Accounting Standards Board (“FASB”)

issued Accounting Standards Update (“ASU”) No. 2014-09, “Revenue from Contracts with Customers (Topic 606)” (“ASU 2014-09”), which clarifies the principles for recognizing revenue based on the core principle that an

entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. As a result of the

evaluation performed to date, we have preliminarily determined that the timing and/or amount of revenue that we recognize on certain contracts will be impacted by the adoption of the new standard. Our preliminary evaluation indicates that the

application of the standard would have resulted in a decrease in Adjusted EBITDA of approximately $30 million to continuing operations for fiscal year 2016, primarily due to the change in recognition of dealer incentives and rebates. Our evaluation

of the impact of ASU 2014-09 on our results of operations is subject to further change, and undue reliance should not be placed on such preliminary evaluation.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

SUNOCO LP

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

SUNOCO GP LLC,

its General

Partner

|

|

|

|

|

|

|

Date: January 8, 2018

|

|

|

|

By:

|

|

/s/ Thomas R. Miller

|

|

|

|

|

|

Name:

|

|

Thomas R. Miller

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

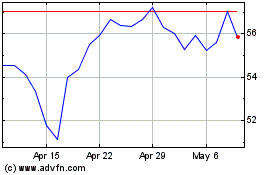

Sunoco (NYSE:SUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

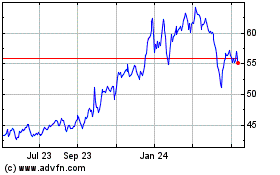

Sunoco (NYSE:SUN)

Historical Stock Chart

From Apr 2023 to Apr 2024