Current Report Filing (8-k)

January 08 2018 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 1, 2018

|

EVIO, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Colorado

|

|

000-12350

|

|

47-1890509

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

62930 O.B. Riley Rd #300

Bend, OR

|

|

97703

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(408) 702-2167

No change

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On December 31, 2017, EVIO, Inc. (the “Company”) entered into a Membership Purchase Agreement (the “Purchase Agreement”) with C3 Labs LLC., a Nevada limited liability company (“C3 Labs”); and the Current Members of C3 Labs (“C3 Member”); for the acquisition of 60% of the ownership interest of C3 Labs. (the “Acquisition”). The Acquisition was closed on January 1, 2018, for total consideration of $600,000. Upon consummation of the Acquisition, the Company became the majority member of C3 Labs.

The Company has been granted two options to purchase additional interest of C3 Labs subject to the following terms and conditions.

(a) 30% Option. Effective as of Closing and terminating the date three (3) years from the Closing Date, the C3 Members hereby collectively grant EVIO the right to ratably purchase from the C3 Members an aggregate of 30% of the Interests in C3 LABS following the issuance of 60% of the Interests to EVIO. EVIO may exercise its option by providing C3 LABS and the C3 Members written notice of its intent to exercise the option. The C3 Members shall have three (3) days following the date of such notice to execute assignments of Interests totaling 30% of the then outstanding membership interests in C3 LABS in favor of EVIO California. If EVIO should elect to exercise its option within nine (9) months from the Closing Date, the exercise price for the 30% of Interests shall be $450,000.00, to be paid in cash or EVIO’s common stock, as agreed by the C3 Members. If EVIO does not exercise the option within nine (9) months from the Closing Date, the exercise price shall be set by mutual agreement between the parties or, if no such agreement can be reached, as determined by an independent third-party valuation by an appraiser agreed to by the parties.

(b) 10% Option. Effective as of three (3) years after the Closing Date and terminating the date twenty four (24) months therefrom, the C3 Members hereby collectively grant EVIO the right to ratably purchase from the C3 Members an aggregate of 10% of the then outstanding Interests in C3 LABS (comprising the remaining Interests not owned by EVIO). EVIO may exercise its option by providing C3 LABS and the C3 Members written notice of its intent to exercise the option. The C3 Members shall have three (3) days following the date of such notice to execute assignments of Interests totaling 10% of the then outstanding membership interests in C3 LABS in favor of EVIO. Upon notice of its intent to exercise the option granted hereby, the exercise price shall be set by mutual agreement between the parties or, if no such agreement can be reached, as determined by an independent third-party valuation by an appraiser agreed to by the parties.

The Company financed the Acquisition pursuant to the finance arrangements described in Item 2.03 below.

The foregoing is a summary of the Transfer Agreement qualified in its entirety by reference to the Transfer Agreement which is filed as Exhibit 2.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

The information provided in response to Item 2.03 of this Current Report with respect to the Note, the Security Agreement and the Pledge Agreement (each as defined below), is incorporated by reference into this Item 1.01.

On January 2, 2018, EVIO Inc. (the “Company”) issued a press release announcing the appointment of Acquisition of C3 Labs, LLC. A copy of the press release is attached as Exhibit 99.1 to this Report.

ITEM 2.01 COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

On Janaury 1, 2018, the Company completed the Acquisition pursuant to the Purchase Agreement. The consideration to be paid for the Membership Interest included an aggregate of (A) $500,000 in Convertible Promissory Note; and (B) a $100,000 Promissory Note in an aggregate principal amount of $600,000 (the “Notes”). The information disclosed in Item 1.01 of this Current Report is incorporated herein by reference.

Other than in respect of the transaction contemplated by the Purchase Agreement, there is no material relationship between the Seller Parties and the Company or any of its affiliates, or any director or officer of the Company, or any associate of any such director or officer.

ITEM 2.03 CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT

On January 1, 2018, the Company issued a $500,000 Convertible Promissory Note to C3 Members. The Note accrues interest at a rate of 0% annually, upon the maturity of this note six months from the effective date (Maturity Date), the unpaid Principal Amount of this Note shall be automatically converted into shares of the Company’s common stock (“Shares”) at a conversion price per share of $0.75. In the event the “Market Price” of the Company’s common stock is less than $0.75 on the Maturity Date, the Company will promptly pay Holder, in cash or cash equivalent, the difference between $0.75 and the Market Price per share converted. For purposes of this Note, “Market Price” is defined as the average of the lowest trading prices for the Company’s common stock as reported on the OTCMarkets.com, or any exchange upon which EVIO’s common stock may be traded in the future, for the five (5) trading days prior to the Maturity Date.

On January 1, 2018, the Company issued a $100,000 Promissory Note to C3 Members. The Note accrues interest at a rate of 0% annually, upon the maturity of this note 90 days from the effective date (Maturity Date) the unpaid principal shall be due and payable. Should the Company fail to pay the Principal Amount within five (5) days from the Maturity Date, it shall be considered an event of default and the Holder shall have the option to convert the principal balance due hereunder into common shares of the Company. The Principal Amount will be converted into common stock of the Company at a conversion price per share equal to 50% of the lowest trading price of the Company’s common stock as reported on the OTCMarkets.com, or any exchange upon which the Company’s common stock may be traded in the future, for the five (5) trading days prior to the date of conversion.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(a) Financial Statements of Businesses Acquired

To the extent required, the Company will file by amendment to this Current Report on Form 8-K the historical financial information provided by this Item 9.01(a) within 71 calendar days of the date on which this Current Report on Form 8-K is required to be filed.

(b) Pro Forma Financial Information

To the extent required, the Company will file by amendment to this Current Report on Form 8-K the pro forma financial information provided by this Item 9.01(b) within 71 calendar days of the date on which this Current Report on Form 8-K is required to be filed.

(d) Exhibits

* Filed herewith.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EVIO, INC.

|

|

|

|

|

|

|

|

Date: January 5, 2018

|

By:

|

/s/ William Waldrop

|

|

|

|

|

Name: William Waldrop

Title: Chief Executive Officer

|

|

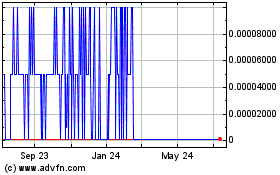

EVIO (CE) (USOTC:EVIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

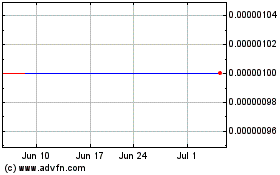

EVIO (CE) (USOTC:EVIO)

Historical Stock Chart

From Apr 2023 to Apr 2024