Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on January 5, 2018

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

FRANKLIN STREET PROPERTIES CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

Maryland

(State or other jurisdiction of

incorporation or organization)

|

|

04-3578653

(I.R.S. Employer

Identification Number)

|

401 Edgewater Place, Suite 200

Wakefield, MA 01880

(781) 557-1300

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

George J. Carter

Chief Executive Officer

Franklin Street Properties Corp.

401 Edgewater Place, Suite 200

Wakefield, MA 01880

(781) 557-1300

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copy to:

Thomas S. Ward, Esq.

Wilmer Cutler Pickering Hale and Dorr LLP

60 State Street

Boston, Massachusetts 02109

(617) 526-6000

Approximate date of commencement of proposed sale to the public:

From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box.

o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box.

ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing

with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

ý

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities

or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an

emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

Large accelerated filer

ý

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

(Do not check if a

smaller reporting company)

|

|

Smaller reporting company

o

Emerging growth company

o

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

o

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities

to be Registered

|

|

Amount to be Registered/Proposed

Maximum Offering Price per Unit/

Proposed Maximum Aggregate Offering

Price/ Amount of Registration Fee per Unit

|

|

|

|

Debt Securities

|

|

(1)

|

|

|

|

Common Stock, par value $0.0001 per share

|

|

(1)

|

|

|

|

Preferred Stock, par value $0.0001 per share

|

|

(1)

|

|

|

|

Depositary Shares(2)

|

|

(1)

|

|

|

-

(1)

-

Pursuant

to Form S-3 General Instructions II.E information is not required to be included. An indeterminate amount of the securities of each identified

class is being registered as may from time to time be offered hereunder at indeterminate prices, along with an indeterminate number of securities that may be issued upon exercise, settlement, exchange

or conversion of securities offered or sold hereunder or that are represented by depositary shares. Pursuant to Rule 416 under the Securities Act of 1933, as amended (the "Securities Act"),

this registration statement also covers any additional securities that may be offered or issued in connection with any stock split, stock dividend or pursuant to anti-dilution provisions of any of the

securities. Separate consideration may or may not be received for securities that are issuable upon conversion, exercise or exchange of other securities. In accordance with Rules 456(b) and

457(r) under the Securities Act, the registrant is deferring payment of all registration fees and will pay the registration fees subsequently in advance or on a "pay-as-you-go" basis.

-

(2)

-

Each

depositary share will be issued under a deposit agreement, will represent an interest in a fractional share or multiple shares of preferred stock and will be

evidenced by a depositary receipt.

Table of Contents

PROSPECTUS

FRANKLIN STREET PROPERTIES CORP.

Debt Securities

Common Stock

Preferred Stock

Depositary Shares

We may offer and sell securities from time to time in one or more offerings. This prospectus describes the general terms of these securities and

the general manner in which these securities will be offered. We will provide the specific terms of these securities in supplements to this prospectus. The prospectus supplements will also describe

the specific manner in which these securities will be offered and may also supplement, update or amend information contained in this document. You should read this prospectus and any applicable

prospectus supplement before you invest. The shares of common stock, par value $0.0001 per share, of Franklin Street Properties Corp., or FSP Corp., covered by this

prospectus may be offered and sold from time to time by FSP Corp. or certain selling stockholders of FSP Corp. in one or more offerings.

We

may offer these securities, and any selling stockholder may offer shares of our common stock, in amounts, at prices and on terms determined at the time of offering. The securities may

be sold directly to you, through agents, or through underwriters and dealers. If agents, underwriters or dealers are used to sell the securities, we will name them and describe their compensation in a

prospectus supplement. Unless otherwise set forth in a prospectus supplement, we will not receive any proceeds from the sale of shares of our common stock by any selling stockholders.

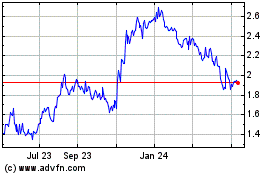

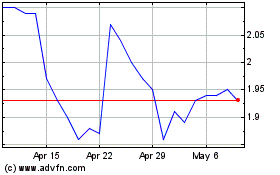

Our

common stock is listed on the NYSE American under the symbol FSP.

Investing in these securities involves certain risks. See "Risk Factors" included in any accompanying prospectus supplement and in the documents

incorporated by reference in this prospectus for a discussion of the factors you should carefully consider before deciding to purchase these securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these

securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is January 5, 2018

Table of Contents

TABLE OF CONTENTS

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, which we refer to as the "SEC,"

utilizing a "shelf" registration process. Under this shelf registration process, we may from time to time sell any combination of the securities described in this prospectus in one or more offerings,

and certain selling stockholders may from time to time sell shares of our common stock in one or more offerings.

This

prospectus provides you with a general description of the securities we may offer. Each time we sell securities, we will provide one or more prospectus supplements that will contain

specific information about the terms of the offering. The prospectus supplement may also add, update or change information contained in this prospectus. You should read both this prospectus and the

accompanying prospectus supplement together with the additional information described under the heading "Where You Can Find More Information" beginning on page 2 of this prospectus.

You

should rely only on the information contained in or incorporated by reference in this prospectus, any accompanying prospectus supplement or in any related free writing prospectus

filed by us with the SEC. We have not authorized anyone to provide you with different information. This prospectus and any accompanying prospectus supplement do not constitute an offer to sell or the

solicitation of an offer to buy any securities other than the securities described in this prospectus or such accompanying prospectus supplement or an offer to sell or the solicitation of an offer to

buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that the information appearing in this prospectus, any prospectus supplement, the documents

incorporated by reference and any related free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed

materially since those dates.

Unless

the context otherwise indicates, references in this prospectus to "FSP Corp.," the "company," "we," "our" and "us" refer, collectively, to Franklin Street Properties Corp., a

Maryland corporation, and its consolidated subsidiaries.

1

Table of Contents

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public

over the Internet at the SEC's website at http://www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at www.fspreit.com. Our website is not a part of

this prospectus and is not incorporated by reference in this prospectus. You may also read and copy any document we file at the SEC's Public Reference Room, 100 F Street, N.E., Washington, D.C.

20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room.

This

prospectus is part of a registration statement we filed with the SEC. This prospectus omits some information contained in the registration statement in accordance with SEC rules and

regulations. You should review the information and exhibits in the registration statement for further information about us and our consolidated subsidiaries and the securities we are offering.

Statements in this prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are

qualified by reference to these filings. You should review the complete document to evaluate these statements.

INCORPORATION BY REFERENCE

The SEC allows us to incorporate by reference much of the information we file with the SEC, which means that we can disclose important

information to you by referring you to those publicly available documents. The information that we incorporate by reference in this prospectus is considered to be part of this prospectus. Because we

are incorporating by reference future filings with the SEC, this prospectus is continually updated and those future filings may modify or supersede some of the information included or incorporated in

this prospectus. This means that you must look at all of the SEC filings that we incorporate by reference to determine if any of the statements in this prospectus or in any document previously

incorporated by reference have been modified or superseded. This prospectus incorporates by reference the documents listed below (File No. 001-32470) and any future filings we make with the SEC

under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act (in each case, other than those documents or the portions of those documents not

deemed to be filed) until the offering of the securities under the registration statement is terminated or completed:

-

•

-

Annual Report on Form 10-K for the fiscal year ended December 31, 2016, including the information specifically incorporated by

reference into the Annual Report on Form 10-K from our definitive proxy statement for the 2017 Annual Meeting of Stockholders;

-

•

-

Quarterly Reports on Form 10-Q for the fiscal quarters ended March 31, 2017, June 30, 2017 and September 30, 2017;

-

•

-

Current Reports on Form 8-K filed on May 12, 2017 and October 24, 2017;

-

•

-

Current Report on Form 8-K/A filed on February 10, 2017 and September 13, 2017; and

-

•

-

The description of our common stock contained in our Registration Statement on Form 8-A filed on April 5, 2005, including any

amendments or reports filed for the purpose of updating such description.

You

may request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Franklin

Street Properties Corp.

401 Edgewater Place, Suite 200

Wakefield, MA 01880

Attn: Investor Relations

(781) 557-1300

2

Table of Contents

FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference in this prospectus include "forward-looking statements" within the meaning of

Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act. These statements are based on current judgments and current knowledge

of management, which are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements. Accordingly,

readers are cautioned not to place undue reliance on forward-looking statements. Investors are cautioned that our forward-looking statements involve risks and uncertainty, including without

limitation, economic conditions in the United States, disruptions in the debt markets, economic conditions in the markets in which we own properties, risks of a lessening of demand for the types of

real estate owned by us, uncertainties relating to fiscal policy, changes in government regulations and regulatory uncertainty, geopolitical events, and expenditures that cannot be anticipated such as

utility rate and usage increases, unanticipated repairs, additional staffing, insurance increases and real estate tax valuation reassessments. You are cautioned that these forward-looking statements

are only predictions and are subject to risks, uncertainties and assumptions that are referenced in the section of any accompanying prospectus supplement entitled "Risk Factors." You should also

carefully review the risk factors and cautionary statements described in the other documents we file from time to time with the SEC, specifically our most recent Annual Report on

Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K. Although we believe the expectations reflected in the forward-looking statements are reasonable,

we cannot guarantee future results, levels of activity, performance or achievements. We may not update any of the forward-looking statements after the date this prospectus is filed to conform them to

actual results or to changes in our expectations that occur after such date, other than as required by law.

3

Table of Contents

FRANKLIN STREET PROPERTIES CORP.

FSP Corp. operates in a single reportable segment: real estate operations. The real estate operations market involves real estate rental

operations, leasing, secured financing of real estate and services provided for asset management, property management, property acquisitions, dispositions and development. Our current strategy is to

invest in select urban infill and central business district properties, with primary emphasis on our five core markets of Atlanta, Dallas, Denver, Houston and Minneapolis. We believe that our five

core markets have macro-economic drivers that have the potential to increase occupancies and rents. We will also monitor other markets for opportunistic investments. We seek value-oriented investments

with an eye towards long-term growth and appreciation, as well as current income.

As

of September 30, 2017, approximately 7.6 million square feet, or approximately 75.5% of our total owned portfolio, was located in our five core markets. From

time-to-time we may dispose of our smaller, suburban office assets and replace them with larger urban infill and central business district office assets located primarily in our five core markets. As

we execute this strategy, short term operating results could be adversely impacted. However, we believe that the transformed portfolio has the potential to provide higher profit and asset value growth

over a longer period of time.

The

main factor that affects our real estate operations is the broad economic market conditions in the United States. These market conditions affect the occupancy levels and the rent

levels on both a national and local level. We have no influence on broader economic/market conditions. We look to acquire and/or develop quality properties in good locations in order to lessen the

impact of downturns in the market and to take advantage of upturns when they occur.

Our

principal executive offices are located at 401 Edgewater Place, Suite 200, Wakefield, Massachusetts, 01880, and our telephone number is (781) 557-1300.

4

Table of Contents

CONSOLIDATED RATIOS OF EARNINGS TO FIXED CHARGES AND

RATIOS OF EARNINGS TO COMBINED FIXED CHARGES AND PREFERRED STOCK DIVIDENDS

The following table sets forth our ratio of earnings to fixed charges and the ratio of earnings to combined fixed charges and preferred stock

dividends for each of the periods indicated. You should read this table in conjunction with the consolidated financial statements and notes incorporated by reference in this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ended

|

|

|

Nine Months

Ended

September 30,

2017

|

|

|

December 31,

2016

|

|

December 31,

2015

|

|

December 31,

2014

|

|

December 31,

2013

|

|

December 31,

2012

|

|

Consolidated ratios of earnings to fixed charges

|

|

0.62

|

|

1.40

|

|

2.46

|

|

1.57

|

|

1.91

|

|

2.50

|

|

Consolidated ratios of earnings to combined fixed charges and preferred stock dividends

|

|

0.62

|

|

1.40

|

|

2.46

|

|

1.57

|

|

1.91

|

|

2.50

|

For

purposes of calculating the ratios above, earnings consist of net income from continuing operations plus provision for income taxes, (earnings) loss of equity investees,

distributions of income from equity investees and fixed charges. Fixed charges include interest expense plus interest capitalized and the interest portion of rent expense which is deemed to be

representative of the interest factor.

5

Table of Contents

USE OF PROCEEDS

We intend to use the net proceeds from the sale of any securities offered under this prospectus by us for general corporate purposes, which may

include the repayment of debt, the financing of potential acquisitions, the provision of lines of credit and other loans to our Sponsored REITs, the funding of capital improvements on our portfolio

companies' properties, the funding of working capital and other purposes described in any prospectus supplement. We have not determined the amount of net proceeds to be used specifically for such

purposes. As a result, management will retain broad discretion over the allocation of net proceeds. Unless otherwise set forth in a prospectus supplement, to the extent any shares of our common stock

registered under this registration statement are for the account of selling stockholders, we will not receive any of the proceeds of the sale of such shares by such stockholders.

SELLING STOCKHOLDERS

We may register shares of our common stock covered by this prospectus for re-offers and resales by any selling stockholders to be named in a

prospectus supplement. Because we are a well-known seasoned issuer, as defined in Rule 405 of the Securities Act, we may add secondary sales of shares of our common stock by any selling

stockholders by filing a prospectus supplement with the SEC. We may register these shares to permit selling stockholders to resell their shares when they deem appropriate. A selling stockholder may

resell all, a portion or none of its shares at any time and from time to time. Selling stockholders may also sell, transfer or otherwise dispose of some or all of their shares of our common stock in

transactions exempt from the registration requirements of the Securities Act. We do not know when or in what amounts the selling stockholders may offer shares for sale under this prospectus and any

prospectus supplement. We may pay all expenses incurred with respect to the registration of the shares of our common stock owned by the selling stockholders, other than underwriting fees, discounts or

commissions, which will be borne by the selling stockholders. A prospectus supplement for any selling stockholders will name the selling stockholder, the amount of shares to be registered and sold and

any other terms of the shares of our common stock being sold by such selling stockholder.

6

Table of Contents

DESCRIPTION OF DEBT SECURITIES

We may offer debt securities which may be senior or subordinated. We refer to the senior debt securities and the subordinated debt securities

collectively as debt securities. The following description summarizes the general terms and provisions of the debt securities. We will describe the specific terms of the debt securities and the

extent, if any, to which the general provisions summarized below apply to any series of debt securities in the prospectus supplement relating to the series and any applicable free writing prospectus

that we authorize to be delivered. When we refer to "FSP Corp.," "the company," "we," "our" and "us" in this section, we mean Franklin Street Properties Corp. excluding, unless the context otherwise

requires or as otherwise expressly stated, our subsidiaries.

We

may issue senior debt securities from time to time, in one or more series under a senior indenture to be entered into between us and a senior trustee to be named in a prospectus

supplement, which we refer to as the senior trustee. We may issue subordinated debt securities from time to time, in one or

more series under a subordinated indenture to be entered into between us and a subordinated trustee to be named in a prospectus supplement, which we refer to as the subordinated trustee. The forms of

senior indenture and subordinated indenture are filed as exhibits to the registration statement of which this prospectus forms a part. The senior indenture and the subordinated indenture are

referred to individually as an indenture and together as the indentures and the senior trustee and the subordinated trustee are referred to individually as a trustee and together as the trustees. This

section summarizes some of the provisions of the indentures and is qualified in its entirety by the specific text of the indentures, including definitions of terms used in the indentures. Wherever we

refer to particular sections of, or defined terms in, the indentures, those sections or defined terms are incorporated by reference in this prospectus or the applicable prospectus supplement. You

should review the indentures that are filed as exhibits to the registration statement of which this prospectus forms a part for additional information.

Neither

indenture will limit the amount of debt securities that we may issue. The applicable indenture will provide that debt securities may be issued up to an aggregate principal amount

authorized from time to time by us and may be payable in any currency or currency unit designated by us or in amounts determined by reference to an index.

General

The senior debt securities will constitute our unsecured and unsubordinated general obligations and will rank equally in right of payment with

our other unsecured and unsubordinated obligations. The subordinated debt securities will constitute our unsecured and subordinated general obligations and will be junior in right of payment to our

senior indebtedness (including senior debt securities), as described under the heading "—Certain Terms of the Subordinated Debt Securities—Subordination." The debt securities

will be structurally subordinated to all existing and future indebtedness and other liabilities of our subsidiaries unless such subsidiaries expressly guarantee such debt securities.

The

debt securities will be our unsecured obligations. Any secured debt or other secured obligations will be effectively senior to the debt securities to the extent of the value of the

assets securing such debt or other obligations. Unless otherwise indicated in the applicable prospectus supplement, the debt securities will not be guaranteed by any of our subsidiaries.

The

applicable prospectus supplement and/or free writing prospectus will include any additional or different terms of the debt securities of any series being offered, including the

following terms:

-

•

-

the title and type of the debt securities;

-

•

-

whether the debt securities will be senior or subordinated debt securities, and, with respect to any subordinated debt securities the terms on

which they are subordinated;

7

Table of Contents

-

•

-

the initial aggregate principal amount of the debt securities;

-

•

-

the price or prices at which we will sell the debt securities;

-

•

-

the maturity date or dates of the debt securities and the right, if any, to extend such date or dates;

-

•

-

the rate or rates, if any, at which the debt securities will bear interest, or the method of determining such rate or rates;

-

•

-

the date or dates from which such interest will accrue, the interest payment dates on which such interest will be payable or the method of

determination of such dates;

-

•

-

the right, if any, to extend the interest payment periods and the duration of that extension;

-

•

-

the manner of paying principal and interest and the place or places where principal and interest will be payable;

-

•

-

provisions for a sinking fund, purchase fund or other analogous fund, if any;

-

•

-

any redemption dates, prices, obligations and restrictions on the debt securities;

-

•

-

the currency, currencies or currency units in which the debt securities will be denominated and the currency, currencies or currency units in

which principal and interest, if any, on the debt securities may be payable;

-

•

-

any conversion or exchange features of the debt securities;

-

•

-

whether the debt securities will be subject to the defeasance provisions in the indenture;

-

•

-

whether the debt securities will be issued in definitive or global form or in definitive form only upon satisfaction of certain conditions;

-

•

-

whether the debt securities will be guaranteed as to payment or performance;

-

•

-

any special tax implications of the debt securities;

-

•

-

any events of defaults or covenants in addition to or in lieu of those set forth in the indenture; and

-

•

-

any other material terms of the debt securities.

When

we refer to "principal" in this section with reference to the debt securities, we are also referring to "premium, if any."

We

may from time to time, without notice to or the consent of the holders of any series of debt securities, create and issue further debt securities of any such series ranking equally

with the debt securities of such series in all respects (or in all respects other than (1) the payment of interest accruing prior to the issue date of such further debt securities or

(2) the first payment of interest following the issue date of such further debt securities). Such further debt securities may be consolidated and form a single series with the debt

securities of such series and have the same terms as to status, redemption or otherwise as the debt securities of such series.

You

may present debt securities for exchange and you may present debt securities for transfer in the manner, at the places and subject to the restrictions set forth in the debt

securities and the applicable prospectus supplement. We will provide you those services without charge, although you may have to pay any tax or other governmental charge payable in connection with any

exchange or transfer, as set forth in the indenture.

Debt

securities may bear interest at a fixed rate or a floating rate. Debt securities bearing no interest or interest at a rate that at the time of issuance is below the prevailing

market rate (original

8

Table of Contents

issue

discount securities) may be sold at a discount below their stated principal amount. U.S. federal income tax considerations applicable to any such discounted debt securities or to certain debt

securities issued at par which are treated as having been issued at a discount for U.S. federal income tax purposes will be described in the applicable prospectus supplement.

We

may issue debt securities with the principal amount payable on any principal payment date, or the amount of interest payable on any interest payment date, to be determined by

reference to one or more currency exchange rates, securities or baskets of securities, commodity prices or indices. You may receive a payment of principal on any principal payment date, or a payment

of interest on any interest payment date, that is greater than or less than the amount of principal or interest otherwise payable on such dates, depending on the value on such dates of the applicable

currency, security or basket of securities, commodity or index. Information as to the methods for determining the amount of principal or interest payable on any date, the currencies, securities or

baskets of securities, commodities or indices to which the amount payable on such date is linked and certain related tax considerations will be set forth in the applicable prospectus supplement.

Certain Terms of the Senior Debt Securities

Covenants.

Unless we indicate otherwise in a prospectus supplement with respect to a particular series of senior debt securities, the

senior debt

securities will not contain any financial or restrictive covenants, including covenants restricting either us or any of our subsidiaries from incurring, issuing, assuming or guaranteeing any

indebtedness secured by a lien on any of our or our subsidiaries' property or capital stock, or restricting either us or any of our subsidiaries from entering into sale and leaseback transactions.

Consolidation, Merger and Sale of Assets.

Unless we indicate otherwise in a prospectus supplement with respect to a particular series

of senior debt

securities, we may not consolidate with or merge into any other person, in a transaction in which we are not the surviving corporation, or convey, transfer or lease our properties and assets

substantially as an entirety to any person, in either case, unless:

-

•

-

the successor entity, if any, is a U.S. corporation, limited liability company, partnership or trust;

-

•

-

the successor entity assumes our obligations on the senior debt securities and under the senior indenture;

-

•

-

immediately after giving effect to the transaction, no default or event of default shall have occurred and be continuing; and

-

•

-

we have delivered to the senior trustee an officer's certificate and an opinion of counsel, each stating that the consolidation, merger,

conveyance, transfer or lease and, if a supplemental indenture is required in connection with such transaction, such supplemental indenture, comply with the senior indenture and all conditions

precedent provided for in the senior indenture relating to such transaction have been complied with.

The

restrictions described in the bullets above do not apply (1) to our consolidation with or merging into one of our affiliates, if our board of directors determines in good

faith that the purpose of the consolidation or merger is principally to change our state of incorporation or our form of organization to another form or (2) if we merge with or into a single

direct or indirect wholly-owned subsidiary of ours.

The

surviving business entity will succeed to, and be substituted for, us under the senior indenture and the senior debt securities and, except in the case of a lease, we shall be

released from all obligations under the senior indenture and the senior debt securities.

No Protection in the Event of a Change in Control.

Unless we indicate otherwise in a prospectus supplement with respect to a particular

series of

senior debt securities, the senior debt securities will

9

Table of Contents

not

contain any provisions that may afford holders of the senior debt securities protection in the event we have a change in control or in the event of a highly leveraged transaction (whether or not

such transaction results in a change in control).

Events of Default.

Unless we indicate otherwise in a prospectus supplement with respect to a particular series of senior debt

securities, the

following are events of default under the senior indenture with respect to senior debt securities of each series:

-

•

-

failure to pay interest on any senior debt securities of such series when due and payable, if that default continues for a period of

30 days (or such other period as may be specified for such series);

-

•

-

failure to pay principal on the senior debt securities of such series when due and payable whether at maturity, upon redemption, by declaration

or otherwise (and, if specified for such series, the continuance of such failure for a specified period);

-

•

-

default in the performance of or breach of any of our covenants or agreements in the senior indenture applicable to senior debt securities of

such series, other than a covenant breach which is specifically dealt with elsewhere in the senior indenture, and that default or breach continues for a period of 90 days after we receive

written notice from the trustee or from the holders of 25% or more in aggregate principal amount of the senior debt securities of such series;

-

•

-

certain events of bankruptcy or insolvency, whether or not voluntary; and

-

•

-

any other event of default provided for in such series of senior debt securities as may be specified in the applicable prospectus supplement.

The

default by us under any other debt, including any other series of debt securities, is not a default under the senior indenture.

If

an event of default other than an event of default specified in the fourth bullet point above occurs with respect to a series of senior debt securities and is continuing under the

senior indenture, then, and in each such case, either the trustee or the holders of not less than 25% in aggregate principal amount of such series then outstanding under the senior indenture (each

such series voting as a separate class) by written notice to us and to the trustee, if such notice is given by the holders, may, and the trustee at the request of such holders shall, declare the

principal amount of and accrued interest on such series of senior debt securities to be immediately due and payable, and upon this declaration, the same shall become immediately due and payable.

If

an event of default specified in the fourth bullet point above occurs and is continuing, the entire principal amount of and accrued interest on each series of senior debt securities

then outstanding shall automatically become immediately due and payable.

Unless

otherwise specified in the prospectus supplement relating to a series of senior debt securities originally issued at a discount, the amount due upon acceleration shall include

only the original issue price of the senior debt securities, the amount of original issue discount accrued to the date of acceleration and accrued interest, if any.

Upon

certain conditions, declarations of acceleration may be rescinded and annulled and past defaults may be waived by the holders of a majority in aggregate principal amount of all the

senior debt securities of such series affected by the default, each series voting as a separate class. Furthermore, subject to various provisions in the senior indenture, the holders of a majority in

aggregate principal amount of a series of senior debt securities, by notice to the trustee, may waive a continuing default or event of default with respect to such senior debt securities and its

consequences, except a default in the payment of principal of or interest on such senior debt securities (other than any such default in payment resulting solely from an acceleration of the senior

debt securities) or in

10

Table of Contents

respect

of a covenant or provision of the senior indenture which cannot be modified or amended without the consent of the holders of each such senior debt security. Upon any such waiver, such default

shall cease to exist, and any event of default with respect to such senior debt securities shall be deemed to have been cured, for every purpose of the senior indenture; but no such waiver shall

extend to any subsequent or other default or event of default or impair any right consequent thereto.

The

holders of a majority in aggregate principal amount of a series of senior debt securities may direct the time, method and place of conducting any proceeding for any remedy available

to the trustee or exercising any trust or power conferred on the trustee with respect to such senior debt securities. However, the trustee may refuse to follow any direction that conflicts with law or

the senior indenture, that may involve the trustee in personal liability or that the trustee determines in good faith may be unduly prejudicial to the rights of holders of such series of senior debt

securities not joining in the giving of such direction and may take any other action it deems proper that is not inconsistent with any such direction received from holders of such series of senior

debt securities. A holder may not pursue any remedy with respect to the senior indenture or any series of senior debt securities unless:

-

•

-

the holder gives the trustee written notice of a continuing event of default;

-

•

-

the holders of at least 25% in aggregate principal amount of such series of senior debt securities make a written request to the trustee to

pursue the remedy in respect of such event of default;

-

•

-

the requesting holder or holders offer the trustee indemnity satisfactory to the trustee against any costs, liability or expense;

-

•

-

the trustee does not comply with the request within 60 days after receipt of the request and the offer of indemnity; and

-

•

-

during such 60-day period, the holders of a majority in aggregate principal amount of such series of senior debt securities do not give the

trustee a direction that is inconsistent with the request.

These

limitations, however, do not apply to the right of any holder of a senior debt security of any affected series to receive payment of the principal of and interest on such senior

debt security in accordance with the terms of such debt security, or to bring suit for the enforcement of any such payment in accordance with the terms of such debt security, on or after the due date

for the senior debt securities, which right shall not be impaired or affected without the consent of the holder.

The

senior indenture requires certain of our officers to certify, on or before a fixed date in each year in which any senior debt security is outstanding, as to their knowledge of our

compliance with all covenants, agreements and conditions under the senior indenture.

Satisfaction and Discharge.

We can satisfy and discharge our obligations to holders of any series of debt securities

if:

-

•

-

we have paid or caused to be paid the principal of and interest on all senior debt securities of such series (with certain limited exceptions)

when due and payable; or

-

•

-

we deliver to the senior trustee for cancellation all senior debt securities of such series theretofore authenticated under the senior

indenture (with certain limited exceptions); or

-

•

-

all senior debt securities of such series have become due and payable or will become due and payable within one year (or are to be called for

redemption within one year under arrangements satisfactory to the senior trustee) and we deposit in trust an amount of cash or a combination of cash and U.S. government or U.S. government agency

obligations (or in the case of senior debt securities denominated in a foreign currency, foreign government securities or foreign government agency securities) sufficient to make interest, principal

and any other payments on the debt securities of that series on their various due dates;

11

Table of Contents

and

if, in any such case, we also pay or cause to be paid all other sums payable under the senior indenture, as and when the same shall be due and payable and we deliver to the senior trustee an

officer's certificate and an opinion of counsel, each stating that these conditions have been satisfied.

Under

current U.S. federal income tax law, the deposit and our legal release from the debt securities would be treated as though we took back your debt securities and gave you your share

of the cash and debt securities or bonds deposited in trust. In that event, you could recognize gain or loss on the debt securities you give back to us. Purchasers of the debt securities should

consult their own advisers with respect to the tax consequences to them of such deposit and discharge, including the applicability and effect of tax laws other than the U.S. federal income tax law.

Defeasance.

Unless the applicable prospectus supplement provides otherwise, the following discussion of legal defeasance and covenant

defeasance will

apply to any series of debt securities issued under the indentures.

Legal Defeasance.

We can legally release ourselves from any payment or other obligations on the debt securities of any series (called

"legal

defeasance") if certain conditions are met, including the following:

-

•

-

We deposit in trust for your benefit and the benefit of all other direct holders of the debt securities of the same series cash or a

combination of cash and U.S. government or U.S. government agency obligations (or, in the case of senior debt securities denominated in a foreign currency, foreign government or foreign government

agency obligations) that will generate enough cash to make interest, principal and any other payments on the debt securities of that series on their various due dates.

-

•

-

There is a change in current U.S. federal income tax law or an IRS ruling that lets us make the above deposit without causing you to be taxed

on the debt securities any differently than if we did not make the deposit and instead repaid the debt securities ourselves when due. Under current U.S. federal income tax law, the deposit and our

legal release from the debt securities would be treated as though we took back your debt securities and gave you your share of the cash and debt securities or bonds deposited in trust. In that event,

you could recognize gain or loss on the debt securities you give back to us.

-

•

-

We deliver to the trustee a legal opinion of our counsel confirming the tax law change or ruling described above.

If

we accomplish legal defeasance, as described above, you would have to rely solely on the trust deposit for repayment of the debt securities. You could not look to us for repayment in

the event of any shortfall.

Covenant Defeasance.

Without any change in current U.S. federal tax law, we can make the same type of deposit described above and be

released from

some of the covenants in the debt securities (called "covenant defeasance"). In that event, you would lose the protection of those covenants but would gain the protection of having money and

securities set aside in trust to repay the debt securities. In order to achieve covenant defeasance, we must do the following (among other things):

-

•

-

We must deposit in trust for your benefit and the benefit of all other direct holders of the debt securities of the same series cash or a

combination of cash and U.S. government or U.S. government agency obligations (or, in the case of senior debt securities denominated in a foreign currency, foreign government or foreign government

agency obligations) that will generate enough cash to make interest, principal and any other payments on the debt securities of that series on their various due dates.

12

Table of Contents

-

•

-

We must deliver to the trustee a legal opinion of our counsel confirming that under current U.S. federal income tax law we may make the above

deposit without causing you to be taxed on the debt securities any differently than if we did not make the deposit and instead repaid the debt securities ourselves when due.

If

we accomplish covenant defeasance, you could still look to us for repayment of the debt securities if there were a shortfall in the trust deposit. In fact, if one of the events of

default occurred (such as our bankruptcy) and the debt securities become immediately due and payable, there may be such a shortfall. Depending on the events causing the default, you may not be able to

obtain payment of the shortfall.

Modification and Waiver.

We and the trustee may amend or supplement the senior indenture or the senior debt securities of any series

without the

consent of any holder:

-

•

-

to convey, transfer, assign, mortgage or pledge any assets as security for the senior debt securities of one or more series;

-

•

-

to evidence the succession of a corporation, limited liability company, partnership or trust to us, and the assumption by such successor of our

covenants, agreements and obligations under the senior indenture or to otherwise comply with the covenant relating to mergers, consolidations and sales of assets;

-

•

-

to comply with requirements of the SEC in order to effect or maintain the qualification of the senior indenture under the Trust Indenture Act

of 1939, as amended (the "Trust Indenture Act");

-

•

-

to add to our covenants such new covenants, restrictions, conditions or provisions for the protection of the holders, and to make the

occurrence, or the occurrence and continuance, of a default in any such additional covenants, restrictions, conditions or provisions an event of default;

-

•

-

to cure any ambiguity, defect or inconsistency in the senior indenture or in any supplemental indenture or to conform the senior indenture or

the senior debt securities to the description of senior debt securities of such series set forth in this prospectus or any applicable prospectus supplement;

-

•

-

to provide for or add guarantors with respect to the senior debt securities of any series;

-

•

-

to establish the form or forms or terms of the senior debt securities as permitted by the senior indenture;

-

•

-

to evidence and provide for the acceptance of appointment under the senior indenture by a successor trustee, or to make such changes as shall

be necessary to provide for or facilitate the administration of the trusts in the senior indenture by more than one trustee;

-

•

-

to add to, change or eliminate any of the provisions of the senior indenture in respect of one or more series of senior debt securities,

provided that any such addition, change or elimination shall (a) neither (1) apply to any senior debt security of any series created prior to the execution of such supplemental indenture

and entitled to the benefit of such provision nor (2) modify the rights of the holder of any such senior debt security with respect to such provision or (b) become effective only when

there is no senior debt security described in clause (a)(1) outstanding;

-

•

-

to make any change to the senior debt securities of any series so long as no senior debt securities of such series are outstanding; or

13

Table of Contents

-

•

-

to make any change that does not adversely affect the rights of any holder in any material respect.

Other

amendments and modifications of the senior indenture or the senior debt securities issued may be made, and our compliance with any provision of the senior indenture with respect to

any series of senior debt securities may be waived, with the consent of the holders of a majority of the aggregate principal amount of the outstanding senior debt securities of each series affected by

the amendment or modification (voting as separate series); provided, however, that each affected holder must consent to any modification, amendment or waiver

that:

-

•

-

extends the final maturity of any senior debt securities of such series;

-

•

-

reduces the principal amount of any senior debt securities of such series;

-

•

-

reduces the rate, or extends the time for payment of, interest on any senior debt securities of such series;

-

•

-

reduces the amount payable upon the redemption of any senior debt securities of such series;

-

•

-

changes the currency of payment of principal of or interest on any senior debt securities of such series;

-

•

-

reduces the principal amount of original issue discount securities payable upon acceleration of maturity or the amount provable in bankruptcy;

-

•

-

waives a continuing default in the payment of principal of or interest on the senior debt securities (other than any such default in payment

resulting solely from an acceleration of the senior debt securities);

-

•

-

changes the provisions relating to the waiver of past defaults or impairs the right of holders to receive payment or to institute suit for the

enforcement of any payment or conversion of any senior debt securities of such series on or after the due date therefor;

-

•

-

modifies any of the provisions of these restrictions on amendments and modifications, except to increase any required percentage or to provide

that certain other provisions cannot be modified or waived without the consent of the holder of each senior debt security of such series affected by the modification;

-

•

-

adversely affects the right to convert or exchange senior debt securities into common stock or other property in accordance with the terms of

the senior debt securities; or

-

•

-

reduces the above-stated percentage of outstanding senior debt securities of such series whose holders must consent to a supplemental indenture

or modifies, amends or waives certain provisions of or defaults under the senior indenture.

It

shall not be necessary for the holders to approve the particular form of any proposed amendment, supplement or waiver, but it shall be sufficient if the holders' consent approves the

substance thereof. After an amendment, supplement or waiver of the senior indenture in accordance with the provisions described in this section becomes effective, the trustee must give to the holders

affected thereby certain notice briefly describing the amendment, supplement or waiver. Any failure by the trustee to give such notice, or any defect therein, shall not, however, in any way impair or

affect the validity of any such amendment, supplemental indenture or waiver.

No Personal Liability of Incorporators, Stockholders, Officers, Directors.

The senior indenture provides that no recourse shall be had

under any

obligation, covenant or agreement of ours in the senior indenture or any supplemental indenture, or in any of the senior debt securities or because of the creation of any indebtedness represented

thereby, against any of our incorporators, stockholders, officers or directors, past, present or future, or of any predecessor or successor entity thereof under any

14

Table of Contents

law,

statute or constitutional provision or by the enforcement of any assessment or by any legal or equitable proceeding or otherwise. Each holder, by accepting the senior debt securities, waives and

releases all such liability.

Concerning the Trustee.

The senior indenture provides that, except during the continuance of an event of default, the trustee will not

be liable

except for the performance of such duties as are specifically set

forth in the senior indenture. If an event of default has occurred and is continuing, the trustee will exercise such rights and powers vested in it under the senior indenture and will use the same

degree of care and skill in its exercise as a prudent person would exercise under the circumstances in the conduct of such person's own affairs.

The

senior indenture and the provisions of the Trust Indenture Act incorporated by reference therein contain limitations on the rights of the trustee thereunder, should it become a

creditor of ours or any of our subsidiaries, to obtain payment of claims in certain cases or to realize on certain property received by it in respect of any such claims, as security or otherwise. The

trustee is permitted to engage in other transactions, provided that if it acquires any conflicting interest (as defined in the Trust Indenture Act), it must eliminate such conflict or resign.

We

may have normal banking relationships with the senior trustee in the ordinary course of business.

Unclaimed Funds.

All funds deposited with the trustee or any paying agent for the payment of principal, premium, interest or additional

amounts in

respect of the senior debt securities that remain unclaimed for two years after the date upon which such amounts became due and payable will be repaid to us. Thereafter, any right of any holder of

senior debt securities to such funds shall be enforceable only against us, and the trustee and paying agents will have no liability therefor.

Governing Law.

The senior indenture and the senior debt securities will be governed by, and construed in accordance with, the internal

laws of the

State of New York.

Certain Terms of the Subordinated Debt Securities

Other than the terms of the subordinated indenture and subordinated debt securities relating to subordination or otherwise as described in the

prospectus supplement relating to a particular series of subordinated debt securities, the terms of the subordinated indenture and subordinated debt securities are identical in all material respects

to the terms of the senior indenture and senior debt securities.

Additional

or different subordination terms may be specified in the prospectus supplement applicable to a particular series.

Subordination.

The indebtedness evidenced by the subordinated debt securities is subordinate to the prior payment in full of all of our

senior

indebtedness, as defined in the subordinated indenture. During the continuance beyond any applicable grace period of any default in the payment of principal, premium, interest or any other payment due

on any of our senior indebtedness, we may not make any payment of principal of or interest on the subordinated debt securities (except for certain sinking fund payments). In addition, upon any payment

or distribution of our assets upon any dissolution, winding-up, liquidation or reorganization, the payment of the principal of and interest on the subordinated debt securities will be subordinated to

the extent provided in the subordinated indenture in right of payment to the prior payment in full of all our senior indebtedness. Because of this subordination, if we dissolve or otherwise liquidate,

holders of our subordinated debt securities may receive less, ratably, than holders of our senior indebtedness. The subordination provisions do not prevent the occurrence of an event of default under

the subordinated indenture.

15

Table of Contents

The

term "senior indebtedness" of a person means with respect to such person the principal of, premium, if any, interest on, and any other payment due pursuant to any of the following,

whether outstanding on the date of the subordinated indenture or incurred by that person in the future:

-

•

-

all of the indebtedness of that person for money borrowed;

-

•

-

all of the indebtedness of that person evidenced by notes, debentures, bonds or other securities sold by that person for money;

-

•

-

all of the lease obligations that are capitalized on the books of that person in accordance with generally accepted accounting principles;

-

•

-

all indebtedness of others of the kinds described in the first two bullet points above and all lease obligations of others of the kind

described in the third bullet point above that the person, in any manner, assumes or guarantees or that the person in effect guarantees through an agreement to purchase, whether that agreement is

contingent or otherwise; and

-

•

-

all renewals, extensions or refundings of indebtedness of the kinds described in the first, second or fourth bullet point above and all

renewals or extensions of leases of the kinds described in the third or fourth bullet point above;

unless,

in the case of any particular indebtedness, renewal, extension or refunding, the instrument creating or evidencing it or the assumption or guarantee relating to it expressly provides that such

indebtedness, renewal, extension or refunding is not superior in right of payment to the subordinated debt securities. Our senior debt securities constitute senior indebtedness for purposes of the

subordinated indenture.

16

Table of Contents

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock is intended as a summary only and therefore is not a complete description of our capital stock.

This description is based upon, and is qualified by reference to, our Articles of Incorporation, our Bylaws and applicable provisions of Maryland corporate law. You should read our Articles of

Incorporation and Bylaws, which are filed as exhibits to the registration statement of which this prospectus forms a part, for the provisions that are important to you.

Our

authorized capital stock consists of 200,000,000 shares of capital stock, consisting of 180,000,000 shares of common stock, par value $0.0001 per share, and 20,000,000 shares of

preferred stock, par value $0.0001 per share. Our Articles of Incorporation authorize our board of directors to amend our Articles of Incorporation to increase or decrease the aggregate number of

shares of capital stock or the number of shares of stock of any class without stockholder approval. As of December 31, 2017,

107,231,155 shares of common stock were outstanding and no shares of preferred stock were outstanding.

Common Stock

Voting Rights.

Subject to the provisions of our Articles of Incorporation regarding the restrictions on transfer and ownership of

shares of our

common stock, each outstanding share of common stock entitles the holder to one vote on all matters submitted to a vote of stockholders, including the election of directors. Subject to the provisions

of our Articles of Incorporation regarding the restrictions on transfer and ownership of shares of our common stock and except as provided with respect to any class or classes of our preferred stock

that may be issued in the future, the holders of shares of our common stock will possess the exclusive voting power. There is no cumulative voting in the election of directors.

Pursuant

to the Maryland General Corporation Law, or the MGCL, a corporation generally cannot dissolve, amend its articles of incorporation, merge, sell all or substantially all of its

assets, engage in a share exchange or consolidate or engage in similar transactions outside the ordinary course of business unless such action is advised by the board of directors and approved by the

affirmative vote of holders of at least two-thirds of the shares of stock entitled to vote on the matter unless a lesser percentage (but not less than a majority of all of the votes to be cast on the

matter) is set forth in the corporation's articles of incorporation. Our Articles of Incorporation provide that we may amend the Articles of Incorporation (with several exceptions), merge, sell all or

substantially all of our assets, engage in a share exchange or consolidate or engage in similar transactions outside the ordinary course of business, with the approval of the holders of a majority of

the shares of stock entitled to vote on the matter. However, the MGCL permits a corporation to transfer all or substantially all of its assets without the approval of the stockholders of the

corporation to one or more persons if all of the equity interests of the person or persons are owned, directly or indirectly, by the corporation. We may use the merger or sale of subsidiaries to which

we have transferred all or substantially all of our assets without the approval of the holders of our common stock to transfer all or substantially all of our assets without the approval of the

holders of our common stock.

Our

Articles of Incorporation provide that in addition to any vote of the holders required by the terms of any then outstanding shares of preferred stock, the affirmative vote of at

least 80% of the shares of our capital stock entitled to vote shall be required to:

-

•

-

add, amend or repeal any term or provision of our Articles of Incorporation in any respect that would, in the determination of our board of

directors, cause us not to qualify as a REIT under the Internal Revenue Code of 1986, as amended, unless our board of directors has determined that such qualification is no longer in our best

interests;

-

•

-

amend or repeal, or adopt any provision inconsistent with, the provisions of our Articles of Incorporation: establishing our classified board

of directors; establishing the standards and

17

Table of Contents

procedures

for the removal of a director; eliminating the personal liability of a director or officer to us or our stockholders for monetary damages; requiring us to indemnify our directors, officers,

employees, agents and other persons acting on behalf of or at the request of us to the fullest extent permitted from time to time by Maryland law; or establishing this super-majority voting

requirement; and

-

•

-

adding to our Articles of Incorporation any provision imposing cumulative voting in the election of directors.

Dividends, Liquidation and Other Rights.

Subject to the preferential rights of any other class or series of our stock and to the

provisions of our

Articles of Incorporation regarding the restrictions on ownership and transfer of shares of stock, holders of shares of common stock are entitled to receive dividends on such shares of common stock

if, as and when authorized by our board of directors, and declared by us out of assets legally available therefor. Such holders are also entitled to share ratably in the assets of our company legally

available for distribution to our stockholders in the event of our liquidation, dissolution or winding up after payment or establishment of reserves or other adequate provision for all debts and

liabilities of our company and any stock with preferential rights related thereto. Under Maryland law, stockholders generally are not liable for the corporation's debts or obligations.

Holders

of shares of common stock have no preference, conversion, exchange or sinking fund rights, have no preemptive rights to subscribe for any of our securities and generally have no

appraisal rights. Subject to the provisions of our Articles of Incorporation regarding the restrictions on ownership and transfer of shares of stock, shares of common stock will have equal dividend,

liquidation and other rights.

Power to Reclassify Our Unissued Shares of Stock.

Our board of directors is authorized by our Articles of Incorporation to classify and

reclassify

any of our unissued shares of capital stock by, among other alternatives, setting, altering or eliminating in any one or more respects, from time to time before the issuance of such shares, any

feature of such shares, including but not limited to the designation, preferences, conversion or other rights, voting powers, qualifications and terms and conditions of redemption of, limitations as

to dividends and any other restrictions on such shares, without the approval of the holders of our common stock. As a result, our board of directors could authorize, without further action by the

holders of our common stock, the issuance of shares of preferred stock that have priority over the shares of our common stock with respect to dividends, distributions and rights upon liquidation and

with other terms and conditions that could have the effect of delaying, deterring or preventing a transaction or a change in control that might involve a premium price for holders of shares of our

common stock or otherwise might be in their best interest.

Transfer Agent.

The registrar and transfer agent for shares of our common stock is American Stock Transfer and Trust Company.

Preferred Stock

Currently, no shares of our preferred stock are issued or outstanding. Our board of directors may authorize from time to time, without further

action by our stockholders, the issuance of shares of preferred stock in one or more separately designated classes. Our board of directors may set the preferences, conversion or other rights, voting

powers, restrictions, limitations as to dividends or other distributions, qualifications and terms and conditions of redemption of the shares of each class of our preferred stock. The authorized

shares of our preferred stock are available for issuance without further action by our stockholders, unless such action is required by applicable law or the rules of any stock exchange on which our

securities may be listed. If the approval of our stockholders is not required for the issuance of shares of our preferred stock, our board may determine not to seek stockholder

18

Table of Contents

approval.

The specific terms of any class of preferred stock offered pursuant to this prospectus will be described in the prospectus supplement relating to that class of preferred stock.

A

class of our preferred stock could, depending on the terms of such class, impede the completion of a merger, tender offer or other takeover attempt. Our board of directors will make

any determination to issue preferred shares based upon its judgment as to the best interests of our stockholders. Our directors, in so acting, could issue preferred stock having terms that could

discourage an acquisition attempt through which an acquirer may be able to change the composition of our board of directors, including a tender offer or other transaction that some, or a majority, of

our stockholders might believe to be in their best interests or in which stockholders might receive a premium for their stock over the then-current market price of the stock.

The

preferred stock has the terms described below unless otherwise provided in the prospectus supplement relating to a particular class of preferred stock. You should read the prospectus

supplement relating to the particular class of preferred stock being offered for specific terms, including:

-

•

-

the designation and stated value per share of the preferred stock and the number of shares offered;

-

•

-

the amount of liquidation preference per share;

-

•

-

the price at which the preferred stock will be issued;

-

•

-

the dividend rate, or method of calculation of dividends, the dates on which dividends will be payable, whether dividends will be cumulative or

noncumulative and, if cumulative, the dates from which dividends will commence to accumulate;

-

•

-

any redemption or sinking fund provisions;

-

•

-

if other than the currency of the United States, the currency or currencies including composite currencies in which the preferred stock is

denominated and/or in which payments will or may be payable;

-

•

-

any conversion provisions;

-

•

-

whether we have elected to offer depositary shares as described under "Description of Depositary Shares;" and

-

•

-

any other rights, preferences, privileges, limitations and restrictions on the preferred stock.

The

preferred stock will, when issued, be fully paid and non-assessable. Unless otherwise specified in the prospectus supplement, each class of preferred stock will rank equally as to

dividends and liquidation rights in all respects with each other class of preferred stock. The rights of holders of shares of each class of preferred stock will be subordinate to those of our general

creditors.

As

described under "Description of Depositary Shares," we may, at our option, with respect to any class of preferred stock, elect to offer fractional interests in shares of preferred

stock, and provide for the issuance of depositary receipts representing depositary shares, each of which will represent a fractional interest in a share of the class of preferred stock. The fractional

interest will be specified in the prospectus supplement relating to a particular class of preferred stock.

Rank.

Unless otherwise specified in the prospectus supplement, the preferred stock will, with respect to dividend rights and rights upon

our

liquidation, dissolution or winding up of our affairs, rank:

-

•

-

senior to our common stock and to all equity securities ranking junior to such preferred stock with respect to dividend rights or rights upon

our liquidation, dissolution or winding up of our affairs;

19

Table of Contents

-

•

-

on a parity with all equity securities issued by us, the terms of which specifically provide that such equity securities rank on a parity with

the preferred stock with respect to dividend rights or rights upon our liquidation, dissolution or winding up of our affairs; and

-

•

-

junior to all equity securities issued by us, the terms of which specifically provide that such equity securities rank senior to the preferred

stock with respect to dividend rights or rights upon our liquidation, dissolution or winding up of our affairs.

The

term "equity securities" does not include convertible debt securities.

Dividends.

Holders of the preferred stock of each class will be entitled to receive, when, as and if declared by our board of directors,

cash

dividends at such rates and on such dates described in the prospectus supplement. Different classes of preferred stock may be entitled to dividends at different rates or based on different methods of

calculation. The dividend rate may be fixed or variable or both. Dividends will be payable to the holders of record as they appear on our stock books on record dates fixed by our board of directors,

as specified in the applicable prospectus supplement.

Dividends

on any class of preferred stock may be cumulative or noncumulative, as described in the applicable prospectus supplement. If our board of directors does not declare a dividend

payable on a dividend payment date on any class of noncumulative preferred stock, then the holders of that noncumulative preferred stock will have no right to receive a dividend for that dividend

payment date, and we will have no obligation to pay the dividend accrued for that period, whether or not dividends on that class are declared payable on any future dividend payment dates. Dividends on

any class of cumulative preferred stock will accrue from the date we initially issue shares of such class or such other date specified in the applicable prospectus supplement.

No

dividends may be declared or paid or funds set apart for the payment of any dividends on any parity securities unless full dividends have been paid or set apart for payment on the

preferred stock. If full dividends are not paid, the preferred stock will share dividends pro rata with the parity securities.

No

dividends may be declared or paid or funds set apart for the payment of dividends on any junior securities unless full dividends for all dividend periods terminating on or prior to

the date of the declaration or payment will have been paid or declared and a sum sufficient for the payment set apart for payment on the preferred stock.

Liquidation Preference.

Upon any voluntary or involuntary liquidation, dissolution or winding up of our affairs, then, before we make

any

distribution or payment to the holders of any common stock or any other class or series of our capital stock ranking junior to the preferred stock in the distribution of assets upon any liquidation,

dissolution or winding up of our affairs, the holders of each class of preferred stock shall be entitled to receive out of assets legally available for distribution to stockholders, liquidating

distributions in the amount of the liquidation preference per share set forth in the prospectus supplement, plus any accrued and unpaid dividends thereon. Such dividends will not include any

accumulation in respect of unpaid noncumulative dividends for prior dividend periods. Unless otherwise specified in the prospectus supplement, after payment of the full amount of their liquidating