Statement of Changes in Beneficial Ownership (4)

January 04 2018 - 12:02PM

Edgar (US Regulatory)

|

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue.

See

Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Bassani Dominic

|

2. Issuer Name

and

Ticker or Trading Symbol

BION ENVIRONMENTAL TECHNOLOGIES INC

[

BNET

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director

__

X

__ 10% Owner

__

X

__ Officer (give title below)

_____ Other (specify below)

CEO

|

|

(Last)

(First)

(Middle)

C/O BRIGHT CAPITAL, LTD., 64 VILLAGE HILLS DRIVE

|

3. Date of Earliest Transaction

(MM/DD/YYYY)

5/15/2017

|

|

(Street)

DIX HILLS, NY 11746

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_

X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

|

Common Stock

|

|

|

|

|

|

|

|

56577

|

D

|

|

|

Common Stock

|

|

|

|

|

|

|

|

108000

|

I

|

By Daughter

|

|

Common Stock

|

|

|

|

|

|

|

|

354342

|

I

|

By Wife

|

|

Common Stock

|

|

|

|

|

|

|

|

400000

|

I

|

By Daughter (trust)

|

|

Common Stock

|

|

|

|

|

|

|

|

10050

|

I

|

By Roth IRA

|

|

Common Stock

|

5/15/2017

|

|

J

(1)

|

|

260000

|

A

|

$0.00

|

260000

|

I

|

By Roth IRA

|

|

Common Stock

|

5/15/2017

|

|

J

(1)

|

|

260000

|

D

|

$0.00

|

249397

|

I

|

By IRA

|

|

Common Stock

|

5/15/2017

|

|

J

(2)

|

|

235000

|

D

|

$0.00

|

41104

|

I

|

By Wife's IRA

|

|

Common Stock

|

5/15/2017

|

|

J

(2)

|

|

235000

|

A

|

$0.00

|

279382

|

I

|

By Wife's Roth IRA

|

Table II - Derivative Securities Beneficially Owned (

e.g.

, puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3)

|

2. Conversion or Exercise Price of Derivative Security

|

3. Trans. Date

|

3A. Deemed Execution Date, if any

|

4. Trans. Code

(Instr. 8)

|

5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

6. Date Exercisable and Expiration Date

|

7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4)

|

8. Price of Derivative Security

(Instr. 5)

|

9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4)

|

10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4)

|

11. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

(A)

|

(D)

|

Date Exercisable

|

Expiration Date

|

Title

|

Amount or Number of Shares

|

|

Warrants Class CAP2017-5

(3)

|

$0.75

|

11/7/2017

|

|

P

|

|

1765000

|

|

11/7/2017

|

12/31/2020

|

Common Stock

|

1765000

|

$0.05

|

1765000

|

D

|

|

|

Warrants Class CAP2017-5

(3)

|

$0.75

|

12/31/2017

|

|

G

|

|

|

150000

|

11/7/2017

|

12/31/2020

|

Common Stock

|

1615000

|

$0.05

|

1615000

|

D

|

|

|

Convertible Deferred Compensation

|

$0.72

|

11/7/2017

|

|

J

|

|

|

1408583

|

(4)

|

(4)

|

Common Stock

|

1408583

|

(4)

|

0

|

D

|

|

|

Convertible Deferred Compensation

|

$0.66

|

12/31/2017

|

|

A

|

|

46967

|

|

(5)

|

(5)

|

Common Stock

|

46967

|

(5)

|

0

|

D

|

|

|

January 2015 Convertible Note Warrants

|

$1.00

|

11/7/2017

|

|

A

|

|

815472

|

|

(6)

|

(6)

|

Common Stock

|

1630943

|

(6)

|

0

(6)

|

D

|

|

|

January 2015 Convertible Note

(7)

|

$0.50

|

11/30/2017

|

|

J

|

|

1630943

|

|

(7)

|

(7)

|

Warrants

|

3261886

|

(7)

|

0

(7)

|

D

|

|

|

Explanation of Responses:

|

|

(1)

|

The Shares held in the Reporting Person's IRA Account were distributed to the Reporting Person's ROTH IRA Account.

|

|

(2)

|

The Shares held in Reporting Person's Wife's IRA Account were distributed to the Reporting Person's Wife's ROTH IRA Account.

|

|

(3)

|

Each of these purchased warrants includes a potential future 90% "exercise Bonus" (See Notes 9 & 10, Financial Statements, Form 10Q for quarter ended 9/30/2017. These warrants were purchased with a $88,250 Promissory Note which matures on July 1, 2020 and the Company is holding certain securities that the Reporting Person owns as collateral until the promissory note is satisfied.

|

|

(4)

|

This report reflects the cancellation (effective November 7, 2017) (per agreements reached between October 14 - Nov 6) of $1,147,210 of accrued convertible deferred compensation (including November 2017 accrual) which was convertible into 1,408,583 shares of common stock at November 7, 2017 (See Notes 5 & 10, Financial Statements Form 10-Q for quarter ended 9/30/17) (Note that per item 12, Form 10K (for year ended June 30, 2017) $1,043,646 of convertible deferred compensation was convertible into 1,217,194 shares at August 15, 2017). This category of security had been previously reported on Form 4 dated January 5, 2016. Since that date its amount has varied with the addition of accrued deferred compensation, has been reduced when conversions have taken place and has fluctuated in number as the market-based conversion price has varied by formula.

|

|

(5)

|

New monthly accrual of $31,000 compensation commenced during December 2017 convertible at $.66/share (based on market price formula-the amount will vary as the market price of Bion's common stock varies and will increase for future net accruals (including interest), if any).

|

|

(6)

|

The number of warrants included in Units to be received in conversion of existing "January 2015 Convertible Note" (as defined in Form 10-Q, Financial Statements, Note 7 and other SEC filings) has increased from 1/4 to 1/2 per Unit which change increased potential warrants to be received in the event of conversion of Reporting Person's " January 2015 Convertible Note" by 815,472 at November 7, 2017 including interest accruals through November 30, 2017 (with future increases due to subsequent interest accruals). The potential future "exercise bonus" for these warrants (and all other options and warrants owned by the Reporting Person (and his donees/assignees) was increased to 75% from 50%. (See Notes 7, 9 & 10, Financial Statements, Form 10-Q for quarter ended 9/30/17).

|

|

(7)

|

Outstanding "January 2015 Convertible Note" (as defined in Form 10-Q, financial Statements, Note 7 and other SEC filings) has a balance (principal plus accrued interest) of approximately $1,630,943 as of November 30, 2017. The note is convertible at $.50 per Unit into Units consisting of 1 share of common stock and 1/2 warrant ( 3,261,886 Units consisting of 3, 261,886 shares of common stock and 1,630,943 warrants, in aggregate). See Note 6 above. (See Notes 7, 9 & 10, Financial Statements, Form 10-Q for quarter ended 9/30/17. The number of Units will increase as interest accrues.

|

Reporting Owners

|

|

Reporting Owner Name / Address

|

Relationships

|

|

Director

|

10% Owner

|

Officer

|

Other

|

Bassani Dominic

C/O BRIGHT CAPITAL, LTD.

64 VILLAGE HILLS DRIVE

DIX HILLS, NY 11746

|

|

X

|

CEO

|

|

Signatures

|

|

/s/ Dominic Bassani

|

|

1/3/2018

|

|

**

Signature of Reporting Person

|

Date

|

|

Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly.

|

|

*

|

If the form is filed by more than one reporting person,

see

Instruction 4(b)(v).

|

|

**

|

Intentional misstatements or omissions of facts constitute Federal Criminal Violations.

See

18 U.S.C. 1001 and 15 U.S.C. 78ff(a).

|

|

Note:

|

File three copies of this Form, one of which must be manually signed. If space is insufficient,

see

Instruction 6 for procedure.

|

|

Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

|

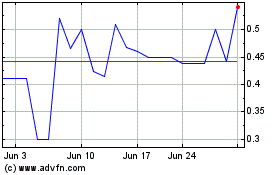

Bion Environmental Techn... (QB) (USOTC:BNET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bion Environmental Techn... (QB) (USOTC:BNET)

Historical Stock Chart

From Apr 2023 to Apr 2024