Banner Corporation (NASDAQ GSM:BANR), the parent company of Banner

Bank and Islanders Bank, today announced that as a result of the

Tax Cuts and Job Act enacted December 22, 2017, it will be required

to revalue its deferred tax assets and liabilities to account for

the future impact of lower corporate tax rates and other provisions

of the legislation.

Based on its preliminary analysis, Banner

expects to record a one-time net tax charge currently estimated to

be between $40 million and $43 million primarily related to the

revaluation of these deferred tax items. This increase in income

tax expense will be reflected in Banner’s operating results for the

fourth quarter of 2017 and will be in addition to the normal

provision for income tax related to pre-tax net operating income.

Banner has not completed its determination of the valuation

adjustments related to these items, and the ultimate amount of the

actual net tax charge and deferred tax asset write down will be

based upon a number of factors, including completion of Banner’s

consolidated financial statements as of and for the year ended

December 31, 2017 and completion of Banner’s 2017 tax returns.

Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable income in the

years in which those temporary differences are expected to be

recognized or settled. The effect on deferred tax assets and

liabilities of a change in tax rates is recognized in income in the

period that includes the enactment date.

In addition, Banner announced a number of

strategic balance sheet initiatives that were implemented during

the fourth quarter of 2017 and designed to keep the Company’s

assets below $10 billion at December 31, 2017 in order to postpone

the adverse impact of the Durbin Amendment to

the Dodd-Frank Act regarding limits on, among other

things, debit card interchange fees. (The Company has

previously disclosed its estimate that the Durbin Amendment will

have a $12 million annualized negative impact on its pre-tax

revenues commencing six months after the calendar year end it

crosses $10 billion in assets.) In particular, Banner sold

approximately $450 million of investment securities in the

available for sale portfolio during the fourth quarter of 2017,

using the proceeds to fund loans and operations and to pay down

certain wholesale borrowings and maturing brokered deposits.

Banner incurred pre-tax net losses of approximately $2.3

million in connection with the sale of these investment securities,

which will produce tax benefits based upon the 2017 marginal

federal income tax rate of 35%. To the extent that the

Company re-leverages its balance sheet in future periods, the net

interest income on replacement securities will be subject to the

new 21% marginal corporate federal income tax rate. In

recent periods Banner has incurred a blended effective federal and

state tax rate of 33% to 34%. As a result of the reduced

marginal federal tax rate Banner anticipates that its blended

effective federal and state tax rate will be approximately 22% to

23% in 2018.

Banner also reduced it equity capital during the

fourth quarter of 2017 through the repurchase of 520,166 shares of

its common stock at an average price per share of $56.99 for a

total purchase price of $29.6 million that further enhanced its

efforts to close the year below $10 billion in total assets.

Banner cautions that the estimates presented in

this press release are preliminary and subject to change. These

preliminary estimates of the impact of tax reform on Banner and

Banner’s strategic initiatives should not be viewed as a substitute

for full financial statements prepared in accordance with U.S.

generally accepted accounting principles, and are not necessarily

indicative of the results to be expected for any future periods.

The estimates have been prepared by management and Banner’s

independent auditors have not completed their audit or review of

such information.

You should not place undue reliance on

forward-looking statements, which speak only as of the date they

are made, and the Company undertakes no obligation to update any

such statements. The Company will provide additional discussion and

analysis and other important information about its fourth quarter

2017 financial results and condition when it reports actual results

after the market closes on Wednesday, January 24, 2018.

Management will host a conference call on Thursday, January 25,

2018 at 8:00 a.m. PST (11:00 a.m. EST) to discuss the

results. The call will also be broadcast live via the

internet.

Interested investors may listen to the call live

at www.bannerbank.com. Investment professionals are invited

to dial (866) 235-9915 to participate in the call. A replay

will be available for one week at (877) 344-7529 using access code

10115119 or at www.bannerbank.com.

About the Company

Banner Corporation is a bank holding company

operating two commercial banks in four Western states through a

network of branches offering a full range of deposit services and

business, commercial real estate, construction, residential,

agricultural and consumer loans. Visit Banner Bank on the Web

at www.bannerbank.com.

Forward-Looking Statements

When used in this press release and in other

documents filed with or furnished to the Securities and Exchange

Commission (the “SEC”), in press releases or other public

stockholder communications, or in oral statements made with the

approval of an authorized executive officer, the words or phrases

“believe,” “will,” “will likely result,” “are expected to,” “will

continue,” “is anticipated,” “estimate,” “project,” “plans,” or

similar expressions are intended to identify “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. You are cautioned not to place undue

reliance on any forward-looking statements, which speak only as of

the date such statements are made and based only on information

then actually known to Banner. Banner does not undertake and

specifically disclaims any obligation to revise any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements. These statements may relate to future financial

performance, strategic plans or objectives, revenues or earnings

projections, or other financial information. By their nature,

these statements are subject to numerous uncertainties that could

cause actual results to differ materially from those anticipated in

the statements and could negatively affect Banner's operating and

stock price performance.

Important factors that could cause actual

results to differ materially from the results anticipated or

projected include, but are not limited to, the following: (1)

the risk that tax charges may be greater than currently

anticipated, (2) the risk that rules affecting revaluing deferred

tax assets and liabilities may change, (3) the risk that future

changes to tax rates may adversely affect the value of Banner’s

deferred tax assets and liabilities, (4) the risk that Banner may

not be able to realize the value of deferred tax assets which

depend on sufficient net income in the future, and (5) the risk

that costs associated with the tax reform legislation may be

greater than expected and other risks detailed from time to time in

our filings with the Securities and Exchange Commission including

our Quarterly Reports on Form 10-Q and our Annual Reports on Form

10-K.

Transmitted on Globe Newswire on January 4, 2018

at 6:00 a.m. PST.

Banner Corporation (NASDAQ GSM:BANR), the parent company of

Banner Bank and Islanders Bank, today announced that as a result of

the Tax Cuts and Job Act enacted December 22, 2017, it will be

required to revalue its deferred tax assets and liabilities to

account for the future impact of lower corporate tax rates and

other provisions of the legislation.

Based on its preliminary analysis, Banner

expects to record a one-time net tax charge currently estimated to

be between $40 million and $43 million primarily related to the

revaluation of these deferred tax items. This increase in income

tax expense will be reflected in Banner’s operating results for the

fourth quarter of 2017 and will be in addition to the normal

provision for income tax related to pre-tax net operating income.

Banner has not completed its determination of the valuation

adjustments related to these items, and the ultimate amount of the

actual net tax charge and deferred tax asset write down will be

based upon a number of factors, including completion of Banner’s

consolidated financial statements as of and for the year ended

December 31, 2017 and completion of Banner’s 2017 tax returns.

Deferred tax assets and liabilities are measured

using enacted tax rates expected to apply to taxable income in the

years in which those temporary differences are expected to be

recognized or settled. The effect on deferred tax assets and

liabilities of a change in tax rates is recognized in income in the

period that includes the enactment date.

In addition, Banner announced a number of

strategic balance sheet initiatives that were implemented during

the fourth quarter of 2017 and designed to keep the Company’s

assets below $10 billion at December 31, 2017 in order to postpone

the adverse impact of the Durbin Amendment to

the Dodd-Frank Act regarding limits on, among other

things, debit card interchange fees. (The Company has

previously disclosed its estimate that the Durbin Amendment will

have a $12 million annualized negative impact on its pre-tax

revenues commencing six months after the calendar year end it

crosses $10 billion in assets.) In particular, Banner sold

approximately $450 million of investment securities in the

available for sale portfolio during the fourth quarter of 2017,

using the proceeds to fund loans and operations and to pay down

certain wholesale borrowings and maturing brokered deposits.

Banner incurred pre-tax net losses of approximately $2.3

million in connection with the sale of these investment securities,

which will produce tax benefits based upon the 2017 marginal

federal income tax rate of 35%. To the extent that the

Company re-leverages its balance sheet in future periods, the net

interest income on replacement securities will be subject to the

new 21% marginal corporate federal income tax rate. In

recent periods Banner has incurred a blended effective federal and

state tax rate of 33% to 34%. As a result of the reduced

marginal federal tax rate Banner anticipates that its blended

effective federal and state tax rate will be approximately 22% to

23% in 2018.

Banner also reduced it equity capital during the

fourth quarter of 2017 through the repurchase of 520,166 shares of

its common stock at an average price per share of $56.99 for a

total purchase price of $29.6 million that further enhanced its

efforts to close the year below $10 billion in total assets.

Banner cautions that the estimates presented in

this press release are preliminary and subject to change. These

preliminary estimates of the impact of tax reform on Banner and

Banner’s strategic initiatives should not be viewed as a substitute

for full financial statements prepared in accordance with U.S.

generally accepted accounting principles, and are not necessarily

indicative of the results to be expected for any future periods.

The estimates have been prepared by management and Banner’s

independent auditors have not completed their audit or review of

such information.

You should not place undue reliance on

forward-looking statements, which speak only as of the date they

are made, and the Company undertakes no obligation to update any

such statements. The Company will provide additional discussion and

analysis and other important information about its fourth quarter

2017 financial results and condition when it reports actual results

after the market closes on Wednesday, January 24, 2018.

Management will host a conference call on Thursday, January 25,

2018 at 8:00 a.m. PST (11:00 a.m. EST) to discuss the

results. The call will also be broadcast live via the

internet.

Interested investors may listen to the call live

at www.bannerbank.com. Investment professionals are invited

to dial (866) 235-9915 to participate in the call. A replay

will be available for one week at (877) 344-7529 using access code

10115119 or at www.bannerbank.com.

About the Company

Banner Corporation is a bank holding company

operating two commercial banks in four Western states through a

network of branches offering a full range of deposit services and

business, commercial real estate, construction, residential,

agricultural and consumer loans. Visit Banner Bank on the Web

at www.bannerbank.com.

Forward-Looking Statements

When used in this press release and in other

documents filed with or furnished to the Securities and Exchange

Commission (the “SEC”), in press releases or other public

stockholder communications, or in oral statements made with the

approval of an authorized executive officer, the words or phrases

“believe,” “will,” “will likely result,” “are expected to,” “will

continue,” “is anticipated,” “estimate,” “project,” “plans,” or

similar expressions are intended to identify “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. You are cautioned not to place undue

reliance on any forward-looking statements, which speak only as of

the date such statements are made and based only on information

then actually known to Banner. Banner does not undertake and

specifically disclaims any obligation to revise any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements. These statements may relate to future financial

performance, strategic plans or objectives, revenues or earnings

projections, or other financial information. By their nature,

these statements are subject to numerous uncertainties that could

cause actual results to differ materially from those anticipated in

the statements and could negatively affect Banner's operating and

stock price performance.

Important factors that could cause actual

results to differ materially from the results anticipated or

projected include, but are not limited to, the following: (1)

the risk that tax charges may be greater than currently

anticipated, (2) the risk that rules affecting revaluing deferred

tax assets and liabilities may change, (3) the risk that future

changes to tax rates may adversely affect the value of Banner’s

deferred tax assets and liabilities, (4) the risk that Banner may

not be able to realize the value of deferred tax assets which

depend on sufficient net income in the future, and (5) the risk

that costs associated with the tax reform legislation may be

greater than expected and other risks detailed from time to time in

our filings with the Securities and Exchange Commission including

our Quarterly Reports on Form 10-Q and our Annual Reports on Form

10-K.

CONTACT:MARK J. GRESCOVICH,PRESIDENT & CEOLLOYD W. BAKER,

CFO(509) 527-3636

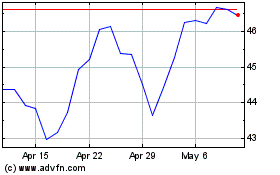

Banner (NASDAQ:BANR)

Historical Stock Chart

From Mar 2024 to Apr 2024

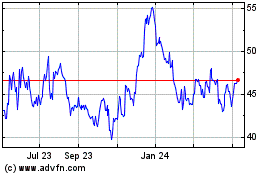

Banner (NASDAQ:BANR)

Historical Stock Chart

From Apr 2023 to Apr 2024