UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D

Under the Securities Exchange Act of

1934

(Amendment No. )*

STRATA

SKIN SCIENCES, INC.

(Name of Issuer)

Common

Stock

(Title of Class of Securities)

86272A107

(CUSIP Number)

Robert Grundstein

Sabby Management, LLC

10 Mountainview Road, Suite 205

Upper Saddle River, New Jersey 07458

United States of America

Tel. No.: (646) 307-4500

(Name, Address and Telephone Number of Person

Authorized to

Receive Notices and Communications)

January

2, 2018

(Date of Event Which Requires Filing of

this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. [X]

Note

: Schedules filed in paper format shall include a

signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are

to be sent.

* The remainder of this cover page shall be filled out for a

reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“

Act

”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

|

1

|

NAMES OF REPORTING PERSONS

Sabby Healthcare Master Fund, Ltd.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

o

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(D) OR 2(E)

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

335,105

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

335,105

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

8.22%

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (SEE INSTRUCTIONS)

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

8.22%

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

Sabby Volatility Warrant Master Fund, Ltd.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

o

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

WC

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(D) OR 2(E)

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

72,096

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

72,096

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

72,096

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (SEE INSTRUCTIONS)

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.77%

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

Sabby Management, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

o

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(D) OR 2(E)

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

407,201

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

407,201

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

407,201

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (SEE INSTRUCTIONS)

x

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99% (1)

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO

|

|

|

|

|

|

|

1

|

NAMES OF REPORTING PERSONS

Hal Mintz

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

o

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

AF

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEM 2(D) OR 2(E)

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

0

|

|

8

|

SHARED VOTING POWER

407,201

|

|

9

|

SOLE DISPOSITIVE POWER

0

|

|

10

|

SHARED DISPOSITIVE POWER

407,201

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

407,201

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN

SHARES (SEE INSTRUCTIONS)

x

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99% (1)

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

|

|

|

|

|

Item 1. Security and Issuer

The name of the issuer is Strata Skin Sciences, Inc., a Delaware

corporation (the “Issuer”). The address of the Issuer's principal office is

100

Lakeside Drive, Suite 100, Horsham, Pennsylvania 19044

, United States of America. This Schedule 13D relates to the Issuer's

Common Stock, par value $0.001 (the “Shares”).

Item 2. Identity and Background

|

|

(a), (f)

|

This joint statement on Schedule 13D is being filed by

Sabby Healthcare Master Fund, Ltd. (the “Sabby Healthcare”), which was formed in the Cayman Islands, Sabby Volatility

Warrant Master Fund, Ltd. (“Sabby Volatility”), which was formed in the Cayman Islands, Sabby Management, LLC (“Sabby

Management”), which was formed in Delaware, and Hal Mintz, a United States citizen. Sabby Healthcare Master Fund, Ltd.,

Sabby Volatility Warrant Master Fund, Ltd., Sabby Management, LLC and Hal Mintz are each a “Reporting Person” and

are collectively referred to herein as the “Reporting Persons.” Mr. Mintz is the manager of Sabby Management, which

is the investment manager of Sabby Healthcare and Sabby Volatility. The Reporting Persons have entered into a Joint Filing Agreement,

dated as of the date hereof, a copy of which is filed with this Schedule 13D as Exhibit 1 (which is incorporated herein by reference),

pursuant to which the Reporting Persons have agreed to file this statement jointly in accordance with the provisions of Rule 13d-1(k)

under the Act.

|

|

|

(b)

|

Residence or business address;

|

Sabby Healthcare

Master Fund, Ltd.

c/o Ogier

Fiduciary Services (Cayman) Limited

89 Nexus Way,

Camana Bay

Grand Cayman

KY1-9007

Cayman Islands

Sabby Volatility

Warrant Master Fund, Ltd.

c/o Ogier

Fiduciary Services (Cayman) Limited

89 Nexus Way,

Camana Bay

Grand Cayman

KY1-9007

Cayman Islands

Sabby Management,

LLC

10 Mountainview

Road, Suite 205

Upper Saddle

River, New Jersey 07458

Hal Mintz

c/o Sabby

Management, LLC

10 Mountainview

Road, Suite 205

Upper Saddle

River, New Jersey 07458

|

|

(c)

|

Mr. Mintz serves as the Manager of Sabby Management. The address of Sabby Management is 10 Mountainview

Road, Suite 205, Upper Saddle River, New Jersey 07458, United States of America.

|

|

|

(d)

|

None of the Reporting Persons have, during the last five years, been convicted

in a criminal proceeding (excluding traffic violations or similar misdemeanors).

|

|

|

(e)

|

None of the Reporting Persons have, during the last five years, been a party

to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or

is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violation with respect to such laws.

|

Item 3.

Source and Amount of Funds or Other Consideration

The

funds for the purchase of Shares came from the investment capital of Sabby Healthcare and Sabby Volatility, which are managed by

Sabby Management.

No

borrowed funds were used to purchase the Shares, other than any borrowed funds used for investment purposes in the ordinary course

of Sabby Healthcare’s and Sabby Volatility’s business.

Item 4. Purpose of Transaction

The Reporting Persons have acquired their Shares of the Issuer

for investment. The Reporting Persons evaluate their respective investments in the Shares on a continual basis.

On January 2, 2018, the Reporting Persons sent to the Board

of Directors of the Issuer a letter (the “Letter”) expressing dissatisfaction with recent actions taken by the Issuer’s

Board of Directors. A copy of the

Letter is filed as Exhibit 2 to this Schedule 13D and is incorporated

herein in its entirety by reference.

Except as set forth in the letter to the Issuer's Board

of Directors filed as an exhibit attached hereto, the Reporting Persons have no present plan or proposal that would relate to or

result in any of the matters set forth in subparagraphs (a)-(j) of Item 4 of Schedule 13D.

The Reporting Persons from time to time intend

to review their investment in the Issuer on the basis of various factors, including the Issuer’s business, financial condition,

results of operations and prospects, general economic and industry conditions, the securities markets in general and those for

the Issuer’s Shares in particular, as well as other developments and other investment opportunities. Based upon such review,

the Reporting Persons will take such actions in the future as the Reporting Persons may deem appropriate in light of the circumstances

existing from time to time. If the Reporting Persons believe that further investment in the Issuer is attractive, whether because

of the market price of the Issuer’s Shares or otherwise, they may acquire shares of common stock or other securities of the

Issuer either in the open market or in privately negotiated transactions. Similarly, depending on market and other factors, the

Reporting Persons may determine to dispose of some or all of the Shares currently owned by the Reporting Persons or otherwise acquired

by the Reporting Persons either in the open market or in privately negotiated transactions.

The Reporting Persons reserve the right to be

in contact with members of the Issuer's management, the members of the Issuer's Board of Directors, other significant shareholders

and others regarding alternatives that the Issuer could employ to increase shareholder value.

The Reporting Persons further reserve the right

to act in concert with any other shareholders of the Issuer, or other persons, for a common purpose should it determine to do so,

and/or to recommend courses of action to the Issuer's management, the Issuer's Board of Directors, the Issuer's shareholders and

others.

Item 5. Interest in Securities

of the Issuer

|

|

(a)

|

As of the date hereof, each of the Sabby Management and Hal Mintz may be deemed to be the beneficial

owners of 407,201 Shares, constituting 9.99% of the Shares. As of the date hereof, Sabby Healthcare may be deemed the beneficial

owner of 335,105 Shares, constituting 8.22% of the Shares. As of the date hereof, Sabby Volatility may be deemed the beneficial

owner of 72,096 Shares, constituting 1.77% of the Shares.*

|

|

|

(b)

|

Each of

Sabby Management and Hal Mintz

(i) has the sole

power to vote or direct the vote of 0 Shares; (ii) has the shared power to vote or direct the vote of

407,201

Shares; (iii) has the sole power to dispose or direct the disposition of 0 Shares; and (iv) has the shared power to dispose

or direct the disposition of

407,201

Shares. Sabby Healthcare (i) has the sole power to

vote or direct the vote of 0 Shares; (ii) has the shared power to vote or direct the vote of

335,105

Shares; (iii) has the sole power to dispose or direct the disposition of 0 Shares; and (iv) has the shared power to dispose or

direct the disposition of

335,105

Shares. Sabby Volatility (i) has the sole power to vote

or direct the vote of 0 Shares; (ii) has the shared power to vote or direct the vote of

72,096

Shares; (iii) has the sole power to dispose or direct the disposition of 0 Shares; and (iv) has the shared power to dispose or

direct the disposition of

72,096

Shares*

|

|

|

(c)

|

The Reporting Persons have engaged in the following transactions in the Issuer’s Common

Stock during the last 60 days:

|

|

Entity

|

Transaction

|

Trade Date

|

Shares

|

Price/

Share

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

11/6/2017

|

2,813

|

$1.20

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

11/7/2017

|

16,033

|

$1.17

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

11/9/2017

|

4,064

|

$1.01

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Sale

|

11/14/2017

|

51,911

|

$1.59

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

11/14/2017

|

11,133

|

$1.24

|

|

Sabby Volatility Warrant Master Fund, Ltd.

|

Open Market Sale

|

11/14/2017

|

6,200

|

$1.67

|

|

Sabby Volatility Warrant Master Fund, Ltd.

|

Open Market Purchase

|

11/14/2017

|

7,450

|

$1.25

|

|

Sabby Volatility Warrant Master Fund, Ltd.

|

Open Market Sale

|

11/14/2017

|

13,020

|

$1.63

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

11/15/2017

|

700

|

$1.25

|

|

Sabby Volatility Warrant Master Fund, Ltd.

|

Open Market Purchase

|

11/15/2017

|

200

|

$1.25

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Sale

|

11/16/2017

|

16,733

|

$1.50

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Sale

|

11/16/2017

|

105

|

$1.51

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Sale

|

11/17/2017

|

5,566

|

$1.49

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Sale

|

11/30/2017

|

300

|

$1.48

|

|

Sabby Volatility Warrant Master Fund, Ltd.

|

Open Market Purchase

|

11/30/2017

|

8,930

|

$1.33

|

|

Sabby Volatility Warrant Master Fund, Ltd.

|

Open Market Purchase

|

12/1/2017

|

2,640

|

$1.33

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/4/2017

|

3,998

|

$1.26

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/5/2017

|

4,904

|

$1.25

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/6/2017

|

600

|

$1.25

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/7/2017

|

13,257

|

$1.22

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/8/2017

|

4,423

|

$1.20

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/8/2017

|

11,743

|

$1.20

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/11/2017

|

4,132

|

$1.21

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/13/2017

|

4,368

|

$1.21

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/14/2017

|

5,800

|

$1.19

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/15/2017

|

2,028

|

$1.21

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Sale

|

12/18/2017

|

3,600

|

$1.38

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Sale

|

12/18/2017

|

5,700

|

$1.37

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/19/2017

|

20,000

|

$1.21

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/21/2017

|

19,227

|

$1.18

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/22/2017

|

5,773

|

$1.20

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/26/2017

|

6,321

|

$1.17

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/26/2017

|

3,263

|

$1.19

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/26/2017

|

8,795

|

$1.18

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/27/2017

|

9,988

|

$1.20

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/27/2017

|

1,200

|

$1.20

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/27/2017

|

648

|

$1.20

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/28/2017

|

4,084

|

$1.23

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/28/2017

|

2,210

|

$1.20

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/29/2017

|

16,067

|

$1.23

|

|

Sabby Healthcare Master Fund, Ltd.

|

Open Market Purchase

|

12/29/2017

|

100

|

$1.20

|

*As calculated in accordance with Rule

13d-3 of the Securities Exchange Act of 1934, as amended, Sabby Management and Hal Mintz each beneficially own 407,201 Shares of

the Issuer, representing approximately 9.99% of the issued and outstanding Shares, based on

4,076,089 shares

issued and outstanding on November 10, 2017

. Sabby Management and Hal Mintz do not directly own any Shares, but each indirectly

owns 407,201 shares of Common Stock. Sabby Management indirectly owns 407,201 shares of Common Stock because it serves as the investment

manager of Sabby Healthcare and Sabby Volatility, which directly hold 335,105 Shares and 72,096 Shares, respectively. Mr. Mintz

indirectly owns 407,201 shares of Common Stock in his capacity as manager of Sabby Management.

Excluded

from each Reporting Person's beneficial ownership are an aggregate of 7,947,182 shares of Common Stock underlying certain

securities including: (i) 859,306 shares of Common Stock underlying warrants owned by Sabby Healthcare, (ii) 4,971,375 shares of

Common Stock issuable upon conversion of Series C Convertible Preferred Stock owned by Sabby Healthcare, (iii) 179,327 shares of

Common Stock underlying warrants owned by Sabby Volatility, and (iv) 1,937,174 shares of Common Stock issuable upon conversion

of Series C Convertible Preferred Stock owned by Sabby Volatility (excluded warrants and Series C Convertible Preferred Stock,

collectively, the “Excluded Securities”). The Excluded Securities are not beneficially owned by the Reporting Persons

due to the beneficial ownership limitation in the form of a conversion cap that precludes the Reporting Persons from converting

or exercising, as applicable, such Excluded Securities, to the extent that the Reporting Persons would, after such conversion or

exercise, collectively beneficially own (as determined in accordance with Section 13(d) of the Securities Exchange Act of 1934,

as amended) in excess of 9.99% of the shares of Common Stock outstanding. The Reporting Persons may choose to convert or exercise,

as applicable, the Excluded Securities, while continuing to comply with such beneficial ownership limitation.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer

The Reporting Persons have entered

into a Joint Filing Agreement, dated as of the date hereof, a copy of which is filed with this Schedule 13D as Exhibit 1 (which

is incorporated herein by reference), pursuant to which the Reporting Persons have agreed to file this statement jointly in accordance

with the provisions of Rule 13d-1(k) under the Act.

Item 7. Material to Be Filed as Exhibits

Exhibit 1 — Joint

Filing Agreement, dated January 2, 2018, among Sabby Healthcare Master Fund, Ltd., Sabby Volatility Warrant Master Fund, Ltd.,

Sabby Management, LLC and Hal Mintz

Exhibit 2 — Letter

to the Board of Directors of the Issuer, dated January 2, 2018

SIGNATURES

After reasonable inquiry and to the best of my knowledge and

belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

January 2, 2018

|

|

|

(Date)

|

|

|

|

|

|

|

|

|

Sabby Healthcare Master Fund, Ltd.

By:

/s/ Harry Thompson

Name: Harry Thompson

Title: Authorized Person of TDF Management

Ltd., a Director

Sabby Volatility Warrant Master Fund, Ltd.

By:

/s/ Harry Thompson

Name: Harry Thompson

Title: Authorized Person of TDF Management

Ltd., a Director

|

|

|

Sabby Management, LLC*

By:

/s/ Robert Grundstein

Name: Robert Grundstein

Title: Chief Operating Officer

|

|

|

|

|

|

|

|

|

/s/ Hal Mintz*

Hal Mintz

|

*This Reporting Person disclaims beneficial

ownership over the securities reported herein except to the extent of its pecuniary interest therein.

EXHIBIT 1

----------

JOINT FILING AGREEMENT

The undersigned hereby agree that this

Statement on Schedule 13D with respect to the beneficial ownership of shares of Common Stock of STRATA Skin Sciences, Inc. is filed

jointly, on behalf of each of them.

Dated: January 2, 2018

|

Sabby Healthcare Master Fund, Ltd.

By:

/s/ Harry Thompson

Name: Harry Thompson

Title: Authorized Person of TDF Management

Ltd., a Director

Sabby Volatility Warrant Master Fund, Ltd.

By:

/s/ Harry Thompson

Name: Harry Thompson

Title: Authorized Person of TDF Management

Ltd., a Director

|

|

Sabby Management, LLC

By:

/s/ Robert Grundstein

Name: Robert Grundstein

Title: Chief Operating Officer

|

|

|

|

|

|

/s/ Hal Mintz

Hal Mintz

|

EXHIBIT 2

January 2, 2018

SABBY MANAGEMENT, LLC

10 Mountainview Road, Suite 205

Upper Saddle River, New Jersey 07458

Members of the Board of Directors

STRATA Skin Sciences,

Inc.

100 Lakeside Drive, Suite

100

Horsham, Pennsylvania

19044

Re:

Recent Actions

by the Board of Directors

Dear Members of the Board

of Directors:

We, Sabby Management, LLC (“Sabby”),

are writing this letter to express our dissatisfaction with certain actions taken by the board of directors of Strata Skin Sciences,

Inc. (“Strata” or the “Company”) in the past few weeks, including declining the proposed investment of

$15 million in equity (the “Proposed Investment”) in Strata by, who we believe to be, a prominent med-tech investor

(the “Proposed Investor”), and instead chose to “evaluate strategic alternatives,” as stated by the Company

in its press release issued on December 18, 2017 (the “Press Release”). We acquired our shares of the Company for investment

purposes, which we continually evaluate. Through our evaluation of our investment, we believe that Strata became a leading provider

of laser therapy for dermatological conditions two and a half years ago when it purchased certain XTRAC laser assets and VTRAC

excimer lamp systems. In the ensuing thirty months, the value of Strata’s equity for shareholders has declined approximately

80%; based on public disclosures, revenue for 2017 is expected to be roughly 20% below 2015 levels; and the CFO recently resigned,

which we believe are a result of mismanagement by the board of directors and a sign of dysfunction in the case of the CFO resignation.

Change in the leadership at the board level may be necessary.

With regard to the Proposed Investment,

we became aware of its terms through the Proposed Investor, who came to us asking if we would vote in favor of the Proposed Investment,

as shareholder approval was necessary for the Proposed Investment and we hold a large minority stake in the Company. We were informed

that the terms of the Proposed Investment recently presented to and rejected by the Strata board were as follows: $15 million in

the form of preferred stock convertible at $1.40 per share (a 10% premium over the then 30 day volume weighted average price of

Strata stock) with no economic preferences or warrants. We strongly believe that this was the best financing alternative Strata

will be able to find anywhere. The Proposed Investment was predicated on major changes to the composition of the board and a change

in CEO leadership. The replacement CEO that the Proposed Investor intended to appoint was personally investing $2 million of the

$15 million raise. However, and to our great dismay, instead of presenting the Proposed Investment to Strata’s shareholders

for consideration, we learned, through the Press Release, that the board decided to explore alternative strategies and to potentially

engage a financial advisor to evaluate all options for the company. Ultimately, it should be up to the shareholders to decide whether

or not the investment is beneficial for the Company and if the current board should remain in place. You failed to provide them

with the opportunity to vote.

We supported the Proposed Investment

even though it would have resulted in substantial dilution of our holdings at a stock price that is 50% below the level at

which we invested in Strata, as we believe the Proposed Investment could reverse what we believe is a negative market

perception and expectations for the Company. We believe the infusion of $15 million in added working capital could enable the

company to invest as necessary in advertising via both traditional means and social media, and other expenditures that have

been cut to virtually zero due to capital constraints. The additional capital could also be used to move

Strata’s Optimal Dosing Technology (“OTD”) program forward – which we believe harbors vast potential

over the coming years, if nurtured through the regulatory process and adopted by patients, payers, and dermatologists.

It is also perplexing that the board voted

LuAnn Via to be chairman of the board (“COB”) in the days following its move to explore strategic alternatives, as,

based on the Company’s disclosure on Form 10-K for the fiscal year ended December 31, 2016, Ms. Via has no experience in

the healthcare industry or (more specifically) in the medical device space and was specifically brought on to the board for her

experience in retail sales and manufacturing and her extensive experience as a CEO and senior

executive of several publicly-listed companies, which we deem is unrelated to the Company’s business

. Without specific

experience in the medical device space, we do not believe that Ms. Via is qualified to serve as the COB.

The Proposed Investor behind the rejected

Proposed Investment is a device specialist with vast experience investing in public companies and helping them grow their businesses.

They have access to executives who have been leaders at multiple healthcare entities that Strata can greatly use as fresh voices

at the board level, and we support both their investment in Strata and their vision for changes in management.

The board specifically noted in the Press

Release that:

“

The

Board has not set a timetable for this process nor has it made any decisions related to any specific strategic alternatives at

this time. There can be no assurance that the exploration of strategic alternatives will result in a transaction. STRATA

does not intend to provide any updates unless or until it determines that further disclosure is appropriate or necessary.”

In

our opinion, the Company has rejected its best path forward without proposing another clear alternative. While we are open minded

regarding viable alternatives for a justifiable path forward, we would like the board to provide

an update by January 22,

2018 on its exploration of its strategic alternatives. At such time, whether or not we receive an update from the Company, we may

reevaluate our investment and may consider taking action, including calling on all shareholders to vote for alternative leadership

at the board level at the next shareholder’s meeting. Please kindly respond to this letter by January 22, 2018 with the board’s

update.

Sincerely,

Sabby Management, LLC

/s/ Hal D. Mintz

By: Hal D. Mintz, Manager

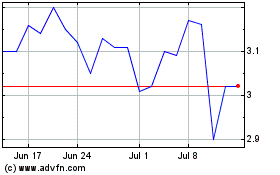

Strata Skin Sciences (NASDAQ:SSKN)

Historical Stock Chart

From Mar 2024 to Apr 2024

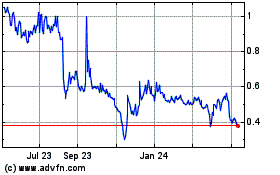

Strata Skin Sciences (NASDAQ:SSKN)

Historical Stock Chart

From Apr 2023 to Apr 2024