Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

January 02 2018 - 7:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

January 1, 2018

ARCHROCK, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-33666

|

|

74-3204509

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

9807 Katy Freeway, Suite 100

|

|

|

|

Houston, Texas

|

|

77024

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(281) 836-8000

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

x

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 1.01.

Entry Into a Material Definitive Agreement.

On January 1, 2018, Archrock, Inc. (“Archrock”), Archrock Partners, L.P., a Delaware limited partnership (the “Partnership”), Archrock General Partner, L.P., a Delaware limited partnership and the general partner of the Partnership (the “General Partner”), and Archrock GP LLC, a Delaware limited liability company and the general partner of the General Partner (the “Managing GP”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which a wholly owned subsidiary of Archrock will merge with and into the Partnership, with the Partnership surviving as an indirect wholly owned subsidiary of Archrock (the “Merger”).

Under the terms of the Merger Agreement, at the effective time of the Merger, each outstanding common unit of the Partnership (each, a “Partnership Common Unit”) other than Partnership Common Units owned by Archrock and its subsidiaries (each, a “Public Common Unit”) will be converted into the right to receive 1.40 shares of common stock, par value $0.01 per share, of Archrock (the “Archrock Common Stock”). In connection with the Merger, all of the Partnership’s incentive distribution rights, which are owned indirectly by Archrock, will be canceled and will cease to exist.

The board of directors of Archrock and the board of directors of Managing GP (the “Managing GP Board”) have each approved the Merger Agreement. The Conflicts Committee of the Managing GP Board (the “Conflicts Committee”) and the Managing GP Board (acting upon the recommendation of the Conflicts Committee) have determined that the Merger is in the best interests of the Partnership, including the holders of Public Common Units, and each has resolved to recommend that the holders of the Partnership Common Units approve the Merger Agreement. In addition, the Archrock Board has resolved to recommend that Archrock’s stockholders approve the issuance of Archrock Common Stock in connection with the Merger (the “Archrock Share Issuance”).

Archrock has agreed not to directly or indirectly solicit competing acquisition proposals or to enter into discussions concerning, or provide confidential information in connection with, any unsolicited alternative business combinations, subject to certain exceptions with respect to unsolicited proposals received by Archrock. In addition, each of Archrock and the Partnership has agreed to cause its stockholder or unitholder meeting, as applicable, to be held to approve the Archrock Share Issuance, in the case of Archrock, and to approve the Merger Agreement and the Merger, in the case of the Partnership. However, the Archrock board may, subject to certain conditions, change its recommendation in favor of approval of the Archrock Share Issuance if, in connection with receipt of a superior proposal, it determines in good faith that failure to take such action would be inconsistent with its duties under applicable law. In connection with the unitholder meeting to be held to approve the Merger Agreement and the Merger, Archrock has agreed to vote all Partnership Common Units that it beneficially owns at the time of such unitholder meeting in favor of approving the Merger Agreement and the Merger, subject to certain conditions. In addition, the Managing GP Board or the Conflicts Committee may, subject to certain conditions, change its recommendation in favor of approval of the Merger Agreement and the Merger if it determines in good faith that failure to take such action would be inconsistent with its duties under the Partnership’s partnership agreement and applicable law.

The Merger Agreement contains customary representations and warranties from the parties, and each party has agreed to customary covenants, including, among others, covenants relating to (1) the conduct of business during the interim period between the execution of the Merger Agreement and the effective time of the Merger and (2) the obligation to use reasonable best efforts to cause the Merger to be consummated.

Completion of the Merger is subject to certain customary conditions, including, among others: (1) approval of the Merger Agreement by holders of a majority of the outstanding Partnership Common Units; (2) approval of the Archrock Share Issuance by a majority of the shares of Archrock Common Stock present in person or represented by proxy at the special meeting of Archrock stockholders; (3) expiration or termination of applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act, if required; (4) there being no law or injunction prohibiting consummation of the transactions contemplated under the Merger Agreement; (5) the effectiveness of a registration statement on Form S-4 relating to the Archrock Share Issuance; (6) approval for listing on the New York Stock Exchange of the shares of Archrock Common Stock issuable pursuant to the Archrock Share Issuance; (7) subject to specified materiality standards, the accuracy of certain representations and warranties of the other party; and (8) compliance by the other party in all material respects with its covenants.

2

The Merger Agreement provides for certain termination rights for both Archrock and the Partnership. The Merger Agreement provides that upon termination of the Merger Agreement under certain circumstances, Archrock will be obligated to either (1) pay the Partnership a termination fee equal to $10 million or (2) reimburse the Partnership for its expenses in an amount not to exceed $2 million. The Merger Agreement also provides that upon termination of the Merger Agreement under certain circumstances, the Partnership will be obligated to reimburse Archrock for its expenses in an amount not to exceed $2 million.

The Merger Agreement is attached hereto as Exhibit 2.1 and is incorporated into this Item 1.01 by reference. The foregoing summary has been included to provide investors and security holders with information regarding the terms of the Merger Agreement and is qualified in its entirety by the terms and conditions of the Merger Agreement. It is not intended to provide any other factual information about Archrock, the Partnership or their respective subsidiaries and affiliates. The Merger Agreement contains representations and warranties by each of the parties to the Merger Agreement, which were made only for purposes of the Merger Agreement and as of specified dates. The representations, warranties and covenants in the Merger Agreement were made solely for the benefit of the parties to the Merger Agreement; may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the Merger Agreement instead of establishing these matters as facts; and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of Archrock, the Partnership or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in Archrock’s or the Partnership’s public disclosures.

Item 7.01.

Regulation FD Disclosure.

Archrock and the Partnership issued a joint press release on January 2, 2018 announcing the execution of the Merger Agreement. A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 7.01 by reference. On January 2, 2018, Archrock also posted to its website an investor presentation related to the Merger, which is included as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated into this Item 7.01 by reference.

The information set forth in this Item 7.01 and the attached Exhibit 99.1 and Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number

|

|

Description

|

|

2.1

|

|

Agreement and Plan of Merger, dated as of January 1, 2018, by and among Archrock, Inc., Archrock GP LLC, Archrock General Partner, L.P. and Archrock Partners, L.P.*

|

|

99.1

|

|

Press Release dated January 2, 2018

|

|

99.2

|

|

Investor Presentation dated January 2, 2018

|

*

The schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K and will be provided to the Securities and Exchange Commission upon request.

Forward-Looking Statements

All statements in this report (and oral statements made regarding the subjects of this communication) other than historical facts are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties and factors, many of which are outside the control of Archrock and the Partnership, which could cause actual results to differ materially from such statements. Forward-looking information includes, but is not limited to: statements regarding the expected benefits of the proposed transaction to the Partnership and its unitholders; the anticipated completion of the proposed transaction and the timing thereof; the expected future growth, dividends and distributions of the combined company; and plans and objectives of management for future operations. While Archrock believes that the assumptions concerning future events are reasonable, it cautions that there are inherent difficulties in predicting certain important factors that could impact the future performance or results of its business. Among the factors that could cause results to differ materially from those indicated by such forward-looking statements are: the failure to realize the anticipated costs savings, synergies and other benefits of the transaction; the possible diversion of management time on transaction-related issues; the risk that the requisite approvals to complete the transaction are not obtained; local, regional and national economic conditions and the impact they may have on Archrock, the Partnership and their customers; changes in tax laws that impact master limited partnerships; conditions in the oil and gas industry, including a sustained decrease in the level of supply or demand for oil or natural gas or a sustained decrease in the price of oil or natural gas; the financial condition of Archrock’s and the Partnership’s customers; any non-performance by customers of their contractual obligations; changes in customer, employee or supplier relationships resulting from the transaction; changes in safety, health, environmental and other regulations; the results of any reviews, investigations or other proceedings by government authorities; the results of any shareholder actions that may be filed relating to the restatement of Archrock’s financial statements; the potential additional costs relating to Archrock’s restatement, cost-sharing with Exterran Corporation and to addressing any reviews, investigations or other proceedings by government authorities or shareholder actions; and the performance of the Partnership.

These forward-looking statements are also affected by the risk factors, forward-looking statements and challenges and uncertainties described in each of Archrock’s and the Partnership’s Annual Reports on Form 10-K for the year ended December 31, 2016, and those set forth from time to time in each party’s filings with the SEC, which are available at www.archrock.com. Except as required by law, Archrock and the Partnership expressly disclaim any intention or obligation to revise or update any forward-looking statements whether as a result of new information, future events or otherwise.

3

No Offer or Solicitation

This report is for informational purposes only and shall not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the proposed transaction or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Additional Information and Where You Can Find It

This report does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. The proposed merger between Archrock and the Partnership will be submitted to Archrock’s shareholders and the Partnership’s unitholders for their consideration.

In connection with the proposed transaction, Archrock will file a registration statement on Form S-4, including a joint proxy statement/prospectus of Archrock and the Partnership, with the SEC. INVESTORS AND SECURITY HOLDERS OF ARCHROCK AND THE PARTNERSHIP ARE ADVISED TO CAREFULLY READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION, THE PARTIES TO THE TRANSACTION AND THE RISKS ASSOCIATED WITH THE TRANSACTION. A definitive joint proxy statement/prospectus will be sent to security holders of Archrock and the Partnership in connection with Archrock’s shareholder meeting and the Partnership’s unitholder meeting. Investors and security holders may obtain a free copy of the joint proxy statement/prospectus (when available) and other relevant documents filed by Archrock and the Partnership with the SEC from the SEC’s website at www.sec.gov. Security holders and other interested parties will also be able to obtain, without charge, a copy of the joint proxy statement/prospectus and other relevant documents (when available) from www.archrock.com under the tab “Investors” and then under the heading “SEC Filings.” Security holders may also read and copy any reports, statements and other information filed with the SEC at the SEC public reference room at 100 F Street N.E., Room 1580, Washington D.C. 20549. Please call the SEC at (800) 732-0330 or visit the SEC’s website for further information on its public reference room.

Archrock, the Partnership and their respective directors, executive officers and certain other members of management may be deemed to be participants in the solicitation of proxies from their respective security holders with respect to the transaction. Information about these persons is set forth in Archrock’s proxy statement relating to its 2017 Annual Meeting of Stockholders, which was filed with the SEC on March 14, 2017, and the Partnership’ Annual Report on Form 10-K for the year ended December 31, 2016, which was filed with the SEC on February 23, 2017, and subsequent statements of changes in beneficial ownership on file with the SEC. Security holders and investors may obtain additional information regarding the interests of such persons, which may be different than those of the respective companies’ security holders generally, by reading the joint proxy statement/prospectus and other relevant documents regarding the transaction, which will be filed with the SEC.

4

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized

|

|

ARCHROCK, INC.

|

|

|

|

|

|

|

|

|

|

January 2, 2018

|

By:

|

/s/ Stephanie C. Hildebrandt

|

|

|

|

Stephanie C. Hildebrandt

|

|

|

|

Senior Vice President, General Counsel and Secretary

|

5

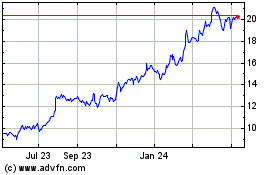

Archrock (NYSE:AROC)

Historical Stock Chart

From Mar 2024 to Apr 2024

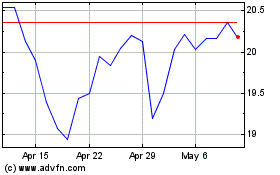

Archrock (NYSE:AROC)

Historical Stock Chart

From Apr 2023 to Apr 2024