UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM F-10

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

ASANKO GOLD INC.

(Exact

name of Registrant as specified in its charter)

|

British Columbia

|

1040

|

Not Applicable

|

|

(Province or other jurisdiction

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

|

of incorporation or organization)

|

Classification Code Number)

|

Identification Number)

|

Suite 680, 1066 West Hastings Street

Vancouver,

British Columbia, Canada V6E 3X2

Telephone: (604) 683-8193

(Address and telephone number of Registrant’s principal executive

offices)

Puglisi & Associates

850 Library Avenue, Suite

204

Newark, Delaware

United States 19711

Tel:

(302) 738-6680

(Name, address (including zip code) and telephone

number (including area code) of agent for service in the United States)

|

Copy to:

|

|

Peter Breese, Chief Executive Officer

|

Bernie Zinkhofer

|

|

Fausto Di Trapani, Chief Financial Officer

|

Michael Taylor

|

|

Asanko Gold Inc.

|

McMillan LLP

|

|

Suite 680, 1066 West Hastings Street

|

1500 – 1055 West Georgia Street

|

|

Vancouver, British Columbia

|

Vancouver, British Columbia

|

|

Canada V6E 3X2

|

Canada V6E 4N7

|

|

Telephone: (604) 683-8193

|

Telephone: (604) 689-9111

|

Approximate date of commencement of proposed sale of the

securities to the public:

From time to time after this Registration Statement becomes

effective.

Province of British Columbia, Canada

(Principal jurisdiction regulating this offering)

It is proposed that this filing shall become effective (check

appropriate box below):

|

A.

|

[ ]

|

upon filing with the Commission, pursuant to Rule 467(a)

(if in connection with an offering being made contemporaneously in the

United States and Canada).

|

|

|

|

|

|

B.

|

[X]

|

at some future date (check appropriate box below)

|

|

|

1.

|

[ ]

|

pursuant to Rule 467(b) on (

date

) at (

time

)

(designate a time not sooner than 7 calendar days after

filing).

|

|

|

2.

|

[ ]

|

pursuant to Rule 467(b) on (

date

) at (

time

)

(designate a time 7 calendar days or sooner after filing) because the

securities regulatory authority in the review jurisdiction has issued a

receipt or notification of clearance on (

date

).

|

|

|

|

|

|

|

|

3.

|

[ ]

|

pursuant to Rule 467(b) as soon as practicable after

notification of the Commission by the Registrant or the Canadian

securities regulatory authority of the review jurisdiction that a receipt

or notification of clearance has been issued with respect

hereto.

|

|

|

|

|

|

|

|

4.

|

[X]

|

after the filing of the next amendment to this Form (if

preliminary material is being filed).

|

If any of the securities being registered on this form are to

be offered on a delayed or continuous basis pursuant to the home jurisdiction’s

shelf prospectus offering procedures, check the following box. [X]

CALCULATION OF REGISTRATION FEE

Title of each

class of securities

to be registered

|

Amount to be

registered

(1)

|

Proposed maximum

offering price per

unit

|

Proposed maximum

aggregate offering

price

(3)

|

Amount of

registration

fee

(3)(4)

|

Common Shares, no par value

Common Share Purchase

Warrants

Subscription Receipts Debt Securities Units

|

|

|

|

|

|

Total

|

US$300,000,000

|

(2)

|

US$300,000,000

|

US$37,350

|

|

(1)

|

Includes an indeterminate number of common shares, common

share purchase warrants, debt securities, subscription receipts for any

combination thereof or units of any combination thereof. The securities

which may be offered pursuant to this registration statement include,

pursuant to Rule 416 of the Securities Act of 1933, as amended (the

“

U.S. Securities Act

”), such additional number of common shares of

the Registrant that may become issuable as a result of any stock split,

stock dividends or similar event.

|

|

|

|

|

(2)

|

The proposed maximum initial offering price per security

will be determined, from time to time, by the Registrant in connection

with the sale of the securities under this Registration

Statement.

|

|

|

|

|

(3)

|

The estimated registration fee for the securities has

been calculated pursuant to Rule 457(o).

|

|

|

|

|

(4)

|

Based on the SEC’s registration fee of $124.50 per

$1,000,000 of securities registered.

|

The Registrant hereby amends this registration statement on

such date or dates as may be necessary to delay its effective date until the

registration statement shall become effective as provided in Rule 467 under the

U.S. Securities Act, or on such date as the Commission, acting pursuant to

Section 8(a) of the U.S. Securities Act, may determine.

A–1

PART I

INFORMATION REQUIRED TO BE DELIVERED TO OFFEREES OR

PURCHASERS

I-1

Information contained herein is subject

to completion or amendment. A registration statement relating to these

securities has been filed with the U.S. Securities and Exchange Commission.

These securities may not be sold nor may offers to buy be accepted prior to the

time the registration statement becomes effective. This prospectus shall not

constitute an offer to sell or the solicitation of an offer to buy nor shall

there be any sale of these securities in any U.S. state in which such offer,

solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such U.S. state.

No securities regulatory authority has expressed an opinion

about these securities and it is an offence to claim otherwise. This short form

base shelf prospectus constitutes a public offering of these securities only in

those jurisdictions where they may be lawfully offered for sale and therein only

by persons permitted to sell such securities.

Information has been incorporated by reference in this

prospectus from documents filed with the securities commissions or similar

authorities in Canada.

Copies of the documents incorporated herein by

reference may be obtained on request without charge from The Company Inc., Suite

680, 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X2 (Telephone

778-729-0627) (Attn: the Chief Financial Officer), and are also available

electronically at

www.sedar.com

.

|

PRELIMINARY SHORT FORM BASE SHELF PROSPECTUS

|

|

New Issue

|

December 28, 2017

|

US$300,000,000

Common Shares

Warrants

Subscription

Receipts

Units

Debt Securities

This short-form base shelf prospectus (the “

Prospectus

”)

relates to the offering for sale of common shares (the “

Common Shares

”),

warrants (the “

Warrants

”), subscription receipts (the “

Subscription

Receipts

”), debt securities (the “

Debt Securities

”), or any

combination of such securities (the “

Units

”) (all of the foregoing,

collectively, the “

Securities

”) by Asanko Gold Inc. (the “

Company

”

or “

Asanko

”) from time to time, during the 25-month period that the

Prospectus, including any amendments hereto, remains effective, in one or more

series or issuances, with a total offering price of the Securities in the

aggregate, of up to US$300,000,000. The Securities may be offered in amounts at

prices to be determined based on market conditions at the time of the sale and

set forth in an accompanying prospectus supplement (a “

Prospectus

Supplement

”). In addition, the Securities may be offered and issued in

consideration for the acquisition of other businesses, assets or securities by

the Company or a subsidiary of the Company. The consideration for any such

acquisition may consist of any of the Securities separately, a combination of Securities or any combination of,

among other things, Securities, cash and assumption of liabilities.

Investing in the Securities of the Company involves a high

degree of risk. You should carefully review the risks outlined in this

Prospectus (together with any Prospectus Supplement) and in the documents

incorporated by reference in this Prospectus and consider such risks in

connection with an investment in such Securities. See “Risk Factors”.

This offering is made by a Canadian issuer that is

permitted, under a multijurisdictional disclosure system adopted by the United

States and Canada (“MJDS”), to prepare this Prospectus in accordance with

Canadian disclosure requirements. Prospective investors in the United States

should be aware that such requirements are different from those of the United

States. Financial statements included or incorporated by reference herein have

been prepared in accordance with International Financial Reporting Standards

(“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and

may not be comparable to financial statements of United States companies. Our

financial statements are subject to Canadian generally accepted auditing

standards and auditor independence standards, in addition to the independence

standards of the Public Company Accounting Oversight Board (United States) and

the United States Securities and Exchange Commission (“SEC”).

Prospective investors should be aware that the acquisition

of the Securities described herein may have tax consequences both in the United

States and in Canada. Such consequences for investors who are resident in, or

citizens of, the United States may not be described fully herein. Prospective

investors should read the tax discussion contained in the applicable Prospectus

Supplement with respect to a particular offering of Securities.

The enforcement by investors of civil liabilities under the

United States federal securities laws may be affected adversely by the fact that

the Company is incorporated under the laws of British Columbia, Canada, that the

majority of its officers and directors are residents of Canada or other foreign

countries, that none of the experts named in the registration statement are

residents of the United States, and that all of the assets of the Company and

said persons are located outside the United States.

NEITHER THE SEC NOR ANY STATE OR CANADIAN SECURITIES

COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR DETERMINED IF THIS

PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A

CRIMINAL OFFENCE.

The specific terms of the Securities with respect to a

particular offering will be set out in one or more Prospectus Supplements and

may include, where applicable: (i) in the case of Common Shares, the number of

Common Shares offered, the offering price and any other specific terms; (ii) in

the case of Warrants, the offering price, the designation, number and terms of

the Common Shares issuable upon exercise of the Warrants, any procedures that

will result in the adjustment of these numbers, the exercise price, dates and

periods of exercise, the currency in which the Warrants are issued and any other

specific terms; (iii) in the case of Subscription Receipts, the number of

Subscription Receipts being offered, the offering price, the procedures for the

exchange of the Subscription Receipts for Common Shares or Warrants, as the case

may be, and any other specific terms; (iv) in the case of Debt Securities, the

specific designation, aggregate principal amount, the currency or the currency

unit for the Debt Securities being offered, the maturity, interest provisions,

authorized denominations, offering price, covenants, events of default, any

terms for redemption or retraction, any exchange or conversion terms, whether

the Debt Securities are secured, affiliate-guaranteed, senior or subordinated

and any other terms specific to the Debt Securities being offered; and (v) in

the case of Units, the designation, number and terms of the Common Shares,

Warrants, Subscription Receipts or Debt Securities comprising the Units. Where

required by statute, regulation or policy, and where Securities are offered in

currencies other than Canadian dollars, appropriate disclosure of foreign

exchange rates applicable to the Securities will be included in the Prospectus

Supplement describing the Securities.

The Debt Securities that may be offered may be guaranteed by

certain direct and indirect subsidiaries of Asanko with respect to the payment

of the principal, premium, if any, and interest on the Debt Securities. The

Company expects that any guarantee provided in respect of senior Debt Securities

would constitute a senior and unsecured obligation of the applicable guarantor,

subordinated to current debt unless it is discharged by the proceeds of Debt

Securities. In order to comply with certain registration

statement form requirements under U.S. law, such subsidiary guarantees may be

guaranteed by Asanko on a senior and unsecured basis.

For a more detailed

description of the Debt Securities that may be offered, see “Description of

Securities – Description of Debt Securities - Guarantees”, below.

ii

All information permitted under applicable securities

legislation to be omitted from the Prospectus will be contained in one or more

Prospectus Supplement(s) that will be delivered to purchasers together with the

Prospectus, except in cases where an exemption from such delivery requirements

have been obtained. Each Prospectus Supplement will be incorporated by reference

into the Prospectus for the purposes of applicable securities legislation as of

the date of the Prospectus Supplement and only for the purposes of the

distribution of the Securities to which the Prospectus Supplement pertains.

Investors should read the Prospectus and any applicable Prospectus Supplement

carefully before investing in the Company’s Securities.

This Prospectus constitutes a public offering of the Securities

only in those jurisdictions where they may be lawfully offered for sale and only

by persons permitted to sell the Securities in such jurisdictions. We may offer

and sell Securities to, or through, underwriters or dealers, directly to one or

more other purchasers, or through agents pursuant to exemptions from

registration or qualification under applicable securities laws. A Prospectus

Supplement relating to each issue of Securities will set forth the names of any

underwriters, dealers or agents involved in the offering and sale of the

Securities and will set forth the terms of the offering of the Securities, the

method of distribution of the Securities, including, to the extent applicable,

the proceeds to us and any fees, discounts, concessions or other compensation

payable to the underwriters, dealers or agents, and any other material terms of

the plan of distribution. In connection with any offering of the Securities,

other than an “at-the-market distribution” (as defined under applicable Canadian

securities legislation) unless otherwise specified in a Prospectus Supplement,

the underwriters or agents may over-allot or effect transactions which stabilize

or maintain the market price of the Securities offered at a higher level than

that which might exist in the open market. Such transaction, if commenced, may

be interrupted or discontinued at any time. See “Plan of Distribution”.

In connection with any offering of the Securities (unless

otherwise specified in a Prospectus Supplement), other than an “at-the-market

distribution”, the underwriters may over-allot or effect transactions which

stabilize or maintain the market price of the Securities offered at a level

above that which might otherwise prevail in the open market. Such transactions,

if commenced, may be discontinued at any time. No underwriter or dealer involved

in an “at-the-market distribution” under this Prospectus, no affiliate of such

an underwriter or dealer and no person or company acting jointly or in concert

with such an underwriter or dealer will over-allot securities in connection with

such distribution or effect any other transactions that are intended to

stabilize or maintain the market price of the Securities. See “Plan of

Distribution”.

No underwriter has been involved in the preparation of the

Prospectus or performed any review of the contents of the Prospectus.

Michael Price, Peter Breese, William Smart, Collin Steyn, Hugo

Truter and Josephat Zvapia, each a director and/or an officer of the Company,

and Charles Muller, David Morgan, Doug Heher, Malcolm Titley, Thomas

Obiri-Yeboah, Glenn Bezuidenhout, Phil Bentley and Dr Godknows Njowa, each named

as an expert herein, reside outside of Canada. Each of the above individuals has

appointed McMillan LLP, located at Suite 1500 – 1055 West Georgia Street,

Vancouver, British Columbia V6E 4N7, as his agent for service of process in

British Columbia. Purchasers are advised that it may not be possible for

investors to enforce judgments obtained in Canada against any such person, even

though they have each appointed an agent for service of process.

iii

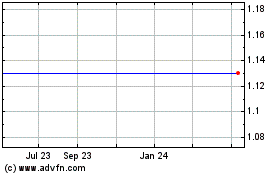

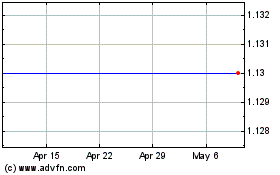

The Company’s outstanding Common Shares are listed for trading

on the Toronto Stock Exchange (the “

TSX

”) under the trading symbol “AKG”

and on the NYSE American Stock Exchange, formerly NYSE MKT (“

NYSE

American

”) under the trading symbol “AKG”. The closing price of the

Company’s Common Shares on the TSX and NYSE American on December 27, 2017, the

last trading day before the date of the Prospectus, was C$0.81 per Common Share

and US$0.6456 per Common Share, respectively.

Unless otherwise disclosed in

any applicable Prospectus Supplement, the Debt Securities, the Warrants, the

Subscription Receipts and the Units will not be listed on any securities

exchange. Unless the Securities are disclosed to be listed, there will be no

market through which these Securities may be sold and purchasers may not be able

to resell these Securities purchased under this Prospectus. This may affect the

pricing of such Securities in the secondary market, the transparency and availability of trading prices, the

liquidity of such Securities, and the extent of issuer regulation.

The head office of the Company is located at Suite 680, 1066

West Hastings Street, Vancouver, British Columbia, V6E 3X2. The registered

office of the Company is located at Suite 1500 – 1055 West Georgia Street,

Vancouver, British Columbia V6E 4N7.

iv

TABLE OF CONTENTS

You should rely only on the information contained in or

incorporated by reference into this Prospectus and in any applicable Prospectus

Supplement. The Company has not authorized anyone to provide you with different

information. The Company is not making any offer of these Securities in any

jurisdiction where the offer is not permitted. You should not assume that the

information contained in this Prospectus and any Prospectus Supplement is

accurate as of any date other than the date on the front of those documents or

that any information contained in any document incorporated by reference is

accurate as of any date other than the date of that document.

Unless the context otherwise requires, references in this

Prospectus and any Prospectus Supplement to “we”, “our”, “us”, “Asanko” or the

“Company” refer to Asanko Gold Inc. and each of its material subsidiaries.

v

- 1 -

DOCUMENTS INCORPORATED BY REFERENCE

We incorporate by reference into this Prospectus documents

that we have filed with securities commissions or similar authorities in Canada,

which have also been filed with, or furnished to, the United States Securities

and Exchange Commission (the “SEC”).

You may obtain copies of the documents

incorporated herein by reference without charge from Asanko Gold Inc., Suite

680, 1066 West Hastings Street, Vancouver, British Columbia, V6E 3X2 (Telephone

778-729-0627) Attn: Chief Financial Officer. These documents are also available

electronically from the website of Canadian Securities Administrators at

www.sedar.com

(“

SEDAR

”) and from the EDGAR filing website of the

United States Securities Exchange Commission at www.sec.gov (“

EDGAR

”).

The Company’s filings through SEDAR and EDGAR are not incorporated by reference

in the Prospectus except as specifically set out herein.

The following documents filed on SEDAR with the securities

regulatory authorities in the jurisdictions in Canada in which the Company is a

reporting issuer are specifically incorporated by reference into and, except

where herein otherwise provided, form an integral part of, this Prospectus:

|

|

1.

|

our annual information form for the year ended December

31, 2016, dated as at March 15, 2017 and filed on March 16, 2017 (our

“

2016 AIF

”);

|

|

|

|

|

|

|

2.

|

our consolidated financial statements for the fiscal

years ended December 31, 2016 and 2015 comprised of the consolidated

balance sheets as at December 31, 2016 and 2015 and the consolidated

statements of operations and comprehensive income (loss), cash flows and

changes in equity for the years then ended, and the notes thereto and the

report of the independent auditor thereon, as filed March 16,

2017;

|

|

|

|

|

|

|

3.

|

our management's discussion and analysis for the year

ended December 31, 2016, filed March 16, 2017 (our “

2016 Annual

MD&A

”);

|

|

|

|

|

|

|

4.

|

our condensed consolidated interim financial statements

for the three and nine months ended September 30, 2017 and 2016 and the

notes thereto, filed November 3, 2017;

|

|

|

|

|

|

|

5.

|

our management’s discussion and analysis for the three

and nine months ended September 30, 2017 and 2016, filed November 3, 2017

(our “

Q3 2017 MD&A

”);

|

|

|

|

|

|

|

6.

|

the management information circular dated April 28, 2017

with respect to the annual general and special meeting of our shareholders

held on June 9, 2017; and

|

|

|

|

|

|

|

7.

|

the technical report titled “Definitive Feasibility

Study” in relation our Asanko Gold Mine filed on SEDAR July 18, 2017 and

as amended and restated on December 20, 2017 and filed on SEDAR on December 27, 2017 (our

“

12/17/DFS

”).

|

In addition, we also incorporate by reference into this

Prospectus any document of the types referred to in the preceding paragraph

(excluding press releases) or of any other type required to be incorporated by

reference into a short form prospectus pursuant to National Instrument 44- 101 –

Short Form Prospectus Distributions

that are filed by us with a

securities commission or similar authority in Canada after the date of this

Prospectus and prior to the termination of the offering under any Prospectus

Supplement. As discussed below, this Prospectus may also expressly update or

revise any document incorporated by reference and such document should be deemed

so amended or updated hereby.

- 2 -

To the extent that any document or information incorporated by

reference into the Prospectus is included in any report on Form 6-K, Form 40-F,

Form 20-F, Form 10-K, Form 10-Q or Form 8-K (or any respective successor form)

that is filed with or furnished to the SEC after the date of the Prospectus,

such document or information shall be deemed to be incorporated by reference as

an exhibit to the registration statement of which the Prospectus forms a part.

In addition, we may incorporate by reference into the Prospectus, or the

registration statement of which it forms a part, other information from

documents that we file with or furnish to the SEC pursuant to Section 13(a) or

15(d) of the United States Securities Exchange Act of 1934, as amended (the

“

Exchange Act

”), if and to the extent expressly provided therein.

Any statement contained in a document incorporated or deemed

to be incorporated by reference herein will be deemed to be modified or

superseded for the purposes of the Prospectus to the extent that a statement

contained herein or in any other subsequently filed document that is also

incorporated or is deemed to be incorporated by reference herein modifies or

supersedes such statement. The modifying or superseding statement need not state

that it has modified or superseded a prior statement or include any other

information set forth in the document that it modifies or supersedes. The making

of a modifying or superseding statement will not be deemed an admission for any

purpose that the modified or superseded statement, when made, constituted a

misrepresentation, an untrue statement of a material fact or an omission to

state a material fact that is required to be stated or that is necessary to make

a statement not misleading in light of the circumstances in which it was made.

Any statement so modified or superseded will not be deemed, except as so

modified or superseded, to constitute a part of the Prospectus.

All information permitted under applicable securities

legislation to be omitted from the Prospectus will be contained in one or more

Prospectus Supplements that will be delivered to purchasers together with the

Prospectus, except in cases where an exemption from such delivery requirements

has been obtained. A Prospectus Supplement containing the specific terms of an

offering of Securities will be delivered to purchasers of such Securities

together with this Prospectus and will be deemed to be incorporated by reference

into this Prospectus as of the date of such Prospectus Supplement, but only for

the purposes of the offering of Securities covered by that Prospectus

Supplement. Investors should read the Prospectus and any applicable Prospectus

Supplement carefully before investing in the Company’s Securities.

Any template version of any “marketing materials” (as such term

is defined in NI 44-101) filed after the date of a Prospectus Supplement and

before the termination of the distribution of the Securities offered pursuant to

such Prospectus Supplement (together with this Prospectus) is deemed to be

incorporated by reference in such Prospectus Supplement.

Upon a new annual information form and related annual financial

statements being filed by us with, and where required, accepted by, the

applicable securities regulatory authority during the currency of this

Prospectus, the previous annual information form, the previous annual financial

statements and all interim financial statements, material change reports and

information circulars and all Prospectus Supplements filed prior to the

commencement of our financial year in which a new annual information form is

filed shall be deemed no longer to be incorporated into this Prospectus for

purposes of future offers and sales of Securities hereunder.

- 3 -

FORWARD LOOKING STATEMENTS

The Prospectus, including the documents incorporated by

reference, contain forward-looking statements and forward-looking information

(collectively referred to as “

forward-looking statements

”) which may not

be based on historical fact, including without limitation statements regarding

our expectations in respect of future financial position, business strategy,

future production, reserve potential, exploration drilling, exploitation

activities, events or developments that we expect to take place in the future,

projected costs and plans and objectives. Often, but not

always, forward-looking statements can be identified by the use of the words

“believes”, “may”, “plan”, “will”, “estimate”, “scheduled”, “continue”,

“anticipates”, “intends”, “expects”, and similar expressions.

Such statements reflect our management’s current views with

respect to future events and are subject to risks and uncertainties and are

necessarily based upon a number of estimates and assumptions that, while

considered reasonable by the Company, are inherently subject to significant

business, economic, competitive, political and social uncertainties and

contingencies. Many factors could cause our actual results, performance or

achievements to be materially different from any future results, performance, or

achievements that may be expressed or implied by such forward-looking

statements, including, among others:

|

|

•

|

the value of its reserves and our outlook for profitable

mining from its operations is dependent on gold prices continuing to be

around US$1,250 and on us achieving our planned production rates and

life-of-mine all-in sustaining costs per ounce of gold sold. Gold prices

are driven by many factors including industrial demand and jewellery use,

but gold also has speculative investment demand and so prices have been

historically volatile and can be subject to long periods of depressed

prices;

|

|

|

|

|

|

|

•

|

the estimation of mineral resources and reserves is, to a

significant degree, a subjective process, the accuracy of which is a

function of the quantity and quality of available data and the assumptions

made in the engineering and geological interpretation of that data and

such assumptions and judgment, may prove mistaken. The Company’s estimates

of resources and reserves may be subject to revision based on various

factors, some of which are beyond our control, for example due to natural

variations in underground structures and future gold price fluctuations;

|

|

|

|

|

|

|

•

|

other mining risks which affect all companies in the

industry to various degrees include impact and cost of compliance with

environmental regulations and the actions of groups opposed to mining,

adverse changes in mining and reclamation laws and compliance with

increasingly complex worker health and safety rules; and

|

|

|

|

|

|

|

•

|

other risks which are detailed in our annual information

forms, annual reports, MD&A, quarterly reports and material change

reports filed with and furnished to securities regulators, and those risks

which are discussed herein under the heading “

Risk Factors

”.

|

Such information is included,

among other places, in the Prospectus under the headings “The Company”, “Use of

Proceeds”, “Risk Factors”, in our 2016 AIF under the headings “Description of

Business” and “Risk Factors” and in our 2016 Annual MD&A, each of which

documents are incorporated by reference into this Prospectus.

Should one or more of these risks and uncertainties

materialize, or should underlying factors or assumptions prove incorrect, actual

results may vary materially from those described in the forward-looking

statements. Material factors or assumptions involved in developing

forward-looking statements include, without limitation, that:

|

|

•

|

that the price of gold over the next several years will

not fall significantly below US$1,250 per ounce for a prolonged period of

time;

|

|

|

|

|

|

|

•

|

that there will be no significant changes to Ghana’s

mining, environmental or tax laws, or the imposition of exchange and

export controls in Ghana that materially adversely affect the

Company’s operations or changes in laws or policy that could

affect title to its Asanko Gold Mine or restrict a change of control of the

Company;

|

- 4 -

|

|

•

|

that no significant impediments develop in respect of the

Company’s ability to comply with environmental, safety and other

regulatory requirements;

|

|

|

|

|

|

|

•

|

that any further material upheavals in world financial

markets will not be prolonged and that interest and exchange rates will

remain relatively low and stable, respectively; and

|

|

|

|

|

|

|

•

|

that key personnel will continue their employment with

the Company.

|

These factors should be considered carefully and readers are

cautioned to appreciate the inherent limitations of forward-looking statements.

Readers are cautioned that the foregoing list of risk factors is not exhaustive

and it is recommended that prospective investors consult the more complete

discussion of risks and uncertainties facing the Company included in the

Prospectus. See “

Risk Factors

” for a more detailed discussion of these

risks.

Although we believe that the expectations conveyed by the

forward-looking statements are reasonable based on the information available to

us on the date such statements were made, no assurances can be given as to

future results, approvals or achievements. The forward-looking statements

contained in the Prospectus and the documents incorporated by reference herein

are expressly qualified by this cautionary statement. We cannot be responsible

to update any of our forward-looking statements after the date of the Prospectus

to conform such statements to actual results or to changes in our expectations

except in the limited circumstances required by applicable law.

GLOSSARY OF CERTAIN TECHNICAL TERMS

This Prospectus uses the certain technical terms presented

below as they are defined in accordance with the CIM Definition Standards on

Mineral Resources and Reserves (the “

2014 CIM Definition Standards

”)

adopted by the Canadian Institute of Mining, Metallurgy and Petroleum (the

“

CIM Council

”). Unless otherwise indicated, all reserve and resource

estimates contained in or incorporated by reference in this Prospectus have been

prepared in accordance with the CIM Standards, as required by Canadian National

Instrument 43-101. The following definitions are reproduced from the latest

version of the CIM Standards, which were adopted by the CIM Council on May 10,

2014:

|

feasibility study

|

A comprehensive technical and economic study of the

selected development option for a mineral project that includes

appropriately detailed assessments of applicable modifying factors

together with any other relevant operational factors and detailed

financial analysis that are necessary to demonstrate, at the time of

reporting, that extraction is reasonably justified (economically

mineable). The results of the study may reasonably serve as the basis for

a final decision by a proponent or financial institution to proceed with,

or finance, the development of the project. The confidence level of the

study will be higher than that of a pre-feasibility study. The Company

uses the term “12/17 DFS” to describe its current definitive feasibility

study.

|

indicated mineral

resource

|

That part of a mineral resource for which quantity, grade

or quality, densities, shape and physical characteristics are estimated

with sufficient confidence to allow the application of modifying factors

in sufficient detail to support mine planning and evaluation of the

economic viability of the deposit. Geological evidence is derived from

adequately detailed and reliable exploration, sampling and testing and is

sufficient to assume geological and grade or quality continuity between

points of observation. An indicated mineral resource has a lower level of

confidence than that applying to a measured mineral resource and may only

be converted to a probable mineral reserve.

|

- 5 -

inferred mineral

resource

|

That part of a mineral resource for which quantity and

grade or quality are estimated on the basis of limited geological evidence

and sampling. Geological evidence is sufficient to imply but not verify

geological and grade or quality continuity. An Inferred Mineral Resource

has a lower level of confidence than that applying to an Indicated Mineral

Resource and may not be converted to a Mineral Reserve. It is reasonably

expected that the majority of Inferred Mineral Resources could be upgraded

to Indicated Mineral Resources with continued exploration.

|

measured mineral

resource

|

That part of a Mineral Resource for which quantity, grade

or quality, densities, shape, and physical characteristics are estimated

with confidence sufficient to allow the application of Modifying Factors

to support detailed mine planning and final evaluation of the economic

viability of the deposit. Geological evidence is derived from detailed and

reliable exploration, sampling and testing and is sufficient to confirm

geological and grade or quality continuity between points of observation.

A Measured Mineral Resource has a higher level of confidence than that

applying to either an Indicated Mineral Resource or an Inferred Mineral

Resource. It may be converted to a Proven Mineral Reserve or to a Probable

Mineral Reserve.

|

|

mineral reserve

|

The economically mineable part of a Measured and/or

Indicated Mineral Resource. It includes diluting materials and allowances

for losses, which may occur when the material is mined or extracted and is

defined by studies at Pre- Feasibility or Feasibility level as appropriate

that include application of Modifying Factors. Such studies demonstrate

that, at the time of reporting, extraction could reasonably be justified.

The reference point at which Mineral Reserves are defined, usually the

point where the ore is delivered to the processing plant, must be stated.

It is important that, in all situations where the reference point is

different, such as for a saleable product, a clarifying statement is

included to ensure that the reader is fully informed as to what is being

reported. The public disclosure of a Mineral Reserve must be demonstrated

by a Pre-Feasibility Study or Feasibility Study.

|

|

mineral resource

|

A concentration or occurrence of solid material of

economic interest in or on the Earth’s crust in such form, grade or

quality and quantity that there are reasonable prospects for eventual

economic extraction. The location, quantity, grade or quality, continuity

and other geological characteristics of a Mineral Resource are known,

estimated or interpreted from specific geological evidence and knowledge,

including sampling.

|

|

modifying factors

|

Considerations used to convert Mineral Resources to

Mineral Reserves. These include, but are not restricted to, mining,

processing, metallurgical, infrastructure, economic, marketing, legal,

environmental, social and governmental factors.

|

- 6 -

|

pre-feasibility study

|

A comprehensive study of a range of options for the

technical and economic viability of a mineral project that has advanced to

a stage where a preferred mining method, in the case of underground

mining, or the pit configuration, in the case of an open pit, is

established and an effective method of mineral processing is determined.

It includes a financial analysis based on reasonable assumptions on the

Modifying Factors and the evaluation of any other relevant factors which

are sufficient for a Qualified Person, acting reasonably, to determine if

all or part of the Mineral Resource may be converted to a Mineral Reserve

at the time of reporting. A Pre-Feasibility Study is at a lower confidence

level than a Feasibility Study.

|

probable mineral

reserve

|

The economically mineable part of an Indicated, and in

some circumstances, a Measured Mineral Resource. The confidence in the

Modifying Factors applying to a Probable Mineral Reserve is lower than

that applying to a Proven Mineral Reserve.

|

proven mineral

reserve

|

The economically mineable part of a Measured Mineral

Resource. A Proven Mineral Reserve implies a high degree of confidence in

the Modifying Factors.

|

In addition, we use the following

defined terms in this Prospectus:

|

AGM

|

Our principal asset, the Asanko Gold Mine located in

Ghana, West Africa. The AGM may also be referred to as the

“

Project

”

|

AISC/oz (all-in

sustaining

cost

per

ounce of gold)

|

This is a non-GAAP financial measurement which the

Company has adopted using World Gold Council's guidance for calculation of

this number. AISC include total cash costs, corporate overhead expenses,

sustaining capital expenditure, capitalized stripping costs and

reclamation cost accretion for each ounce of gold sold. AISC is intended

to assist the comparability of the Company’s operations with those of

other gold producers who disclose operating results using the same or

similar guidance standards.

|

|

Au

|

Chemical symbol for gold

|

|

brownfields

|

A reference to a mining project situated in an existing

mining area with the result that environmental approval procedures are

generally expedited (as contrasted with a “greenfields” project which is a

mine proposed for a previously non-mining area or an altogether

undisturbed area.

|

Carbon-in-leach

process or

“CIL”

|

a process used to recover dissolved gold inside a cyanide

leach circuit. Coarse activated carbon particles are introduced in the

leaching circuit and are moved counter-current to the slurry, absorbing

dissolved gold in solution as they pass through the circuit. Loaded carbon

is removed from the slurry by screening. Gold is recovered from the loaded

carbon by stripping in a caustic cyanide solution followed by

electrolysis. CIL is a process similar to CIP (carbon-in- pulp) except

that the gold leaching and the gold absorption are done simultaneously in

the same stage compared with CIP where the gold-absorption stage follows

the gold-leaching stage.

|

- 7 -

|

concentrate

|

a product containing the valuable metal and from which

most of the waste material in the ore has been eliminated.

|

|

contained ounces

|

means ounces in the mineralized rock without reduction

due to mining loss or processing loss.

|

|

cut-off grade

|

the lowest grade of mineralized material considered

economic; used in the estimation of mineral reserves in a given deposit.

|

|

depletion

|

the decrease in quantity of mineral reserves in a deposit

or property resulting from extraction or production during a particular

period.

|

|

DFS and 12/17 DFS

|

The “Definitive Feasibility Study” technical report for

the Asanko Gold Mine originally filed on SEDAR on July 18, 2017, which was

subsequently amended and restated on December 20, 2017 (the latter version

is herein the “

12/17

DFS

”).

|

|

dilution

|

an estimate of the amount of waste or low-grade

mineralized rock which will be mined with the ore as part of normal mining

practices in extracting an ore body.

|

|

Exchange Act

|

The United States Securities Exchange Act of 1934, as

amended

|

|

Ghana

|

The Republic of Ghana

|

|

g/t Au

|

Reference to ore grade, it means gram of gold per tonne

(1 gm/t is equivalent to one part per million)

|

|

grade

|

the relative quantity or percentage of metal or mineral

content.

|

|

IFRS

|

International Financial Reporting Standards.

|

|

LoM

|

Life of mine

|

|

Mt

|

Million tonnes

|

|

Mtpa

|

Mt per annum

|

|

NI 43-101

|

Canadian National Instrument 43-101 -

Standards of

Disclosure for Mineral

Projects

, as adopted by the Canadian

Securities Administrators

|

|

NYSE American

|

NYSE American Stock Exchange

|

|

ounce

|

refers to one troy ounce, which is equal to 31.1035 grams

|

|

Project

|

the Asanko Gold Mine, also known as the “

AGM

”

|

|

Project 5M or P5M

|

Project 5M (or “P5M”) is a two-stage planned upgrade to

the AGM with first stage being the upgrade of the CIL plant’s throughput

to 5Mtpa and the second stage to expand mining operations to integrate the

Esaase deposit, including the construction of a 27-kilometer overland ore

conveyor. Stage one has an estimated capital cost of US$22 million and the

stage two cost is estimated at US$128 million.

|

- 8 -

Project 10M

or P10M

|

Project 10M (or “P10M”) means a future expansion project

of the AGM which has the potential to increase production from about

200,000 ounces per annum to over 450,000 ounces per annum. Project 10M

requires the construction of an additional 5Mtpa CIL plant to double

throughput from 5Mtpa to 10Mtpa at an estimated cost of some US$200

million.

|

|

qualified person

|

an individual who is an engineer or geoscientist with a

university degree, or equivalent accreditation, in an area of geosciences,

or engineering, relating to mineral exploration or mining who has at least

five years of experience in mineral exploration, mine development or

operation, or mineral project assessment, or any combination of these,

that is relevant to his or her professional degree or area of practice,

and who has experience relevant to the subject matter of the mineral

project or technical report, and who is in good standing with a

professional association, as more fully referenced in NI 43-101

|

|

RC

|

reversed circulation (a method of drilling)

|

|

recovery

|

the proportion of valuable material obtained during

mining or processing. Generally expressed as a percentage of the material

recovered compared to the total material present

|

|

SAG

|

semi-autogenous grinding (ore is tumbled to smash against

itself)

|

|

SEDAR

|

System for Electronic Document Analysis and Retrieval

available on the Internet at www.sedar.com, (the Canadian securities

regulatory filings website)

|

|

SEC

|

The United States Securities and Exchange Commission

|

|

stripping

|

in mining, the process of removing overburden or waste

rock to expose ore

|

|

tailings

|

the material that remains after metals or minerals

considered economic have been removed from ore during processing

|

|

Tailings Storage

Facility

or

TSF

|

a containment area used to deposit tailings from milling

|

|

tonne

|

Is commonly referred to as the metric ton in the United

States, is a metric unit of mass equal to 1,000 kilograms; it is

equivalent to approximately 2,204.6 pounds, 1.102 short tons (US) or 0.984

long tons (imperial).

|

|

TSX

|

Toronto Stock Exchange

|

U.S. Securities

Act

|

The United States Securities Act of 1933, as amended

|

- 9 -

CAUTIONARY NOTE TO UNITED STATES INVESTORS REGARDING

ESTIMATES OF

RESERVES AND MEASURED, INDICATED AND INFERRED RESOURCES

This Prospectus and the documents incorporated by reference

herein have been prepared in accordance with the requirements of Canadian

provincial securities laws, which differ from the requirements of U.S.

securities laws. Unless otherwise indicated, all reserve and resource estimates

included or incorporated by reference in this Prospectus have been prepared in

accordance with NI 43-101 and CIM Standards. NI 43-101 is a rule developed by

the Canadian Securities Administrators that establishes standards for all public

disclosure an issuer makes of scientific and technical information concerning

mineral projects.

The Prospectus includes mineral reserve estimates that have

been calculated in accordance with NI 43-101 and CIM Standards, as required by

Canadian securities regulatory authorities. The terms “mineral reserve”, “proven

mineral reserve” and “probable mineral reserve” are Canadian mining terms as

defined in accordance with NI 43-101 and CIM standards. These definitions differ

from the definitions adopted by the SEC in the SEC’s Industry Guide 7.

In addition, the Prospectus uses the terms “measured mineral

resources”, “indicated mineral resources” and “inferred mineral resources” to

comply with the reporting standards in Canada. We advise investors that while

those terms are recognized and required by Canadian regulations, these terms are

not defined terms under SEC Industry Guide 7, are not recognized by the SEC and

are normally not permitted to be used in reports and registration statements

filed with the SEC. Investors are cautioned not to assume that any part or all

of the mineral deposits in these categories will ever be converted into either

NI 43-101 or SEC defined mineral reserves. These terms have a great amount of

uncertainty as to their existence, and great uncertainty as to their economic

and legal feasibility.

Further, inferred resources have a great amount of uncertainty

as to their existence and as to whether they can be mined legally or

economically. Therefore, investors are also cautioned not to assume that all or

any part of the inferred resources exist. In accordance with Canadian rules,

estimates of “inferred mineral resources” cannot form the basis of feasibility

or other economic studies, except in rare cases.

It cannot be assumed that all or any part of measured mineral

resources, indicated mineral resources, or inferred mineral resources will ever

be upgraded to a higher category. Investors are cautioned not to assume that any

part of the reported measured mineral resources, indicated mineral resources, or

inferred mineral resources in the Prospectus is economically or legally

mineable.

Disclosure of “contained ounces” in a resource is permitted

disclosure under Canadian regulations; however, the SEC normally only permits

issuers to report mineralization that does not constitute “reserves” by SEC

Industry Guide 7 standards as in place tonnage and grade without reference to

unit measures.

For the above reasons, information contained in the Prospectus

and the documents incorporated by reference herein containing descriptions of

the Company’s mineral deposits may not be comparable to similar information made

public by U.S. companies subject to the reporting and disclosure requirements

under the United States federal securities laws and the rules and regulations

thereunder.

NOTE TO UNITED STATES READERS REGARDING DIFFERENCES BETWEEN

UNITED

STATES AND CANADIAN FINANCIAL REPORTING PRACTICES

We prepare our financial statements in accordance with IFRS, as

issued by the IASB, which differs from U.S. generally accepted accounting

principles (“

U.S. GAAP

”). Accordingly, our financial statements incorporated by reference in the Prospectus, and in the

documents incorporated by reference in this Prospectus, may not be comparable to

financial statements of United States companies prepared in accordance with U.S.

GAAP.

- 10 -

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless stated otherwise or as the context otherwise requires,

all references to dollar amounts in this Prospectus and any Prospectus

Supplement are references to United States dollars (“US dollars”). References to

“C$” are to Canadian dollars and references to “$” are to US dollars.

Except as otherwise noted in our 2016 AIF and the Company’s

financial statements and related management’s discussion and analysis of

financial condition and results of operations of the Company that are

incorporated by reference into this Prospectus, the financial information

contained in such documents is expressed in US dollars. The Company operates in

Ghana, which has as its national currency the Ghanaian Cedi. However, a large

proportion of supplies and services available in Ghana are priced in US dollars.

Exchange rates between US dollars and Ghanaian Cedi follow below the Canadian:

US dollars exchange table.

The high, low, average and closing noon rates for the US dollar

in terms of Canadian dollars for each of the financial periods of the Company

ended September 30, 2017, December 31, 2016, and December 31, 2015, as quoted by

the Bank of Canada, were as follows:

|

|

|

Nine months ended

|

|

|

Year ended

December

|

|

|

Year ended

|

|

|

|

|

September 30, 2017

|

|

|

31, 2016

|

|

|

December 31, 2015

|

|

|

|

|

|

|

|

(expressed in

Canadian dollars)

|

|

|

High

|

|

1.3743

|

|

|

1.4589

|

|

|

1.3990

|

|

|

Low

|

|

1.2128

|

|

|

1.2544

|

|

|

1.1728

|

|

|

Average

|

|

1.3074

|

|

|

1.3248

|

|

|

1.2787

|

|

|

Closing

|

|

1.2480

|

|

|

1.3427

|

|

|

1.3840

|

|

On December 27, 2017, the exchange rate for the US dollar

in terms of Canadian dollars, as quoted by the Bank of Canada, was $1.00 =

C$1.2641.

The high, low, average and closing noon rates for the Ghanaian

Cedi in terms of US dollars for each of the financial periods of the Company

ended September 30, 2017, December 31, 2016, and December 31, 2015, as quoted by

the Bank of Canada, were as follows:

|

|

|

Nine months ended

|

|

|

Year ended

December

|

|

|

Year ended

|

|

|

|

|

September 30, 2017

|

|

|

31, 2016

|

|

|

December 31, 2015

|

|

|

|

|

|

|

|

(expressed in US

dollars)

|

|

|

High

|

|

0.2402

|

|

|

0.2644

|

|

|

0.3125

|

|

|

Low

|

|

0.2172

|

|

|

0.2381

|

|

|

0.2306

|

|

|

Average

|

|

0.2303

|

|

|

0.2557

|

|

|

0.2692

|

|

|

Closing

|

|

0.2276

|

|

|

0.2381

|

|

|

0.2635

|

|

On December 27, 2017, the exchange rate for the Ghanaian

Cedi in terms of US dollars, as quoted by the Bank of Canada, was cedi 1.00 =

$0.2208.

- 11 -

THE COMPANY

Asanko is a Canadian-incorporated gold miner with a single mine

operation in the Republic of Ghana. The Company’s primary asset is the AGM

located in Ghana, West Africa. The mine has been commercially operating since

2016 and is planned to be expanded in two phases. The construction of the

current mine, which includes a 3Mtpa CIL processing facility and associated

infrastructure, was completed in early 2016 within budget and ahead of schedule.

Gold production commenced in January, 2016, with commercial production status

declared on April 1, 2016. The base AGM operation reached steady-state

production levels by the end of the second quarter of 2016 and has operated at

processing rates of 20% above design since achieving steady-state. Gold

production is expected to be about 205,000-225,000 ounces for calendar 2017.

Asanko has developed plans for two production expansions, which

combined have the potential to increase production to about 450,000 ounces per

annum. These projects are named with reference to their projected throughput of

ore so that Project 5M will upgrade the existing CIL plant’s throughput from

3.6Mtpa to 5Mtpa. The first stage of Project 5M, the brownfield modifications

and upgrades to the CIL processing plant to increase throughput to 5Mtpa, was

approved in November 2016 and is in process. The Company has completed the

volumetric upgrades to the plant under budget and ahead of schedule. The second

stage of Project 5M includes the construction of a 27km overland conveyor to

integrate the nearby Esaase deposit, which, along with the development of the

Esaase deposit, is estimated to have a total capital cost of $128 million. The

decision to proceed with the second stage of P5M has been deferred until

2018.

A second planned expansion project, known as Project 10M,

comprises the construction of an additional 5Mtpa CIL ore processing plant in

order to double plant capacity from 5Mtpa to 10Mtpa. The timing of the second

stage of Project 5M or Project 10M will be at the Board’s discretion and is also

dependent on the Company’s balance sheet, financing opportunities as well as

favourable market conditions. These two expansion projects were originally

analyzed in a technical report called “

Asanko Gold Mine– Definitive

Feasibility Study – National Instrument 43-101 Technical Report

” with an

effective date of June 5, 2017. This report was amended and restated to clarify

certain of its contents and filed on SEDAR on December 27, 2017. (the amended

version being herein the “

12/17 DFS

”). The 12/17 DFS is the primary

source for the current technical information referenced in this Prospectus.

Corporate Group Structure Planned Simplification

The Company is in the process of implementing a reorganization

of its corporate group structure which has existed since its acquisition of the

previously publicly traded PMI Gold Corp in 2014. The simplification will not

have material tax or financial consequences to shareholders but is expected to

result in some cost savings through elimination of redundant corporate entities

and a more efficient structure. The reorganization is expected to be completed

in Q1 2018 and is subject to approval by the government of Ghana. Before, that

is, as of the date hereof, (right-hand side) and after (left-hand side) Asanko

corporate group organization charts are expected to be as follows:

- 12 -

Figure 1 Asanko Corporate Group and its Planned Simplification

THE ASANKO GOLD MINE

Current Technical Report- the 12/17 DFS

Subsequent to the filing of the Company’s 2016 AIF on March 16,

2017, the Company filed its DFS on July 18, 2017. The DFS was amended and

restated on December 20, 2017 (the “

12/17 DFS

”) to revise and clarify

some of the contents of the original DFS. This Prospectus incorporates by

reference disclosure from both the 2016 AIF and the 12/17 DFS, however the

narrative in this Prospectus focuses on highlighting matters which have been

revised or refined since the 2016 AIF through to the filing of the 12/17

DFS.

The summary disclosure herein about the AGM is supported by the

12/17 DFS and is qualified by reference to the entire 12/17 DFS. Readers seeking

details beyond the summarized information contained in this Prospectus and the

2016 AIF, are encouraged to review the full 12/17 DFS filed under the Company’s

profile at www.sedar.com on December 27, 2017.

Project Description and Location

The AGM (or ‘

Project

”) comprises two mining concessions,

seven mining leases and a number of prospecting licenses aggregating some 679

sq. km over a 30km strike-length in the Asankrangwa Gold Belt in Ghana. This gold belt lies within the Amansie West

District of the Ashanti Region of Ghana, as illustrated in the map below. The

leases, licenses and the two mining concessions (Obotan and Esaase) are all

owned 100% by Asanko Gold Ghana Limited (“

Asanko Gold Ghana

”) which is a

100% indirectly owned Ghanaian subsidiary. Ownership of mineral interests in

Ghana are subject to a 10% free carried interest (described further below) in

favour of the Government of Ghana.

- 13 -

Figure 2 Asanko Gold Mine Location

The following map shows the location of the various mining

tenements comprising the AGM along with the proposed route of the P5M (Stage 2)

ore conveyor:

- 14 -

Figure 3 AGM Concessions and Leases

The Company ‘s mining leases are summarized in the table below.

The mining lease concessions cover an area of approximately 213.2 km.

Asanko Gold Mine Mining Licenses

|

Tenement

name

|

Licence

Category

|

100% owned

title

holder

|

Minerals

Commission

|

Status of licence

|

Area

Km²

|

|

Datano

|

Mining Lease

|

Asanko Gold Ghana – 100%

|

PL 6/32/Vol 3

|

Valid-ML renewal

|

53.78

|

|

Abore

|

Mining Lease

|

Asanko Gold Ghana – 100%

|

PL 6/303

|

Valid-ML received

|

28.47

|

|

Abirem

|

Mining Lease

|

Asanko Gold Ghana – 100%

|

PL 6/303

|

Valid-ML received

|

47.13

|

|

Adubea

|

Mining Lease

|

Asanko Gold Ghana – 100%

|

PL 6/310

|

Valid-ML received

|

13.38

|

|

Esaase

|

Mining Lease

|

Asanko Gold Ghana – 100%

|

PL 6/8/Vol.8

|

Valid-ML received

|

27.03

|

|

Jeni River

|

Mining Lease

|

Asanko Gold Ghana – 100%

|

RL 6/21

|

Valid

|

43.41

|

|

Miradani

|

Mining Lease

|

Asanko Gold Ghana – 100%

|

PL 6/22

|

Valid

|

14.98

|

- 15 -

The Obotan, Esaase, Abore, Abirem, Datano, Jenni River and

Adubea Mining Leases contain all of the mineral resources defined to date. All

other concessions held by the Company in the area contain exploration potential

defined to date and in some instances locations for infrastructure. The Ghana

Environmental Protection Agency (“

EPA

”) grants permits on a perennial

basis to conduct exploration. The Company believes that all permitting is up to

date with governmental permitting requirements and in good standing.

All Ghanaian concessions are subject to a 10% free carried

interest in favour of the Ghanaian government. The government interest is

reflected in an entitlement based on 10% of profits available for dividend

distributions in the Company’s operating subsidiary (Asanko Gold Ghana Limited).

The free-carried interest does not entitle or obligate the government to

contribute any capital. The Ghanaian government receives its 10% only when

dividends are declared by Asanko Gold Ghana, although the Company recognizes the

Ghanaian government`s 10% entitlement on an ongoing basis. The leases are also

subject to a 5% royalty payable to the Government of Ghana. The Adubea

concession is also subject to an additional 0.5% gross revenue royalty to a

predecessor owner, as is the Esaase mining lease. There is also a 35% income tax

rate on taxable income earned in Ghana. Changes of control in the owners of

mining rights in Ghana are subject to Ghanaian government approval.

Accessibility, Climate, Infrastructure and Physiography

The AGM concessions and leases are located approximately 250 km

northwest of the capital Accra, and about 50 km to 80 km southwest of the

regional capital of Kumasi. There are several local villages near the AGM

project areas, with the villages of Tetrem and Esaase being in close proximity

to the Esaase deposit. Mining personnel are readily available in Ghana, due to

its long tradition of gold mining, with a highly skilled workforce and numerous

mining operations in the country. Gold accounts for some 48% of Ghanaian

exports. Several other gold mining companies operate there.

There are daily flights from Accra to Kumasi flown by several

airlines. In addition, there is an airstrip located adjacent to the Obatan

project site west of the Nkran village, which is used by the AGM to transport

staff and critical service providers to and from Accra on bi-weekly return

trips. Existing road access to the site is available from the west, south and

east, but the main access used will be from the ports of Tema and Takoradi to

the south via Kumasi, or Obuasi. The total distance from Tema to the project

site, via Kumasi is approximately 400 km.

- 16 -

The AGM is located in hilly terrain dissected by broad, flat

drainages that typically form swamps in the wet season between May and late

October. Hill tops are generally at very similar elevations, reflecting the

elevation of a previous erosional peneplane that is now extensively eroded.

Maximum elevations are around 80m above sea level, but the areas impacted by the

AGM deposits generally lie at less than 50m elevation. Despite the subdued

topography, hill slopes are typically steep. Ecologically the AGM area is

situated in the wet evergreen forest zone.

History

There have been no updates to the history of the Project since

the 2016 AIF

.

The project lies on the Asankrangwa Gold Belt and

much of the Project area has seen historical workings from artisanal miners.

There are 9 known deposits comprising the AGM located in 11 pits (see Fig 3).

The Nkran area in particular has a history of artisanal gold mining that dates

back many generations and remains quite extensive to the present day. In the

late 1980’s, Nkran attracted the attention of explorers and by early 1995

resource estimates were being reported. Resolute Mining Limited (“Resolute”)

started initial mining at Nkran in 1997 and by May 1997, the first gold was

poured. Resolute reportedly produced about 730,000 ounces before closing the

mine. Mining operations ceased in 2002 due to low gold prices and the

concessions were reclaimed and returned to the Government of Ghana.

The Abore area was covered in a prospecting concession granted

to the Oda River Gold small-scale mining licence (Asuadai prospect) at Adubea in

1991. Early artisanal pits focused mainly on narrow quartz veins associated with

the stock work system. Extensive drilling in the area (mainly RC, but

considerable diamond drilling as well) has outlined a sizeable resource (now

known as the Abore north prospect). In early 2001, an agreement was reached with

Resolute whereby ore was trucked from Abore north to the Resolute plant for

treatment.

During the late 1990’s, the Resolute plant started to process

oxide ores from the Adubiaso gold deposit, located about 7.5 km north-north-west

of Nkran. There were no known historical workings on this area. The Asuadai

prospect has predominantly been worked by local artisanal miners who have

undertaken minor pitting in the region down to 5m to 10m through the oxide

material in order to expose these stock work vein sets. There were no known

formal historical mining workings on this area. There was no historical

exploration or mining activity known at Dynamite Hill.

Predecessors had reportedly recovered an estimated 200,000 oz

of alluvial gold on the Esaase concession and another 300,000 oz downstream on

the Jeni River concession, prior to entering into receivership in 2002. It

should be noted that previous gold production is of no relevance to the

Company’s mine development program, which is entirely focused on the development

of in-situ (hard rock) resources.

Geological Setting, Mineralization and Deposit Types

The Project is located in one of several gold belts known in

Ghana. A detailed technical discussion of the regional geological setting can be

found in the 12/17 DFS. The figures below summarize regional gold occurrences.

- 17 -

A discussion of the significant mineralized zones encountered

on the Project, surrounding rock types and relevant geological controls, and the

length, width, depth and continuity of the mineralization together with a

description of the type, character and distribution of the mineralization as

well as the mineral deposit type or geological model or concepts being applied

are all reviewed in the 2016 AIF and the 12/17 DFS.

AGM Gold Deposits

The AGM or Project is a collective term for the significant

Nkran and Esaase gold deposits plus nine other satellite deposits. These are all

located on the Asankrangwa Belt within the Kumasi Basin sediments. AGM

mineralization is hosted along multiple parallel shear corridors, which is

typical of other Ghanaian gold deposits. A majority of deposits are sediment or

intrusive hosted. One deposit, Nkran, was previously exploited by Resolute

(1997-2001). The Nkran pit was dewatered and reopened by the Company in 2015-

2016.

Although each gold occurrence within the AGM has its own

idiosyncrasies, geological and geophysical studies have advanced a similar mine

scale setting for all the deposits discovered to date. There is an underlying

structural relationship between reactivated WNW basement structures and the

dominant NE-SW shears that have juxtaposed the sandstone, siltstone and lesser

shale meta-sedimentary packages, coupled by N-S structures that may control

flexures in the steeply dipping sediments.

Gold mineralisation has occurred at least twice at two or more

distinct deformational events. Gold occurs largely as free particles. It is

deposited in economic concentrations predominantly around zones of rheological

contrast between sandstone (porous) and siltstone facies (non-porous) that are

commonly subvertical shear zones, as well as in late, shallow dipping conjugate

quartz vein arrays that transgress rheologically contrasting meta-sedimentary

units and the later granite intrusives.

The Project deposits are all located along major shear zones

with cross- cutting faults. The mineralisation is directly related to the

structural setting and specific lithological units. Delineated geological models

based on lithological- structural interpretations form the

basis for the MRE. Lower grade background lithologies host higher grade veins,

and the individual mineralisation boundaries of these high-grade veins can be

difficult to define.

- 18 -

Previous Exploration

The nature and extent of the exploration work conducted by the

Company, including a summary and interpretation of the relevant results, is

contained in the 12/17 DFS. The work formed the basis for the decision in 2014

to proceed to commercial production which was achieved in 2016. Ongoing

exploration is discussed below under “Planned Exploration”.

Drilling

In excess of 1,200 km of drilling has been effected on the

various deposits on the AGM property. This drilling included some 651 diamond

drill holes over 151,686 meters, 2,567 reverse circulation drill holes over

248,570 meters, and 105,931 rotary air blast drilling, over some 727,289 meters,

as summarized in the table below. The results of this drilling are discussed in

detail in the 12/17 DFS on an area by area basis.

Sampling, Analysis and Data Verification

The Company’s sampling and assaying including sample

preparation methods and quality control measures employed before they are sent

to an analytical or testing laboratory, the security measures taken to ensure the validity and integrity of samples taken, assaying

and analytical procedures used and quality control measures and data

verification procedures, as well as their results are discussed in detail in the

12/17 DFS, which does not materially change any disclosure from the 2016 AIF.

The Company and its QPs consider the data collection and verification procedures

used to represent good industry practice.

- 19 -

Mineral Processing and Metallurgical Testing

The Company conducted extensive testing of mineral processing

and metallurgical testing before construction of the AGM. These tests and the

process flow diagram are detailed in the 12/17 DFS which does not materially

vary from disclosures in the 2016 AIF. The Company’s experience from over 18

months of commercial operations is that the predicted gold recoveries of over

94% are being consistently realized (see operating results table for the nine

months to September 30, 2017 below).

Mineral Resource Estimates