Current Report Filing (8-k)

December 27 2017 - 3:12PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported):

December 22, 2017

REDHAWK

HOLDINGS CORP.

(Exact

name of registrant as specified in its charter)

Nevada

(State

or other jurisdiction of incorporation)

000-54323

(Commission

file number)

20-3866475

(I.R.S.

Employer Identification No.)

120

Rue Beauregard, Suite 206, Louisiana 70508

(Address

of principal executive offices) (Zip Code)

(337)

269-5933

(Company’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

[ ]

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ]

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ]

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ]

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

.

On

December 22, 2017, RedHawk Holdings Corp. (the “Company”) entered into a 12-month convertible promissory note (the

“Convertible Note”) with EMA Financial, LLC, a Delaware limited liability company, in the principal amount of $81,500.

As defined in the agreements, the Convertible Note accrues interest at a rate of 10% per annum and if the Convertible Note has

not been pre-paid before 180 days from the date of the Convertible Note, is convertible into the Company’s common stock

at a price equal the lower of: (i) the closing sale price of the Common Stock on the Principal Market on the Trading Day immediately

preceding the Closing Date, and (ii) 65% of either the lowest sale price for the Common Stock on the Principal Market during the

twenty (20) consecutive Trading Days including and immediately preceding the Conversion Date, or the closing bid price, whichever

is lower. . The proceeds of the Convertible Note will be used to retire third party debt.

Simultaneous

with executing the Convertible Note, RedHawk said it has entered into a common stock purchase and sale agreement with Beechwood

Properties, LLC (“Beechwood”) who beneficially owns approximately 60% of the Company’s outstanding common stock.

Mr. G. Darcy Klug, the Company’s Chairman of the Board and Chief Financial Officer owns and controls Beechwood.

Under

the terms of the Purchase and Sale Agreement, RedHawk has agreed to purchase from Beechwood a like number shares (the “Beechwood

Shares”) to be issued under the Convertible Note if there is a conversion. The purchase price for the Beechwood Shares will

also be $81,500 and will be paid with the issuance of a promissory note (the “Promissory Note”) to Beechwood. The

Promissory Note will accrue interest at 5% per annum and will mature three years from date of issuance. After two years from its

issuance, the Promissory Note and any accrued interest, will become convertible into the Company’s Series A Preferred Stock.

The

Company said the Convertible Note and the Sale and Purchase Agreement were entered into with the objective of continuing to restructure

the Company’s balance sheet by eliminating approximately $153,000 of 3

rd

party debt from the balance sheet, preventing

shareholder dilution with the Transaction, and preserving cash to be used for future operations and strategic transactions. Additionally,

RedHawk said, upon completion of the Transaction, the Beechwood Shares will be returned into the Company’s treasury with

no increase in the number of outstanding shares.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

December 27, 2017

|

RedHawk

Holdings Corp.

|

|

|

|

|

|

By:

|

/s/

G. Darcy Klug

|

|

|

Name:

|

G.

Darcy Klug

|

|

|

Title:

|

Chief

Financial Officer

|

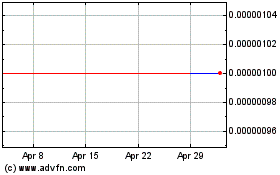

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

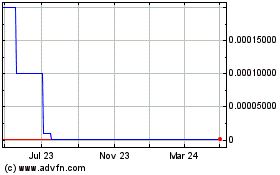

RedHawk (CE) (USOTC:SNDD)

Historical Stock Chart

From Apr 2023 to Apr 2024