National Holdings Corporation (NASDAQ:NHLD) (“National” or the

“Company”), a leading full service independent brokerage,

investment banking, trading and asset management firm providing

diverse services including tax preparation, today announced its

financial results for the 2017 fiscal year.

Fiscal 2017 Financial Highlights:

- Record revenue of $189.9 million, versus $174.1 million for

fiscal 2016.

- Adjusted EBITDA increased to $11.5 million from $.7 million in

the prior year.

- Income before other income and income taxes of $8.0 million

versus a loss of $2.5 million in fiscal 2016.

- Income before income taxes of $16.6 million includes $8.6

million of other income, principally due to the change in the fair

value of warrants issued in fiscal 2016. This is a non-operating,

non-taxable earnings adjustment.

- Investment banking continued to produce excellent results,

generating $44.6 million of revenue, versus $34.9 million in the

prior year.

- Net dealer inventory gains improved to $15.1 million on the

increase in the value of the firm’s warrant portfolio during the

fiscal fourth quarter.

- Cash and cash equivalents of $27.9 million and no debt as of

September 30, 2017 versus $27.5 million as of the fiscal year-end

2016.

- Equity of $38.9 million as of September 30, 2017.

Management Commentary

Michael Mullen, Chief Executive Officer of National stated, “I

am extremely impressed by the progress we made in fiscal

2017. We hit record revenue of nearly $190 million, in part

fueled by a 28% increase in investment banking revenue, showing

clear demand from our clients.” Mr. Mullen continued, “In

addition to the positive revenue growth, our business has also made

many important strides forward, most recently with the expansion of

our management team. The quality of leadership executives

interested in joining our thriving company speaks volumes to the

success of our refocused business model. Fiscal 2017 was about

National reconnecting with our core competencies and our mission

statement of ‘Customers First’. I am confident the results seen in

fiscal 2017 are just the beginning for our company. With other

initiatives just starting to take shape, including the planned

expansion of our Capital Markets division to complement our strong

banking performance, as well as a renewed focus toward accretive

business acquisition, I look forward to an even more productive and

impactful fiscal 2018.”

Fiscal 2017 Financial Results

National reported fiscal year revenue of $189.9 million, up

$15.8 million or 9% over fiscal year 2016. Total expenses increased

$5.4 million or 3% to $181.9 million.

Revenue

Strong results were recorded across our major revenue

categories. The majority of the increase was recorded in

investment banking, which increased to $44.6 million in fiscal

2017, up $9.7 million, or 28%, on strong issuance across multiple

industries and the related continuing demand from our clients.

Net dealer inventory gains increased $5.2 million, to $15.1

million. While the markets in which the company trades

remained challenging in fiscal 2017, a significant increase in the

value of the firm’s warrant portfolio offset lower equity volume

executed and the impact of the continuing low interest rate

environment in fixed income securities traded.

Commissions and related revenue increased 1% to $104.2

million. While this increase is small versus the very

favorable equity markets in fiscal 2017, our overall product

offering diversification has yielded a more appropriate

distribution of results across revenue categories.

Investment advisory revenue increased $.5 million, to $14.5

million, up 3%. New account openings and strong markets have

contributed to consistent growth in this revenue category, and we

expect this to continue.

Tax preparation and accounting revenue declined to $7.4 million

in fiscal 2017 versus $8.3 million in the prior year. We have

implemented a continuous review of this business over the past

year, addressing unprofitable and marginally profitable

offices. The reduction in revenue is a direct result of

actions taken during the year.

Expenses

Total expenses increased to $181.9 million in the current fiscal

year, up $5.4 million (3%) over the comparative year.

Variable compensation expenses directly associated with overall

revenue generation were responsible for $4.1 million of this

increase.

Aside from the compensation expense increase noted, the majority

of our expense categories remained relatively unchanged.

Several significant items to note affected professional fees and

other administrative expenses:

- Professional fees declined $2.4 million from fiscal 2016.

Costs associated with the tender offer for National by Fortress

Biotech during fiscal 2016 increased this expense category in the

prior year period.

- Other administrative expenses increased $3.4 million. As

previously reported in our fiscal third quarter earnings

announcement, provisions for legal and arbitration costs increased

during that period; in addition, at this fiscal year-end, the firm

recognized a $1.1 million impairment of goodwill and intangible

assets.

Earnings

Income before other income and income taxes totaled $8.0 million

versus a loss of $2.5 million in fiscal 2016. Income before

income taxes of $16.6 million was positively impacted by $8.5

million, due to the change in the fair value of the firms warrant

liability, which decreased from the September 30, 2016 measurement

date. This positive adjustment is a non-operating, non-taxable

income adjustment and should be viewed as such.

Net income per share, basic and fully diluted, was $1.01 and

$1.00 respectively in fiscal 2017, versus a loss per share of $.45

in fiscal 2016.

Adjusted EBITDA increased to $11.5 million in the current year,

from $.7 million in fiscal 2016.

Balance Sheet

As of September 30, 2017 National had $27.9 million of cash and

cash equivalents, versus $27.5 million as of September 30, 2016.

The Company's balance sheet remains debt free.

About National Holdings Corporation

National Holdings Corporation (NHLD) is a full-service

investment banking and asset management firm that, through its

affiliates, provides a range of services, including independent

retail brokerage and advisory services, investment banking,

institutional sales and trading, equity research, financial

planning, market making, tax preparation, insurance, to

corporations, institutions, high net-worth and retail investors.

With over 900 advisors, registered reps, traders, sales associates

and corporate staff, National Holdings operates through various

subsidiaries including National Securities Corporation, National

Asset Management, Inc., National Insurance Corporation, vFinance

Investments, Inc., Gilman Ciocia, Inc. and GC Capital

Corporation. Formed as a holding company in 1999,

National Holdings’ largest subsidiary National Securities

Corporation has been in business since 1947. National Holdings is

headquartered in New York and Florida. For more information, visit

www.nhldcorp.com. Fortress Biotech, Inc. (NASDAQ: FBIO) through its

affiliate FBIO Acquisition, Inc., is a majority shareholder of

NHLD.

FORWARD-LOOKING STATEMENTS

This press release may contain certain forward-looking

statements. Any such statements, other than statements of

historical fact, are based on management’s current expectations,

estimates, projections, beliefs and assumptions about the Company,

its current and prospective portfolio investments, and its

industry. These statements are not guarantees of future performance

and are subject to risks, uncertainties and other factors, some of

which are beyond the Company’s control, difficult to predict and

could cause actual results to differ materially from those expected

or forecasted in such forward-looking statements. Actual

developments and results are likely to vary materially from these

estimates and projections as a result of a number of factors,

including those described from time to time in National’s filings

with the Securities and Exchange Commission. Such statements speak

only as of the time when made, and National undertakes no

obligation to update any such forward-looking statements, whether

as a result of new information, future events, or otherwise, except

as required by law.

CONTACTS:National Holdings Corporation:Michael

Mullen, Chief Executive

OfficerEmail: mm@nhldcorp.comTelephone: +1 212-417-8055

Investor Relations:Email: ir@nhldcorp.comTelephone: +1 212

554 4351

| NATIONAL HOLDINGS CORPORATION AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF FINANCIAL

CONDITION |

| |

September 30, |

| |

2017 |

|

2016 |

|

ASSETS |

|

|

|

| Cash |

$ |

23,508,000 |

|

|

$ |

21,694,000 |

|

|

Restricted cash |

1,381,000 |

|

|

354,000 |

|

| Cash

deposits with clearing organizations |

1,041,000 |

|

|

1,030,000 |

|

|

Securities owned, at fair value |

7,102,000 |

|

|

2,357,000 |

|

|

Receivables from broker dealers and clearing organizations |

2,850,000 |

|

|

3,357,000 |

|

|

Forgivable loans receivable |

1,616,000 |

|

|

1,712,000 |

|

| Other

receivables, net |

5,180,000 |

|

|

5,430,000 |

|

| Prepaid

expenses |

2,490,000 |

|

|

1,910,000 |

|

| Fixed

assets, net |

2,397,000 |

|

|

1,164,000 |

|

|

Intangible assets, net |

4,843,000 |

|

|

5,704,000 |

|

|

Goodwill |

5,217,000 |

|

|

6,531,000 |

|

| Deferred

tax asset, net |

6,420,000 |

|

|

8,958,000 |

|

| Other

assets, principally refundable deposits |

353,000 |

|

|

345,000 |

|

| Total

Assets |

$ |

64,398,000 |

|

|

$ |

60,546,000 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

Liabilities |

|

|

|

|

Securities sold, not yet purchased at fair value |

$ |

151,000 |

|

|

$ |

298,000 |

|

| Accrued

commissions and payroll payable |

10,065,000 |

|

|

11,940,000 |

|

| Accounts

payable and other accrued expenses |

8,715,000 |

|

|

7,166,000 |

|

| Deferred

clearing and marketing credits |

786,000 |

|

|

995,000 |

|

| Warrants

issued in 2017 and issuable in 2016 |

5,597,000 |

|

|

14,055,000 |

|

|

Other |

181,000 |

|

|

319,000 |

|

| Total

Liabilities |

25,495,000 |

|

|

34,773,000 |

|

| |

|

|

|

|

Stockholders’ Equity |

|

|

|

| Preferred

stock, $0.01 par value, 10,000,000 shares authorized; none

outstanding |

— |

|

|

— |

|

| Common

stock $0.02 par value, authorized 75,000,000 shares at September

30, 2017 and 150,000,000 shares at September 30, 2016; 12,437,916

shares issued and outstanding at September 30, 2017 and 2016 |

248,000 |

|

|

248,000 |

|

|

Additional paid-in-capital |

66,955,000 |

|

|

66,353,000 |

|

|

Accumulated deficit |

(28,315,000 |

) |

|

(40,843,000 |

) |

| |

|

|

|

|

Total National Holdings

Corporation Stockholders’

Equity |

38,888,000 |

|

|

25,758,000 |

|

| |

|

|

|

|

Non-controlling interest |

15,000 |

|

|

15,000 |

|

|

Total Stockholders’

Equity |

38,903,000 |

|

|

25,773,000 |

|

| |

|

|

|

|

Total Liabilities and Stockholders’

Equity |

$ |

64,398,000 |

|

|

$ |

60,546,000 |

|

| NATIONAL HOLDINGS CORPORATION AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF OPERATIONS |

| |

Years Ended September 30, |

| |

2017 |

|

2016 |

| |

|

|

|

|

Revenues |

|

|

|

|

Commissions |

$ |

96,807,000 |

|

|

$ |

95,942,000 |

|

| Net

dealer inventory gains |

15,108,000 |

|

|

9,929,000 |

|

|

Investment banking |

44,595,000 |

|

|

34,937,000 |

|

|

Investment advisory |

14,528,000 |

|

|

14,080,000 |

|

| Interest

and dividends |

2,764,000 |

|

|

3,109,000 |

|

| Transfer

fees and clearing services |

7,393,000 |

|

|

7,152,000 |

|

| Tax

preparation and accounting |

7,439,000 |

|

|

8,294,000 |

|

|

Other |

1,236,000 |

|

|

633,000 |

|

| Total

Revenues |

189,870,000 |

|

|

174,076,000 |

|

| |

|

|

|

| Operating

Expenses |

|

|

|

|

Commissions, compensation and fees |

155,187,000 |

|

|

151,057,000 |

|

| Clearing

fees |

2,343,000 |

|

|

2,309,000 |

|

|

Communications |

2,767,000 |

|

|

3,157,000 |

|

|

Occupancy |

4,286,000 |

|

|

3,819,000 |

|

| Licenses

and registration |

1,726,000 |

|

|

1,625,000 |

|

|

Professional fees |

4,531,000 |

|

|

6,896,000 |

|

|

Interest |

14,000 |

|

|

51,000 |

|

|

Depreciation and amortization |

1,229,000 |

|

|

1,213,000 |

|

| Other

administrative expenses |

9,819,000 |

|

|

6,418,000 |

|

| Total Operating

Expenses |

181,902,000 |

|

|

176,545,000 |

|

| Income (Loss)

before Other Income and Income Taxes |

7,968,000 |

|

|

(2,469,000 |

) |

| |

|

|

|

| Other

Income |

|

|

|

| Gain on disposal of

Gilman branches |

137,000 |

|

|

— |

|

| Change in fair value of

warrants |

8,458,000 |

|

|

— |

|

| Other income |

16,000 |

|

|

— |

|

| Total Other

Income |

8,611,000 |

|

|

— |

|

| Income (Loss)

before Income Taxes |

16,579,000 |

|

|

(2,469,000 |

) |

| |

|

|

|

| Income tax expense |

4,051,000 |

|

|

3,090,000 |

|

| Net Income

(Loss) |

$ |

12,528,000 |

|

|

$ |

(5,559,000 |

) |

| |

|

|

|

| Net income

(loss) per share - Basic |

$ |

1.01 |

|

|

$ |

(0.45 |

) |

| Net income

(loss) per share - Diluted |

$ |

1.00 |

|

|

$ |

(0.45 |

) |

| |

|

|

|

| Weighted

average number of shares outstanding - Basic |

12,437,916 |

|

|

12,435,923 |

|

| Weighted

average number of shares outstanding - Diluted |

12,472,541 |

|

|

12,435,923 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

The following table presents a reconciliation of net income as

reported in accordance with generally accepted accounting

principles, or GAAP, to EBITDA, as adjusted.

| |

Fiscal Year Ended |

| |

2017 |

|

2016 |

| |

|

|

|

| Net income (loss), as

reported |

$ |

12,528,000 |

|

|

$ |

(5,559,000 |

) |

| Interest expense |

14,000 |

|

|

51,000 |

|

| Income taxes |

4,051,000 |

|

|

3,090,000 |

|

| Depreciation and

amortization |

1,229,000 |

|

|

1,213,000 |

|

| EBITDA |

17,822,000 |

|

|

(1,205,000 |

) |

| Non-cash compensation

expense |

602,000 |

|

|

211,000 |

|

| Change in fair value of

warrant liability |

(8,458,000 |

) |

|

— |

|

| Forgivable loan

amortization |

693,000 |

|

|

788,000 |

|

| Impairment of goodwill

and intangible assets |

1,011,000 |

|

|

894,000 |

|

| Gain on disposal of

Gilman branches |

(137,000 |

) |

|

— |

|

| EBITDA, as

adjusted |

$ |

11,533,000 |

|

|

$ |

688,000 |

|

EBITDA, as adjusted for non-cash compensation expense, change in

fair value of warrant liability, forgivable loan amortization,

impairment of goodwill and intangible assets and gain on disposal

of Gilman branches is a key metric we use in evaluating our

business. EBITDA is considered a non-GAAP financial measure as

defined by Regulation G promulgated by the SEC.

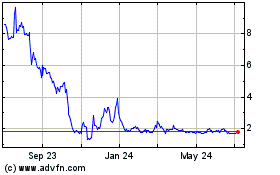

Fortress Biotech (NASDAQ:FBIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

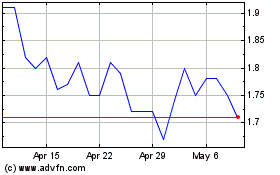

Fortress Biotech (NASDAQ:FBIO)

Historical Stock Chart

From Apr 2023 to Apr 2024