Current Report Filing (8-k)

December 22 2017 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

December 22, 2017

Date of Report (Date of earliest event reported)

ATYR PHARMA, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37378

|

|

20-3435077

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

3545 John Hopkins Court, Suite #250

San Diego, California 92121

|

|

(Address of principal executive offices, including zip code)

|

(858) 731-8389

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company

☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☒

Item 1.01 Entry into a Material Definitive Agreement.

Loan and Security Agreement

On December 22, 2017, aTyr Pharma, Inc. (the “Company”) entered into an amendment (the “Loan Amendment”) to the Loan and Security Agreement with Silicon Valley Bank (“SVB”) and Solar Capital Ltd. (“Solar”, and together with SVB, the “Lenders”). The Loan Amendment amends that certain Loan and Security Agreement between the Company and the Lenders, dated as of November 18, 2016 (the “Loan Agreement”).

The Loan Agreement provides for up to $20.0 million in term loans in three tranches.

The Loan Amendment modifies the milestone requirements for the draw of the third tranche of the loan to include Australia as a qualifying geography for the initiation of a Phase 1 clinical trial for iMod.Fc. In connection with the Loan Amendment, the third tranche of $5.0 million was funded on December 22, 2017.

The foregoing is only a brief description of the Loan Agreement and the Loan Amendment, does not purport to be a complete description of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to the Loan Agreement and the Loan Amendment. The Loan Agreement was previously filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2016, an amendment to the Loan Agreement was previously filed as an exhibit to the

Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2017

and the Loan Amendment will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ended December 31, 2017.

Warrants

As previously disclosed, in connection with the Loan Agreement, the Company agreed to issue warrants to each of SVB and Solar to purchase that number of shares of the Company’s common stock equal to 3% of the amount loaned under the Loan Agreement by SVB and Solar, respectively, or $75,000, divided by the lesser of (i) the average closing price of the Company’s common stock for the 10 trading days prior to the date of issuance of the warrants and (ii) the closing price of the Company’s common stock on the date prior to the date of issuance of the warrants in connection with the Company’s draw down of the third tranche under the Loan Agreement (the “Warrants”). The number of shares for each Warrant is 20,188 and the exercise price for each Warrant is $3.715 per share. The Warrants are immediately exercisable and will expire on December 22, 2024, provided that such Warrants have not been previously exercised or have expired in connection with certain fundamental transactions involving the Company.

The foregoing is only a brief description of the Warrants, does not purport to be a complete description of the rights and obligations of the parties thereunder and is qualified in its entirety by reference to the Warrants which will be filed as exhibits to the Company’s Annual Report on Form 10-K for the year ended December 31, 2017.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information contained in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference in this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The information contained in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference in this Item 3.02.

The Warrants described in Item 1.01 above were offered and sold in reliance upon the exemption from registration provided by Section 4(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”). The Warrants contain representations to support the Company’s reasonable belief that each of the recipients of such securities had access to information concerning the Company’s operations and financial condition, that each such recipient is acquiring the securities for its own account and not with a view to the distribution thereof, and that each such recipient is an “accredited investor” as defined by Rule 501 promulgated under the Securities Act.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ATYR PHARMA, INC.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ John T. Blake

|

|

|

|

John T. Blake

|

|

|

|

Senior Vice President, Finance

|

|

|

|

|

|

Date: December 22, 2017

|

|

|

3

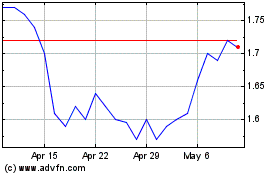

aTyr Pharma (NASDAQ:LIFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

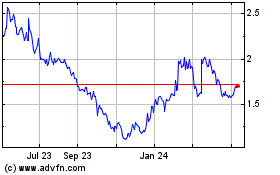

aTyr Pharma (NASDAQ:LIFE)

Historical Stock Chart

From Apr 2023 to Apr 2024