Report of Foreign Issuer (6-k)

December 22 2017 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer Pursuant

to Rule 13a-16 or 15d-16

Under the Securities Exchange Act of 1934

For the Month of December 2017

001-36345

(Commission File Number)

GALMED

PHARMACEUTICALS LTD.

(Exact name of Registrant as specified in

its charter)

16 Tiomkin St.

Tel Aviv 6578317, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover

Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(1):

____

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

____

On December 22, 2017, Galmed Pharmaceuticals

Ltd. (the “Company”) entered into an At-the-Market Equity Offering Sales Agreement (the “Sales Agreement”)

with Stifel, Nicolaus & Company, Incorporated (“Stifel”), pursuant to which the Company may offer and sell ordinary

shares, par value NIS 0.01 per share, of the Company (the “Ordinary Shares”), having an aggregate offering price of

up to $35.0 million (the “Shares”) from time to time through Stifel, acting as sales agent (the “Offering”).

Any Shares offered and sold will be issued pursuant to the Company’s shelf registration statement on Form F-3 (Registration

No. 333-203133) and the related prospectus previously declared effective by the Securities and Exchange Commission (the “SEC”)

on July 1, 2015, as amended on August 4, 2017 (the “Registration Statement”), as supplemented by a prospectus supplement,

dated December 22, 2017, which the Company will file with the SEC pursuant to Rule 424(b)(5) under the Securities Act.

Upon delivery of a placement notice and

subject to the terms and conditions of the Sales Agreement, Stifel may sell the Shares by methods deemed to be an “at the

market offering” as defined in Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended (the “Securities

Act”). The Company may sell the Shares in amounts and at times to be determined by the Company from time to time subject

to the terms and conditions of the Sales Agreement, but it has no obligation to sell any of the Shares in the Offering.

The Company or Stifel may suspend or terminate

the offering of Shares upon notice to the other party and subject to other conditions. Stifel will act as sales agent on a commercially

reasonable efforts basis consistent with its normal trading and sales practices and applicable state and federal law, rules and

regulations and the rules of Nasdaq.

The Company has agreed to pay Stifel a

commission rate of up to 3.0% of the aggregate gross proceeds from each sale of Shares and has agreed to provide Stifel with customary

indemnification and contribution rights. The Company has also agreed to reimburse Stifel for certain specified expenses.

The foregoing description of the Sales

Agreement is not complete and is qualified in its entirety by reference to the full text of such agreement, a copy of which is

furnished herewith as Exhibit 1.1 to this Current Report on Form 6-K and is incorporated herein by reference.

Meitar

Liquornik Geva Leshem Tal,

Israeli counsel to the Company, has issued a legal opinion relating to the Shares. A copy

of such legal opinion, including the consent included therein, is attached as Exhibit 5.1 hereto.

This Current Report on Form 6-K shall not

constitute an offer to sell or the solicitation of an offer to buy the Shares, nor shall there be any offer, solicitation, or sale

of the Shares in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of any such state.

On December 21, 2017, the

Company delivered written notice to Cantor Fitzgerald & Co. (“Cantor”) that it was terminating, with

immediate effect, its Controlled Equity Offering

SM

Sales Agreement dated May 31, 2016 (the

“2016 Agreement”). Under the 2016 Agreement, the Company was entitled to issue and sell, from time to time,

through Cantor, Ordinary Shares, having an aggregate offering price of up to $16 million in an “at the market

offering” program (the “Former ATM Program”). From May 31, 2016, when the Former ATM Program was announced,

until its termination on December 21, 2017, the Company sold an aggregate of 1,711,769 Ordinary Shares under the Former ATM

Program for net proceeds of approximately $11.1 million, including an aggregate of 779,209 Ordinary Shares for net

proceeds of approximately $6.5 million sold after September 30, 2017.

This Form 6-K (including exhibits) is incorporated

by reference into the Company's Registration Statement on Form S-8 filed with the Securities and Exchange Commission on August

11, 2015 (Registration No. 333-206292) and its Registration Statement on Form F-3 filed with the Securities and Exchange Commission

on March 31, 2015 (Registration No. 333- 203133) except that Exhibit 5.1 is only incorporated by reference into the foregoing Form

F-3.

EXHIBIT INDEX

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

|

1.1

|

|

At-the-Market Equity

Offering Sales Agreement, dated December 22, 2017, by and between Galmed Pharmaceuticals

Ltd. and Stifel, Nicolaus & Company, Incorporated

|

|

|

|

|

|

5.1

|

|

Opinion of Meitar Liquornik

Geva Leshem Tal

|

|

|

|

|

|

23.1

|

|

Consent of Meitar Liquornik Geva

Leshem Tal (contained in Exhibit 5.1)

|

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

Galmed Pharmaceuticals Ltd.

|

|

|

|

|

|

|

Date: December 22, 2017

|

By:

|

/s/ Allen Baharaff

|

|

|

|

|

Allen Baharaff

|

|

|

|

|

President and Chief Executive Officer

|

|

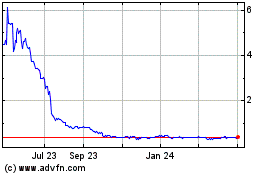

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

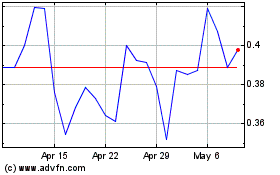

Galmed Pharmaceuticals (NASDAQ:GLMD)

Historical Stock Chart

From Apr 2023 to Apr 2024