U.S. Stocks Finish Trading Higher -- WSJ

December 22 2017 - 3:02AM

Dow Jones News

By Michael Wursthorn and Riva Gold

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 22, 2017).

-- U.S. stocks move higher

-- Shares of banks and energy firms lead S&P 500

-- Utility stocks fall

Shares of banks and energy firms rose Thursday to help major

indexes snap a two-day streak of declines.

Recent pledges from several companies -- including banks and

telecommunications firms -- to share the benefits of Republicans'

tax cuts with their employees helped investors overcome concerns

around how much of the tax bill had already been priced into the

market this year, money managers said. The S&P 500 is up 20% in

2017, with gains partly driven by the expectations of lower

taxes.

"Corporate America is feeling flush," said Charlie Smith, chief

investment officer of Fort Pitt Capital Group. Instead of using the

tax cuts to pay more dividends or repurchase shares, some companies

are promising to pay their employees more or invest in big

projects, he added. "This could mark a sea change in corporate

behavior versus what we've seen the last 10 years."

Energy shares also rose as U.S. oil prices settled at their

second-highest level of the year. The gains helped offset declines

among shares of technology firms late in the session, which caused

indexes to pull back from their intraday highs, and utilities.

The Dow Jones Industrial Average climbed 55.64 points, or 0.2%,

to 24782.29, while the S&P 500 rose 5.32 points, or 0.2%, to

2684.57. The Nasdaq Composite added 4.40 points, or less than 0.1%,

to 6965.36.

Wells Fargo & Co. and Fifth Third Bancorp said Wednesday

they would raise their minimum wage to $15 an hour, while AT&T

and Comcast promised to pay a $1,000 bonus to most of their U.S.

workers.

Wells Fargo's stock added $1.47, or 2.4%, to $61.61, while Fifth

Third rose 42 cents, or 1.4%, to 30.93. AT&T gained 33 cents,

or 0.9%, to 38.88, and Comcast shares rose 1.43, or 3.6%, to

40.81.

Banks were also getting a boost from a multiday surge in U.S.

government bond yields. The yield on the 10-year U.S. Treasury note

edged down to 2.483% from 2.497% on Wednesday, when it hit its

highest level since March. Yields rise as prices fall.

Gains among Wells Fargo and other banks pushed the KBW Nasdaq

Bank index of large U.S. lenders 1.2% higher.

Meanwhile, energy stocks in the S&P 500 rose 2.1%, as crude

oil gained 0.5%, to $58.36 a barrel.

Chevron added 3.93, or 3.3%, to 124.82, contributing roughly 27

points to the Dow's gain. Exxon Mobil added 98 cents, or 1.2%, to

83.85.

With the tax bill nearly complete, some analysts and investors

say they are concerned that any resulting lift to corporate profits

and the economy could spur the Federal Reserve to quicken the pace

of interest-rate increases.

U.S. output grew at a 3.2% annual rate in the third quarter, the

economy's best quarter since the first three months of 2015, the

Commerce Department said Thursday.

"It could give corporates more clarity and a one-year jump in

earnings growth, but any pickup may be offset by tighter [monetary]

policy," said Zahra Ward-Murphy, equity strategist at Absolute

Strategy Research.

Investors were also following lawmakers' year-end talks over a

bill to keep the government funded, analysts said.

Elsewhere, the Stoxx Europe 600 rose 0.6% after two consecutive

sessions of losses. In Asia, South Korea's Kospi fell 1.7% after

shares of Samsung Electronics slid. The Shanghai Composite Index

rose 0.4%, while the Hang Seng gained 0.5%.

Corrections & Amplifications The Dow Jones Industrial

Average closed at 24782. An earlier version of this article

incorrectly stated the index closed at 23782.

Write to Michael Wursthorn at Michael.Wursthorn@wsj.com and Riva

Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

December 22, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

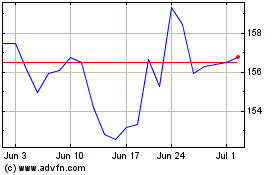

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

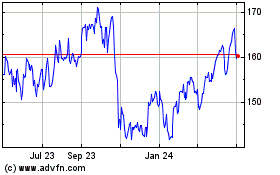

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024