Current Report Filing (8-k)

December 21 2017 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 20, 2017

Federal National Mortgage Association

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federally chartered corporation

|

|

000-50231

|

|

52-0883107

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3900 Wisconsin Avenue, NW

Washington, DC

|

|

20016

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (800) 2FANNIE (800-232-6643)

(Former name or former address, if changed since last report): ______________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§203.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

Emerging growth company

¨

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01 Entry into a Material Definitive Agreement.

Increase in Fannie Mae Capital Reserve to $3 billion

On December 21, 2017, Fannie Mae (formally known as the Federal National Mortgage Association), through the Federal Housing Finance Agency (“FHFA”), in its capacity as conservator, and the United States Department of the Treasury (“Treasury”) entered into a letter agreement that provides the following:

|

|

|

|

•

|

For the dividend period from October 1, 2017 through and including December 31, 2017, the dividend otherwise payable to Treasury on Fannie Mae’s senior preferred stock will be reduced by $2.4 billion. Consequently, upon the conservator, acting as successor to the rights, titles, powers and privileges of the Board of Directors, declaring a senior preferred stock dividend for this dividend period, Fannie Mae will pay a dividend to Treasury of approximately $650 million by December 31, 2017.

|

|

|

|

|

•

|

The dividend payable on the senior preferred stock for a dividend period is the amount, if any, by which our net worth as of the end of the immediately preceding fiscal quarter exceeds an applicable capital reserve amount. The capital reserve amount would have decreased to zero on January 1, 2018. For dividend periods beginning January 1, 2018, the letter agreement increases the applicable capital reserve amount back up to $3 billion.

|

|

|

|

|

•

|

If, for any future dividend period, Fannie Mae does not declare and pay a dividend in the full amount provided for in the senior preferred stock, the capital reserve amount will thereafter be zero. Under the terms of the senior preferred stock, if we do not have a positive net worth or if our net worth does not exceed the applicable capital reserve amount as of the end of a fiscal quarter, then no dividend amount will accrue or be payable for the applicable dividend period.

|

|

|

|

|

•

|

Fannie Mae will amend or replace the existing Certificate of Designation for the senior preferred stock to reflect the revised dividend provisions.

|

|

|

|

|

•

|

In addition, the liquidation preference on the senior preferred stock, which is currently $117.1 billion, will increase by $3 billion on December 31, 2017.

|

A copy of the letter agreement is filed as Exhibit 10.1 to this report and incorporated herein by reference. The description of the agreement herein is qualified in its entirety by reference to the full text of the agreement filed as Exhibit 10.1 to this report.

Treasury beneficially owns more than 5% of the outstanding shares of our common stock by virtue of the warrant we issued to Treasury on September 7, 2008. Fannie Mae’s Form 10-K for the year ended December 31, 2016 contains a description of Fannie Mae’s amended and restated senior preferred stock purchase agreement with Treasury under the heading “Business—Conservatorship and Treasury Agreements—Treasury Agreements” and discussions, which are incorporated herein by reference, of Treasury’s beneficial ownership of our common stock and our transactions with Treasury in “Certain Relationships and Related Transactions, and Director Independence—Transactions with Related Persons—Transactions with Treasury.”

Item 8.01 Other Events.

On December 20, 2017, Congress passed tax legislation that, among other things, reduces the corporate income tax rate from 35% to 21%. Because of this reduction in the corporate tax rate, Fannie Mae is required to measure its deferred tax assets using the new rate in the period in which the bill containing the rate change is signed by the President and enacted into law. This will result in an estimated one-time charge through our provision for federal income taxes of approximately $10 billion in that period. We expect this charge, combined with the restrictions on the amount of capital we are permitted to retain, will result in our being required to draw from Treasury under our Senior Preferred Stock Purchase Agreement with Treasury

.

Our expectations are based on assumptions relating to a number of factors, including the value of our deferred tax assets as of December 31, 2017. Upon drawing funds from Treasury, the amount of remaining funding under the agreement, currently $117.6 billion, will be reduced by the amount of our draw. Our need for a draw will be due to restrictions on the amount of capital we may retain and not an indication of our underlying business fundamentals, which remain strong. We also expect that we will benefit from the lower corporate tax rate in the future.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

. The following exhibits are being submitted with this report:

|

|

|

|

|

|

|

Exhibit Number

|

|

Description of Exhibit

|

|

10.1

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

FEDERAL NATIONAL MORTGAGE ASSOCIATION

|

|

|

|

|

|

|

By

|

/s/ Timothy J. Mayopoulos

|

|

|

|

Timothy J. Mayopoulos

President and Chief Executive Officer

|

|

|

|

|

Date: December 21, 2017

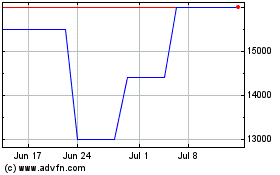

Federal National Mortgag... (PK) (USOTC:FNMFO)

Historical Stock Chart

From Mar 2024 to Apr 2024

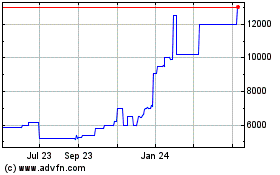

Federal National Mortgag... (PK) (USOTC:FNMFO)

Historical Stock Chart

From Apr 2023 to Apr 2024