Current Report Filing (8-k)

December 20 2017 - 4:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the Securities Exchange Act of 1934

Commission File

Number:

333-202970

|

Sheng Ying Entertainment Corp.

|

|

(Exact name of Registrant as specified in its charter)

|

|

|

|

Nevada

|

|

30-0828224

|

|

(State of incorporation)

|

|

(IRS Employer ID Number)

|

|

|

|

|

|

5348 Vegas Drive, Las Vegas, NV 89108

|

|

Address of Principal Executive Office

|

|

|

|

Avenidida Doutor Mario Soares N. 320

Edificio Finance & IT Centre

5 Andar A

Macau

|

|

(Previous Address of principal executive offices)

|

|

|

|

(310) 982-1331

|

|

Registrant’s telephone number, including area code

|

Date of Report

(Date of earliest event reported):

December 19, 2017

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

At a Special Meeting of the Board of Directors of

Sheng Ying Entertainment Corp., a Nevada corporation, December 19, 2017, the Board adopted the following Resolutions:

|

|

1)

|

authorizing the Company seek, through a private placement memorandum, to raise up to a maximum of US$2,000,000.00 through the

sale of a maximum of 2,000,000 shares of the Company’s restricted Common Stock, at a sale price of US$1.00 per share. The

Directors shall have total discretion to sell less than the 2,000,000 shares;

|

|

|

2)

|

authorizing the Company to present to shareholders for approval an amendment to the Company’s

Articles of Incorporation to effect the change of the Company’s name to “

VITALIBIS, INC

., all pursuant to applicable

Nevada state laws, rules and regulations, as well as the Company’s Bylaws;

|

|

|

3)

|

authorizing the total issued and outstanding shares of Common Stock of the

Company to be forward split on the basis of 2.5 for 1, as of December 31, 2017, or upon approval of the split and name change by

FINRA, which ever first occurs. The effect of the split would result in each one (1) share of the Common Stock issued and outstanding

to become two and one-half (2½) shares. The total authorized shares would remain at 50,000,000 (45,000,000 shares of Common

Stock and 5,000,000 shares of Preferred Stock), par value remaining at $.001 per share. Any fractional shares resulting from the

split shall be rounded up to the next whole number;

|

|

|

4)

|

directing the officers and the Company’s corporate and securities counsel

work together and take any and all actions, and execute any and all documents deemed necessary and appropriate, to effect the Resolutions

adopted herein, including coordinating the protocols for approval of the name change by shareholders, consistent with Nevada corporate

law (NRS Ch. 78), together with actions to file and notify regulatory authorities of this action, as well as the forward split

and otherwise comply with all applicable laws, rules and regulations, including coordinating with FINRA on the change of the Company’s

name, forward split and change of symbol and CUSIP number; and

|

|

|

5)

|

directing the officers and the Company’s corporate and securities counsel

to work together on the private placement, and take any and all actions to insure the Company’s compliance with the Securities

Act of 1933, as amended (the “Act”), and Regulation D promulgated thereunder, to insure that the proposed offering

will be exempt from registration under state and federal securities laws, rules and regulations applicable to publicly trading

companies offering securities and raising capital without a filing a registration statement for same, together with actions to

file and notify regulatory authorities of this action, and otherwise comply with all applicable state and federal laws, rules and

regulations. It is specifically stipulated that the proposed offering shall be made to a limited number (no more than 10) “accredited

investors”, as that term is defined in Regulation D promulgated under the Act.

|

(d) Exhibits

.

The exhibits listed

in the following Exhibit Index are filed as part of this Current Report on Form 8-K:

________________

Signatures

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 20, 2017

SHENG YING ENTERTAINMENT CORP.

By:

/s/ Steve Raack

Steve Raack

President and Chief Executive Officer

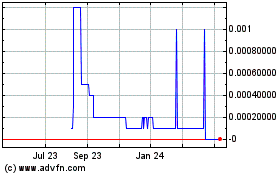

Vitalibis (CE) (USOTC:VCBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

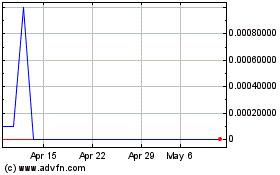

Vitalibis (CE) (USOTC:VCBD)

Historical Stock Chart

From Apr 2023 to Apr 2024