Current Report Filing (8-k)

December 20 2017 - 9:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (Date of earliest event reported): December 19, 2017

PRIMERICA, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware

|

001-34680

|

27-1204330

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

1 Primerica Parkway

Duluth, Georgia 30099

|

|

|

|

(Address of Principal Executive Offices)

|

|

|

|

|

|

|

|

(770) 381-1000

|

|

|

|

(Registrant's telephone number, including area code)

|

|

|

|

|

|

|

Not applicable.

|

|

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01

Entry into a Material Definitive Agreement

The information included pursuant to Item 2.03 is incorporated under this Item 1.01.

Item 2.03

Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant

On December 19, 2017, we entered into a new $200 million five-year unsecured revolving credit facility ("Revolving Credit Facility") with a syndicate of commercial banks consisting of The Bank of New York Mellon, Citibank, N.A., JP Morgan Chase Bank, N.A., Royal Bank of Canada, The Bank of Nova Scotia, and Wells Fargo Bank, National Association (“Administrative Agent”). The Revolving Credit Facility agreement is attached as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference. Proceeds drawn from the Revolving Credit Facility may be used for general corporate purposes. The material terms of the Revolving Credit Facility are as set forth below. The following description of the Revolving Credit Facility is a general description and is qualified in its entirety by reference to the Revolving Credit Facility.

Generally, amounts outstanding under the Revolving Credit Facility bear interest at either a base rate or a LIBOR rate. Amounts outstanding bear interest at a periodic rate equal to LIBOR or the base rate, plus in either case an applicable margin. The Revolving Credit Facility also permits the issuance of letters of credit. The applicable margins are based on our Debt Rating, as defined in the Revolving Credit Facility, with such margins for LIBOR rate loans and letters of credit ranging from 1.125% to 1.625% per annum and for base rate loans ranging from 0.125% to 0.625% per annum. Interest on advances is payable quarterly in arrears for base rate loans and at the end of the interest period for LIBOR rate loans. The Revolving Credit Facility will mature and all amounts outstanding thereunder will be due and payable on December 19, 2022.

We are required to pay certain fees in connection with the Revolving Credit Facility. For example, we must pay a commitment fee that is payable quarterly in arrears and is determined by our Debt Rating as defined in the Revolving Credit Facility. This commitment fee ranges from 0.125% to 0.225% per annum of the aggregate $200 million commitment of the lenders under the Revolving Credit Facility. Additionally, we are required to pay certain fees to the Administrative Agent for administrative services.

The Revolving Credit Facility contains customary covenants including, but not limited to, the preservation and maintenance of our corporate existence, material compliance with laws, payment of taxes, and maintenance of insurance and of our properties. Further, the Revolving Credit Facility contains financial covenants including a leverage ratio of consolidated indebtedness to total capitalization, as such terms are defined in the Revolving Credit Facility agreement, and a minimum consolidated net worth. These ratios are computed at the end of each fiscal quarter. The Revolving Credit Facility includes customary events of default including, but not limited to, the failure to pay any interest, principal or fees when due, the failure to perform any covenant or agreement, inaccurate or false representations or warranties, insolvency or bankruptcy, change of control, the occurrence of certain ERISA events and judgment defaults.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits.

10.1

Credit Agreement dated as of December 19, 2017

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: December 20, 2017

|

PRIMERICA, INC.

|

|

|

|

|

|

|

|

|

/s/ Michael Wells

|

|

|

|

Michael Wells

|

|

|

Executive Vice President and Treasurer

|

3

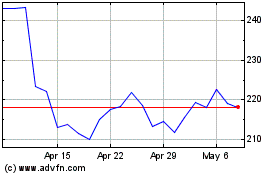

Primerica (NYSE:PRI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Primerica (NYSE:PRI)

Historical Stock Chart

From Apr 2023 to Apr 2024