Bank of America Corporation (the “Corporation”) today announced

the determination of pricing terms of its previously announced

private offers (the “Exchange Offers”) for Eligible Holders (as

defined below) of the Corporation’s outstanding debt securities

listed in the tables below (collectively, the “Existing Notes”) to

exchange Existing Notes for new fixed/floating rate senior notes

(the “New Notes”) in two categories of Exchange Offers, on the

terms and conditions set forth in the confidential offering

memorandum (the “Offering Memorandum”) dated December 4, 2017, and

the accompanying letter of transmittal (the “Letter of

Transmittal”).

The pricing terms for the Exchange Offers were determined at 11

a.m., New York City time, on December 18, 2017 (the “Price

Determination Date”), as described in the Offering Memorandum.

Eligible Holders of Existing Notes validly tendered in the first

category of Exchange Offers, and not validly withdrawn, at or prior

to 5 p.m., New York City time, on December 15, 2017 (the “Early

Participation Date”) and accepted for exchange will be entitled to

receive the applicable Total Exchange Consideration (as defined in

the Offering Memorandum) set forth in the table immediately below

for each $1,000 principal amount of such Existing Notes.

CUSIP No. Title

of Security

Reference U.S. Treasury

Security

Yield of Reference

U.S. Treasury Security

Fixed Spread

(bps)

Exchange Offer Yield

Total Exchange

Consideration

06051GDZ9 7.625% Senior Notes, due June 2019 1.250% U.S.T due

5/31/19 1.802% +20 2.002% $1,079.80 06051GEC9 5.625% Senior Notes,

due July 2020 1.625% U.S.T due 6/30/20 1.895% +25 2.145% $1,085.26

06051GEE5 5.875% Senior Notes, due January 2021 1.750% U.S.T due

12/31/20 1.963% +30 2.263% $1,105.58 06051GEX3 2.600% Senior Notes,

due January 2019 1.125% U.S.T due 1/15/19 1.767% +10 1.867%

$1,007.72 06051GFD6 2.650% Senior Notes, due April 2019 1.250%

U.S.T due 3/31/19 1.798% +10 1.898% $1,009.45 59018YN64 6.875%

Senior Notes, due April 2018 0.750% U.S.T due 4/15/18 1.371% +5

1.421% $1,018.80 06051GDX4 5.650% Senior Notes, due May 2018 0.750%

U.S.T due 4/30/18 1.416% +5 1.466% $1,015.11 590188JN9 6.875%

Senior Notes, due November 2018 1.250% U.S.T due 11/15/18 1.734% +5

1.784% $1,045.37 590188JF6 6.500% Senior Notes, due July 2018

0.875% U.S.T due 7/15/18 1.555% +5 1.605% $1,027.62

Eligible Holders of Existing Notes validly tendered in the

second category of Exchange Offers, and not validly withdrawn, at

or prior to the Early Participation Date and accepted for exchange

will be entitled to receive the applicable Total Exchange

Consideration set forth in the table immediately below for each

$1,000 principal amount of such Existing Notes.

CUSIP No. Title

of Security

Reference U.S. Treasury

Security

Yield of Reference

U.S. Treasury Security

Fixed Spread

(bps)

Exchange Offer Yield

Total Exchange

Consideration

06051GEM7 5.700% Senior Notes, due January 2022 2.000% U.S.T due

11/30/22 2.154% +25 2.404% $1,127.77 06051GEH8 5.000% Senior Notes,

due May 2021 2.000% U.S.T due 11/30/22 2.154% +15 2.304% $1,087.59

590188JB5 6.750% Senior Notes, due June 2028 2.250% U.S.T due

11/15/27 2.369% +125 3.619% $1,270.34 06051GFS3 3.875% Senior

Notes, due August 2025 2.250% U.S.T due 11/15/27 2.369% +72 3.089%

$1,052.94 06051GFG9 4.875% Senior Notes, due April 2044 2.750%

U.S.T due 8/15/47 2.721% +85 3.571% $1,221.06 59018YTM3 6.050%

Senior Notes, due June 2034 2.750% U.S.T due 8/15/47 2.721% +140

4.121% $1,228.75 06051GFF1 4.000% Senior Notes, due April 2024

2.250% U.S.T due 11/15/27 2.369% +58 2.949% $1,059.82 06053FAA7

4.100% Senior Notes, due July 2023 2.000% U.S.T due 11/30/22 2.154%

+76 2.914% $1,060.79 06051GFB0 4.125% Senior Notes, due January

2024 2.250% U.S.T due 11/15/27 2.369% +54 2.909% $1,067.39

06051GFC8 5.000% Senior Notes, due January 2044 2.750% U.S.T due

8/15/47 2.721% +92 3.641% $1,227.60 06051GEN5 5.875% Senior Notes,

due February 2042 2.750% U.S.T due 8/15/47 2.721% +110 3.821%

$1,321.84

The Total Exchange Consideration amounts set forth in the tables

above include the Early Participation Premium (as defined in the

Offering Memorandum) and will be payable in the applicable

principal amount of the applicable series of New Notes. Eligible

Holders of Existing Notes validly tendered after the Early

Participation Date but at or prior to the Expiration Date and

accepted by the Corporation for exchange will receive the Exchange

Consideration (as defined in the Offering Memorandum), which does

not include the Early Participation Premium. In addition to the

Total Exchange Consideration or the Exchange Consideration, as

applicable, Eligible Holders of Existing Notes accepted by the

Corporation for exchange will receive (i) a cash payment for any

accrued and unpaid interest on the applicable series of Existing

Notes to, but excluding, the applicable Settlement Date (as defined

below), and (ii) a cash payment for any amounts due in lieu of

fractional amounts of the applicable series of New Notes issuable

in exchange for Existing Notes accepted in the applicable category

of Exchange Offers.

The table below sets forth the interest rate on each series of

New Notes for the Fixed Rate Period (as defined in the Offering

Memorandum), determined as described in the Offering

Memorandum.

Title of Series of New

Notes

Reference Security

Spread to Reference

Security (bps)

Fixed Rate Coupon

Fixed/Floating Rate Senior Notes, due December 2023 2.000% U.S.

Treasury due November 30, 2022 +85 3.004% Fixed/Floating Rate

Senior Notes, due December 2028 2.250% U.S. Treasury due November

15, 2027 +105 3.419%

For the Floating Rate Period (as defined in the Offering

Memorandum) of the New Notes, (i) the Fixed/Floating Rate Senior

Notes due December 2023 will bear interest at a floating rate equal

to three-month LIBOR plus a spread of 79 basis points, and (ii) the

Fixed/Floating Rate Senior Notes due December 2028 will bear

interest at a floating rate equal to three-month LIBOR plus a

spread of 104 basis points.

The principal amount of New Notes issuable in all of the

Exchange Offers is initially limited to $4,000,000,000, and the

principal amount of New Notes issuable in each category of Exchange

Offers is initially limited to $2,000,000,000. However, the

Corporation intends to increase these limits to the extent

necessary to allow the acceptance of all Existing Notes validly

tendered and not validly withdrawn at or prior to the Early

Participation Date to an overall New Notes limit of up to

$12,000,000,000 and a New Notes limit for each category of Exchange

Offers of up to $6,000,000,000. In addition, the principal amount

of each series of Existing Notes that is accepted pursuant to the

Exchange Offers will be subject to the applicable “acceptance

priority level” as described in the Offering Memorandum.

The “Early Settlement Date” for Existing Notes validly tendered

and not validly withdrawn at or prior to the Early Participation

Date and accepted by the Corporation for exchange is expected to be

December 20, 2017. The Exchange Offers will expire at 11:59 p.m.,

New York City time, on January 4, 2018, unless extended by the

Corporation (the “Expiration Date”), and the “Final Settlement

Date” (if any) for any Existing Notes validly tendered after the

Early Participation Date but at or prior to the Expiration Date and

accepted by the Corporation for exchange is expected to be January

8, 2018. The Early Settlement Date and the Final Settlement Date

each are referred to as a “Settlement Date.”

The Withdrawal Deadline (as defined in the Offering Memorandum)

for valid tenders of Existing Notes occurred at 5 p.m., New York

City time, on December 15, 2017. As a result, tendered Existing

Notes may no longer be withdrawn pursuant to the Exchange Offers,

except as may be required by law.

Consummation of each Exchange Offer is subject to the

satisfaction or waiver of certain conditions as described in the

Offering Memorandum, including (i) the condition that at least

$1,000,000,000 of each series of New Notes be issued in the

Exchange Offers, (ii) the condition that the Existing Notes and the

New Notes receive certain accounting and tax treatment (as

described in the Offering Memorandum) and (iii) the absence of

certain adverse legal and market developments and other customary

conditions. Each Exchange Offer may be amended, extended or

terminated individually.

The Exchange Offers are made, and copies of the documents

relating to the Exchange Offers will be made available, only to a

holder of Existing Notes who has certified in an eligibility letter

(each, an “Eligible Holder”) certain matters to the Corporation,

including its status as (i) a “qualified institutional buyer” as

defined in Rule 144A under the Securities Act of 1933, as amended

(the “Securities Act”), or (ii) a person outside the United States

who is (a) not a “U.S. person” as defined in Rule 902 under the

Securities Act, (b) not acting for the account or benefit of a U.S.

person, and (c) a “non-U.S. qualified offeree” as defined in the

Offering Memorandum. Holders of Existing Notes who desire access to

the electronic eligibility certification should contact D.F. King

& Co., Inc., the information agent for the Exchange Offers, at

866.342.4881 (U.S. toll-free), 212.269.5550 (collect), or at

bac@dfking.com. Holders who wish to receive the Offering Memorandum

and the Letter of Transmittal can certify eligibility at

http://www.dfking.com/bac.

If and when issued, the New Notes will not be registered under

the Securities Act or any state securities laws. Therefore, the New

Notes may not be offered or sold in the United States absent

registration or an applicable exemption from the registration

requirements of the Securities Act and any applicable state

securities laws. The Corporation will enter into a registration

rights agreement with respect to the New Notes.

This press release is not an offer to sell or a solicitation of

an offer to buy any security. The Exchange Offers are being made

solely by the Offering Memorandum and only to such persons and in

such jurisdictions as are permitted under applicable law.

This communication has not been approved by an authorized person

for the purposes of Section 21 of the Financial Services and

Markets Act 2000, as amended (the “FSMA”). Accordingly, this

communication is not being directed at or communicated to persons

within the United Kingdom save in circumstances where section 21(1)

of the FSMA does not apply.

In particular, this communication is only addressed to and

directed at: (A) in any Member State of the European Economic Area

that has implemented the Prospectus Directive (as defined below) (a

“Relevant Member State”), qualified investors in that Relevant

Member State within the meaning of the Prospectus Directive and (B)

(i) persons that are outside the United Kingdom or (ii) persons in

the United Kingdom falling within the definition of investment

professionals (as defined in Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005 (the

“Financial Promotion Order”)) or within Article 43 of the Financial

Promotion Order or are high net-worth entities and other persons

falling within article 69(2)(a) to (d) of the Financial Promotion

Order, or to other persons to whom it may otherwise lawfully be

communicated or caused to be communicated by virtue of an exemption

to Section 21(1) of the FSMA or otherwise in circumstance where it

does not apply (such persons together being “relevant persons”).

The New Notes are only available to, and any invitation, offer or

agreement to subscribe, purchase or otherwise acquire such New

Notes will be engaged in only with, relevant persons. Any person

who is not a relevant person should not act or rely on the Offering

Memorandum or any of its contents. For purposes of the foregoing,

the “Prospectus Directive” means the Prospectus Directive

2003/71/EC, as amended, including pursuant to Directive 2010/73/EU

and includes any relevant implementing measure in a Relevant Member

State.

Forward-looking statements

Certain statements in this news release represent the current

expectations, plans or forecasts of Bank of America Corporation

(“Bank of America”) based on available information and are

forward-looking statements. Forward-looking statements can be

identified by the fact that they do not relate strictly to

historical or current facts. These statements often use words like

“expects,” “anticipates,” “believes,” “estimates,” “targets,”

“intends,” “plans,” “predict,” “goal” and other similar expressions

or future or conditional verbs such as “will,” “may,” “might,”

“should,” “would” and “could.” Forward-looking statements speak

only as of the date they are made, and Bank of America undertakes

no obligation to update any forward-looking statement to reflect

the impact of circumstances or events that arise after the date the

forward-looking statement was made.

Forward-looking statements represent Bank of America’s current

expectations, plans or forecasts of its future results, revenues,

expenses, efficiency ratio, capital measures, and future business

and economic conditions more generally, and other future matters.

These statements are not guarantees of its future results or

performance and involve certain known and unknown risks,

uncertainties and assumptions that are difficult to predict and are

often beyond Bank of America’s control. Actual outcomes and results

may differ materially from those expressed in, or implied by, any

forward-looking statements. You should not place undue reliance on

any forward-looking statement and should consider all of the

uncertainties and risks discussed under Item 1A. “Risk Factors” of

Bank of America’s Annual Report on Form 10-K for the year ended

December 31, 2016 and in any of Bank of America's other subsequent

Securities and Exchange Commission filings.

Visit the Bank of America newsroom for more Bank of America

news.

www.bankofamerica.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171218006032/en/

Reporters May Contact:Jerry Dubrowski, Bank of America,

1.646.855.1195jerome.f.dubrowski@bankofamerica.comInvestors May

Contact:Lee McEntire, Bank of America, 1.980.388.6780Jonathan G.

Blum, Bank of America (Fixed Income), 1.212.449.3112

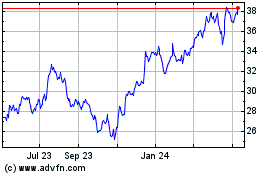

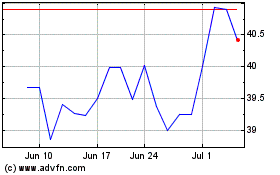

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024