Report of Foreign Issuer (6-k)

December 15 2017 - 4:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE

ACT OF 1934

For the month of December 2017

Commission File Number: 001-34985

Globus Maritime Limited

(Translation of registrant’s name

into English)

128 Vouliagmenis Avenue, 3rd Floor, Glyfada,

Athens, Greece, 166 74

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F

x

Form

40-F

¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Information Contained in this Report on Form 6-K

On June 23, 2017 the

Company entered its Fifth Supplemental Agreement with DVB BANK SE, relating to a loan in the principal amount of up to (originally)

US$40,000,000 to Artful Shipholding S.A. and Longevity Maritime Limited. The main points agreed in this Supplemental Agreement

were:

|

|

·

|

Additional deferrals to the last scheduled

repayment date of the principal amount of the loan of $880,000 in relation to Artful and 832,500 in relation to Longevity.

|

|

|

·

|

Payment of $880,000 in relation to Artful

and $832,500 in relation to Longevity on or before September 28, 2017

|

|

|

·

|

Value maintenance clause respecting the

ships owned by the borrowers in respect of the outstanding principal amount of its loan drops to 50% until 31 December 2017; 105%

from 1

st

of January 2018, and 130% after 30

th

June 2018.

|

|

|

·

|

Replacing the requirement that George

Karageorgiou be the Chief Executive Officer of the Company at all times and George Feidakis be a member of the board of directors

of the Company at all times with the requirement that Athanasios Feidakis be the Chief Executive Officer of the Company at all

times after December 28, 2015 and George Feidakis be a member of the board of directors of the Company at all times.

|

|

|

·

|

Waiver from April 1, 2017 ending April

1, 2018 of the requirement that the Company on a consolidated basis with its subsidiaries (i) hold cash of at least $10,000,000

or 1,000,000 per each of its vessels, (ii) maintain a net worth of at least $50,000,000, and (iii) maintain a ratio of at least

35% of its assets less liabilities to its assets.

|

|

|

·

|

Reducing from January 1, 2018 ending June

30, 2018 the requirement of the Company to maintain a minimum value of the mortgaged ships and other pledged collateral to 105

per cent of the outstanding principal amount of the loan.

|

|

|

·

|

Back-end fee of .75 per cent per annum

of the outstanding principal amount of the loan calculated from April 1, 2017 until April 1, 2018.

|

On July 10, 2017, the

Company entered its Second Supplemental Agreement with HSH NORDBANK AG, relating to a loan in the principal amount of (originally)

up to US$30,000,000 to Devocean Maritime Ltd., Domina Maritime Ltd., and Dulac Maritime S.A. The main points agreed in this Supplemental

Agreement were:

|

|

·

|

Additional deferrals to the last scheduled

repayment date of the principal amount of the loan during the period from June 3, 2016 ending March 3, 2018, in relation to Devocean

of $956,460, in relation to Domina of $920,000, and in relation to Dulac of $897,920.

|

|

|

·

|

Deferral fee of 2.5 per cent per annum

on the additional deferred amounts calculated from March 4, 2017 until March 3, 2018.

|

|

|

·

|

Prepayment of $1,000,000 on or before

September 27

th

2017.

|

|

|

·

|

Undertaking that the Company raise at

least $1,800,000 from its shareholders by December 31, 2017.

|

|

|

·

|

Restriction of the borrowers to make distributions

or other payments to the Company so long as such additional deferred amounts remain outstanding.

|

|

|

·

|

Waiver from June 3, 2016 ending March

3, 2018 of the requirement that the Company maintain a net worth of at least $30,000,000 and hold cash on a consolidated basis

with its subsidiaries of at least 5% of their consolidated indebtedness.

|

The representations,

warranties and covenants contained in the relative Supplemental Agreements were made solely for the benefit of the parties to those

agreements and may be subject to limitations agreed upon by the contracting parties. Accordingly, the Supplemental Agreements that

are incorporated herein by reference only to provide investors with information regarding the terms and conditions of the Supplemental

Agreements, and not to provide investors with any other factual information regarding the Company or its business, and should be

read in conjunction with the disclosures in the Company’s periodic reports and other filings with the Securities and Exchange

Commission.

The foregoing description

of the Supplemental Agreements, does not purport to be complete and is qualified in its entirety by reference to the full text

of those agreements, which are filed as Exhibit 10.1,& 10.2, to this current Report on Form 6-K incorporated herein by reference.

EXHIBITS

The following exhibit is filed as part of this Report on

Form 6-K:

|

10.1

|

DVB Bank SE-Globus Maritime Limited, Fifth Supplemental Agreement,

dated June 23, 2017

|

|

10.2

|

HSH Nord Bank AG-Globus Maritime Limited,

Second Supplemental Agreement, dated July 10, 2017

|

THIS REPORT ON FORM 6-K

IS HEREBY INCORPORATED BY REFERENCE INTO THE COMPANY’S REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333-217282) FILED WITH

THE SECURITIES AND EXCHANGE COMMISSION ON APRIL 13, 2017, AS AMENDED MAY 17, 2017 AND DECLARED EFFECTIVE MAY 30, 2017.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

Date: December 15, 2017

|

|

|

|

GLOBUS MARITIME LIMITED

|

|

|

|

|

|

|

By:

|

/s/Athanasios Feidakis

|

|

|

Name:

|

Athanasios Feidakis

|

|

|

Title:

|

President, Chief Executive Officer and Chief Financial Officer

|

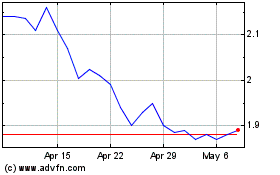

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Globus Maritime (NASDAQ:GLBS)

Historical Stock Chart

From Apr 2023 to Apr 2024