Current Report Filing (8-k)

December 15 2017 - 1:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8

‑

K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 11, 2017

VERIFONE SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

Commission File Number: 001-32465

Delaware

(State or Other Jurisdiction of Incorporation or Organization)

04-3692546

(IRS Employer Identification No.)

88 West Plumeria Drive

San Jose, CA 95134

(Address of principal executive offices, including zip code)

408-232-7800

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01

Entry into a Material Definitive Agreement.

On December 11, 2017, VeriFone, Inc. (“Verifone”), an indirect wholly-owned subsidiary of VeriFone Systems, Inc. (the “Company”), entered into an Asset Purchase Agreement (the “Purchase Agreement”) with Curb Technologies, LLC (“Curb”), pursuant to which Verifone agreed to sell to Curb certain assets and liabilities of Verifone Taxi Solutions business (“Taxi Solutions”) for $30 million in cash, consisting of $22.5 million paid at closing and a $7.5 million deferred payment due 90 days after closing. In addition, in connection with the transaction, Verifone received a 10% equity stake in a limited liability company that is an indirect parent of Curb. The purchase price is subject to upward adjustment based on working capital in certain circumstances. As part of the transaction, Curb received the net working capital assets (other than cash) of Taxi Solutions, which had a carrying value of $8.4 million as of October 31, 2017, and which are primarily comprised of accounts receivable, prepaid expenses and accounts payable. Curb also assumed responsibility for the $50.3 million of associated operating lease commitments, and has generally assumed post-closing liabilities related to the business and current liabilities to the extent included in the calculation of net working capital. Verifone will retain certain liabilities incurred prior to closing other than current liabilities included in the calculation of net working capital.

The transaction closed simultaneously with the signing of the Purchase Agreement. Amos Tamam, the Company’s former Senior Vice President of Taxi Solutions and founder of Verifone’s taxi solutions business, provided a portion of the funding in connection with the transaction and acquired an interest in a limited liability company that is an indirect parent of Curb.

The foregoing description of the Purchase Agreement is not complete and is qualified in its entirety by reference to the text of the Purchase Agreement, a copy of which is filed as Exhibit 2.1 to this Form 8-K and is incorporated herein by reference. The Company has omitted schedules and similar attachments to the Purchase Agreement pursuant to Item 601(b)(2) of Regulation S-K.

Item 2.01. Completion of the Acquisition or Disposition of Assets

The information regarding the transaction described under Item 1.01 is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(b) Pro Forma Financial Information

The unaudited pro forma consolidated balance sheet of Verifone Systems, Inc. as of July 31, 2017, and the unaudited pro forma consolidated statements of operations of Verifone Systems, Inc. for the year ended October 31, 2016 and the nine months ended July 31, 2017 are included as Exhibit 99.1 to this report and are incorporated into this Item 9.01 by reference.

(d) Exhibits

The following exhibit is filed as part of this Current Report on Form 8-K.

2.1 Asset Purchase Agreement, dated December 11, 2017, by and between VeriFone, Inc. and Curb Technologies, LLC. The Company agrees to furnish supplementally a copy of any omitted exhibit or schedule to the Securities and Exchange Commission on request.

The following exhibit is furnished as part of this Current Report on Form 8-K.

99.1 Unaudited Pro Forma Condensed Consolidated Financial Information of VeriFone Systems, Inc.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

VERIFONE SYSTEMS, INC.

|

|

|

|

|

Date: December 15, 2017

|

By:

/s/ Albert Liu

Name: Albert Liu

Title: Executive Vice President, Corporate Development and

General Counsel

|

|

|

|

EXHIBIT INDEX

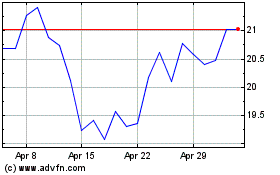

Paymentus (NYSE:PAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

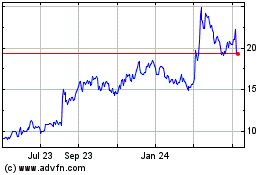

Paymentus (NYSE:PAY)

Historical Stock Chart

From Apr 2023 to Apr 2024