Wildfires Threaten SoCal Housing Markets Already Struggling with Unaffordability and Low Inventory, According to Redfin

December 14 2017 - 8:00AM

Business Wire

- National home prices rose 7.8 percent

in November as inventory declined 12.8 percent

- Pace and competition in housing market

continued to accelerate in November after 26 months of inventory

declines

- Sonoma County housing market felt

impact of October wildfires as inventory plunged 47 percent

- In Ventura and Santa Barbara counties

where wildfires are threatening homes, inventory has declined by

double-digits for three months straight and fires could worsen the

inventory shortage

- San Jose prices climbed 23 percent and

competition reached new heights in November

(NASDAQ: RDFN) — Home price growth was strong in November, up

7.8 percent from last year, according to Redfin (www.redfin.com),

the next-generation real estate brokerage. The median sale price

was $292,000 across the markets Redfin serves. Sales were down 1.3

percent. The number of homes for sale declined 12.8 percent

compared to a year ago, marking 26 months in a row of inventory

declines.

“Overall, 2017 has been an uneven year for home sales. The year

started out strong, but a combination of low inventory and weather

events overtook sales growth; sales have been flat to declining in

six out of the past 11 months,” said Redfin chief economist Nela

Richardson. “The good news is markets have been quick to recover

from severe weather events, even as challenges remain. For example,

Houston home sales were up 4.3 percent in November from a year ago,

and Tampa sales were up 6.1 percent. We are hopeful that Southern

California markets show the same level of resilience in the

aftermath of wildfires there.”

The number of homes newly listed for sale in November increased

a modest 1.1 percent. Any increase in new listings is welcome news

for buyers, however, the number of homes put on the market in

November wasn’t enough to put a dent in the long-standing inventory

shortage. There were 3.1 months of supply in November, far below

the six months of supply that represent a market balanced between

buyers and sellers. Nationally, the typical home spent 46 days on

the market, four days fewer than last November.

2017 has been the fastest market on record and if current trends

continue, Redfin predicts 2018 will be even faster.

Wildfires Threaten California Communities Already Facing

Inventory Shortages

In parts of Los Angeles, Ventura and Santa Barbara counties,

hundreds of homes have been destroyed by wildfires and hundreds

more are under threat from fires that remain uncontained. While it

is too early to know how many families and homes will be impacted,

we do know these counties are already facing a shortage of homes

for sale. Families who are displaced by the wildfires will find it

challenging to find another home for sale nearby.

In Ventura County in November, inventory was down 17.6 percent

and prices grew 9.8 percent year over year to a median of $600,000.

In Santa Barbara County, inventory was down 23.3 percent and prices

grew 6.8 percent year over year to a median of $575,000. The fires

will cause further stress in an already tight housing market.

“The fires have had a big impact on the people and communities

in and around Ventura, Ojai and Santa Barbara,” said Redfin agent

John Venti. “Our already low inventory levels are likely to take a

beating in the coming months not only from the loss of homes but

also the disruption of life and business in the area. A few

prospective home sellers have texted me as they were being

evacuated to cancel our listing consultation appointments. But

these fires, devastating as they are, are temporary. I’m optimistic

that people will resume their holiday festivities and business as

usual as soon as the fires are extinguished and the air

clears.”

The impact of the October wildfires in Northern California was

seen in November market data. In Santa Rosa, one of the hardest hit

cities, inventory fell 46.6 percent in November from a year prior,

a 27.8 percent drop from October. Across Sonoma County, inventory

declined 31.2 percent year over year and prices rose 15.2 percent

to a median of $633,000. The typical home in Sonoma County sold for

101.6 percent of the asking price, the highest sale-to-list price

ratio since 2013. This spike in competition is unusual for the

November market and likely related to the fires.

Home sales were up 8 percent year over year in Santa Rosa and

6.4 percent in Sonoma County in November. December sales in the

affected areas may decline as a result of the fire activity.

Other November Highlights

Competition

- The most competitive market in November

was San Jose, CA where 75.9% of homes sold above list price,

followed by 73.1% in San Francisco, CA, 66.0% in Oakland, CA, 43.5%

in Seattle, WA, and 42.0% in Tacoma, WA.

- The average sale-to-list price ratio in

San Jose was 107.9 percent, the highest on record in that market

since Redfin began tracking this data in 2009.

- San Jose, CA and Seattle, WA were the

fastest markets at 12 median days on market, followed by Oakland,

CA (14), Boston, MA (15) and San Francisco, CA (17).

Prices

- San Jose, CA had the nation’s highest

price growth, rising 23% since last year to $1,076,000. San

Francisco, CA had the second highest growth at 18.5% year-over-year

price growth, followed by Cleveland, OH (15.9%), Seattle, WA

(15.4%), and Salt Lake City, UT (13%).

- Honolulu, HI was the only metro with a

price decline in November falling 3.2%.

Sales

- 4 out of 73 metros saw sales surge by

double digits from last year. Richmond, VA led the nation in

year-over-year sales growth, up 14.6%, followed by Honolulu, HI, up

14.2%. Philadelphia, PA rounded out the top three with sales up

10.8% from a year ago.

- Allentown, PA saw the largest decline

in sales since last year, falling 13.3%. Home sales in Grand

Rapids, MI and Rochester, NY declined by 13.1% and 11.0%,

respectively.

Inventory

- San Jose, CA had the largest decrease

in overall inventory, falling 50.2% since last November. Atlanta,

GA (-32.1%), Buffalo, NY (-30.4%), and Oakland, CA (-29.1%) also

saw far fewer homes available on the market than a year ago.

- Salt Lake City, UT had the highest

increase in the number of homes for sale, up 40.3% year over year,

followed by Baton Rouge, LA (10.9%) and Austin, TX (9.1%).

To read the full report, complete with data and charts, please

visit the following link:

https://www.redfin.com/blog/2017/12/market-tracker-november-2017.html

About Redfin

Redfin (www.redfin.com) is the next-generation real estate

brokerage, combining its own full-service agents with modern

technology to redefine real estate in the consumer's favor. Founded

by software engineers, Redfin has the country's #1 brokerage

website and offers a host of online tools to consumers, including

the Redfin Estimate, the automated home-value estimate with the

industry's lowest published error rate for listed homes. Homebuyers

and sellers enjoy a full-service, technology-powered experience

from Redfin real estate agents, while saving thousands in

commissions. Redfin serves more than 80 major metro areas across

the U.S. The company has closed more than $50 billion in home

sales.

For more information or to contact a local Redfin real estate

agent, visit www.redfin.com. To learn about housing market trends

and download data, visit the Redfin Data Center. To be added to

Redfin's press release distribution list, subscribe here. To view

Redfin's press center, click here.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171214005178/en/

Redfin Journalist Services:Alina Ptaszynski,

206-588-6863press@redfin.com

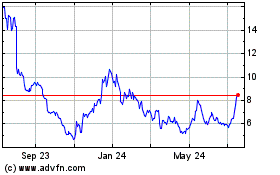

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

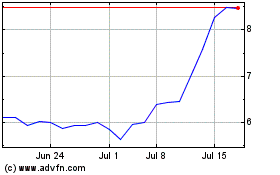

Redfin (NASDAQ:RDFN)

Historical Stock Chart

From Apr 2023 to Apr 2024