Amended Statement of Beneficial Ownership (sc 13d/a)

December 13 2017 - 4:51PM

Edgar (US Regulatory)

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

SCHEDULE 13D/A

|

|

|

|

Under the Securities Exchange Act of 1934

|

|

(Amendment No. 10)*

|

|

|

|

Genco Shipping

& Trading Limited

|

|

(Name of Issuer)

|

|

|

|

Common Stock,

$0.01 Par Value

|

|

(Title of Class of Securities)

|

|

|

|

Y2685T115

|

|

(CUSIP Number)

|

|

|

|

Susanne V. Clark

|

c/o Centerbridge Partners, L.P.

375 Park Avenue

New York, NY 10152

(212) 672-5000

|

|

(Name, Address and Telephone Number of Person

|

|

Authorized to Receive Notices and Communications)

|

|

|

|

December

12, 2017

|

|

(Date of Event Which Requires Filing of This Statement)

|

|

|

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule

13d-1(f) or Rule 13d-1(g), check the following box.

¨

(Page 1 of 20 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting

person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or

otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

2

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Centerbridge Credit Partners, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

1,144,768

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

1,144,768

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,144,768

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

3.32%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

3

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Centerbridge Credit Partners General Partner, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

1,144,768

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

1,144,768

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,144,768

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

3.32%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

4

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Centerbridge Credit Cayman GP Ltd.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

3,805,114

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

3,805,114

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

3,805,114

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

11.02%

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

5

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Centerbridge Credit Partners Master, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,660,346

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,660,346

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,660,346

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

7.70%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

6

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Centerbridge Credit Partners Offshore General Partner,

L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

2,660,346

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

2,660,346

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,660,346

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

7.70%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

7

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Centerbridge Capital Partners II (Cayman), L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

4,810,328

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

4,810,328

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,810,328

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

13.93%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

8

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Centerbridge Capital Partners SBS II (Cayman), L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

35,214

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

35,214

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

35,214

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.10%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

9

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Centerbridge Associates II (Cayman), L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

4,810,328

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

4,810,328

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,810,328

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

13.93%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

10

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

CCP II Cayman GP Ltd.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

4,845,542

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

4,845,542

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,845,542

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

14.03%

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

11

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Centerbridge Special Credit Partners II AIV IV (Cayman),

L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

1,193,731

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

1,193,731

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,193,731

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

3.46%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

12

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Centerbridge Special Credit Partners General Partner

II (Cayman), L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

1,193,731

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

1,193,731

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,193,731

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

3.46%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

13

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Centerbridge Special Credit Partners II, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

242,235

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

242,235

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

242,235

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.70%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

14

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Centerbridge Special Credit Partners General Partner

II, L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

242,235

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

242,235

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

242,235

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

0.70%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

15

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

CSCP II Cayman GP Ltd.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

1,435,966

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

1,435,966

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,435,966

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

4.16%

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

16

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Mark T. Gallogly

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

10,086,622

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

10,086,622

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

10,086,622

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

29.21%

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

17

of 20 Pages

|

|

1

|

NAME OF REPORTING PERSON

Jeffrey H. Aronson

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

10,086,622

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

10,086,622

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

10,086,622

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

29.21%

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

18

of 20 Pages

|

This Amendment No. 10 ("

Amendment No. 10

") amends

and supplements the statement on Schedule 13D (the "

Original Schedule 13D

") filed with the Securities and Exchange

Commission (the "

SEC

") on July 21, 2014, as amended by Amendment No. 1 ("

Amendment No. 1

") filed

with the SEC on July 23, 2015, Amendment No. 2 ("

Amendment No. 2

") filed with the SEC on September 17, 2015, Amendment

No. 3 ("

Amendment No. 3

") filed with the SEC on May 11, 2016, Amendment No. 4 ("

Amendment No. 4

")

filed with the SEC on June 10, 2016, Amendment No. 5 ("

Amendment No. 5

") filed with the SEC on July 1, 2016, Amendment

No. 6 ("

Amendment No. 6")

filed with the SEC on October 11, 2016, Amendment No. 7 ("

Amendment No. 7")

filed with the SEC on October 31, 2016, Amendment No. 8 ("

Amendment No. 8")

filed with the SEC on December 6,

2016 and Amendment No. 9 ("

Amendment No. 9")

filed with the SEC on January 6, 2017 (the Original Schedule 13D

as amended by Amendment No. 1, Amendment No. 2, Amendment No. 3, Amendment No. 4, Amendment No. 5, Amendment No. 6, Amendment No.

7, Amendment No. 8, Amendment No. 9 and this Amendment No. 10, the "

Schedule 13D

"), with respect to the shares

of common stock, par value $0.01 per share (the "

Common Stock

") of Genco Shipping & Trading Limited, a corporation

organized under the laws of the Republic of the Marshall Islands (the "

Issuer

"). This Amendment No. 10 amends

Item 3, 5 and 6 as set forth below.

|

Item 3.

|

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

|

|

|

|

|

|

Item 3 of the Schedule 13D is hereby amended and restated as follows:

|

|

|

|

|

|

The Reporting Persons acquired (i) 1,835,792

shares of Common Stock

(after giving effect to the one-for-ten reverse stock split effected by the Issuer on July 7, 2016)

pursuant to the

Plan (as defined in Item 4), as more fully described in Item 4, (ii) 119,902 shares of Common Stock

(after

giving effect to the one-for-ten reverse stock split effected by the Issuer on July 7, 2016)

as consideration for the 5,551,073

shares of common stock, par value $0.01 per share, of Baltic Trading Limited, a Marshall Islands corporation ("

Baltic

")

that certain of the Reporting Persons held, pursuant to the terms and conditions of the merger (the "

Merger

")

consummated pursuant to that certain Agreement and Plan of Merger by and among the Baltic, the Issuer and Poseidon Merger Sub Limited,

a Marshall Islands corporation and an indirect wholly owned subsidiary of the Issuer ("

Merger Sub

"), dated as

of April 7, 2015, pursuant to which, Merger Sub merged with and into Baltic, with Baltic continuing as the surviving corporation

and an indirect wholly owned subsidiary of the Issuer, as more fully described in that certain Current Report on Form 8-K filed

by the Issuer on July 17, 2015, (iii) 6,597,938 shares of Common Stock upon the Automatic Conversion of Series A Preferred Stock

purchased pursuant to the Stock Purchase Agreement for an aggregate purchase price of $31,999,999.30, which were derived from the

working capital of CCP, CCPM, CSCP II, CSCP Cayman, CCP II Cayman and CCP SBS II Cayman, (iv) 1,032,990 shares of Common Stock

upon the Automatic Conversion of Series A Preferred Stock purchased pursuant to the Additional Stock Purchase Agreement for an

aggregate purchase price of $5,010,001.50, which were derived from the working capital of CCP, CCPM, CSCP II, CSCP Cayman, CCP

II Cayman and CCP SBS II Cayman and (v) 500,000 shares of Common Stock upon the Automatic Conversion of Series A Preferred Stock

purchased pursuant to the Stock Purchase Agreement in exchange for the Reporting Persons' Backstop Commitment (as defined in Item

4).

|

|

Item

5.

|

INTEREST IN SECURITIES OF THE ISSUER

|

|

|

|

|

|

Items 5(a)-(c) of the Schedule 13D is hereby amended and restated as follows:

|

|

|

|

|

|

(a) – (b) The percentages of Common Stock reported herein are based

on 34,532,004 shares of Common Stock outstanding as of November 7, 2017

, as reported in the Issuer's Quarterly Report on Form 10-Q for the quarterly period ended December 30, 2017 filed with the Securities and Exchange Commission on November 7, 2017.

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

19

of 20 Pages

|

|

|

|

|

|

The information required by Items 5(a) – (b) is set forth in rows 7 – 13 of the cover page for each of the Reporting Persons and is incorporated herein by reference.

|

|

|

|

|

|

(c) On December 12, 2017, CCP sold an aggregate of 320,462 shares of Common Stock at $13.11 per share in

a privately negotiated transaction. The 320,462 shares of Common Stock sold represent approximately 3.08% of the aggregate number

of shares of Common Stock beneficially owned by the Reporting Persons immediately prior to such sale. The transactions reported in this Amendment No. 10 reflect year-end planning activities, and the Reporting

Persons' overall beneficial ownership of Common Stock remains substantially unchanged by the reported transactions.

|

|

Item 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

|

|

|

|

|

|

Item 6 of the Schedule 13D is hereby amended and supplemented by the addition of the following:

|

|

|

|

|

|

On December 12, 2017, in a

privately negotiated transaction CCP wrote: (i) 2,000 put options for an aggregate of 200,000 shares of Common Stock with a

strike price of $15.50 and an expiration date of January 25, 2018 and (ii) 2,000 put options for an aggregate of 200,000 shares of Common Stock with a strike price of $16.06

and an expiration date of February 2, 2018.

|

|

CUSIP No. Y2685T115

|

SCHEDULE 13D/A

|

Page

20

of 20 Pages

|

SIGNATURES

After reasonable inquiry and to the best

of his or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Date: December 13, 2017

|

|

CENTERBRIDGE CREDIT PARTNERS, L.P.

|

|

|

|

|

|

By: Centerbridge Credit Partners

|

|

|

|

General Partner, L.P., its general partner

|

|

|

By: Centerbridge Credit Cayman GP Ltd., its general

|

|

|

partner

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

CENTERBRIDGE CREDIT PARTNERS GENERAL

|

|

|

PARTNER, L.P.

|

|

|

|

|

|

By: Centerbridge Credit Cayman GP Ltd., its general

|

|

|

partner

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

Centerbridge Credit Cayman GP Ltd.

|

|

|

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

|

|

|

CENTERBRIDGE CREDIT PARTNERS MASTER,

|

|

|

L.P.

|

|

|

|

|

|

By: Centerbridge Credit Partners Offshore General

|

|

|

Partner, L.P., its general partner

|

|

|

By: Centerbridge Credit Cayman GP Ltd., its general

|

|

|

partner

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

|

|

|

CENTERBRIDGE CREDIT PARTNERS OFFSHORE

|

|

|

GENERAL PARTNER, L.P.

|

|

|

|

|

|

|

|

|

By: Centerbridge Credit Cayman GP Ltd., its general

|

|

|

partner

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

CENTERBRIDGE CAPITAL PARTNERS II

|

|

|

(CAYMAN), L.P.

|

|

|

|

|

|

By: Centerbridge Associates II (Cayman), L.P.,

|

|

|

its general partner

|

|

|

By: CCP II Cayman GP Ltd., its

|

|

|

general partner

|

|

|

By: Centerbridge GP Investors II, LLC, its

|

|

|

director

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

CENTERBRIDGE CAPITAL PARTNERS SBS II

|

|

|

(CAYMAN), L.P.

|

|

|

|

|

|

By: CCP II Cayman GP Ltd., its

|

|

|

general partner

|

|

|

By: Centerbridge GP Investors II, LLC, its

|

|

|

director

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

CENTERBRIDGE ASSOCIATES II (CAYMAN),

|

|

|

L.P.

|

|

|

|

|

|

By: CCP II Cayman GP Ltd., its

|

|

|

general partner

|

|

|

By: Centerbridge GP Investors II, LLC, its

|

|

|

director

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

|

|

|

CCP II CAYMAN GP LTD.

|

|

|

|

|

|

By: Centerbridge GP Investors II, LLC, its

|

|

|

director

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

|

|

|

CENTERBRIDGE SPECIAL CREDIT PARTNERS II

|

|

|

AIV IV (CAYMAN), L.P.

|

|

|

|

|

|

By: Centerbridge Special Credit Partners General

|

|

|

Partner II (Cayman), L.P., its general partner

|

|

|

By: CSCP II Cayman GP Ltd., its general partner

|

|

|

By: Centerbridge Special GP Investors II, L.L.C., its

|

|

|

director

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

|

|

|

CENTERBRIDGE SPECIAL CREDIT PARTNERS

|

|

|

GENERAL PARTNER II (CAYMAN), L.P.

|

|

|

|

|

|

By: CSCP II Cayman GP Ltd., its general partner

|

|

|

By: Centerbridge Special GP Investors II, L.L.C., its

|

|

|

director

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

|

|

|

CSCP II CAYMAN GP LTD.

|

|

|

|

|

|

By: Centerbridge Special GP Investors II, L.L.C., its

|

|

|

director

|

|

|

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

|

|

|

CENTERBRIDGE SPECIAL CREDIT PARTNERS

|

|

|

II, L.P.

|

|

|

|

|

|

By: Centerbridge Special Credit Partners

|

|

|

General Partner II, L.P.,

|

|

|

its general partner

|

|

|

|

|

|

By: CSCP II Cayman GP Ltd., its

|

|

|

general partner

|

|

|

By: Centerbridge Special GP Investors II, L.L.C., its

|

|

|

director

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

|

|

|

CENTERBRIDGE SPECIAL CREDIT PARTNERS

|

|

|

GENERAL PARTNER II, L.P.

|

|

|

|

|

|

By: CSCP II Cayman GP Ltd., its general partner

|

|

|

By: Centerbridge Special GP Investors II, L.L.C., its

|

|

|

director

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

Name: Jeffrey H. Aronson

|

|

|

Title: Authorized Signatory

|

|

|

|

|

|

MARK T. GALLOGLY

|

|

|

|

|

|

/

s

/

Mark T. Gallogly

|

|

|

|

|

|

|

|

|

Jeffrey H. Aronson

|

|

|

|

|

|

/s/ Jeffrey H. Aronson

|

|

|

|

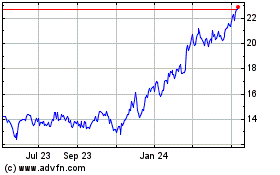

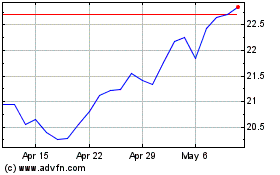

Genco Shipping and Trading (NYSE:GNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Genco Shipping and Trading (NYSE:GNK)

Historical Stock Chart

From Apr 2023 to Apr 2024