Current Report Filing (8-k)

December 13 2017 - 4:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 7, 2017

Federal Realty Investment Trust

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Maryland

|

|

1-07533

|

|

52-0782497

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

1626 East Jefferson Street

Rockville, Maryland 20852-4041

(301)

998-8100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

230.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

230.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Securities Act (17 CFR

230.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events

On December 7, 2017, Federal Realty Investment Trust (the “Registrant”) entered into an underwriting agreement with Deutsche Bank Securities

Inc., Goldman Sachs & Co. LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated and Wells Fargo Securities, LLC, as representatives of the several underwriters named in Schedule I to the related pricing agreement, whereby the

Registrant agreed to issue and sell $175,000,000 aggregate principal amount of 3.25% Notes due 2027 (the “Notes”) in an underwritten public offering. The Notes are of the same series as the 3.25% Notes due 2027 that the Registrant first

issued on June 23, 3017. The Notes will be governed by the Indenture, dated as of September 1, 1998, between the Registrant and U.S. Bank National Association (successor trustee to Wachovia Bank, National Association (successor trustee to

First Union National Bank)). The offering is expected to close on December 21, 2017, subject to customary closing conditions.

The Notes will be

senior unsecured obligations of the Registrant and will rank equally with all of the Registrant’s other senior unsecured indebtedness. The Notes will bear interest at 3.25% per annum, and interest will be payable on January 15 and

July 15 of each year, beginning on January 15, 2018. The notes will mature on July 15, 2027 (unless redeemed prior to such date in accordance with their terms).

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits.

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated December 7, 2017, by and among the Registrant and Deutsche Bank Securities Inc., Goldman Sachs & Co. LLC, Merrill Lynch, Pierce, Fenner

& Smith Incorporated and Wells Fargo Securities, LLC, as representatives of the underwriters named in Schedule I to the related pricing agreement

|

|

|

|

|

1.2

|

|

Pricing Agreement, dated December 7, 2017, by and among the Registrant and Deutsche Bank Securities Inc., Goldman Sachs & Co. LLC, Merrill Lynch, Pierce, Fenner

& Smith Incorporated and Wells Fargo Securities, LLC, as representatives of the underwriters named therein

|

|

|

|

|

12.1

|

|

Statement Regarding Computation of Ratio of Earnings to Fixed Charges

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

FEDERAL REALTY INVESTMENT TRUST

|

|

|

|

|

|

|

Date: December 13, 2017

|

|

|

|

By:

|

|

/s/ Dawn M. Becker

|

|

|

|

|

|

|

|

Dawn M. Becker

|

|

|

|

|

|

|

|

Executive Vice President-General Counsel and Secretary

|

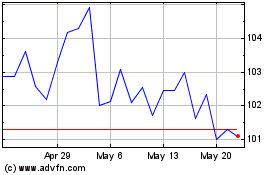

Federal Realty Investment (NYSE:FRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

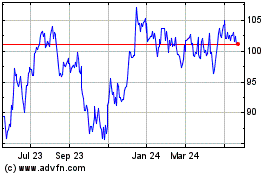

Federal Realty Investment (NYSE:FRT)

Historical Stock Chart

From Apr 2023 to Apr 2024