Current Report Filing (8-k)

December 12 2017 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 6, 2017

Commission file number: 001-33225

Great Lakes Dredge & Dock Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

20-5336063

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

2122 York Road, Oak Brook, IL

|

|

60523

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(630) 574-3000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 1.01 Entry into a Material Definitive Agreement.

On December 6, 2017, Great Lakes Dredge & Dock Corporation (the “

Company

” or “

Great Lakes

”) and certain of its subsidiaries (collectively with the Company, the “

Credit Parties

”) entered into a Consent and Amendment No. 3 (the “

Credit Amendment

”) to their Revolving Credit and Security Agreement dated December 30, 2016 (as amended, the “

Credit Agreement

”) with PNC Bank, National Association, as a lender and agent for the lenders thereunder (the “

Agent

”), and the other required lenders thereunder. The Credit Amendment was entered into to, among other things, obtain consent from the required lenders under the Credit Agreement to permit the Company to consummate certain asset sales, retirements and other restructuring activities described therein, as part of the Company’s plan to reduce overhead, retire certain underperforming and underutilized assets and close out the Company’s Brazilian operations. This consent is subject to a number of important conditions, qualifications, limitations and exceptions that are described in the Credit Amendment.

The Credit Amendment also amends the Credit Agreement to provide that (i) with respect to the Company’s 2017 and 2018 fiscal years, upon written election from the Company to Agent, including supporting documentation in form and substance satisfactory to Agent, up to an aggregate of $20,000,000 of expenses related to the buy-out of operating leases shall not constitute capital expenditures under the Credit Agreement; and (ii) if the amount of capital expenditures incurred by all Credit Parties in fiscal year 2017 does not exceed $75,000,000, then any amount remaining may be carried forward to be incurred in fiscal year 2018; provided further that, the aggregate amount of all capital expenditures incurred by all Credit Parties in fiscal years 2017 and 2018 does not exceed $135,000,000. Additionally, the Credit Amendment contains acknowledgments and agreements from the Agent and the required lenders with respect to certain EBITDA add-backs for fiscal years 2017 and 2018 described therein.

The foregoing description of the Credit Amendment does not purport to be complete and is qualified in its entirety by reference to the text thereof, which will be filed as an exhibit to the Registrant’s annual report on Form 10-K for the year ended December 31, 2017.

{B1164756.1}

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Great Lakes Dredge & Dock Corporation

|

|

|

|

|

|

|

|

|

|

Date: December 12, 2017

|

By:

|

/s/MARK W. MARINKO

|

|

|

|

Mark W. Marinko

|

|

|

|

Senior Vice President and Chief Financial Officer

|

|

|

|

|

{B1164756.1}

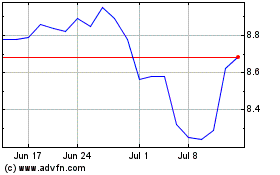

Great Lakes Dredge and D... (NASDAQ:GLDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

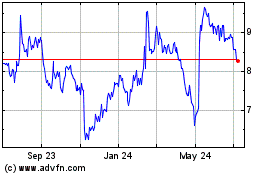

Great Lakes Dredge and D... (NASDAQ:GLDD)

Historical Stock Chart

From Apr 2023 to Apr 2024