Current Report Filing (8-k)

December 11 2017 - 5:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December 6, 2017

XOMA CORPORATION

(Exact

name of registrant as specified in its charter)

|

|

|

|

|

|

|

000-14710

|

|

Delaware

|

|

52-2154066

|

|

(Commission

File Number)

|

|

(State or other jurisdiction

of incorporation)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

2200 Powell Street, Suite 310, Emeryville, California

|

|

94608

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code

(510) 204-7200

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934 (§

240.12b-2

of

this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement

|

On December 6, 2017, XOMA Corporation

(the “Company,” “XOMA” or “we”), through its wholly-owned subsidiary, XOMA (US) LLC, entered into a license agreement (“License Agreement “) with AntriaBio, Inc. (“AntriaBio”) pursuant to which we

granted an exclusive global license to AntriaBio to develop and commercialize XOMA 358 (X358) for all indications. The Company and AntriaBio also entered into a common stock purchase agreement (the “Purchase Agreement” and, together with

the License Agreement, the “Transaction Documents”).

Under the terms of the License Agreement, AntriaBio is responsible for all

development, regulatory, manufacturing and commercialization activities associated with X358 and is required to make certain clinical, regulatory and annual net sales milestone payments to us of up to $222 million in the aggregate based on the

achievement of

pre-specified

criteria. AntriaBio is also obligated to pay XOMA royalties ranging from the high single digits to the

mid-teens

based upon annual net sales

of X358. Finally, under the terms of the License Agreement, AntriaBio is required to pay XOMA a low single digit royalty on sales of AntriaBio’s other products from its current programs. AntriaBio is obligated to take customary steps to advance

X358, including using diligent efforts to commence the next clinical study for X358 by a certain deadline and to meet certain spending requirements on an annual basis for the program until a marketing approval application for X358 is accepted by the

FDA.

AntriaBio’s obligation to pay milestones will continue for so long as AntriaBio is developing or selling products under the

License Agreement, subject to the maximum milestone payment amounts set forth above. AntriaBio’s obligation to pay royalties with respect to a particular X358 product and country will continue for the longer of the date of expiration of the

last valid patent claim covering the product in that country, or twelve years from the date of the first commercial sale of the product in that country. AntriaBio’s obligation to pay royalties with respect to a particular AntriaBio product and

country will continue for the longer of twelve years from the date of the first commercial sale of the product in that country or for so long as AntriaBio or its licensee is selling such product in such country, provided that such royalty will

terminate upon the termination of the licensee’s obligation to make payments to AntriaBio based on sales of such product in such country.

The License Agreement contains customary termination rights relating to material breach by either party. AntriaBio also has a unilateral right

to terminate the License Agreement in its entirety on ninety days’ notice at any time. XOMA has the right to terminate the License Agreement if AntriaBio challenges the licensed patents.

Pursuant to the Transaction Documents, the AntriaBio is also required to pay us $6 million in cash and to issue us $12 million worth

of its common stock related to its financing activities. Further, in the event that AntriaBio does not conduct a financing that raises at least $20 million in aggregate gross proceeds (“Qualified Financing”) by March 31, 2019,

then it shall issue to XOMA an additional number of shares of its common stock equal to $7 million divided by the weighted average of the closing bid and asked prices or the average closing prices of AntriaBio’s common stock on the ten day

trading period prior to March 31, 2019. Finally, in the event that AntriaBio is unable to complete a Qualified Financing by March 31, 2020, it will be obliged to pay XOMA $15 million in order to maintain the license.

The descriptions of the License Agreement and the Purchase Agreement contained herein do not purport to be complete and are qualified in their

entirety by reference to such agreements, together with the exhibits thereto, copies of which will be filed as exhibits to XOMA’s Annual Report on Form

10-K

for the period ending December 31, 2017.

Certain terms of the License Agreement have been omitted from this

Form 8-K and

will be omitted from the version to be filed as an exhibit to the

Form 10-K pursuant

to a Confidential Treatment Request that the Company plans to submit to the Securities and Exchange Commission at the time of the filing of the

Form 10-K.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

XOMA CORPORATION

|

|

|

|

|

|

|

Date: December 11, 2017

|

|

|

|

|

|

/s/ Thomas Burns

|

|

|

|

|

|

|

|

Thomas Burns

|

|

|

|

|

|

|

|

Senior Vice President, Finance and Chief Financial Officer

|

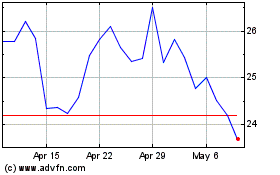

XOMA (NASDAQ:XOMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

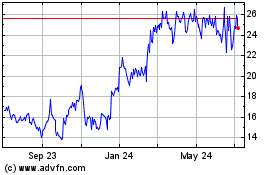

XOMA (NASDAQ:XOMA)

Historical Stock Chart

From Apr 2023 to Apr 2024