SCHEDULE 14A

INFORMATION

Proxy Statement

Pursuant To Section 14(a) of the

Securities Exchange

Act of 1934

(Amendment No. )

|

|

Filed by the

Registrant [X]

|

|

|

Filed by a

Party other than the Registrant [ ]

|

|

|

|

|

|

Check the appropriate

box:

|

|

|

|

|

[

]

|

Preliminary Proxy Statement

|

|

[ ]

|

Confidential, for Use of the Commission

Only (as permitted by Rule 14a-6(e)(2))

|

|

[

X

]

|

Definitive Proxy Statement

|

|

[ ]

|

Definitive Additional Materials

|

|

[ ]

|

Soliciting Material Pursuant to §240.14a-12

|

First Hartford

Corporation

(Name of Registrant

as Specified In Its Charter)

____________________________________________________________

(Name of Person(s)

Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

[

X

] No fee required.

[ ] Fee computed on table below

per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class

of securities to which transaction applies:

(2) Aggregate number of

securities to which transaction applies:

(3) Per

unit price or other underlying value of transaction computed pursuant to

Exchange Act Rule 0-11

(

set forth the amount on

which the filing fee is calculated and state how it was determined

):

(4) Proposed maximum

aggregate value of transaction:

(5) Total fee paid:

[ ] Fee paid previously with

preliminary materials:

[ ] Check box if any part of

the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify

the filing for which the offsetting fee was paid previously.

Identify the previous

filing by registration statement number,

or the Form or Schedule

and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or

Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

FIRST HARTFORD CORPORATION

P.O. Box

1270

149 Colonial Road

Manchester, CT 06045-1270

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

January 17, 2018

We will hold the FY 2017 annual meeting of

shareholders (the “

Annual Meeting

”) of First Hartford Corporation, a

Maine corporation (the “

Company

”), at The Hartford Club – 46 Prospect

Street, Hartford, CT on Wednesday, January 17, 2018 at 10:00 a.m. local time.

At the Annual Meeting, shareholders will be asked to

consider and vote upon the following matters:

1.

The election of five (5) directors

nominated to serve on the Company’s Board of Directors.

2.

To approve the Company suspending

or terminating its filing obligations with the U.S. Securities and Exchange

Commission, also called “Going Dark”, once the Company is eligible.

3.

The conduct of other business if

properly raised before the Annual Meeting or any adjournments thereof.

The Board of Directors of the Company

believes that the election of the director nominees being submitted to the

shareholders is in the best interests of the Company and its shareholders and

urges you to vote “FOR ALL” of the director nominees.

The Board of Directors has fixed the close

of business on November 21, 2017 as the record date for the Annual Meeting.

Only shareholders of record at the close of business on the record date are

entitled to notice of, and to vote at, the Annual Meeting or any adjournments

thereof.

All shareholders are invited to attend the

Annual Meeting. Whether or not you contemplate attending the Annual Meeting,

we suggest that you promptly mark, sign and return the enclosed proxy in the

accompanying envelope. In the event that you attend the Annual Meeting, you

may vote in person, even if you have returned a proxy. You may also revoke the

proxy that you have submitted at any time before it is exercised by delivering

a properly executed, later-dated proxy or a written revocation of your proxy to

the Secretary of the Company at any time before the proxies are voted at the

Annual Meeting.

Your vote is important. To vote your

shares, please mark, sign, and date the enclosed proxy and promptly mail it to

the Company in the enclosed return envelope.

|

December 11, 2017

|

By

Order of the Board of Directors,

|

|

|

Neil

H. Ellis

|

|

|

Chairman

|

|

Proxy

Statement

|

Page 1

|

First

Hartford Corporation

|

PROXY STATEMENT

TO

THE EXTENT THAT INFORMATION INCLUDED IN THIS PROXY STATEMENT CONFLICTS WITH

INFORMATION INCLUDED IN PART III OF THE COMPANY’S FORM 10-K FOR THE FISCAL YEAR

ENDED APRIL 30, 2017, THE DISCLOSURES MADE IN THIS PROXY STATEMENT SUPERSEDE

THE DISCLOSURES MADE IN PART III OF THE COMPANY’S FORM 10-K FOR SUCH YEAR.

This proxy statement is furnished to you

in connection with the solicitation of proxies by the Board of Directors of

First Hartford Corporation for use at the FY 2017 annual meeting of

shareholders of First Hartford Corporation (the “

Annual Meeting

”) or any

adjournments thereof. This proxy statement and the accompanying Notice of

Annual Meeting and proxy card are first being mailed to shareholders of record

on or about December 11, 2017. References in this proxy statement to the

“Company,” “First Hartford,” “we,” “us,” and “our” refer to First Hartford

Corporation.

First Hartford is a Maine corporation

founded in 1909. First Hartford engages in the purchase, development,

ownership, management and sale of real estate and provides preferred developer

services for two corporate franchise operators.

QUESTIONS AND ANSWERS

Questions and answers about these proxy materials and

the Annual Meeting are as follows:

|

Question:

|

Where and when will the Annual Meeting

be held?

|

|

Answer:

|

We

will hold the Annual Meeting on Wednesday, January 17, 2018 at 10:00 a.m.,

local time, at The Hartford Club – 46 Prospect Street, Hartford, CT for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

|

|

Question:

|

On what proposals am I being asked to

vote?

|

|

|

|

|

Answer:

|

1.

|

The election of five directors, Neil H.

Ellis, John Toic, Jeffrey M. Carlson, William M. Connolly, and Jonathan R. Bellock

nominated to serve on the Company’s Board of Directors;

|

|

|

2.

|

To approve the Company suspending or terminating its

filing obligations with the U.S. Securities and Exchange Commission, also

called “Going Dark”, once the Company is eligible; and.

|

|

|

3.

|

The conduct of other business if properly raised before

the Annual Meeting or any adjournments thereof.

|

|

Question:

|

How

will my proxy be voted?

|

|

Answer:

|

Shares

of our common stock represented by properly executed proxies received in time

for the Annual Meeting, unless previously revoked, will be voted at the Annual

Meeting as specified by the shareholders on the proxies. If a proxy is

returned without voting instructions on a particular matter, the shares

represented will be voted “FOR ALL” of the director nominees.

|

|

Question:

|

Once

I send in my proxy, may I revoke it and change my vote?

|

|

Answer:

|

If

you give a proxy, you have the power to revoke it at any time before it is

voted. You can do so in one of three ways:

|

|

Proxy

Statement

|

Page 2

|

First

Hartford Corporation

|

|

|

-

First, you can send a written, signed notice to our Secretary at

the address given below stating that you revoke your proxy.

-

Second, you can complete and sign a new proxy card stating that

you revoke your earlier proxy and send it to our Secretary at the address given

below.

-

Third, you can attend the Annual Meeting and vote in person with

proper state issued identification. If you elect to vote in person, you must

inform the corporate secretary at or before the start of the meeting so that

your earlier proxy can be cancelled.

|

|

|

You should sign and send any written

notice or new proxy card to Jeffrey M. Carlson, Secretary, First Hartford

Corporation, P.O. Box 1270, 149 Colonial Road, Manchester, Connecticut

06045-1270. You may request a new proxy card by calling Mr. Carlson at (860)

646-6555.

|

|

Question:

|

Which

shareholders will be entitled to receive notice of and vote at the Annual

Meeting?

|

|

Answer:

|

Only

shareholders of record at the close of business on November 21, 2017, the

“record date”, will be entitled to receive notice of and vote at the Annual Meeting.

As of November 4, 2017, as a date as close as possible to the record date of November

21, 2017, there were 2,315,799 shares of common stock of the Company issued and

outstanding.

|

|

Question:

|

How

many votes will be allocated to each share for voting at the Annual Meeting?

|

|

Answer:

|

Each

share of Company common stock is entitled to one (1) vote on each matter on

which holders of Company common stock are entitled to vote.

|

|

Question:

|

What

constitutes a quorum for purposes of conducting business at the Annual Meeting?

|

|

Answer:

|

A

majority of the outstanding shares of Company common stock entitled to vote

must be represented in person or by proxy at the Annual Meeting in order for a

quorum to be present. An abstention and a broker non-vote both count toward the

establishment of a quorum.

|

|

Question:

|

What

is a Broker “Non-Vote”?

|

|

Answer:

|

A

broker “non-vote” occurs when a broker acting as the nominee holding shares for

a beneficial owner does not vote on a particular matter because the nominee

does not have discretionary voting power for that particular matter and has not

received instructions from the beneficial owner.

|

|

Question:

|

What

vote is required to approve electing the directors at the Annual Meeting?

|

|

Answer:

|

Each director will be elected by the affirmative vote

of a plurality of the votes cast in person or by proxy in the election at the

Annual Meeting whether in person or by proxy.

|

|

Question:

|

What

vote is required to approve the Company suspending or terminating its filing

obligations with the Securities and Exchange Commission, also called “Going

Dark”?

|

|

Proxy

Statement

|

Page 3

|

First

Hartford Corporation

|

|

Answer:

|

The affirmative vote of a majority of our common stock

outstanding is recommended to approve the Company suspending or terminating its

filing obligations with the Securities and Exchange Commission, also called

“Going Dark”. But this action is not required to be submitted to the

shareholders for a vote, and could alternatively be executed by an affirmative

vote of the Board of Directors without any vote input by the shareholders.

Further, the chairman of the Company holds a majority of voting stock of the

Company and thus, alone, he can cast a vote to approve the action sought. But

because the shares are thinly traded, and since the chairman controls a

majority of the shares, it was decided to effectively poll the shareholders

through a vote on the topic. If a majority of the public actively votes in

opposition to the Company Going Dark, the Board and management may reconsider

so proceeding.

|

|

Question:

|

What

will be the effect of abstentions and broker non-votes have on the vote on the

matters to be acted upon at the Annual Meeting?

|

|

Answer:

|

Abstentions and broker non-votes will have no effect

on the election of directors. The effect of an abstention or a broker

non-vote, if any, on the Going Dark question as it is a “routine” matter, is

the same as that of a vote against the proposal. However, the Company will not

consider abstentions and broker non-votes as “active” votes for purposes of the

potential of reconsidering taking action to Go Dark as discussed in Item 2 of

this proxy statement.

|

|

Question:

|

Who

will count the votes for the Annual Meeting?

|

|

Answer:

|

Our transfer agent provides vote tabulating services

and a certified report of the tabulation will be provided. Ballots at the

meeting will be counted by the inspectors and judges of election at the

meeting; it is anticipated that two officers of the Company will serve as the

inspectors and judges of election.

|

|

Question:

|

Who

will solicit proxies for the Annual Meeting and who will bear the cost of such

solicitation?

|

|

Answer:

|

The Board of Directors are soliciting proxies, the

form of which is enclosed, for the Annual Meeting. The cost of this

solicitation will be borne by the Company. Our officers, directors or regular

employees may communicate with shareholders personally or by mail, e-mail, telephone,

telegram or otherwise for the purpose of soliciting proxies but will receive no

additional compensation for such solicitations. We and our authorized agents

will request brokers or other custodians, nominees and fiduciaries to forward

proxy soliciting material to the beneficial owners of shares held of record by

these persons and will reimburse their reasonable out-of-pocket expenses in

forwarding the material.

|

|

Question:

|

Will

a copy of this year’s Annual Report be sent to me?

|

|

Answer:

|

Copies

of our Annual Report on Form 10-K for the fiscal year ended April 30, 2017 are

being delivered to shareholders together with this proxy statement.

|

|

Question:

|

Does

the Company expect representation of its independent registered public accounting

firm to be present and available to answer questions at the Annual Meeting?

|

|

Answer:

|

Representatives

of our auditors, Mahoney Sabol & Company are not expected to be present at

our Annual Meeting and thus will not have an opportunity to make a statement there.

The Company believes that Mahoney Sabol & Company’s presence is not

required as they are expected to be available to respond to appropriate

questions submitted in writing to Mr. Carlson prior to or at the Annual

Meeting.

|

|

Proxy

Statement

|

Page 4

|

First

Hartford Corporation

|

ITEM

1 - ELECTION OF DIRECTORS

It is the intention of the persons named

in the enclosed form of proxy, unless such proxy specifies otherwise, to vote

the shares represented by such proxy “FOR ALL” of the director nominees listed

below and that they will hold office until the next annual meeting of

shareholders or until their respective successors have been duly elected and

qualified.

The number of nominees was determined by

the Board of Directors pursuant to the Company’s Bylaws. The Company has no

reason to believe that any of the nominees will become unavailable to serve as

directors for any reason before this year’s Annual Meeting. If, for any

reason, any nominees for director are unable or unavailable to serve or for

good cause will not serve, the shares represented by the accompanying proxy

will be voted for a substitute nominee designated by the Board or the size of

the Board may be reduced.

Certain information regarding each nominee

is set forth in the table and text below. The number of shares, if any,

beneficially owned by each nominee is listed below under “Security Ownership of

Certain Beneficial Owners and Management.”

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth: (i) the

names and ages of the nominees for election to director; (ii) the other

positions and offices presently held by such persons with the Company; (iii)

the period during which such persons have served on the Board of Directors of

the Company; (iv) the expiration of each director’s term as director; and (v)

the principal occupations and employment of the persons. Additional

biographical information for each person follows the table. Each nominee has

consented to being named in this proxy statement as a nominee for election as

director and has agreed to serve if elected. There are no arrangements or

understandings between any of the nominees and any other person pursuant to

which such nominee was or is to be selected as such.

Nominees of Directors for Election at FY 2017 Annual

Meeting

|

Name

|

Age

|

Position

|

Expiration of

Term

|

Period of Board

Service

|

Period of Service as

Executive Officer

|

|

Neil H. Ellis

|

89

|

Chairman and director

|

January 31, 2019

|

1966 - Present

|

1968 - Present

|

|

John Toic

|

45

|

President and director

|

January 31, 2019

|

2015 - Present

|

2015 - Present

|

|

Jeffrey M. Carlson

|

62

|

General Counsel, Secretary,

and director

|

January 31, 2019

|

2015 - Present

|

2015 - Present

|

|

William M. Connolly

|

68

|

Managing Partner of

Connolly & Partners, and director

|

January 31, 2019

|

2015 - Present

|

N/A

|

|

Jonathan Bellock

|

31

|

Vice President and director

|

January 31, 2019

|

2017 - Present

|

2017 - Present

|

Executives or Directors

Not Standing for Re-election:

|

David B. Harding

|

73

|

Retired

Vice President and director

|

Nov. 20, 2017

|

1998 –Nov 2017

|

1992 - Nov. 2017

|

Nominees for Directors

Neil H. Ellis

served as President and as a director of the Company

since 1966 until 2015, at which time he resigned as President and continued as

Chairman of the Board. Mr. Ellis also serves as President and a director of

Green Manor Corporation, a holding company owned by Mr. Ellis and his wife, and

as a Vice President of Journal Publishing Company, Inc., a corporation that

publishes a newspaper in New England, which is owned by Green

Manor Corporation. Mr. Ellis also serves as a director of

the Gerald P. Murphy Cancer Foundation and as a trustee of the Jonathan G.

Ellis Leukemia Foundation.

|

Proxy

Statement

|

Page 5

|

First

Hartford Corporation

|

John Toic

was appointed President of the Company and elected a director in 2015. He has

been employed by the Company since 2003. In 2005, he was placed in charge of

the then newly formed fee-for-service segment (preferred developer services to

CVS and Cumberland Farms). Prior to 2003, Mr. Toic was Assistant Director of

Administration for the City of Cranston, RI.

Jeffrey M. Carlson

has been serving as General Counsel since 2000 and has been counsel to

the Company since 1981. He was appointed to be Secretary of the Company and

elected a director of the Company in 2015. He is admitted to practice law in

the State of Connecticut since 1981, and holds both a B.A. from Fairfield

University and a law degree from Southwestern University School of Law.

William M. Connolly

has been a director of the Company since 2015. Mr. Connolly has been the

Managing Partner of Connolly and Partners, LLC (75% owned by the Company) since

2005. Connolly and Partners develops mixed income and affordable housing which

comprises the Housing portion of the Company. Mr. Connolly has been involved

in the management development and redevelopment of real estate since 1972.

Jonathan R. Bellock

was appointed a director of the Company on November 20, 2017 to fill

the vacancy created upon Mr. Harding’s retirement. Mr. Bellock became vice

president to the Company also on November 20, 2017. Mr. Bellock received his

Bachelor of Arts at Union College and has been with the company since 2009. In

2011, he opened and began operating a new regional office in Houston, TX. Since

2011, he has worked in Houston, TX on project acquisition and development in

both the fee-for-service and shopping center development programs. Mr. Bellock

is the grandson of Mr. Ellis, the chairman of the Company; please see: “Family

Relationships”.

Although the Company does not have an Independent

Audit Committee, the directors bring to the Board the background and experience

of people who would otherwise be eligible to be on the Audit Committee.

The Board does not have a policy with regard of diversity

in identifying nominees for Directors.

Executives or Directors

Not Standing for Re-election:

David B. Harding

retired as an executive officer and director of the Company on

November 20, 2017. He had been a Vice President of First Hartford since 1992

and a director of the Company since 1998. The Company appreciates Mr.

Harding’s dedicated and valuable service to the Company.

Family

Relationships

Jonathan R. Bellock, was appointed a director and an executive

officer of the Company on November 20, 2017. Mr. Bellock is the grandson of

Mr. Ellis, the chairman of the Company. Mr. Ellis is also the majority

shareholder of the Company’s common stock. Mr. Bellock owns 23,763 shares of

the Company. Mr. Ellis and Mr. Bellock disclaim formation of or acting as a

group.

|

Proxy

Statement

|

Page 6

|

First

Hartford Corporation

|

Recommendation

and Vote Required

A director will be

elected by the affirmative vote of a plurality of the votes cast in person or

by proxy in the election at the Annual Meeting.

THE COMPANY’S BOARD OF DIRECTORS

UNANIMOUSLY RECOMMENDS A VOTE “FOR ALL” OF THE DIRECTOR NOMINEES.

CORPORATE

GOVERNANCE

Board Composition and Committee Memberships

The Board of Directors is composed of Neil

H. Ellis, John Toic, Jeffrey M. Carlson, William M. Connolly, and Jonathan R.

Bellock. The Board of Directors in its entirety performs such functions as

would otherwise be performed by an audit committee, compensation committee and

nominating and corporate governance committee.

Director Independence

The

Board of Directors has determined that none of the director nominees, each of

whom currently serves on the Board or is nominated to serve, are either

“independent” within the meaning of The NASDAQ Stock Market (“

Nasdaq

”)

independence standards or for purposes of Section 10A(m)(3) of the Securities

Exchange Act of 1934, as amended (the “

Exchange Act

”)

relating to audit committees.

Meetings

of the Board of Directors

There were 14 board meetings during the

period May 1, 2016 to the present approving various guaranties of the Company

to affiliates/subsidiaries for various construction/development projects and/or

refinancing of existing loans for developed projects. There was a quorum at

all of these meetings.

The Board of Directors does not have a standing audit,

compensation or nominating and corporate governance committee, or committees

performing similar functions. The Board of Directors does not believe a

standing nominating and corporate governance committee is necessary because the

full Board of Directors currently participates in the consideration of director

nominees. The Board of Directors does not have a charter with respect to the

duties it fulfills in its nominating capacity. Mr. Ellis is the grandfather of Mr. Bellock. Messrs. Ellis, Toic, Carlson, and Bellock are members

of our management and Mr. Ellis has various business relationships with First

Hartford described under “Certain Relationships and Related Transactions.

Mr. Ellis is Chairman of the Board of Directors and,

as such, is the Company’s principal executive officer. It is not feasible at

this time given the ownership, economics and size of the Company that an

Independent Chairman be appointed. If and when Mr. Ellis chooses to retire,

the issue will be revisited.

Selection of Director Candidates

The Board of Directors will give

consideration to director candidates recommended by shareholders in accordance

with the procedures described under “Shareholder Proposals” described within.

When considering nominations for membership on the Board, whether submitted by

shareholders or otherwise, the Board of Directors will seek to identify persons

who the board believes to have the highest capabilities, judgment and ethical

standards and who have an understanding of our business.

|

Proxy

Statement

|

Page 7

|

First

Hartford Corporation

|

Shareholder

Communications with our Board of Directors

The Board of Directors has implemented a

process by which shareholders may communicate with our Board of Directors.

Shareholders may communicate with any of our directors by writing to them c/o First

Hartford Corporation, P.O. Box 1270, 149 Colonial Road, Manchester, Connecticut 06045-1270.

Audit

Committee

The Company does not have an audit

committee or an audit committee charter; accordingly, the entire Board of

Directors performs the functions described in the audit committee report set

forth below. Messrs. Ellis, Toic, Carlson, and Harding were members of our

management as of the date of the report, and Mr. Connolly is an employee of the

Company through serving as a managing partner of a 75% affiliate of the Company.

Mr. Harding resigned from the Board and the audit committee as of November 20,

2017; on such date Jonathan R. Bellock was appointed to the Board and to the

audit committee. Mr. Ellis is the grandfather of Mr. Bellock. Also, Mr. Ellis

has various business relationships with First Hartford described under “Certain

Relationships and Related Transactions” herein. Thus, none of the members of

the Board of Directors meet the criteria for independence established by Nasdaq

or other self-regulatory organizations. The Company does not otherwise meet

the eligibility requirements for listing on Nasdaq or other self-regulatory

organizations.

The Board has not determined whether any

member of the Board of Directors qualifies as an “audit committee financial

expert”, as such term is defined in Item 407(d)(5)(ii) of Regulation S-K.

Audit Committee Report

The Board of Directors has:

(a) reviewed and

discussed our audited financial statements;

(b) discussed with our

independent auditors the matters required to be discussed by the Statement on

Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1,

AU §380), as adopted by the Public Company Accounting Oversight Board in Rule

3200T; and

(c) received the

written disclosures and the letter from our auditors required by applicable

requirements of the Public Company Accounting Oversight Board regarding the

independent accountant’s communication with the audit committee concerning

independence and discussed the independence of our auditors with our

independent auditors.

Based on the review and discussions

described above, the Board of Directors approved the inclusion of our audited consolidated

financial statements in our Annual Report on Form 10-K for the fiscal year

ended April 30, 2017.

The Board of Directors

Neil

H. Ellis (Chairman)

John

Toic

Jeffrey

M. Carlson

William

M. Connolly

David

B. Harding

Compensation Committee

The Company does not have a

separately designated compensation committee or a compensation committee

charter because it believes that, in a company of its size with no independent

Directors, it is most

appropriate for the full Board to

serve this function. Each member of the Board (with the exception of Mr.

Connolly) was a named executive officer of the Company during the fiscal year

ended April 30, 2017.

Mr. Connolly is an

employee of the Company through serving as a managing partner of a 75%

affiliate of the Company. Mr. Harding resigned from the Board and the

compensation committee as of November 20, 2017; on such date Jonathan R.

Bellock was appointed to the Board and to the compensation committee. Mr.

Ellis is the grandfather of Mr. Bellock.

From time

to time the Board has engaged a compensation consultant to advise it with

regard to compensation matters. No compensation consultant was engaged by the

Board in connection with compensation matters for the fiscal year ended April

30, 2017.

|

Proxy

Statement

|

Page 8

|

First

Hartford Corporation

|

Compensation Committee Interlocks and Insider

Participation

During the fiscal year ended April

30, 2017, Mr. Ellis (who served as our Chairman), Mr. Toic (who served as our

President), Mr. Carlson (who served as our Secretary), and Mr. Harding (who

served as our Vice President and retired November 20, 2017), each participated

in the Company's deliberations regarding executive compensation. Mr. Bellock

will participate in future deliberations.

Mr.

Ellis is the grandfather of Mr. Bellock.

It is noted

that

Mr. Ellis is the president and a director of Green Manor

Corporation and has various business relationships with First Hartford

described under “Certain Relationships and Related Transactions”.

Certain

Relationships and Related Transactions

(a)

Parkade Center Inc. (a wholly

owned subsidiary of First Hartford Corporation) has a 1.99% interest in

Hartford Lubbock Parkade LP II, a partnership, which owns a shopping center in

Lubbock, Texas. Lubbock Parkade Inc., a wholly owned subsidiary of Journal

Publishing Inc., owns 98.01% of the Partnership. Journal Publishing Inc. is

owned by Neil H. Ellis, the Chairman of First Hartford Corporation, and his

wife Elizabeth, through their ownership of Green Manor Inc. First Hartford

Realty Corporation manages the property and receives a 4% management fee, which

is the industry norm for a shopping center.

For the fiscal years ended April 30, 2017 and 2016, Parkade

Center Inc. and First Hartford Realty Corporation earned the following:

|

|

2017

|

2016

|

|

Management

Fee (at 4%)

|

$70,554

|

$71,217

|

|

|

|

|

For the years ended April 30, 2017 and 2016, Parkade

Center Inc. received distributions of $17,802 and $7,264, respectively. For

the years ended April 30, 2017 and 2016, Lubbock Parkade Inc. received

distributions of $962,378 and $312,000, respectively, from Hartford Lubbock LP

II.

(b) Jonathan

R. Bellock, was appointed a director and an executive officer of the Company on

November 20, 2017. Mr. Bellock is the grandson of Mr. Ellis, the chairman of

the Company. Mr. Ellis is also the majority shareholder of the Company’s

common stock. Mr. Bellock owns 23,763 shares of the Company. Mr. Ellis and

Mr. Bellock disclaim formation of or acting as a group.

Principal Accountant Fees and Services

On December 5, 2013, the Company engaged Mahoney,

Sabol & Company, LLP to audit 2012 and 2013, which engagement has been

renewed annually through 2017.

The amounts in the table below represent fees paid to

Mahoney, Sabol & Company, LLP during the following fiscal years:

|

|

2017

|

2016

|

|

Audit Fees

(1)

|

$128,000

|

$125,000

|

|

Audit Related Fees

(2)

|

19,000

|

-0-

|

|

Tax Fees

|

-0-

|

-0-

|

|

All Other Fees

(3)

|

4,922

|

-0-

|

|

Proxy

Statement

|

Page 9

|

First

Hartford Corporation

|

(1)

Includes fees for the audit of the

Company’s annual financial statements included in its Annual Report on Form

10-K and Form 10-Q’s filed quarterly.

(2)

Fees for the audit of one of the

Company’s subsidiaries.

(3)

Fees for the review of CAM charges

at one of the Company’s subsidiaries.

Audit Committee Pre-Approval Procedures

Because the Company has no separately

designated audit committee or charter, the functions of an audit committee are

performed by the entire Board of Directors. The Board has not adopted a formal

policy, but follows a standard practice concerning the pre-approval of audit

and non-audit services to be provided by the Company’s independent registered

public accounting firm. The practice requires that all services to be

performed by the Company’s independent registered public accounting firm,

including audit services, audit-related services and permitted non-audit

services, be pre-approved by the Board of Directors. The Company’s independent

registered public accounting firm submits an engagement letter to the Board

outlining the services it proposes to perform, and the letter is signed and

agreed to by the Chairman. At subsequent Board of Directors meetings, the

Board of Directors may receive updates on services being provided by the

independent registered public accounting firm. Since May 6, 2003, the

effective date of the SEC rule applicable to services being provided by the independent

accountants, each new engagement of the Company’s independent registered public

accounting firm was approved in advance by the Board of Directors.

|

Proxy

Statement

|

Page 10

|

First

Hartford Corporation

|

EXECUTIVE COMPENSATION

Summary Compensation Table

|

Name& Principal Position

|

Year

|

Salary

|

Bonus

|

Stock

Awards

|

Option

Awards

|

Non-Equity

Incentive

Plan

Compensation

|

Non-qualified

Deferred

Compensation

Earnings

|

All

Other

Compensation

|

Total

|

|

Neil H. Ellis,

Chairman

|

2017

|

$399,989

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$399,989

|

|

|

2016

|

$400,000

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$400,000

|

|

John Toic, President

|

2017

|

$400,000

|

$75,000

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$8,477

(1)

|

$483,477

|

|

|

2016

|

$201,455

|

$299,166

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$11,090

(1)

|

$511,711

|

|

Jeffrey Carlson,

General Counsel & Secretary

|

2017

|

$175,000

|

$25,000

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$7,710

(1)

|

$207,710

|

|

|

2016

|

$175,000

|

$25,000

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$7,682

(1)

|

$207,682

|

|

Jonathan R.

Bellock, Vice President

|

2017

|

$100,558

|

$60,000

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$6,475

(1)

|

$167,033

|

|

|

2016

|

$78,535

|

$30,000

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$3,844

(1)

|

$112,379

|

|

Eric Harrington,

Treasurer

|

2017

|

$140,000

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$5,616

(1)

|

$145,616

|

|

|

2016

|

$134,616

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$4,457

(1)

|

$139,073

|

|

William Connolly,

Managing Director of Connolly and

Partners, LLC

|

2016

|

$149,993

|

$55,460

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$6,358

(1)

|

$211,811

|

|

|

2015

|

$149,988

|

$72,243

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$4,979

(1)

|

$227,210

|

|

David B. Harding,

retired as

Vice President

(2)

|

2017

|

$113,738

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$113,738

|

|

|

2016

|

$150,010

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$-0-

|

$5,681

(1)

|

$155,691

|

Footnote

1

: The compensation referenced is

compensation received by each respective person under the Company’s 401(k)

deferred compensation plan and predecessor SIMPLE IRA plan.

Footnote

2

: Mr. Harding was serving until the date of his retirement, November 20,

2017. Compensation totaling $20,960 will be paid to him from November 21, 2017

through January 2, 2018 as a post-employment Board-approved severance benefit

for Mr. Harding’s loyalty and long-term service to the Company.

|

Proxy

Statement

|

Page 11

|

First

Hartford Corporation

|

STOCK OPTIONS

The

Company does not have a stock option plan.

BENEFITS

AND PERQUISITES

Medical

All employees, including executive officers, working

over 30 hours a week are entitled to Company-paid medical insurance of which

the employee pays, family $109 a week, employee and spouse $97 a week, and

employee alone $44 a week.

Mr.

Ellis has opted out of the Company plan and is covered by Medicare.

Disability

Short-term

(up to 180 days)

Non-management employees receive the first

week week’s pay at 100% of their salary or rate of pay when out on short term

disability. The following weeks (based on years of service - one week per year

of service) are paid at 70% of salary or rate of pay. Any additional weeks are

paid at 60% of salary or rate of pay. The maximum benefit will not exceed

$6,000 a month and ends at the 180

th

day of disability, at which

time the long-term disability insurance takes effect.

Management employees, as defined by the Company and including

executive officers, receive 100% of their pay for the first 180 days of

disability and, thereafter, the long-term disability insurance takes effect.

Long-term

(over 180 days)

After 180 days of disability, employees receive 60% of

their regular straight-time salary for absences due to long-term illness or

injury until they reach eligibility for Social Security or death. Management

employees, as defined by the Company and including executive officers, will

have the difference between the long-term disability benefits and normal full

salary paid for by the Company as determined by the Board of Directors.

Life Insurance

Each employee of First Hartford, including each

executive officer, is eligible to receive life insurance until such employee reaches

the age of 70 that, in the event of such employee’s death, will provide

proceeds of two times the annual salary of each employee. At the age of 70,

the amount of life insurance proceeds each employee is entitled to receive upon

his death is equal to one times such employee’s annual salary.

Automobiles

To assist management of the Company in carrying out

its responsibilities and to improve job performance, the Company provides all

of its named executive officers with automobiles. The Company cannot

specifically or precisely ascertain the amount of personal benefit, if any,

derived by those officers from such automobiles. However, after reasonable

inquiry, the Company has concluded that the amount of any such personal benefit

is immaterial and does not in any event exceed $10,000 to any officer. No

provision has therefore been disclosed in the Summary Compensation Table for

any such benefit. All of the above mentioned officers are provided

automobiles.

GRANT OF PLAN-BASED AWARDS DURING THE FISCAL YEAR ENDED

APRIL 30, 2017

None of the Company’s named executive officers

received a grant of plan-based compensation during the fiscal year ended April

30, 2017.

|

Proxy

Statement

|

Page 12

|

First

Hartford Corporation

|

BONUSES

APRIL 30, 2017

Prior to December 31, 2015, Mr. Toic’s

base salary was $105,019. In addition, Mr. Toic had an agreement to receive a

$7,500 bonus on each CVS / Cumberland Farms fee for service closing, with a

minimum of $175,000 for any calendar year. During fiscal years 2017 and 2016,

Mr. Toic received bonuses of $-0- and $174,167, respectively, under this

agreement. In addition, in fiscal years 2017 and 2016, Mr. Toic received

bonuses totaling $75,000 and $125,000, respectively, for his work on the sale

of several properties. Beginning on January 1, 2016, Mr. Toic no longer

receives bonuses prospectively (he may still be paid for certain identified

property sales that have not yet occurred as of that date) and his base salary

was increased to $400,000.

In fiscal years 2017 and 2016, Mr. Carlson

received $25,000 bonuses, respectively, for his work on the sale of several

properties.

Mr. Connolly receives commissions equal to

8% of gross management fees paid by the three residential properties. In

fiscal years 2017 and 2016, he received $55,460 and $72,243, respectively.

Mr. Bellock receives a $5,000 bonus on

each CVS fee for service closing in TX. In fiscal years 2017 and 2016, he

received bonuses totaling $60,000 and $27,500, respectively.

OPTION EXERCISES AND STOCK VESTED FOR THE FISCAL YEAR ENDED APRIL 30, 2017

The Company does not have a stock option

plan in effect.

PENSION BENEFITS FOR

THE FISCAL YEAR ENDED APRIL 30, 2017

The Company no longer maintains a defined

benefit pension plan.

NONQUALIFIED

DEFERRED COMPENSATION

FOR THE FISCAL

YEAR ENDED APRIL 30, 2017

On December 1, 2014, the Company adopted a

Deferred Bonus Plan that awarded six employees an annual payment of $21,667

each for three years. Included in these six employees are Mr. Harding, Mr.

Toic, and Mr. Carlson. All of the six employees satisfied the vesting

requirement and received the first two annual payments as of April 30, 2017.

The total expense recorded for this bonus was $390,000, of which $195,000

related to the three named executives.

On March 6, 2014, the Company adopted a

Deferred Bonus Plan for Mr. Harding agreeing to pay him 7% of the amount of any

remaining Operating Reserve held at Clarendon, as defined, payable to the

Company upon approved distribution of the Operating Reserve upon termination of

the Partnership Agreement. There has been no expense recognized as of April

30, 2017 as the event needed to trigger this payment has not yet occurred.

Each employee of First Hartford may

participate in the First Hartford 401(k) Plan (which replaced the First

Hartford SIMPLE IRA on January 1, 2016), a tax-qualified defined contribution

plan, pursuant to which First Hartford will match up to 4% of each employee’s

annual salary. Mr. Ellis has never participated in this plan. The other

officers received Company matching contributions for the fiscal years ended April

30, 2017 and 2016, as reflected in the “All Other Compensation” column of the

Summary Compensation Table above.

POTENTIAL

PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL

The Company does not have employment

agreements with any of our named executive officers and does not maintain a

severance policy or arrangement that provides for payments to any named

executive officer in the

event of a termination of

employment or a change in control of the Company. As a result, none of our

named executive officers would have been entitled to any payments or other

benefits if a termination or change in control event had occurred on the last

business day of the Company’s fiscal year ended April 30, 2017.

|

Proxy

Statement

|

Page 13

|

First

Hartford Corporation

|

DIRECTOR

COMPENSATION

The Company’s Board of Directors is

comprised of Neil H. Ellis, John Toic, David B. Harding, Jeffrey M. Carlson, Jonathan

R. Bellock, and William M. Connolly, each of whom (with the exception of Mr.

Connolly) also is a named executive officer of the Company. Mr. Connolly is an

employee of the Company through serving as a managing partner of a 75%

affiliate of the Company. Further, Mr. Harding retired from his service as a

director and executive officer of the Company effective November 20, 2017. No

separate fees are paid to any of the directors for serving on the Board of

Directors, and during the fiscal year ended April 30, 2017, no directors

received any compensation for their service in such capacity. The compensation

received by Messrs. Ellis, Toic, Harding, Carlson, Bellock, and Connolly for

their service as employees of the Company during the fiscal year ended April

30, 2017 is shown in the Summary Compensation Table above.

SECURITY OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table

sets forth information concerning the beneficial ownership of Company common

stock as of November 4, 2017, as a date as close as possible to the record date

of November 21, 2017, by each director nominee, by the Company’s named

executive officers, by all directors and executive officers as a group, and by

any individual or group owning more than 5% of Company common stock. Except as

set forth in the table below, the Company knows of no person or group that

beneficially owns 5% or more of the Company common stock. Unless otherwise

specified, all persons listed below have sole voting and investment power with

respect to their shares of Company common stock.

|

Name and Address of

Beneficial Owner

|

Number of Shares

Beneficially Owned

(1)

|

Percent of Stock

(2)

|

|

Neil H. Ellis

|

1,355,326

(3)

|

58.5%

|

|

|

43 Butternut Road

Manchester, CT 06040

|

|

|

|

|

John Filippelli

23 Lakeview Drive

Pawling, NY 12564

|

280,458

(4)

|

12.1%

|

|

|

|

|

|

|

|

Joel Lehrer

231 Atlantic Street, Unit

58

Keyport, NJ 07735

|

200,000

(5)

|

8.6%

|

|

|

|

|

|

|

|

All directors and executive

officers as a group:

6 in number of which 3 are

shareholders:

Mr. Ellis reported above, Mr. Connolly

owns 100 shares of the

Company, and

Mr. Bellock owns 23,763 shares

of the Company.

|

1,379,189

|

59.6%

|

|

|

|

|

|

|

|

____________________

(1)

The securities “beneficially

owned” by an individual are determined in accordance with the definition of

“beneficial ownership” set forth in SEC regulations and, accordingly, may

include securities owned by or for, among others, the wife and/or minor

children of the individual and any other relative who has the same

home as the individual, as well as other securities as to

which the individual has or shares voting or dispositive power. Beneficial

ownership may be disclaimed as to some of the shares. A person is also deemed

to beneficially own shares of Company common stock which such person does not

own but has a right to acquire presently or within sixty days after the mailing

date of this proxy statement.

|

Proxy

Statement

|

Page 14

|

First

Hartford Corporation

|

(2)

Percent of class calculation based

on 2,315,799 shares outstanding as of November 4, 2017, as a date as close as

possible to November 21, 2017, the record date, plus, solely in the case of

persons who own exercisable options, the shares which may be obtained upon the

exercise of such options.

(3)

Includes: 417,183 shares owned by

a corporation that is wholly owned by Mr. and Mrs. Ellis; 18,593 shares owned

beneficially and of record by Mr. Ellis’ wife; and 53,412 shares held as

Trustee of a Trust for Mr. Ellis’ daughters with respect to which Mr. Ellis

disclaims beneficial ownership. Excludes 14,250 shares of Company common stock

held as Trustee for the Jonathan G. Ellis Leukemia Foundation (a charitable

foundation).

(4)

Based on a Schedule 13G jointly filed

by John Filippelli and his wife, Barbara K. Filippelli, with the SEC for period

ending December 31, 2016. Included in Mr. Filippelli’s shares are 279,806

shares over which he has Shared Dispositive Power with his wife and 652 shares

owned by Mrs. Filippelli.

(5)

Based on a Schedule 13G filed by Joel

Lehrer with the SEC on February 11, 2010.

ITEM 2 - “GOING DARK”

The Board of Directors has approved and requests that

the shareholders vote to approve the Company suspending or terminating its

filing obligations with the U.S. Securities and Exchange Commission (“

SEC

”)

also called “Going Dark”, once the Company is so eligible. The Company has

been filing annual, quarterly, and current reports with the SEC on forms 10-K,

10-Q and 8-K, as well as its annual proxy statement on Schedule 14A since 1967.

There were approximately 318 shareholders of record

for the Company’s common stock as of April 30, 2017. A trend the Company has

noticed is the number of shareholders of record has been consistently

attenuating each quarter. The Company anticipates the number of shareholders

of record will fall below 300 in the very near term. Once the number of

shareholders of record falls below 300, subject to other conditions of the SEC’s

Regulations, the Company may be eligible to Go Dark. The Board of Directors is

in favor of the Company “going dark” since doing so would create savings in the

Company’s accounting, legal, and professional expenses since the SEC reporting compliance

obligations would then cease.

The Company estimates its incremental external audit

costs as an SEC reporting company and to comply with Sarbanes-Oxley and general

SEC regulations such as Regulation S-K and Regulation S-X are approximately $40,000

annually. Similarly, the Company incurs incremental external legal compliance

costs with addressing its regulatory burdens under the identified regulations, which

are approximately $20,000 annually. Also, the Company incurs other external professional

and consulting services, such as Annual Report printing and SEC EDGAR

conversion and filing expenses, of approximately $17,000 annually. Finally,

the Company also incurs approximately $15,000 of internal compliance costs of

staff time attending to the audit and legal requirements for its regulatory

burdens under the identified regulations that will no longer be incurred. Thus,

the Company estimates its total SEC reporting company regulatory burden exceeds

$92,000 annually. These cost savings will benefit the profitability of the

Company.

The common stock of the Company currently trades on

the OTC Securities Market under the symbol “FHRT”. The common stock of the

Company has an illiquid trading market and fails to attract any market

following. The trading volume over the past ten years has netted four (4)

trading days exceeding 10,000 shares traded; its highest volume was 21,500

shares on one of those four days over the ten years. Most days volume equals

zero, and on the sporadic trading days most trades range from a volume of a few

hundred shares to under 5,000

shares. The average

volume over the 30 days from September 15 through October 16, 2017 equal 103

shares. The economic impact thus ranges from $300 to up to a rare high mark

over ten (10) years of $15,000 in trading value on the days shares are

exchanged. Yet the economic impact on the Company to remain an SEC reporting

company is heavy as discussed below.

|

Proxy

Statement

|

Page 15

|

First

Hartford Corporation

|

The Company understands that its public shareholders

have freely tradable common stock and that maintaining a trading market is beneficial

for the continued ability of the public shareholders to trade the stock.

Therefore, the Company intends to maintain at least one of its listings in the

Mergent Industrial Manual, the Mergent OTC Industrial Manual, and/or the

Mergent OTC Unlisted Manual which by being tri-published in a “recognized

securities manual” provides the 39 individual states’ securities regulations “manual

exemption” provision under which broker-dealers are free to solicit and trade

stock of the published companies thus permitting secondary trading in the

Company’s stock for investors in up to 39 states. Further, the Company will

attempt to maintain a continued listing through the OTC Securities Market

through its Pink Sheets listings;

however, there can be no assurance that any broker-dealer will make or continue

to make a market in the Company’s common stock; it is required for trading on

the OTC Pink Sheets that at least one broker-dealer make a market in the

Company’s common stock. However, once it

Goes Dark, it is anticipated that the Company’s shares would have far less

visibility and the current limited liquidity may be further constrained in the

market, and the current broker-dealers making markets in the Company’s common

stock may cease doing so.

Once the Company Goes Dark, it will have reduced

regulatory oversight and therefore may be able to implement shareholder

initiatives such as share repurchase programs with less regulatory

restrictions. By Going Dark the Company will produce and share far less

information available to the investing public. Thus investors will often not

have relatively current information on which to base their investment

decisions. However, the Company’s common stock will still be eligible to trade

among public investors and thus continues to be a publicly traded entity and

continues to be subject to the antifraud and insider trading provisions of the

Securities Exchange Act of 1934.

But since so few shares of the Company trade annually

and on a daily basis, the Company believes the value of Going Dark outweighs

the value of providing more information to the public under SEC regulations.

All of the above factors support the decision of the Board for the Company to

Go Dark.

The Company intends to voluntarily file a current

report on a Form 8-K approximately two weeks in advance of suspending or

terminating its Securities Exchange Act of 1934 reporting obligations in order

to provide specific advance notice to its shareholders and the public market.

Vote Required

:

The affirmative vote of a majority of our

common stock outstanding is recommended to approve the Company suspending or

terminating its filing obligations with the Securities and Exchange Commission,

also called “Going Dark”. But this action is not required to be submitted to

the shareholders for a vote, and could alternatively be executed by an

affirmative vote of the Board of Directors without any vote input by the

shareholders. Further, the chairman of the Company holds a majority of voting

stock of the Company and thus, alone, he can cast a vote to approve the action

sought. But because the shares are thinly traded, and since the chairman

controls a majority of the shares, it was decided to effectively poll the

shareholders through a vote on the topic. If a majority of the public actively

votes in opposition to the Company Going Dark, the Board and management may reconsider

so proceeding. However, the Company will not consider abstentions and broker

non-votes as “active” votes for purposes of the potential of reconsidering

taking action to Go Dark.

The Board of Directors recommends a vote FOR Item 2,

“Going Dark”.

SECTION

16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires the

Company’s directors and executive officers, and persons who own more than 10%

of a registered class of the Company’s equity securities, to file with the Commission

initial reports of beneficial ownership on Form 3 and reports of changes in

beneficial ownership of the Company’s equity securities on Forms 4 and 5. The

rules promulgated by the Commission under Section 16(a) of the Exchange Act

require those persons to furnish the Company with copies of all reports filed

with the Commission pursuant to Section 16(a). Based solely upon a review of

such forms actually furnished to the Company, and written

representations

of the Company’s directors and executive officers that no forms were required

to be filed, the Company believes that during fiscal year 2017, all directors,

executive officers and 10% shareholders of the Company have filed with the

Commission on a timely basis all reports required to be filed under Section

16(a) of the Exchange Act,

except

that the Company believes that

during fiscal year ended April 30, 2017 that: one 10% shareholder, Mr. John

Filippelli filed three Form 5 filings on a late basis correcting his missed

filings required to have been filed on Form 4 at the times of such transactions

during fiscal years ended April 2014, 2015 and 2016 by filing a late filed Form

5 for each such fiscal year; the late filings report 15 late filed

transactions. Additionally, the wife of such 10% shareholder, Barbara K.

Filippelli, timely filed on a Form 5 for fiscal year ended April 2017 that five

transactions should have been filed on Form 4 at the times of such transactions

and thus the filing reports such as late filed transactions.

|

Proxy

Statement

|

Page 16

|

First

Hartford Corporation

|

SHAREHOLDER PROPOSALS

Shareholders

who intend to present a proposal for action at next year’s Annual Meeting of

Shareholders must notify our management of such intention by notice received at

our principal executive offices not later than June 30, 2018, together with a

copy of the proposal, for such proposal to be included in our proxy statement

relating to such meeting. Shareholders who wish to present a proposal at next

year’s Annual Meeting of Shareholders, but do not wish to have the proposal

included in the proxy statement for the meeting, must give notice of the

proposal to the Secretary of First Hartford no later than 30 days prior to the

next annual meeting in order for the notice to be considered timely under Rule

14a-4(c) of the Exchange Act, which provides that the proxies may have

discretionary authority to vote against such a proposal submitted after such

date without making any disclosure in the 2018 proxy statement.

If the Company changes the date of its 2018

annual meeting to a date more than 30 days from the date of the 2017 Annual

Meeting, then the deadline for submission of shareholder proposals will be

changed to a reasonable time before the Company begins to print and send its

proxy materials. If the Company changes the date of its 2017 annual meeting in

a manner that alters the deadline, the Company will so state under Part II,

Item 5 of the first quarterly report on Form 10-Q it files with the SEC after

the date change, or will notify its shareholders by another reasonable method.

OTHER

MATTERS

The Board is not aware of any other

matters that may come before the Annual Meeting. However, in the event such

other matters come before the Annual Meeting, the persons named on the white

proxy card will have the discretion to vote on those matters using their best

judgment.

Shareholders are urged to mark, sign and

date the enclosed proxy, which is solicited on behalf of the Board, and return

it in the enclosed envelope.

|

|

By Order of the Board of Directors,

|

|

|

Neil

H. Ellis

|

|

December

11, 2017

|

Chairman

|

An

Annual Report to shareholders for fiscal year ended April 30, 2017 accompanies

this proxy statement.

YOUR VOTE IS IMPORTANT. PLEASE VOTE TODAY.

|

FIRST HARTFORD

|

Annual Meeting of

|

|

CORPORATION

|

Stockholders

|

|

|

|

|

January 17,

|

|

|

2018 Wednesday

|

|

|

10:00 A.M. local time

|

|

|

|

|

This Proxy is Solicited On Behalf

|

|

|

Of The Board Of Directors

|

|

Please Be Sure To Mark, Sign, Date and Return Your Proxy Card

in the Envelope Provided

|

▲

FOLD HERE • DO NOT SEPARATE • INSERT IN ENVELOPE PROVIDED

▲

|

PROXY

THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED IN THE MANNER DIRECTED BY THE UNDERSIGNED. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED TO ELECT ALL NOMINEES NAMED IN THIS PROXY TO THE BOARD OF DIRECTORS, AND IN FAVOR OF PROPOSAL 2. THIS PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE TIME IT IS VOTED AT THE MEETING.

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Election of Directors

|

FOR

|

WITHHOLD AUTHORITY

|

|

.

|

FOR

|

AGAINST

|

ABSTAIN

|

|

|

(1) NEIL H. ELLIS

|

◻

|

◻

|

2. To approve the

Company suspending or terminating its filing obligations with the U.S. Securities and Exchange Commission, also called “Going Dark”, once the Company is eligible:

|

|

◻

|

◻

|

◻

|

|

|

|

|

|

|

|

|

|

|

|

(2) JOHN TOIC

|

◻

|

◻

|

|

|

|

|

|

|

|

|

(3) JEFFREY M. CARLSON

|

◻

|

◻

|

|

|

|

|

|

|

|

|

|

(4) WILLIAM M. CONNOLLY

|

◻

|

◻

|

|

|

|

|

|

|

|

|

|

(5) JONATHAN R. BELLOCK

|

◻

|

◻

|

|

|

|

|

|

Signature

_________________________

Signature, if held jointly

_________________________

Date

____________,

2017/18.

Note: Please sign exactly as your name or names appear(s) on this proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee, guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

▲

FOLD HERE • DO NOT SEPARATE • INSERT IN ENVELOPE PROVIDED

▲

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

ANNUAL MEETING OF STOCKHOLDERS

Wednesday January 17, 2018

FIRST HARTFORD CORPORATION

The undersigned shareholder hereby appoints Jeffrey Carlson and Eric Harrington, and each of them, with full power of substitution and revocation, to vote on behalf of the undersigned all shares of common stock of First Hartford Corporation which the undersigned is entitled to vote at the annual meeting of shareholders to be held on Wednesday, January 17, 2018 or any adjournments thereof.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED AS INDICATED. IF NO CONTRARY INDICATION IS MADE, THE PROXY WILL BE VOTED IN FAVOR OF ELECTING THE FIVE NOMINEES TO THE BOARD OF DIRECTORS, AND IN FAVOR OF PROPOSAL 2, AND IN ACCORDANCE WITH THE JUDGMENT OF THE PERSONS NAMED AS PROXY HEREIN ON ANY OTHER MATTERS THAT MAY PROPERLY COME BEFORE THE ANNUAL MEETING. THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS.

(Continued and to be marked, dated and signed, on the other side)

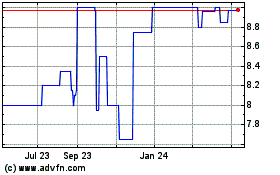

First Hartford (PK) (USOTC:FHRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

First Hartford (PK) (USOTC:FHRT)

Historical Stock Chart

From Apr 2023 to Apr 2024