Filed Pursuant to Rule 424(b)(3)

Registration No. 333-220183

PROSPECTUS

CareDx, Inc.

1,022,544 Shares of Common Stock

This prospectus

relates to the resale by the investors listed in the section of this prospectus entitled “Selling Stockholders” (the “Selling Stockholders”), of up to 1,022,544 shares (the “Shares”) of our common stock, par value

$0.001 per share (the “Common Stock”). The Shares consist of 1,022,544 shares of Common Stock issued on July 3, 2017 pursuant to those certain Third Amendments to Conditional Share Purchase Agreements and Conversion Agreements, dated

July 1, 2017, as amended (collectively, the “Conversion Agreements”), that we entered into with each of Midroc Invest AB, FastPartner AB and Xenella Holding AB (collectively, the “Former Majority Shareholders”). We are

registering the resale of the Shares as required by the Registration Rights Agreement we entered into with the Former Majority Shareholders on July 3, 2017, as amended (the “Registration Rights Agreement”).

Our registration of the Shares covered by this prospectus does not mean that the Selling Stockholders will offer or sell any of the

Shares. The Selling Stockholders may sell the Shares covered by this prospectus in a number of different ways and at varying prices. For additional information on the possible methods of sale that may be used by the Selling Stockholders, you

should refer to the section of this prospectus entitled “Plan of Distribution” beginning on page 8 of this prospectus. We will not receive any of the proceeds from the Shares sold by the Selling Stockholders.

No underwriter or other person has been engaged to facilitate the sale of the Shares in this offering. We will bear all costs, expenses

and fees in connection with the registration of the Shares. The Selling Stockholders will bear all commissions and discounts, if any, attributable to their respective sales of the Shares.

You should read this prospectus, any applicable prospectus supplement and any related free writing prospectus carefully before you invest.

Investing in our Common Stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the

heading “

Risk Factors

” contained on page 3 of this prospectus, any applicable prospectus supplement and in any applicable free writing prospectuses, and under similar headings in the documents that are

incorporated by reference into this prospectus.

Our Common Stock is currently listed on the NASDAQ Global Market under the symbol

“CDNA”. On December 7, 2017, the last reported sales price for our Common Stock was $6.60 per share.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 8, 2017.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should rely only on the information we have provided or incorporated by reference into this prospectus, any applicable prospectus

supplement and any related free writing prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. No

dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. You must not rely on any unauthorized

information or representation. This prospectus is an offer to sell only the Shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus, any

applicable prospectus supplement or any related free writing prospectus is accurate only as of the date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the document

incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security.

The Selling Stockholders are

offering the Shares only in jurisdictions where such issuances are permitted. The distribution of this prospectus and the issuance of the Shares in certain jurisdictions may be restricted by law. Persons outside the United States who come into

possession of this prospectus must inform themselves about, and observe any restrictions relating to, the issuance of the Shares and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be

used in connection with, an offer to sell, or a solicitation of an offer to buy, the Shares offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission (the “SEC”), under

which the Selling Stockholders may offer from time to time up to an aggregate of 1,022,544 shares of our Common Stock in one or more offerings. If required, each time a Selling Stockholder offers Common Stock, in addition to this prospectus, we will

provide you with a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to

that offering. We may also use a prospectus supplement and any related free writing prospectus to add, update or change any of the information contained in this prospectus or in documents we have incorporated by reference. This prospectus, together

with any applicable prospectus supplements, any related free writing prospectuses and the documents incorporated by reference into this prospectus, includes all material information relating to this offering. To the extent that any statement that we

make in a prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in a prospectus supplement. Please carefully read both this

prospectus and any prospectus supplement together with the additional information described below under “Important Information Incorporated by Reference”.

SUMMARY

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and

does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, any applicable prospectus supplement and any related free writing prospectus, including the risks

of investing in our Common Stock discussed under the heading “Risk Factors” contained in this prospectus, any applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that

are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this

prospectus forms a part. Unless otherwise mentioned or unless the context requires otherwise, all references in this prospectus to “CareDx”, “the Company”, “we”, “us”, “our” or similar references

mean CareDx, Inc. and its consolidated subsidiaries.

CareDx, Inc.

We are a global transplant diagnostics company with product offerings along the

pre-

and

post-transplant continuum. We focus on discovery, development and commercialization of clinically differentiated, high-value diagnostic surveillance solutions for transplant patients. In post-transplant diagnostics, we offer AlloMap

®

, which is a heart transplant molecular test (“AlloMap”). In

pre-transplant

diagnostics, we offer high quality products that increase the chance

of successful transplants by facilitating a better match between a donor and a recipient of stem cells and organs.

AlloMap is a gene

expression test that helps clinicians monitor and identify heart transplant recipients with stable graft function who have a low probability of moderate to severe acute cellular rejection. Since 2008, we have sought to expand the adoption and

utilization of our AlloMap solution through ongoing studies to substantiate the clinical utility and actionability of AlloMap, secure positive reimbursement decisions for AlloMap from large private and public payers, develop and enhance our

relationships with key members of the transplant community, including opinion leaders at major transplant centers, and explore opportunities and technologies for the development of additional solutions for post-transplant surveillance. We believe

the use of AlloMap, in conjunction with other clinical indicators, can help healthcare providers and their patients better manage long-term care following a heart transplant. In particular, we believe AlloMap can improve patient care by helping

healthcare providers avoid the use of unnecessary, invasive surveillance biopsies and determine the appropriate dosage levels of immunosuppressants. AlloMap has received 510(k) clearance from the U.S. Food and Drug Administration (the

“FDA”) for marketing and sale as a test to aid in the identification of recipients with a low probability of moderate or severe acute cellular rejection. A 510(k) submission is a premarketing submission made to the FDA. Clearance may be

granted by the FDA if it finds the device or test provides satisfactory evidence pertaining to the claimed intended uses and indications for the device or test. We are also pursuing the development of additional products for transplant monitoring

using a variety of technologies, including AlloSure

®

, our proprietary next-generation sequencing-based test to detect donor-derived cell-free DNA

(“dd-cfDNA”)

after transplantation. Through the acquisition of ImmuMetrix, Inc., a privately held development-stage company working on dd-cfDNA-based solutions in transplantation and other fields, we

added to our existing

know-how,

expertise, and intellectual property the ability to apply

dd-cfDNA

technology to the surveillance of transplant recipients, which has

contributed to the development of AlloSure.

With the acquisition of CareDx International AB, formerly Allenex AB on April 14, 2016,

we develop, manufacture, market and sell high quality products that increase the chance of successful transplants by facilitating a better match between a donor and a recipient of stem cells and organs. Olerup SSP

®

is used to type HLA alleles based on the sequence specific primer technology and has a market in Europe and selected other markets for

pre-transplant

solutions. We also offer Olerup

XM-ONE

®

, a standardized test that identifies a patient’s antigens against HLA Class I or Class II, as

well as antibodies against a donor’s endothelium. This cross-match test has primarily been used prior to kidney transplants. With the acquisition of the business assets of Conexio Genomics Pty Ltd on January 20, 2017, we offer a complete

product range for sequence-based typing of HLA alleles. Olerup SBT Resolver

TM

is a test kit for sequence based HLA typing, while Assign SBT

TM

is the companion software for sequence analysis. In 2014, Olerup began active development of a new HLA typing product, Olerup QTYPE

®

that uses real-time polymerase chain reaction methodology.

Olerup QTYPE

®

was commercially launched at the end of September 2016.

For a

complete description of our business, financial condition, results of operations and other important information, we refer you to our filings with the SEC that are incorporated by reference in this prospectus, including our Annual Report on Form

10-K

for the year ended December 31, 2016. For instructions on how to find copies of these documents, see “Where You Can Find More Information”.

Corporate Information

We

were originally incorporated in Delaware in December 1998 under the name Hippocratic Engineering, Inc. In April 1999, we changed our name to BioCardia, Inc., and in June 2002, again we changed our name, this time to Expression Diagnostics, Inc. In

1

July 2007, we changed our name to XDx, Inc. and in March 2014, we most recently changed our name to CareDx, Inc. Our principal executive offices are located at 3260 Bayshore Boulevard,

Brisbane, California and our telephone number is

(415) 287-2300.

Implications of Being an

Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012.

We will remain an emerging growth company until the earlier of (1) the beginning of the first fiscal year following the fifth anniversary of our initial public offering, or January 1, 2020, (2) the beginning of the first fiscal year after

our annual gross revenue is $1.07 billion (subject to adjustment for inflation) or more, (3) the date on which we have, during the previous three-year period, issued more than $1.0 billion in

non-convertible

debt securities and (4) as of the end of any fiscal year in which the market value of our Common Stock held by

non-affiliates

exceeded

$700 million as of the end of the second quarter of that fiscal year.

For as long as we remain an “emerging growth

company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to public companies that are not “emerging growth companies” including, but not limited to, not being required to comply

with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation and financial statements in our periodic reports and proxy statements, and exemptions from the

requirements of holding a nonbinding advisory vote to approve executive compensation and shareholder approval of any golden parachute payments not previously approved. We will take advantage of these reporting exemptions until we are no longer an

“emerging growth company.”

2

RISK FACTORS

Investing in shares of our Common Stock involves a high degree of risk. Before making an investment decision, you should carefully consider

the risks described under “Risk Factors” in any applicable prospectus supplement and in our most recent Annual Report on Form

10-K,

or any updates in our Quarterly Reports on Form

10-Q,

together with all of the other information appearing in or incorporated by reference into this prospectus and any applicable prospectus supplement, before deciding whether to purchase any of the Common Stock

being offered. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. The trading price of shares of our Common Stock could decline due to any of these risks, and you may lose all or

part of your investment.

3

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus may contain forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), about the Company and its subsidiaries. These

forward-looking statements are intended to be covered by the safe harbor for forward-looking statements provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact, and can be

identified by the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “could”, “should”, “projects”, “plans”, “goal”,

“targets”, “potential”, “estimates”, “pro forma”, “seeks”, “intends” or “anticipates” or the negative thereof or comparable terminology. Forward-looking statements include

discussions of strategy, financial projections, guidance and estimates (including their underlying assumptions), statements regarding plans, objectives, expectations or consequences of various transactions, and statements about the future

performance, operations, products and services of the Company and its subsidiaries. We caution our stockholders and other readers not to place undue reliance on such statements.

You should read this prospectus and the documents incorporated by reference completely and with the understanding that our actual future

results may be materially different from what we currently expect. Our business and operations are and will be subject to a variety of risks, uncertainties and other factors. Consequently, actual results and experience may materially differ from

those contained in any forward-looking statements. Such risks, uncertainties and other factors that could cause actual results and experience to differ from those projected include, but are not limited to, the risk factors set forth in Part

I—Item 1A, “Risk Factors”, in our Annual Report on Form

10-K

for the year ended December 31, 2016, as filed with the SEC on April 21, 2017, and elsewhere in the documents incorporated

by reference into this prospectus.

You should assume that the information appearing in this prospectus, any accompanying prospectus

supplement, any related free writing prospectus and any document incorporated herein by reference is accurate as of its date only. Because the risk factors referred to above could cause actual results or outcomes to differ materially from those

expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made. New factors emerge

from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking statements. All written or oral forward-looking statements attributable to us or any person acting on our behalf made after the date of this prospectus are expressly qualified in their

entirety by the risk factors and cautionary statements contained in and incorporated by reference into this prospectus. Unless legally required, we do not undertake any obligation to release publicly any revisions to such forward-looking statements

to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated events.

4

USE OF PROCEEDS

We will receive no proceeds from the sale of the Shares by the Selling Stockholders.

The Selling Stockholders will pay any underwriting discounts and commissions and any similar expenses they incur in disposing of the Shares.

We will bear all other costs, fees and expenses incurred in effecting the registration of the Shares covered by this prospectus. These may include, without limitation, all registration and filing fees, printing fees and fees and expenses of our

counsel and accountants.

5

SELLING STOCKHOLDERS

Unless the context otherwise requires, as used in this prospectus, “Selling Stockholders” includes the selling stockholders listed

below and donees, pledgees, transferees or other

successors-in-interest

selling shares received after the date of this prospectus from a selling stockholder as a gift,

pledge or other

non-sale

related transfer.

We have prepared this prospectus to allow the Selling

Stockholders or their successors, assignees or other permitted transferees to sell or otherwise dispose of, from time to time, up to 1,022,544 shares of our Common Stock. The 1,022,544 shares of Common Stock to be offered hereby consist of 1,022,544

shares of Common Stock issued to the Selling Stockholders on July 3, 2017 pursuant to the Conversion Agreements. Pursuant to the Registration Rights Agreement, we agreed to register the shares of Common Stock issued pursuant to the Conversion

Agreements.

All of the 1,022,544 shares of Common Stock to be offered hereby were issued in reliance on the exemption from securities

registration in Section 4(a)(2) under the Securities Act and Rule 506 promulgated thereunder.

The shares of Common Stock to be

offered by the Selling Stockholders are “restricted” securities under applicable federal and state securities laws and are being registered under the Securities Act to give the Selling Stockholders the opportunity to sell these shares

publicly. The registration of these shares does not require that any of the shares be offered or sold by the Selling Stockholders. Subject to these resale restrictions, the Selling Stockholders may from time to time offer and sell all or a

portion of their shares indicated below in privately negotiated transactions or on the NASDAQ Global Market or any other market on which our Common Stock may subsequently be listed.

The registered shares may be sold directly or through brokers or dealers, or in a distribution by one or more underwriters on a firm

commitment or best effort basis. To the extent required, the names of any agent or broker-dealer and applicable commissions or discounts and any other required information with respect to any particular offering will be set forth in a

prospectus supplement. See the section of this prospectus entitled “Plan of Distribution”.

No estimate can be given as to

the amount or percentage of Common Stock that will be held by the Selling Stockholders after any sales made pursuant to this prospectus because the Selling Stockholders are not required to sell any of the Shares being registered under this

prospectus. The following table assumes that the Selling Stockholders will sell all of the Shares listed in this prospectus.

Unless

otherwise indicated in the footnotes below, no Selling Stockholder has had any material relationship with us or any of our affiliates within the past three years other than as a security holder.

We have prepared this table based on written representations and information furnished to us by or on behalf of the Selling Stockholders.

Since the date on which the Selling Stockholders provided this information, the Selling Stockholders may have sold, transferred or otherwise disposed of all or a portion of the shares of Common Stock in a transaction exempt from the registration

requirements of the Securities Act. Unless otherwise indicated in the footnotes below, we believe that: (1) none of the Selling Stockholders are broker-dealers or affiliates of broker-dealers, (2) no Selling Stockholder has direct or

indirect agreements or understandings with any person to distribute their Shares, and (3) the Selling Stockholders have sole voting and investment power with respect to all Shares beneficially owned, subject to applicable community property

laws. To the extent any Selling Stockholder identified below is, or is affiliated with, a broker-dealer, it could be deemed, individually but not severally, to be an “underwriter” within the meaning of the Securities Act. Information about

the Selling Stockholders may change over time. Any changed information will be set forth in supplements to this prospectus, if required.

The following table sets forth information with respect to the beneficial ownership of our Common Stock held, as of November 20, 2017, by

the Selling Stockholders and the number of Shares being registered hereby and information with respect to shares to be beneficially owned by the Selling Stockholders after completion of the offering of the shares for resale. The percentages in

the column “Shares Beneficially Owned Prior to the Offering of Shares for Resale” in the following table reflect the shares beneficially owned by the Selling Stockholders as a percentage of the 28,603,602 shares of Common Stock outstanding

as of November 20, 2017, adjusted as required by rules promulgated by the SEC. These rules attribute beneficial ownership of shares of Common Stock issuable upon conversion of convertible securities or upon exercise of warrants that are

convertible or exercisable, as applicable, either immediately or on or before January 19, 2018, which is 60 days after November 20, 2017. These shares are deemed to be outstanding and beneficially owned by the person holding such

convertible securities or warrants for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Additionally, the percentages

in the column “Shares Beneficially Owned After the Offering of Shares for Resale” in the following table reflect the shares beneficially owned by the Selling Stockholders as a percentage of the 28,603,602 shares of Common Stock outstanding

as of November 20, 2017, adjusted as required by rules promulgated by the SEC and described above in this paragraph.

6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Beneficially Owned

Prior to the Offering of Shares

for

Resale

(1)

|

|

|

Maximum

Number of

Shares of

Common Stock

to be Offered for

Resale Pursuant

to this

Prospectus

(2)

|

|

|

Shares Beneficially Owned

After the Offering of Shares for

Resale

(1)(2)

|

|

|

Name

|

|

Number

|

|

|

Percentage

|

|

|

Number

|

|

|

Number

|

|

|

Percentage

|

|

|

FastPartner AB

|

|

|

2,130,996

|

(3)

|

|

|

7.4

|

%

|

|

|

424,184

|

|

|

|

1,706,812

|

|

|

|

5.9

|

%

|

|

Midroc Invest AB

|

|

|

2,394,504

|

(4)

|

|

|

8.2

|

%

|

|

|

476,463

|

|

|

|

1,918,041

|

|

|

|

6.6

|

%

|

|

Xenella Holding AB

|

|

|

871,291

|

(5)

|

|

|

3.0

|

%

|

|

|

121,897

|

|

|

|

749,394

|

|

|

|

2.6

|

%

|

|

TOTAL

|

|

|

5,396,791

|

|

|

|

—

|

|

|

|

1,022,544

|

|

|

|

4,374,247

|

|

|

|

—

|

|

|

(1)

|

Beneficial ownership is determined in accordance with Rule

13d-3

under the Exchange Act. In computing the number of shares beneficially owned by a person and the percentage

ownership of that person, shares of Common Stock subject to warrants, options and other convertible securities held by that person that are currently exercisable or exercisable within 60 days (of November 20, 2017) are deemed outstanding. Does

not take into account any limitations on exercise contained in any warrants. Shares subject to warrants, options and other convertible securities, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other

person.

|

|

(2)

|

Assumes that the Selling Stockholders dispose of all of the shares of Common Stock covered by this prospectus and that the Selling Stockholders do not acquire beneficial ownership of any additional

shares.

|

|

(3)

|

Consists of (i) 1,751,046 shares of Common Stock held by the Selling Stockholder, including 424,184 shares of Common Stock issued to the Selling Stockholder on July 3, 2017 pursuant to the Conversion Agreement

between ourselves and FastPartner AB; and (ii) 379,950 shares of Common Stock issuable upon exercise of warrants held by the Selling Stockholder. Mr. Sven Olof Johansson has sole voting and investment power with respect to the shares owned by

the Selling Stockholder. The address for the Selling Stockholder is Post Office Box 55625, 102 14 Stockholm, Sweden.

|

|

(4)

|

Consists of (i) 1,967,436 shares of Common Stock held by the Selling Stockholder, including 476,463 shares of Common Stock issued to the Selling Stockholder on July 3, 2017 pursuant to the Conversion Agreement

between ourselves and Midroc Invest AB; and (ii) 427,068 shares of Common Stock issuable upon exercise of warrants held by the Selling Stockholder. Mr. Mohammed Al Amoudi has sole voting and investment power with respect to the shares owned by

the Selling Stockholder. The address for the Selling Stockholder is Post Office Box 3002, 169 03 Solna, Sweden.

|

|

(5)

|

Consists of (i) 675,802 shares of Common Stock held by the Selling Stockholder, including 121,897 shares of Common Stock issued to the Selling Stockholder on July 3, 2017 pursuant to the Conversion Agreement

between ourselves and Xenella Holding AB; and (ii) 195,489 shares of Common Stock issuable upon exercise of warrants held by the Selling Stockholder. Mssrs. Sven Olof Johansson and Mohammed Al Amoudi have shared voting and investment power with

respect to the shares owned by the Selling Stockholder. The address for the Selling Stockholder is C/O Västra Hamnen Corporate Finance AB, 211 19 Malmö, Sweden.

|

Indemnification

Under the Registration

Rights Agreement, we have agreed to indemnify the Selling Stockholders of the Shares against certain losses, claims, damages, liabilities, settlement costs and expenses, including liabilities under the Securities Act.

7

PLAN OF DISTRIBUTION

The Selling Stockholders may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which

the shares are traded or in private transactions. These sales may be at fixed or negotiated prices. The Selling Stockholders may use any one or more of the following methods when selling shares:

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

•

|

|

broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

•

|

|

a combination of any such methods of sale; and

|

|

|

•

|

|

any other method permitted pursuant to applicable law.

|

The Selling Stockholders may also sell shares under

Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the Selling Stockholders may arrange for

other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated.

The Selling Stockholders do not expect these commissions and discounts to exceed what is customary in the types of transactions involved. Any profits on the resale of shares of common stock by a broker-dealer acting as principal might be deemed to

be underwriting discounts or commissions under the Securities Act. Discounts, concessions, commissions and similar selling expenses, if any, attributable to the sale of shares will be borne by a Selling Stockholder. The Selling Stockholders may

agree to indemnify any agent, dealer or broker-dealer that participates in transactions involving sales of the shares if liabilities are imposed on that person under the Securities Act.

The Selling Stockholders may from time to time pledge or grant a security interest in some or all of the shares of common stock owned by them and, if they

default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares of common stock from time to time under this prospectus after we have filed a supplement to this prospectus under Rule 424(b)(3)

or other applicable provision of the Securities Act supplementing or amending the list of Selling Stockholders to include the pledgee, transferee or other successors in interest as Selling Stockholders under this prospectus.

The Selling Stockholders also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in

interest will be the selling beneficial owners for purposes of this prospectus and may sell the shares of common stock from time to time under this prospectus after we have filed a supplement to this prospectus under Rule 424(b)(3) or other

applicable provision of the Securities Act supplementing or amending the list of Selling Stockholders to include the pledgee, transferee or other successors in interest as Selling Stockholders under this prospectus.

The Selling Stockholders and any broker-dealers or agents that are involved in selling the shares of common stock may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be

underwriting commissions or discounts under the Securities Act.

We are required to pay all fees and expenses incident to the registration of the shares

of common stock. We have agreed to indemnify the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

The Selling Stockholders have advised us that they have not entered into any agreements, understandings or arrangements with any underwriters or

broker-dealers regarding the sale of their shares of common stock, nor is there an underwriter or coordinating broker acting in connection with a proposed sale of shares of common stock by any Selling Stockholder. If we are notified by any Selling

Stockholder that any material arrangement has been entered into with a broker-dealer for the sale of shares of common stock, if required, we will file a supplement to this prospectus. If the Selling Stockholders use this prospectus for any sale of

the shares of common stock, they will be subject to the prospectus delivery requirements of the Securities Act.

The anti-manipulation rules of Regulation

M under the Securities Exchange Act of 1934, as amended, may apply to sales of our common stock and activities of the Selling Stockholders.

8

DESCRIPTION OF CAPITAL STOCK

The following is a description of the material terms of our capital stock as provided in our (i) amended and restated certificate of

incorporation, and (ii) amended and restated bylaws. We also refer you to our amended and restated certificate of incorporation (including our amendment to our amended and restated certificate of incorporation) and our amended and restated

bylaws, copies of which are incorporated by reference as exhibits to the registration statement of which this prospectus forms a part.

Authorized

Capitalization

Our authorized capital stock consists of 100,000,000 shares of Common Stock with a $0.001 par value per share, and

10,000,000 shares of preferred stock with a $0.001 par value per share. Our board of directors may establish the rights and preferences of the preferred stock from time to time. As of November 20, 2017, there were 28,603,602 shares of our

Common Stock issued and outstanding and no shares of preferred stock outstanding.

The following is a summary of the material provisions

of the Common Stock provided for in our amended and restated certificate of incorporation and amended and restated bylaws. For additional detail about our capital stock, please refer to our amended and restated certificate of incorporation and

amended and restated bylaws.

Listing

Our Common Stock is listed on the NASDAQ Global Market under the symbol “CDNA.”

Transfer Agent and Registrar

The

transfer agent and registrar for the Common Stock is Computershare Trust Company, N.A. Its address is 250 Royall Street, Canton, MA 02021, and its telephone number is

1-800-962-4284.

Common Stock

Each holder of our Common Stock is entitled to one vote for each share on all matters to be voted upon by the stockholders. Subject to any

preferential rights of any outstanding preferred stock, holders of our Common Stock are entitled to receive ratably the dividends, if any, as may be declared from time to time by the board of directors out of funds legally available therefor. We

have never declared or paid any cash dividend on our capital stock and do not anticipate paying any cash dividends in the foreseeable future. The Debentures restrict our ability to pay cash dividends on our Common Stock, and we may also enter into

credit agreements or other borrowing arrangements in the future that will further restrict our ability to declare or pay cash dividends on our Common Stock. In the event of our liquidation, dissolution or winding up, holders of our Common Stock are

entitled to share ratably in our assets remaining after the payment of liabilities and any preferential rights of any outstanding preferred stock.

Holders of our Common Stock have no preemptive or conversion rights or other subscription rights, and there are no redemption or sinking fund

provisions applicable to the Common Stock. The outstanding shares of Common Stock are fully paid and

non-assessable.

The rights, preferences and privileges of the holders of our Common Stock are subject to,

and may be adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate and issue in the future.

Voting Rights

Each share of our Common Stock entitles its holder to one vote in the election of each director. No share of our Common Stock affords any

cumulative voting rights. This means that the holders of a majority of the voting power of the shares voting for the election of directors can elect all directors to be elected if they choose to do so, subject to any voting rights granted to holders

of any outstanding preferred stock. Generally, except as discussed in “Effects of Certain Provisions of our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws and the Delaware Anti-Takeover Statute” below,

all matters to be voted on by stockholders must be approved by a majority of the total voting power of the Common Stock present in person or represented by proxy at a meeting at which a quorum exists, subject to any voting rights granted to holders

of any outstanding preferred stock. Except as otherwise provided by law or in the amended and restated certificate of incorporation (as further discussed in “Effects of Certain Provisions of our Amended and Restated Certificate of Incorporation

and Amended and Restated Bylaws and the Delaware Anti-Takeover Statute”), and subject to any voting rights granted to holders of any outstanding preferred stock, amendments to the amended and restated certificate of incorporation must be

approved by a majority of the votes entitled to be cast by the holders of Common Stock.

9

Dividends

Subject to the rights of holders of any outstanding preferred stock, holders of our Common Stock are entitled to dividends in such amounts and

at such times as our board of directors in its discretion may declare out of funds legally available for the payment of dividends. Dividends on our Common Stock will be paid at the discretion of our board of directors after taking into account

various factors, including:

|

|

•

|

|

our financial condition;

|

|

|

•

|

|

our results of operations;

|

|

|

•

|

|

our capital requirements and development expenditures;

|

|

|

•

|

|

our future business prospects; and

|

|

|

•

|

|

any restrictions imposed by future debt instruments.

|

Other Rights

On our liquidation, dissolution or winding up, after payment in full of the amounts required to be paid to holders of any outstanding preferred

stock, all holders of Common Stock are entitled to receive the same amount per share with respect to any distribution of assets to holders of shares of Common Stock.

No shares of Common Stock are subject to redemption or have preemptive rights to purchase additional shares of our Common Stock or other

securities.

Preferred Stock

Our

board of directors is authorized, subject to limitations prescribed by Delaware law, to issue up to 10,000,000 shares of our preferred stock in one or more series, to establish from time to time the number of shares to be included in each series,

and to fix the designation, powers, preferences, and rights of the shares of each series and any of its qualifications, limitations or restrictions, in each case without further vote or action by our stockholders. Our board of directors can also

increase or decrease the number of shares of any series of preferred stock, but not below the number of shares of that series then outstanding, without any further vote or action by our stockholders. Our board of directors may authorize the issuance

of preferred stock with voting or conversion rights that could adversely affect the voting power or other rights of the holders of our Common Stock. The issuance of preferred stock, while providing flexibility in connection with possible

acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in control of our company and might adversely affect the market price of our Common Stock and the voting and other

rights of the holders of our Common Stock.

Equity Awards

As of November 20, 2017, options to purchase 2,129,677 shares of our Common Stock with a weighted-average exercise price of $5.22 per

share were outstanding and restricted stock units with respect to 438,288 shares of our Common Stock were outstanding.

Warrants

As of November 20, 2017, warrants to purchase an aggregate of 3,862,082 shares of Common Stock with a weighted-average exercise price of

$4.55 per share were outstanding. All of such warrants to purchase shares of Common Stock are currently exercisable, except to the extent that they are subject to a blocker provision, which restricts the exercise of a warrant if, as a result of such

exercise, the warrant holder, together with its affiliates and any other person whose beneficial ownership of Common Stock would be aggregated with the warrant holder’s for purposes of Section 13(d) of the Exchange Act, would beneficially

own in excess of 4.9% or 9.9% of our then issued and outstanding shares of Common Stock (including the shares of Common Stock issuable upon such exercise), as such percentage ownership is determined in accordance with the terms of such warrant (the

“Warrant Blocker”) and contain provisions for the adjustment of the exercise price in the event of stock dividends, stock splits or similar transactions or certain dilutive issuances.

10

Debentures

As of November 20, 2017, we had outstanding debentures with an aggregate principal amount of $26.5 million, which mature on

February 28, 2020, accrue interest at 9.5% per year and are convertible, at the holder’s option, into shares of Common Stock at a price of $4.33 per share (the “Conversion Price”), which is subject to adjustment for accrued and

unpaid interest and upon the occurrence of certain transactions (the “Debentures”). Additionally, upon the satisfaction of certain conditions, including the volume weighted average price of the Common Stock exceeding 250% of the Conversion

Price for twenty consecutive trading days, we can require that the Debentures be converted into shares of our Common Stock, subject to certain limitations. Commencing on March 1, 2018, the holders of the Debentures will have the right, at their

option, to require us to redeem up to an aggregate of $937,500 of the outstanding principal amount of the Debentures per month. We will be required to promptly, but in any event no more than one trading day after a holder delivers a redemption

notice to us, pay the applicable redemption amount in cash or, at our election and subject to certain conditions, in shares of Common Stock. If we elect to pay the redemption amount in shares of Common Stock, then the shares will be delivered based

on a price equal to the lesser of (a) a 12% discount to the average of the three lowest volume weighted average prices of the Common Stock over the prior 20 trading days, (b) a 12% discount to the prior trading day’s volume weighted

average price, or (c) the Conversion Price. We may only opt for payment in shares of Common Stock if certain conditions are met.

Registration

Rights

On July 3, 2017, we entered into the Registration Rights Agreement, pursuant to which we agreed, among other things, that

we would file with the SEC a Registration Statement under the Securities Act that covers the resale of the shares issued and issuable pursuant to the Conversion Agreements. We are registering 1,022,544 shares of Common Stock for resale pursuant to

the registration statement of which this prospectus forms a part as required by the Registration Rights Agreement.

On March 15,

2017, we entered into a registration rights agreement with certain accredited investors in connection with the sale of the Debentures and warrants to purchase 1,250,000 shares of Common Stock, pursuant to which we agreed, among other things, that we

would file with the SEC a Registration Statement under the Securities Act that covers the resale of (i) the shares of Common Stock issuable upon conversion or redemption of the Debentures and (ii) the shares of Common Stock issuable upon

exercise of the warrants. Pursuant to the anti-dilution adjustments in the warrants issued on March 15, 2017, the number of shares subject to the warrants was adjusted on July 3, 2017 and again on October 10, 2017 and the warrants are

currently exercisable for an aggregate of 1,338,326 shares of Common Stock.

On April 12, 2016, we entered into a securities purchase

agreement (the “April SPA”) with certain accredited investors in connection with the sale and issuance of approximately $14.1 million worth of units (“Units”), each Unit comprised of: (i) one share of Common Stock,

(ii) five shares of Series A Mandatorily Convertible Preferred Stock of the Company, par value $0.001 per share (the “Series A Preferred”) and (iii) three warrants, each to purchase one share of Common Stock upon exercise of such

warrants. The April SPA also provided that we file with the SEC, by no later than May 30, 2016, a Registration Statement under the Securities Act that covers the resale of (i) the shares of Common Stock, (ii) the shares of Common

Stock into which the Series A Preferred is convertible and (iii) the shares of Common Stock issuable upon exercise of the warrants, in each case as issued pursuant to the April SPA.

On June 15, 2016, we entered into a securities purchase agreement (the “June SPA”) with certain accredited investors in

connection with the sale and issuance of an additional approximately $8.0 million worth of Units. The June SPA also provided that we file with the SEC, by no later than August 1, 2016, a Registration Statement under the Securities Act that

covers the resale of (i) the shares of Common Stock, (ii) the shares of Common Stock into which the Series A Preferred is convertible and (iii) the shares of Common Stock issuable upon exercise of the warrants, in each case as issued

pursuant to the June SPA. On June 16, 2016, each share of Series A Preferred was converted into one share of the Common Stock. We filed a Registration Statement registering the shares of Common Stock issued and issuable pursuant to the April

SPA and the June SPA for resale on May 27, 2016, as amended on June 15, 2016 and June 30, 2016, and the Registration Statement was declared effective on July 12, 2016.

Effect of Certain Provisions of our Amended and Restated Certificate of Incorporation and Bylaws and the Delaware Anti-Takeover Statute

Certain provisions of Delaware law, along with certain provisions of our amended and restated certificate of incorporation and our amended and

restated bylaws, may have the effect of delaying, deferring or discouraging another person from acquiring control of our company and could make the following transactions more difficult:

|

|

•

|

|

acquisition of us by means of a tender offer;

|

|

|

•

|

|

acquisition of us by means of a proxy contest or otherwise; or

|

11

|

|

•

|

|

removal of our incumbent officers and directors.

|

These provisions, summarized below, are

expected to discourage coercive takeover practices and inadequate takeover bids and to promote stability in our management. These provisions are also designed, in part, to encourage persons seeking to acquire control of our company to first

negotiate with our board of directors. However, these provisions could have the effect of deferring hostile takeovers or delaying, discouraging or preventing attempts to acquire us, which could deprive our stockholders of opportunities to sell their

shares of Common Stock at prices higher than prevailing market prices.

Amended and Restated Certificate of Incorporation and

Amended and Restated Bylaws

Our amended and restated certificate of incorporation and our amended and restated bylaws include a

number of provisions that could deter hostile takeovers or delay or prevent changes relating to the control of our board of directors or management team, including the following:

|

|

•

|

|

Board of Directors Vacancies. Our amended and restated certificate of incorporation and amended and restated bylaws authorize only our board of directors to fill vacant directorships, including newly created seats. In

addition, the number of directors constituting our board of directors can be set only by a resolution adopted by a majority vote of our entire board of directors. These provisions would prevent a stockholder from increasing the size of our board of

directors and then gaining control of our board of directors by filling the resulting vacancies with its own nominees. This makes it more difficult to change the composition of our board of directors and promotes continuity of management.

|

|

|

•

|

|

Classified Board. Our amended and restated certificate of incorporation provides that our board of directors is classified into three classes of directors. A third party may be discouraged from making a tender offer or

otherwise attempting to obtain control of our company as it is more difficult and time consuming for stockholders to replace a majority of the directors on a classified board of directors.

|

|

|

•

|

|

Stockholder Action; Special Meeting of Stockholders. Our amended and restated certificate of incorporation provides that our stockholders may not take action by written consent, but may only take action at annual or

special meetings of our stockholders. As a result, a holder controlling a majority of our capital stock would not be able to amend our amended and restated bylaws or remove directors without holding a meeting of our stockholders called in accordance

with our amended and restated bylaws. Our amended and restated bylaws further provide that special meetings of our stockholders may be called only by a majority of our board of directors, the Chairperson of our board of directors, our Chief

Executive Officer or our President, thus prohibiting a stockholder (in the capacity as a stockholder) from calling a special meeting. These provisions might delay the ability of our stockholders to force consideration of a proposal or for

stockholders controlling a majority of our capital stock to take any action, including the removal of directors.

|

|

|

•

|

|

Advance Notice Requirements for Stockholder Proposals and Director Nominations. Our amended and restated bylaws provide advance notice procedures for stockholders seeking to bring business before our annual meeting of

stockholders or to nominate candidates for election as directors at our annual meeting of stockholders. Our amended and restated bylaws also specify certain requirements regarding the form and content of a stockholder’s notice. These provisions

might preclude our stockholders from bringing matters before our annual meeting of stockholders or from making nominations for directors at our annual meeting of stockholders if the proper procedures are not followed. We expect that these provisions

may also discourage or deter a potential acquirer from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our company.

|

|

|

•

|

|

No Cumulative Voting. The DGCL provides that stockholders may cumulate votes in the election of directors if the corporation’s certificate of incorporation allows for such mechanism. Our amended and restated

certificate of incorporation does not provide for cumulative voting.

|

|

|

•

|

|

Directors Removed Only for Cause. Our amended and restated certificate of incorporation provides that stockholders may remove directors only for cause and only by the affirmative vote of the holders of at least 66 2/3%

in voting power of our stock entitled to vote thereon.

|

|

|

•

|

|

Amendment of Charter Provisions. Any amendment of the above provisions in our amended and restated certificate of incorporation, with the exception of the ability of our board of directors to issue shares of preferred

stock and designate any rights, preferences and privileges thereto, would require approval by the affirmative vote of the holders of at least 66 2/3% of our then outstanding common stock.

|

|

|

•

|

|

Issuance of Undesignated Preferred Stock. Our board of directors has the authority, without further action by the

stockholders, to issue up to 10,000,000 shares of undesignated preferred stock with rights and preferences, including voting rights,

|

12

|

|

designated from time to time by our board of directors. The existence of authorized but unissued shares of preferred stock would enable our board of directors to render more difficult or to

discourage an attempt to obtain control of our company by means of a merger, tender offer, proxy contest or other means.

|

Delaware Anti-Takeover Statute

We are subject to the provisions of Section 203 of the General Corporation Law of the State of Delaware (the “DGCL”) regulating

corporate takeovers. In general, those provisions prohibit a public Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years following the date that the stockholder became an

interested stockholder, unless:

|

|

•

|

|

the transaction is approved by the board of directors before the date the interested stockholder attained that status;

|

|

|

•

|

|

upon consummation of the transaction which resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the

transaction commenced; or

|

|

|

•

|

|

on or after the date of the transaction, the transaction is approved by the board of directors and authorized at a meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the

outstanding voting stock that is not owned by the interested stockholder.

|

In general, Section 203 of the DGCL defines

a business combination to include the following:

|

|

•

|

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

•

|

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

|

|

•

|

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

|

|

•

|

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

|

|

|

•

|

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

|

In general, Section 203 of the DGCL defines an interested stockholder as any entity or person beneficially owning, or who within three

years prior to the time of determination of interested stockholder status did own, 15% or more of the outstanding voting stock of the corporation and any entity or person affiliated with or controlling or controlled by any such entity or person.

A Delaware corporation may opt out of this provision by express provision in its original certificate of incorporation or by amendment to

its certificate of incorporation or bylaws approved by its stockholders. However, we have not opted out of, and do not currently intend to opt out of, this provision. The statute could prohibit or delay mergers or other takeover or change in control

attempts and, accordingly, may discourage attempts to acquire our company.

13

LEGAL MATTERS

Unless otherwise indicated in the applicable prospectus supplement, the validity of the Common Stock offered by this prospectus, and any

supplement thereto, will be passed upon for us by Paul Hastings LLP, Palo Alto, California.

EXPERTS

Ernst & Young LLP, independent registered public accounting firm, has audited our consolidated financial statements included in our

Annual Report on Form

10-K

for the year ended December 31, 2016, as set forth in their report (which contains an explanatory paragraph describing conditions that raise substantial doubt about the

Company’s ability to continue as a going concern as described in Note 1 to the consolidated financial statements), which is incorporated by reference in this prospectus and elsewhere in the registration statement. Our financial statements

are incorporated by reference in reliance on Ernst & Young LLP’s report, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We are a reporting company and file annual, quarterly and current reports, proxy statements and other information with the SEC. We have filed

with the SEC a registration statement on Form

S-1

under the Securities Act with respect to the Common Stock being offered under this prospectus. This prospectus does not contain all of the information set

forth in the registration statement and the exhibits to the registration statement. For further information with respect to us and the shares of Common Stock being offered under this prospectus, we refer you to the registration statement and the

exhibits and schedules filed as a part of the registration statement. You may read and copy the registration statement, as well as our reports, proxy statements and other information, at the SEC’s Public Reference Room at 100 F Street, N.E.,

Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330

for more information about the operation of the Public Reference

Room. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including CareDx, Inc. The SEC’s Internet site can be found

at

http://www.sec.gov

.

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT

LIABILITIES

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers,

and persons controlling us pursuant to the provisions described in Item 14 of the registration statement of which this prospectus forms a part or otherwise, we have been advised that in the opinion of the SEC such indemnification is against public

policy as expressed in the Securities Act and is therefore unenforceable. In the event that a claim for indemnification against such liabilities (other than our payment of expenses incurred or paid by our directors, officers, or controlling persons

in the successful defense of any action, suit, or proceeding) is asserted by our directors, officers, or controlling persons in connection with the Common Stock being registered, we will, unless in the opinion of our counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed in the Securities Act and will be governed by the final adjudication of the issue.

14

IMPORTANT INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important

information to you by referring you to another document filed separately with the SEC. The documents incorporated by reference into this prospectus contain important information that you should read about us.

The following documents are incorporated by reference into this prospectus:

|

|

(a)

|

The Registrant’s Annual Report on Form

10-K

for the fiscal year ended December 31, 2016, filed with the SEC on April 21, 2017;

|

|

|

(b)

|

The Registrant’s Amendment No. 1 to Annual Report on Form

10-K/A,

filed with the SEC on May 1, 2017;

|

|

|

(c)

|

The Registrant’s Quarterly Reports on Form

10-Q

filed with the SEC on (i) June 9, 2017, (ii) August 11, 2017, and (iii) November 9, 2017;

|

|

|

(d)

|

The Registrant’s Current Reports on Form

8-K

filed with the SEC on (i) January 23, 2017, filed at 8:49 a.m. Eastern Time, (ii) January 23, 2017, filed at

8:56 a.m. Eastern Time (other than information furnished under Item 7.01 therein), (iii) March 15, 2017, (iv) April 21, 2017, filed at 3:14 p.m. Eastern Time (other than information furnished under Item 7.01 or Item 9.01 therein), (v) May

22, 2017 (other than information furnished under Item 7.01 or Item 9.01 therein), (vi) July 3, 2017 (other than information furnished under Item 2.02, Item 7.01 or Item 9.01 therein), (vii) July 14, 2017, (viii) October 5,

2017, (ix) October 10, 2017, and (x) November 15, 2017; and

|

|

|

(e)

|

The description of the Registrant’s Common Stock set forth in the Registrant’s Registration Statement on Form

8-A

(File

No. 001-36536),

filed with the SEC on July 11, 2014, including any amendments or reports filed for the purpose of updating such description.

|

We also incorporate by reference any future filings (other than current reports furnished under Item 2.02 or Item 7.01 of Form

8-K

and exhibits filed on such form that are related to such items unless such Form

8-K

expressly provides to the contrary) made with the SEC pursuant to Sections 13(a),

13(c), 14 or 15(d) of the Exchange Act, including those made after the date of the initial filing of the registration statement of which this prospectus forms a part and prior to effectiveness of such registration statement, until we file a

post-effective amendment that indicates the termination of the offering of the Common Stock made by this prospectus and such future filings will become a part of this prospectus from the respective dates that such documents are filed with the SEC.

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes hereof or of the related prospectus supplement to the extent that a statement

contained herein or in any other subsequently filed document which is also incorporated or deemed to be incorporated herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so

modified or superseded, to constitute a part of this prospectus.

The documents incorporated by reference into this prospectus are also

available on our corporate website at www.caredx.com under the heading “Investors.” Information contained on, or that can be accessed through, our website is not part of this prospectus, and you should not consider information on our

website to be part of this report unless specifically incorporated herein by reference You may obtain copies of the documents incorporated by reference in this prospectus from us free of charge by requesting them in writing or by telephone at the

following address:

CareDx, Inc.

3260 Bayshore Boulevard

Brisbane,

California 94005

Attn: Investor Relations

Telephone: (415)

287-2300

15

CAREDX, INC.

1,022,544 SHARES OF COMMON STOCK

PROSPECTUS

December 8, 2017

Neither we nor the

Selling Stockholders have authorized any dealer, salesperson or other person to give any information or to make any representations not contained in this prospectus or any prospectus supplement. You must not rely on any unauthorized information.

This prospectus is not an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. The information in this prospectus is current as of the date of this prospectus. You should not assume that this prospectus is

accurate as of any other date.

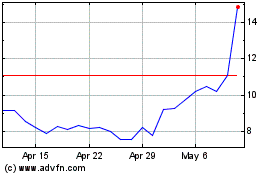

CareDx (NASDAQ:CDNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

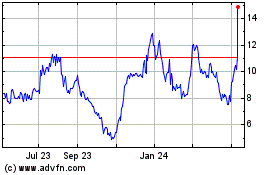

CareDx (NASDAQ:CDNA)

Historical Stock Chart

From Apr 2023 to Apr 2024