UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO.

1

TO

SCHEDULE

TO

SCHEDULE 13E-3

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) or 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934.

SUNLINK HEALTH

SYSTEMS, INC.

(Name Of Subject Company (Issuer))

SUNLINK HEALTH SYSTEMS, INC.

(Name of Filing Persons (Issuer and Offeror))

Common Shares,

no par value

(Title of Class of Securities)

867370102

(CUSIP Number

of Class of Securities)

Robert M. Thornton, Jr.

Chairman

SunLink Health

Systems, Inc.

900 Circle 75 Parkway

Suite 1120

Atlanta,

Georgia 30339

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing

persons)

with a copy to:

Howard E. Turner, Esq.

M. Timothy Elder, Esq.

Smith, Gambrell & Russell, LLP

Suite 3100, Promenade II

1230 Peachtree Street, N.E.

Atlanta, Georgia 30309-3592

(404) 815-3500

|

|

|

|

|

CALCULATION OF FILING FEE

|

|

Transaction Valuation*

|

|

Amount of Filing Fee**

|

|

$2,500,000

|

|

$311.25***

|

|

|

|

*

|

Estimated solely for purposes of calculating the filing fee pursuant to Rules 0-11 under the Securities Exchange Act of 1934, as amended, based on the dollar amount to be used in the purchase of shares in the tender

offer described in this Schedule TO.

|

|

**

|

The amount of the filing fee, calculated in accordance with Rule 0-11(b) of the Securities Exchange Act of 1934, as amended, and Fee Rate Advisory #1 for Fiscal Year 2018 issued by the Securities and Exchange

Commission (the “SEC”), equals $124.50 per $1,000,000 of the aggregate value of the transaction.

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

Amount Previously Paid: $331.25

|

|

Filing Party: SunLink Health Systems, Inc.

|

|

Form or Registration No.: Schedule TO (File No. 005-03600)

|

|

Date Filed: November 21, 2017

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☐

|

third-party tender offer subject to Rule 14d-1.

|

|

|

☒

|

issuer tender offer subject to Rule 13e-4.

|

|

|

☒

|

going-private transaction subject to Rule 13e-3.

|

|

|

☐

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is

a final amendment reporting the results of the tender offer: ☐

This Amendment No. 1 to the Tender Offer Statement on Schedule TO amends and

supplements the Schedule TO originally filed with the Securities and Exchange Commission (“

SEC

”) on November 21, 2017 (together with any amendments and supplements thereto and the exhibits hereto, the

“

Schedule

TO

”) relating to a tender offer by SunLink Health Systems, Inc. (“

SunLink

” or the “

Company

”) to purchase up to 1,562,500 common shares

of SunLink, no par value, for an aggregate purchase price of up to $2,500,000, to the sellers in cash, without interest, upon the terms and subject to the conditions set forth in the offer to purchase, dated November 21, 2017 (the

“

Offer to Purchase

”) and the accompanying letter of transmittal (the “

Letter of Transmittal

”) as amended hereby, which together, as each may be amended and supplemented from time to time, constitute

the tender offer (the “

Offer

”). This Amendment No. 1 to Schedule TO also is intended to satisfy the reporting requirements of

Rule 13e-4(c)(2) of

the Securities

Exchange Act of 1934, as amended, and amend the Schedule TO with respect thereto.

The information contained in the Offer to Purchase and

the accompanying Letter of Transmittal, copies of which were attached to the Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively, which, except as amended and supplemented hereby, is incorporated herein by reference in response to all of

the items of this Schedule TO as more particularly described below.

The Offer to Purchase and the Schedule TO, to the extent Item 1, Item 2, Item 10, and

Item 13 incorporate by reference the information contained in the Offer to Purchase are hereby amended and supplemented as set forth below.

1. In the Offer to Purchase, the second sentence of Section 1 of the Offer to Purchase under the subheading entitled “

Has

SunLink or its board of directors adopted a position on the Offer?

” is hereby amended and supplemented by amending the second sentence thereof to read as follows:

“As discussed in Section 2, the Company’s Board, on behalf of the Company, believes that the Offer, taken as a

whole, is procedurally and substantively fair to the unaffiliated shareholders of the Company including both those who tender their shares and receive payment and those who continue to hold the Company’s common shares after the Offer.”

2. In the Offer to Purchase, the first sentence of the seventh paragraph under the subheading entitled

“

INTRODUCTION

”, the first sentence of the sixth paragraph under the subheading “

Purpose of the Offer

” in Section 2, and the first sentence under the subheading “

Fairness of the Offer

” in

Section 2, each are amended and supplemented to read as follows:

“The Board, on behalf of the Company, believes

that the Offer, as a whole, is procedurally and substantively fair to the unaffiliated shareholders of the Company, both those who tender their shares and receive payment and those who continue to hold the Company’s common shares after the

Offer is completed.”

3. In the Offer to Purchase, the information in Section 2 under the subheading

“

Certain Effects of the Offer

”

is amended and supplemented by adding the following text at the end of the ninth paragraph after such subheading:

“SunLink may be the beneficiary of existing and future operating loss carryforwards (“

NOLs

”). As of

September 30, 2017, SunLink had estimated NOL carryforwards for federal income tax purposes of $12,400,000 million. Such NOLs expire in 2025. Use of this NOL carry-forward is subject to (a) the Company achieving taxable income, and

(b) the limitation provisions of Internal Revenue Code Section 382. As a result, some or all of the NOLs carry-forward may not be applied in the future. SunLink cannot estimate the exact amount of NOLs that it would be able to use to

reduce any future income tax liability because SunLink cannot predict the amount and timing of its future taxable income. SunLink believes its NOLs are a valuable assets and has taken steps to avoid the IRC Section 382 limitation of its NOLs,

including a shareholder rights provision and a Code of Regulations amendment to limit the risk of an IRC Section 382 limitation. Nevertheless, if an ownership change were to occur, the limitations imposed by Section 382 could result in a

material amount of SunLink’s NOLs expiring unused and, therefore, significantly impair the value of SunLink’s NOLs. While the complexity of Section 382’s provisions and the limited knowledge that SunLink, like other public

companies generally, has about the ownership of its publicly traded common equity make it difficult to determine whether an ownership change has occurred, SunLink currently believes that an ownership change has not occurred and will not occur solely

as a result of the tender offer even if fully subscribed.”

2

|

ITEM 13.

|

INFORMATION REQUIRED BY SCHEDULE

13E-3

|

4. The information in the Schedule TO is amended and supplemented to add the following sentence immediately after the Item 13 heading in

the Schedule TO:

“The following sets forth the information required by Schedule

13E-3

that has not already been set forth in Items

1-12

above. The information set forth in the Offer to Purchase is incorporated herein by reference to the items

required by Schedule

13E-3.”

Schedule 13E-3,

Item 2.

Subject Company Information is amended and supplemented as follows:

5. In the Offer to Purchase, the information set forth

under the heading “

Section

9 Certain Information Concerning the Company”

in the

Unaudited Pro Forma Financial Data

table is amended and supplemented to add line item disclosure for noncurrent liabilities

and noncurrent assets such that such table reads in its entirety as follows:

Unaudited Pro Forma

Financial Data

(All amounts

in thousands, except for per share)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2017

|

|

|

As of September 30, 2017

|

|

|

|

|

As

Reported

|

|

|

Trace

Prepayment

1

Pro Forma

Adjustments

|

|

|

Tender Offer

Pro Forma

Adjustments

|

|

|

Pro Forma

Results

|

|

|

As

Reported

|

|

|

Trace

Prepayment

Pro Forma

Adjustments

|

|

|

Tender

Offer

Pro Forma

Adjustments

|

|

|

Pro Forma

Results

|

|

|

Cash and cash equivalents

|

|

$

|

10,494

|

|

|

$

|

(2,548

|

)

|

|

$

|

(2,700

|

)

|

|

$

|

5,246

|

|

|

$

|

9,909

|

|

|

$

|

(2,548

|

)

|

|

$

|

(2,700

|

)

|

|

$

|

4,661

|

|

|

Restricted cash

|

|

|

1,000

|

|

|

|

(1,000

|

)

|

|

|

—

|

|

|

|

0

|

|

|

|

1,000

|

|

|

|

(1,000

|

)

|

|

|

|

|

|

|

0

|

|

|

Other current assets

|

|

|

11,127

|

|

|

|

|

|

|

|

|

|

|

|

11,127

|

|

|

|

11,607

|

|

|

|

|

|

|

|

|

|

|

|

11,607

|

|

|

Total current assets

|

|

|

22,621

|

|

|

|

(3,548

|

)

|

|

|

(2,700

|

)

|

|

|

16,373

|

|

|

|

22,516

|

|

|

|

(3,548

|

)

|

|

|

(2,700

|

)

|

|

|

16,268

|

|

|

Noncurrent assets

|

|

|

12,715

|

|

|

|

|

|

|

|

|

|

|

|

12,715

|

|

|

|

12,886

|

|

|

|

|

|

|

|

|

|

|

|

12,886

|

|

|

Total assets

|

|

|

35,336

|

|

|

|

(3,548

|

)

|

|

|

(2,700

|

)

|

|

|

29,088

|

|

|

|

35,402

|

|

|

|

(3,548

|

)

|

|

|

(2,700

|

)

|

|

|

29,154

|

|

|

Current liabilities

|

|

|

12,314

|

|

|

|

(3,305

|

)

|

|

|

|

|

|

|

9,009

|

|

|

|

12,658

|

|

|

|

(3,308

|

)

|

|

|

|

|

|

|

9,350

|

|

|

Noncurrent liabilities

|

|

|

1,329

|

|

|

|

|

|

|

|

|

|

|

|

1,329

|

|

|

|

1,322

|

|

|

|

|

|

|

|

|

|

|

|

1,322

|

|

|

Total shareholders’ equity

|

|

|

21,693

|

|

|

|

(243

|

)

|

|

|

(2,700

|

)

|

|

|

18,750

|

|

|

|

21,422

|

|

|

|

(240

|

)

|

|

|

(2,700

|

)

|

|

|

18,482

|

|

|

Total liabilities and shareholders’ equity

|

|

$

|

35,336

|

|

|

$

|

(3,548

|

)

|

|

$

|

(2,700

|

)

|

|

$

|

29,088

|

|

|

$

|

35,402

|

|

|

$

|

(3,548

|

)

|

|

$

|

(2,700

|

)

|

|

$

|

29,154

|

|

|

Book value per share

|

|

$

|

2.37

|

|

|

|

|

|

|

|

|

|

|

$

|

2.47

|

|

|

$

|

2.34

|

|

|

|

|

|

|

|

|

|

|

$

|

2.43

|

|

|

1

|

The Company, as guarantor, and Southern Health Corporation of Houston, Inc. (“Trace”), as borrower, a wholly owned subsidiary of the Company which operates the Company’s sole remaining hospital, are

parties to a mortgage loan agreement (“Trace RDA Loan”) with a bank, originally entered into on July 5, 2012, which loan had an outstanding principal amount of approximately $7,000 at October 30, 2017. The Company and Trace are

discussing and believe they have reached an agreement in principal with the bank for a modification of the Trace RDA Loan. If completed the modification would require a prepayment of approximately $3,500 of the outstanding principal loan balance.

The outstanding loan balance after the prepayment would be

re-amortized

over the remaining term of the Trace RDA Loan, which matures in July 2027, resulting in monthly payments of approximately $39 per

month at an interest rate equal to the prime rate (as published in The Wall Street Journal) plus 1% with an interest rate floor of 5.5%. The loan covenants also would be modified, including a waiver of covenant violations for the quarters ended

June 30 and September 30, 2017. Such modification, if completed November 30, 2017, would result in a loss on early extinguishment of debt of approximately $234. In connection with such proposed modification, an existing deposit of

$1,000 into a blocked interest bearing account with the lender would be released. There can be no assurance any such modification will be achieved or that Trace will receive waivers of its existing covenant violations under the Trace RDA Loan, and

if the modification is completed, there can be no assurance Trace will be able to achieve compliance with the modified loan covenants.

|

3

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Document

|

|

|

|

|

(a)(1)(A)**

|

|

Offer to Purchase dated November 21, 2017.

|

|

|

|

|

(a)(1)(B)**

|

|

Form of Letter of Transmittal.

|

|

|

|

|

(a)(1)(C)**

|

|

Form of Notice of Guaranteed Delivery (including Guidelines of the Internal Revenue Service for Certification of Taxpayer Identification Number

on

substitute Form W-9).

|

|

|

|

|

(a)(1)(D)**

|

|

Form of Letter to Brokers, Dealers, Banks, Trust Companies and Other Nominees.

|

|

|

|

|

(a)(1)(E)**

|

|

Form of Letter to Clients for Use by Brokers, Dealers, Banks, Trust Companies and Other Nominees.

|

|

|

|

|

(a)(1)(F)**

|

|

Form of Notice of Withdrawal of Tender for Individual Investors

|

|

|

|

|

(a)(1)(G)**

|

|

Form of Notice of Withdrawal of Tender for Brokers, Dealers, Banks, Trust Companies and other Nominees and DTC Participants

|

|

|

|

|

(a)(5)(A)**

|

|

Notice to Executive Officers and Directors of Blackout Period, dated November

9, 2017.

|

|

|

|

|

(a)(5)(B)

|

|

Press Release regarding Tender Offer dated November 21, 2017 (incorporated by reference to Exhibit 99.1 to the Current Report on

Form 8-K filed

November 21, 2017).

|

|

|

|

|

(a)(5)(C)**

|

|

Press Release announcing commencement of the Tender Offer dated November 21, 2017.

|

|

|

|

|

(b)

|

|

Not applicable.

|

|

|

|

|

(c)

|

|

Not applicable.

|

|

|

|

|

(d)(1)

|

|

2005 Equity Incentive Plan (incorporated by reference from Exhibit 99.1 of the Company’s Registration Statement on

Form S-8filed

September 20, 2006). (Commission File No. 061100389).

|

|

|

|

|

(d)(2)

|

|

SunLink Health Systems, Inc. 2011 Director Stock Option Plan (incorporated by reference from Appendix

A to the Company’s Schedule 14A Definitive Proxy Statement filed September 29, 2011) (Commission File No. 111115265).

|

|

|

|

|

(d)(3)

|

|

Agreement of Understanding between SunLink Health Systems, Inc. and Christopher H.B. Mills regarding service as a director (incorporated by reference

from Exhibit 99.2 of the Company’s Current Report on

Form 8-K dated

July 1, 2007 filed July 16, 2007)

(Commission File No. 001-12607).

|

|

|

|

|

(f)

|

|

Not applicable.

|

|

|

|

|

(g)

|

|

Not applicable.

|

|

|

|

|

(h)

|

|

Not applicable.

|

4

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

|

|

|

|

|

|

|

|

|

|

SunLink Health Systems, Inc.

|

|

|

|

|

|

|

Dated: December 7, 2017

|

|

|

|

By:

|

|

/s/ Robert M. Thornton, Jr.

|

|

|

|

|

|

Name:

|

|

Robert M. Thornton, Jr.

|

|

|

|

|

|

Title:

|

|

Chief Executive Officer

|

5

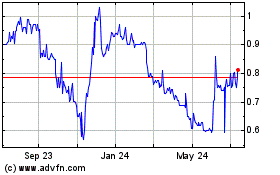

Sunlink Health Systems (AMEX:SSY)

Historical Stock Chart

From Mar 2024 to Apr 2024

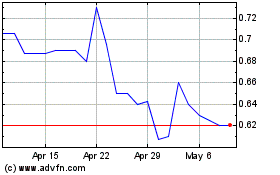

Sunlink Health Systems (AMEX:SSY)

Historical Stock Chart

From Apr 2023 to Apr 2024