UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

Form 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES

EXCHANGE ACT OF

1934

For December 7,

2017

Harmony Gold Mining Company

Limited

Randfontein

Office Park

Corner Main Reef

Road and Ward Avenue

Randfontein,

1759

South

Africa

(Address of principal executive

offices)

*-

(Indicate by

check mark whether the registrant files or will file annual reports

under cover of Form 20- F or Form 40-F.)

(Indicate by

check mark whether the registrant by furnishing the information

contained in this form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities

Exchange Act of 1934.)

Harmony Gold

Mining Company Limited

Registration

number 1950/038232/06

Incorporated in

the Republic of South Africa

ISIN:

ZAE000015228

JSE share code:

HAR

(“Harmony”

or "the Company")

Availability and posting of circular and further details in

relation to the proposed acquisition of the Moab Khotsong

operations

Johannesburg. Thursday 7 December 2017

.

Harmony advises that further to the announcement of the proposed

acquisition of the Moab Khotsong operations, which incorporates the

Great Noligwa underground mine and related infrastructure (the

"Target Assets") on 19 October 2017, Harmony has made available to

download on its website, www.harmony.co.za/investors, today, a

circular to Harmony shareholders. The circular will be posted on or

about Friday, 8 December 2017. Defined terms used but not defined

in this announcement have the meaning set out in the

circular.

The circular

provides further information in relation to:

●

The acquisition of the

underground mine Moab Khotsong, which incorporates the Great

Noligwa underground mine and related infrastructure from AngloGold

Ashanti Limited for a consideration of US$300 million in

cash;

●

Proposed amendments to

Harmony's memorandum of incorporation;

●

The specific authority for

the issue of Ordinary Shares to the ESOP Trust to facilitate a

Black Economic Empowerment transaction;

●

The specific authority for

the issue of Preference Shares and Conversion Shares to the Harmony

Community Trust to facilitate a Black Economic Empowerment

transaction;

●

Salient details pertaining to

the establishment of an empowerment partner equal to an equity

interest of 3% in the Harmony SPV and funding related to this

specific BEE transaction. No shareholder authorisation required;

and

●

A potential capital raising

to refinance the acquisition bridge facility.

Further information on Target Assets

By acquiring the

Moab Khotsong underground mine, which incorporates the Great

Noligwa underground mine and related infrastructure, Harmony

believes it will significantly improve its overall operating cash

flows, increase its average overall underground recovered grade and

significantly grow its South African underground Mineral Resource

base.

Harmony believes

that there is the potential to increase the Moab Khotsong and Great

Noligwa Mines’ Life of Mine (as understood in the context of

the SAMREC Code) by mining additional high grade Isolated Blocks of

Ground (IBGs), extraction of the high grade Great Noligwa shaft

pillar, as well as optimising the current plant facilities to treat

the Mispah Tailings Facilities. Harmony believes that there is also

further optionality in the Zaaiplaats project.

Relating to the

foregoing, the underground Mineral Reserves above infrastructure

totalled approximately 1.7 million ounces at 8.8 g/t as at 31

December 2016, while the underground Mineral Resources above

infrastructure at the Moab Khotsong and Great Noligwa mines as at

31 December 2016 were approximately 4.98 million ounces at 18.5

g/t.

Harmony believes

that Moab Khotsong is a high quality, cash generating gold mine

with well-invested and maintained infrastructure which can underpin

near term cash flows and support the creation of value. Harmony's

assessment of the value is broadly in-line with the preferred value

of US$260 million recommended by the independent competent valuator

as part of the Competent Persons Report.

The Great Noligwa

Mine, which has been placed on care and maintenance in recent years

by AngloGold Ashanti has existing infrastructure utilised to

service the Moab Khotsong mining operations. The Mineral Reserve of

the Great Noligwa Mine is currently being extracted through the

Moab Khotsong Mine.

Harmony has

performed due diligence on Great Noligwa and believes that

additional value can be extracted by mining additional high grade

IBGs as well as the high grade shaft pillar.

Extraction of the

shaft pillar is technically similar to what Harmony has

successfully achieved at its Bambanani operation in or around the

city of Welkom in the Free State, where since February 2010,

Harmony has been able to extract 479 252 oz of gold at an average

recovered grade of 9.89 g/t, and extend the Life of Mine (as

understood in the context of the SAMREC Code) to 2022. Total

project capital to mine the Bambanani shaft pillar was ZAR610

million.

Harmony believes

that the extraction of the Great Noligwa shaft pillar will yield a

similarly positive outcome. The technical nature of the mining is

similar and Harmony has proven expertise in this area.

Further to the

above and based on its experience in mining IBGs, Harmony believes

that it will be able to extend the life of the Moab Khotsong and

Great Noligwa Mines from 5 to at least 10 years subject to the

outcome of the necessary studies after completion of the

Acquisition.

Harmony estimates

that the net present value from extracting the shaft pillar and

mining the IBGs has the potential to be substantial, based on a set

of macroeconomic, technical and operational assumptions consistent

with Harmony’s customary planning assumptions.

Harmony’s

internal assessment of the value of mining additional high grade

IBGs as well as the high grade shaft pillar at Great Noligwa Mine

is broadly in line with the valuation of the Moab Khotsong

Mine.

c)

Mispah

Tailings Retreatment

The Mispah 1

tailings facility specifically, contains a Mineral Resource of over

70 million tonnes of surface tailings with an average gold grade of

0.30 g/t. With the current installed plant excess capacity and the

treatment and processing of waste rock nearing the end of its life,

Harmony believes that there is considerable scope to convert these

facilities to a surface tailings re-treatment operation, similar to

those currently operated by Harmony at the Phoenix plant and the

Central plant operations situated in or around the city of Welkom

in the Free State.

Harmony believes

that optimisation of current plant facilities would have minimal

capital requirements and low technical risk, and would create a

relatively low cost, long life operation.

The necessary

studies, including obtaining the necessary permissions, still have

to be completed to ensure value can be unlocked after completion of

the Acquisition. Harmony estimates a potential net present value of

approximately US$20-40 million based on its prior experience of

developing similar plants and on a set of macroeconomic, technical

and operational assumptions that are consistent with its customary

planning assumptions.

The Zaaiplaats

project is potentially an extension of the Moab Khotsong Mine which

contained a Mineral Resource base of 6.8 Moz with an average gold

grade of 17.2 g/t as at 31 December 2016. It is currently in

pre-feasibility stage and Harmony will assess its attractiveness

after completion of the Acquisition. Zaaiplaats is expected to

provide Harmony with optionality, particularly in a rising Rand

gold price environment. Harmony has attributed no value to

Zaaiplaats. It is currently viewed as a potential future expansion

opportunity.

Further studies

will be conducted, after completion of the Acquisition and the

appropriate decision will be made subject to the outcome of those

studies.

Through its

analysis and due diligence investigation, and in applying the

“Harmony Operational Excellence and Operating Model” to

Moab Khotsong Mine's operations, Harmony believes that it will be

able to realise substantial cost savings. These are reflected in

its operating model and valuation.

Harmony believes

that the main source of these cost savings will be through a

reduction in central support services costs allocated to the Mine

i.e. incorporating the Moab Khotsong Mine into its existing

centralised management structures and support services. Alongside

these savings, Harmony has also identified certain procurement and

metallurgy-related savings which it believes can be

achieved.

In estimating

these cost opportunities, Harmony has been cognisant of the

environment in which it operates and its social responsibilities

and these factors have been factored into Harmony's

estimates.

Harmony believes

the Acquisition is value accretive and will enhance its position as

a higher-grade producer and cash-generative gold mining company.

Harmony anticipates that the Acquisition will boost Harmony's

operational cash flows by more than 60%, and increase its average

overall underground recovered grade by 11% and grow its South

African underground Mineral Resource base by 38%, in each case as

compared to performance in FY17.

Furthermore,

Harmony’s assessment of value of the Target Operations is

based on what Harmony believes is a conservative set of

macroeconomic, technical and operational assumptions that are

consistent with its customary planning assumptions indicates

significant upside to the Purchase Price.

1.

Notice of

General Meeting

Notice is hereby

given to the Shareholders that a General Meeting of the

Shareholders will be held at the Hilton Hotel, 138 Rivonia Road,

Sandton, Johannesburg, South Africa at 11:00 (South African

Standard Time) on Thursday, 01 February 2018.

2.

Salient

dates and times

|

|

|

|

|

Posting Record

Date to be eligible to receive the Circular and Notice of General

Meeting

|

|

Friday, 01

December 2017

|

|

Posting Circular

to Shareholders

|

|

Friday, 08

December 2017

|

|

Last Day to Trade

in order to be eligible to participate and vote at the General

Meeting

|

|

Tuesday, 23

January 2018

|

|

Voting Record

Date to participate in and vote at the General Meeting

|

|

Friday, 26

January 2018

|

|

Last Day and time

to give notice to Transfer Secretaries to participate in the

General Meeting electronically by 11:00 on

|

|

Monday, 29

January 2018

|

|

Last day and time

to lodge Forms of Proxy with the Transfer Secretaries, by 11:00

on

|

|

Tuesday, 30

January 2018

|

|

General Meeting

of Shareholders at 11:00 on

|

|

Thursday, 01

February 2018

|

|

Results of

General Meeting released on SENS

|

|

Thursday, 01

February 2018

|

|

Notes:

|

|

|

(1)

All

dates and times above are South African local times unless

otherwise stated.

|

|

(2)

The

above dates and times are subject to amendments. Any such material

amendment will be released on SENS and published in the South

African press.

|

07 December

2017

Transaction

sponsor: UBS

JSE Sponsor: J.P.

Morgan Equities South Africa Proprietary Limited

South African

Legal Advisor: Bowmans

For more details

contact:

Lauren

Fourie

Investor

Relations Manager

+27 (0) 71 607

1498 (mobile)

or

Marian van der

Walt

Executive:

Corporate and Investor Relations

+27 (0) 82 888

1242 (mobile)

Disclaimers

The release,

publication or distribution of this announcement in certain

jurisdictions may be restricted by law and therefore persons in

such jurisdictions into which this announcement is released,

published or distributed should inform themselves about and observe

such restrictions. This announcement is for information purposes

only and does not constitute or form part of an offer to sell or

the solicitation of an offer to buy or subscribe to any securities

of Harmony. The securities referred to herein have not been and

will not be registered under the United States Securities Act of

1933 (the "Securities Act") or with any securities regulatory

authority of any state or other jurisdiction of the United States

and may not be offered, sold, resold, transferred or delivered,

directly or indirectly, in the United States except pursuant to

registration under, or an exemption from the registration

requirements of, the Securities Act.

The financial

information of the Target Assets disclosed in this announcement has

been extracted from the historical combined financial information

of the Target Assets, which historical combined financial

information had been derived from the consolidated financial

statements of AngloGold Ashanti using the historical results of

operations, assets and liabilities attributable to the Target

Assets.

Having relied

on the fact that the historical combined financial information of

the Target Assets has been derived from the consolidated financial

statements of AngloGold Ashanti, that are free from material

misstatement, whether due to fraud or error, and that AngloGold

Ashanti’s directors were responsible for the compilation of

AngloGold Ashanti’s consolidated financial statements and the

internal controls as they determined is necessary to enable the

preparation and presentation of their consolidated interim

financial statements, Harmony is satisfied as to the quality of the

historical combined financial information of the Target

Assets.

The reserves and

resources information disclosed in relation to the Target Assets

have been extracted from the Mineral Resources and Ore Reserve

Report for 2016 of AngloGold Ashanti. The report states that VA

Chamberlain, MSc (Mining Engineering), BSc (Hons) (Geology), MGSSA,

FAusIMM, an employee of AngloGold Ashanti, assumes responsibility

for the Mineral Resource and Ore Reserve processes for AngloGold

Ashanti and is satisfied that the Competent Person have fulfilled

his responsibilities and has consented to the information to be

included in the announcement and for his name to be disclosed in

this announcement.

Forward looking

statements

Certain

statements included in this announcement, as well as oral

statements that may be made by Harmony, or by officers, directors

or employees acting on its behalf related to the subject matter

hereof, constitute or are based on forward-looking statements.

Forward-looking statements are preceded by, followed by or include

the words “may”, “will”,

“should”, “expect”, “envisage”,

“intend”, “plan”, “project”,

“estimate”, “anticipate”,

“believe”, “hope”, “can”,

“is designed to”, “confident” or similar

phrases.

These

forward-looking statements involve a number of known and unknown

risks, uncertainties and other factors, many of which are difficult

to predict and generally beyond the control of Harmony, that could

cause Harmony’s actual results and outcomes to be materially

different from historical results or from any future results

expressed or implied by such forward-looking statements. Such

risks, uncertainties and other factors include, among others,

Harmony’s ability to complete the Transaction,

Harmony’s ability to successfully integrate the acquired

assets with its existing operations, Harmony’s ability to

achieve anticipated efficiencies and other cost savings in

connection with the Transaction, Harmony’s ability to

increase production, the success of exploration and development

activities and other risks. Harmony undertakes no obligation to

update publicly or release any revisions to these forward-looking

statements to reflect events or circumstances after the date of

this announcement or to reflect any change in Harmony’s

expectations with regard thereto.

This release

includes mineral reserves and resources information prepared in

accordance with the South African Code for the Reporting of

Exploration Results, Mineral Resources and Mineral

Reserves.

Although Harmony

believes that the expectations reflected in any such

forward-looking statements (or this announcement) relating to the

Transaction are reasonable, the information has not been reviewed

or reported on by the reporting accountants and auditors and no

assurance can be given by Harmony that such expectations will prove

to be correct. Harmony does not undertake any obligation to

publicly update or revise any of the information given in this

announcement that may be deemed to be forward-looking.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused

this report to be signed on

its behalf by the undersigned, thereunto duly

authorized.

|

|

Harmony Gold Mining

Company Limited

|

|

|

|

|

|

Date:

December 7, 2017

|

By:

|

/s/

Frank Abbott

|

|

|

|

Name

Frank

Abbott

|

|

|

|

Title

Financial

Director

|

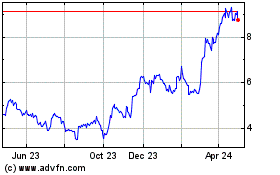

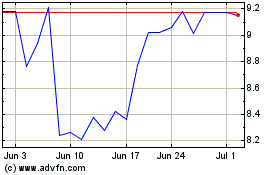

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harmony Gold Mining (NYSE:HMY)

Historical Stock Chart

From Apr 2023 to Apr 2024