Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As previously announced, on November 17, 2017,

Real Industry, Inc. (the “Company”) and Real Alloy Intermediate Holding, LLC (“RAIH”), Real Alloy Holding, Inc. (“Real Alloy”) and certain of the Real Alloy U.S. subsidiaries (collectively, the “Real Alloy Debtors”, and together with the Company, the “Debtors”)

filed for Chapter 11 bankruptcy protection with the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) in the jointly administered proceedings,

“In re Real Industry, Inc., et al.”, Case No. 17-12464 (the “Chapter 11 Proceedings”). On November 20 and 21, 2017, the Real Alloy Debtors secured debtor-in-possession financing from Bank of America, N.A., the Real Alloy Debtors’ prepetition asset-based lender, and certain holders of the Real Alloy Debtors’ prepetition senior-secured notes (the “DIP Financing”). This DIP Financing includes covenants regarding compliance by the Real Alloy Debtors with certain milestones in the Chapter 11 Proceedings, including retention of a chief restructuring officer satisfactory to the providers of the DIP Financing.

On November 30, 2017, in accordance with the requirements of the DIP Financing, RAIH engaged M-III Advisory Partners, LP (“M-III”) to provide restructuring and advisory services (the “Services”) to RAIH and the other Real Alloy Debtors in connection with the Chapter 11 Proceedings, and retained Mohsin Y. Meghji to serve as Chief Restructuring Officer (“CRO”) of the Real Alloy Debtors.

The Services will include:

|

|

·

|

|

supervision and assistance with obtaining and presenting information required by the Bankruptcy Court, any creditors’ committees and other parties in interest to the Chapter 11 Proceedings;

|

|

|

·

|

|

supervision and assistance in developing and administering short-term cash-flow forecasting and cash management planning;

|

|

|

·

|

|

assisting the Real Alloy Debtors with the development of a business plan, restructuring plans, or strategic alternatives to maximize enterprise value and related forecasts required by creditor constituencies;

|

|

|

·

|

|

supervision and assistance of the other professionals representing the Real Alloy Debtors or their stakeholders to coordinate and facilitate the restructuring goals;

|

|

|

·

|

|

assisting the Real Alloy Debtors in communications and negotiations with outside constituents, including creditors, trade vendors and their advisors;

|

|

|

·

|

|

provision of other services as requested or as reasonable and customary for a CRO in connection with the administration and prosecution of a bankruptcy proceeding; and

|

|

|

·

|

|

in coordination with the RAIH Board of Directors (the “RAIH Board”), serving as principal liaison to the Real Alloy Debtors’ creditor constituencies and other stakeholders with respect to Real Alloy’s financial and operational matters and leading efforts of the Real Alloy Debtors and their advisors to develop and implement restructuring plans and other strategic alternatives, including the sale process in order to maximize Real Alloy enterprise value.

|

M-III anticipates tha

t the Services will be initially provided by Mr. Meghji as CRO and one other M-III employee, with expansion of this team as necessary and cost-efficient, and as determined in consultation with the RAIH Board. Mr. Meghji and other M-III personnel providing the Services to the Real Alloy Debtors will remain employed by M-III, and will serve as independent contractors to the Real Alloy Debtors, and shall have no fiduciary duties to the Real Alloy Debtors. Mr. Meghji will report to the RAIH Board during the engagement.

Fees for the Services, along with the reasonable and documented out-of-pocket expenses of M-III personnel, will be invoiced to RAIH on a monthly basis, with hourly rates varying from $375 per hour for associates, $450 per hour for senior associates, $650 per hour for directors, to $950 per hour for managing partners, including Mr. Meghji. Concurrent with the engagement of M-III, RAIH has paid M-III a retainer of $125,000, which retainer is to be held by M-III for the duration of the engagement and applied to the final bill from M-III. In the event that M-III applies any portion of the retainer to any fees or expenses owing from RAIH prior to the final invoice, RAIH must replenish the full retainer amount. M-III will file monthly reports with the Bankruptcy Court to report on their compensation earned and expenses incurred.

The engagement between M-III and RAIH may be terminated by either party upon ten (10) business days’ written notice, without further obligation beyond confidentiality, settlement of outstanding amounts, a one-year mutual non-solicitation of the other party’s employees and contractors, and a three-year prohibition on M-III making an investment in any Real Alloy Debtor. RAIH has agreed to indemnify and hold harmless the CRO and each M-III employee participating in the engagement from and against any and all claims asserted against them arising out of, or in connection with, the engagement, unless such losses arise

from such individual’s bad faith, willful misconduct or gross negligence. Further, RAIH will indemnify the CRO and any other M-III employee who serves as an officer or director of a Real Alloy affiliate to the fullest extent as the other directors and officers of such Real Alloy Debtor entities are protected by law, charter, bylaw, contract or otherwise. Such individuals shall also be covered by the director and officer insurance policies of the Company (and if not available, by supplemental insurance policy).

Mr. Meghji, age 52, has served as the Founder and Managing Partner of M-III since February 2014. He also is currently the Chairman and CEO of MIII Acquisition Corp., a NASDAQ listed special purpose acquisition company, which he joined in August 2015. Mr. Meghji has more than 25 years of professional experience advising companies that are experiencing financial, operational, or strategic transitions and in maximizing value for shareholders and other stakeholders of such entities. In connection with this work, he has held management and advisory roles in partnership with some of the world’s leading financial institutions, private equity and distressed hedge fund investors. Mr. Meghji’s most recent corporate role was as Executive Vice President and Head of Strategy at Springleaf (NYSE-listed in late 2013 and now known as OneMain Holdings, Inc.), as well as Chief Executive Officer of Springleaf’s captive insurance companies, from January 2012 to February 2014. Prior to Springleaf, Mr. Meghji served as a Senior Managing Director at C-III Capital Partners, LLC, a real-estate focused merchant banking firm, from October to December 2011. Mr. Meghji co-founded Loughlin Meghji + Company, a privately-held financial advisory firm and leading U.S. restructuring boutique, and he served as a Principal and Managing Director there from February 2002 to October 2011. During his tenure with Loughlin Meghji + Company, Mr. Meghji periodically served as Chief Restructuring Officer (or analogous position) of companies which elected to utilize bankruptcy proceedings as a part of their financial restructuring process and, as such, he served as an executive officer of various companies which filed bankruptcy petitions under federal law, including, without limitation, Pappas Telecasting in 2008, Capmark Finance, Inc. in 2009, and Medical Staffing Network in 2010. Mr. Meghji has served as an independent director of Toys “R” Us, Inc. since September 2017 and of Philadelphia Energy Solutions since August 2017. Previously, he was appointed as an independent director of MS Resorts in connection with the filing of its bankruptcy petition and served in such capacity from January 2011 through February 2013.

Earlier in his career, Mr. Meghji was with Arthur Andersen & Co. from 1987 to 2002 in the firm’s London, Toronto and New York offices, including as a Partner in the Global Corporate Finance group from 2001 to 2002. He has served as a director on a number of corporate boards including Mariner Health Care Inc. from 2002 to 2004, Cascade Timberlands, LLC from 2004 to 2005 and MS Resorts from January 2011 to February 2013. Mr. Meghji is a graduate of the Schulich School of Business, York University, Canada and has taken executive courses at the INSEAD School of Business in France. He has previously qualified as a U.K. and Canadian Chartered Accountant as well as a U.S. Certified Turnaround Professional.

Mr. Meghji has no family relationship with any director or executive officer of any Debtor and has not been involved in any related person transaction that would require disclosure pursuant to Item 404(a) of Regulation S-K.

|

Item 7.01

|

Regulation FD Disclosure.

|

On December 4, 2017,

the Debtors

filed their unaudited initial monthly operating report (the “Initial Operating Report”) with the Bankruptcy Court in the

Chapter 11 Proceedings. A c

opy of this report is contained in the attached Exhibit 99.1 and is incorporated herein by reference. This Current Report on Form 8-K (including the exhibits hereto) shall not be deemed an admission as to the materiality of any information required to be disclosed herein.

In accordance with General Instruction B.2 of Form 8-K, the information contained in this Item 7.01 and in Exhibit 99.1 furnished as an exhibit hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section, and shall not be deemed incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing or document.

Cautionary Note Regarding the Initial Operating Report

The Initial Operating Report has been prepared by the Debtors solely for the purpose of complying with the monthly reporting requirements in the Chapter 11 Proceedings and is in a format acceptable to the United States Trustee. Any financial information contained therein is limited in scope and covers a limited time period. Such information is preliminary and unaudited, and is not prepared in accordance with U.S. generally accepted accounting principles (GAAP).

Cautionary Note Regarding the Company’s Common Stock

The Company cautions that trading in its securities during the pendency of the Chapter 11 Proceedings is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery, if any, by holders of such securities in the Chapter 11 Proceedings.

Additional Information on the Chapter 11 Proceedings

Court filings and other information related to the court-supervised proceedings are available at a website administered by the Company’s claims agent, Prime Clerk, at

https://cases.primeclerk.com/realindustry

. Additional information on Real Industry can be found at its website

www.realindustryinc.com

.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements, which are based on our current expectations, estimates, and projections about the businesses and prospects of the Company, Real Alloy and their subsidiaries (“we” or “us”), as well as management’s beliefs, and certain assumptions made by management. Words such as “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “should,” “will” and variations of these words are intended to identify forward-looking statements. Such statements speak only as of the date hereof and are subject to change. The Company undertakes no obligation to revise or update publicly any forward-looking statements for any reason. These statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict. Forward-looking statements discuss, among other matters: our financial and operational results, as well as our expectations for future financial trends and performance of our business in future periods; our strategy; risks and uncertainties associated with Chapter 11 proceedings; the negative impacts on our businesses as a result of filing for and operating under Chapter 11 protection; the time, terms and ability to confirm a Chapter 11 plan of reorganization for our businesses; the adequacy of the capital resources of our businesses and the difficulty in forecasting the liquidity requirements of the operations of our businesses; the unpredictability of our financial results while in Chapter 11 proceedings; our ability to discharge claims in Chapter 11 proceedings; negotiations with the holders of Real Alloy’s Senior Secured Notes, its asset-based facility lender, and its trade creditors; risks and uncertainties with performing under the terms of the debtor-in-possession (“DIP”) financing and any other arrangement with lenders or creditors while in Chapter 11 proceedings; our ability to operate our businesses within the terms of any DIP financing; our forecasted uses of funds in our DIP budget; the impact of Real Alloy’s Chief Restructuring Officer on its restructuring efforts and negotiations with creditors and other stakeholders in the Chapter 11 proceedings; our ability to retain employees, suppliers and customers as a result of Chapter 11 proceedings;

Real Alloy’s ability to conduct business as usual in the United States and worldwide; Real Alloy’s ability to continue to serve customers, suppliers and other business partners at the high level of service and performance they have come to expect from Real Alloy; Real Alloy’s ability to continue to pay suppliers; Real Alloy’s ability to fund ongoing business operations through the DIP financing; the use of the funds anticipated to be received in the DIP financing; the ability to control costs during Chapter 11 proceedings; the risk that our Chapter 11 proceedings may be converted to cases under Chapter 7 of the Bankruptcy Code; the ability of the Company to preserve and utilize the NOLs following Chapter 11 proceedings; the Company’s ability to secure operating capital; the Company’s ability to take advantage of opportunities to acquire assets with upside potential; the Company’s ability to execute on its strategic plan to evaluate and close potential M&A opportunities; our long-term outlook; our preparation for future market conditions; and any statements or assumptions underlying any of the foregoing. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties, and assumptions that are difficult to predict. Accordingly, actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors.

Important factors that may cause such differences include, but are not limited to, the decisions of the bankruptcy court; negotiations with Real Alloy’s debtholders and our creditors; our ability to meet the requirements, and compliance with the terms, including restrictive covenants, of the DIP financing and any other financial arrangement while in Chapter 11 proceedings; changes in our operational or cash needs from the assumptions underlying our DIP budgets and forecasts; changes in our cash needs as compared to our historical operations or our planned reductions in operating expense; adverse litigation; changes in domestic and international demand for recycled aluminum; the cyclical nature and general health of the aluminum industry and related industries; commodity and scrap price fluctuations and our ability to enter into effective commodity derivatives or arrangements to effectively manage our exposure to such commodity price fluctuations; inventory risks, commodity price risks, and energy risks associated with Real Alloy’s buy/sell business model; the impact of tariffs and trade regulations on our operations; the impact of any changes in U.S. or non-U.S. tax laws on our operations or the value of our NOLs; our ability to successfully identify, acquire and integrate additional companies and businesses that perform and meet

expectations after completion of such acquisitions; our ability to achieve future profitability; our ability to control operating costs and other expenses; that general economic conditions may be worse than expected; that competition may increase significantly; changes in laws or government regulations or policies affecting our current business operations and/or our legacy businesses, as well as those risks and uncertainties disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Real Industry, Inc.’s Forms 10-Q filed with the Securities and Exchange Commission (“SEC”) on May 10, 2017, August 8, 2017 and November 9, 2017 and Form 10-K filed with the SEC on March 13, 2017, and similar disclosures in subsequent reports filed with the SEC.

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) EXHIBITS. The following exhibits are filed herewith:

Exhibit 99.1

Initial Monthly Operating Report to the Bankruptcy Court, dated December 4, 2017.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

REAL INDUSTRY, INC.

|

|

|

|

|

|

|

Date: December 6, 2017

|

|

By:

|

/s/ Kelly G. Howard

|

|

|

|

Name:

|

Kelly G. Howard

|

|

|

|

Title:

|

Executive Vice President and General Counsel

|

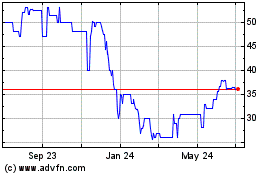

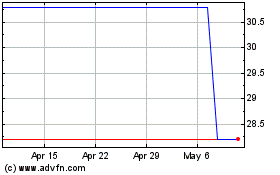

Elah (PK) (USOTC:ELLH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Elah (PK) (USOTC:ELLH)

Historical Stock Chart

From Apr 2023 to Apr 2024