Conference Call to Discuss Selected

Financial Information and Outlook to be Held Today at 4:30 p.m.

ET

Verint® Systems Inc. (NASDAQ: VRNT), a

global leader in Actionable Intelligence® solutions and value-added

services, today announced results for the three and nine months

ended October 31, 2017.

Financial Highlights

Below is selected unaudited financial information for the three

and nine months ended October 31, 2017 prepared in accordance with

generally accepted accounting principles (“GAAP”) and not in

accordance with GAAP (“non-GAAP”).

Three Months Ended October 31, 2017 - GAAP

Three Months Ended October 31, 2017

- Non-GAAP Revenue: $280.7 million(1) Revenue:

$283.8 million(1) Operating income: $17.8 million Operating income:

$55.8 million Diluted net income per share: $0.04 Diluted net

income per share: $0.66

Nine Months Ended October 31,

2017 - GAAP Nine Months Ended October 31, 2017 -

Non-GAAP Revenue: $816.5 million(1) Revenue: $827.7 million(1)

Operating income: $12.4 million Operating income: $144.1 million

Net loss per share: $(0.38) Diluted net income per share: $1.75

(1) Please refer to Table 6 for constant currency revenue

information, and "Supplemental Information about Non-GAAP Financial

Measures" at the end of this press release for more

information.

CEO Commentary

“We are pleased with our strong third quarter and year-to-date

results. For Q3, we had sequential and year-over-year revenue

growth in both of our segments and earnings increased faster than

revenue driven by top line growth and expanding margins,” said Dan

Bodner, Verint CEO and President.

Bodner continued, “In Customer Engagement, we are a market

leader, offering one of the broadest portfolios of hybrid cloud

solutions to simplify and modernize customer engagement. We expect

our ongoing innovation, including the recent introduction of new

automation and artificial intelligence capabilities, will

contribute to sustained long-term growth.”

“In Cyber Intelligence, we are a market leader in security and

intelligence data mining software and we are pleased with our

double digit year-over-year revenue growth for the third

consecutive quarter this year. Our results reflect the demand for

solutions that can address terrorism, crime, cyber-attacks, and

other threats that remain pervasive around the world. We believe

our broad portfolio, domain expertise and on-going innovation will

contribute to sustained long-term growth,” Bodner concluded.

Financial Outlook

Verint's non-GAAP outlook for the year ending January 31, 2018

is as follows:

- Segment Revenue Outlook:

- In our Customer Engagement segment, we

expect around 5% revenue growth.

- In our Cyber Intelligence segment, we

expect around 10% revenue growth.

- Total Revenue and EPS outlook: Based on

the above, we expect total revenue of $1.14 billion with a narrower

range of +/- 1% and diluted earnings per share of $2.75 at the

midpoint.

Verint's preliminary non-GAAP outlook for the year ending

January 31, 2019 is as follows:

- Segment Revenue Outlook:

- In our Customer Engagement segment, we

expect around 5% revenue growth.

- In our Cyber Intelligence segment, we

expect around 10% revenue growth.

- Total Revenue and EPS outlook: Based on

the above, we expect total revenue of $1.215 billion with a range

of +/- 2% and diluted earnings per share of $3.00 at the

midpoint.

Our non-GAAP outlook for the year ending January 31, 2018

excludes the following GAAP measures which we are able to quantify

with reasonable certainty:

- Amortization of intangible assets of

approximately $71 million.

- Amortization of discount on convertible

notes of approximately $11 million.

Our non-GAAP outlook for the year ending January 31, 2018

excludes the following GAAP measures for which we are able to

provide a range of probable significance:

- Revenue adjustments related to

completed acquisitions are expected to be between approximately $12

million and $14 million for the year ending January 31, 2018.

- Stock-based compensation is expected to

be between approximately $65 million and $70 million for the year

ending January 31, 2018, assuming market prices for our common

stock approximately consistent with current levels.

Our preliminary non-GAAP outlook for the year ending January 31,

2019 excludes the following GAAP measures which we are able to

quantify with reasonable certainty:

- Amortization of intangible assets of

approximately $47 million.

- Amortization of discount on convertible

notes of approximately $12 million.

Our preliminary non-GAAP outlook for the year ending January 31,

2019 excludes the following GAAP measures for which we are able to

provide a range of probable significance:

- Revenue adjustments related to

completed acquisitions are expected to be between approximately $4

million and $6 million for the year ending January 31, 2019.

- Stock-based compensation is expected to

be between approximately $60 million and $70 million for the year

ending January 31, 2019, assuming market prices for our common

stock approximately consistent with current levels.

Our non-GAAP outlook does not include the potential impact of

any in-process business acquisitions that may close after the date

hereof, and, unless otherwise specified, reflects foreign currency

exchange rates approximately consistent with current rates.

We are unable, without unreasonable efforts, to provide a

reconciliation for other GAAP measures which are excluded from our

non-GAAP outlook, including the impact of future business

acquisitions or acquisition expenses, future restructuring

expenses, and non-GAAP income tax adjustments due to the level of

unpredictability and uncertainty associated with these items. For

these same reasons, we are unable to assess the probable

significance of these excluded items. While historical results may

not be indicative of future results, actual amounts for the three

and nine months ended October 31, 2017 and 2016 for the GAAP

measures excluded from our non-GAAP outlook appear in Table 3 to

this press release.

Conference Call

Information

We will conduct a conference call today at 4:30 p.m. ET to

discuss our results for the three and nine months ended October 31,

2017 and outlook. An online, real-time webcast of the conference

call will be available on our website at www.verint.com. The conference call can also be

accessed live via telephone at 1-844-309-0615 (United States and

Canada) and 1-661-378-9462 (international) and the passcode is

3286436. Please dial in 5-10 minutes prior to the scheduled start

time.

About Non-GAAP Financial Measures

This press release and the accompanying tables include non-GAAP

financial measures. For a description of these non-GAAP financial

measures, including the reasons management uses each measure, and

reconciliations of non-GAAP financial measures presented for

completed periods to the most directly comparable financial

measures prepared in accordance with GAAP, please see Tables 2, 3,

6 and 7 as well as "Supplemental Information About Non-GAAP

Financial Measures" at the end of this press release.

About Verint Systems Inc.

Verint® (Nasdaq: VRNT) is a global leader in Actionable

Intelligence® solutions with a focus on customer engagement

optimization, security intelligence, and fraud, risk and

compliance. Today, over 10,000 organizations in more than 180

countries—including over 80 percent of the Fortune 100—count on

intelligence from Verint solutions to make more informed, effective

and timely decisions. Learn more about how we’re creating A Smarter

World with Actionable Intelligence® at www.verint.com.

Cautions About Forward-Looking Statements

This press release contains forward-looking statements,

including statements regarding expectations, predictions, views,

opportunities, plans, strategies, beliefs, and statements of

similar effect relating to Verint Systems Inc. These

forward-looking statements are not guarantees of future performance

and they are based on management's expectations that involve a

number of known and unknown risks, uncertainties, assumptions, and

other important factors, any of which could cause our actual

results or conditions to differ materially from those expressed in

or implied by the forward-looking statements. Some of the factors

that could cause our actual results or conditions to differ

materially from current expectations include, among others:

uncertainties regarding the impact of general economic conditions

in the United States and abroad, particularly in information

technology spending and government budgets, on our business; risks

associated with our ability to keep pace with technological

changes, evolving industry standards, and customer challenges, such

as the proliferation and strengthening of encryption, and the

transition of portions of the software market to the cloud, to

adapt to changing market potential from area to area within our

markets, and to successfully develop, launch, and drive demand for

new, innovative, high-quality products that meet or exceed customer

needs, while simultaneously preserving our legacy businesses and

migrating away from areas of commoditization; risks due to

aggressive competition in all of our markets, including with

respect to maintaining margins and sufficient levels of investment

in our business; risks created by the continued consolidation of

our competitors or the introduction of large competitors in our

markets with greater resources than we have; risks associated with

our ability to successfully compete for, consummate, and implement

mergers and acquisitions, including risks associated with

valuations, capital constraints, costs and expenses, maintaining

profitability levels, expansion into new areas, management

distraction, post-acquisition integration activities, and potential

asset impairments; risks relating to our ability to effectively and

efficiently enhance our existing operations and execute on our

growth strategy and profitability goals, including managing

investments in our business and operations, managing our cloud

transition and our revenue mix, and enhancing and securing our

internal and external operations; risks associated with our ability

to effectively and efficiently allocate limited financial and human

resources to business, developmental, strategic, or other

opportunities, and risk that such investments may not come to

fruition or produce satisfactory returns; risks that we may be

unable to establish and maintain relationships with key resellers,

partners, and systems integrators; risks associated with our

reliance on third-party suppliers, partners, or original equipment

manufacturers (“OEMs”) for certain components, products, or

services, including companies that may compete with us or work with

our competitors; risks associated with the mishandling or perceived

mishandling of sensitive or confidential information and with

security vulnerabilities or lapses, including information

technology system breaches, failures, or disruptions; risks that

our products or services, or those of third-party suppliers,

partners, or OEMs which we use in or with our offerings or

otherwise rely on, may contain defects or may be vulnerable to

cyber-attacks; risks associated with our significant international

operations, including, among others, in Israel, Europe, and Asia,

exposure to regions subject to political or economic instability,

fluctuations in foreign exchange rates, and challenges associated

with a significant portion of our cash being held overseas; risks

associated with a significant amount of our business coming from

domestic and foreign government customers, including the ability to

maintain security clearances for applicable projects and

reputational risks associated with our security solutions; risks

associated with complex and changing local and foreign regulatory

environments in the jurisdictions in which we operate, including,

among others, with respect to privacy, information security, trade

compliance, anti-corruption, and regulations related to our

security solutions; risks associated with our ability to retain and

recruit qualified personnel in regions in which we operate,

including in new markets and growth areas we may enter; challenges

associated with selling sophisticated solutions, including with

respect to educating our customers on the benefits of our solutions

or assisting them in realizing such benefits; challenges associated

with pursuing larger sales opportunities, including with respect to

longer sales cycles, transaction reductions, deferrals, or

cancellations during the sales cycle, risk of customer

concentration, our ability to accurately forecast when a sales

opportunity will convert to an order, or to forecast revenue and

expenses, and increased volatility of our operating results from

period to period; risks that our intellectual property rights may

not be adequate to protect our business or assets or that others

may make claims on our intellectual property or claim infringement

on their intellectual property rights; risks that our customers or

partners delay or cancel orders or are unable to honor contractual

commitments due to liquidity issues, challenges in their business,

or otherwise; risks that we may experience liquidity or working

capital issues and related risks that financing sources may be

unavailable to us on reasonable terms or at all; risks associated

with significant leverage resulting from our current debt position

or our ability to incur additional debt, including with respect to

liquidity considerations, covenant limitations and compliance,

fluctuations in interest rates, dilution considerations (with

respect to our convertible notes), and our ability to maintain our

credit ratings; risks arising as a result of contingent or other

obligations or liabilities assumed in our acquisition of our former

parent company, Comverse Technology, Inc. (“CTI”), or associated

with formerly being consolidated with, and part of a consolidated

tax group with, CTI, or as a result of CTI's former subsidiary,

Comverse, Inc. (now known as Mavenir, Inc.), being unwilling or

unable to provide us with certain indemnities to which we are

entitled; risks relating to the adequacy of our existing

infrastructure, systems, processes, policies, procedures, and

personnel and our ability to successfully implement and maintain

enhancements to the foregoing and adequate systems and internal

controls for our current and future operations and reporting needs,

including related risks of financial statement omissions,

misstatements, restatements, or filing delays; and risks associated

with changing accounting principles or standards, tax rates, tax

laws and regulations, and the continuing availability of expected

tax benefits. We assume no obligation to revise or update any

forward-looking statement, except as otherwise required by law. For

a detailed discussion of these risk factors, see our Annual Report

on Form 10-K for the fiscal year ended January 31, 2017, our

Quarterly Report on Form 10-Q for the quarter ended October 31,

2017, when filed, and other filings we make with the SEC.

VERINT, ACTIONABLE INTELLIGENCE, MAKE BIG DATA ACTIONABLE,

CUSTOMER-INSPIRED EXCELLENCE, INTELLIGENCE IN ACTION, IMPACT 360,

WITNESS, VERINT VERIFIED, KANA, LAGAN, VOVICI, GMT, VICTRIO,

AUDIOLOG, CONTACT SOLUTIONS, OPINIONLAB, ADTECH, VERBA, CUSTOMER

ENGAGEMENT SOLUTIONS, CYBER INTELLIGENCE SOLUTIONS, VOICE OF THE

CUSTOMER ANALYTICS, NEXTIVA, EDGEVR, RELIANT, VANTAGE, STAR-GATE,

ENGAGE, CYBERVISION, FOCALINFO, SUNTECH, and VIGIA are trademarks

or registered trademarks of Verint Systems Inc. or its

subsidiaries. Other trademarks mentioned are the property of their

respective owners.

Table 1

VERINT SYSTEMS INC. AND

SUBSIDIARIES

Condensed Consolidated Statements of

Operations

(Unaudited)

Three Months EndedOctober 31,

Nine Months EndedOctober 31, (in

thousands, except per share data)

2017

2016 2017 2016 Revenue:

Product $ 94,827 $ 88,004 $ 279,056 $ 254,172 Service and support

185,899 170,898 537,442 512,075

Total revenue 280,726 258,902

816,498 766,247 Cost of revenue:

Product 32,840 29,499 98,708 82,455 Service and support 69,383

64,007 205,928 195,892 Amortization of acquired technology 9,182

9,700 28,246 28,014

Total cost of

revenue 111,405 103,206

332,882 306,361 Gross profit

169,321 155,696 483,616

459,886 Operating expenses: Research and

development, net 47,157 41,028 141,911 128,847 Selling, general and

administrative 97,304 98,899 302,605 300,080 Amortization of other

acquired intangible assets 7,048 10,244 26,727

32,976

Total operating expenses 151,509

150,171 471,243 461,903

Operating income (loss) 17,812 5,525

12,373 (2,017 ) Other income

(expense), net: Interest income 654 229 1,793 695 Interest

expense (8,891 ) (8,708 ) (26,997 ) (25,976 ) Loss on early

retirement of debt — — (1,934 ) — Other (expense) income, net (565

) (1,121 ) 2,529 (2,660 )

Total other expense, net

(8,802 ) (9,600 ) (24,609

) (27,941 ) Income (loss) before provision

for income taxes 9,010 (4,075 )

(12,236 ) (29,958 ) Provision for

income taxes 5,944 3,359 9,504 4,747

Net income (loss) 3,066 (7,434 )

(21,740 ) (34,705 ) Net income

attributable to noncontrolling interests 577 803

1,984 2,693

Net income (loss) attributable to

Verint Systems Inc. $ 2,489 $

(8,237 ) $ (23,724 ) $

(37,398 )

Net income (loss) per common share

attributable to Verint Systems

Inc.:

Basic $ 0.04 $ (0.13

) $ (0.38 ) $ (0.60

) Diluted $ 0.04 $

(0.13 ) $ (0.38 ) $

(0.60 ) Weighted-average common shares

outstanding: Basic 63,759 62,895

63,152 62,602 Diluted

64,588 62,895 63,152

62,602

Table 2

VERINT SYSTEMS INC. AND

SUBSIDIARIES

Segment Revenue

(Unaudited)

Three Months

Ended

October

31,

Nine Months

Ended

October

31,

(in thousands)

2017 2016

2017 2016 GAAP Revenue By

Segment: Customer Engagement $ 181,590 $ 172,757 $ 531,643 $

519,010 Cyber Intelligence 99,136 86,145 284,855

247,237

GAAP Total Revenue $ 280,726

$ 258,902 $ 816,498

$ 766,247 Revenue Adjustments

Related to Acquisitions: Customer Engagement $ 2,916 $ 1,103 $

11,065 $ 6,610 Cyber Intelligence 118 24 169

300

Total Revenue Adjustments Related to Acquisitions

$ 3,034 $ 1,127 $

11,234 $ 6,910 Non-GAAP

Revenue By Segment: Customer Engagement $ 184,506 $ 173,860 $

542,708 $ 525,620 Cyber Intelligence 99,254 86,169

285,024 247,537

Non-GAAP Total Revenue $

283,760 $ 260,029 $

827,732 $ 773,157

Table 3

VERINT SYSTEMS INC. AND

SUBSIDIARIES

Reconciliation of GAAP to Non-GAAP

Results

(Unaudited)

Three Months Ended

October 31,

Nine Months Ended

October 31,

(in thousands, except per share data)

2017

2016 2017 2016

Table of

Reconciliation from GAAP Gross Profit to Non-GAAP Gross

Profit

GAAP gross profit $ 169,321

$ 155,696 $ 483,616

$ 459,886 GAAP gross margin 60.3

% 60.1 % 59.2 % 60.0

% Revenue adjustments related to acquisitions 3,034 1,127

11,234 6,910 Amortization of acquired technology 9,182 9,700 28,246

28,014 Stock-based compensation expenses 2,197 1,807 5,868 5,573

Acquisition expenses, net 23 — 91 2 Restructuring expenses 919

787 1,937 1,829

Non-GAAP gross

profit $ 184,676 $ 169,117

$ 530,992 $ 502,214

Non-GAAP gross margin 65.1 %

65.0 % 64.2 % 65.0 %

Table of

Reconciliation from GAAP Operating Income (Loss) to Non-GAAP

Operating Income

GAAP operating income (loss) $ 17,812

$ 5,525 $ 12,373

$ (2,017 ) As a percentage of GAAP

revenue 6.3 % 2.1 % 1.5

% (0.3 )% Revenue adjustments related to

acquisitions 3,034 1,127 11,234 6,910 Amortization of acquired

technology 9,182 9,700 28,246 28,014 Amortization of other acquired

intangible assets 7,048 10,244 26,727 32,976 Stock-based

compensation expenses 15,966 13,954 50,453 45,682 Acquisition

expenses, net (4,063 ) 3,480 2,455 8,063 Restructuring expenses

6,309 4,955 11,557 12,220 Other adjustments 490 58

1,091 401

Non-GAAP operating income $

55,778 $ 49,043 $

144,136 $ 132,249 As a

percentage of non-GAAP revenue 19.7 % 18.9

% 17.4 % 17.1 %

Table of

Reconciliation from GAAP Other Expense, Net to Non-GAAP Other

Expense, Net

GAAP other expense, net $ (8,802

) $ (9,600 ) $ (24,609

) $ (27,941 ) Unrealized (gains) losses

on derivatives, net (890 ) 87 (1,877 ) 479 Amortization of

convertible note discount 2,829 2,684 8,377 7,948 Loss on early

retirement of debt — — 1,934 — Acquisition expenses, net (10 ) (30

) 710 56 Restructuring expenses 1 (144 ) 139 219 Impairment charges

— — — 2,400

Non-GAAP other expense,

net(1) $ (6,872 ) $

(7,003 ) $ (15,326 ) $

(16,839 )

Table of

Reconciliation from GAAP Provision for Income Taxes to Non-GAAP

Provision for Income Taxes

GAAP provision for income taxes $ 5,944

$ 3,359 $ 9,504

$ 4,747 GAAP effective income tax rate

66.0 % (82.4 )% (77.7 )%

(15.8 )% Non-GAAP tax adjustments (91 ) 665

5,082 5,895

Non-GAAP provision for income

taxes $ 5,853 $ 4,024

$ 14,586 $ 10,642

Non-GAAP effective income tax rate 12.0 %

9.6 % 11.3 % 9.2 %

Table of

Reconciliation from GAAP Net Income (Loss) Attributable to Verint

Systems Inc. to Non-GAAP Net Income Attributable to Verint

Systems Inc.

GAAP net income (loss) attributable to Verint Systems

Inc. $ 2,489 $ (8,237

) $ (23,724 ) $ (37,398

) Revenue adjustments related to acquisitions 3,034 1,127

11,234 6,910 Amortization of acquired technology 9,182 9,700 28,246

28,014 Amortization of other acquired intangible assets 7,048

10,244 26,727 32,976 Stock-based compensation expenses 15,966

13,954 50,453 45,682 Unrealized (gains) losses on derivatives, net

(890 ) 87 (1,877 ) 479 Amortization of convertible note discount

2,829 2,684 8,377 7,948 Loss on early retirement of debt — — 1,934

— Acquisition expenses, net (4,073 ) 3,450 3,165 8,119

Restructuring expenses 6,310 4,811 11,696 12,439 Impairment charges

— — — 2,400 Other adjustments 490 58 1,091 401 Non-GAAP tax

adjustments 91 (665 ) (5,082 ) (5,895 ) Total GAAP net

income (loss) adjustments 39,987 45,450 135,964

139,473

Non-GAAP net income attributable to Verint

Systems Inc. $ 42,476 $

37,213 $ 112,240 $

102,075

Table Comparing

GAAP Diluted Net Income (Loss) Per Common Share Attributable to

Verint Systems Inc. to Non-GAAP Diluted Net Income Per Common

Share Attributable to Verint Systems Inc.

GAAP diluted net income (loss) per common

share attributable toVerint Systems Inc.

$ 0.04 $ (0.13 ) $ (0.38 ) $ (0.60 )

Non-GAAP diluted net income per common

share attributable toVerint Systems Inc.

$ 0.66 $ 0.59 $ 1.75 $ 1.62

GAAP weighted-average shares used in

computing diluted net income (loss) per common share

attributable to Verint Systems Inc.

64,588 62,895 63,152 62,602

Additional weighted-average shares

applicable to non-GAAPdiluted net income per common share

attributable to VerintSystems Inc.

— 355 912 385

Non-GAAP diluted weighted-average

shares used in computing net income per common share

attributable to Verint Systems Inc.

64,588 63,250 64,064

62,987

Table of

Reconciliation from GAAP Net Income (Loss) Attributable to Verint

Systems Inc. to Adjusted EBITDA

GAAP net income (loss) attributable to Verint Systems

Inc. $ 2,489 $ (8,237

) $ (23,724 ) $

(37,398 ) As a percentage of GAAP revenue

0.9 % (3.2 )% (2.9 )%

(4.9 )% Net income attributable to noncontrolling

interest 577 803 1,984 2,693 Provision for income taxes 5,944 3,359

9,504 4,747 Other expense, net 8,802 9,600 24,609 27,941

Depreciation and amortization(2) 23,798 27,566 77,652 83,007

Revenue adjustments related to acquisitions 3,034 1,127 11,234

6,910 Stock-based compensation expenses 15,966 13,954 50,453 45,682

Acquisition expenses, net (4,063 ) 3,480 2,455 8,063 Restructuring

expenses 6,309 4,289 11,553 11,550 Other adjustments 490 58

1,091 401

Adjusted EBITDA $

63,346 $ 55,999 $

166,811 $ 153,596 As a

percentage of non-GAAP revenue 22.3 % 21.5

% 20.2 % 19.9 %

Table of

Reconciliation from Gross Debt to Net Debt

October 31,

2017

January 31,

2017

Current maturities of long-term debt $ 4,552 $ 4,611

Long-term debt 766,006 744,260 Unamortized debt discounts and

issuance costs 53,681 60,571

Gross debt

824,239 809,442 Less: Cash and cash

equivalents 312,666 307,363 Restricted cash and bank time deposits

63,326 9,198 Short-term investments 6,411 3,184

Net debt, excluding long-term restricted cash 441,836

489,697 Long-term restricted cash 31,637

54,566

Net debt, including long-term restricted

cash $ 410,199 $ 435,131

(1) For the three months ended October 31, 2017, non-GAAP other

expense, net of $6.9 million was comprised of $5.4 million of

interest and other expense, and $1.5 million of foreign exchange

charges primarily related to balance sheet translations.

(2) Adjusted for financing fee amortization.

Table 4

VERINT SYSTEMS INC. AND

SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(Unaudited)

October 31, January

31, (in thousands, except share and per share data)

2017

2017 Assets Current Assets: Cash and cash

equivalents $ 312,666 $ 307,363 Restricted cash and bank time

deposits 63,326 9,198 Short-term investments 6,411 3,184

Accounts receivable, net of allowance for

doubtful accounts of $2.2 million and $1.8

million, respectively

284,050 266,590 Inventories 19,522 17,537 Deferred cost of revenue

4,271 3,621 Prepaid expenses and other current assets 81,436

64,561

Total current assets 771,682

672,054 Property and equipment, net 85,248 77,551

Goodwill 1,304,971 1,264,818 Intangible assets, net 199,545 235,259

Capitalized software development costs, net 7,881 9,509 Long-term

deferred cost of revenue 3,402 5,463 Other assets 70,224

98,130

Total assets $ 2,442,953

$ 2,362,784 Liabilities and

Stockholders' Equity Current Liabilities: Accounts

payable $ 73,820 $ 62,049 Accrued expenses and other current

liabilities 220,772 217,835 Deferred revenue 166,945 182,515

Total current liabilities 461,537

462,399 Long-term debt 766,006 744,260 Long-term

deferred revenue 24,095 20,912 Other liabilities 117,948

120,173

Total liabilities 1,369,586

1,347,744 Commitments and Contingencies

Stockholders' Equity:

Preferred stock - $0.001 par value;

authorized 2,207,000 shares at October 31, 2017 and January

31, 2017, respectively; none issued.

— —

Common stock - $0.001 par value;

authorized 120,000,000 shares. Issued 65,442,000

and 64,073,000 shares; outstanding 63,781,000 and

62,419,000 shares at October 31, 2017 and

January 31, 2017, respectively.

65 64 Additional paid-in capital 1,505,492 1,449,335

Treasury stock, at cost - 1,661,000 and

1,654,000 shares at October 31, 2017 and January 31,

2017, respectively.

(57,425 ) (57,147 ) Accumulated deficit (255,409 ) (230,816 )

Accumulated other comprehensive loss (132,363 ) (154,856 )

Total

Verint Systems Inc. stockholders' equity 1,060,360

1,006,580 Noncontrolling interests 13,007 8,460

Total stockholders' equity 1,073,367

1,015,040 Total liabilities and stockholders'

equity $ 2,442,953 $

2,362,784

Table 5

VERINT SYSTEMS INC. AND

SUBSIDIARIES

Condensed Consolidated Statements of

Cash Flows

(Unaudited)

Nine Months EndedOctober

31,

(in thousands)

2017 2016 Cash flows

from operating activities: Net loss $ (21,740 ) $ (34,705 )

Adjustments to reconcile net loss to net cash provided by

operating activities: Depreciation and amortization 79,879

85,411 Stock-based compensation, excluding cash-settled awards

50,397 45,547 Amortization of discount on convertible notes 8,377

7,948 Non-cash (gains) losses on derivative financial instruments,

net (292 ) 693 Loss on early retirement of debt 1,934 — Other

non-cash items, net 307 8,767

Changes in operating assets and

liabilities, net of effects of business combinations: Accounts

receivable (15,824 ) 3,708 Inventories (2,232 ) (2,823 ) Deferred

cost of revenue 1,503 1,349 Prepaid expenses and other assets

(12,947 ) (6,066 ) Accounts payable and accrued expenses 13,145

(21,305 ) Deferred revenue (14,129 ) (21,749 ) Other, net 7,796

4,914

Net cash provided by operating

activities 96,174 71,689

Cash flows from investing activities: Cash paid for business

combinations, including adjustments, net of cash acquired (28,071 )

(72,269 ) Purchases of property and equipment (26,445 ) (20,611 )

Purchases of investments (8,305 ) (34,215 ) Maturities and sales of

investments 5,244 79,930 Cash paid for capitalized software

development costs (909 ) (1,730 )

Change in restricted cash and bank time

deposits, including long-term portion, and other

investingactivities, net

(30,207 ) (31,737 )

Net cash used in investing activities

(88,693 ) (80,632 ) Cash

flows from financing activities: Proceeds from borrowings, net

of original issuance discount 424,469 — Repayments of borrowings

and other financing obligations (410,536 ) (1,987 ) Payments of

debt-related costs (7,107 ) (249 ) Proceeds from exercises of stock

options — 1 Purchases of treasury stock — (35,896 ) Dividends paid

to noncontrolling interest (716 ) — Payments of contingent

consideration for business combinations (financing portion) (7,210

) (3,231 ) Other financing activities, net (320 ) (827 )

Net

cash used in financing activities (1,420 )

(42,189 ) Effect of foreign currency exchange rate

changes on cash and cash equivalents (758 ) (5,144 )

Net

increase (decrease) in cash and cash equivalents 5,303

(56,276 ) Cash and cash equivalents, beginning of

period 307,363 352,105 Cash and

cash equivalents, end of period $ 312,666

$ 295,829

Table 6

VERINT SYSTEMS INC. AND

SUBSIDIARIES

Calculation of Change in Revenue on a

Constant Currency Basis

(Unaudited)

GAAP Revenue

Non-GAAP Revenue

(in thousands, except percentages)

Three Months

Ended

Nine Months

Ended

Three Months

Ended

Nine Months

Ended

Total Revenue Revenue for the three and nine months

ended October 31, 2016 $ 258,902 $ 766,247 $ 260,029 $ 773,157

Revenue for the three and nine months ended October 31, 2017 $

280,726 $ 816,498 $ 283,760 $ 827,732

Revenue for the three and nine months

ended October 31, 2017 atconstant currency(1)

$ 278,000 $ 818,000 $ 281,000 $ 829,000 Reported period-over-period

revenue growth 8.4 % 6.6 % 9.1 % 7.1 % % impact from change in

foreign currency exchange rates (1.0 )% 0.2 % (1.0 )% 0.1 %

Constant currency period-over-period revenue growth 7.4 % 6.8 % 8.1

% 7.2 %

Customer Engagement Revenue for the three and

nine months ended October 31, 2016 $ 172,757 $ 519,010 $ 173,860 $

525,620 Revenue for the three and nine months ended October 31,

2017 $ 181,590 $ 531,643 $ 184,506 $ 542,708

Revenue for the three and nine months

ended October 31, 2017 atconstant currency(1)

$ 180,000 $ 534,000 $ 183,000 $ 545,000 Reported period-over-period

revenue growth 5.1 % 2.4 % 6.1 % 3.3 % % impact from change in

foreign currency exchange rates (0.9 )% 0.5 % (0.8 )% 0.4 %

Constant currency period-over-period revenue growth 4.2 % 2.9 % 5.3

% 3.7 %

Cyber Intelligence Revenue for the three and

nine months ended October 31, 2016 $ 86,145 $ 247,237 $ 86,169 $

247,537 Revenue for the three and nine months ended October 31,

2017 $ 99,136 $ 284,855 $ 99,254 $ 285,024

Revenue for the three and nine months

ended October 31, 2017 atconstant currency(1)

$ 98,000 $ 284,000 $ 98,000 $ 284,000 Reported period-over-period

revenue growth 15.1 % 15.2 % 15.2 % 15.1 % % impact from change in

foreign currency exchange rates (1.3 )% (0.3 )% (1.5 )% (0.4 )%

Constant currency period-over-period revenue growth 13.8 % 14.9 %

13.7 % 14.7 %

(1) Revenue for the three and nine months ended October 31, 2017

at constant currency is calculated by translating current-period

foreign currency revenue into U.S. dollars using average foreign

currency exchange rates for the three and nine months ended October

31, 2016 rather than actual current-period foreign currency

exchange rates.

For further information see "Supplemental Information About

Constant Currency" at the end of this press release.

Table 7

VERINT SYSTEMS INC. AND

SUBSIDIARIES

Estimated Non-GAAP Fully Allocated

Operating Margins

(Unaudited)

Three Months Ended

October 31,

2017 2016 (in thousands)

Customer Engagement

Cyber Intelligence

Consolidated

Customer Engagement

Cyber Intelligence

Consolidated Non-GAAP segment revenue $

184,506 $ 99,254 $ 283,760 $ 173,860 $

86,169 $ 260,029 Segment contribution (1)

70,768 23,160 93,928 65,085 20,575 85,660

Estimated allocation of shared

supportexpenses (2)

25,484 12,666 38,150 24,460 12,157

36,617

Estimated non-GAAP operatingincome

$ 45,284 $ 10,494 $ 55,778 $ 40,625 $

8,418 $ 49,043

Estimated non-GAAP fully

allocatedoperating margin

24.5 % 10.6 % 19.7 % 23.4 % 9.8 % 18.9 %

Nine Months Ended

October 31,

2017 2016 (in thousands)

Customer Engagement

Cyber Intelligence

Consolidated

Customer Engagement

Cyber Intelligence

Consolidated Non-GAAP segment revenue $ 542,708

$ 285,024 $ 827,732 $ 525,620 $ 247,537

$ 773,157 Segment contribution (1) 195,756

62,402 258,158 188,800 55,506 244,306

Estimated allocation of shared

supportexpenses (2)

76,167 37,855 114,022 74,854 37,203

112,057

Estimated non-GAAP operatingincome

$ 119,589 $ 24,547 $ 144,136 $ 113,946

$ 18,303 $ 132,249

Estimated non-GAAP fully

allocatedoperating margin

22.0 % 8.6 % 17.4 % 21.7 % 7.4 % 17.1 %

(1) See footnote 14 to our Form 10-Q for the three and nine

months ended October 31, 2017, when filed.

(2) Represents our shared support expenses (as disclosed in

footnote 14 to our Form 10-Q for the three and nine months ended

October 31, 2017, when filed), allocated proportionally to our year

ended January 31, 2017 annual non-GAAP segment revenue, which we

believe provides a reasonable approximation for purposes of

understanding the relative non-GAAP operating margins of our two

businesses.

Verint Systems Inc. and

SubsidiariesSupplemental Information About Non-GAAP

Financial Measures

This press release contains non-GAAP financial measures,

consisting of non-GAAP revenue, non-GAAP gross profit and gross

margin, non-GAAP operating income and operating margin, non-GAAP

other income (expense), net, non-GAAP provision (benefit) for

income taxes and non-GAAP effective income tax rate, non-GAAP net

income attributable to Verint Systems Inc., non-GAAP net income per

common share attributable to Verint Systems Inc., adjusted EBITDA,

net debt, constant currency measures and estimated non-GAAP fully

allocated operating margins. Tables 2 and 3 include a

reconciliation of each non-GAAP financial measure for completed

periods presented in this press release to the most directly

comparable GAAP financial measure.

We believe these non-GAAP financial measures, used in

conjunction with the corresponding GAAP measures, provide investors

with useful supplemental information about the financial

performance of our business by:

- facilitating the comparison of our

financial results and business trends between periods, including by

excluding certain items that either can vary significantly in

amount and frequency, are based upon subjective assumptions, or in

certain cases are unplanned for or difficult to forecast,

- facilitating the comparison of our

financial results and business trends with other technology

companies who publish similar non-GAAP measures, and

- allowing investors to see and

understand key supplementary metrics used by our management to run

our business, including for budgeting and forecasting, resource

allocation, and compensation matters.

We also make these non-GAAP financial measures available because

a number of our investors have informed us that they find this

supplemental information useful.

Non-GAAP financial measures should not be considered in

isolation as substitutes for, or superior to, comparable GAAP

financial measures. The non-GAAP financial measures we present have

limitations in that they do not reflect all of the amounts

associated with our results of operations as determined in

accordance with GAAP, and these non-GAAP financial measures should

only be used to evaluate our results of operations in conjunction

with the corresponding GAAP financial measures. These non-GAAP

financial measures do not represent discretionary cash available to

us to invest in the growth of our business, and we may in the

future incur expenses similar to or in addition to the adjustments

made in these non-GAAP financial measures. Other companies may

calculate similar non-GAAP financial measures differently than we

do, limiting their usefulness as comparative measures.

Our non-GAAP financial measures are calculated by making the

following adjustments to our GAAP financial measures:

Revenue adjustments related to acquisitions. We exclude from our

non-GAAP revenue the impact of fair value adjustments required

under GAAP relating to acquired customer support contracts, which

would have otherwise been recognized on a stand-alone basis. We

believe that it is useful for investors to understand the total

amount of revenue that we and the acquired company would have

recognized on a stand-alone basis under GAAP, absent the accounting

adjustment associated with the business acquisition. Our non-GAAP

revenue also reflects certain adjustments from aligning an acquired

company’s revenue recognition policies to our policies. We believe

that our non-GAAP revenue measure helps management and investors

understand our revenue trends and serves as a useful measure of

ongoing business performance.

Amortization of acquired technology and other acquired

intangible assets. When we acquire an entity, we are required under

GAAP to record the fair values of the intangible assets of the

acquired entity and amortize those assets over their useful lives.

We exclude the amortization of acquired intangible assets,

including acquired technology, from our non-GAAP financial measures

because they are inconsistent in amount and frequency and are

significantly impacted by the timing and size of acquisitions. We

also exclude these amounts to provide easier comparability of pre-

and post-acquisition operating results.

Stock-based compensation expenses. We exclude stock-based

compensation expenses related to restricted stock awards, stock

bonus programs, bonus share programs, and other stock-based awards

from our non-GAAP financial measures. We evaluate our performance

both with and without these measures because stock-based

compensation is typically a non-cash expense and can vary

significantly over time based on the timing, size and nature of

awards granted, and is influenced in part by certain factors which

are generally beyond our control, such as the volatility of the

price of our common stock. In addition, measurement of stock-based

compensation is subject to varying valuation methodologies and

subjective assumptions, and therefore we believe that excluding

stock-based compensation from our non-GAAP financial measures

allows for meaningful comparisons of our current operating results

to our historical operating results and to other companies in our

industry.

Unrealized gains and losses on certain derivatives, net. We

exclude from our non-GAAP financial measures unrealized gains and

losses on certain foreign currency derivatives which are not

designated as hedges under accounting guidance. We exclude

unrealized gains and losses on foreign currency derivatives that

serve as economic hedges against variability in the cash flows of

recognized assets or liabilities, or of forecasted transactions.

These contracts, if designated as hedges under accounting guidance,

would be considered “cash flow” hedges. These unrealized gains and

losses are excluded from our non-GAAP financial measures because

they are non-cash transactions which are highly variable from

period to period. Upon settlement of these foreign currency

derivatives, any realized gain or loss is included in our non-GAAP

financial measures.

Amortization of convertible note discount. Our non-GAAP

financial measures exclude the amortization of the imputed discount

on our convertible notes. Under GAAP, certain convertible debt

instruments that may be settled in cash upon conversion are

required to be bifurcated into separate liability (debt) and equity

(conversion option) components in a manner that reflects the

issuer’s assumed non-convertible debt borrowing rate. For GAAP

purposes, we are required to recognize imputed interest expense on

the difference between our assumed non-convertible debt borrowing

rate and the coupon rate on our $400.0 million of 1.50% convertible

notes. This difference is excluded from our non-GAAP financial

measures because we believe that this expense is based upon

subjective assumptions and does not reflect the cash cost of our

convertible debt.

Loss on early retirement of debt. We exclude from our non-GAAP

financial measures losses on early retirements of debt attributable

to refinancing or repaying our debt because we believe they are not

reflective of our ongoing operations.

Acquisition Expenses, net. In connection with acquisition

activity (including with respect to acquisitions that are not

consummated), we incur expenses, including legal, accounting, and

other professional fees, integration costs, changes in the fair

value of contingent consideration obligations, and other costs.

Integration costs may consist of information technology expenses as

systems are integrated across the combined entity, consulting

expenses, marketing expenses, and professional fees, as well as

non-cash charges to write-off or impair the value of redundant

assets. We exclude these expenses from our non-GAAP financial

measures because they are unpredictable, can vary based on the size

and complexity of each transaction, and are unrelated to our

continuing operations or to the continuing operations of the

acquired businesses.

Restructuring Expenses. We exclude restructuring expenses from

our non-GAAP financial measures, which include employee termination

costs, facility exit costs, certain professional fees, asset

impairment charges, and other costs directly associated with

resource realignments incurred in reaction to changing strategies

or business conditions. All of these costs can vary significantly

in amount and frequency based on the nature of the actions as well

as the changing needs of our business and we believe that excluding

them provides easier comparability of pre- and post-restructuring

operating results.

Impairment Charges and Other Adjustments. We exclude from our

non-GAAP financial measures asset impairment charges other than

those associated with restructuring or acquisition activity, rent

expense for redundant facilities, and gains or losses on sales of

property, all of which are unusual in nature and can vary

significantly in amount and frequency.

Non-GAAP income tax adjustments. We exclude our GAAP provision

(benefit) for income taxes from our non-GAAP measures of net income

attributable to Verint Systems Inc., and instead include a non-GAAP

provision for income taxes, determined by applying a non-GAAP

effective income tax rate to our income before provision for income

taxes, as adjusted for the non-GAAP items described above. The

non-GAAP effective income tax rate is generally based upon the

income taxes we expect to pay in the reporting year. We adjust our

non-GAAP effective income tax rate to exclude current-year tax

payments or refunds associated with prior-year income tax returns

and related amendments which were significantly delayed as a result

of our previous extended filing delay. Our GAAP effective income

tax rate can vary significantly from year to year as a result of

tax law changes, settlements with tax authorities, changes in the

geographic mix of earnings including acquisition activity, changes

in the projected realizability of deferred tax assets, and other

unusual or period-specific events, all of which can vary in size

and frequency. We believe that our non-GAAP effective income tax

rate removes much of this variability and facilitates

meaningful comparisons of operating results across periods.

Our non-GAAP effective income tax rate for the year ending January

31, 2018 is currently approximately 11%, and was 8.8% for the year

ended January 31, 2017. We evaluate our non-GAAP effective income

tax rate on an ongoing basis and it can change from time to time.

Our non-GAAP income tax rate can differ materially from our GAAP

effective income tax rate.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP measure defined as net income

(loss) before interest expense, interest income, income taxes,

depreciation expense, amortization expense, revenue adjustments

related to acquisitions, restructuring expenses, acquisition

expenses, and other expenses excluded from our non-GAAP financial

measures as described above. We believe that adjusted EBITDA is

also commonly used by investors to evaluate operating performance

between competitors because it helps reduce variability caused by

differences in capital structures, income taxes, stock-based

compensation accounting policies, and depreciation and amortization

policies. Adjusted EBITDA is also used by credit rating agencies,

lenders, and other parties to evaluate our creditworthiness.

Net Debt

Net Debt is a non-GAAP measure defined as the sum of long-term

and short-term debt on our consolidated balance sheet, excluding

unamortized discounts and issuance costs, less the sum of cash and

cash equivalents, restricted cash and bank time deposits, and

short-term investments. We use this non-GAAP financial measure to

help evaluate our capital structure, financial leverage, and our

ability to reduce debt and to fund investing and financing

activities, and believe that it provides useful information to

investors.

Supplemental Information About Constant

Currency

Because we operate on a global basis and transact business in

many currencies, fluctuations in foreign currency exchange rates

can affect our consolidated U.S. dollar operating results. To

facilitate the assessment of our performance excluding the effect

of foreign currency exchange rate fluctuations, we calculate our

GAAP and non-GAAP revenue, cost of revenue, and operating expenses

on both an as-reported basis and a constant currency basis,

allowing for comparison of results between periods as if foreign

currency exchange rates had remained constant. We perform our

constant currency calculations by translating current-period

foreign currency results into U.S. dollars using prior-period

average foreign currency exchange rates or hedge rates, as

applicable, rather than current period exchange rates. We believe

that constant currency measures, which exclude the impact of

changes in foreign currency exchange rates, facilitate the

assessment of underlying business trends.

Unless otherwise indicated, our financial outlook for revenue,

operating margin, and diluted earnings per share, which is provided

on a non-GAAP basis, reflects foreign currency exchange rates

approximately consistent with rates in effect when the outlook is

provided.

We also incur foreign exchange gains and losses resulting from

the revaluation and settlement of monetary assets and liabilities

that are denominated in currencies other than the entity’s

functional currency. We periodically report our historical non-GAAP

diluted net income per share both inclusive and exclusive of these

net foreign exchange gains or losses. Our financial outlook for

diluted earnings per share includes net foreign exchange gains or

losses incurred to date, if any, but does not include potential

future gains or losses.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171206006246/en/

Investor RelationsVerint

Systems Inc.Alan Roden, 631-962-9304alan.roden@verint.com

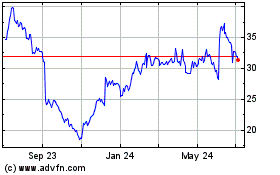

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Mar 2024 to Apr 2024

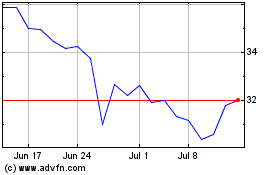

Verint Systems (NASDAQ:VRNT)

Historical Stock Chart

From Apr 2023 to Apr 2024