We are offering up to 2,279,411

(the “Offering Amount”) shares of our common stock, par value $0.001 per share, to certain service providers and vendors

(the “Providers”) in connection with the satisfaction of current outstanding amounts payable to the providers in an

amount that will not exceed the aggregate offering amount at a price per share equal to $0.34. We will not receive cash proceeds

from the offering of these shares of common stock.

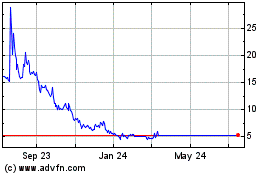

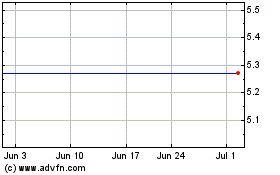

Our common stock is listed

on The NASDAQ Capital Market under the symbol “INPX.”

On December 5, 2017, the

last completed trading day prior to the date of this prospectus supplement, the last reported sale price of our common shares on

the NASDAQ Capital Market was $0.34. The aggregate market value of our outstanding voting common stock held by non-affiliates,

based upon the closing price of our common stock on October 20, 2017 ($0.53) was $8,646,239. During the 12 calendar month period

that ends on, and includes, the date of this prospectus supplement, we have offered securities with an aggregate market value of

$2 million pursuant to General Instruction I.B.6. of Form S-3. Pursuant to General Instruction I.B.6 of Form S-3, in no event will

we sell securities registered on the registration statement of which this prospectus supplement is a part in a public primary offering

with a value exceeding more than one-third of the aggregate market value of the voting and non-voting common equity in any 12 month

period so long as our public float remains below $75 million.

We currently anticipate that the final settlement of the offering will take place on or prior to December

7, 2017. See “Plan of Distribution.” The shares of common stock offered hereby are being sold directly by us without

the use of underwriters or agents.

DISCLOSURE

REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus, and the documents that we incorporate by reference, may contain forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Forward-looking

statements in this prospectus supplement and any accompanying prospectus include, without limitation, statements related to our

plans, strategies, objectives, expectations, intentions and adequacy of resources. Investors are cautioned that such forward-looking

statements involve risks and uncertainties including, without limitation, the following: (i) our plans, strategies, objectives,

expectations and intentions are subject to change at any time at our discretion; (ii) our plans and results of operations will

be affected by our ability to manage growth and competition; and (iii) other risks and uncertainties indicated from time to time

in our filings with the Securities and Exchange Commission (the “SEC”). Important factors that could cause actual

results to differ materially from those indicated in the forward-looking statements include, but are not limited to, the rate

and degree of market acceptance of our products, our ability to develop and market new and enhanced products, our ability to obtain

financing as and when we need it, competition from existing and new products and our ability to effectively react to other risks

and uncertainties described from time to time in our SEC filings, such as fluctuation of quarterly financial results, reliance

on third party manufacturers and suppliers, litigation or other proceedings, government regulation and stock price volatility.

In

some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,”

“continue,” “could,” “depends,” “estimates,” “expects,” “intends,”

“may,” “ongoing,” “plan,” “potential,” “predict,” “project,”

“should,” “will,” “would” or the negative of such terms or other comparable terminology. Although

we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results,

levels of activity, performance or achievements. Readers are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof. We do not undertake any obligation to publicly update or review any forward-looking statement.

PROSPECTUS

SUPPLEMENT SUMMARY

This

is only a summary and may not contain all the information that is important to you. You should carefully read both this prospectus

supplement and the accompanying prospectus and any other offering materials, together with the additional information described

under the heading “Where You Can Find More Information.”

The

Company

Inpixon

is a technology company that helps to secure, digitize and optimize any premises with Indoor Positioning Analytics, sometimes

referred to in this prospectus as “IPA,” for businesses and governments in the connected world. Inpixon Indoor Positioning

Analytics is based on new sensor technology that finds all accessible cellular, Wi-Fi, Bluetooth and RFID signals anonymously.

Paired with a high-performance, data analytics platform, this technology delivers visibility, security and business intelligence

on any commercial or government premises world-wide. Inpixon’s products, infrastructure solutions and professional services

group help customers take advantage of mobile, Big Data, analytics and the Internet of Things (“IoT”).

Inpixon

Indoor Positioning Analytics offer:

|

|

●

|

New

sensors with proprietary technology that can find all accessible cellular, Wi-Fi, Bluetooth and RF signals. Utilizing various

radio signal technologies ensures precision device positioning accurately down to arm’s length. This enables a highly

detailed understanding of customer journey and dwell time in retail scenarios, detection and identification of authorized

and unauthorized devices, and prevention of rogue devices through alert notification based on rules when unknown devices are

detected in restricted areas.

|

|

|

●

|

Data

science analytics with lightning fast data mining using an in-memory database that uses a dynamic blend of RAM and NAND along

with specially optimized algorithms that both minimize data movement and maximize system performance. This enables the system

to deliver reports with valuable insights to the user as well as to integrate with common third party visualization, charting,

graphing and dashboard systems.

|

|

|

●

|

Insights

that deliver visibility and business intelligence about detailed customer journey and flow analysis of in-stores and storefronts

allowing businesses to better understand customer preferences, measure campaign effectiveness, uncover revenue opportunities

and deliver an exceptional shopping experience.

|

Inpixon

Indoor Positioning Analytics can assist all types of establishments, including brands, retailers, shopping malls and shopping

centers, hotels and resorts, gaming operators, airports, healthcare facilities, office buildings and government agencies, by providing

greater security, gaining better business intelligence, increasing consumer confidence and reducing risk while being compliant

with applicable “Personal Identifiable Information” regulations.

Inpixon

also provides supporting products and services including enterprise computing and storage, virtualization, business continuity,

data migration, custom application development, networking and information technology business consulting services. These allow

Inpixon to offer turnkey solutions when requested by customers.

Our

Products and Services

We

provide the following products and services that may be used by any number of businesses and government agencies. The AirPatrol

products and LightMiner Studio product and their related services form the foundation and have been integrated into our IPA for

businesses and governments.

|

|

●

|

LightMiner

Analytics Platform

— This is an advanced solution for aggregating and mining multi-terabyte Big Data sets in

real time for instant insights. The product is Cloud-based so there’s nothing to install and it is fully scalable to

meet even the most demanding business requirements. Our quick start analytics modules are available for a variety of industry

verticals and applications.

|

|

|

●

|

Data

Science and Advanced Analytics Consulting Services —

Our consulting services are backed by our data science

and analytics team that develops data driven solutions for the most complex challenges. Our team’s extensive experience

and unique strategies allow it to leverage Big Data in new ways to uncover hidden insights and create new business opportunities.

|

|

|

●

|

AirPatrol

for Security (formerly ZoneDefense)

— This is a mobile security and detection product that locates devices operating

within a monitored area, determines their compliance with network security policies for that zone, and if the device is not

compliant, can trigger policy modification of device apps and/or features either directly or via third party mobile device,

application and network management tools.

|

|

|

●

|

AirPatrol

for Retail (formerly ZoneAware)

— This is a commercial product for enabling location and/or context-based marketing

services and information delivery to mobile devices based on zones as small as 10 feet or as large as a square mile. The monitored

areas may include a building, a campus, a mall, and outdoor regions like a downtown. Unlike other mobile locationing technologies,

AirPatrol technologies use passive sensors that work over both cellular and WiFi networks and offer device locationing and

zone-based app and information delivery accurate to within 10 feet. Additionally, unlike geo-fencing systems, AirPatrol technologies

are capable of simultaneously enabling different policies and delivering different apps or information to multiple devices

within the same zone based on contexts such as the type of device, the device user and time of day.

|

|

|

●

|

Shoom

Products

(eTearsheets; eInvoice, AdDelivery, ePaper) — The Shoom products are Cloud based applications and analytics

for the media and publishing industry. These products also generate critical data analytics for the customers.

|

|

|

●

|

Enterprise

Infrastructure Solutions and Services —

These products and services help organizations tackle challenges and

accelerate business goals by implementing best of breed technology solutions. We believe that our expertise in a broad range

of infrastructure solutions, from storage and Big Data solutions to converged infrastructure and cyber security, delivers

the results our clients want and need.

|

|

|

●

|

IT

Services

— From enterprise architecture design to custom application development, Inpixon offers a full range

of information technology development and implementation services with expertise in a broad range of IT practices including

project design and management, systems integration, outsourcing, independent validation and verification, cyber security and

more.

|

Corporate

History and Structure

The

Company was formed in Nevada in April 1999.

On

July 29, 2011, we acquired all of the stock of the U.S. federal government business of the Company, which included Sysorex Federal,

Inc. and its subsidiary Sysorex Government Services, Inc., and 50.2% of the stock of the operating unit of the Company engaged

in Saudi Arabian government contracts, Sysorex Arabia, LLC.

On

March 20, 2013, we completed the acquisition of the assets of Lilien LLC, including all the outstanding capital stock of Lilien

Systems. In conjunction with our name change to Inpixon, effective on March 1, 2017, Lilien Systems was renamed Inpixon USA. Inpixon

USA, based in Larkspur, California, is an information technology company that provides a Big Data analytics platform and enterprise

infrastructure capabilities. Inpixon USA delivers right-fit information technology solutions in enterprise computing and storage,

virtualization, business continuity, networking and IT business consulting that help organizations reach their next level of business

advantage.

Effective

August 31, 2013, we acquired 100% of the stock of Shoom, Inc. Shoom, Inc., which was merged into Inpixon USA in January 2016,

provides us with Cloud based data analytics and enterprise solutions to the media, publishing and entertainment industries.

Effective

April 18, 2014, we acquired 100% of the stock of AirPatrol Corporation (“AirPatrol”). AirPatrol, which was merged

into Inpixon USA in January 2016, developed indoor device locationing, monitoring and management technologies for mobile devices

operating on WiFi, cellular and wideband RF networks. Through AirPatrol we acquired two product lines, ZoneDefense (now rebranded

“AirPatrol for Security”) and ZoneAware (now rebranded “AirPatrol for Retail”). These products and technologies

deliver solutions to address an exploding global location-based mobile security and services (“LBS”) and real-time

location systems (“RTLS”) market estimated to be more than $15.0 billion in 2016 and to grow to $77.8 billion by 2021,

growing at 37.5% (Source: http://

www.marketsandmarkets.com

/Market Reports/location based service market 96994431.html?gclid=CKz8gKml69ICFQx6fgodTkoBNQ).

AirPatrol for Retail also serves as a location-based services, sales and marketing system. The security platform, which connects

to third party apps on a user’s mobile device, provides functions including, but not limited to, location-based offers,

discounts and suggestive selling, VIP service functions (for hotels, resorts, casinos, etc.), and location-based information delivery

such as mobile-based guided tours of historic sites, points of interest and museums, shopping center maps and building floor plans.

These products require no app installation for anonymous collection of behavioral data such as traffic flow, entry and exit patterns,

length of stay and other business intelligence and analytics functions.

On

April 24, 2015, we completed the acquisition of substantially all of the assets of LightMiner Systems, Inc. (“LightMiner”),

which was in the business of developing and commercializing in-memory structured query language, or SQL, databases. The assets

acquired from LightMiner included an in-memory, real-time, data analysis system designed to perform very large, highly complex

and extremely difficult calculations using off-the-shelf hardware and memory. The system supports both traditional SQL-based business

intelligence and analytics applications as well as a host of integrated statistical, machine learning and artificial intelligence

algorithms allowing it to provide supercomputer-like performance at competitive prices.

On

December 4, 2015 and effective January 1, 2016, our board of directors (“Board” or “Board of Directors”)

approved a series of reorganization transactions to streamline the organizational structure of the Company and its direct and

indirect subsidiaries. In 2015, we had five operating subsidiaries: (i) Sysorex Federal, Inc. (100% ownership) (“Sysorex

Federal”) and its wholly owned subsidiary Sysorex Government Services, Inc. (“Sysorex Government” or “Sysorex

Government Services”) based in Herndon, Virginia, which focused on the U.S. federal government market; (ii) Lilien Systems

(100% ownership) (“Lilien”) based in Larkspur, California; (iii) Shoom, Inc. (100% ownership) (“Shoom”)

based in Encino, California, (iv) AirPatrol Corporation (100% ownership) (“AirPatrol”) based in Maple Lawn, Maryland

and its wholly owned subsidiary AirPatrol Research Corp. based in Coquitlam, British Columbia, and (v) Sysorex Arabia LLC (50.2%

ownership) (“Sysorex Arabia”) based in Riyadh, Saudi Arabia. As a result of the reorganization transactions, effective

January 1, 2016 we have three operating subsidiaries: (i) Inpixon USA (100% ownership) based in Larkspur, California and its wholly-owned

subsidiary Inpixon Federal, Inc. (“Inpixon Federal”) based in Herndon, Virginia, which focuses on the U.S. federal

government market; (ii) Inpixon Canada Corp. based in Coquitlam, British Columbia; and (iii) Sysorex Arabia LLC (50.2% ownership)

based in Riyadh, Saudi Arabia.

On

November 21, 2016 we completed the acquisition of the business and certain assets of Integrio Technologies, LLC (“Integrio”

or “Integrio Technologies”) and Emtech Federal, LLC (“Emtech Federal”). Integrio, together with Emtech

Federal, is an IT integration and engineering company that provides solutions for network performance, secure wireless infrastructure,

software application lifecycle support, and physical cyber security for federal, state and local government agencies.

Effective

March 1, 2017, the Company changed its name to Inpixon through a statutory merger with a wholly owned subsidiary. Each of its

wholly-owned subsidiaries, Sysorex USA, Sysorex Government Services, Inc. and Sysorex Canada Corp. also amended their corporate

charters and changed their names to Inpixon USA, Inpixon Federal, Inc. and Inpixon Canada, Inc., respectively. Also effective

March 1, 2017, the Company filed a Certificate of Amendment to its Articles of Incorporation with the Secretary of State of the

State of Nevada to effect a 1-for-15 reverse stock split of the Company’s issued and outstanding shares of common stock.

Our

consolidated subsidiaries operate in the following business segments:

|

|

●

|

Indoor

Positioning Analytics: This segment includes Inpixon’s proprietary products and services delivered on premise or

in the Cloud as well as our hosted SaaS based solutions. Our Indoor Positioning Analytics product is based on a unique and

patented sensor technology that detects and locates accessible cellular, Wi-Fi and Bluetooth devices and then uses a lightning

fast data-analytics engine to deliver actionable insights and intelligent reports for security, marketing, asset management,

etc.

|

|

|

●

|

Infrastructure: This

segment includes third party hardware, software and related maintenance/warranty products and services that Inpixon resells

to commercial and government customers. It includes but is not limited to products for enterprise computing; storage; virtualization;

networking; etc. as well as services including custom application/software design; architecture and development; staff augmentation

and project management.

|

Although

the subsidiaries are separate legal entities, the Company is structured by function and organized to operate in an integrated

fashion as one business.

Corporate

Strategy

Management’s

corporate strategy is to continue to build and develop Inpixon as a technology company that provides turnkey solutions from the

collection of data to delivering insights from that data to our customers with a focus on securing, digitizing and optimizing

premises with IPA for businesses and governments. In connection with such strategy and in order to facilitate our long-term growth,

we have acquired certain companies, technologies and intellectual property (“IP”) that complement such goals and will

continue to consider completing additional strategic acquisitions as long as our financial condition permits. An important element

of this mergers and acquisitions strategy is to acquire companies with complementary capabilities and/or innovative and commercially

proven technologies in indoor positioning and Big Data analytics and to obtain an established customer base. We believe that acquiring

complementary products and/or IP will add value to the Company, and the customer base of each potential acquisition will also

present an opportunity to cross-sell our existing solutions. Candidates with proven technologies that complement our overall strategy

may come from anywhere in the world, so long as there are strategic and financial reasons to make the acquisition. If we make

any acquisitions in the future, we expect to pay for such acquisitions using restricted common stock, cash and debt financing

in combinations appropriate for each acquisition. In connection with our strategic business plan, Inpixon may also consider the

sale or divestment of certain assets for strategic and financial purposes should management deem such transactions necessary or

desirable in order to facilitate its overall strategy.

Implications

of Being an Emerging Growth Company

We

qualify as an “emerging growth company” as defined in Section 2(a) of the Securities Act of 1933, as amended, which

we refer to as the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging

growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable, in

general, to public companies that are not emerging growth companies. These provisions include:

|

|

●

|

reduced

disclosure about our executive compensation arrangements;

|

|

|

●

|

no

non-binding shareholder advisory votes on executive compensation or golden parachute arrangements;

|

|

|

●

|

exemption

from the auditor attestation requirement in the assessment of our internal control over financial reporting; and

|

|

|

●

|

reduced

disclosure of financial information in this prospectus supplement and the accompanying prospectus, limited to two years of

audited financial information.

|

We

may take advantage of these exemptions as an emerging growth company until the earlier of (i) the last day of the fiscal year

following the fifth anniversary of the first sale of our common equity securities in a public offering, (ii) we have more than

$1.0 billion in annual revenues as of the end of a fiscal year, (iii) the date on which we are deemed to be a large accelerated

filer under the rules of the SEC, or (iv) the date on which we issue more than $1.0 billion of non-convertible debt over a three-year-period.

The

JOBS Act permits an emerging growth company to take advantage of an extended transition period to comply with new or revised accounting

standards applicable to public companies. We have chosen to “opt out” of this provision. Therefore, we are subject

to the same new or revised accounting standards as other public companies that are not emerging growth companies.

Corporate

Information

Our

principal executive offices are located at 2479 E. Bayshore Road, Suite 195, Palo Alto, California 94303, and our telephone number

is (408) 702-2167. Our subsidiaries maintain offices in Herndon Virginia, Larkspur California, Honolulu Hawaii, Bellevue Washington,

Carlsbad California, Encino California, and Coquitlam, British Columbia. Our Internet website is

www.inpixon.com

. The information

contained on, or that may be obtained from, our website is not a part of this prospectus supplement and the accompanying prospectus

and should not be considered a part of this prospectus supplement or such accompanying prospectus. We have included our website

address in this prospectus supplement and accompanying prospectus solely as an inactive textual reference.

For

a description of our business, financial condition, results of operations and other important information regarding us, we refer

you to our filings with the SEC incorporated by reference in this prospectus supplement. For instructions on how to find copies

of these documents, see “Where You Can Find More Information.”

The

Offering

Common

stock offered by us pursuant

to this prospectus supplement

|

Up to 2,279,411 shares of Common Stock (the “Shares”), including the shares of Common Stock issuable

upon exercise of the Rights (defined below).

|

|

|

|

|

Common

stock to be outstanding immediately after the offering

(1)

|

As of December 5, 2017, the number of shares of common stock outstanding was 16,583,635. The number of

shares outstanding after giving effect to the offering, including the shares issuable upon exercise of the Rights, will be 18,863,046.

|

|

|

|

|

Use

of proceeds

|

We

will receive no proceeds from the offering of the Shares, which are being offered in connection with the satisfaction of certain

outstanding amounts payable to certain service providers and vendors (the “Providers”) of the Company.

|

|

|

|

|

The

NASDAQ Capital Market symbol

|

“INPX.”

|

|

|

|

|

Right

to Shares

|

In

the event that the number of Shares issuable to any Provider in order to satisfy the amounts payable to such Provider will exceed

4.99% of the Company’s outstanding Common Stock after giving effect to the issuance of the Shares, such additional Shares

will be reserved for issuance to the Company and the Provider will have the right (the “Rights”) to receive such additional

Shares of Common Stock upon the delivery of a notice of issuance to the Company at any time for no additional consideration.

|

|

|

|

|

Risk

factors

|

See

“Risk Factors” beginning on page S-6 of this prospectus supplement, as well as the other information included

in or incorporated by reference in this prospectus supplement and the accompanying prospectus, for a discussion of risks you

should carefully consider before investing in our securities.

|

|

|

(1)

|

The number of shares of our common stock outstanding after this offering is based on 16,583,635 shares of

common stock outstanding as of December 5, 2017 and excludes, as of that date:

|

|

|

●

|

286,894 shares of common stock issuable upon the exercise of outstanding non-plan stock options and stock

options under our Amended and Restated 2011 Employee Stock Incentive Plan, as amended (the “2011 Employee Stock Incentive

Plan”), having a weighted average exercise price of $25.64 per share;

|

|

|

●

|

2,626,592

shares of common stock issuable upon the exercise of outstanding warrants, having a weighted average exercise price of $0.84

per share;

|

|

|

●

|

391,992

shares of common stock issuable upon the conversion of the outstanding balance of $2,763,545 of the Company’s 8% Original

Issue Discount Senior Secured Convertible Debenture (the “Debenture”), originally issued on August 9, 2016 at

the present conversion price of $7.05 per share; and

|

|

|

●

|

3,877,777

shares of common stock issuable upon the conversion of the outstanding balance of $1,745,000 of the Company’s convertible

promissory note originally issued on November 17, 2017.

|

Unless

otherwise indicated, all information in this prospectus supplement:

|

|

●

|

has

been adjusted to give effect to the 1-for-15 reverse stock split effected on March 1, 2017;

|

|

|

●

|

assumes

no exercise of any outstanding options or warrants to purchase our common stock; and

|

|

|

●

|

assumes

no conversion of our outstanding Debenture.

|

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks

described below, together with all of the other information included in this prospectus supplement, the accompanying prospectus,

and the information incorporated by reference herein and therein.

For

a discussion of additional risks associated with our business, our intellectual property, government regulation, our industry

and an investment in our securities, see the section entitled “Risk Factors” in our most recent Annual Report on Form

10-K, as filed with the SEC on March 23, 2017, and any other subsequently filed document that is also incorporated or deemed to

be incorporated by reference in this prospectus supplement.

If

any of the risks described below, or those incorporated by reference into this prospectus supplement actually occur, our business,

financial condition or results of operations could suffer. In that case, the trading price of our common stock may decline and

you may lose all or part of your investment. The risks and uncertainties we have described are not the only ones we face. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our business, financial

condition and results of operations. Certain statements below are forward-looking statements. See the information included under

the heading “Disclosure Regarding Forward-Looking Statements.”

Our

obligations to our senior secured lender, Payplant LLC (“PayPlant”) and the holders of the Debenture (the “Debenture

Holders”), are secured by a security interest in substantially all of our assets, so if we default on those obligations,

the lenders could foreclose on, liquidate and/or take possession of our assets. If that were to happen, we could be forced to

curtail, or even to cease, our operations.

We

originally issued the Debenture, on August 9, 2016 at the present conversion price of $7.05 per share. As of September 30, 2017,

we had approximately $2,850,000 outstanding under the Debentures. We issued a revolving Secured Promissory Note to GemCap Lending

I, LLC dated as of November 14, 2016 which was assigned to Payplant LLC, or “Payplant”, on August 14, 2017 together

with the Amended and Restated GemCap Loan and Security Agreement: Payplant Loan and Security Agreement, dated as of August 14,

2017 (the “Payplant Loan Agreement”). As of September 30, 2017, we had approximately $3.4 million in outstanding revolving

credit loans. All amounts due under the Secured Promissory Note and Debenture are secured by our assets. As a result, if we default

on our obligations under the Secured Promissory Note or the Debenture, Payplant or the Debenture Holders could foreclose on its

security interest and liquidate or take possession of some or all of these assets, which would harm our business, financial condition

and results of operations and could require us to curtail, or even to cease, our operations.

Payplant,

the Debenture Holders and the holders of convertible promissory notes (the “November 2017 Notes”) issued in November

2017 ( the “November Noteholders”) have certain rights upon an event of default under their respective agreements

that could harm our business, financial condition and results of operations and could require us to curtail or cease our operations.

Payplant,

the Debenture Holders, and the November Noteholders have certain rights upon an event of default. With respect to Payplant, such

rights include an increase in the interest rate on any advances made pursuant to the Payplant Loan Agreement, the right to accelerate

the payment of any outstanding advances made pursuant to the Payplant Loan Agreement, the right to directly receive payments made

by account debtors and the right to foreclose on our assets, among other rights. The Payplant Loan Agreement includes in its definition

of an event of default, among other occurrences, the failure to pay any principal when due within two business days, the termination,

winding up, liquidation or dissolution of any borrower, the filing of a tax lien by a governmental agency against any borrower,

and any reduction in ownership of our wholly owned subsidiaries, Inpixon USA and Inpixon Federal.

With

respect to the Debenture Holders, such rights include the right to accelerate all amounts outstanding under the Debenture and

demand a mandatory default payment in an amount equal to the greater of (i) the outstanding principal amount of the Debenture,

plus all accrued and unpaid interest, divided by the conversion price on the date the mandatory default amount is either (A) demanded

(if demand or notice is required to create an event of default) or otherwise due or (B) paid in full, whichever has a lower conversion

price, multiplied by the VWAP (as defined in the Debenture) on the date the mandatory default amount is either (x) demanded or

otherwise due or (y) paid in full, whichever has a higher VWAP, or (ii) 125% of the outstanding principal amount plus 100% of

accrued and unpaid interest, and (b) all other amounts, costs, expenses and liquidated damages due in respect of the Debenture.

Each of the following events shall constitute an event of default: failure to make a payment obligation, failure to observe certain

covenants of the Debenture or related agreements (subject to applicable cure periods), breach of a representation or warranty,

bankruptcy, default under another significant contract or credit obligation, delisting of the common stock, a change in control,

or failure to deliver stock certificates in a timely manner.

The

November Holders have the right to accelerate all amounts outstanding under the November 2017 Notes payble in cash in an amount

equal to the greater of (a) the outstanding balance divided by $0.45(subject to adjustment as set forth in the November 2017 Notes)

on the date the note is demanded, multiplied by the VWAP on such date, or (b) the outstanding balance following multiplying the

putstanding balance as of the date the applicable default occurred by (a) 15% for each occurrence of any Major Default (as defined

in the November 2017 Notes), or (b) 5% for each occurrence of any Minor Default (as defined in the November 2017 Notes), and then

adding the resulting product to the outstanding balance as of the date the applicable default occurred, with the sum of the foregoing

then becoming the outstanding balance under the November 2017 Notes as of the date the applicable default occurred; provided that

the Default Effect (as defined in the November 2017 Notes) may only be applied three (3) times with respect to Major Defaults

and three (3) times with respect to Minor Defaults; and provided further that the Default Effect shall not apply to any default

pursuant to Section 4.1(b) of the November 2017 Notes. Each of the following events shall constitute an event of default: failure

to pay any principal, interest, fees, charges, or any other amount when due and payable under the November 2017 Notes; (b) failure

to deliver any Lender Conversion Shares (as defined in the November 2017 Notes); (c) failure to deliver any Redemption Conversion

Shares (as defined below); (d) a receiver, trustee or other similar official shall be appointed over the Company or a material

part of its assets and such appointment shall remain uncontested for twenty (20) days or shall not be dismissed or discharged

within sixty (60) days; (e) Company becomes insolvent or generally fails to pay, or admits in writing its inability to pay, its

debts as they become due, subject to applicable grace periods, if any; (f) Company makes a general assignment for the benefit

of creditors; (g) Company files a petition for relief under any bankruptcy, insolvency or similar law (domestic or foreign); (h)

an involuntary bankruptcy proceeding is commenced or filed against Company; (i) Company defaults or otherwise fails to observe

or perform any covenant, obligation, condition or agreement of the Company, with certain limitations; (j) any representation,

warranty or other statement made or furnished by or on behalf of the Company in connection with the issuance of the November 2017

Notes is false, incorrect, incomplete or misleading in any material respect when made or furnished; (k) the occurrence of a Fundamental

Transaction (as defined in the November 2017 Notes) without lender’s prior written consent; (l) the Company fails to maintain

the Share Reserve (as defined in the November 2017 Notes); (m) the Company effectuates a reverse split of its common stock without

twenty (20) trading days prior written notice to lender; (n) any money judgment, writ or similar process is entered or filed against

the Company or any subsidiary or any of its property or other assets for more than $600,000.00, and shall remain unvacated, unbonded

or unstayed for a period of twenty (20) calendar days unless otherwise consented to by lender; (o) the Company fails to be DWAC

eligible; (p) the Company fails to observe or perform any covenant set forth in the purchase agreement; and (q) the Company breaches

any covenant or other term or condition contained in any Other Agreements (as defined in the November 2017 Notes).

The

exercise of any of these rights upon an event of default could substantially harm our financial condition and force us to curtail,

or even to cease, our operations.

If

we are unable to comply with certain financial and operating restrictions required by the Payplant Loan Agreement, we may be limited

in our business activities and access to credit or may default under the Payplant Loan Agreement.

Provisions

in the Payplant Loan Agreement impose restrictions or require prior approval on our ability, and the ability of certain of our

subsidiaries to, among other things:

|

|

●

|

sell,

lease, transfer, convey, or otherwise dispose of any or all of our assets or collateral, except in the ordinary course of

business;

|

|

|

●

|

make

any loans to any person, as that term is defined in the Payplant Loan Agreement, with the exception of employee loans made

in the ordinary course of business;

|

|

|

●

|

declare

or pay cash dividends, make any distribution on, redeem, retire or otherwise acquire directly or indirectly, any of our Equity

Interests, as defined in the Payplant Loan Agreement;

|

|

|

●

|

guarantee

the indebtedness of any person;

|

|

|

●

|

compromise,

settle or adjust any claims in any amount relating to any of the collateral;

|

|

|

●

|

incur,

create or permit to exist any lien on any of our property or assets;

|

|

|

●

|

engage

in new lines of business;

|

|

|

●

|

change,

alter or modify, or permit any change, alteration or modification of our organizational documents in any manner that might

adversely affect Payplant’s rights;

|

|

|

●

|

sell,

assign, transfer, discount or otherwise dispose of any accounts or any promissory note payable to us, with or without recourse;

|

|

|

●

|

incur,

create, assume, or permit to exist any indebtedness or liability on account of either borrowed money or the deferred purchase

price of property; and

|

|

|

●

|

make

any payments of cash or other property to any affiliate.

|

The

Payplant Loan Agreement also contains other customary covenants. We may not be able to comply with these covenants in the future.

Our failure to comply with these covenants may result in the declaration of an event of default and cause us to be unable to borrow

under the Payplant Loan Agreement. In addition to preventing additional borrowings under the Payplant Loan Agreement, an event

of default, if not cured or waived, may result in the acceleration of the maturity of indebtedness outstanding under the Loan

Agreement, which would require us to pay all amounts outstanding. If the maturity of our indebtedness is accelerated, we may not

have sufficient funds available for repayment or we may not have the ability to borrow or obtain sufficient funds to replace the

accelerated indebtedness on terms acceptable to us or at all. Our failure to repay the indebtedness would result in Payplant foreclosing

on all or a portion of our assets and force us to curtail, or even to cease, our operations.

Adverse

judgments or settlements in legal proceedings could materially harm our business, financial condition, operating results and cash

flows.

We

are currently subject to pending claims for non-payment by certain vendors in an aggregate amount of approximately $1.7 million,

which is approximately 8% of our total current assets. In addition, as of the date of this prospectus we have received a notice

to cure in connection with the failure to pay charges of approximately $150,000 in connection with certain property lease agreements.

We may also be a party to other claims that arise from time to time in the ordinary course of our business, which may include

those related to, for example, contracts, sub-contracts, protection of confidential information or trade secrets, adversary proceedings

arising from customer bankruptcies, employment of our workforce and immigration requirements or compliance with any of a wide

array of state and federal statutes, rules and regulations that pertain to different aspects of our business. We may also be required

to initiate expensive litigation or other proceedings to protect our business interests. There is a risk that we will not be successful

or otherwise be able to satisfactorily resolve any pending or future litigation. In addition, litigation and other legal claims

are subject to inherent uncertainties and management’s view of currently pending legal matters may change in the future.

Those uncertainties include, but are not limited to, litigation costs and attorneys’ fees, unpredictable judicial or jury

decisions and the differing laws and judicial proclivities regarding damage awards among the states in which we operate. Unexpected

outcomes in such legal proceedings, or changes in management’s evaluation or predictions of the likely outcomes of such

proceedings (possibly resulting in changes in established reserves), could have a material adverse effect on our business, financial

condition, results of operations and cash flows. Due to recurring losses and net capital deficiency, our current financial status

may increase our default and litigation risks and may make us more financially vulnerable in the face of pending or threatened

litigation.

Our

common stock may be delisted from The NASDAQ Capital Market if we cannot satisfy NASDAQ’s continued listing requirements

in the future.

On

May 19, 2017, we received written notice from the Listing Qualifications Staff of NASDAQ notifying us that we no longer comply

with NASDAQ Listing Rule 5550(b)(1) due to our failure to maintain a minimum of $2,500,000 in stockholders’ equity (the

“Minimum Stockholders’ Equity Requirement”) or any alternatives to such requirement. We reported stockholders’

equity of ($11,867,000) in our Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2017.

On

October 24, 2017, the Company received notification (the “Staff Delisting Determination”) from NASDAQ that it has

not regained compliance with the Minimum Stockholders’ Equity Requirement. The Company has appealed the Staff Delisting

Determination and requested a hearing which is currently scheduled for December 7, 2017. As a result, the suspension and delisting

will be stayed until pending the issuance of a written decision by the hearings panel. The Company is currently evaluating various

alternative courses of action to regain compliance with the Minimum Stockholders’ Equity Requirement.

If

we are unable to comply with the Minimum Stockholders’ Equity Requirement, our common stock may be delisted, which could

make trading our common stock more difficult for investors, potentially leading to declines in our share price and liquidity.

Without a NASDAQ listing, stockholders may have a difficult time getting a quote for the sale or purchase of our stock, the sale

or purchase of our stock would likely be made more difficult and the trading volume and liquidity of our stock could decline.

Delisting from NASDAQ could also result in negative publicity and could also make it more difficult for us to raise additional

capital. Further, if we are delisted, we would also incur additional costs under state blue sky laws in connection with any sales

of our securities. These requirements could severely limit the market liquidity of our common stock and the ability of our stockholders

to sell our common stock in the secondary market. If our common stock is delisted by NASDAQ, our common stock may be eligible

to trade on an over-the-counter quotation system, such as the OTCQB market, where an investor may find it more difficult to sell

our stock or obtain accurate quotations as to the market value of our common stock. We cannot assure you that our common stock,

if delisted from NASDAQ, will be listed on another national securities exchange or quoted on an over-the counter quotation system.

On

August 14, 2017, we received a deficiency letter from NASDAQ indicating that, based on our closing bid price for the last 30 consecutive

business days, we do not comply with the minimum bid price requirement of $1.00 per share, as set forth in NASDAQ Listing Rule

5550(a)(2). The notification has no immediate effect on the listing of our common stock on The NASDAQ Capital Market.

In

accordance with NASDAQ Listing Rule 5810(c)(3)(A), we have a grace period of 180 calendar days, or until February 12, 2018, to

regain compliance with the minimum closing bid price requirement for continued listing. In order to regain compliance, the minimum

closing bid price per share of our common stock must be at least $1.00 for a minimum of ten consecutive business days. In the

event INPX does not regain compliance by February 12, 2018, we may be afforded an additional 180-day compliance period, provided

we demonstrate that we meet all other applicable standards for initial listing on The NASDAQ Capital Market (except the bid price

requirement), and provide written notice of our intention to cure the minimum bid price deficiency during the second grace period,

by effecting a reverse stock split, if necessary. If we fail to regain compliance after the second grace period, our common stock

will be subject to delisting by NASDAQ.

There

may be future sales or other dilution of our equity, which may adversely affect the market price of our common stock.

We

are generally not restricted from issuing additional common stock, including any securities that are convertible into or exchangeable

for, or that represent the right to receive, common stock. The market price of our common stock could decline as a result of sales

of common stock or securities that are convertible into or exchangeable for, or that represent the right to receive, common stock

after this offering or the perception that such sales could occur.

You

will experience immediate and substantial dilution in the net tangible book value per share of our common stock.

The public offering price

of our common stock being offered is substantially higher than the net tangible book value per share of our common stock outstanding

prior to this offering. Therefore, if you purchase our common stock in this offering, you will incur an immediate substantial

dilution of $2.16 in net tangible book value per share from the price you paid, based on our financial statements as of

September 30, 2017. If outstanding options or warrants to purchase our common stock are exercised, you will experience additional

dilution. For a further description of the dilution that you will experience immediately after this offering, see “Dilution.”

If

securities or industry analysts do not publish research or reports about our business, or if they change their recommendations

regarding our stock adversely, our stock price and trading volume could decline.

The

trading market for our common stock relies in part on the research and reports that equity research analysts publish about us

and our business. We do not control these analysts. The price of our common stock could decline if one or more equity research

analysts downgrade our common stock or if they issue other unfavorable commentary or cease publishing reports about us or our

business.

USE

OF PROCEEDS

We will receive no proceeds

from the offering of the shares of common stock, which are being offered for the purpose of satisfying outstanding amounts payable

to certain service providers and vendors of the Company at a price per share that is based upon the closing price of the Company’s

common stock as last reported by Nasdaq.

DILUTION

The

shares of common stock issued to in the offering may be diluted to the extent of the difference between the price each share of

common stock and the net tangible book value per share of our common stock immediately after this offering. Our net tangible book

value as of September 30, 2017 was approximately $(32.9 million), or ($2.14) per share of our common stock. Net tangible book

value per share is equal to our total tangible assets minus total liabilities, all divided by 15,397,847 shares of common stock

outstanding as of September 30, 2017.

Assuming that we issue

an aggregate of 2,279,411 shares of common stock in this Offering at a price of $0.34, our net tangible book deficit as of September

30, 2017 would have been approximately ($32.2 million), or ($1.82) per share of our common stock. This amount represents an immediate

increase in net tangible book value of $0.32 per share to our existing stockholders and an immediate dilution in net tangible

book value of $2.16 per share to the investors in this offering.

We

determine dilution by subtracting the adjusted net tangible book value per share after this offering from the conversion price

per share of our common stock. The following table illustrates the per share dilution to investors purchasing securities in the

offering:

|

Price per share of common stock to be issued in the Offering

|

|

|

|

|

|

$

|

0.34

|

|

|

Net tangible book value per share as of September 30, 2017

|

|

$

|

(2.14

|

)

|

|

|

|

|

|

Increase in net tangible book value per share attributable to Offering

|

|

$

|

0.32

|

|

|

|

|

|

|

Adjusted net tangible book value per share as of September 30, 2017 after giving effect to the Offering

|

|

|

|

|

|

$

|

(1.82

|

)

|

|

Dilution in net tangible book value per share to investors in this Offering

|

|

|

|

|

|

$

|

2.16

|

|

The

amounts above are based on 15,397,847 shares of common stock outstanding as of September 30, 2017, which excludes as of that date:

|

|

●

|

309,609

shares of common stock issuable upon the exercise of outstanding non-plan stock options and stock options under our Amended

and Restated 2011 Employee Stock Incentive Plan, as amended (the “2011 Employee Stock Incentive Plan”), having

a weighted average exercise price of $25.18 per share;

|

|

|

●

|

3,812,449

shares of common stock issuable upon the exercise of outstanding warrants, having a weighted average exercise price of $0.67

per share;

|

|

|

●

|

404,255

shares of common stock issuable upon the conversion of the outstanding balance of $2,850,000 of the Debentures issued on August

9, 2016 to at the present conversion price of $7.05 per share;

|

|

|

●

|

shares

of common stock or other securities of the Company convertible or exercisable for shares of common stock issued after September

30, 2017.

|

To the extent that any of our outstanding options or warrants are exercised or the Debenture or any other

outstanding securities of the Company convertible or exercisable for shares of common stock are converted or exercised, we grant

additional options under our stock option plans or issue additional warrants or preferred stock, or we issue additional shares

of common stock in the future, there may be further dilution to the Providers.

DESCRIPTION

OF SECURITIES

Authorized

and Outstanding Capital Stock

We have authorized 55,000,000

shares of capital stock, par value $0.001 per share, of which 50,000,000 are shares of common stock and 5,000,000 are shares of

“blank check” preferred stock. As of December 5, 2017, we had 16,583,635 shares of common stock outstanding and held

by 587 stockholders of record, and 0 shares of preferred stock outstanding. For information on how to obtain copies of our articles

of incorporation, as amended, amended and restated bylaws, certificate of designation, outstanding warrants, Debenture and other

outstanding notes, see “Where You Can Find Additional Information” and “Information Incorporated by Reference.”

Common

Stock

The

holders of our common stock are entitled to one vote per share. In addition, the holders of our common stock will be entitled

to receive pro rata dividends, if any, declared by our Board of Directors out of legally available funds; however, the current

policy of our Board of Directors is to retain earnings, if any, for operations and growth. Upon liquidation, dissolution or winding-up,

the holders of our common stock are entitled to share ratably in all assets that are legally available for distribution. The holders

of our common stock have no preemptive, subscription, redemption or conversion rights. The rights, preferences and privileges

of holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of any series of preferred

stock, which may be designated solely by action of our Board of Directors and issued in the future.

Preferred

Stock

Our

Board of Directors is authorized, subject to any limitations prescribed by law, without further vote or action by our stockholders,

to issue from time to time shares of preferred stock in one or more series. Each series of preferred stock will have the number

of shares, designations, preferences, voting powers, qualifications and special or relative rights or privileges as shall be determined

by our Board of Directors, which may include, among others, dividend rights, voting rights, liquidation preferences, conversion

rights and preemptive rights.

The

issuance of our preferred stock could adversely affect the voting power of holders of common stock and the likelihood that such

holders will receive dividend payments and payments upon liquidation. In addition, the issuance of preferred stock could have

the effect of delaying, deferring or preventing a change of control or other corporate action. We have no current plan to issue

any additional shares of preferred stock.

Series

2 Preferred

Our

Board of Directors designated 4,669 shares of preferred stock as Series 2 Preferred. As of the date of this Prospectus, there

are no more shares of Series 2 Preferred stock outstanding. Although there is no current intent to do so, our Board may, without

stockholder approval, issue shares of an additional class or series of preferred stock with voting and conversion rights which

could adversely affect the voting power of the holders of the common stock or the convertible preferred stock.

Warrants

As of December 5, 2017,

we have warrants issued and outstanding for the purchase of up to 2,626,592 shares of our common stock, at exercise prices ranging

from $0.30 to $112.50. The warrants are held by 34 security holders. Outstanding warrants to purchase our common stock are as

follows:

|

Issuance Date

|

|

Number of Shares

|

|

Exercise Period

|

|

Exercise Price

|

|

|

December 21, 2012

|

|

18,113

|

|

From December 21, 2012 to December 21, 2017

|

|

$

|

4.68

|

|

|

March 20, 2013

|

|

5,556

|

|

From March 20, 2013 to March 20, 2020 (except the Lock-Up Period as defined in the warrant)

|

|

$

|

13.50

|

|

|

August 29, 2013

|

|

3,750

|

|

From August 29, 2013 to August 29, 2020 (except the Lock-Up Period as defined in the warrant)

|

|

$

|

36.00

|

|

|

April 15, 2014

|

|

6,672

|

|

From April 15, 2015 to April 14, 2019

|

|

$

|

112.50

|

|

|

November 17, 2015

|

|

3,334

|

|

From November 17, 2015 to November 17, 2018

|

|

$

|

15.00

|

|

|

December 15, 2016

|

|

250,001

|

|

From June 15, 2017 to June 15, 2022

|

|

$

|

0.50

|

|

|

June 30, 2017

|

|

1,243,447

|

|

June 30, 2017 to June 30, 2022

|

|

$

|

0.30

|

|

|

August 9, 2017

|

|

1,095,719

|

|

From August 9, 2017 to August 9, 2022

|

|

$

|

0.55

|

|

Debenture

The

following is a summary of the material terms of the Debenture.

Interest

and Conversion

. Interest on the Debenture accrues at a rate of 8.0% per annum and is payable in cash, or upon notice

to the holder and compliance with certain equity conditions as set forth in the Debenture in shares of the Company’s common

stock. The number of shares of common stock to be paid for any interest payment equals the quotient of (x) the applicable dollar

amount to be paid divided by (y) the Conversion Price (as defined below). Subject to certain limitations including the beneficial

ownership limitation, the Debenture is convertible at any time at the option of the holder at a conversion price of $7.05 per

share, subject to adjustments provided in the Debenture (the “Conversion Price”). The current amount outstanding under

the Debenture is $2,763,545.

Redemption

. Subject

to certain equity conditions, the Company has the option to redeem the Debenture before its maturity by payment in cash of 120%

or 110% (depending on the timing of the redemption) of the then outstanding principal amount plus accrued interest and other charges.

The Company is required to redeem 25% of the initial principal amount plus accrued unpaid interest and other charges on November

9, 2017, February 9, 2018, May 9, 2018, and August 9, 2018 (each, a “Periodic Redemption”). In lieu of a cash Periodic

Redemption payment, the Company may, upon notice to the holder and compliance with certain equity conditions, elect to pay all

or part of a Periodic Redemption in shares of common stock based on a conversion price equal to the Conversion Price.

Default

Events

. Each of the following events constitutes an event of default under the Debenture: failure to make a payment obligation,

failure to observe certain covenants of the Debenture or related agreements (subject to applicable cure periods), breach of a

representation or warranty, bankruptcy, default under another significant contract or credit obligation, delisting of the common

stock, a change in control, or failure to deliver stock certificates in a timely manner. In the event of a default, the holder

shall have the right to accelerate all amounts outstanding under the Debenture and demand a mandatory default payment in an amount

(the “Mandatory Default Amount”) equal to the greater of (i) the outstanding principal amount of the Debenture, plus

all accrued and unpaid interest, divided by the conversion price on the date the Mandatory Default Amount is either (A) demanded

(if demand or notice is required to create an event of default) or otherwise due or (B) paid in full, whichever has a lower conversion

price, multiplied by the VWAP (as defined in the Debenture) on the date the Mandatory Default Amount is either (x) demanded or

otherwise due or (y) paid in full, whichever has a higher VWAP, or (ii) 125% of the outstanding principal amount plus 100% of

accrued and unpaid interest, and (b) all other amounts, costs, expenses and liquidated damages due in respect of the Debenture.

Security

. The

Debenture is secured with a subordinated lien by certain property of the Company in accordance with the terms of a Security Agreement,

dated August 9, 2016 by and among the Company, each of its subsidiaries and the holder. Each of the subsidiaries also entered

into a guarantee in favor of the holder, pursuant to which each subsidiary guaranteed the complete payment and performance by

the Company of its obligations under the Debenture and related agreements.

Payplant

Accounts Receivable Bank Line

Pursuant

to the terms of a Commercial Loan Purchase Agreement, dated as of August 14, 2017, Gemcap Lending I, LLC (“Gemcap”)

sold and assigned to Payplant LLC, as agent for Payplant Alternatives Fund LLC, all of its right, title and interest to that certain

revolving Secured Promissory Note in an aggregate principal amount of up to $10,000,000 issued in accordance with that certain

Loan and Security Agreement, dated as of November 14, 2016 by and among Gemcap and the Company and its wholly-owned subsidiaries,

Inpixon USA and Inpixon Federal, Inc. for an aggregate purchase price of $1,402,770.16. In connection with the purchase and assignment,

the GemCap loan was amended and restated in accordance with the terms and conditions of the Payplant Loan and Security Agreement,

dated as of August 14, 2017, between the Company and Payplant (the “Loan Agreement”) The Loan Agreement allows the

Company to request loans from Payplant with a term of no greater than 360 days in amounts that are equivalent to 80% of the face

value of purchase orders received. In connection with the assignment, the Company entered into the Payplant Client Agreement (the

“Client Agreement”), pursuant to which the Company will offer to Payplant for purchase those receivables payable to

the Company in connection with the purchase orders under which advances have been made pursuant to the Loan Agreement for the

purposes of paying off any notes issued pursuant to the Loan Agreement. Under the Client Agreement, the Company cannot raise additional

financings, without Payplant’s approval, which will not be unreasonably withheld by Payplant unless it is an equity financing

or a convertible equity financing, where the Company can force conversion, while Payplant’s advances are outstanding. In

accordance with the terms of the Loan Agreement, Inpixon Federal, Inc. issued a promissory note to Payplant with a term of 30

days in an aggregate principal amount of $995,472.61 in connection with a purchase order received. The promissory note is subject

to the interest rates described in the Loan Agreement and is secured by the assets of the Company pursuant to the Loan Agreement

and will be satisfied in accordance with the terms of the Client Agreement.

November

2017 Notes

On

November 17, 2017, the Company issued a $1,745,000 principal face amount note to an accredited investor which yielded net proceeds

of $1,500,000 to the Company. The note bears interest at the rate of 10% per year and is due 10 months after the date of issuance.

There is a fixed conversion price of $0.45 per share, and the Company is required to reserve 25 million of the 50 million shares

set forth in Proposal 8 of the Definitive Schedule 14A filed with the SEC in October 2017. Redemptions may occur at any time after

the 6 month anniversary of the date of issuance of the note with a minimum redemption price of $0.57 per share, and if the conversion

rate is less than the market price, then the redemptions must be made in cash. The note contains standard events of default and

a schedule of redemption premiums. There is also a most favored nations clause for the term of the note.

The

note contains customary events of default (defined terms as defined in the Note): 1)The Company fails to pay any principal, interest,

fees, charges, or any other amount when due and payable hereunder; 2)The Company fails to deliver any Lender Conversion Shares

in accordance with the terms hereof; 3)The Company fails to deliver any Redemption Conversion Shares (as defined below) in accordance

with the terms hereof; 4)a receiver, trustee or other similar official shall be appointed over The Company or a material part

of its assets and such appointment shall remain uncontested for twenty (20) days or shall not be dismissed or discharged within

sixty (60) days; 5)The Company becomes insolvent or generally fails to pay, or admits in writing its inability to pay, its debts

as they become due, subject to applicable grace periods, if any; 6)The Company makes a general assignment for the benefit of creditors;

7)The Company files a petition for relief under any bankruptcy, insolvency or similar law (domestic or foreign); 8)an involuntary

bankruptcy proceeding is commenced or filed against The Company; 9)The Company defaults or otherwise fails to observe or perform

any covenant, obligation, condition or agreement of The Company contained herein or in any other Transaction Document (as defined

in the Purchase Agreement), other than those specifically set forth in this Section 4.1 and Section 4 of the Purchase Agreement;

10)any representation, warranty or other statement made or furnished by or on behalf of The Company to Lender herein, in any Transaction

Document, or otherwise in connection with the issuance of this Note is false, incorrect, incomplete or misleading in any material

respect when made or furnished; 11)the occurrence of a Fundamental Transaction without Lender’s prior written consent; 12)The

Company fails to maintain the Share Reserve as required under the Purchase Agreement; 13)The Company effectuates a reverse split

of its Common Stock without twenty (20) Trading Days prior written notice to Lender; 14)any money judgment, writ or similar process

is entered or filed against The Company or any subsidiary of The Company or any of its property or other assets for more than

$600,000.00, and shall remain unvacated, unbonded or unstayed for a period of twenty (20) calendar days unless otherwise consented

to by Lender; 15)The Company fails to be DWAC Eligible; 16)The Company fails to observe or perform any covenant set forth in Section

4 of the Purchase Agreement; and 17)The Company breaches any covenant or other term or condition contained in any Other Agreements.

There

is also a most favored nations clause for six months from the date of issuance of the note such that if during that term, the

Company enters into a transaction with terms more favorable than the terms under the note transaction, the note holder has a right

to substitute the existing note terms with the more favorable terms in the new transaction. Furthermore, so long as the note is

outstanding, if the Company issues a lower priced security than the conversion price of the note, the conversion price of the

note is reduced to the price of that lower priced security.

Prepayments

may be made on the note as follows:

|

Prepayment Date

|

|

Prepayment Amount

|

|

|

|

|

|

On or before December 31, 2017

|

|

100% of the Outstanding Balance

|

|

|

|

|

|

On or after January 1, 2018 until February 1, 2018

|

|

115% of the Outstanding Balance

|

|

|

|

|

|

On or after February 1, 2018 until the Maturity Date

|

|

120% of the Outstanding Balance

|

The

note documents are governed by Utah law and jurisdiction for disputes is Utah. Furthermore, the parties agree to settle all disputes

through binding arbitration.

PLAN

OF DISTRIBUTION

We are offering 2,279,411

shares of our common stock directly to the Providers in connection with the satisfaction of outstanding amounts payable by the

Company in an aggregate amount equal to $775,000.

We

will not receive any proceeds from the Offering of these securities. No underwriters or agents will be involved, and no commissions

will be payable by us with respect to the Offering.

LEGAL

MATTERS

The

validity of the issuance of the securities offered hereby will be passed upon for us by Mitchell Silberberg & Knupp, LLP,

New York, New York.

EXPERTS

Marcum

LLP, independent registered public accounting firm, has audited our consolidated financial statements as of December 31, 2016

and 2015, and for the years then ended, included in our Annual Report on Form 10-K for the year ended December 31, 2016, as set

forth in their report, which is incorporated by reference in this prospectus supplement, the accompanying prospectus and elsewhere

in the registration statement. Our consolidated financial statements are incorporated by reference in reliance on Marcum LLP,

given on their authority as experts in accounting and auditing.

Mitchell Silberberg &

Knupp, LLP (“MSK”), with an office at 11377 W. Olympic Blvd., Los Angeles, CA 90064, will pass upon the validity of

the shares of common stock offered by this prospectus. MSK may receive up shares of our common stock pursuant to this prospectus

supplement in connection with the satisfaction of outstanding legal fees payable to MSK. Although MSK is not under any obligation

to accept shares of our common stock in payment for services, it may do so in the future.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form S-3 under the Securities Act, with respect to the securities covered

by this prospectus supplement and any accompanying prospectus. This prospectus supplement and the accompanying prospectus, which

is a part of the registration statement, does not contain all of the information set forth in the registration statement or the

exhibits and schedules filed therewith. For further information with respect to us and the securities covered by this prospectus

supplement, please see the registration statement and the exhibits filed with the registration statement. A copy of the registration

statement and the exhibits filed with the registration statement may be inspected without charge at the Public Reference Room

maintained by the SEC, located at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information

about the operation of the Public Reference Room. The SEC also maintains an Internet website that contains reports, proxy and

information statements and other information regarding registrants that file electronically with the SEC. The address of the website

is http://

www.sec.gov

.

We

are subject to the information and periodic reporting requirements of the Exchange Act and, in accordance therewith, we file periodic

reports, proxy statements and other information with the SEC. Such periodic reports, proxy statements and other information are

available for inspection and copying at the Public Reference Room and website of the SEC referred to above. We maintain a website

at http://

www.inpixon.com

. You may access our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports

on Form 8-K and amendments to those reports filed pursuant to Sections 13(a) or 15(d) of the Exchange Act with the SEC free of

charge at our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the

SEC. Our website and the information contained on that site, or connected to that site, are not incorporated into and are not

a part of this prospectus supplement, or any accompanying prospectus.

INFORMATION

INCORPORATED BY REFERENCE

The

SEC and applicable law permits us to “incorporate by reference” into this prospectus supplement information that we

have or may in the future file with the SEC (excluding those portions of any Form 8-K that are not deemed “filed”

pursuant to the General Instructions of Form 8-K). This means that we can disclose important information by referring you to those

documents. You should read carefully the information incorporated herein by reference because it is an important part of this

prospectus supplement. We hereby incorporate by reference the following documents into this prospectus supplement:

|

|

●

|

our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed with the SEC on April 17, 2017;

|

|

|

●

|

our Quarterly Reports on Form 10-Q for the periods ended March 31, 2017, June 30, 2017 and September 30, 2017 filed with the SEC on May 15, 2017, August 21, 2017 and November 20, 2017, respectively;

|

|

|

●

|

our Current Reports on Form 8-K filed with the SEC on March 1, 2017, April 20, 2017, May 22, 2017, June 1, 2017, June 29, 2017, July 3, 2017, July 20, 2017, August 9, 2017, August 14, 2017, August 18, 2017, September 8, 2017 and October 27, 2017; and

|

|

|

●

|

The description of our common stock included in our Registration Statement on Form 8-A, as filed with the SEC on April 7, 2014 pursuant to Section 12(b) of the Exchange Act, including any amendment or report filed for the purpose of updating such description.

|

Additionally,

all documents filed by us subsequent to those listed above with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the

Exchange Act (other than any portions of filings that are furnished rather than filed pursuant to Items 2.02 and 7.01 of a Current

Report on Form 8-K), prior to the termination or completion of the offering shall be deemed to be incorporated by reference into

this prospectus supplement from the respective dates of filing of such documents. Any information that we subsequently file with

the SEC that is incorporated by reference as described above will automatically update and supersede any previous information

that is part of this prospectus supplement.

Upon

written or oral request, we will provide you without charge, a copy of any or all of the documents incorporated by reference,

other than exhibits to those documents unless the exhibits are specifically incorporated by reference in the documents. Please

send requests to Inpixon, 2479 E. Bayshore Road, Suite 195, Palo Alto, CA 94303, Attn: Corporate Secretary, 408-702-2167.

PROSPECTUS

$75,000,000

Common Stock

Preferred Stock

Warrants

Units

By

this prospectus and an accompanying prospectus supplement, we may from time to time offer and sell, in one or more offerings,

up to $75,000,000 in any combination of common stock, preferred stock, warrants, and units.

We

will provide you with more specific terms of these securities in one or more supplements to this prospectus. You should read this