UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

Amendment Number 1

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934

NUTRAFUELS, INC

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Florida

|

|

46-1482900

|

|

State or Other Jurisdiction of

Incorporation or Organization)

|

|

(I.R.S. Employer

Identification Nos.)

|

|

6601 Lyons Road, Suite L-6, Coconut Creek Fl

|

|

33073

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number including area code:

888-509-8901

Securities registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act: Common Stock, $.0001 par value per share

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

Accelerated filer

|

|

Non-accelerated filer

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

X

|

1

NUTRAFUELS, INC.

FORM 10

TABLE OF CONTENTS

Page

|

|

|

|

|

|

|

|

|

ITEM 1. BUSINESS

|

4

|

|

ITEM 1A. RISK FACTORS

|

16

|

|

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

24

|

|

ITEM 3. PROPERTIES

|

27

|

|

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

27

|

|

ITEM 5. DIRECTORS AND EXECUTIVE OFFICERS

|

29

|

|

ITEM 6. EXECUTIVE COMPENSATION

|

31

|

|

ITEM 7. CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS AND DIRECTOR INDEPENDENCE

|

32

|

|

ITEM 8. LEGAL PROCEEDINGS

|

34

|

|

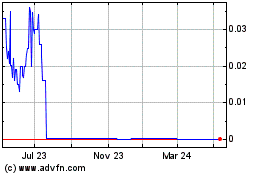

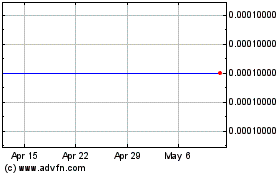

ITEM 9. MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

34

|

|

ITEM 10. RECENT SALES OF UNREGISTERED SECURITIES

|

38

|

|

ITEM 11. DESCRIPTION OF SECURITIES

|

48

|

|

ITEM 12. INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

50

|

|

ITEM 13. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

50

|

|

ITEM 14. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

50

|

|

ITEM 15. FINANCIAL STATEMENTS AND EXHIBITS

|

51

|

2

Explanatory / Cautionary Notes

In this Registration Statement, unless otherwise indicated, the terms “Company”, “we”, “us”, and “our” refer to NutraFuels, Inc. We were previously a public reporting company but exited the reporting system, and at that time we were delinquent in meeting our periodic reporting obligations under the federal securities laws.

We are filing this Registration Statement on Form 10 under the Securities Exchange Act of 1934 ("Registration Statement") on a voluntary basis to become a public reporting company a second time in an attempt to provide current public information to the investment community.

Regarding Forward-Looking Statements

Certain of the matters we discuss in this Form 10 Registration Statement may constitute forward-looking statements. You can identify forward-looking statements because they contain words such as “believes”, “expects”, “may”, “will”, “should”, “seeks”, “approximately”, “intends”, “plans”, “estimates”, “anticipates”, or similar expressions which concern our strategy, plans or intentions. All statements we make relating to estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results are forward-looking statements. In addition, we, through our senior management, from time to time make forward-looking public statements concerning our expected future operations and performance and other developments. All of these forward-looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results may differ materially from those we expected. We derive most of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, of course, it is impossible for us to anticipate all factors that could affect our actual results. There may be other factors not presently known to us or which we currently consider to be immaterial that may cause our actual results to differ materially from the forward-looking statements.

All forward-looking statements and projections attributable to us or persons acting on our behalf apply only as of the date of this Registration Statement and are expressly qualified in their entirety by the cautionary statements included in this Registration Statement. We undertake no obligation to publicly update or revise any written or oral forward-looking statements, made by us or on our behalf including any of the projections presented herein, to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events.

Emerging Growth Company

We are an emerging growth company under the JOBS Act. We shall continue to be deemed an emerging growth company until the earliest of:

·

The last day of our fiscal year during which we have had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every five (5) years by the Securities and Exchange Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

·

The last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective IPO registration statement;

·

The date on which we have, during the previous three (3)-year period, issued more than $1,000,000,000 in non-convertible debt; or

·

The date on which we are deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

3

As an emerging growth company, we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures. Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment and the effectiveness, of the internal control structure and procedures for financial reporting.

As an emerging growth company, we are also exempt from Section 14A (a) and (b) of the Securities Exchange Act of 1934 which requires the shareholder approval of executive compensation and golden parachutes. These exemptions are also available to us as a Smaller Reporting Company.

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of the JOBS Act, that allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies, until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

ITEM 1.

BUSINESS

Form and Year of Organization

NutraFuels, Inc, a Florida corporation (“us”, “we” or “our”) was formed as a limited liability company in the state of Florida on April 1, 2010, to engage in the development and distribution of

CBD (Cannabidiol)

oil products and nutritional and dietary oral spray products. On December 3, 2012, we converted from a Limited Liability Company to a Florida Corporation.

The address of our principal executive office and contact information are below:

NutraFuels, Inc.

6601 Lyons Road, L6

Coconut Creek

Florida 33073

Tel: 888-509-8901

Fax: 754-227-5970

Website: www.nutrafuels.com

Bankruptcy, Receivership or Similar Proceedings

We have not been involved in a bankruptcy receivership or similar proceeding. Additionally, we have not been involved in a reclassification, merger, consolidation, or purchase or sale of a significant amount of assets not in the ordinary course of business.

Organization

We were formed as a limited liability company in the state of Florida on April 1, 2010, to engage in the development and distribution of nutritional and dietary oral spray products. On December 3, 2012, we converted from a limited liability company to a Florida Corporation.

Our principal executive office is located at 6601 Lyons Road L 6, Coconut Creek, Florida 33073, and our telephone number is 888-509-8901. Our website is located at www.nutrafuels.com. Information contained in, or accessible through, our website does not constitute part of this Form 10 Registration Statement.

4

During the years ended December 31, 2015, December 31, 2016, and nine (9) months ended September 30, 2017, we received $1,191,700, $936,000, and

$1,379,500 respectively from the sale of our securities.

For the years ended December 31, 2015, December 31, 2016 and nine months ended September 30, 2017, our revenues were $134,006, $225,293 and $1,029,727, respectively from the sale of our products. For the years ended December 31, 2015, December 31, 2016 and nine (9) months ended September 30, 2017, we incurred net losses of $2,174,541, $2,098,771 and $23,202,212.

Our Business

Since our inception in April of 2010, we have engaged in the development, manufacturing, and distribution of nutritional and dietary products. In March of 2017, we completed development of our CBD products and commenced the distribution of these products. Our distribution strategy includes selling to private label retailers, distributors, and consumers through retail outlets. Our products are primarily sold to private label distributors which represented approximately 100%, 100% and 73.56% of our sales during the year ended December 31, 2015, December 31, 2016 and nine (9) months ended September 30, 2017, respectively.

Product Development

Our products are available as oral spray or tincture products and are designed to provide faster and more efficient absorption than pill or capsule formulas. Each product we offer is based upon the research of Edgar Ward, our Chief Executive Officer, President, and Sole Director, with the assistance of chemists, which we employ. For the year ended December 31, 2016 and nine (9) months ended September 30, 2017, we paid an aggregate of $44,625 and $29,468 to our in house chemists who assisted with the development of our CBD products.

Our products are and, in the future, will continue to be identified by Mr. Ward based upon suggestions from our customers, and from industry and market research he conducts on an ongoing basis. We do not employ medical professionals and our management does not have experience in the healthcare industry or in the treatment of disease. Our products have not been confirmed in any respect by the U.S. Food and Drug Administration or any other governmental agency, and may not produce the results intended.

Once developed, our products are manufactured at our facility in Coconut Creek, Florida. We obtain all raw materials and ingredients for our products from third party suppliers. For all orders we receive, we manufacture, package, label and ship the product to the customer. Our products are primarily sold to private label distributors who sell the products we manufacture under their own brand names. We do not enter into long term contracts with our private label distributors and all sales are made by purchase order. Our private label distributors are not obligated to order any amount of products from us and can discontinue purchasing our product at any time.

Our Hemp Based Products

In March of 2017, we completed development of our CBD

(Cannabidiol)

oil products. Our products have no THC and are parasite-free. Sales of our CBD products represented approximately seventy five percent (75%) of our sales during the nine (9) month period ended September 30, 2017.

Our CBD oil is derived from the seeds and mature stalks of the Cannabis Sativa plant which includes all parts and varieties of the cannabis sativa plant, which contain a tetrahydrocannabinol concentration (“THC”) that does not exceed 0.3 percent on a dry-weight basis." Under 21 U.S.C. § 802(16), the seeds (incapable of germination) and the mature stalks of the

Cannabis Sativa

plant, together with products made from these parts, are known as “Hemp Finished Products” and are exempted from the definition of cannabis and are legal for manufacture and over-the-counter sale to consumers.

5

On December 14, 2016, the DEA issued a final rule effective January 13, 2017 creating a separate Administration Controlled Substances Code Number for “Marihuana Extract” under Schedule I, defining it as “an extract containing one or more cannabinoids,” and stated that “all extracts that contain CBD will also contain at least small amounts of other cannabinoids.” Subsequent thereto, the DEA clarified that: (i) the new drug code (7350) does not include materials or products that are excluded from the definition of marijuana set forth in the Controlled Substances Act (“CSA”), (ii) the new drug code includes only those extracts that fall within the CSA definition of marijuana and (iii) if a product consisted solely of parts of the cannabis plant excluded from the CSA definition of marijuana, such product would not be included in the new drug code (7350) or in the drug code for marijuana (7360).

The CSA definition of marijuana states that, “Marijuana

does not include the mature stalks of such plant, fiber produced from such stalks, oil or cake made from the seeds of such plant, any other compound, manufacture, salt, derivative, mixture, or preparation of such mature stalks (except the resin extracted therefrom), fiber, oil, or cake, or the sterilized seed of such plant which is incapable of germination."

Because our CBD products are Hemp Finished Products derived from the seeds and mature stalks of the cannabis plant, our products are excluded from the CSA definition of marijuana, and as such, our operations are not impacted by the December 14, 2016 final rule.

Despite the foregoing, our operations are potentially subject to a complex web of Federal and state regulations that are evolving at a rapid rate. The DEA and other agencies may change their rules at any time. Should we become subject to DEA or other enforcement proceedings we would have to cease operations.

HempGenix Spray

On March 16, 2017, we completed development of our HempGenix product which is available in an oral spray and tincture drops. HempGenix represented seventy percent (70%) of our product sales for the nine (9) months ended September 30, 2017. HempGenix contains CBD oil and is designed to:

·

Support Pain Relief

·

Increase Energy & Focus

·

Aid in Sleep

·

Reduce Stress & Increase Relaxation

·

Aid in Weight-Loss

Hemp CBD Spray

On March 16, 2017, we completed development of our NutraHemp product

which is available in an oral spray and tincture drops. NutraHemp contains CBD oil and is designed to:

·

Support Pain Relief

·

Increase Energy & Focus

·

Aid in Sleep

·

Reduce Stress & Increase Relaxation

·

Aid in Weight-Loss

6

E-Vape Spray

On March 18, 2017, we completed development of our E-Vape product line which is available as a cartridge to be used with a battery operated vape inhaler. E-Vape contains CBD and is designed to:

·

Support Health and Wellness

·

Support Pain Relief

·

Increase Energy & Focus

·

Aid in Sleep

·

Reduce Stress & Increase Relaxation

·

Aid in Weight-Loss

Non-CBD Products

We presently manufacture and distribute the non-hemp based oral spray products below:

Sleep Support Spray

Our Sleep Spray represents approximately 12.4% of our product sales and is our highest selling product after our HempGenix product. Our Sleep Spray contains Melatonin, GABA, and Valerian Root. Our Sleep Spray is designed to support a healthy sleep cycle and improve the quality of restful sleep. The retail price of our Sleep Spray is $9.95 per .25 (¼) ounce.

Energy Boost Spray

Our Energize Spray contains B complex Vitamins, B12. Energize Spray is designed to increase energy and restore vigor and vitality. The retail price of our Energize Spray is $9.95 per .25 (¼) ounce.

Garcinia Cambogia Weight Loss Spray

Our Appetite and Weight Management Spray contains Garcinia Cambogia. Garcinia Cambogia Spray is designed to suppress the appetite and boost metabolism. The retail price of our Weight Loss Spray is $17.95 per three (3) pack of three (3) .25 (¼) ounce bottles.

Headache & Pain Spray

Our Headache and Pain Spray contains Turmacin, a natural anti-inflammatory. Our Headache and Pain Spray is designed to relieve headaches and pain. The retail price of our Headache and Pain Spray is $9.95 per .25 (¼) ounce.

Spa Treatment Hair, Skin & Nails Spray

Our Hair, Skin and Nails Spray contains Biotin, MSM, and Collagen. Our Hair, Skin and Nails Spray is designed to nourish and encourage hair, skin and nail growth. The retail price of our Hair, Skin and Nails Spray is $9.95 per .25 (¼) ounce.

7

Revenues

Our product revenues for our current products for the nine (9) months ended September 30, 2017 and years ended December 31, 2016 and December 31, 2015 and are summarized below.

|

|

|

|

|

Product

|

Nine (9) Months Ended 9/30/2017

|

Twelve (12) Months Ended 12/31/2016

|

Twelve (12) Months Ended 12/31/2015

|

|

Hemp Based Sprays

|

$

693,459

|

0

|

0

|

|

E-Vape

|

0

|

0

|

0

|

|

Non-Hemp Sleep Support

|

$

128,415

|

$

54,178

|

$

44,196

|

|

Non-Hemp Energy Boost Spray

|

$

70,842

|

$

152,820

|

$

45,756

|

|

Non-Hemp Garcinia Cambogia

Weight Loss Spray

|

$

64,597

|

$

16,892

|

$

42,543

|

|

Non-Hemp Headache & Pain Spray

|

$

62,983

|

$

103

|

0

|

|

Non-Hemp Spa Treatment Hair, Skin & Nails Spray

|

$

9,431

|

$

1,301

|

$

1,511

|

|

Total Sales by Product

|

$

1,029,727

|

$

225,293

|

$

134,006

|

Order Processing

Once developed, our products are manufactured at our facility in Coconut Creek, Florida. We obtain all raw materials and ingredients for our products from third party suppliers. For all orders we receive, we manufacture, package, label and ship the product to the customer. Our products are primarily sold to private label distributors who sell the products we manufacture under their own brand names. We do not enter into long term contracts with our private label distributors and all sales are made by purchase order. Our private label distributors are not obligated to order any amount of products from us and can discontinue purchasing our product at any time. We ship the product ordered within forty-five (45) days to our private label distributors, thirty (30) days to retail customers and within thirty (30) days to wholesale and third party (non-private label) distributors. All orders are shipped by freight delivery at the cost of the customer. All orders placed by My Daily Choice and our other three (3) private label distributors are by purchase order. We require a deposit of fifty (50%) upon an order being places. The balance must be paid by the purchaser prior to shipping.

Distributors

Our products are sold primarily through five (5) private-label distributors. Our three largest distributors, Breadfruit Tree, Inc, Organic By Nature and My Daily Choice represented approximately 73.56% of our total sales during the nine (9) month period ended September 30, 2017. As a result, our revenues are highly concentrated and we are dependent on orders from these three (3) distributors. Should any of these three (3) distributors cease ordering product from us, our revenues would decline or, if either decreased orders, our revenues and results of operations will be negatively affected.

8

We had direct sales of $194,807 and sales to private label distributors in the amount of $834,920 in the nine (9) month period ended September 30, 2017. Our product sales to private label distributors for the nine (9) month period ended September 30, 2017 and years ended December 31, 2016 and 2015 are summarized below:

|

|

|

|

|

|

|

|

Top Current Distributors

|

Sales by Distributor

for the (9) Months

Ended 9/30/2017

|

Percentage

of Total

Sales by Distributor

for the (9) Months

Ended 9/30/2017

|

Sales by

Distributor

for the Year

Ended 12/31/2016

|

Percentage

Of Total Sales

by Distributor

for the Year Ended 12/31/2016

|

Sales by Distributor

for the Year

Ended 12/31/2015

|

Percentage

Of Total Sales

By Distributor

for the Year

Ended

12/31/2015

|

|

My Daily Choice

(1)

|

127,359

|

13.58%

|

204,039

|

95.95%

|

119,514

|

94.74%

|

|

Breadfruit Tree Inc. doing business as NF Skin

(2)

|

562,538

|

59.98%

|

4,277

|

2.01%

|

0

|

0%

|

|

Life Bloom Organics

|

12,900

|

1.38%

|

0

|

0%

|

0

|

0%

|

|

Organic by Nature

|

150,728

|

16.07%

|

0

|

0%

|

0

|

0%

|

|

Oxzgen – 5 Linx, Inc.

|

84,394

|

9.0%

|

0

|

0%

|

0

|

0%

|

|

Other Distributor Sales

|

0

|

0%

|

4,325

|

2.03%

|

6,630

|

5.25%

|

|

Total Sales by Distributors

|

834,920

|

100.0%

|

212,641

|

100.0%

|

126,144

|

100.0%

|

(1) My Daily Choice is an Idaho company controlled by Josh Zwagil who holds 244,514 of our restricted common shares which he received for services rendered to us. As of the date hereof, Mr. Zwagil owns 244,514 restricted common shares

(2) BreadFruit Tree Inc. is a Florida corporation doing business as NF Skin, which is controlled by F. Bruce Hutson who holds 200,000 of our restricted common shares which he received for the price of $0.10 per share or an aggregate of $20,000. As of the date hereof, Mr. Hutson holds 200,000 restricted shares of our common stock.

Product Quality

In developing our products, we require:

·

ingredients that are supported with a certificate of analysis, publicly available scientific research and references which our Chief Executive Officer reviews with a chemist who assists in developing our final products;

·

ingredients that are combined so that their effectiveness is not impaired;

ingredients in our non-hemp based products that are in dosage levels that fall within tolerable upper intake levels established for healthy people by the Institute of Medicine of the National Academies;

·

products that do not contain adulterated ingredients such as ephedra, androstenedione, aspartame, steroids, or human growth hormones; and

·

formulations that have a minimum one-year shelf life.

9

Our Growth Strategy

Our primary growth strategy is to:

·

increase our product distribution and sales through increased private label distributors;

·

increase our margins by focusing on increasing our manufacturing capabilities while seeking operating efficiencies in our operations;

·

continue to conduct additional testing of the safety and efficacy of our products and formulate new products using CBD oil and other ingredients;

·

increase our sales through direct consumer sales, and

·

increase awareness of our products by increasing our marketing and branding opportunities through social media and sponsorships.

Return and Refund Policy

We will exchange any product found to be defective. A written exchange request must be submitted when a customer returns defective or damaged products. Purchasers can apply for a refund in the full amount of purchased products within ten (10) days of purchase. If the purchasers are not satisfied with our products for any reason, they can return products and request for an exchange. All shipping fees for product exchanges or returns must be paid by the purchaser. Historically, product returns as a percentage of our net sales have been nominal.

Our Core Marketing Strategy

Our core marketing strategy is to brand our manufacturing capabilities to private label distributors as the “must have” for Nutraceutical Sprays and tinctures for companies targeting the health conscious and workout enthusiasts as customers. We seek to be known as The Natural Spray Company, that creates high quality products for distributors and consumers in the health conscious and athletic markets. We believe that our marketing mix of social media promotions and providing sample products for our private label distributors to use is an optimal strategy to increase sales.

In 2016, we launched an advanced website at www.nutrafuels.com, seeking to tap into the social networking world and to further our product brand, direct consumer sales, private label distributor opportunities, and consumer awareness.

Patents and Trademarks

We received federal trademark registration for the expression “Spray your way to a healthier day!” that we use, or intend to use, to distinguish ourselves from others. All trademark registrations are protected for an initial period of five (5) years and then are renewable after five (5) years, if still in use, and every ten (10) years thereafter. We hold the following trade names from the U.S. Patent and Trademark office:

·

OralPro NutraSpray

·

NutraSpray

·

NRG X Spray

·

Micro Blast Body Slim

·

Micro Blast

·

Body Slim

·

NutraHemp CBD

·

Spray your way to a healthier day!

10

Material Agreements

On April 10, 2017, we entered into a strategic alliance agreement with Hall Global LLC (“HG”), a Florida limited liability company controlled by Michael Anderson. The agreement has a term of three (3) years and provides that for three (3) years and three (3) months we will manufacture products for HG in exchange for thirty-three point thirty-three percent (33.33%) of the proceeds of such products. Under the terms of the agreement, payment must be made to us within thirty (30) days after the end of each month. In connection with the agreement, on April 10, 2017 we issued 250,000 shares of our restricted common stock to Michael R. Anderson for services rendered as our Chief Scientific Officer. Additionally, we agreed to issue two million (2,000,000) shares of our restricted common stock to Mr. Anderson upon certain equipment being placed at our manufacturing facility. The agreement renews annually with additional consideration of one million (1,000,000) of our common shares. Additionally, we agreed to issue two hundred and fifty thousand (250,000) common shares to Mr. Anderson for our use and distribution of certain technologies including patented Blast Cap and Nutritional drinking straws.

Employees

We have ten (10) full time employees as follows:

·

Our Chief Executive Officer, President and Sole Director, Edgar Ward who oversees our day to day operations;

·

Three (3) full time Chemists;

·

One (1) supervisor of our manufacturing facility;

·

Four (4) employees who assist in our manufacturing facility; and

·

One (1) Executive Assistant.

Neil Catania, our Vice President, works closely with Edgar Ward and provides us with approximately ten (10) hours per month of services. We have no other part time employees. We hire independent contractors on an as needed basis.

None of our employees are employed under a collective bargaining agreement. We believe we have an excellent relationship with our employees and independent contractors.

Manufacturing

We manufacture one hundred percent (100%) of our products. By manufacturing our own products, we believe that we maintain better control over product quality and availability while also reducing production costs. We lease an aggregate of six thousand four hundred (6,400) square feet of office and warehouse space at 6601 Lyons Rd, Suites L-6&7, Coconut Creek, Florida 33073 Approximately five thousand eight hundred (5,800) square feet at his location is used for manufacturing, storage and distribution of our products.

On June 6, 2017, we entered into an agreement to lease nineteen thousand eight hundred and thirty one (19,831) square feet in Deerfield Beach, FL 33441. We plan to use seventeen thousand eight hundred (17,800) square feet of the new Deerfield Beach location for manufacturing, storage and distribution of our products. We expect to occupy this location in January 2018.

Our manufacturing process generally consists of the following operations: (i) sourcing ingredients for products, (ii) warehousing raw ingredients, (iii) efficacy testing and measuring ingredients for inclusion in products, and (iv) blending using automatic equipment. The next step, bottling and packaging, involves filling, capping, coding, labeling and placing the product in packaging with appropriate tamper-evident features then sending the packaged product to our customers.

11

Food and Drug Administration ("FDA") requires companies manufacturing homeopathic medicines to have their facilities certified as Good Manufacturing Practices ("GMPs"). Our non-hemp based nutritional products are subject to FDA regulation. Our manufacturing facility has been fully compliant with its GMP certification. Our quality control program seeks to ensure the superior quality of our products and that they are manufactured in accordance with current GMP. Our processing methods are monitored closely to ensure that only quality ingredients are used and to ensure product purity. Periodically, we retain the services of outside GMP audit firms to assist in our efforts to comply with GMPs.

Sources and Availability of Raw Materials

We obtain the raw materials for our Hemp Finished Products from two state licensed suppliers located in Kentucky. These raw materials consist of Cannabidiol rich oil and isolate. We obtain the raw materials from our non-hemp based products from several ingredient suppliers located in throughout the U.S. These raw materials consist of naturally derived vitamins and nutrients.

Raw materials used by us are available from a variety of suppliers. We maintain a good relationship with our suppliers and do not anticipate that any of our suppliers will terminate their relationship with us in the near term. We have ongoing relationships with secondary and tertiary suppliers. In the event, we are unable to obtain any of our raw materials from our suppliers; we believe that we could obtain alternative sources of any raw materials from other suppliers. We do not have contracts with our suppliers and we order our raw materials on an as needed basis. We have not experienced any material adverse effects on our business as a result of shortages of raw materials or packaging materials used in the manufacturing of our products. An unexpected interruption or a shortage in supply of raw materials could adversely affect our business derived from these products.

Backlog of Orders

We have no backlog of orders.

Seasonal Aspect of our Business

None of our products are affected by seasonal factors.

Status of any Publicly Announced New Product or Service

We do not have any publicly announced new product or service.

Competitive Business Conditions

The nutritional and dietary supplement industries are highly competitive. Nutritional supplements include vitamins, minerals, dietary supplements, herbs, botanicals and compounds derived therefrom. Numerous manufacturers and distributors compete with us for customers throughout the United States in the packaged nutritional supplement industry selling products to retailers such as mass merchandisers, drug store chains, independent pharmacies and health food stores. We are also vulnerable to competition from companies that can purchase similar products to our products and private label them with their own brand name.

Many of our indirect competitors are substantially larger, have more experience than us, have longer operating histories, and have materially greater financial and other resources than us.

Costs and Effects of Compliance with Environmental Laws

We are in a business that involves the use of raw materials in a manufacturing process, however, it is unlikely that such materials are likely to result in the violation of any existing environmental rules and/or regulations. Further, we do not own any real property that could lead to liability as a landowner. Therefore, we do not anticipate that there will be any material costs associated with compliance with environmental laws and regulations.

12

Government Approvals

We are not required to obtain governmental approval of our products.

Product Liability Insurance

We maintain commercial liability, including product liability coverage, and property insurance. Our policy provides for a general liability of five million dollars ($5,000,000) per occurrence, and five million dollars ($5,000,000) annual aggregate coverage which includes our main corporate facility. We carry property coverage on our main office facility to cover our legal liability, tenant’s improvements, business property, and inventory.

Government Regulation

Our operations are potentially subject to a complex web of Federal and state regulations that are evolving at a rapid rate. The DEA and FDA may change rules or enforcement proceedings at any time. We do not believe that current rules and enforcement have a significant potential impact because CBD does not cause the "high" associated with the THC in marijuana. As the legal landscape and understanding about the differences in medical cannabinoids unfolds, it will be increasingly important to distinguish “marijuana” certain CBD products (with noted varying degrees of psychotropic effects and deficits in executive function) from Hemp Finished Products.

The principal uncertainties are whether regulators will, at any time, attempt to treat Hemp Finished Products similarly to THC products.

Some states are considering various taxation of marijuana-related products. These considerations seem to range from routine sales taxes to taxes similar to those imposed on tobacco products. It is unclear whether products like those we offer containing no CBD would fall under these tax plans if and when they are imposed.

IRS section 280E prevents cannabis companies from deducting expenses from their income, except for those considered cost of goods sold. No deduction or credit is allowed for any amount paid or incurred during the taxable year in carrying on any trade or business if such trade or business (or the activities which comprise such trade or business) consists of trafficking in controlled substances (within the meaning of schedule I and II of the Controlled Substances Act) which is prohibited by Federal law or the law of any State in which such trade or business is conducted. If this section is enforced against the Company even though its products contain no THC or other illegal substance, it could create operating and cash flow problems in the future.

The formulation, manufacturing, packaging, labeling, advertising, and distribution of our non-hemp based products are subject to regulation by one or more federal agencies, principally the FDA, the Federal Trade Commission ("FTC"), and, to a lesser extent, the Consumer Product Safety Commission ("CPSC"), the United States Department of Agriculture (“USDA”), and the Environmental Protection Agency (“EPA”). Our activities are also regulated by various governmental agencies for the states and localities in which our products are sold, as well as by governmental agencies in certain countries outside the United States in which our products are sold. Among other matters, regulation by the FDA and FTC are concerned with product safety and claims made with respect to a product's ability to provide health-related benefits. Specifically, the FDA, under the Federal Food, Drug, and Cosmetic Act, ("FDCA"), regulates the formulation, manufacturing, packaging, labeling, distribution and sale of food, including dietary supplements, and over-the-counter drugs. The FTC regulates the advertising of these products. The National Advertising Division ("NAD") of the Council of Better Business Bureaus oversees an industry sponsored, self-regulatory system that permits competitors to resolve disputes over advertising claims. The NAD has no enforcement authority of its own, but may refer matters that appear to violate the Federal Trade Commission Act or the FDCA to the FTC or the FDA for further action, as appropriate.

13

Federal agencies, primarily the FDA and the FTC, have a variety of procedures and enforcement remedies available to them including initiating investigations, issuing warning letters and cease and desist orders, requiring corrective labeling or advertising, requiring consumer redress (for example, requiring that a company offer to repurchase products previously sold to consumers), seeking injunctive relief or product seizures, imposing civil penalties, or commencing criminal prosecution. In addition, certain state agencies have similar authority. These federal and state agencies have in the past used these remedies in regulating participants in the food, dietary supplement and over-the-•counter drug industries, including the imposition of civil penalties in the millions of dollars against a few industry participants.

The Dietary Supplement Health and Education Act ("DSHEA") was enacted in 1994, amending the FDCA. We believe DSHEA is generally favorable to consumers and to the dietary supplement industry. DSHEA establishes a statutory class of "dietary supplements”, which includes vitamins, minerals, herbs, amino acids and other dietary ingredients for human use to supplement the diet. Dietary ingredients marketed in the United States before October 15, 1994 may be marketed without the submission of a "new dietary ingredient" ("NDI") premarket notification to the FDA. Dietary ingredients not marketed in the United States before October 15, 1994 may require the submission, at least seventy-five (75) days before marketing of an NDI notification containing information establishing that the ingredient is reasonably expected to be safe for its intended use. Among other things, DSHEA prevents the FDA from regulating dietary ingredients in dietary supplements as "food additives" and allows the use of statements of nutritional support on product labels and in labeling. The FDA has issued final regulations under DSHEA and has issued draft guidance on NDI notification requirements. Further guidance and regulations are expected. Several bills to amend DSHEA in ways that would make this law less favorable to consumers and industry have been proposed in Congress.

The Nutrition Labeling and Education Act of 1990 ("NLEA”) amended the FDCA to establish additional requirements for ingredient and nutrition labeling and labeling claims for foods. If the NLEA labeling requirements change at a future time, we may need to revise our product labeling. Our non-CBD products are classified as dietary supplements. The FDA has concluded that THC and CBD products are excluded from the definition of a dietary supplement. The FDA issued a Final Rule on GMPs for dietary supplements on June 22, 2007. The GMPs cover manufacturers and holders of finished dietary supplement products, including dietary supplement products manufactured outside the United States that are imported for sale into the United States. Among other things, the new GMPs: (a) require identity testing on all incoming dietary ingredients, call for a "scientifically valid system" for ensuring finished products meet all specifications, (b) include requirements related to process controls, including statistical sampling of finished batches for testing and requirements for written procedures, and (c) require extensive recordkeeping.

We have reviewed the GMPs and have taken steps to ensure compliance. While we believe we are in compliance, there can be no assurance that our operations or those of our suppliers will be in compliance in all respects at all times. Additionally, there is a potential risk of increased audits as the FDA and other regulators seek to ensure compliance with the GMP’s.

On December 22, 2006, Congress passed the Dietary Supplement and Nonprescription Drug Consumer Protection Act, which went into effect on December 22, 2007. The law requires, among other things, that companies that manufacture or distribute nonprescription drugs or dietary supplements report serious adverse events allegedly associated with their products to the FDA and institute recordkeeping requirements for all adverse events (serious and non-serious). There is a risk that consumers, the press and government regulators could misinterpret reported serious adverse events as evidence of causation by the ingredient or product complained of, which could lead to additional regulations, banned ingredients or products, increased insurance costs and a potential increase in product liability litigation, among other things.

The Consumer Product Safety Improvement Act of 2008 ("CPSIA") primarily addresses children's product safety but also improves the administrative process of the CPSC. Among other things, the CPSIA requires testing and certification of certain products and enhances the CPSC's authority to order recalls.

14

The FDA Food Safety Modernization Act ("FSMA"), enacted January 4, 2011, amended the FDCA to significantly enhance the FDA's authority over various aspects of food regulation. The FSMA granted the FDA mandatory recall authority when the FDA determines if there is reasonable probability that a food is adulterated or misbranded and that the use of, or exposure to, the food will cause serious adverse health consequences or death to humans or animals. Other changes include the FDA's expanded access to records; the authority to suspend food facility registrations and require high risk imported food to be accompanied by a certification; stronger authority to administratively detain food; the authority to refuse admission of an imported food if it is from a foreign establishment to which a U.S. inspector is refused entry for an inspection; and the requirement that importers verify that the foods they import meet domestic standards.

One of the FSMA's more significant changes is the requirement of hazard analysis and

risk-based preventive controls ("HARBPC") for all food facilities required to register with the FDA, except dietary supplement facilities in compliance with both GMPs and the serious adverse event reporting requirements. Although dietary supplement facilities are exempt from the HARBPC requirements, dietary ingredient facilities might not qualify for the exemption. The HARBPC requirements, which the FDA has yet to propose, are expected to be onerous because facilities will have to develop and implement preventive controls to assure that identified hazards are significantly minimized or prevented, monitor the effectiveness of the preventive controls and maintain numerous records related to the HARBPC. The HARBPC requirements may increase the costs of dietary ingredients and/or affect our ability to obtain dietary ingredients.

As required by Section 113(b) of the FSMA, the FDA published in July 2011, a draft guidance document clarifying when the FDA believes a dietary ingredient is an NDI, when a manufacturer or distributor must submit an NDI premarket notification to the FDA, the evidence necessary to document the safety of an NDI and the methods for establishing the identity of an NDI. The draft guidance, if implemented as proposed, could have a material impact on our operations. Although our industry has strongly objected to several aspects of the draft guidance, it is unclear whether the FDA will make changes to the final guidance. In addition, it is possible that the FDA will begin taking enforcement actions consistent with the interpretations in the draft guidance before issuing a final version.

The new FSMA requirements, as well as the FDA enforcement of the NDI guidance as written, could require us to incur additional expenses, which could be significant, and negatively impact our business in several ways, including, but not limited to, the detention and refusal of admission of imported products, the injunction of manufacturing of any dietary ingredients or dietary supplements until the FDA determines that such ingredients or products are in compliance and the potential imposition of fees for re-inspection of noncompliant facilities. Each of these events would increase our liability and could have a material adverse effect on our financial

condition, results of operations or cash flows.

The FTC and the FDA have pursued a coordinated effort to challenge what they consider to be unsubstantiated and unsafe weight-loss products, and have also coordinated enforcement against dietary supplement claims in other areas, including children's products. Their efforts to date have focused on manufacturers and marketers as well as media outlets, and have resulted in a significant number of investigations and enforcement actions, some resulting in civil penalties of several million dollars under the Federal Trade Commission Act. We expect that the FTC and the FDA will continue to focus on health-related claims for dietary supplements and foods which could cause our non-CBD products to be the subject of an FTC/FDA inquiry.

15

ITEM 1A. RISK FACTORS

Risks Related to our Financial Condition.

We are dependent on the sale of our securities to fund our operations.

During the years ended December 31, 2015, December 31, 2016, and nine (9) months ended September 30, 2017, we received $1,191,700, $936,000,

and $1,375,500 from the sale of our securities.

For the years ended December 31, 2015, December 31, 2016 and nine (9) months ended September 30, 2017, our revenues were $134,006, $225,293 and $1,029,727, respectively from the sale of our products. Our cash on hand as of the day of this Form 10 Registration Statement is $216,000. Our operating expenses are presently approximately $115,000 per month or $1,380,000 annually which consist of rent, advertising, salaries and other general and administrative expenses. Once this Form 10 Registration Statement becomes effective, our monthly expenses will increase to $121,250 or $1,455,000 annually because of our operating expenses of $115,000 per month ($1,380,000 annually) and costs of being an SEC reporting company of $6,250 per month ($75,000 annually). We do not have any arrangements for future financing. We are dependent on the sale of our securities to help fund our operations. There is no assurance we will be able to obtain future funding for our operations from the sale of our securities. The future issuance of our securities will result in substantial dilution in the percentage of our common stock held by our then existing stockholders, and would likely have an adverse effect on any trading market for our common stock. Obtaining financing would be subject to a number of factors, including investor acceptance. These factors may adversely affect the timing, amount, terms, or conditions of any financing that we may obtain or make any additional financing unavailable to us. If we do not obtain additional financing to fund our future operations, our business could fail and you could lose your investment.

There is substantial doubt about our ability to continue as a going concern as a result of our limited operating history and financial resources, and if we are unable to generate significant revenue or secure financing we may be required to cease or curtail our operations.

For the years ended December 31, 2015, December 31, 2016 and nine (9) months ended September 30, 2017, we incurred net losses of $2,174,541, $2,098,771 and $23,202,212. As a result, our auditor has rendered an opinion that we may be unable to continue as a going concern. Our limited operating history and financial resources raises substantial doubt about our ability to continue as a going concern and our financial statements contain a going concern qualification. Our financial statements do not include adjustments that might result from the outcome of this uncertainty and if we are unable to generate significant revenue or secure financing we may be required to cease or curtail our operations.

We have limited historical performance for you to base an investment decision upon, and we may never become profitable.

For the years ended December 31, 2015, December 31, 2016 and nine (9) months ended September 30, 2017, our revenues were $134,006, $225,293 and $1,029,727. Accordingly, we have limited historical performance upon which you may evaluate our prospects for achieving our business objectives and becoming profitable in light of our operating losses and the risks, difficulties and uncertainties frequently encountered by companies with limited operations such as us. Accordingly, before investing in our common stock, you should consider the challenges, expenses and difficulties that we will face as an early stage company, and whether we will ever become profitable.

16

If we are unable to generate sufficient revenues for our operating expenses we will need financing, which we may be unable to obtain; should we fail to obtain sufficient financing, our potential revenues will be negatively impacted.

For the years ended December 31, 2015, December 31, 2016 and nine (9) months ended September 30, 2017, our revenues were $134,006, $225,293 and $1,029,727, respectively from the sale of our products. For the years ended December 31, 2015, December 31, 2016 and nine (9) months ended September 30, 2017, we incurred net losses of $2,174,541, $2,098,771 and $23,202,212.

Because we have limited revenues and lack historical financial data, including revenue data, our future revenues are unpredictable. Our operating expenses are presently approximately $115,000 per month or $1,380,000 annually to meet our existing operational costs, which consist of rent, advertising, salaries and other general and administrative expenses. Once this Form 10 Registration Statement becomes effective, our monthly expenses will increase to $121,250 or $1,455,000 annually because of our operating expenses of $115,000 per month ($1,380,000 annually) and costs of being an SEC reporting company of $6,250 per month ($75,000 annually).

As of the filing of this Form 10 Registration Statement, we had $216,000 of cash and cash equivalents for our operational needs. If we fail to generate sufficient revenues to meet our monthly operating costs of $121,250 we will not have available cash for our operating needs after approximately two (2) months. In the future, we may require additional debt or equity funding to continue our operations.

We intend to raise additional funds from an offering of our stock in the future; however, this offering may never occur, or if it occurs, we may be unable to raise the required funding. Further new offerings of our common shares will dilute our existing shareholders and your investment in our common shares. We do not have any plans or specific agreements for new sources of funding and we have no agreements for financing in place.

Our liabilities could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from meeting our obligations under our indebtedness.

As of September 30, 2017, our total liabilities were $8,824,895, consisting principally of $8,464,463 of a liability to issue shares of our common stock to our CEO under his employment agreement. Our liabilities could have important consequences for our investors, including: making it more difficult for us to make payments on indebtedness; increasing our vulnerability to general economic and industry conditions; requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest on indebtedness when our indebtedness become due. This reduces our ability to use our cash flow to fund our operations, capital expenditures and future business opportunities; limiting our ability and the ability of our subsidiaries to obtain additional financing for working capital, capital expenditures, product development, debt service requirements, acquisitions and general corporate or other purposes; and limiting our ability to adjust to changing market conditions and placing us at a competitive disadvantage compared to our competitors which have fewer liabilities. We may incur substantial additional indebtedness in the future. If new indebtedness is added to our current debt levels, the related risks that we face could increase.

We may not be able to comply with the reporting obligations of the Securities & Exchange Commission which would have a negative impact on us.

We were previously a public company which filed reports with the Securities & Exchange Commission (“SEC”). We exited the reporting system, and at that time we were delinquent in meeting our periodic reporting obligations under the federal securities laws. Although we plan to comply with our periodic reporting obligations, there is no assurance that we will do so in the future because of the complexity of the federal securities laws, the accounting, auditing and legal costs of SEC reporting and management time required for such compliance.

17

Should we fail to comply with the SEC’s reporting requirements, we could be subject to SEC enforcement action that could result in penalties and fines against us. This would harm our financial condition and make it difficult or impossible for you to sell your shares. Further, should we not comply with the SEC reporting requirements, there will be limited public information available about us which could make it more difficult for you to sell your shares.

Risks Related to Our Business

We have been growing rapidly and expect to continue to invest in our growth for the foreseeable future. If we are unable to manage our growth effectively, our revenue and profits could be adversely affected.

We have experienced rapid growth in a relatively short period of time. Our revenue grew from $$225,293 for the year ended December 31, 2016 to $1,029,727 for the nine (9) months ended September 30, 2017.

We plan to continue to expand our operations, and we anticipate that further significant expansion which will be required. which will place additional demands on our resources and operations. Our future operating results depend to a large extent on our ability to manage this expansion and growth successfully. Sustaining our growth will place significant demands on our management as well as on our administrative, operational, and financial resources. To manage our growth, we must continue to improve our sales and manage our operational systems. If we are unable to manage our growth successfully, our revenue and profits could be harmed. Risks that we face in undertaking future expansion include:

·

effectively recruiting, integrating, training, and motivating a new employees, including our direct sales force, while retaining existing private label distributors and effectively executing our new business plan focusing on the sale of CBD products;

·

satisfying existing customers and attracting new customers of our products;

·

introducing new products and services;

·

Increasing our private label distributors

·

controlling expenses and investments in expanded operations including our new manufacturing facility;

·

implementing and enhancing our administrative, operational, and financial infrastructure, systems, and processes; and

·

addressing new products to meet consumer preferences.

A failure to manage our growth effectively could harm our business, operating results, financial condition. Further, due to our recent rapid growth, we have limited experience operating at our current scale and potentially at a larger scale, and as a result, it may be difficult for us to fully evaluate future prospects and risks. Our recent and historical growth should not be considered indicative of our future performance. We have encountered in the past, and will encounter in the future, risks and uncertainties frequently experienced by growing companies in rapidly changing industries. If our assumptions regarding these risks and uncertainties, which we use to plan and operate our business, are incorrect or change, or if we do not address these risks successfully, our financial condition and operating results could differ materially from our expectations, our growth rates may slow and our business would by adversely impacted.

18

Our operating results may fluctuate between periods, which makes our future results difficult to predict.

Our operating results have fluctuated in the past and may fluctuate in the future. Additionally, we have a limited operating history and in March of 2017, started selling CBD products which represent seventy five percent (75%) of our revenues for the nine (9) month period ended September 30, 2017, which makes it difficult to forecast our future results. As a result, you should not rely upon our past quarterly operating results as indicators of future performance. You should take into account the risks and uncertainties frequently encountered by companies in rapidly evolving markets. Our operating results in any given quarter can be influenced by numerous factors, many of which are unpredictable or are outside of our control, including:

·

our ability to generate significant revenue from our products;

·

our ability to maintain and grow our distributors and direct customer base;

·

the development and introduction of new products and services by us or our competitors;

·

increases in and timing of operating expenses that we may incur to grow and expand our operations and to remain competitive;

·

the impact of existing and new regulation of the CBD industry which is uncertain;

Our revenues are highly dependent upon three private label distributors, which represented

73.56%, 100%, and 100% of our revenues for the nine (9) months ended September 30, 2017 and years ended December 31, 2016 and 2015 and should this distributor reduce its orders from us or should we lose this distributor; our revenues and results of operations would be negatively affected which could cause you to lose your investment.

Our revenues are highly dependent on private label distributors which represented 73.56%,

100%, and 100% of our revenues for the nine (9) months ended September 30, 2017 and years ended December 31, 2016 and 2015. As a result, our revenues are highly concentrated. We have no agreement obligating this distributor to purchase our products. As such, this distributor can cease ordering products from us at any time without notice. Should this occur our revenues and results of operations will be negatively affected which could cause you to lose your investment in our common shares.

Any potential growth in the cannabis or cannabidiol-related industries continues to be subject to new and changing state and local laws and regulations.

Our products are made from Hemp Finished Products. Under 21 U.S.C. § 802(16), the seeds (incapable of germination) and the mature stalks of the Cannabis sativa plant, together with products made from these parts, are known as Hemp Finished Products and are exempted from the definition of cannabis and are legal. Continued development of the cannabis and cannabidiol related industries is dependent upon continued legislative legalization of cannabis and cannabidiol related products at the state level, and a number of factors could slow or halt progress in this area, even where there is public support for legislative action. Any delay or halt in the passing or implementation of legislation for the re-criminalization or restriction of cannabidiol at the state level could negatively impact our business because of the perception that it is related to cannabidiol. Additionally, changes in applicable state and local laws or regulations could restrict the products and services we offer or impose additional compliance costs on us or our customers. Violations of applicable laws, or allegations of such violations, could disrupt our business and result in a material adverse effect on our operations. We cannot predict the nature of any future laws, regulations, interpretations or applications, and it is possible that regulations may be enacted in the future that will have a material adverse effect on our business.

19

We recently entered the CBD Market and as a result, we are subject to numerous potential regulatory matters, which could negatively impact our operations.

The Drug Enforcement Administration (“DEA”) which enforces the controlled substances laws of the United States has issued various rules and announcements concerning various items considered to be marijuana extracts which may encompass Cannabinoids. The uncertainty involves the extent to which the DEA will try to restrict the marketing or distribution of hemp finished/CBD products which we manufacture and distribute. For the period ended September 30, 2017, 73.56% of our revenues were derived from the sale of CBD products. If the DEA were to take any action concerning our CBD products, it would have a negative impact on our revenues and financial condition.

Because we are subject to numerous laws and regulations we could incur substantial costs.

The manufacture, labeling and distribution of the products that we distribute is regulated by various federal, state and local agencies. These governmental authorities may commence regulatory or legal proceedings, which could restrict the permissible scope of our product claims or the ability to sell our products in the future. The FDA regulates our products to ensure that the products are not adulterated or misbranded.

We are subject to regulation by the DEA and other agencies as a result of our CBD products. The shifting compliance environment and the need to build and maintain robust systems to comply with different compliance in multiple jurisdictions increase the possibility that we may violate one or more of the requirements. If our operations are found to be in violation of any of such laws or any other governmental regulations that apply to us, we may be subject to penalties, including, without limitation, civil and criminal penalties, damages, fines, the curtailment or restructuring of our operations, any of which could adversely affect our ability to operate our business and our financial results.

Failure to comply with FDA requirements may result in, among other things, injunctions, product withdrawals, recalls, product seizures, fines and criminal prosecutions. Our advertising is subject to regulation by the FTC under the FTCA. In recent years, the FTC has initiated numerous investigations of dietary and nutrition supplement products and companies. Additionally, some states also permit advertising and labeling laws to be enforced by private attorney generals, who may seek relief for consumers, seek class action certifications, seek class wide damages and product recalls of products sold by us. Any actions against us by governmental authorities or private litigants could have a material adverse effect on our business, financial condition and results of operations.

If the products we sell do not have the healthful effects intended, our business may suffer.

In general, our products contain food, nutritional supplements which are classified in the United States as “dietary supplements” which do not currently require approval from the FDA or other regulatory agencies prior to sale. Many of our products contain innovative ingredients or combinations of ingredients. There is little long term experience with human or other animal consumption of certain of these ingredients or combinations thereof in concentrated form. Our products could have certain side effects if not taken as directed or if taken by a consumer that has certain medical conditions. Furthermore, there can be no assurance that any of the products, even when used as directed, will have the effects intended or will not have harmful side effects.

We may be exposed to material product liability claims, which could increase our costs and adversely affect our reputation and business.

As a manufacturer and distributor of products intended for human consumption, we are subject to product liability claims if the use of our products for others is alleged to have resulted in injury. Our products consist of vitamins, minerals, herbs and other ingredients that are classified as dietary and nutrition supplements and, in most cases, are not subject to pre-market regulatory approval in the United States or internationally. Previously unknown adverse reactions resulting from human consumption of these ingredients could occur.

20

Our insurance coverage may not be sufficient to cover our legal claims or other losses that we may incur in the future.

We maintain insurance, including property, general and product liability, and workers’ compensation to protect ourselves against potential loss exposures. There is no assurance that our insurance will be sufficient to cover any claims that are asserted against us. In the future, insurance coverage may not be available at adequate levels or on adequate terms to cover potential losses, including on terms that meet our customer’s requirements. If insurance coverage is inadequate or unavailable, we may face claims that exceed coverage limits or that are not covered, which could increase our costs and adversely affect our operating results.

Our intellectual property rights are valuable, and any inability to protect them could reduce the value of our products and brand.

We manufacture our products primarily for third parties who sell the products under their own brand names. Our product formulations are not patented and there are numerous companies selling similar products. As such, third parties could copy our products or sell similar products to our distributors and/or customers.

Our competitors may have or develop equivalent or superior manufacturing and design skills, and may develop an enhancement to our formulations that will be patentable or otherwise protected from duplication by others. Further, we may be unable or unwilling to strictly enforce our intellectual property rights, including our trademarks, from infringement. Our inability to obtain and/or failure to enforce our intellectual property rights could diminish the value of our product offerings and have a material adverse effect on our business, prospects, results of operations, and financial condition.

Adverse publicity or consumer perception of our products and any similar products distributed by others could harm our reputation and adversely affect our sales and revenues.

We believe we are highly dependent upon positive consumer perceptions of the safety and quality of our products as well as similar products distributed by other nutrition supplement companies. Consumer perception of nutrition supplements and our products, in particular, can be substantially influenced by scientific research or findings, national media attention and other publicity about product use. Adverse publicity from these sources regarding the safety, quality or efficacy of nutritional supplements and our products could harm our reputation and results of operations. The mere publication of news articles or reports asserting that such products may be harmful or questioning their efficacy could have a material adverse effect on our business, financial condition and results of operations, regardless of whether such news articles or reports are scientifically supported or whether the claimed harmful effects would be present at the dosages recommended for such products.

The Diet and Nutritional Supplement industry is highly competitive, and our failure to compete effectively could adversely affect our market share, financial condition and future growth.

The Diet and Nutritional Supplement industry is highly competitive with respect to price, brand and product recognition and new product introductions. Several of our competitors are larger, more established and possess greater financial, personnel, distribution and other resources. We face competition (a) in the health food channel from a limited number of large nationally known manufacturers, private label brands and many smaller manufacturers of dietary and nutrition supplements; and (b) in the mass-market distribution channel from manufacturers, major private label manufacturers and others. Private label brands at mass-market chains represent substantial sources of income for these merchants and the mass-market merchants often support their own labels at the expense of other brands. As such, the growth of our brands within food, drug, and general mass-market merchants are highly competitive and uncertain. If we cannot compete effectively, we may not be profitable.

21

We may experience greater than expected product returns, which might adversely affect our sales and results of operations.

Product returns are a customary part of our business. Products may be returned for various reasons, including expiration dates or lack of sufficient sales volume. Any increase in product returns could reduce our results of operations.

A shortage in the supply of key raw materials used by our manufacturer could increase our costs or adversely affect our sales and revenues.

Our inability to obtain adequate supplies of raw materials in a timely manner or a material increase in the price of the raw materials used in our products could have a material adverse effect on our business, financial condition and results of operations.

The purchase of many of our products is discretionary, and may be negatively impacted by adverse trends in the general economy and make it more difficult for us to generate revenues.

Our business is affected by general economic conditions since our products are discretionary and we depend, to a significant extent, upon a number of factors relating to discretionary consumer spending. These factors include economic conditions and perceptions of such conditions by consumers, employment rates, the level of consumers' disposable income, business conditions, interest rates, consumer debt levels and availability of credit. Consumer spending on our products may be adversely affected by changes in general economic conditions.

We may not be able to anticipate consumer preferences and trends within the diet and nutritional industry, which could negatively affect acceptance of our products by retailers and consumers and result in a significant decrease in our revenues.

Our products must appeal to a broad range of consumers, whose preferences cannot be predicted with certainty and are subject to rapid change. Our products will need to successfully meet constantly changing consumer demands. If our products are not successfully received by our private label distributors and their customers, our business, financial condition, results of operations and prospects may be harmed.

Risks Related to Our Management

Should we lose the services of Edgar Ward, our founder, chief executive officer, president and sole director, our financial condition and proposed expansion may be negatively impacted.

Our future depends on the continued contributions of Edgar Ward, our founder, chief executive officer, president and sole director who would be difficult to replace. The services of Mr. Ward are critical to the management of our business and operations. Additionally, we do not maintain key man life insurance on Mr. Ward. Should we lose the services of Mr. Ward, and be unable to replace his services with equally competent and experienced personnel, our operational goals and strategies may be adversely affected, which will negatively affect our potential revenues.

Because we do not have an audit or compensation committee, shareholders will have to rely on the one member of our board of directors who is not independent to perform these functions.

We do not have an audit or compensation committee or board of directors as a whole, that is composed of independent directors. These functions are performed by our sole director. Because our Sole Director is not independent, there is a potential conflict between their or our interests and our shareholders’ interests since Edgar Ward, our Sole Board Member, is also our Chief Executive Officer and president who will participate in discussions concerning management compensation and audit issues that may affect management decisions. Until we have an audit committee or independent directors, there may less oversight of management decisions and activities and little ability for minority shareholders to challenge or reverse those activities and decisions, even if they are not in the best interests of minority shareholders.

22

Our vice president devotes limited time to our business, which may negatively impact our plan of operations, implementation of our business plan and our potential profitability.

Neil Catania, our vice president currently devotes only ten (10) hours to our business each month. Our Chief Executive Officer and President, Edgar Ward, devotes full time to our business however, there is no assurance he will be able to do so in the future. Management time devoted to our business activities in the future may be inadequate to implement our plan of operations and develop a profitable business.

Risks Related to Our Common Stock

Our chief executive officer, president and sole director has voting control over all matters submitted to a vote of our common stockholders, which will prevent our minority shareholders from having the ability to control any of our corporate actions.

As of the filing of this Form 10 Registration Statement, we had 80,248,561 shares of common stock outstanding, each entitled to one vote per common share. Our chief executive officer, president and sole director, Edgar Ward, holds 23,744,084 common shares directly, 1,000,000 shares indirectly and 1,000 Series A Preferred Shares which provide him with 500,000 votes per share or an aggregate of 500,000,000 votes on all matters submitted to our stockholders. As a result, Mr. Ward controls 524,744,084 of 580,248,561 votes or 90.428% of all votes and has the ability to determine the outcome of all matters submitted to our stockholders for approval, including the election of directors. Mr. Ward’s control of our voting securities may make it impossible to complete some corporate transactions without his support and may prevent a change in our control. In addition, this ownership could discourage the acquisition of our common stock by potential investors and could have an anti-

‐

takeover effect, possibly depressing the trading price of our common stock.

As of September 30, 2017, we had warrants convertible into an aggregate of 17,331,285 common shares outstanding and we will likely issue additional shares in the future to fund our operations.